Commentaries /

April 2024 CPI: What more could the Bank ask for? April inflation slows, positioning a June rate cut

April 2024 CPI: What more could the Bank ask for? April inflation slows, positioning a June rate cut

In April, inflation grew by 2.7%, aligning with consensus expectations, increasing the likelihood of a rate cut in June.

Andrew DiCapua

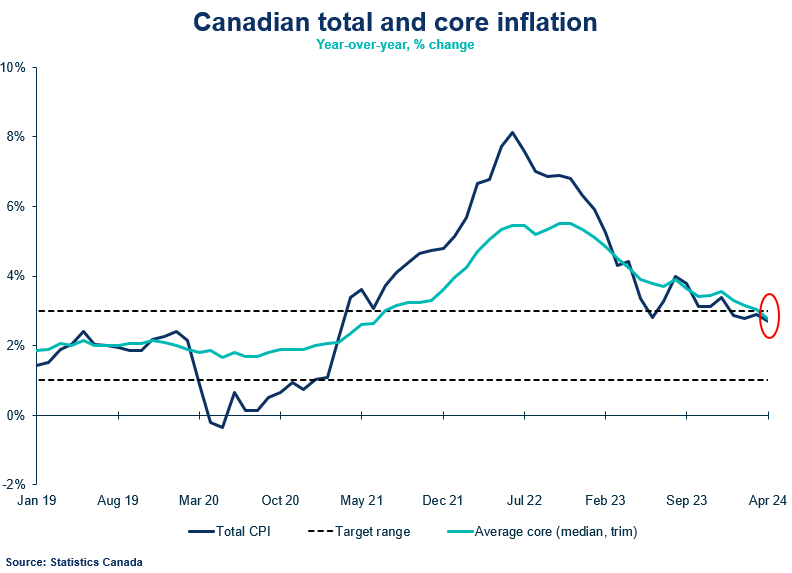

The Bank of Canada should now be confident that inflation is sustainably within the target range. In April, inflation grew by 2.7%, aligning with consensus expectations, increasing the likelihood of a rate cut in June. While inflation is heading in the right direction supported by a strong labour market, our spending tracker shows reduced spending growth in April. Combined with weaker population growth and mortgage renewals ahead, the Canadian economy’s fragility will become more evident. Although rising gasoline prices and high shelter costs continue to exert price pressures, they are less of a risk. Core inflation measures, averaging 2.8%, suggest that broad-based inflation is easing. A rate cut in June is not just possible; it’s becoming the main consideration. The Bank should move in June as the conditions are met to achieve the so-called “soft-landing”.

Andrew DiCapua, Senior Economist, Canadian Chamber of Commerce

KEY TAKEAWAYS

Headline

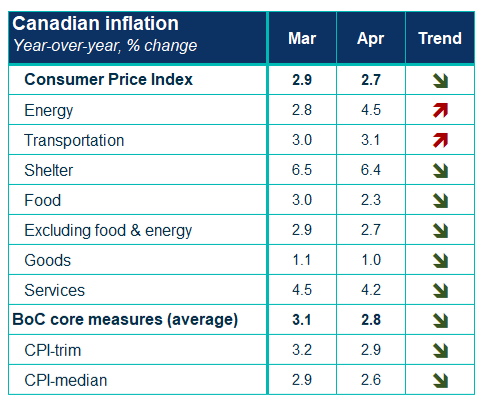

- Canada’s headline CPI inflation grew 2.7% in April, in line with consensus on a year-over-year basis. Despite headline inflation hovering around 3% for the past few months, supported by gasoline and shelter price pressures, inflation is trending lower. On a monthly basis, the seasonally adjusted prices grew 0.2%.

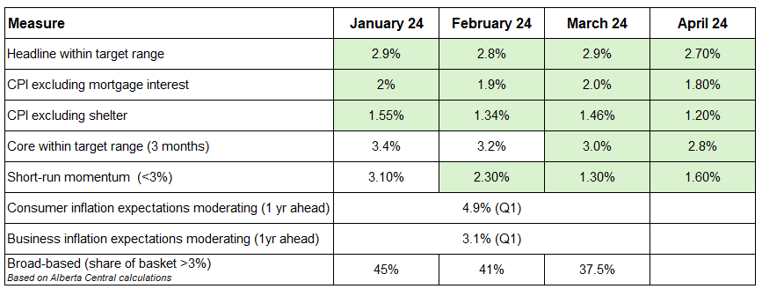

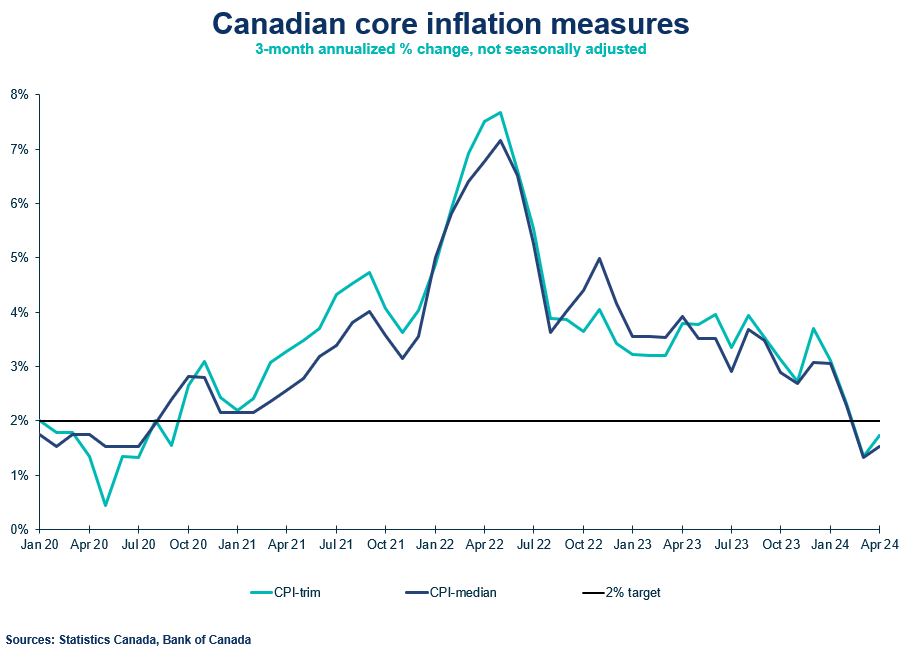

- The Bank of Canada’s core measures (Trim and Median) grew 2.8% year-over-year, down from 3% in March, marking the second consecutive month with core measures within the target range. Short-run core measures (3-month change annualized) are steadily below 2%, running at 1.6%.

CPI Components

- Shelter prices remain high in April, growing 6.4%, down from 6.5% in March, primarily driven by rent, growing nearly 8% in April on a yearly basis.

- Gasoline prices were up 6.1% on a yearly basis following 4.5% growth in March. Prices grew due to increases in the carbon levy and supply concerns. Further upside growth in gasoline prices is muted so far in May.

- Goods inflation slowed in April, growing 1%, which has remained subdued with durable and semi-durable goods continuing mildly negative annual growth. Services inflation also moderated, now growing 4.1%. Wage growth reported in the Labour Force Survey is also trending lower at 4.8%.

- Food prices made great progress in April, growing 2.3% in April. Grocery prices decelerated to 1.4%. Restaurant food prices remain higher, but slowed to 4.3% in April, from 5.1%.

Provincial and Regional Inflation

In April, prices rose at a slower pace in six provinces, and are only slightly above the Bank of Canada’s inflation control band in on province (Nova Scotia at 3.1%).

SENTIMENT, OUTLOOK AND IMPLICATIONS

- April CPI was below the inflation forecast in the Bank of Canada’s April Monetary Policy Report, which expected 2.9% year-over-year growth. The Bank is positioned to still achieve a “soft landing”. What more can they ask for? The labour market remains healthy with the economy adding 90k jobs in April. Wage growth continues to slow, now growing below 5%. Business and consumer surveys showed moderating pricing expectations.

- The risks associated with delaying rate cuts are growing too high and almost guarantee a move by July. The Canadian economy started the year on strong footing, but even the Bank doesn’t expect this to last with population growth slowing and upcoming mortgage renewals to put additional pressure on households. With inflation now comfortably below 3% and broad-based decelerating within the target range for a few months, the Bank can move at their next meeting in June. It’s not only prudent, but the various conditions are now met (see table below).

SUMMARY TABLES

Sources: Statistics Canada; Bank of Canada; Canadian Chamber of Commerce Business Data Lab.

SUMMARY CHARTS

Other Commentaries

Oct 19, 2022

September 2022 Consumer Price Index data: Food and services prices still rising, no progress on core inflation

Sep 20, 2022

August 2022 Consumer Price Index data: Finally some good news on Canadian inflation.

Aug 16, 2022