Commentaries /

CPI January 2024: Some good news on inflation, but too early to celebrate.

CPI January 2024: Some good news on inflation, but too early to celebrate.

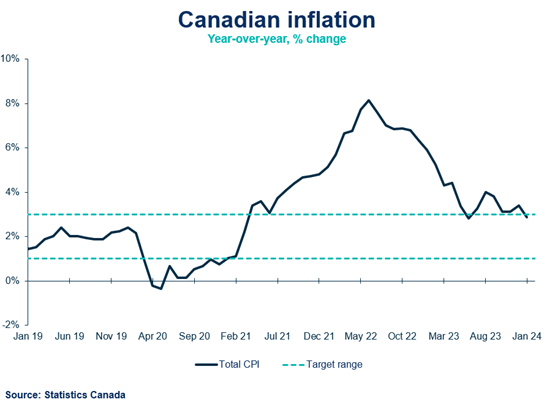

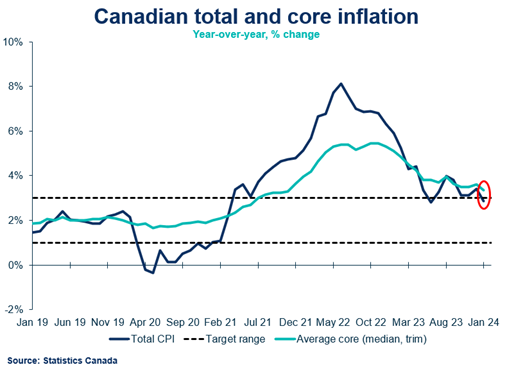

Canada’s headline CPI inflation grew 2.9% in January (below the consensus of 3.3%) on a year-over-year basis.

Andrew DiCapua

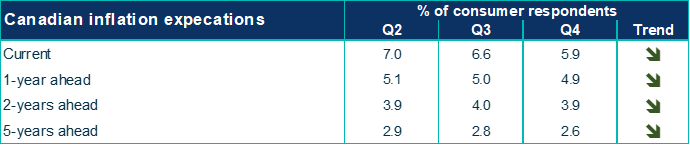

Inflation is now in the target range, which is good news for the Bank of Canada. But the Bank is also acutely aware of the stickiness of core measures and the impact elevated shelter prices. That’s why they will likely keep their policy stable until price pressures abate enough to account for those large contributions that shelter prices are having – and will continue to have – moving forward. All this is making the return to target more difficult. But should the economy and labour market remain buoyant, timing is surely in the Bank’s favour.

Andrew DiCapua, Senior Economist, Canadian Chamber of Commerce

KEY TAKEAWAYS

Headline

- Canada’s headline CPI inflation grew 2.9% in January (below the consensus of 3.3%) on a year-over-year basis. The first inflation print of the year is welcome news and aided by lower gasoline prices last year. Headline inflation is now within the Bank of Canada’s target range of 1-3% for the first time since last June. On a monthly basis, the unadjusted CPI was unchanged.

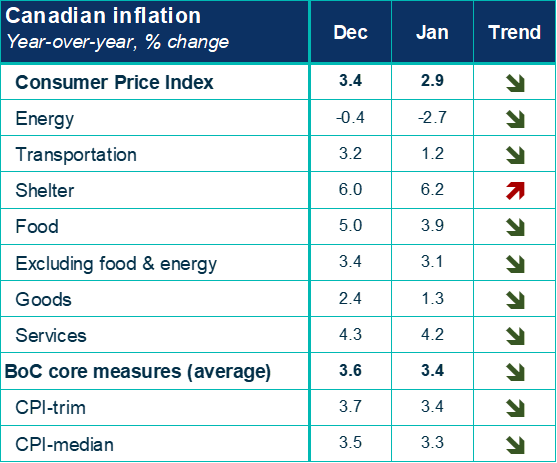

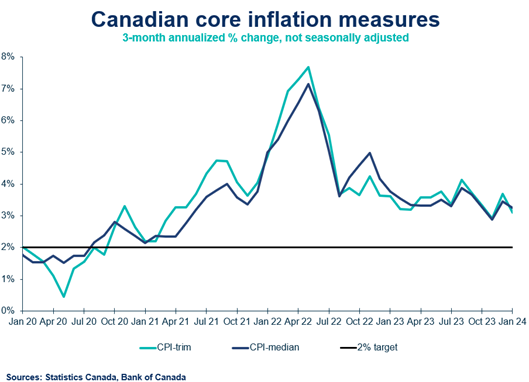

- The Bank of Canada’s core measures of underlying inflation grew 3.4% year-over-year, down from 3.7% in December. The 3-month change annualized for core measures is running at a pace of 3.2%.

CPI Components

- Shelter prices remain high with prices in January increasing 6.2%, primarily driven by rent once again growing (+7.9%).

- Gasoline prices were down 4% on a yearly basis, which helped bring down the energy component of CPI to -2.7% in January.

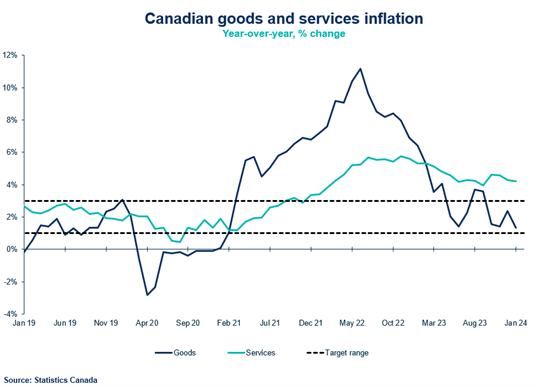

- Goods inflation continues to slow, growing 1.3% in January, coming from a stronger 2.4% growth in December. Services inflation is much higher and grew 4.2% in January, down slightly from 4.3% in December.

- Food prices made further progress, declining to 3.9% in January. Grocery prices decelerated to 3.4% growth, from 4.6% in December. Restaurant food prices remain elevated, growing 5.1% in January, down from 5.6% in December.

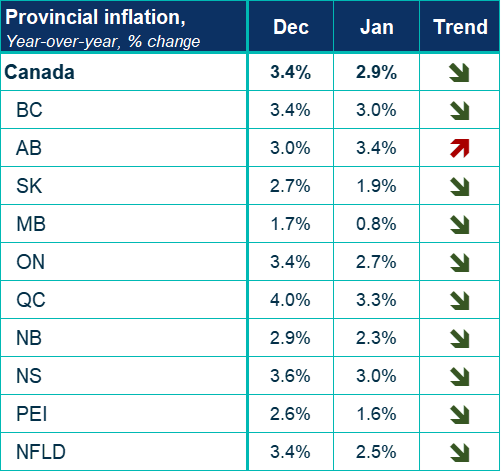

Provincial and Regional Inflation

- Prices decelerated in all parts of the country, except for Alberta, which saw inflation accelerate from 3% to 3.4%.

SENTIMENT, OUTLOOK AND IMPLICATIONS

Bank of Canada

- January CPI data was roughly in line with the Bank of Canada’s Monetary Policy Report, published at their January decision meeting. The Bank was forecasting 3% year-over-year growth in January, reaching 3.3% by March 2024.

- Considering the Bank’s forecast for inflation was in line with January’s print, we don’t expect a rate move at their March meeting. February inflation won’t be available before the Bank’s March meeting, and they’ll need to see three solid months of progress to feel confident with the trend. We continue to expect the Bank to consider a rate cut in the spring, at the earliest.

SUMMARY TABLES

Sources: Statistics Canada; Bank of Canada; Canadian Chamber of Commerce Business Data Lab.

CHARTS

Other Commentaries

Oct 19, 2022

September 2022 Consumer Price Index data: Food and services prices still rising, no progress on core inflation

Sep 20, 2022

August 2022 Consumer Price Index data: Finally some good news on Canadian inflation.

Aug 16, 2022