Commentaries /

September 2023 Consumer Price Index : A welcome step in the right direction. But businesses are not out of the woods.

September 2023 Consumer Price Index : A welcome step in the right direction. But businesses are not out of the woods.

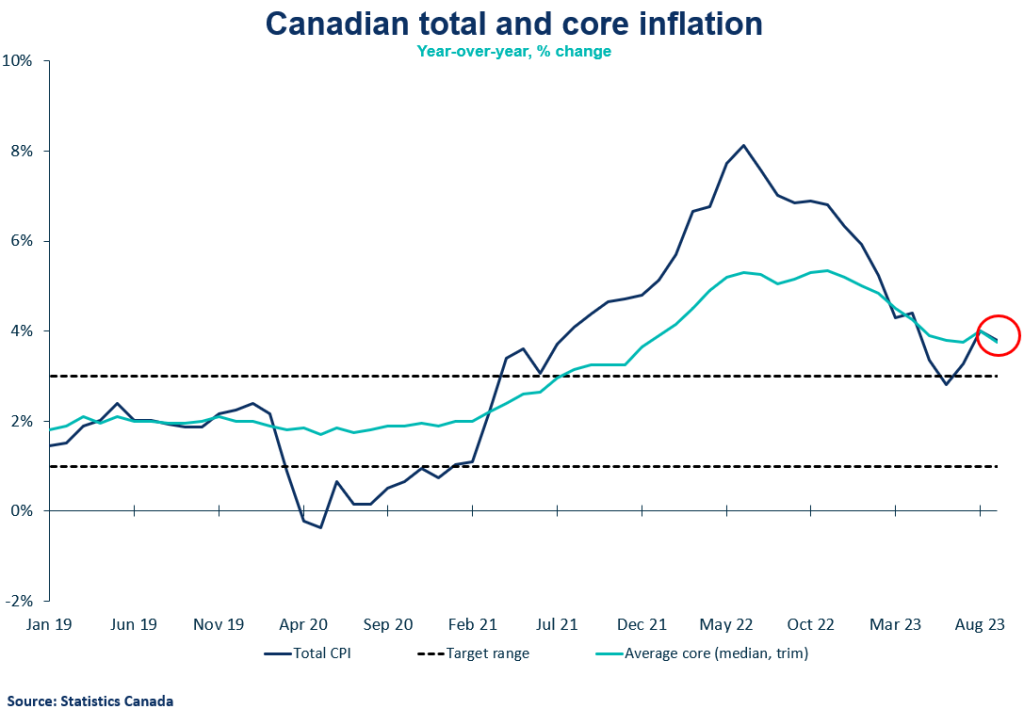

We're moving in the right direction. September inflation came down slightly, which could mean that the Bank of Canada will hold at their next meeting.

Andrew DiCapua

We’re moving in the right direction. September inflation came down slightly, which could mean that the Bank of Canada will hold at their next meeting. If they do, it will likely be because the Bank wants to wait for the moderation of more volatile components, like gasoline prices run off – a prudent move. Market expectations have quickly reversed calls for another rate hike, but businesses are still feeling the pinch of inflation, with elevated inflation expectations remaining a complicating factor.

Andrew DiCapua, Senior Economist, Canadian Chamber of Commerce

KEY TAKEAWAYS

Headline

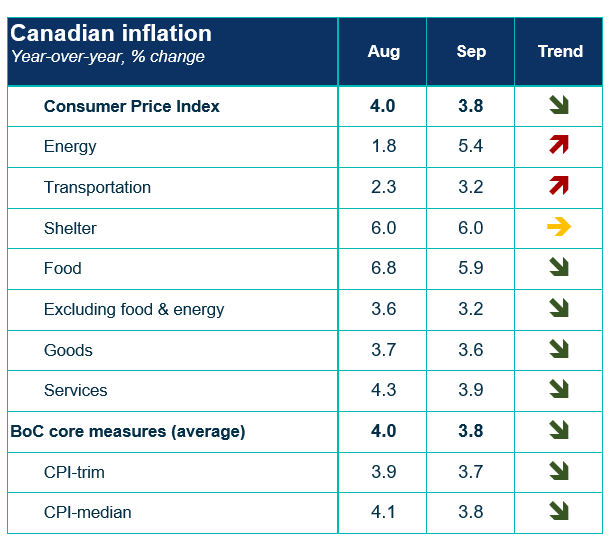

- Today’s release of September CPI was slightly lower than expected. Canada’s headline CPI inflation grew 3.8% in September (compared to consensus of 4%) on a year-over-year basis. Today’s headline CPI is a small relief following two months of reacceleration. On a monthly basis, CPI declined 0.1%.

- The Bank of Canada’s core measures of underlying inflation slowed this month, with an average of two core indicators growing at 3.8% year-over-year, down from 4% in July. That said, the three-month moving average of core measures remains high at 3.7%.

CPI Components

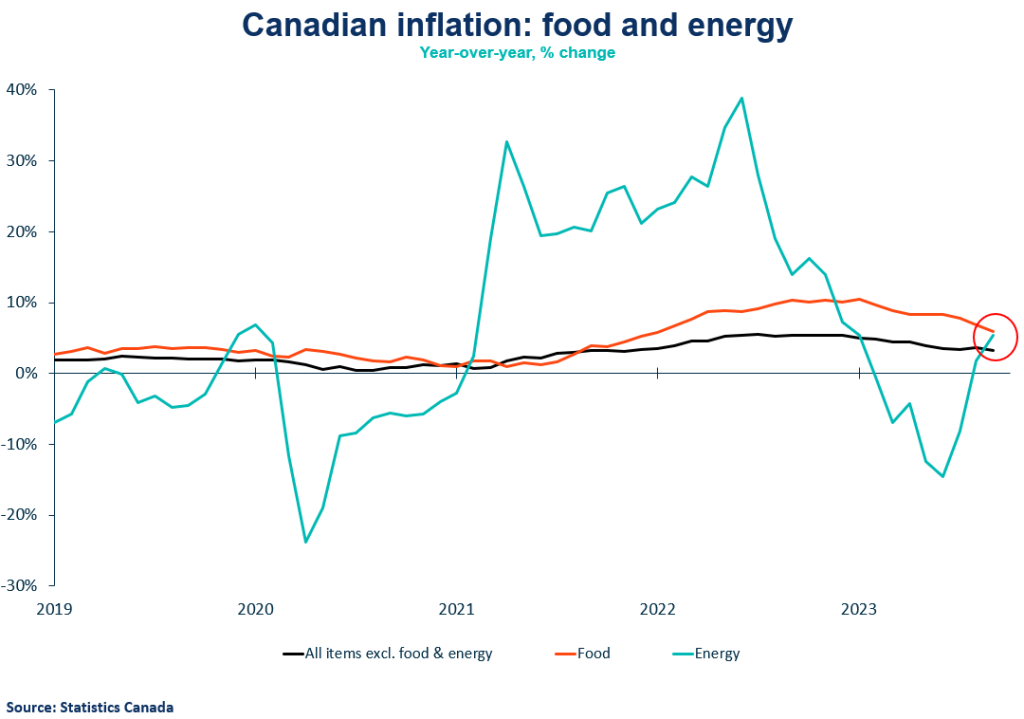

- Gas prices were higher again on a yearly basis, growing by 7.5%. After a nearly 1% increase in prices in August, base effects continued into this month. Excluding food and energy, prices rose 3.2%. Gas prices in October indicate that prices are expected to decline relative to last year.

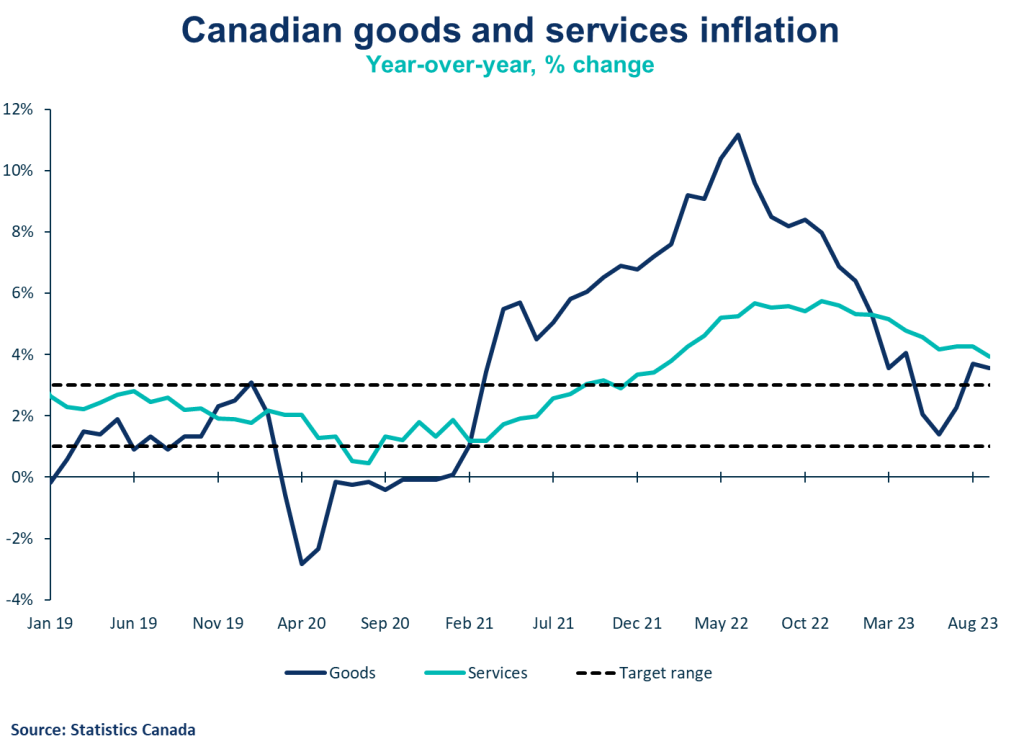

- Following higher durable goods inflation in August, it’s welcome news for goods inflation to decline in September to 3.6%. Services inflation also declined to 3.9% growth, down from 4.3%. Lower durable goods (+0.4%) were driven by cheaper passenger vehicles and lower airfare (-21%).

- As the housing market moderates, shelter prices remain high with prices in September holding steady at 6%, primarily driven by rent price index, and further indicating pressure on supply.

- September’s data brought another month of lower grocery prices with 5.8% growth, from 6.9% in July. That said, food prices continue to grow above headline inflation and will be a continued challenge for affordability.

Provincial and regional inflation

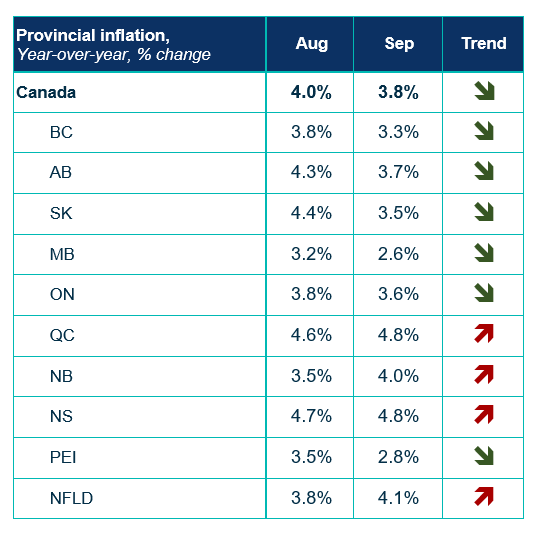

- Year over year, prices increased in all provinces in September but rose at a slower pace compared with August in six provinces.

SENTIMENT, OUTLOOK AND IMPLICATIONS

Bank of Canada

- The Bank of Canada’s core measures edged lower on the month. The moderation in overall inflationary pressures, driven by food, durable goods, and services, will be welcome news for the Bank.

- arkets are now pricing in that the Bank of Canada will hold rates on October 25. However, with the release of their Monetary Policy Report at the next meeting, they could justify one last hike if they see inflation entrenched in their updated forecast.

Inflation expectations

- September’s CPI data combined with the recent release of the Bank of Canada’s Q3 Business Outlook Survey suggests CPI is moving on the right direction. That said, there seems to be a disconnect between prices expected between businesses and consumers, with the latter expecting one-year ahead inflation to remain near 5%. This will need to markedly come down for the Bank to consider their mission accomplished.

SUMMARY TABLES

CPI CHARTS

Other Commentaries

Oct 19, 2022

September 2022 Consumer Price Index data: Food and services prices still rising, no progress on core inflation

Sep 20, 2022

August 2022 Consumer Price Index data: Finally some good news on Canadian inflation.

Aug 16, 2022