Commentaries /

CPI December 2023: Hovering above target, the new year will bring the same challenges in the battle against inflation

CPI December 2023: Hovering above target, the new year will bring the same challenges in the battle against inflation

Our Senior Economist Andrew DiCapua analyzes the key takeaways of the Consumer Price Index (CPI) report for December 2023.

Andrew DiCapua

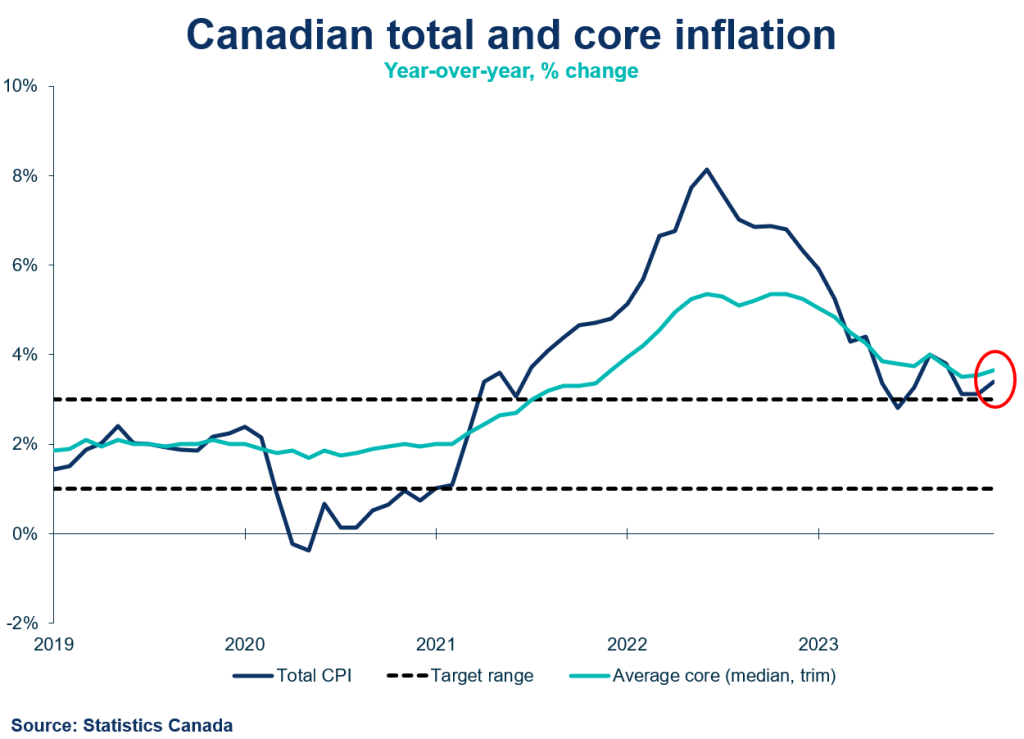

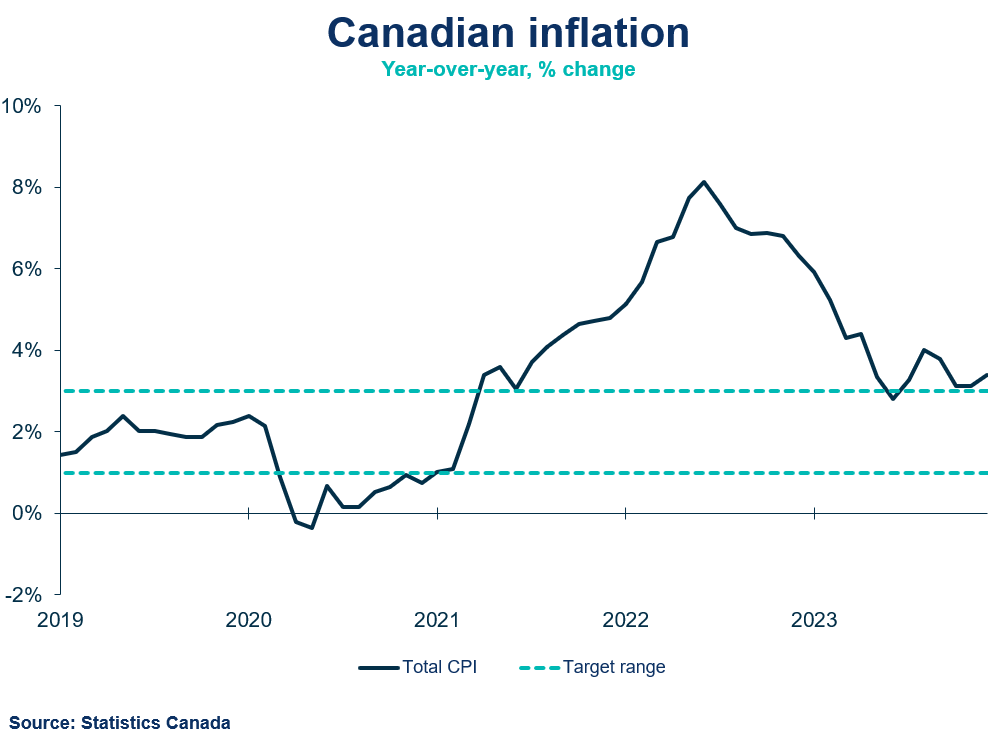

If we’ve learned anything over the past few months, it’s that the last mile of the race against inflation is the hardest and the longest. December marked the second consecutive month where inflation moved in the wrong direction, with essential components like food and shelter still above 5%.

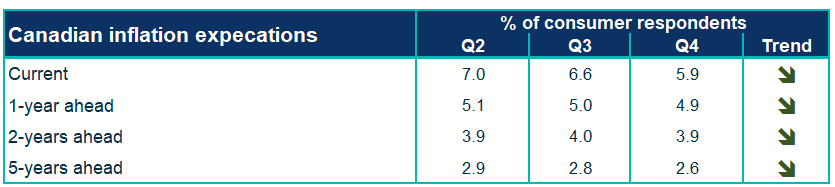

In the Bank of Canada’s fourth quarter consumer and business surveys, one-year inflation expectations remain too high with consumers still believing inflation will be more than double target. Despite progress, unanchored inflation expectations will take time to adjust, keeping the Bank in a tough position in the start of 2024. Long story short – even if the hard data show progress, the Bank will have to battle the perception of inflation at risk of tilting the economy into recession.

Andrew DiCapua, Senior Economist, Canadian Chamber of Commerce

KEY TAKEAWAYS

Headline

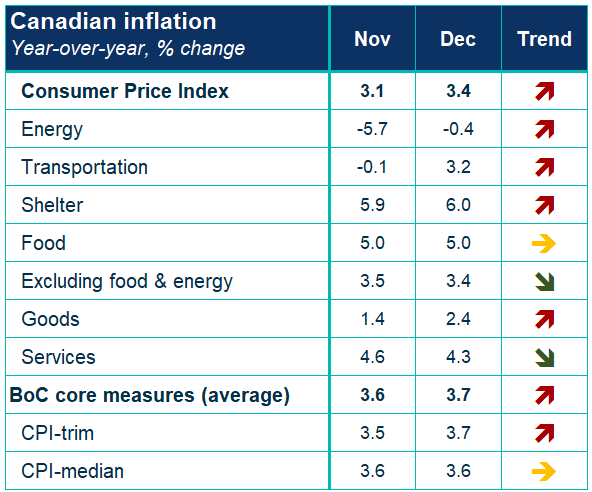

- Canada’s headline CPI inflation grew 3.4% in December (in line with the consensus of 3.4%) on a year-over-year basis. Despite being partly attributed to base effects due to lower gasoline prices last year, inflation remains above target. On a monthly basis, the unadjusted CPI declined 0.3%.

- The Bank of Canada’s core measures of underlying inflation accelerated 0.4% month-over-month, with an average of two core indicators growing at 3.7% year-over-year, up from 3.6% in November.

- Annual CPI for 2023 grew 3.9%, down from the peak 6.8% in 2022.

CPI Components

- Transportation costs led the increase in inflation, shifting from negative growth to 3.2% year-over-year, led by a 31% jump in air transportation prices.

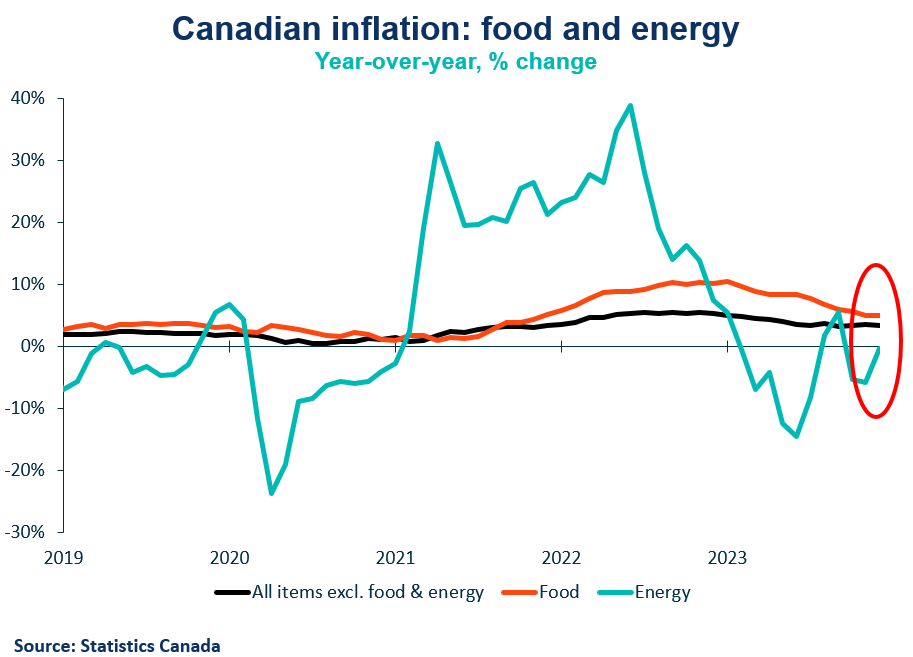

- Gasoline prices were higher again on a yearly basis, growing by 1.4%. Following a 7.7% decline in prices in November, base effects reversed this month. Excluding food and energy, prices rose 3.4%.

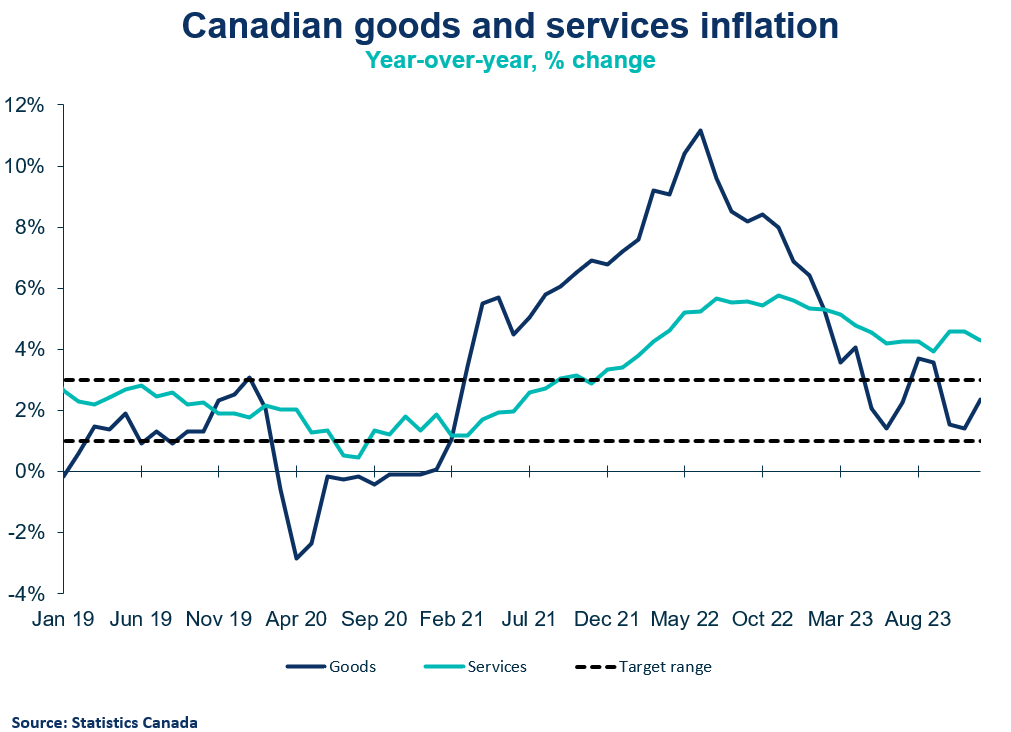

- Following three months of slower goods inflation, December rose to 2.4%. Services inflation declined to 4.3% growth, down from 4.6% in November. Passenger vehicles rose 2.3% as new 2024 models come onto the market.

- As the housing market continues to moderate, shelter prices remain high with prices in December holding steady at 6% for the fifth consecutive month, primarily driven by the rent price index (+7.7%), and further indicating affordability pressures.

- Overall food prices remained steady around 5% growth. Grocery prices declined slightly to 4.6% growth, from 4.7% in November. That said, restaurant food prices continue to grow (+5.6%) and are an ongoing challenge for households.

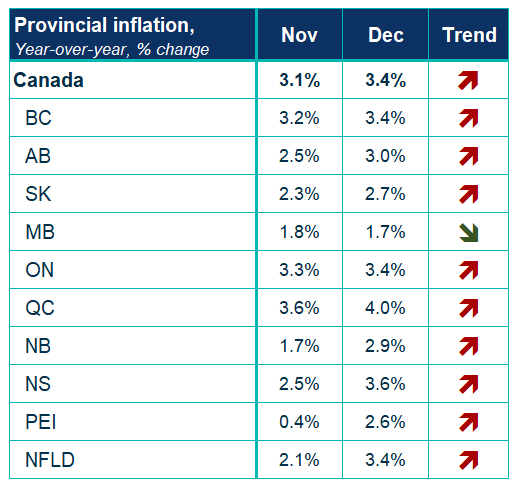

Provincial and regional inflation

- Prices increased in all parts of the country, except for Manitoba, which saw inflation marginally decelerate.

SENTIMENT, OUTLOOK AND IMPLICATIONS

Bank of Canada

- The Bank of Canada’s closely-watched three-month moving average of core inflation measures accelerated from 2.9% to 3.6%.

- Markets fully expect the Bank of Canada to hold rates on January 24. With the release of their Monetary Policy Report at the next announcement, more insight on how they see the Canadian economy evolving will provide their perspective into how they see inflation evolving in 2024. All told, we do not interest rate cuts to start in the first quarter of 2024.

Inflation expectations

- December’s CPI data, along with the Bank of Canada’s Q4 Business Outlook Survey and Canadian Survey on Consumer Expectations suggestthat inflation expectations are moving in the right direction, but remain too high for the Bank’s comfort. The disconnect between prices expected between businesses and consumers continues, with the latter still expecting one-year ahead inflation to remain near 5%. This will need to markedly come down for the Bank to consider their mission accomplished.

SUMMARY TABLES

CHARTS

Other Commentaries

Oct 19, 2022

September 2022 Consumer Price Index data: Food and services prices still rising, no progress on core inflation

Sep 20, 2022

August 2022 Consumer Price Index data: Finally some good news on Canadian inflation.

Aug 16, 2022