Commentaries /

March 2024 CPI: Two months down, one more to go

March 2024 CPI: Two months down, one more to go

Our Senior Economist Andrew DiCapua shares his key takeaways from today's Consumer Price Index (CPI) release.

Business Data Lab

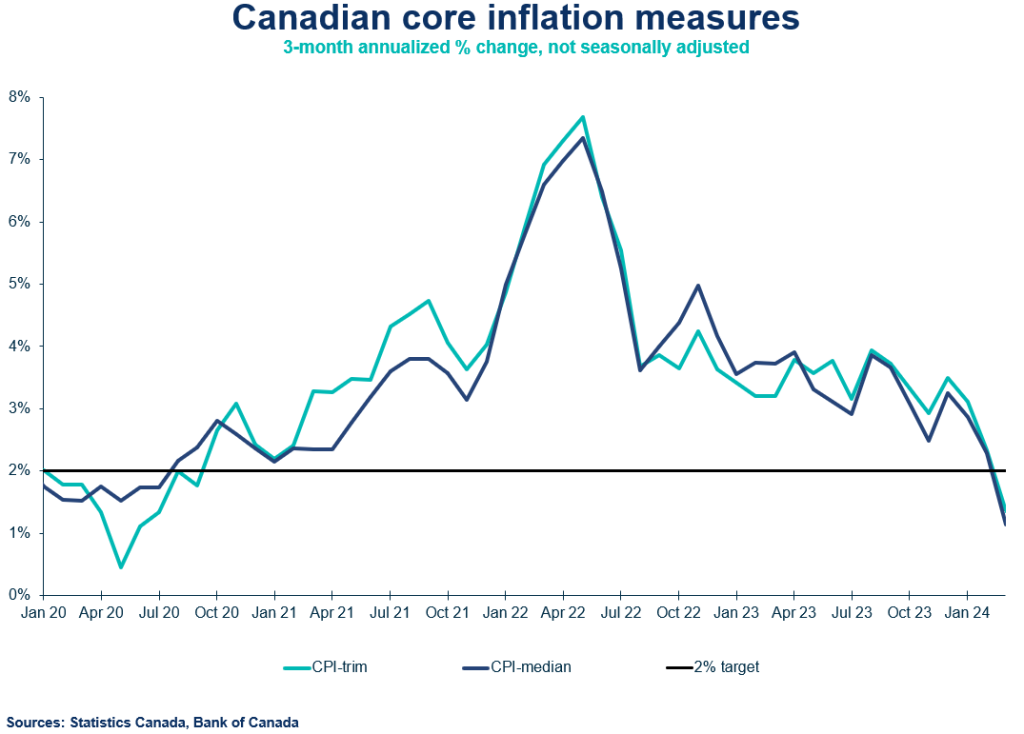

We’re almost there, with just one more step to go. We’ve reached another key milestone ahead of the Bank of Canada’s important meeting in June. Both the headline and core inflation measures are now within the Bank’s target range, with headline inflation stable for three months and core inflation trending downward. This was expected by markets, but was slightly weaker than the Bank’s projections from their April forecast. The ongoing price pressures are mainly due to rising gasoline prices in March and high shelter costs. Short-run core inflation is now below two percent. Despite a minor increase in the main inflation rate, there is increasing evidence that inflation is trending downward. Assuming no major surprises from the federal budget or economic data, this month adds more evidence for the Bank of Canada to consider its first rate cut at the June meeting.

Andrew DiCapua, Senior Economist, Canadian Chamber of Commerce

KEY TAKEAWAYS

Headline

- Canada’s headline CPI inflation grew 2.9% in March (in line with consensus) on a year-over-year basis. Despite the uptick from 2.8% in February, March CPI is being held higher by gasoline, shelter, and services price pressures. CPI excluding energy grew 2.8%. On a monthly basis, the seasonally adjusted prices grew 0.3%. The silver lining is that headline and core inflation are within Bank of Canada’s target range of 1-3%.

- The Bank of Canada’s core measures of underlying inflation grew 3% year-over-year, down from 3.1% in January, marking the third consecutive monthly deceleration in core measures. The short-run core measures (3-month change annualized) are running at a pace of 1.3%.

CPI Components

- Shelter prices remain high in March, growing 6.5%, primarily driven by rent continuing its acceleration, growing 8.6% in March on a yearly basis.

- Gasoline prices were up 4.5% on a yearly basis after softer growth in February. Despite higher prices due to geopolitical conflicts and voluntary production cuts from producers, elevated prices a year ago should help keep any upside surprises on gasoline inflation muted.

- Goods inflation slowed in February, growing 1.1%, which has remained subdued for many months with durable and semi-durable goods showing negative annual growth. Services inflation is supporting higher inflation growth, reaccelerating to 4.5% in March, from 4.2% in February.

- Food prices grew at their slowest pace since August 2021, rising 3% in March. Grocery prices decelerated to 1.9%. Restaurant food prices remain elevated, growing 5.1% in March, at a similar pace to last month.

Provincial and regional inflation

Prices accelerated in seven provinces, led by Quebec prices growing 3.6%.

SENTIMENT, OUTLOOK AND IMPLICATIONS

- March CPI was below the inflation forecast in the Bank of Canada’s April Monetary Policy Report, which expected 3.03% year-over-year growth in March. The Bank remains concerned with the broad-based price pressures above 3%, and in particular stickiness on the services side of the economy.

- Nonetheless, one more inflation report is left before the Bank’s consequential June meeting. Absent of any resurgence in economic activity or short-term stimulus measures in the Federal budget, the Bank should be in a good place to begin easing policy and lowering their policy rate in June.

SUMMARY TABLE

FISCAL CHARTS

Other Commentaries

Oct 19, 2022

September 2022 Consumer Price Index data: Food and services prices still rising, no progress on core inflation

Sep 20, 2022

August 2022 Consumer Price Index data: Finally some good news on Canadian inflation.

Aug 16, 2022