Commentaries /

February 2024 CPI: The Bank of Canada will crack a smile with more good news on inflation

February 2024 CPI: The Bank of Canada will crack a smile with more good news on inflation

Canada’s headline CPI inflation grew 2.8% in February. What does it mean for the economy?

Andrew DiCapua

It’s great to see headline inflation move further within the target range, and core inflation continuing its downward trend. We could see that the market was expecting a slightly higher inflation print, due to gasoline prices rising in February, but grocery store prices have slowed, and short-run core momentum measures are tracking around two percent. That’s going to be welcome news for households.

Governor Macklem will also take this as good news – and a signal that our current holding pattern is working. But we shouldn’t expect any moves from the Bank until June. With two more inflation updates, updated surveys on expectations, and a Federal budget, the Bank will want to see the data and build a case for any changes before they present anything to Canadians.

Andrew DiCapua, Senior Economist, Canadian Chamber of Commerce

KEY TAKEAWAYS

Headline

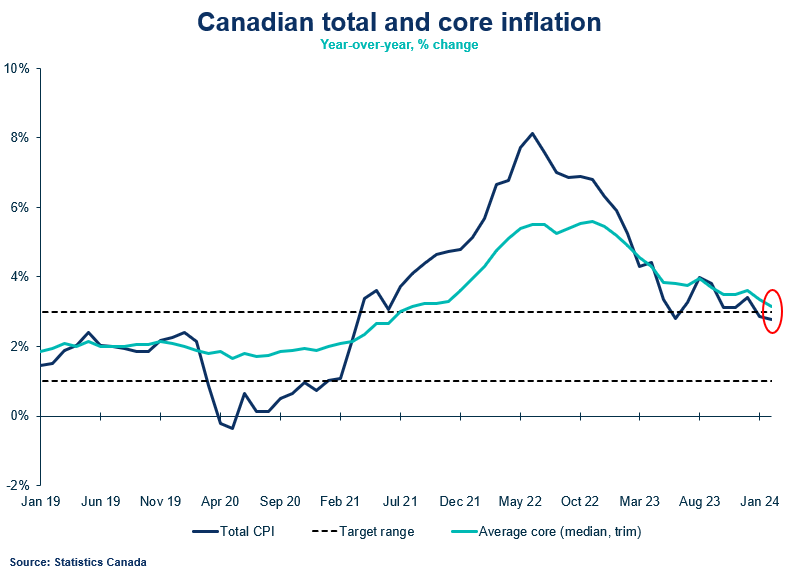

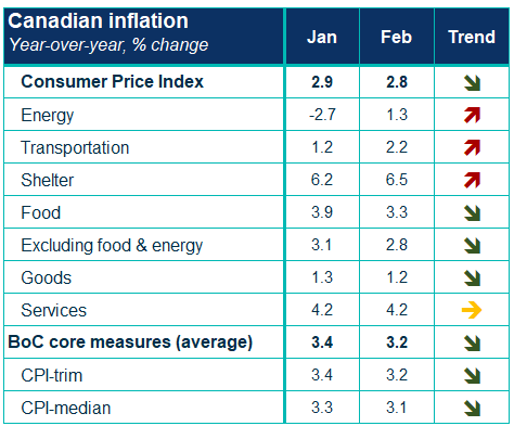

- Canada’s headline CPI inflation grew 2.8% in February (below the consensus of 3.1%) on a year-over-year basis. Two months of slower price growth is surely welcome news to the Bank of Canada, despite stubborn shelter costs and volatile gasoline prices keeping headline inflation higher. CPI excluding food and energy grew 2.8%. Headline inflation moved closer within the Bank of Canada’s target range of 1-3%. On a monthly basis, the unadjusted CPI grew 0.3%.

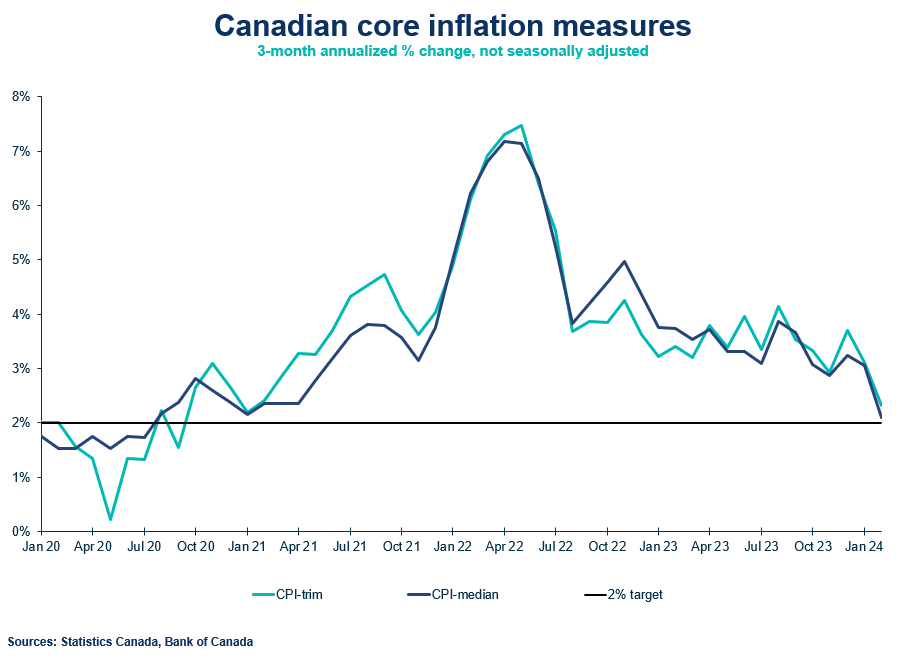

- The Bank of Canada’s core measures of underlying inflation grew 3.2% year-over-year, down from 3.4% in January. The 3-month change annualized is running at a pace of 2.2%.

CPI Components

- Shelter prices remain high in February, growing 6.5% and continuing its reacceleration, primarily driven by rent once again growing (+8.2%).

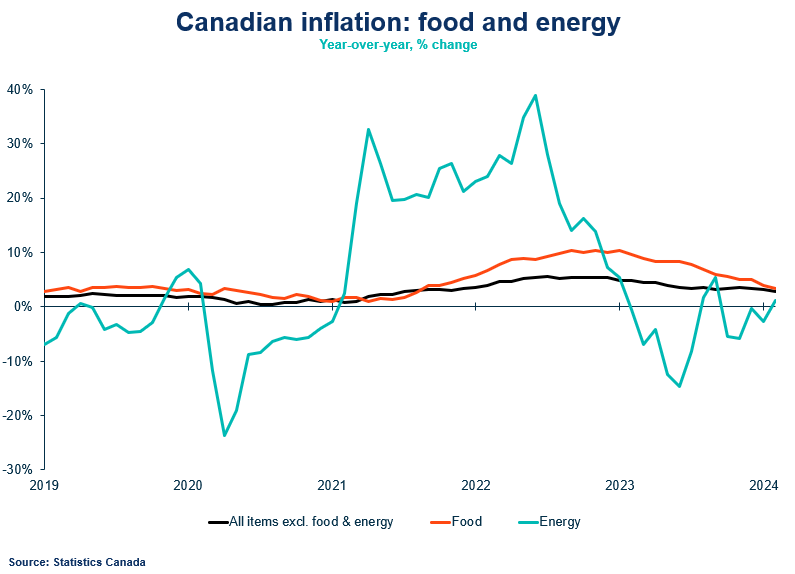

- Gasoline prices were up 0.8% on a yearly basis after a decline in January. Prices are on the upswing, with monthly prices growing 4% m/m.

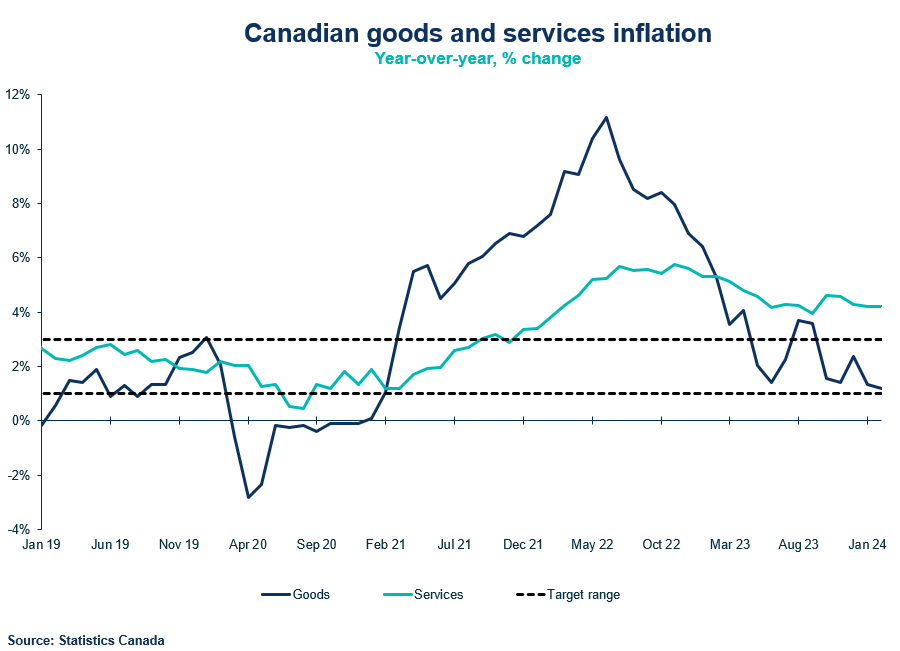

- Goods inflation slowed in February, growing 1.2%, which has remained subdued for many months. Services inflation is much higher and grew 4.2% in February, holding from the same growth rate in January.

- Food prices made further progress in February, declining to 3.3% in February. Grocery prices decelerated to 2.4% growth, from 3.4% in January. This was the first time since October 2021 where grocery prices have undershot headline inflation. Restaurant food prices remain elevated, growing 5.1% in February, at a similar pace to last month.

- Odds and ends: Clothing and footwear was down 4.2% and household operations declined 1.7%, driven primarily by lower cell phone plan prices (-26.5%).

Provincial and regional inflation

Prices decelerated in seven provinces, which continues January broad-based price easing. Though more volatile prices are expected in Alberta with energy prices.

SENTIMENT, OUTLOOK AND IMPLICATIONS

- February CPI was below the inflation forecast in the Bank of Canada’s January Monetary Policy Report, which expected 3.3% year-over-year growth in February, and averaging 3% yearly growth till June. The Bank remains concerned with the broad-based price pressures above 3%, and in particular stickiness on the services side of the economy.

- Despite the positive surprise in February’s print, there is no rush to move, and the Bank will want to communicate their updated position at their April meeting. This tees up June for a cut, where we’ll have two more inflation reports to evaluate.

- The Bank will pay attention to two key April releases. New Business Outlook Survey and Canadian Survey on Consumer Expectations data on April 1 will show updated business and household inflation expectations. The Federal budget, which is expected on April 16, will be important to evaluate any new program spending that could impede progress on returning to target.

SUMMARY TABLE

CHARTS

Other Commentaries

Oct 19, 2022

September 2022 Consumer Price Index data: Food and services prices still rising, no progress on core inflation

Sep 20, 2022

August 2022 Consumer Price Index data: Finally some good news on Canadian inflation.

Aug 16, 2022