Commentaries Topics: Consumer Price Index

Commentaries /

June 2024 CPI: Encouraging progress but a back-to-back move by the Bank still at odds

June 2024 CPI: Encouraging progress but a back-to-back move by the Bank still at odds

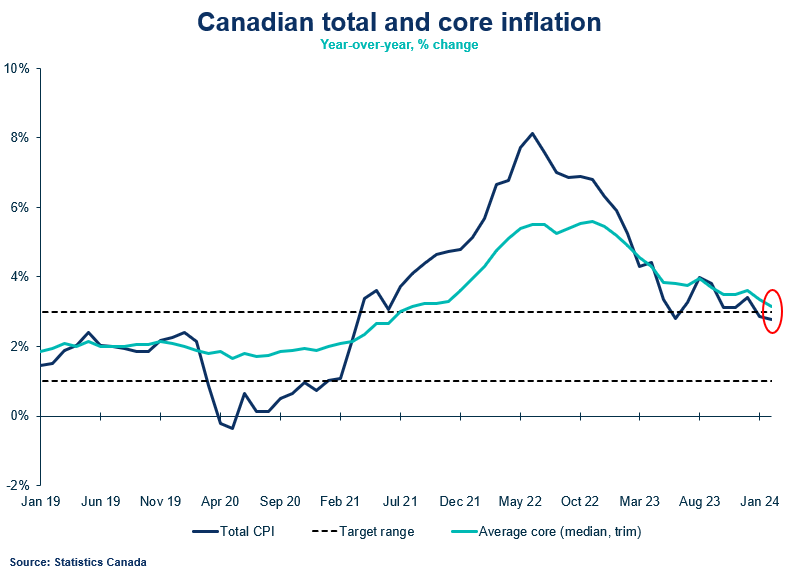

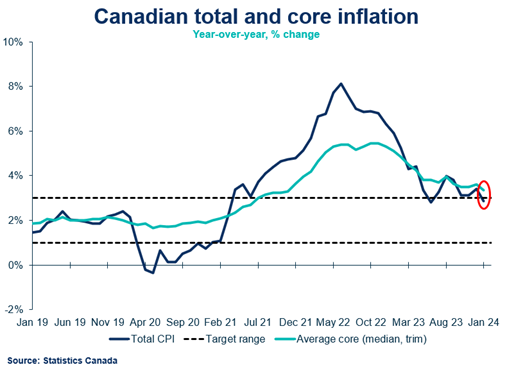

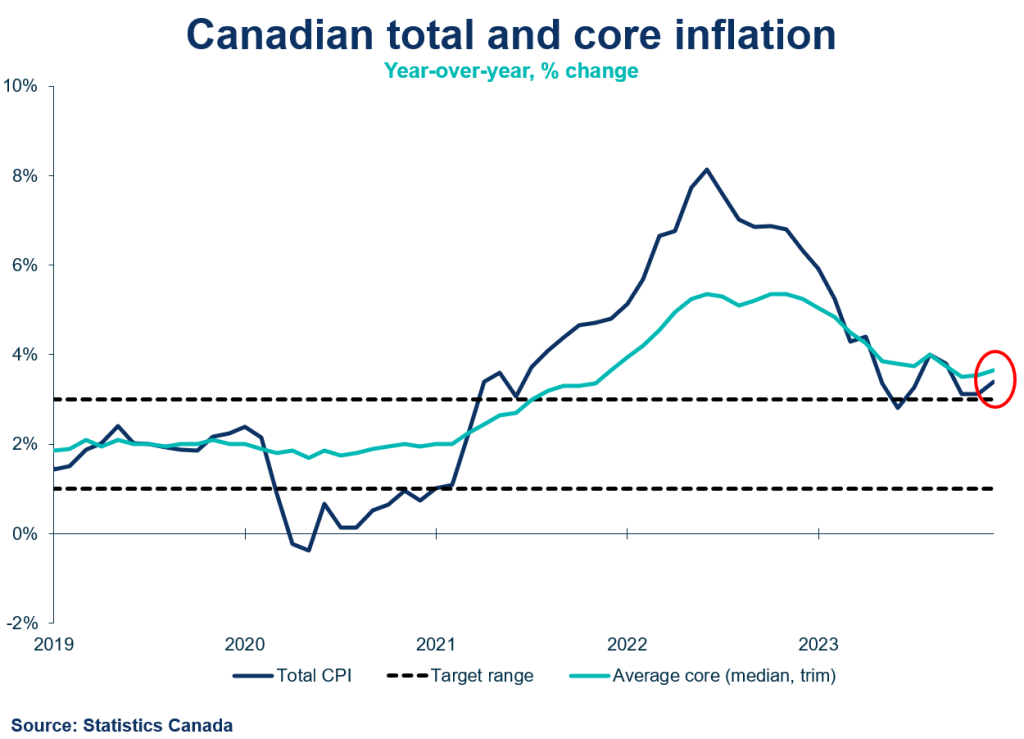

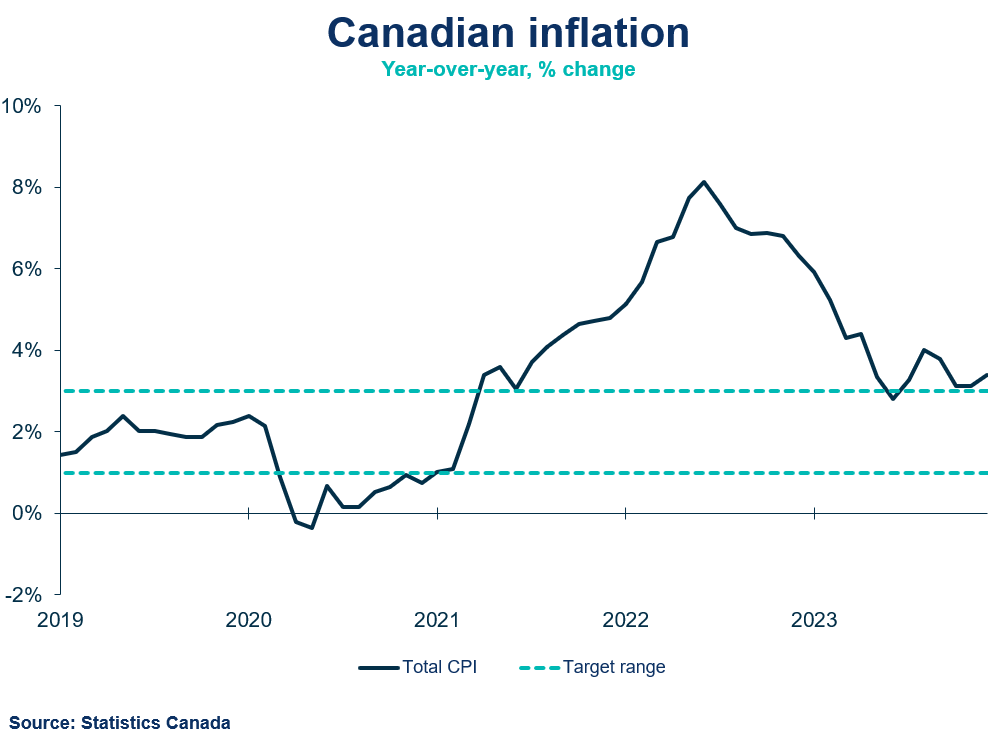

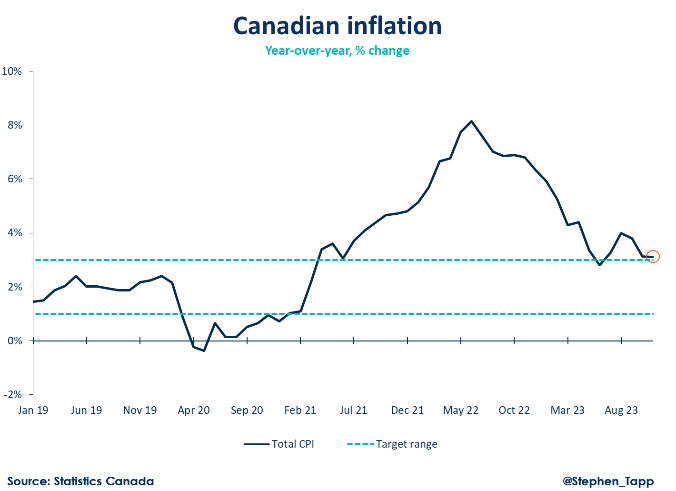

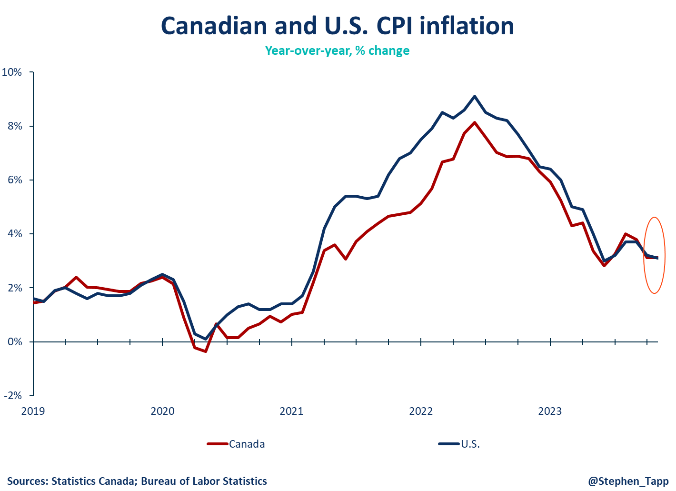

Canada's headline CPI inflation slowed to 2.7% in June, matching market expectations. Although there was progress from May, the annual inflation rate was similar to April.

Andrew DiCapua

I’m not too excited about today’s release, despite growing evidence that the Bank is likely to cut rates next week. We believe they’ll adopt a more cautious approach. Business inflation expectations have fallen within the Bank’s target range, indicating slower and more muted price changes. June’s deceleration was primarily driven by lower transportation costs and subdued energy prices. However, accelerating services inflation poses significant risk to inflation progress. With solid economic growth in the background, waiting until September seems prudent.

Andrew DiCapua, Senior Economist, Canadian Chamber of Commerce

KEY TAKEAWAYS

Headline

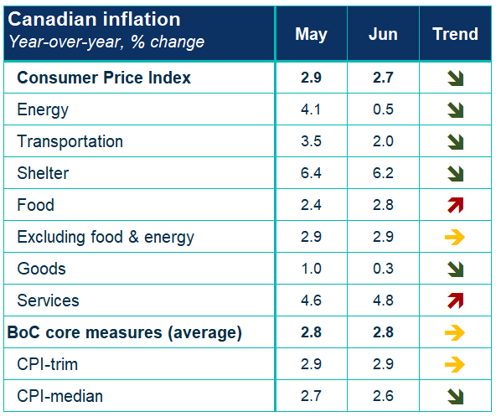

- Canada’s headline CPI inflation decelerated to 2.7% in June, in line with consensus (2.7%) on a year-over-year basis. Despite progress from May, inflation grew similar to April on an annual basis. Monthly seasonally adjusted prices grew a mere 0.1% as prices for travel tours and gasoline decelerated.

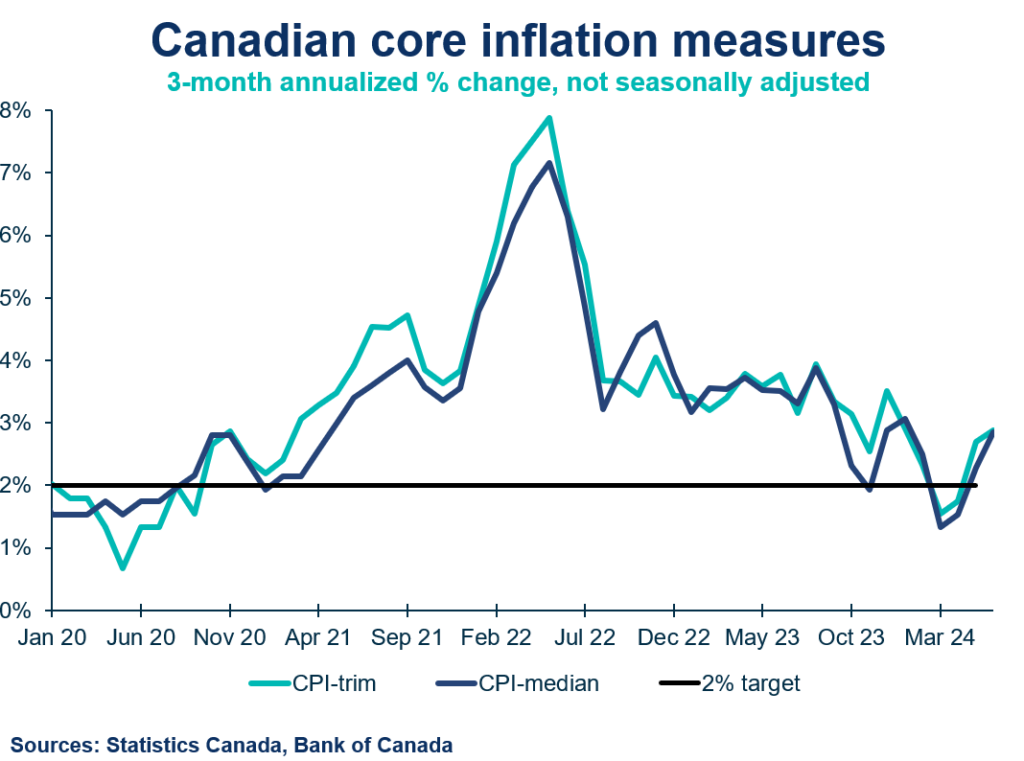

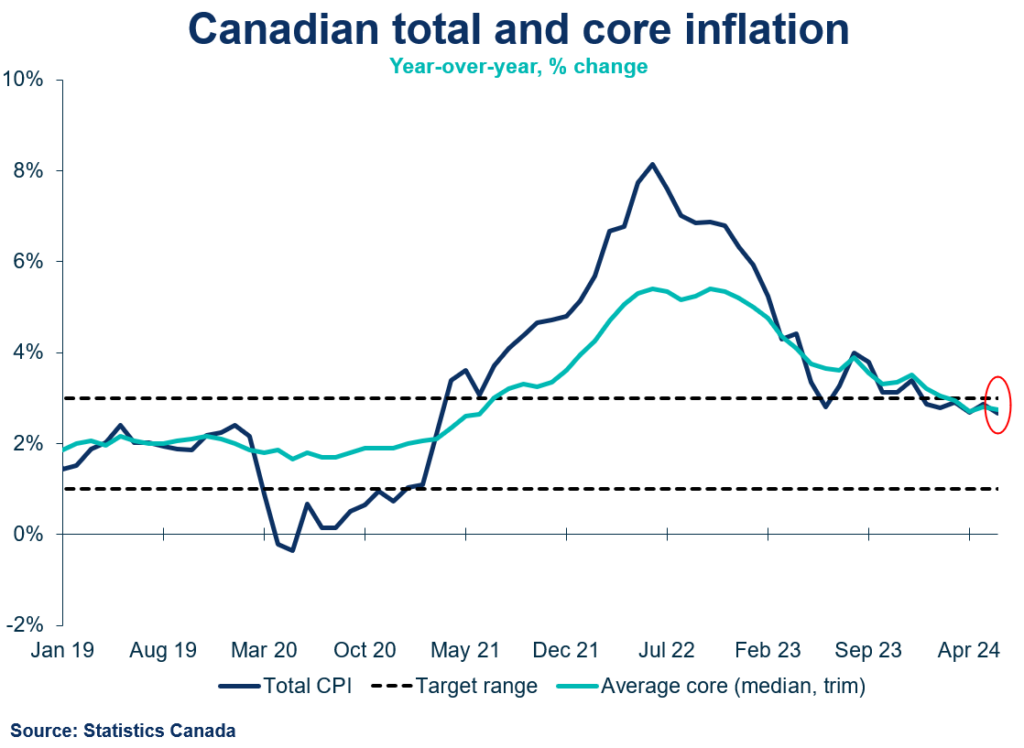

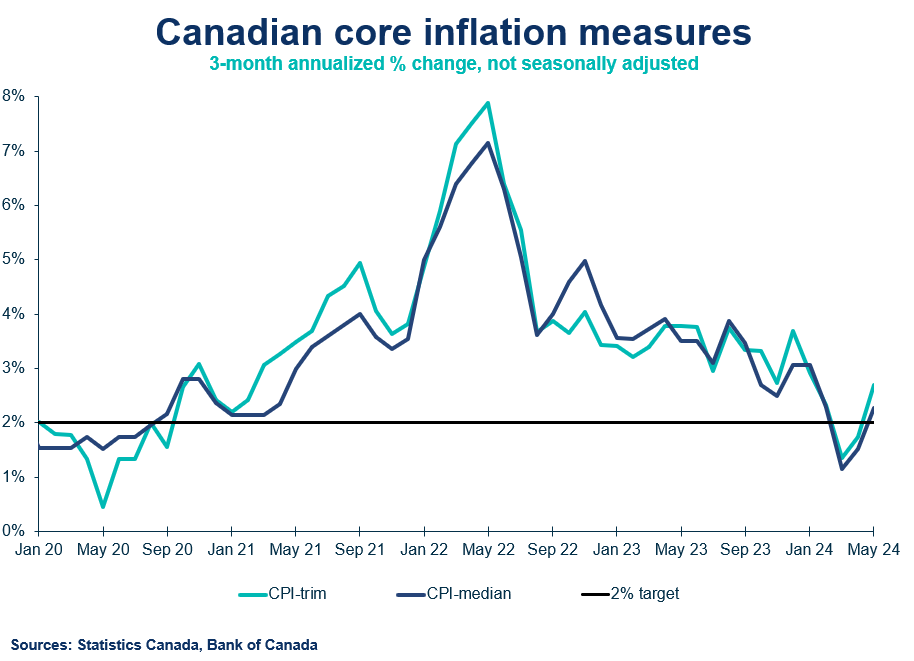

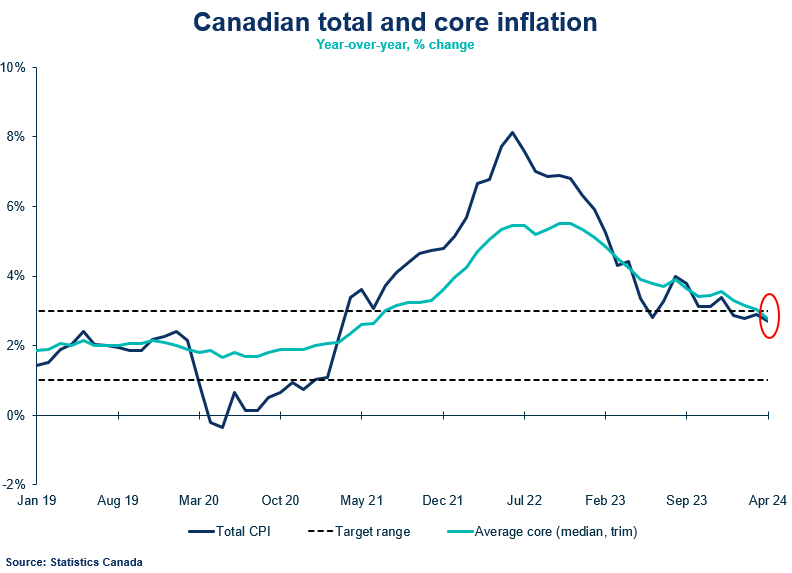

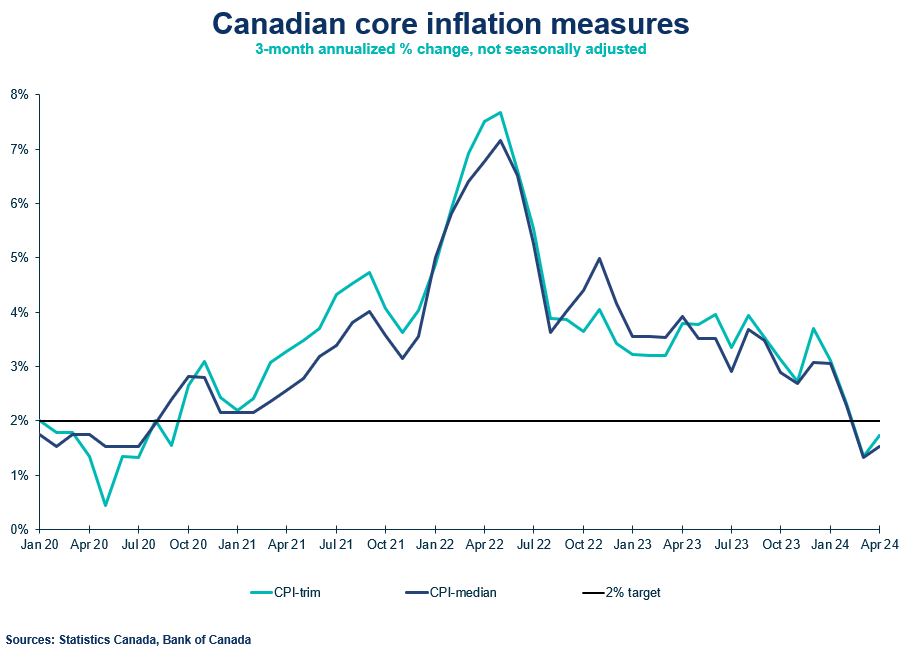

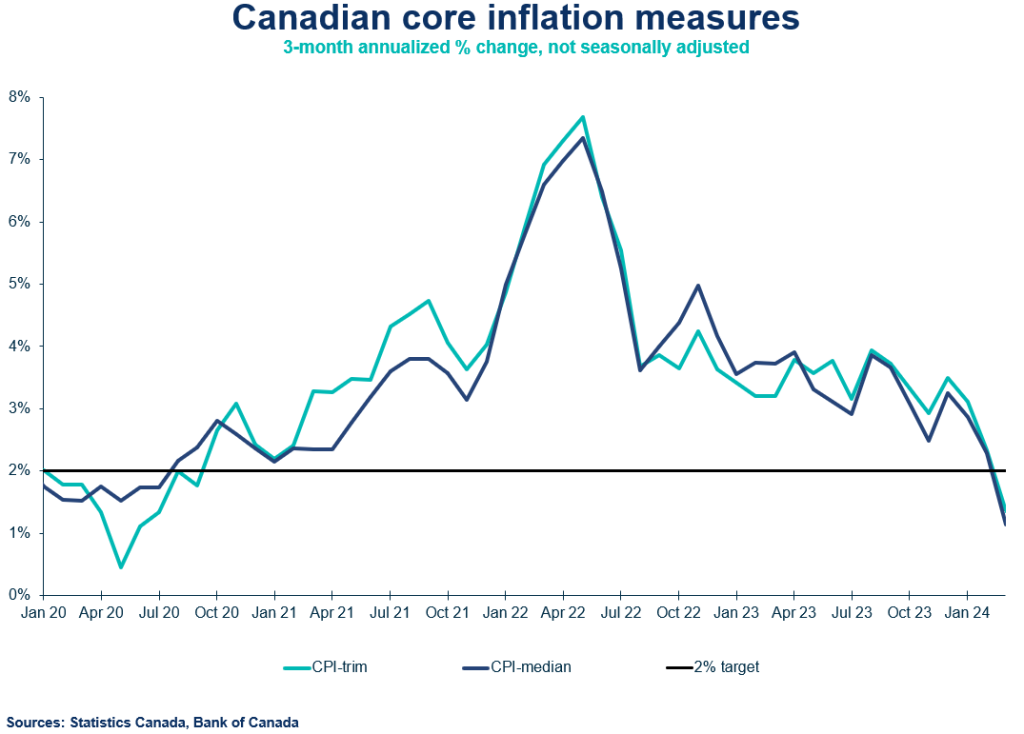

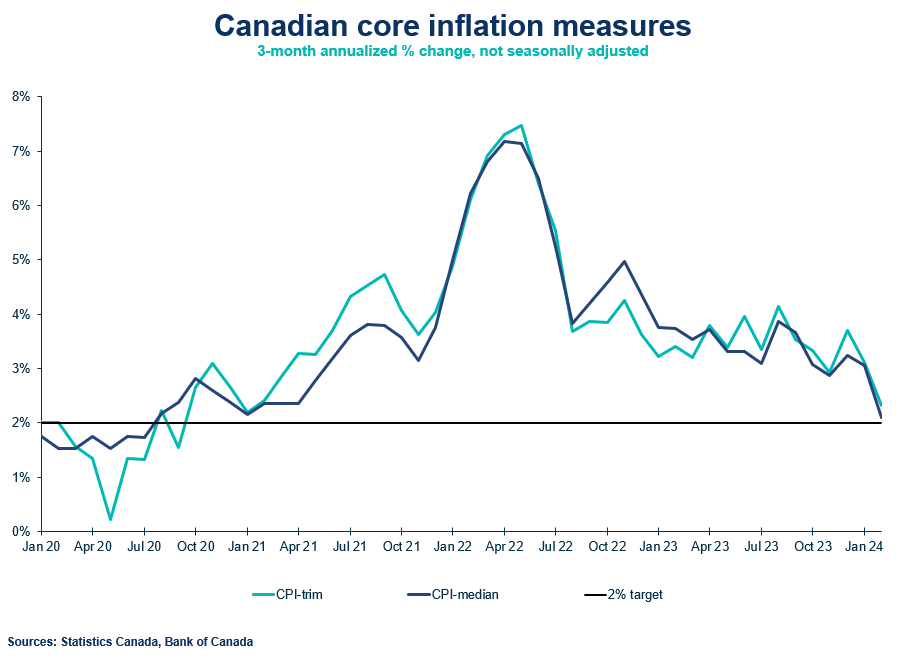

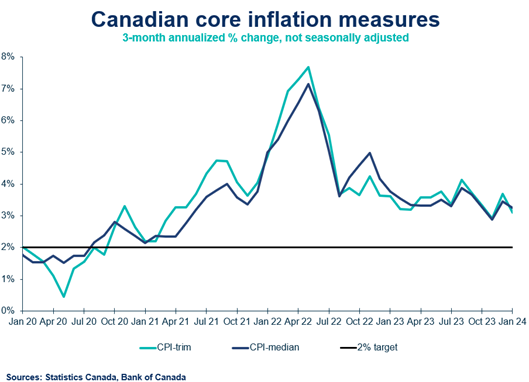

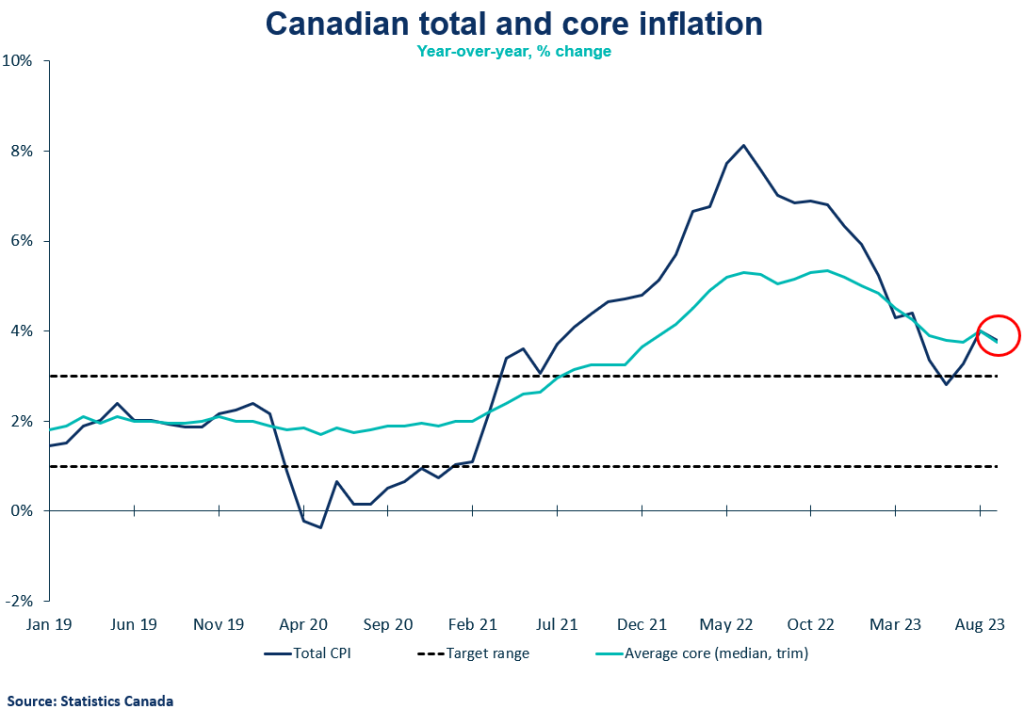

- The Bank of Canada’s core measures (Trim and Median) grew 2.8% year-over-year, consistent with May, marking the fourth consecutive month within the target range. Short-run core measures (3-month change annualized) increased to 2.9%, its strongest reading since January.

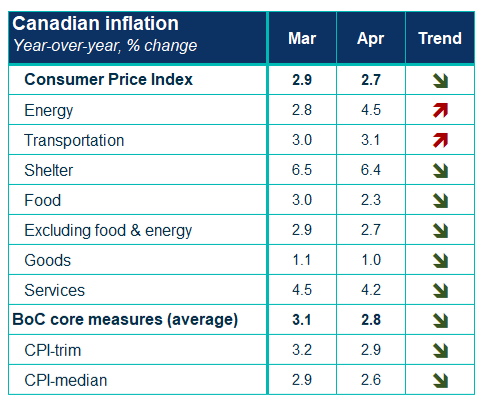

CPI Components

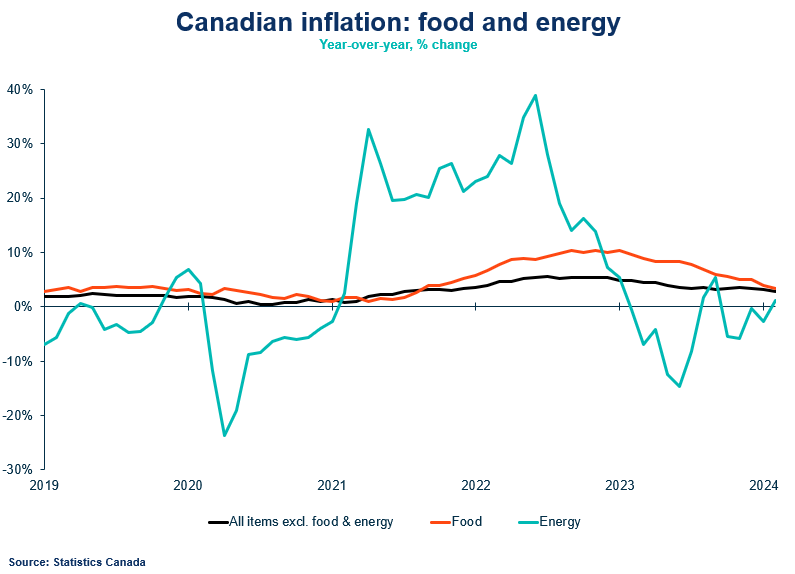

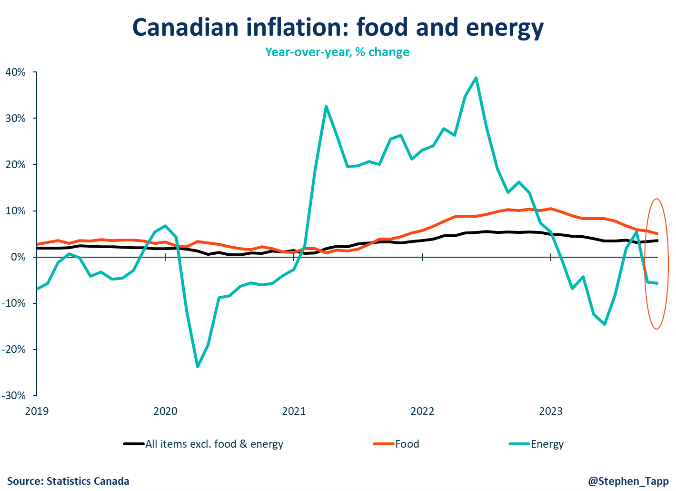

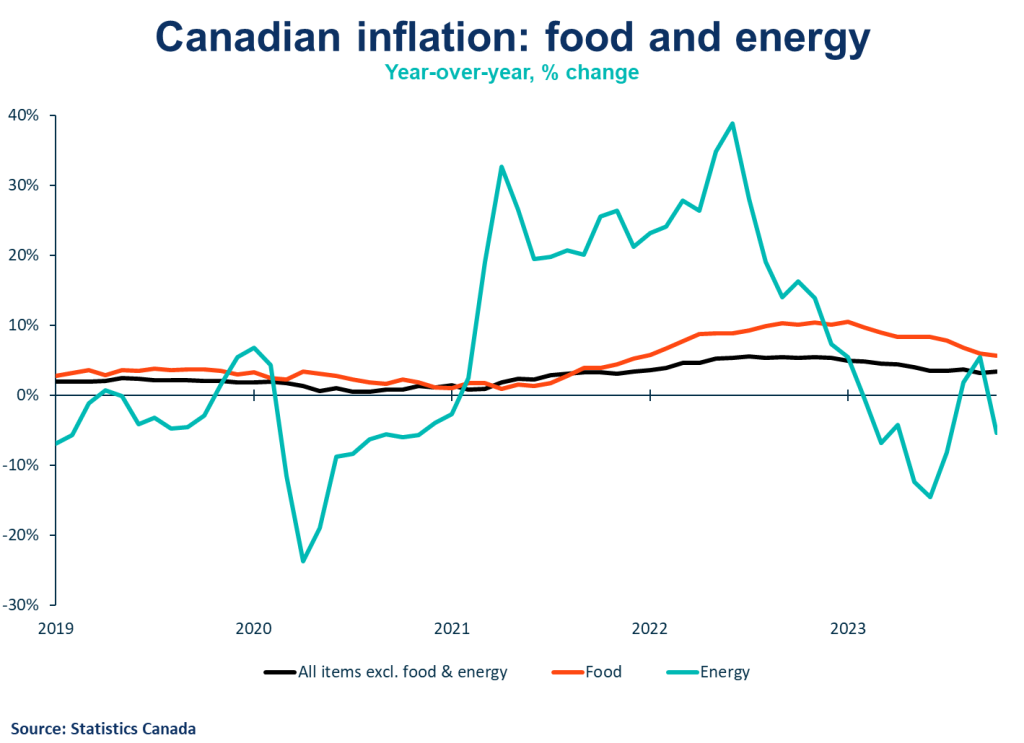

- Energy prices rose annually at a slower pace (+0.5%) compared to May (+4.1%) dragging down headline inflation. Excluding energy, June inflation rose 2.8%.

- Shelter prices decelerated to 6.2%, with rent prices growing 8.8% annually, barely showing progress from May (+8.9%).

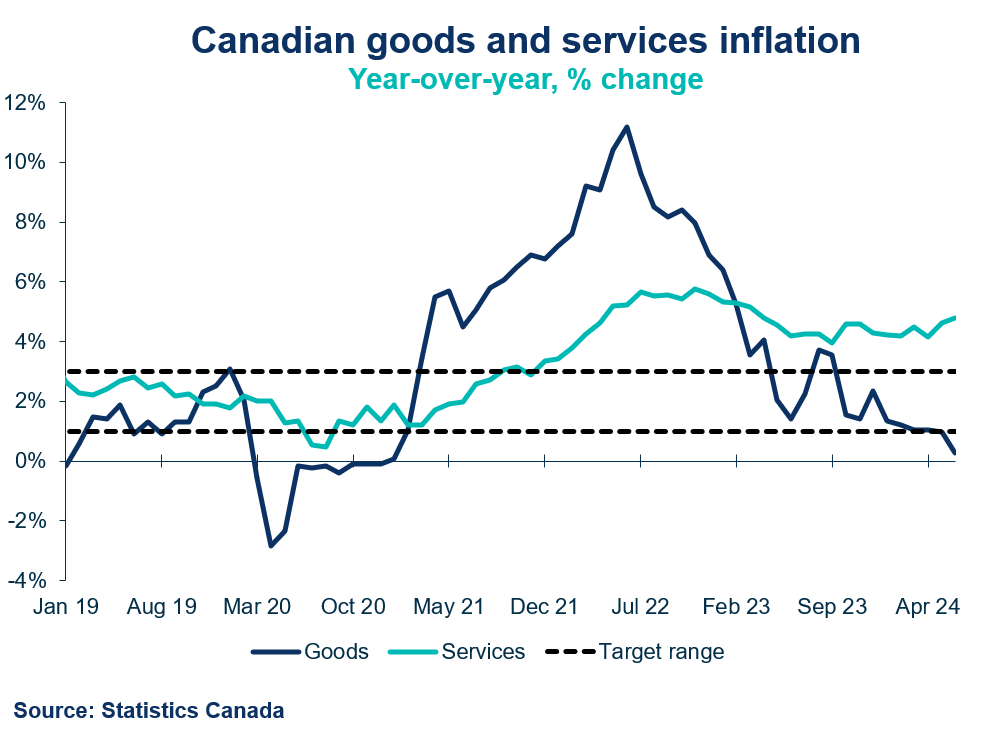

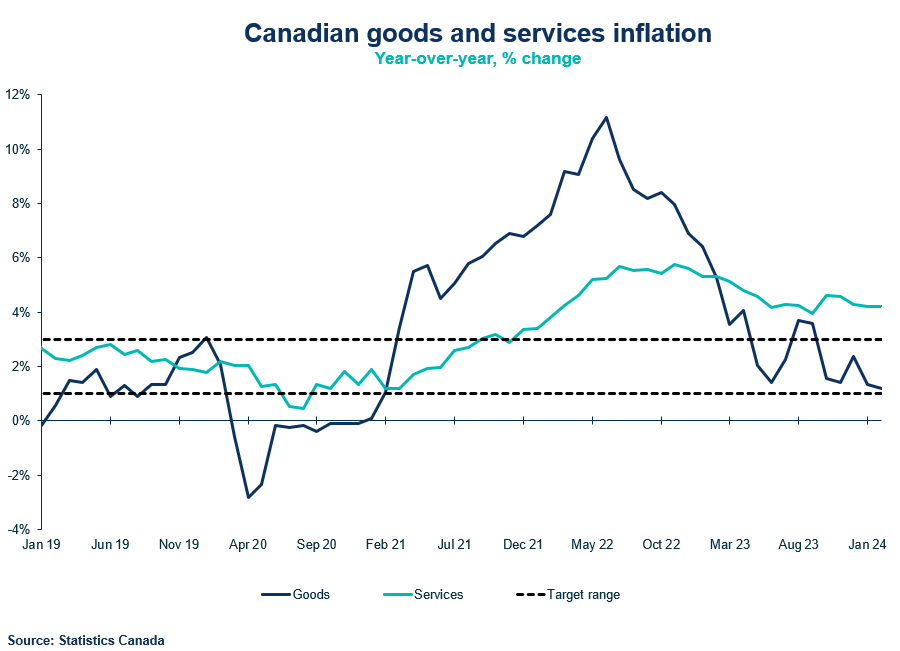

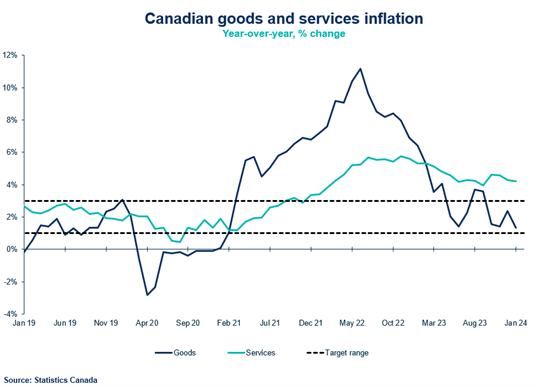

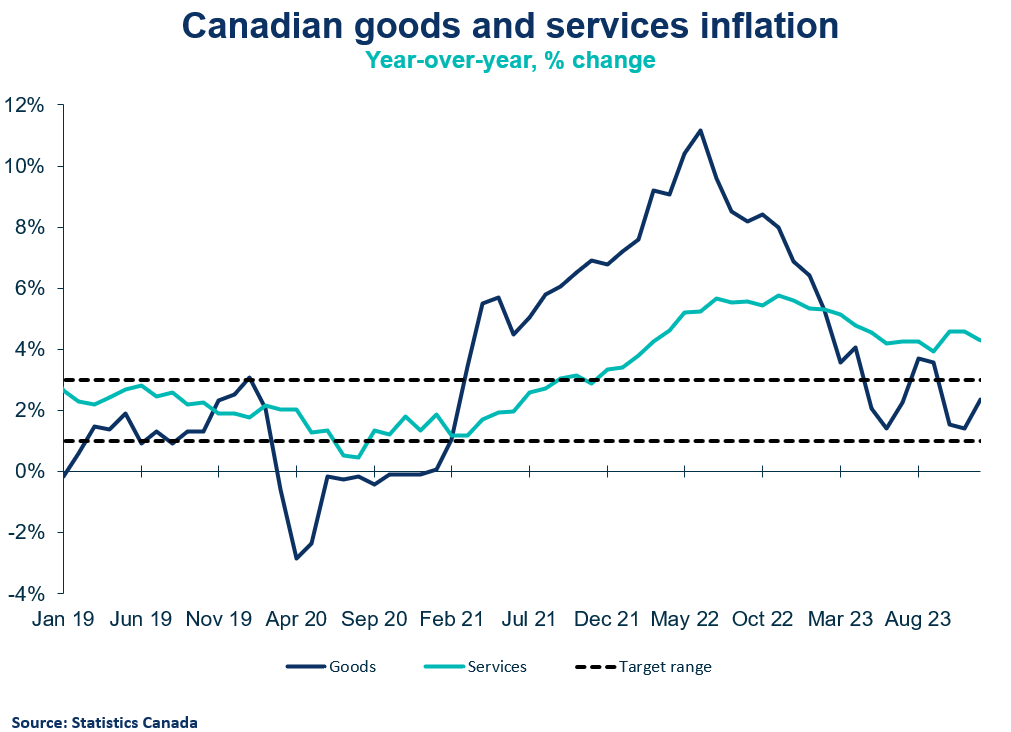

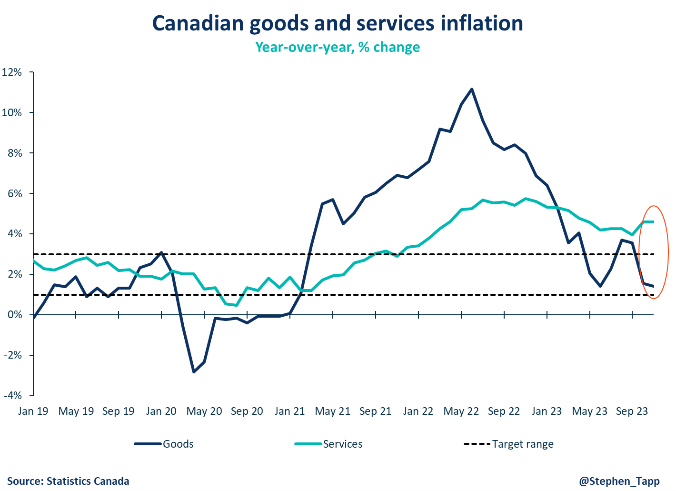

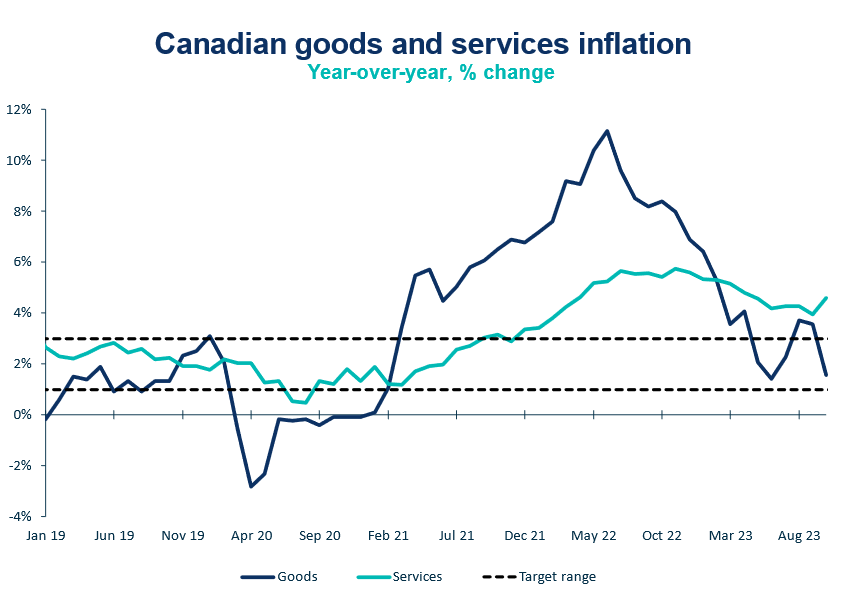

- Goods inflation remains subdued, growing 0.3%, driven down by durable and semi-durable goods. This trend is likely to continue with monthly changes also showing negative growth. Services inflation continues to be stubbornly sticky and reaccelerated to 4.8%. Wage growth reported in the Labour Force Survey (LFS) reaccelerated in June to 5.4% and is likely to keep services inflation higher in the context of a still loosening labour market.

- Food price inflation rose again in June, growing 2.8%. Grocery prices rose 0.8% on a monthly basis, likely due to seasonal price changes. Despite significant progress on food inflation, this momentum is showing a possible upward swing in prices. Restaurant food prices grew 4.3%, holding steady around 4% over the past few months.

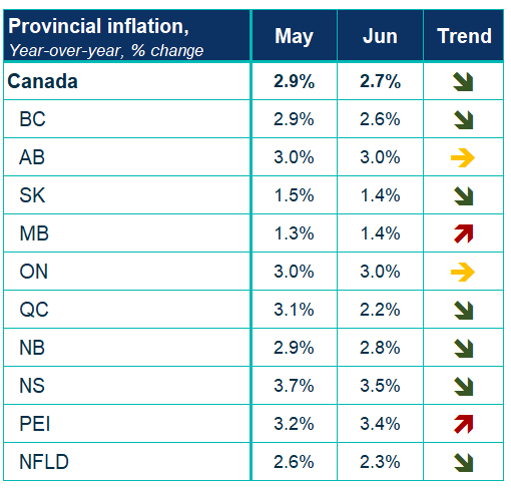

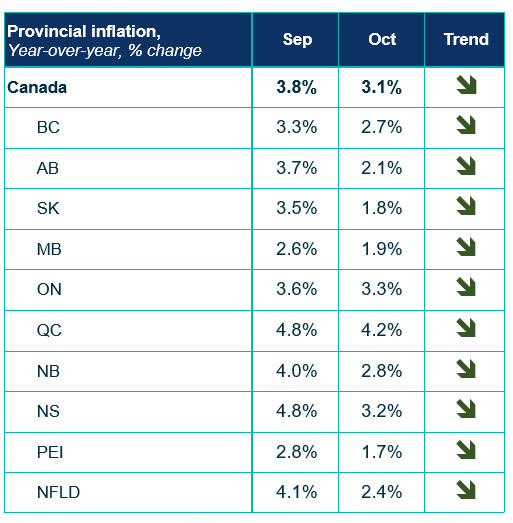

Provincial and regional inflation

- Inflation decelerated in six provinces with Quebec down nearly 1% annually.

SENTIMENT, OUTLOOK AND IMPLICATIONS

- June CPI was better than the inflation forecast in the Bank of Canada’s April Monetary Policy Report, which expected 3% year-over-year growth. The Bank’s Business Outlook Survey released on Monday showed moderating inflation expectations within the target range (1 to 3 percent), and an indication that businesses expect less frequent and muted price changes. With the labour market coming into balance, inflation within range, and recent business surveys showing progress on inflation expectations, the Bank is in a good position. There’s more progress to achieve, especially with wage growth above 5% and services inflation reaccelerating. Despite the fact that Governing Council has leeway to lower the policy rate next week, we still believe that they will take a cautious approach and manage market expectations for further cuts this year.

- Markets have almost solidified expectations of a rate cut in July with the probably increasing from 36% before the announcement to 90%. The strength of the Canadian economy this year including upward revisions to the second quarter provides some risk to the degree of excess supply. With the release of the July Monetary Policy Report alongside next week’s rate decision, the Bank will provide updated guidance on progress and expectations. They have ample evidence to move rates lower at their next meeting, but it’s not a sure thing.

SUMMARY TABLES

CHARTS

Other Commentaries

Oct 19, 2022

September 2022 Consumer Price Index data: Food and services prices still rising, no progress on core inflation

Sep 20, 2022

August 2022 Consumer Price Index data: Finally some good news on Canadian inflation.

Aug 16, 2022

July 2022 Consumer Price Index data: Canada’s inflation finally turns a corner with falling gas prices, but core pressures remain

Commentaries /

May 2024 CPI: Canadians can’t catch a win this week as inflation reverses course in May

May 2024 CPI: Canadians can’t catch a win this week as inflation reverses course in May

Canada’s headline CPI inflation accelerated 2.9% in May, above consensus (2.6%) on a year-over-year basis.

Andrew DiCapua

Not the best news on the Canadian front this morning. Governor Macklem may want to hold off on the soft-landing claim, at least for now as the Bank will likely wait to see how the economy progresses and pause at their next meeting. The increase in services inflation is not helpful, especially as wage growth is elevated. The risk of a strong rebound in the housing market hasn’t materialized yet, but slowing shelter inflation is welcome news. Our consumer spending tracker is showing growth presenting a risk that demand is more robust. Odds of a cut in July are lower and still depend on whether the economy is weaker than the Bank’s recent forecast. Governing Council continues to be heavily data dependent, and this reversal will support their restrictive bias. The Bank will want to take a slow and measured approach, especially with inflation accelerating. This bumpy road on inflation could keep the Bank overly restrictive for the Canadian economy risking any soft-landing.

Andrew DiCapua, Senior Economist, Canadian Chamber of Commerce

KEY TAKEAWAYS

Headline

- Canada’s headline CPI inflation accelerated 2.9% in May, above consensus (2.6%) on a year-over-year basis. Despite headline inflation making considerable progress over the past few months, allowing the Bank to lower their policy rate in June, that progress is paused. On a monthly basis, the seasonally adjusted prices grew 0.3% as prices for travel and tourism accelerate.

- The Bank of Canada’s core measures (Trim and Median) grew 2.9% year-over-year, up from 2.7% in April, marking the third consecutive month within the target range despite moving higher in May. Short-run core measures (3-month change annualized) increased to 2.5%, its strongest reading since February.

CPI Components

- Shelter prices remain high in but levelled off, growing 6.4%, primarily driven by rent prices accelerating 9% in May. Rent is growing the fastest in Ontario as rental supply is insufficient to keep up with rapid population growth.

- Goods inflation has consistently grown by merely 1%, driven down by durable and semi-durable goods. Services inflation accelerated to 4.6% due to higher seasonal prices for travel tours and air transportation. Wage growth reported in the Labour Force Survey (LFS) remains slightly above 5% and is likely to keep services inflation higher in the context of a still loosening labour market.

- Food price inflation rose in May, growing 2.4%. Grocery prices rose on an annual and monthly basis, partly due to seasonal price changes but posted the largest increase since January 2023. Restaurant food prices continue to slow from 4.3% in April to 4.2% in May.

Provincial and Regional Inflation

- Prices accelerated in six provinces.

SENTIMENT, OUTLOOK AND IMPLICATIONS

- May CPI was consistent with the inflation forecast in the Bank of Canada’s April Monetary Policy Report, which expected 2.9% year-over-year growth. Despite the fact that the Bank’s policy remain overly restrictive and risks further weakening the economy, May’s inflation data will continue to give the Bank breathing room. There is more progress to achieve with bringing inflation down, anchoring inflation expectations, and slowing wage growth. Even though Governing Council recognizes that their policy is restrictive, and the economy is in excess supply, the inflation is too high.

- Markets are lessening their expectations of a rate cut in July with the probably decreasing from 60% down to 40%. The strength of the Canadian economy in the second half of this year is still uncertain with population growth expected to slow and mortgage renewals continuing. Unless there are negative surprises in the next few data points for CPI and GDP, the Bank will likely keep rates at current levels in July.

SUMMARY TABLE

CHARTS

Other Commentaries

Oct 19, 2022

September 2022 Consumer Price Index data: Food and services prices still rising, no progress on core inflation

Sep 20, 2022

August 2022 Consumer Price Index data: Finally some good news on Canadian inflation.

Aug 16, 2022

July 2022 Consumer Price Index data: Canada’s inflation finally turns a corner with falling gas prices, but core pressures remain

Commentaries /

April 2024 CPI: What more could the Bank ask for? April inflation slows, positioning a June rate cut

April 2024 CPI: What more could the Bank ask for? April inflation slows, positioning a June rate cut

In April, inflation grew by 2.7%, aligning with consensus expectations, increasing the likelihood of a rate cut in June.

Andrew DiCapua

The Bank of Canada should now be confident that inflation is sustainably within the target range. In April, inflation grew by 2.7%, aligning with consensus expectations, increasing the likelihood of a rate cut in June. While inflation is heading in the right direction supported by a strong labour market, our spending tracker shows reduced spending growth in April. Combined with weaker population growth and mortgage renewals ahead, the Canadian economy’s fragility will become more evident. Although rising gasoline prices and high shelter costs continue to exert price pressures, they are less of a risk. Core inflation measures, averaging 2.8%, suggest that broad-based inflation is easing. A rate cut in June is not just possible; it’s becoming the main consideration. The Bank should move in June as the conditions are met to achieve the so-called “soft-landing”.

Andrew DiCapua, Senior Economist, Canadian Chamber of Commerce

KEY TAKEAWAYS

Headline

- Canada’s headline CPI inflation grew 2.7% in April, in line with consensus on a year-over-year basis. Despite headline inflation hovering around 3% for the past few months, supported by gasoline and shelter price pressures, inflation is trending lower. On a monthly basis, the seasonally adjusted prices grew 0.2%.

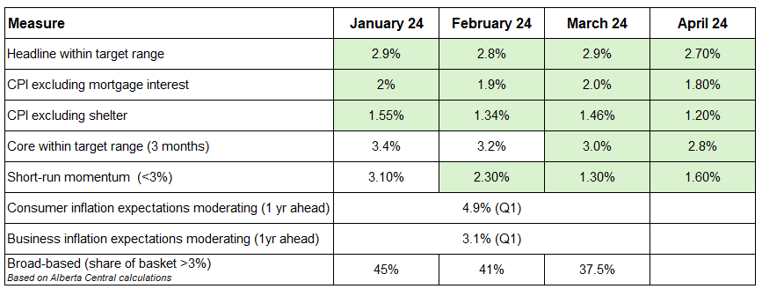

- The Bank of Canada’s core measures (Trim and Median) grew 2.8% year-over-year, down from 3% in March, marking the second consecutive month with core measures within the target range. Short-run core measures (3-month change annualized) are steadily below 2%, running at 1.6%.

CPI Components

- Shelter prices remain high in April, growing 6.4%, down from 6.5% in March, primarily driven by rent, growing nearly 8% in April on a yearly basis.

- Gasoline prices were up 6.1% on a yearly basis following 4.5% growth in March. Prices grew due to increases in the carbon levy and supply concerns. Further upside growth in gasoline prices is muted so far in May.

- Goods inflation slowed in April, growing 1%, which has remained subdued with durable and semi-durable goods continuing mildly negative annual growth. Services inflation also moderated, now growing 4.1%. Wage growth reported in the Labour Force Survey is also trending lower at 4.8%.

- Food prices made great progress in April, growing 2.3% in April. Grocery prices decelerated to 1.4%. Restaurant food prices remain higher, but slowed to 4.3% in April, from 5.1%.

Provincial and Regional Inflation

In April, prices rose at a slower pace in six provinces, and are only slightly above the Bank of Canada’s inflation control band in on province (Nova Scotia at 3.1%).

SENTIMENT, OUTLOOK AND IMPLICATIONS

- April CPI was below the inflation forecast in the Bank of Canada’s April Monetary Policy Report, which expected 2.9% year-over-year growth. The Bank is positioned to still achieve a “soft landing”. What more can they ask for? The labour market remains healthy with the economy adding 90k jobs in April. Wage growth continues to slow, now growing below 5%. Business and consumer surveys showed moderating pricing expectations.

- The risks associated with delaying rate cuts are growing too high and almost guarantee a move by July. The Canadian economy started the year on strong footing, but even the Bank doesn’t expect this to last with population growth slowing and upcoming mortgage renewals to put additional pressure on households. With inflation now comfortably below 3% and broad-based decelerating within the target range for a few months, the Bank can move at their next meeting in June. It’s not only prudent, but the various conditions are now met (see table below).

SUMMARY TABLES

Sources: Statistics Canada; Bank of Canada; Canadian Chamber of Commerce Business Data Lab.

SUMMARY CHARTS

Other Commentaries

Oct 19, 2022

September 2022 Consumer Price Index data: Food and services prices still rising, no progress on core inflation

Sep 20, 2022

August 2022 Consumer Price Index data: Finally some good news on Canadian inflation.

Aug 16, 2022

July 2022 Consumer Price Index data: Canada’s inflation finally turns a corner with falling gas prices, but core pressures remain

Commentaries /

March 2024 CPI: Two months down, one more to go

March 2024 CPI: Two months down, one more to go

Our Senior Economist Andrew DiCapua shares his key takeaways from today's Consumer Price Index (CPI) release.

Business Data Lab

We’re almost there, with just one more step to go. We’ve reached another key milestone ahead of the Bank of Canada’s important meeting in June. Both the headline and core inflation measures are now within the Bank’s target range, with headline inflation stable for three months and core inflation trending downward. This was expected by markets, but was slightly weaker than the Bank’s projections from their April forecast. The ongoing price pressures are mainly due to rising gasoline prices in March and high shelter costs. Short-run core inflation is now below two percent. Despite a minor increase in the main inflation rate, there is increasing evidence that inflation is trending downward. Assuming no major surprises from the federal budget or economic data, this month adds more evidence for the Bank of Canada to consider its first rate cut at the June meeting.

Andrew DiCapua, Senior Economist, Canadian Chamber of Commerce

KEY TAKEAWAYS

Headline

- Canada’s headline CPI inflation grew 2.9% in March (in line with consensus) on a year-over-year basis. Despite the uptick from 2.8% in February, March CPI is being held higher by gasoline, shelter, and services price pressures. CPI excluding energy grew 2.8%. On a monthly basis, the seasonally adjusted prices grew 0.3%. The silver lining is that headline and core inflation are within Bank of Canada’s target range of 1-3%.

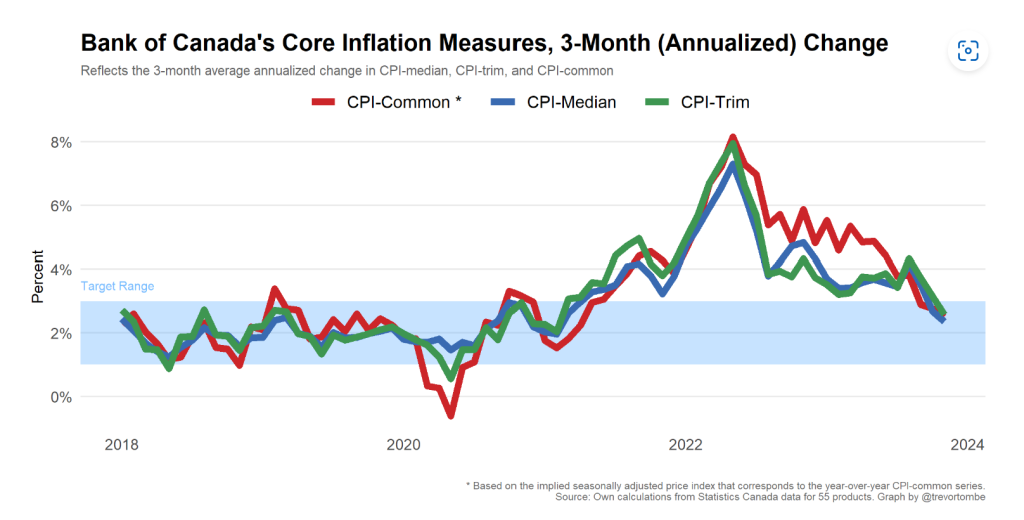

- The Bank of Canada’s core measures of underlying inflation grew 3% year-over-year, down from 3.1% in January, marking the third consecutive monthly deceleration in core measures. The short-run core measures (3-month change annualized) are running at a pace of 1.3%.

CPI Components

- Shelter prices remain high in March, growing 6.5%, primarily driven by rent continuing its acceleration, growing 8.6% in March on a yearly basis.

- Gasoline prices were up 4.5% on a yearly basis after softer growth in February. Despite higher prices due to geopolitical conflicts and voluntary production cuts from producers, elevated prices a year ago should help keep any upside surprises on gasoline inflation muted.

- Goods inflation slowed in February, growing 1.1%, which has remained subdued for many months with durable and semi-durable goods showing negative annual growth. Services inflation is supporting higher inflation growth, reaccelerating to 4.5% in March, from 4.2% in February.

- Food prices grew at their slowest pace since August 2021, rising 3% in March. Grocery prices decelerated to 1.9%. Restaurant food prices remain elevated, growing 5.1% in March, at a similar pace to last month.

Provincial and regional inflation

Prices accelerated in seven provinces, led by Quebec prices growing 3.6%.

SENTIMENT, OUTLOOK AND IMPLICATIONS

- March CPI was below the inflation forecast in the Bank of Canada’s April Monetary Policy Report, which expected 3.03% year-over-year growth in March. The Bank remains concerned with the broad-based price pressures above 3%, and in particular stickiness on the services side of the economy.

- Nonetheless, one more inflation report is left before the Bank’s consequential June meeting. Absent of any resurgence in economic activity or short-term stimulus measures in the Federal budget, the Bank should be in a good place to begin easing policy and lowering their policy rate in June.

SUMMARY TABLE

FISCAL CHARTS

Other Commentaries

Oct 19, 2022

September 2022 Consumer Price Index data: Food and services prices still rising, no progress on core inflation

Sep 20, 2022

August 2022 Consumer Price Index data: Finally some good news on Canadian inflation.

Aug 16, 2022

July 2022 Consumer Price Index data: Canada’s inflation finally turns a corner with falling gas prices, but core pressures remain

Commentaries /

February 2024 CPI: The Bank of Canada will crack a smile with more good news on inflation

February 2024 CPI: The Bank of Canada will crack a smile with more good news on inflation

Canada’s headline CPI inflation grew 2.8% in February. What does it mean for the economy?

Andrew DiCapua

It’s great to see headline inflation move further within the target range, and core inflation continuing its downward trend. We could see that the market was expecting a slightly higher inflation print, due to gasoline prices rising in February, but grocery store prices have slowed, and short-run core momentum measures are tracking around two percent. That’s going to be welcome news for households.

Governor Macklem will also take this as good news – and a signal that our current holding pattern is working. But we shouldn’t expect any moves from the Bank until June. With two more inflation updates, updated surveys on expectations, and a Federal budget, the Bank will want to see the data and build a case for any changes before they present anything to Canadians.

Andrew DiCapua, Senior Economist, Canadian Chamber of Commerce

KEY TAKEAWAYS

Headline

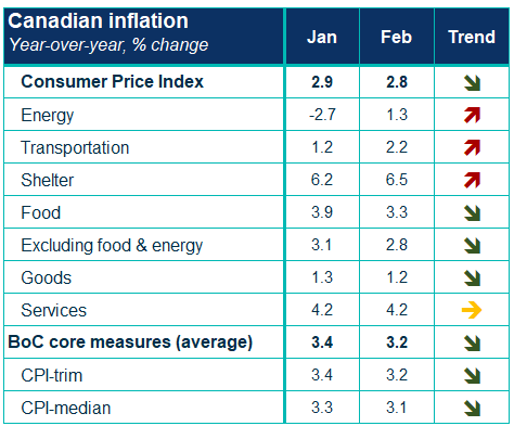

- Canada’s headline CPI inflation grew 2.8% in February (below the consensus of 3.1%) on a year-over-year basis. Two months of slower price growth is surely welcome news to the Bank of Canada, despite stubborn shelter costs and volatile gasoline prices keeping headline inflation higher. CPI excluding food and energy grew 2.8%. Headline inflation moved closer within the Bank of Canada’s target range of 1-3%. On a monthly basis, the unadjusted CPI grew 0.3%.

- The Bank of Canada’s core measures of underlying inflation grew 3.2% year-over-year, down from 3.4% in January. The 3-month change annualized is running at a pace of 2.2%.

CPI Components

- Shelter prices remain high in February, growing 6.5% and continuing its reacceleration, primarily driven by rent once again growing (+8.2%).

- Gasoline prices were up 0.8% on a yearly basis after a decline in January. Prices are on the upswing, with monthly prices growing 4% m/m.

- Goods inflation slowed in February, growing 1.2%, which has remained subdued for many months. Services inflation is much higher and grew 4.2% in February, holding from the same growth rate in January.

- Food prices made further progress in February, declining to 3.3% in February. Grocery prices decelerated to 2.4% growth, from 3.4% in January. This was the first time since October 2021 where grocery prices have undershot headline inflation. Restaurant food prices remain elevated, growing 5.1% in February, at a similar pace to last month.

- Odds and ends: Clothing and footwear was down 4.2% and household operations declined 1.7%, driven primarily by lower cell phone plan prices (-26.5%).

Provincial and regional inflation

Prices decelerated in seven provinces, which continues January broad-based price easing. Though more volatile prices are expected in Alberta with energy prices.

SENTIMENT, OUTLOOK AND IMPLICATIONS

- February CPI was below the inflation forecast in the Bank of Canada’s January Monetary Policy Report, which expected 3.3% year-over-year growth in February, and averaging 3% yearly growth till June. The Bank remains concerned with the broad-based price pressures above 3%, and in particular stickiness on the services side of the economy.

- Despite the positive surprise in February’s print, there is no rush to move, and the Bank will want to communicate their updated position at their April meeting. This tees up June for a cut, where we’ll have two more inflation reports to evaluate.

- The Bank will pay attention to two key April releases. New Business Outlook Survey and Canadian Survey on Consumer Expectations data on April 1 will show updated business and household inflation expectations. The Federal budget, which is expected on April 16, will be important to evaluate any new program spending that could impede progress on returning to target.

SUMMARY TABLE

CHARTS

Other Commentaries

Oct 19, 2022

September 2022 Consumer Price Index data: Food and services prices still rising, no progress on core inflation

Sep 20, 2022

August 2022 Consumer Price Index data: Finally some good news on Canadian inflation.

Aug 16, 2022

July 2022 Consumer Price Index data: Canada’s inflation finally turns a corner with falling gas prices, but core pressures remain

Commentaries /

CPI January 2024: Some good news on inflation, but too early to celebrate.

CPI January 2024: Some good news on inflation, but too early to celebrate.

Canada’s headline CPI inflation grew 2.9% in January (below the consensus of 3.3%) on a year-over-year basis.

Andrew DiCapua

Inflation is now in the target range, which is good news for the Bank of Canada. But the Bank is also acutely aware of the stickiness of core measures and the impact elevated shelter prices. That’s why they will likely keep their policy stable until price pressures abate enough to account for those large contributions that shelter prices are having – and will continue to have – moving forward. All this is making the return to target more difficult. But should the economy and labour market remain buoyant, timing is surely in the Bank’s favour.

Andrew DiCapua, Senior Economist, Canadian Chamber of Commerce

KEY TAKEAWAYS

Headline

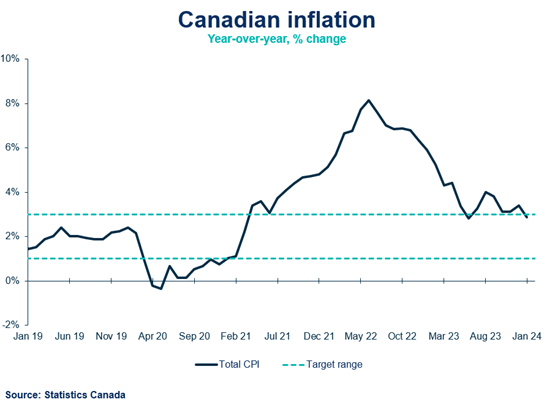

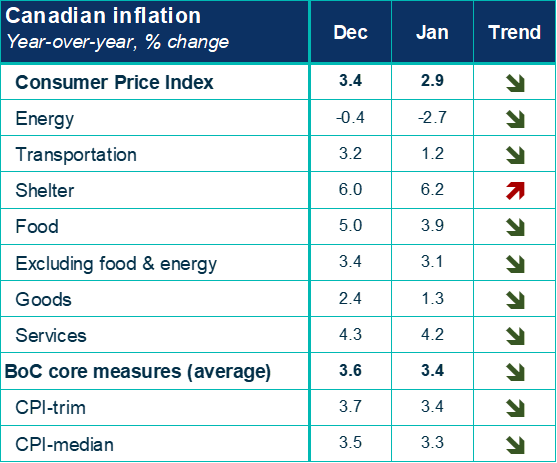

- Canada’s headline CPI inflation grew 2.9% in January (below the consensus of 3.3%) on a year-over-year basis. The first inflation print of the year is welcome news and aided by lower gasoline prices last year. Headline inflation is now within the Bank of Canada’s target range of 1-3% for the first time since last June. On a monthly basis, the unadjusted CPI was unchanged.

- The Bank of Canada’s core measures of underlying inflation grew 3.4% year-over-year, down from 3.7% in December. The 3-month change annualized for core measures is running at a pace of 3.2%.

CPI Components

- Shelter prices remain high with prices in January increasing 6.2%, primarily driven by rent once again growing (+7.9%).

- Gasoline prices were down 4% on a yearly basis, which helped bring down the energy component of CPI to -2.7% in January.

- Goods inflation continues to slow, growing 1.3% in January, coming from a stronger 2.4% growth in December. Services inflation is much higher and grew 4.2% in January, down slightly from 4.3% in December.

- Food prices made further progress, declining to 3.9% in January. Grocery prices decelerated to 3.4% growth, from 4.6% in December. Restaurant food prices remain elevated, growing 5.1% in January, down from 5.6% in December.

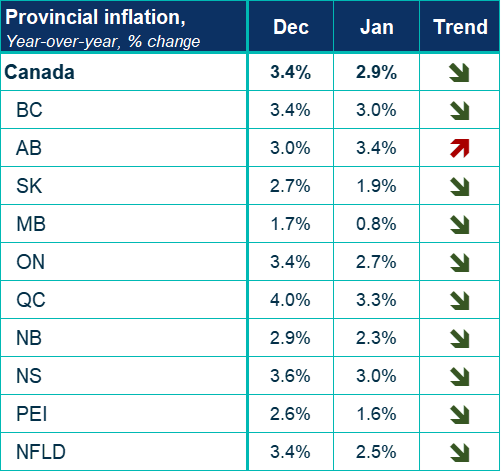

Provincial and Regional Inflation

- Prices decelerated in all parts of the country, except for Alberta, which saw inflation accelerate from 3% to 3.4%.

SENTIMENT, OUTLOOK AND IMPLICATIONS

Bank of Canada

- January CPI data was roughly in line with the Bank of Canada’s Monetary Policy Report, published at their January decision meeting. The Bank was forecasting 3% year-over-year growth in January, reaching 3.3% by March 2024.

- Considering the Bank’s forecast for inflation was in line with January’s print, we don’t expect a rate move at their March meeting. February inflation won’t be available before the Bank’s March meeting, and they’ll need to see three solid months of progress to feel confident with the trend. We continue to expect the Bank to consider a rate cut in the spring, at the earliest.

SUMMARY TABLES

Sources: Statistics Canada; Bank of Canada; Canadian Chamber of Commerce Business Data Lab.

CHARTS

Other Commentaries

Oct 19, 2022

September 2022 Consumer Price Index data: Food and services prices still rising, no progress on core inflation

Sep 20, 2022

August 2022 Consumer Price Index data: Finally some good news on Canadian inflation.

Aug 16, 2022

July 2022 Consumer Price Index data: Canada’s inflation finally turns a corner with falling gas prices, but core pressures remain

Commentaries /

CPI December 2023: Hovering above target, the new year will bring the same challenges in the battle against inflation

CPI December 2023: Hovering above target, the new year will bring the same challenges in the battle against inflation

Our Senior Economist Andrew DiCapua analyzes the key takeaways of the Consumer Price Index (CPI) report for December 2023.

Andrew DiCapua

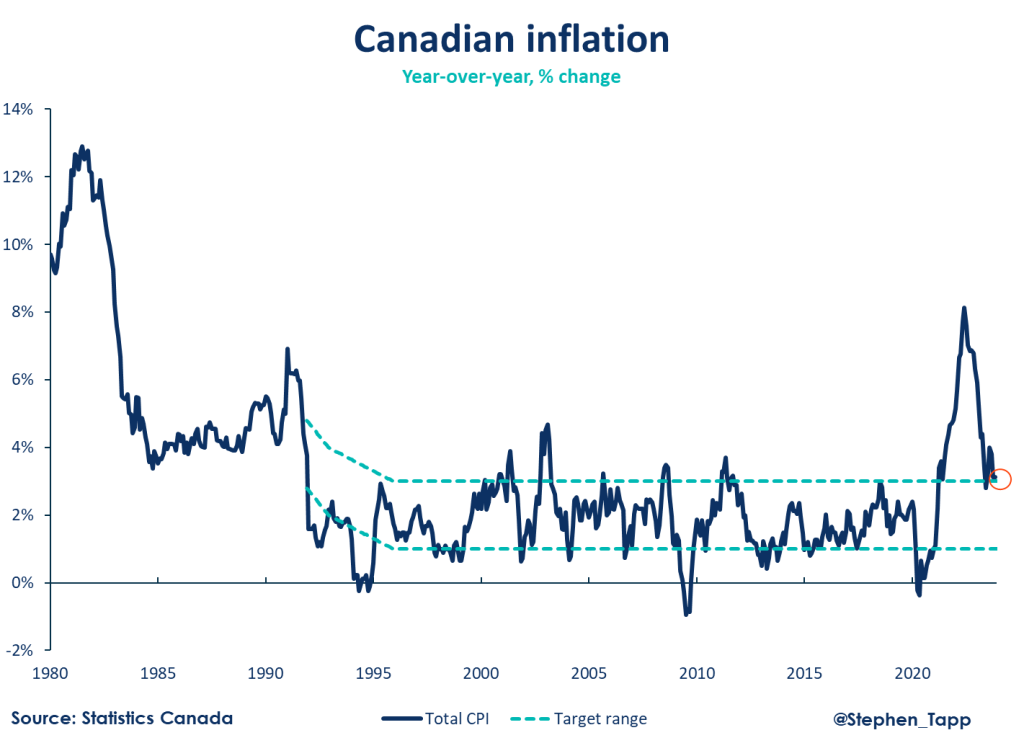

If we’ve learned anything over the past few months, it’s that the last mile of the race against inflation is the hardest and the longest. December marked the second consecutive month where inflation moved in the wrong direction, with essential components like food and shelter still above 5%.

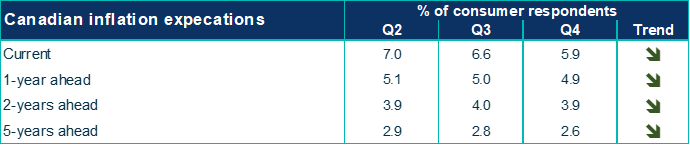

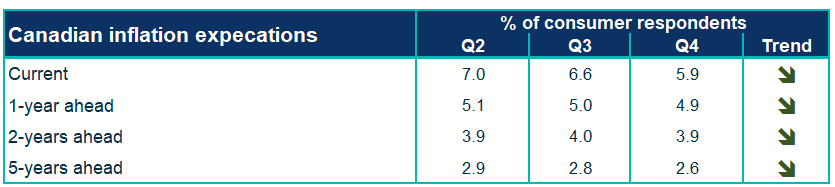

In the Bank of Canada’s fourth quarter consumer and business surveys, one-year inflation expectations remain too high with consumers still believing inflation will be more than double target. Despite progress, unanchored inflation expectations will take time to adjust, keeping the Bank in a tough position in the start of 2024. Long story short – even if the hard data show progress, the Bank will have to battle the perception of inflation at risk of tilting the economy into recession.

Andrew DiCapua, Senior Economist, Canadian Chamber of Commerce

KEY TAKEAWAYS

Headline

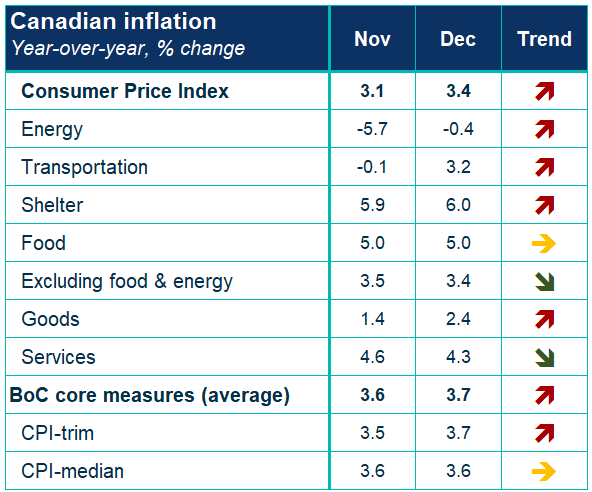

- Canada’s headline CPI inflation grew 3.4% in December (in line with the consensus of 3.4%) on a year-over-year basis. Despite being partly attributed to base effects due to lower gasoline prices last year, inflation remains above target. On a monthly basis, the unadjusted CPI declined 0.3%.

- The Bank of Canada’s core measures of underlying inflation accelerated 0.4% month-over-month, with an average of two core indicators growing at 3.7% year-over-year, up from 3.6% in November.

- Annual CPI for 2023 grew 3.9%, down from the peak 6.8% in 2022.

CPI Components

- Transportation costs led the increase in inflation, shifting from negative growth to 3.2% year-over-year, led by a 31% jump in air transportation prices.

- Gasoline prices were higher again on a yearly basis, growing by 1.4%. Following a 7.7% decline in prices in November, base effects reversed this month. Excluding food and energy, prices rose 3.4%.

- Following three months of slower goods inflation, December rose to 2.4%. Services inflation declined to 4.3% growth, down from 4.6% in November. Passenger vehicles rose 2.3% as new 2024 models come onto the market.

- As the housing market continues to moderate, shelter prices remain high with prices in December holding steady at 6% for the fifth consecutive month, primarily driven by the rent price index (+7.7%), and further indicating affordability pressures.

- Overall food prices remained steady around 5% growth. Grocery prices declined slightly to 4.6% growth, from 4.7% in November. That said, restaurant food prices continue to grow (+5.6%) and are an ongoing challenge for households.

Provincial and regional inflation

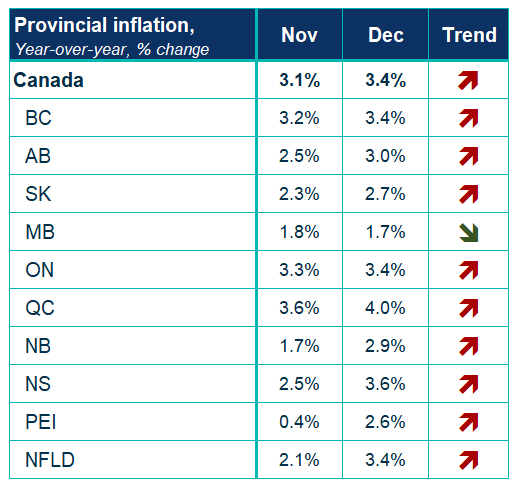

- Prices increased in all parts of the country, except for Manitoba, which saw inflation marginally decelerate.

SENTIMENT, OUTLOOK AND IMPLICATIONS

Bank of Canada

- The Bank of Canada’s closely-watched three-month moving average of core inflation measures accelerated from 2.9% to 3.6%.

- Markets fully expect the Bank of Canada to hold rates on January 24. With the release of their Monetary Policy Report at the next announcement, more insight on how they see the Canadian economy evolving will provide their perspective into how they see inflation evolving in 2024. All told, we do not interest rate cuts to start in the first quarter of 2024.

Inflation expectations

- December’s CPI data, along with the Bank of Canada’s Q4 Business Outlook Survey and Canadian Survey on Consumer Expectations suggestthat inflation expectations are moving in the right direction, but remain too high for the Bank’s comfort. The disconnect between prices expected between businesses and consumers continues, with the latter still expecting one-year ahead inflation to remain near 5%. This will need to markedly come down for the Bank to consider their mission accomplished.

SUMMARY TABLES

CHARTS

Other Commentaries

Oct 19, 2022

September 2022 Consumer Price Index data: Food and services prices still rising, no progress on core inflation

Sep 20, 2022

August 2022 Consumer Price Index data: Finally some good news on Canadian inflation.

Aug 16, 2022

July 2022 Consumer Price Index data: Canada’s inflation finally turns a corner with falling gas prices, but core pressures remain

Commentaries /

November 2023 CPI: Too early to declare victory over inflation as we remain above the target band

November 2023 CPI: Too early to declare victory over inflation as we remain above the target band

Headline inflation in Canada was unchanged in November, staying at 3.1%, which was higher than the market was expecting (2.9%) and still remains slightly above the top of the Bank of Canada’s inflation control target band.

Marwa Abdou

Headline inflation in Canada was unchanged in November, staying at 3.1%, which was higher than the market was expecting (2.9%) and still remains slightly above the top of the Bank of Canada’s inflation control target band.

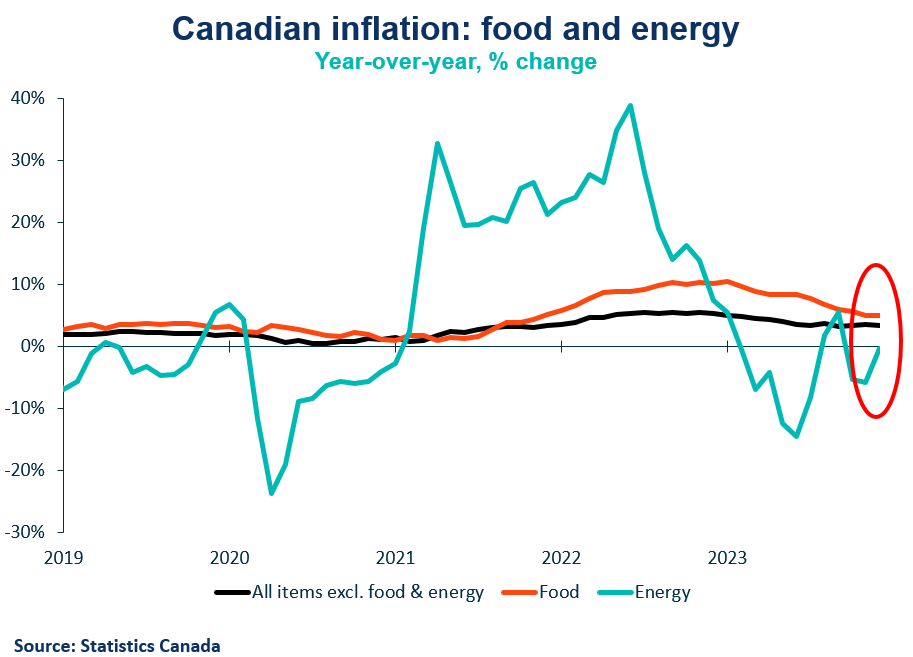

While this was not the Christmas present that the market or the BoC was expecting, if you dig beneath the headline annual numbers, there has been some underlying progress on core inflation in recent months; the three-month moving average of the Bank’s preferred core measures fell from 2.9% to 2.5% in November, as food price inflation thankfully continues to decelerate.

That said, rising rents and elevated wage pressure remain problematic. Given the more optimistic outlook south of the border, we expect the U.S. Federal Reserve to start the easing cycle in 2024 while the Bank of Canada, and most other central banks, sit back, hold the line and nervously wait for more durable progress on the inflation front.

Marwa Abdou, Senior Research Director, Canadian Chamber of Commerce

KEY TAKEAWAYS

Headline

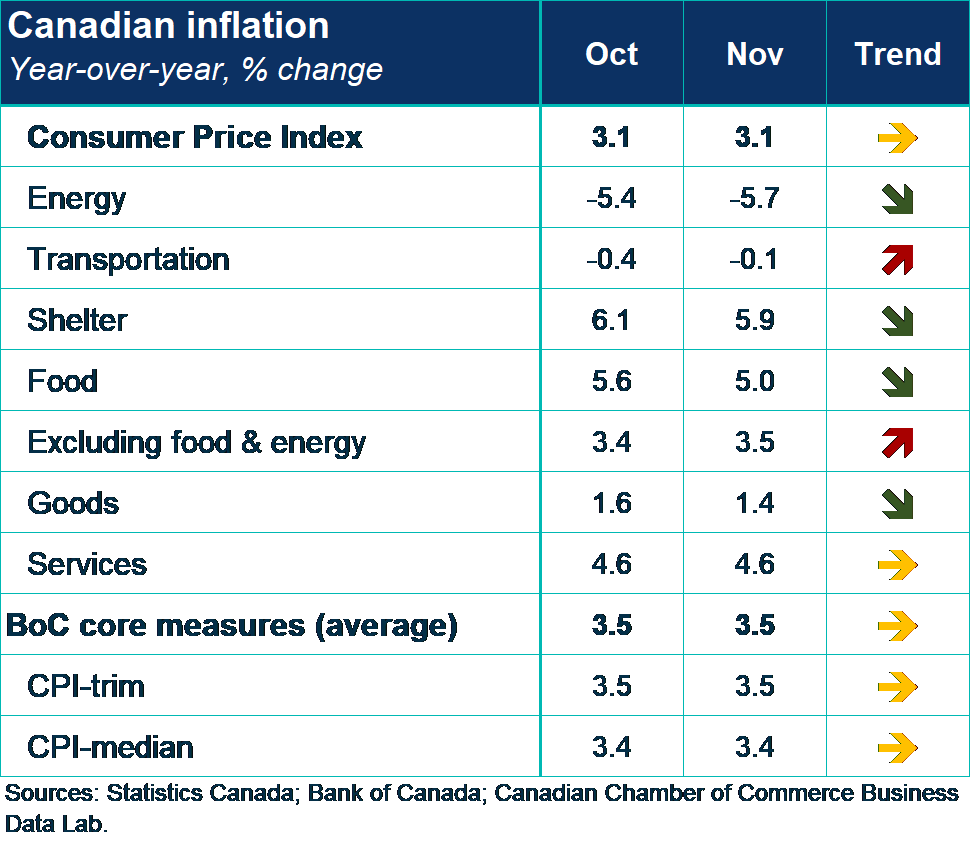

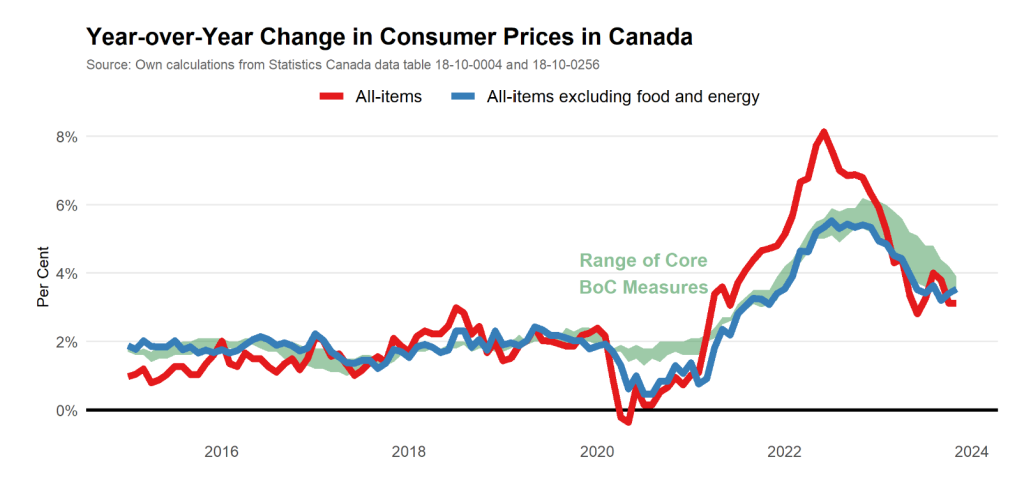

- Headline inflation held steady and above market consensus at 3.1% on a year-over-year (y-o-y) basis. Matching last month’s increase, November’s read was up 0.1% month-over-month (m-o-m) which continued to keep us outside the Bank of Canada’s target range (1-3%).

- We remain above June’s 27-month low of 2.8% when the effects of lower energy prices from a year prior when Russia invaded Ukraine had peaked.

- Unfortunately, excluding food and energy, prices rose 3.5% in November, compared with a 3.4% rise in October.

- While headline inflation remained stuck and the BoC’s core measures didn’t improve on a year-over-year basis, there was one silver lining. There was some progress as the BoC’s closely watched 3-month average of their preferred core measures fell from 2.9% to 2.5%, as food prices decelerated.

CPI Components

- Grocery prices, which had been consistently running hot for most of 2023, continued their fifth consecutive month of y-o-y deceleration.

- Food prices increased in November (+4.7%) but at a slower pace compared with October (+5.4%) with broad-based slowdowns across components including non-alcoholic beverages (-0.6%), fresh vegetables (+2.5%) and other food preparations (+6.4%) making the biggest dents.

- Energy prices fell to a larger extent below year-ago levels in (-5.7%) because of lowered fuel oil prices. The temporary suspension of federal carbon levy on fuel oil contributed to the decline. Prices fell a whopping 23.6% at the national level in November (following October’s downtick of 12.6%).

- Y-o-y services’ prices remained elevated in November and unchanged from October (+4.6%).

- Canadians are also continuing to feel relentless heat from higher prices for mortgage interest costs (+29.8%) and rent (+7.4%), which were the largest contributors to last month’s y-o-y increase.

- Prices pressures also came by way of prices for travel tours which accelerated +26.1% y-o-y compared with October (+11.3%). This was due to “events held in destination cities in the United States during November” as cited by the report.

Provincial Inflation and Regional Notes

- On an annual basis, prices rose at a slower pace in November than October in six provinces – all Atlantic provinces (Newfoundland & Labrador, PEI, Nova Scotia, and New Brunswick), Manitoba and Quebec.

SENTIMENT, OUTLOOK & IMPLICATIONS

Bank of Canada

- As the BoC held its interest rates steady this month at 5% for the fourth consecutive month, this latest report only solidifies that this will unlikely change anytime soon.

- Now more than a year and a half after beginning its aggressive campaign to cool the economy, and with former Governor Tiff Macklem remarks last week, it is “still too soon for the institution to consider rate cuts”.

SUMMARY TABLES

Table 1: Canadian Inflation – CPI Components and BoC Core Measures

Table 2: Provincial Inflation

CPI CHARTS

Other Commentaries

Oct 19, 2022

September 2022 Consumer Price Index data: Food and services prices still rising, no progress on core inflation

Sep 20, 2022

August 2022 Consumer Price Index data: Finally some good news on Canadian inflation.

Aug 16, 2022

July 2022 Consumer Price Index data: Canada’s inflation finally turns a corner with falling gas prices, but core pressures remain

Commentaries /

October 2023 CPI: Some encouraging news on inflation for the Bank of Canada

October 2023 CPI: Some encouraging news on inflation for the Bank of Canada

Today's Fall Economic Statement is likely to focus heavily on affordability, because that's what everyone is talking about. Which is why the slowdown in headline — and more importantly — core inflation, will be welcome news for the Bank of Canada.

Stephen Tapp

Today’s Fall Economic Statement is likely to focus heavily on affordability, because that’s what everyone is talking about. Which is why the slowdown in headline — and more importantly — core inflation, will be welcome news for the Bank of Canada. This ensures that the Bank will hold rates at its next meeting on December 6. But the devil is in the details — main consumer affordability pain points remain high, such as food and shelter costs. We’ll need to see much more progress on those fronts, along with an improved outlook for the overall economy, before the sentiment among Canada consumers improves.

Stephen Tapp, Chief Economist, Business Data Lab, Canadian Chamber of Commerce

KEY TAKEAWAYS

Overall

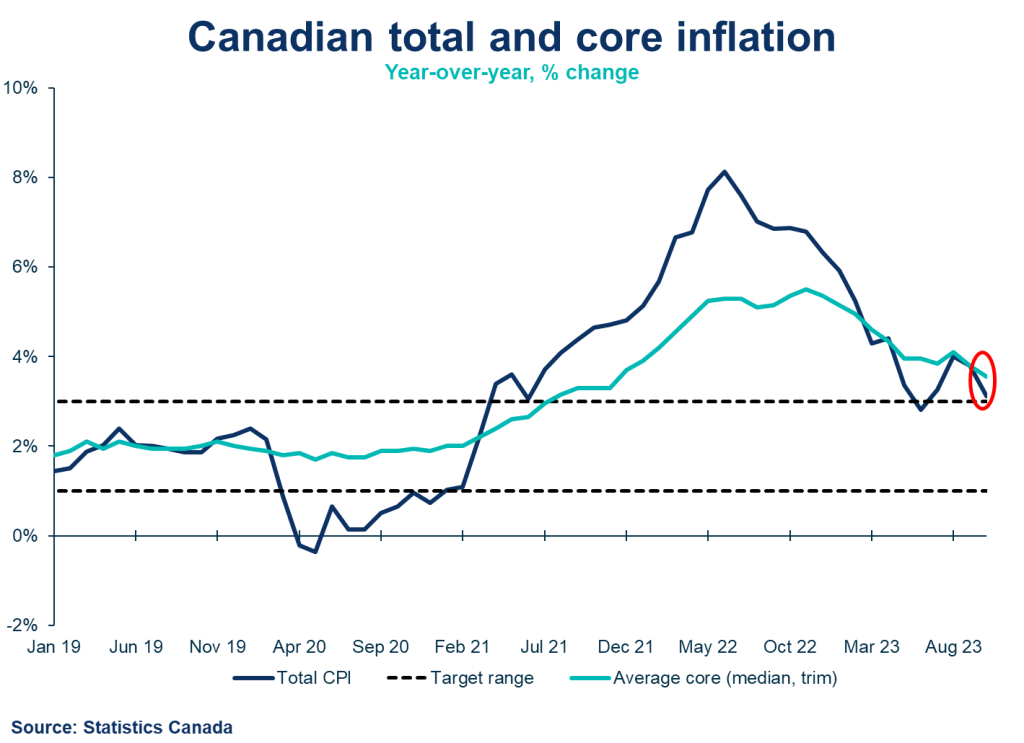

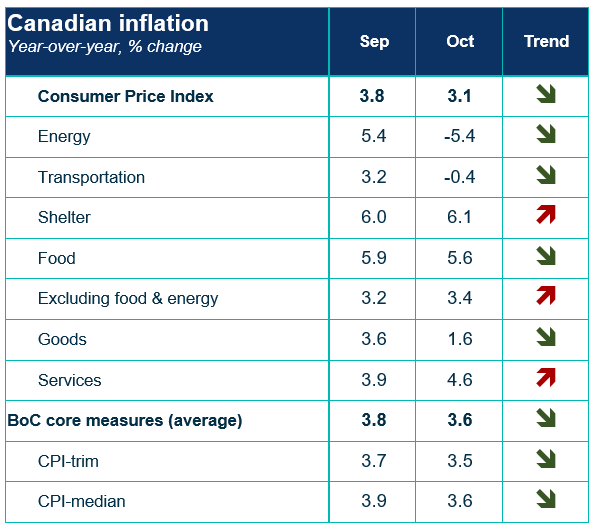

- Headline inflation decelerated to 3.1% year-over-year in October —down noticeably from 3.8% in September, and largely due to lower gasoline prices. This outcome was expected by financial mark.

- On a seasonally-adjusted basis, the CPI actually edged down by 0.1% — the first outright decline since May 2020.

- Importantly and encouragingly, both the Bank of Canada’s core inflation measures continued to slow, averaging 3.6% year-over-year, down from 3.8% a month earlier. Moreover, these shorter-term measures (the closely-watched three-month moving average) finally hit the top of the Bank’s target range at 3.0% (down from 3.7%).

CPI Components

- Lower gas prices were the main contributor to lower headline inflation in October; they were down 8% year-over-year. Excluding gas, prices rose 3.6%.

- That said, the biggest problem areas driving consumers’ affordability concerns remain:

- Shelter prices, which rose further to 6.1% from 6.0%, primarily reflecting accelerating rent prices (8.2%), and the largest increase in property taxes in 31 years; and

- Food inflation, which slowed to 5.6% from 5.9%.

- Goods inflation fell to 1.6% (from 3.6%, again largely from lower gas prices), while services inflation picked up to 4.6% (from 3.9%, driven by higher prices for rents, property taxes and travel).

Provincial Inflation

- Inflation slowed in all provinces in October. It is now highest in Quebec (4.2%) and lowest in PEI (1.7%).

Implications for the Bank of Canada

- Markets fully expect the Bank of Canada to hold rates on December 6, and are now looking for interest rate cuts, beginning as early as March 2024.

SUMMARY TABLES

Sources: Statistics Canada; Bank of Canada; Canadian Chamber of Commerce Business Data Lab

CPI CHARTS

Other Commentaries

Oct 19, 2022

September 2022 Consumer Price Index data: Food and services prices still rising, no progress on core inflation

Sep 20, 2022

August 2022 Consumer Price Index data: Finally some good news on Canadian inflation.

Aug 16, 2022

July 2022 Consumer Price Index data: Canada’s inflation finally turns a corner with falling gas prices, but core pressures remain

Commentaries /

September 2023 Consumer Price Index : A welcome step in the right direction. But businesses are not out of the woods.

September 2023 Consumer Price Index : A welcome step in the right direction. But businesses are not out of the woods.

We're moving in the right direction. September inflation came down slightly, which could mean that the Bank of Canada will hold at their next meeting.

Andrew DiCapua

We’re moving in the right direction. September inflation came down slightly, which could mean that the Bank of Canada will hold at their next meeting. If they do, it will likely be because the Bank wants to wait for the moderation of more volatile components, like gasoline prices run off – a prudent move. Market expectations have quickly reversed calls for another rate hike, but businesses are still feeling the pinch of inflation, with elevated inflation expectations remaining a complicating factor.

Andrew DiCapua, Senior Economist, Canadian Chamber of Commerce

KEY TAKEAWAYS

Headline

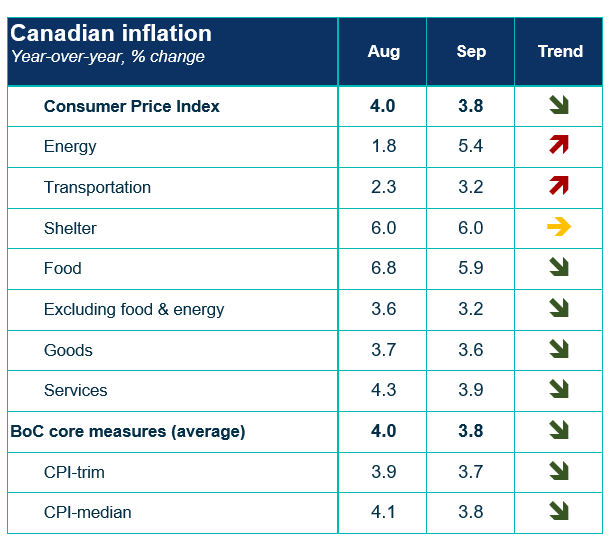

- Today’s release of September CPI was slightly lower than expected. Canada’s headline CPI inflation grew 3.8% in September (compared to consensus of 4%) on a year-over-year basis. Today’s headline CPI is a small relief following two months of reacceleration. On a monthly basis, CPI declined 0.1%.

- The Bank of Canada’s core measures of underlying inflation slowed this month, with an average of two core indicators growing at 3.8% year-over-year, down from 4% in July. That said, the three-month moving average of core measures remains high at 3.7%.

CPI Components

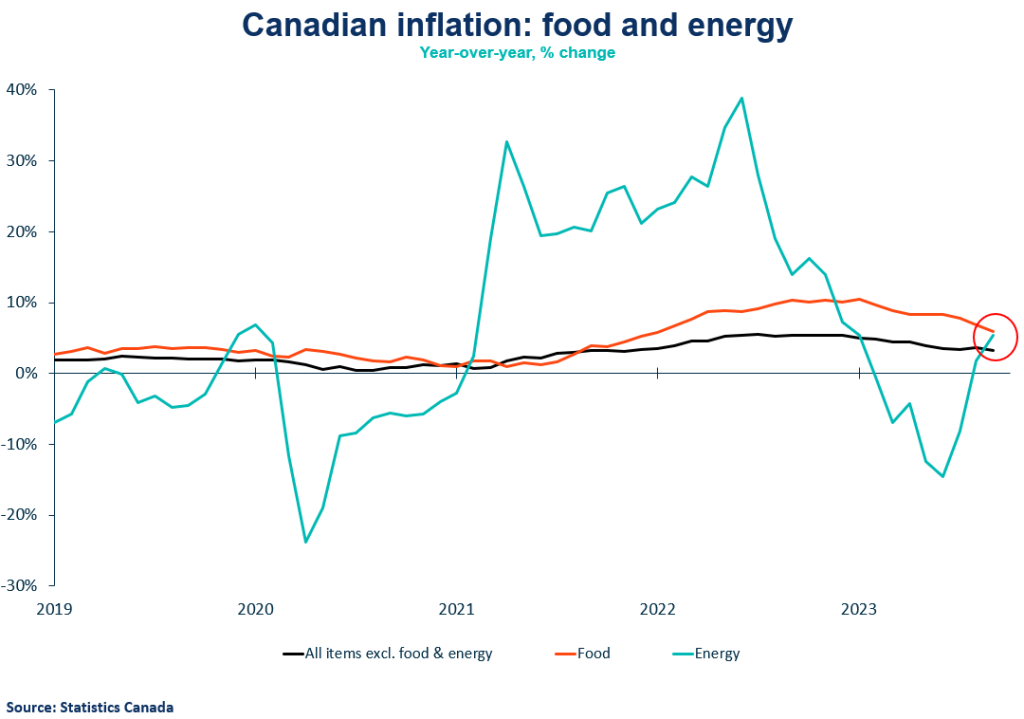

- Gas prices were higher again on a yearly basis, growing by 7.5%. After a nearly 1% increase in prices in August, base effects continued into this month. Excluding food and energy, prices rose 3.2%. Gas prices in October indicate that prices are expected to decline relative to last year.

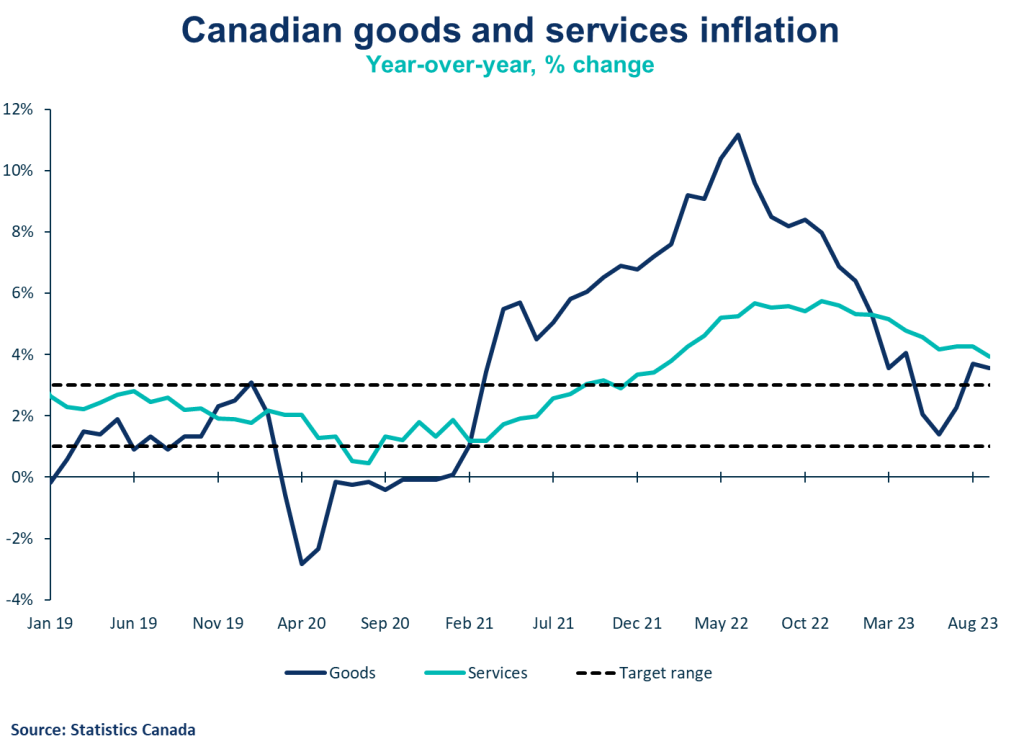

- Following higher durable goods inflation in August, it’s welcome news for goods inflation to decline in September to 3.6%. Services inflation also declined to 3.9% growth, down from 4.3%. Lower durable goods (+0.4%) were driven by cheaper passenger vehicles and lower airfare (-21%).

- As the housing market moderates, shelter prices remain high with prices in September holding steady at 6%, primarily driven by rent price index, and further indicating pressure on supply.

- September’s data brought another month of lower grocery prices with 5.8% growth, from 6.9% in July. That said, food prices continue to grow above headline inflation and will be a continued challenge for affordability.

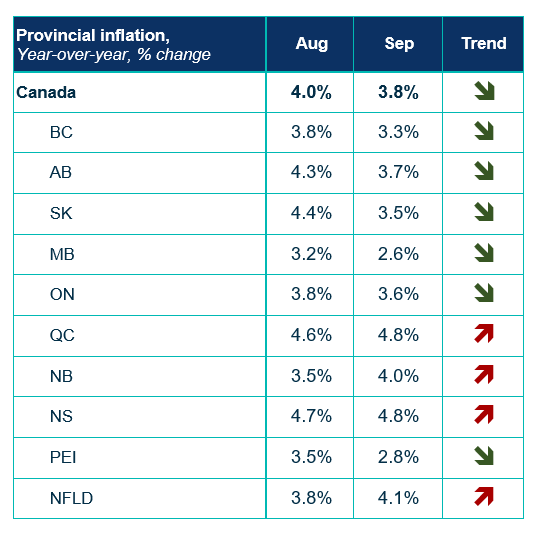

Provincial and regional inflation

- Year over year, prices increased in all provinces in September but rose at a slower pace compared with August in six provinces.

SENTIMENT, OUTLOOK AND IMPLICATIONS

Bank of Canada

- The Bank of Canada’s core measures edged lower on the month. The moderation in overall inflationary pressures, driven by food, durable goods, and services, will be welcome news for the Bank.

- arkets are now pricing in that the Bank of Canada will hold rates on October 25. However, with the release of their Monetary Policy Report at the next meeting, they could justify one last hike if they see inflation entrenched in their updated forecast.

Inflation expectations

- September’s CPI data combined with the recent release of the Bank of Canada’s Q3 Business Outlook Survey suggests CPI is moving on the right direction. That said, there seems to be a disconnect between prices expected between businesses and consumers, with the latter expecting one-year ahead inflation to remain near 5%. This will need to markedly come down for the Bank to consider their mission accomplished.

SUMMARY TABLES

CPI CHARTS

Other Commentaries

Oct 19, 2022

September 2022 Consumer Price Index data: Food and services prices still rising, no progress on core inflation

Sep 20, 2022

August 2022 Consumer Price Index data: Finally some good news on Canadian inflation.

Aug 16, 2022