Commentaries /

September 2022 Consumer Price Index data: Food and services prices still rising, no progress on core inflation

September 2022 Consumer Price Index data: Food and services prices still rising, no progress on core inflation

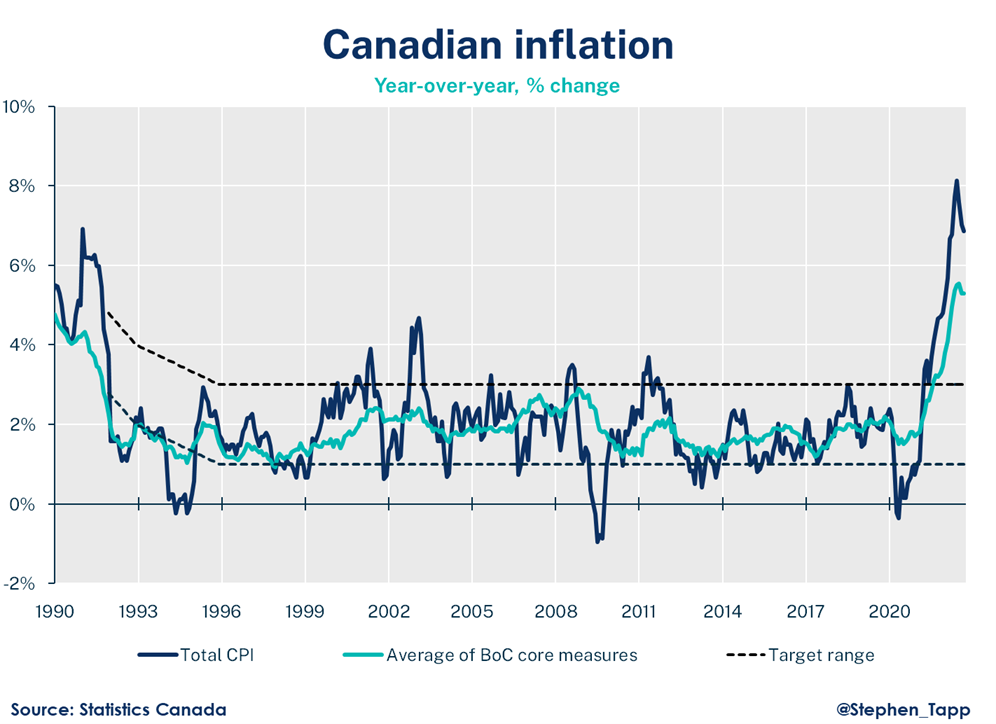

Our Chief Economist, Stephen Tapp, looks at Canada’s headline inflation, which edged down for the third month in a row. There was no progress on “core” inflation, which held steady at 5%.

Stephen Tapp

Canada’s headline inflation edged down for the third month in a row, dragged down by falling gas prices. However, these gains were largely offset by the continued rise of prices for food and services. Unfortunately, there was no progress on “core” inflation, which held steady at 5%.

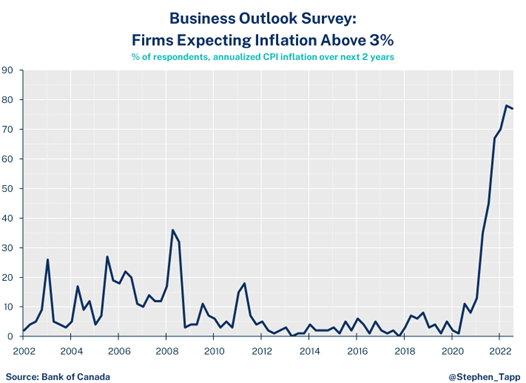

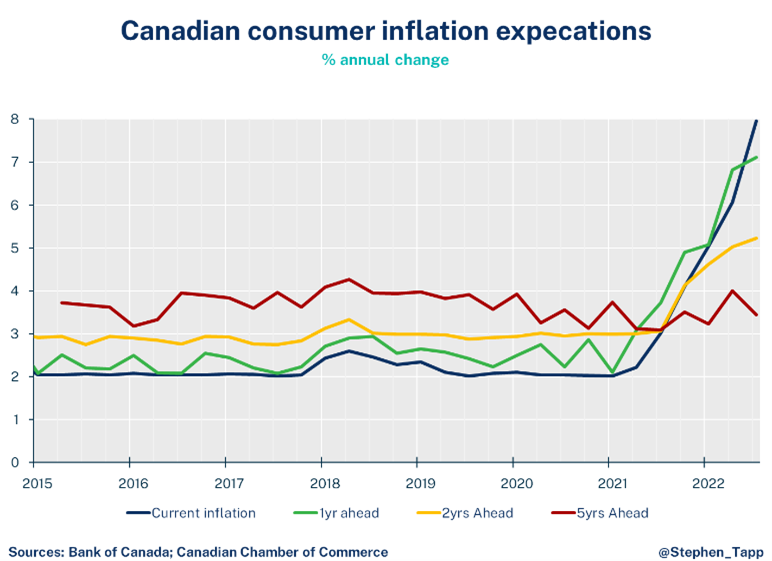

Today’s lack of progress on inflation — together with Bank of Canada surveys released earlier this week that suggested inflation expectations remain elevated — should be concerning enough to the Bank of Canada for them to deliver the 50 basis-point interest rate hike that the market expects next week.

Stephen Tapp, Chief Economist, Canadian Chamber of Commerce

KEY TAKEAWAYS

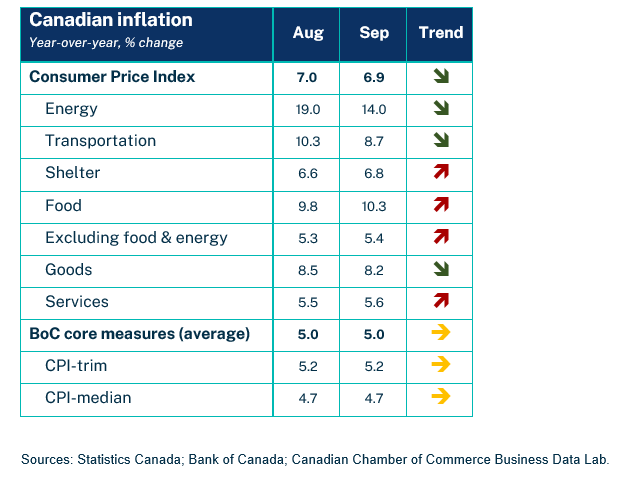

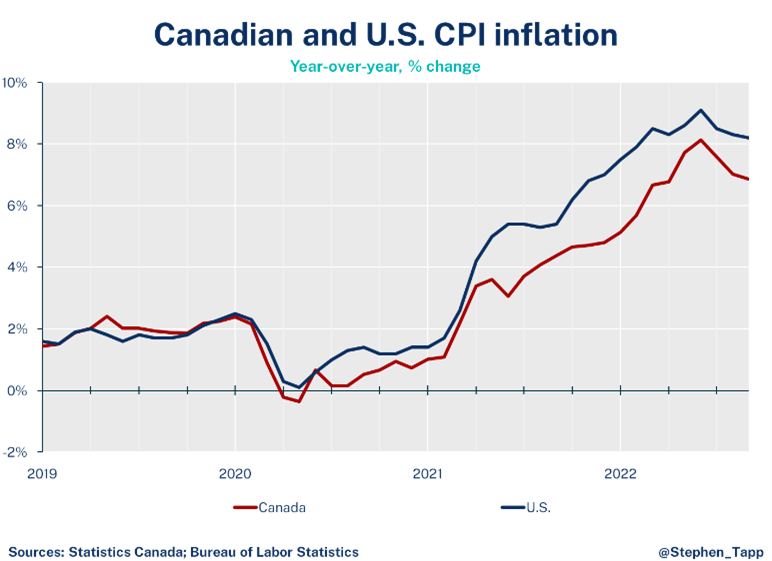

- Canada’s headline Consumer Price Index (CPI) inflation edged down for the third month in a row month — to 6.9% year-over-year, down from record inflation in July of 8.1%. The slowdown in headline inflation was not as strong as the market expected (6.6%).

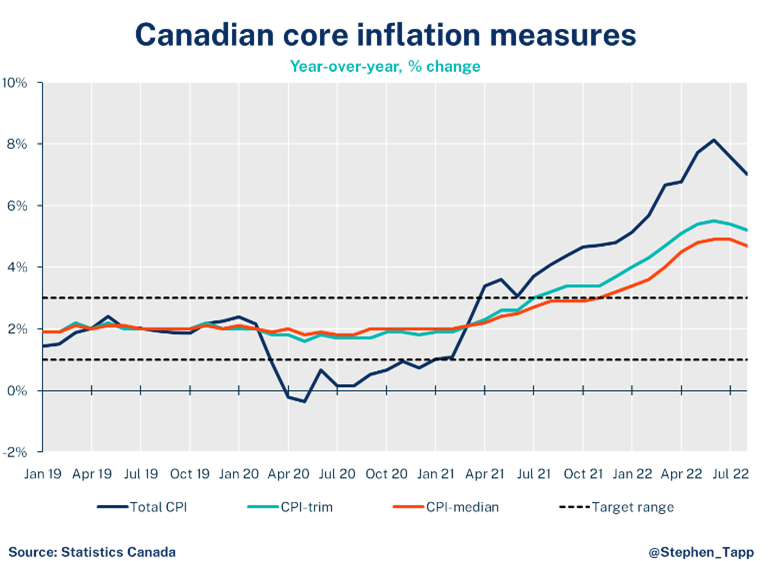

- The Bank of Canada’s two remaining “core inflation” measures held steady at5.0%. They are down only slightly from their peak of 5.2% in July.

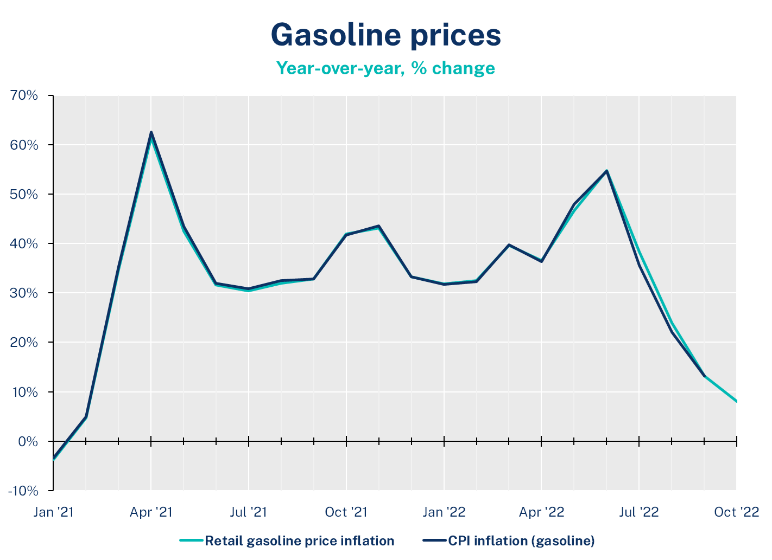

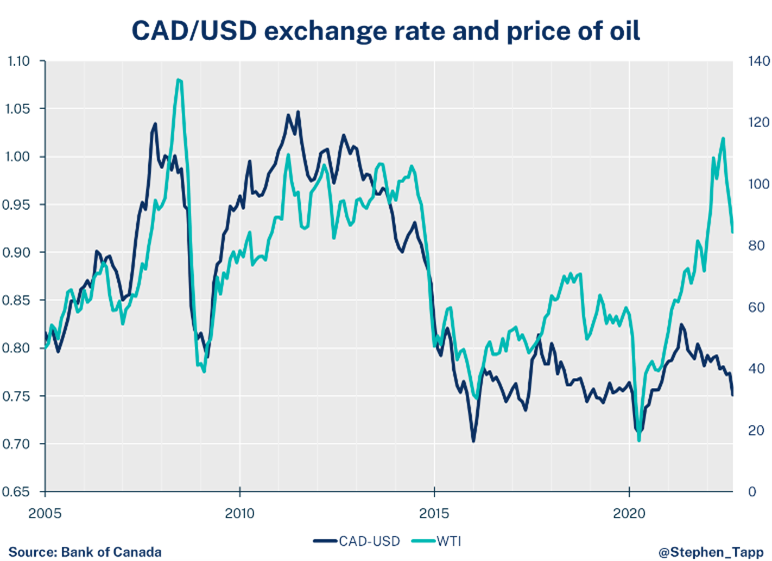

- In September, energy price growth slowed (to 14% from 19%). Gasoline prices were a key driver of headline inflation and a major issue for consumers, especially this summer. They peaked in mid-June at $2.14 per litre and have since dropped back (currently at $1.74). Preliminary data for October suggest gas prices will only be up 8% year-over-year.

- Food prices kept rising (now up to 10.3% overall). Grocery prices are up across-the-board for a total of 11.4% year-over-year, the fastest pace since 1981!

- Price gains slowed for transportation (+9%), but new car prices remain strong reflecting decent demand and supply constraints due to the lingering semi-conductor shortages.

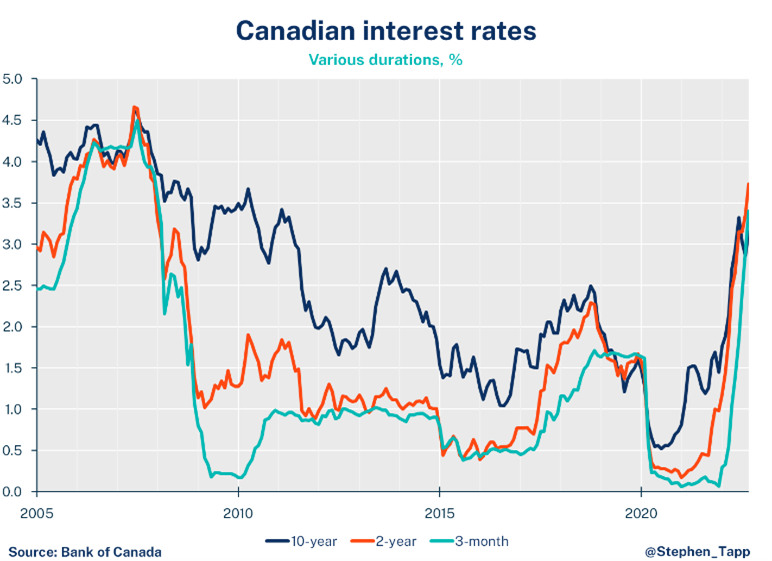

- Shelter costs rose by 6.8%, up from last month. There are opposing forces here with slowing house prices, while mortgage interest costs are rising alongside higher interest rates.

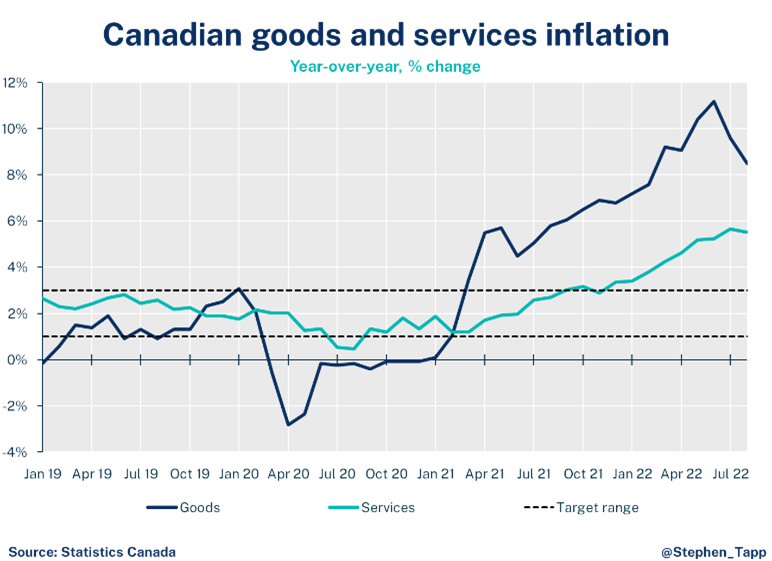

- Price increases for goods continue to slow (to 8.2% from 8.5%), which is expected, but the more significant move was the rise in services inflation (to 5.6% from 5.5%).

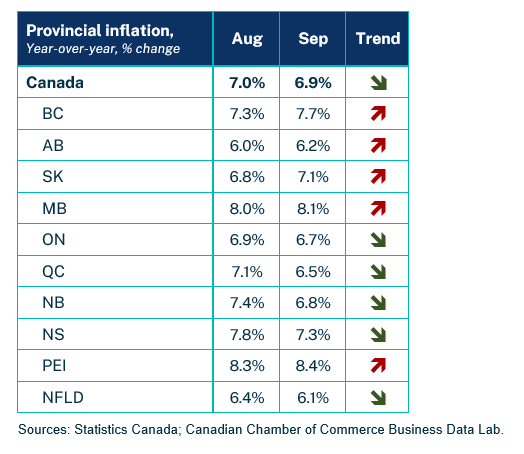

- The inflation rate fell in half of the provinces. It is highest in Prince Edward Island (8.4%) and lowest in Newfoundland and Labrador (6.1%).

- In coming months, headline inflation will likely decelerate further due to slowing growth and positive “base effects” (i.e., comparing 2022 readings with price levels that were rising fast in autumn 2021.) I expect October’s reading to be in the lower 6% range.

- That said, there’s still a long way to go before inflation returns to pre-pandemic levels of 2%. The Bank of Canada’s July Monetary Policy Report forecast CPI inflation of 7.2% in 2022, 4.6% in 2023, and 2.3% in 2024. Next week the Bank will likely revise down its inflation forecast for 2022 and 2023.

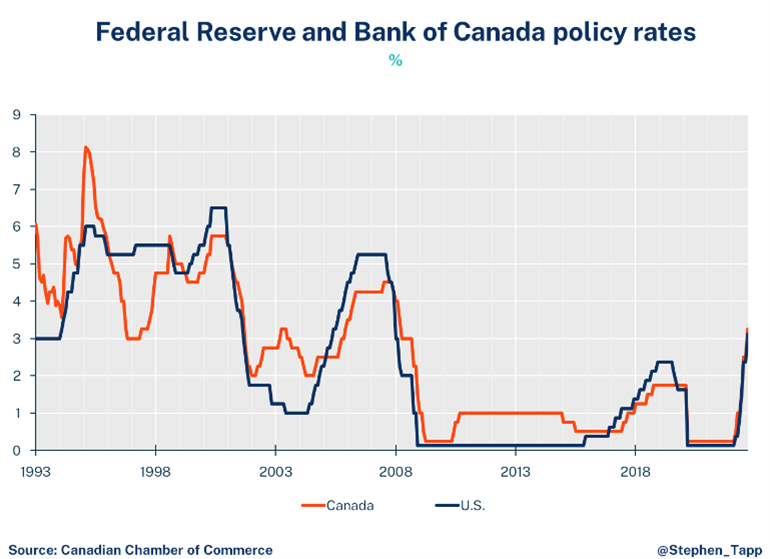

- Most market participants expect the Bank of Canada to deliver a 50-basis point rate hike next week. This would take the policy rate up to 3.75%, and potentially end the year at 4% after a smaller 25-bps increase in December.

SUMMARY TABLES

Other Commentaries

Sep 20, 2022

August 2022 Consumer Price Index data: Finally some good news on Canadian inflation.

Aug 16, 2022

July 2022 Consumer Price Index data: Canada’s inflation finally turns a corner with falling gas prices, but core pressures remain

Oct 07, 2022