Commentaries Topics: Consumer Price Index

Commentaries /

August 2023 CPI: Keep calm and carry on? But, we’re moving in the wrong direction.

August 2023 CPI: Keep calm and carry on? But, we’re moving in the wrong direction.

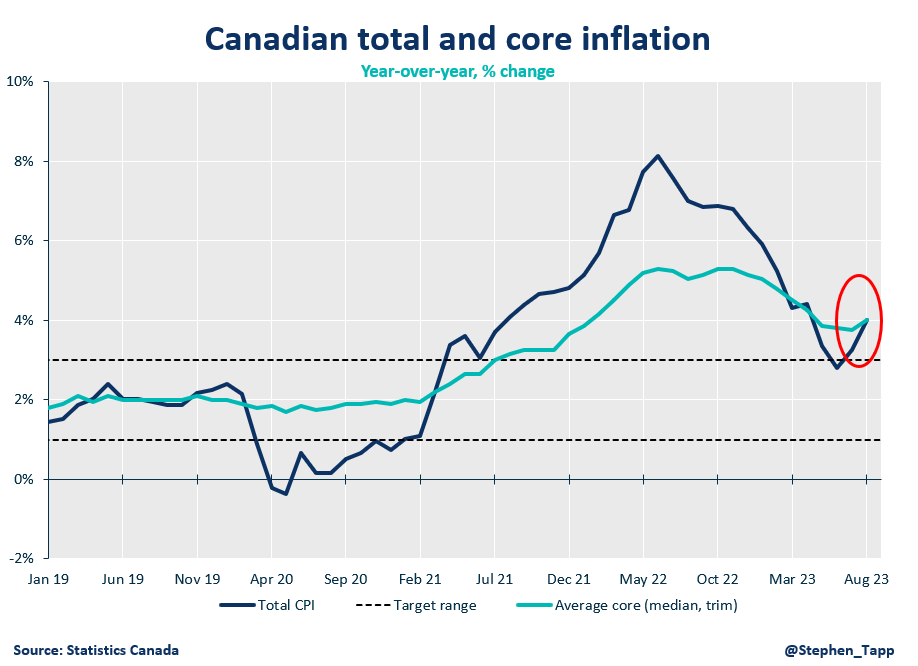

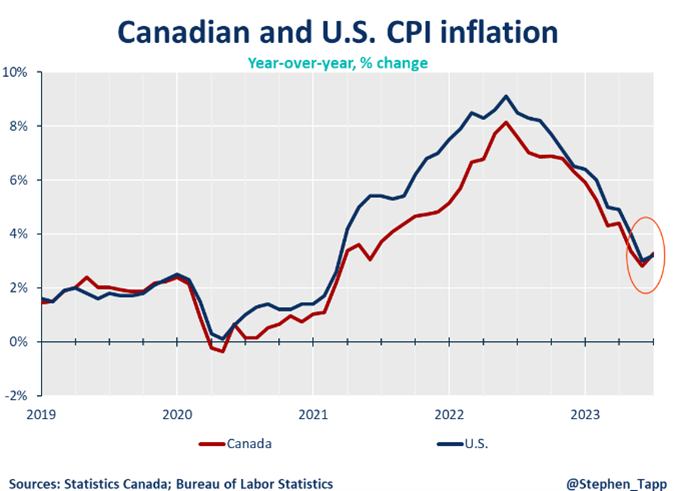

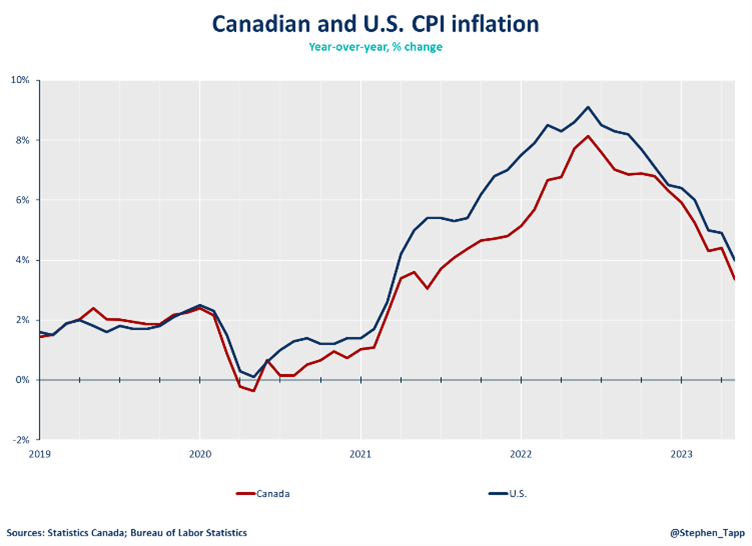

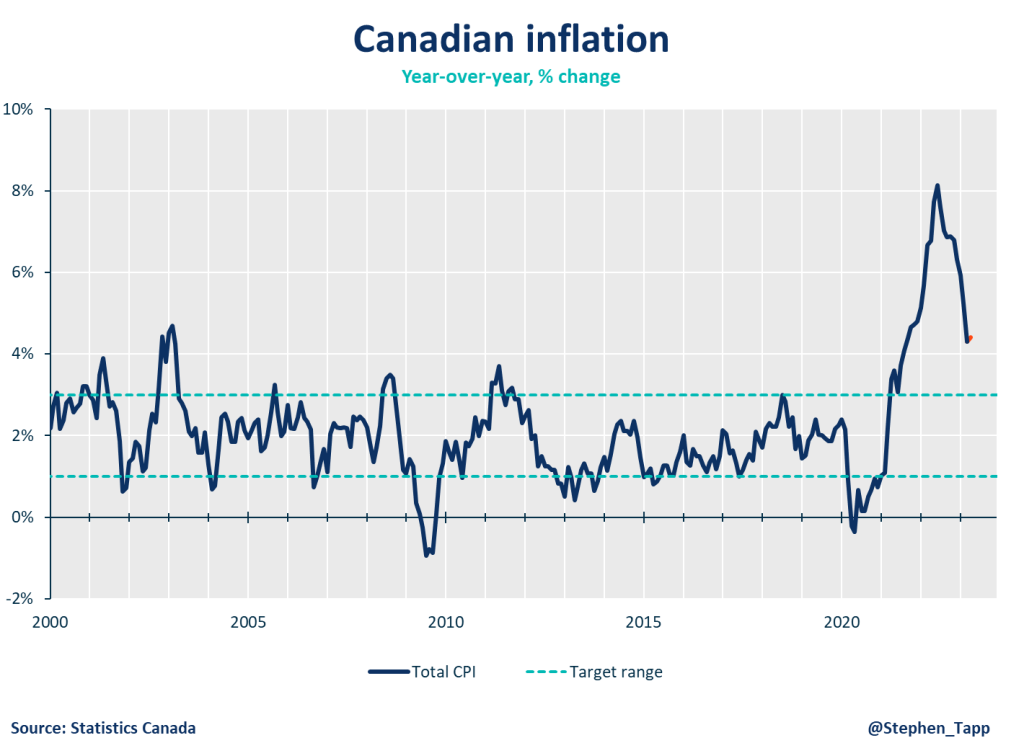

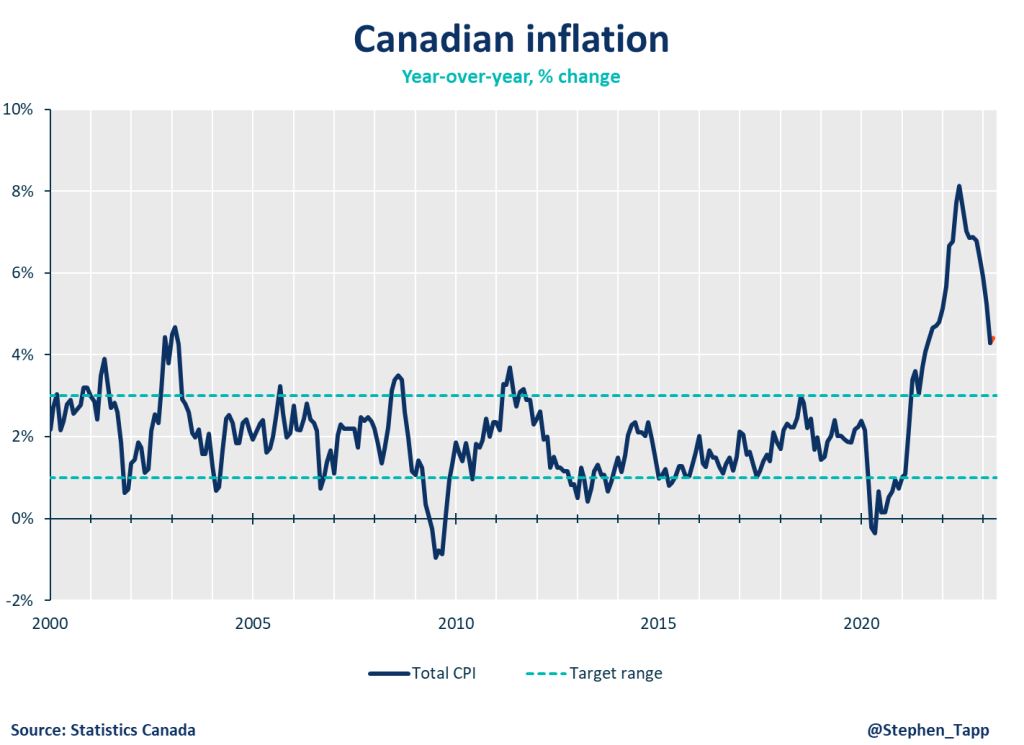

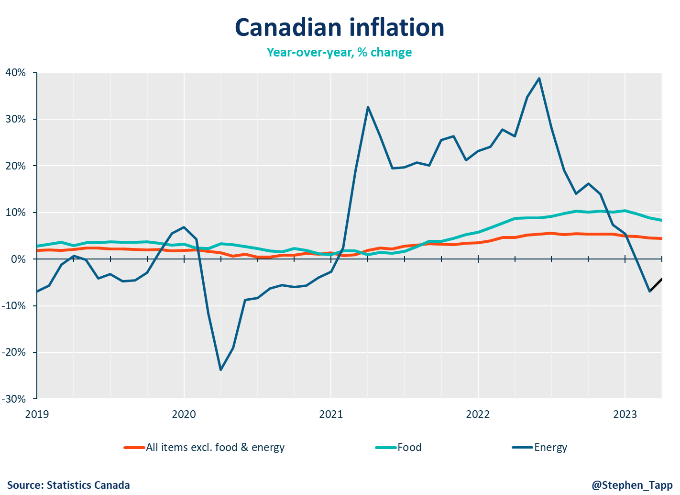

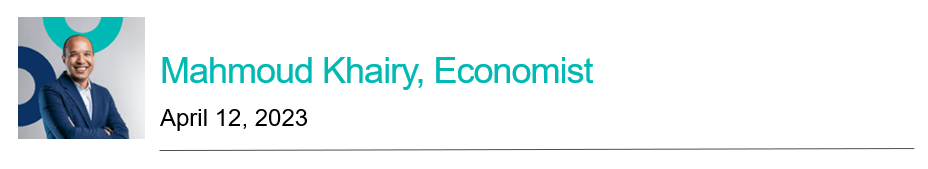

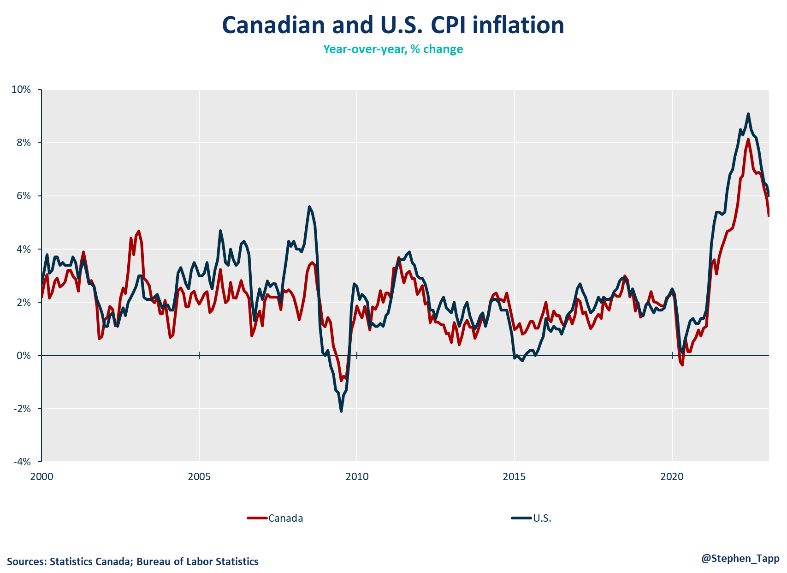

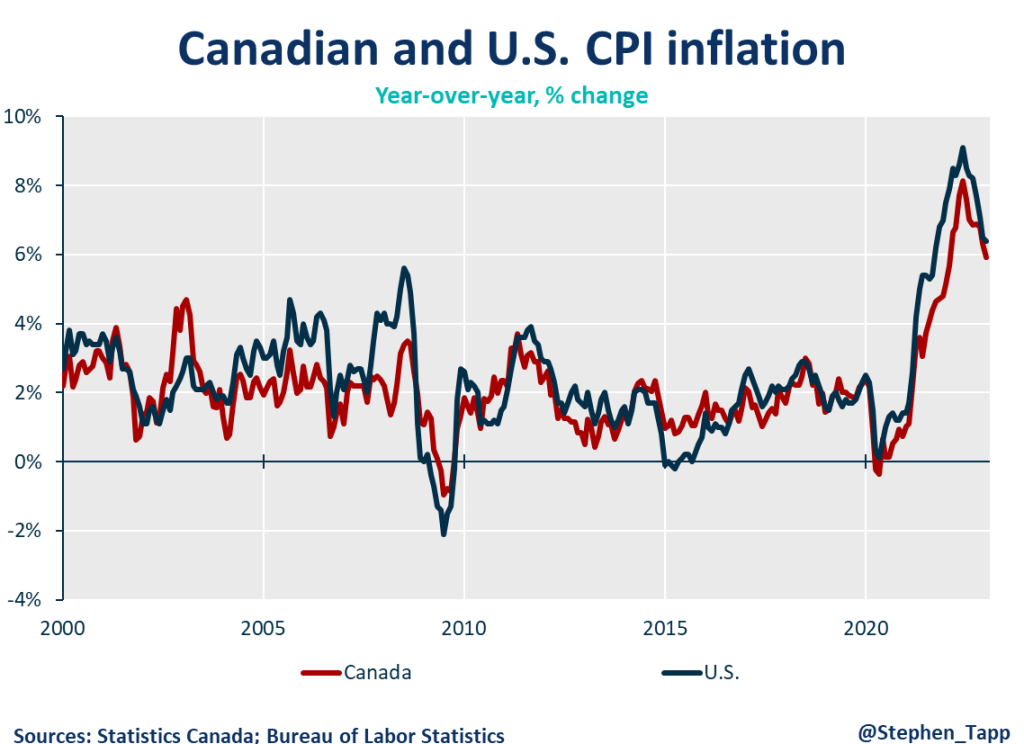

Inflation in August will raise concern at the Bank of Canada and among many Canadians. With a 4% annual growth, surpassing market expectations of 3.8%, the summer months have provided a humbling reminder of the sensitivity of headline prices to volatile commodities like food and energy, with gasoline prices being the primary driver of this month's inflation.

Rewa

Inflation in August will raise concern at the Bank of Canada and among many Canadians. With a 4% annual growth, surpassing market expectations of 3.8%, the summer months have provided a humbling reminder of the sensitivity of headline prices to volatile commodities like food and energy, with gasoline prices being the primary driver of this month’s inflation. Many Canadian consumer and business surveys now show declining inflation expectations. The Bank of Canada, with one more month of data before its next policy meeting, faces mounting market expectations for another rate hike. We’ll likely see more upside surprises in the upcoming months.

Andrew DiCapua, Senior Economist, Canadian Chamber of Commerce

KEY TAKEAWAYS

Headline

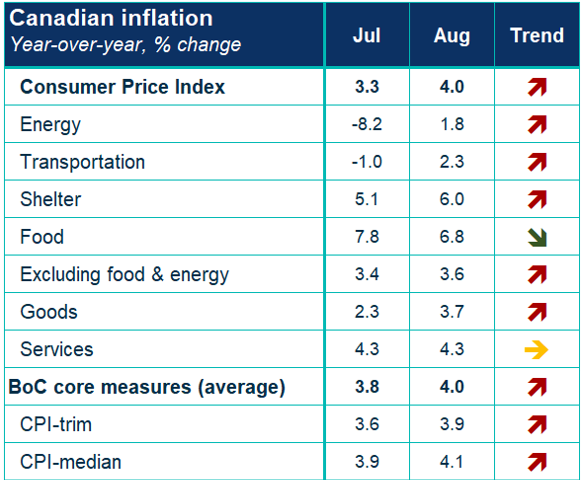

- Today’s release of August CPI was higher than expected. Canada’s headline CPI inflation grew 4% in August (compared to consensus of 3.8%) on a year-over-year basis. This comes after 3.3% growth in July, marking two months of headline CPI increases. Now that base-effects have settled in, headline inflation will swing within a range on a monthly basis.

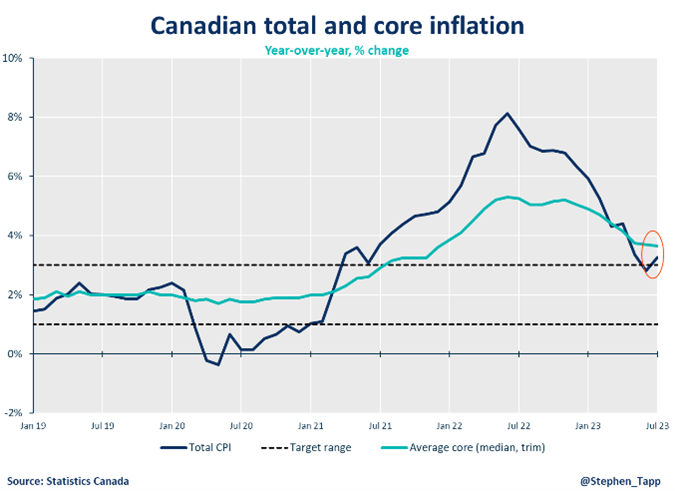

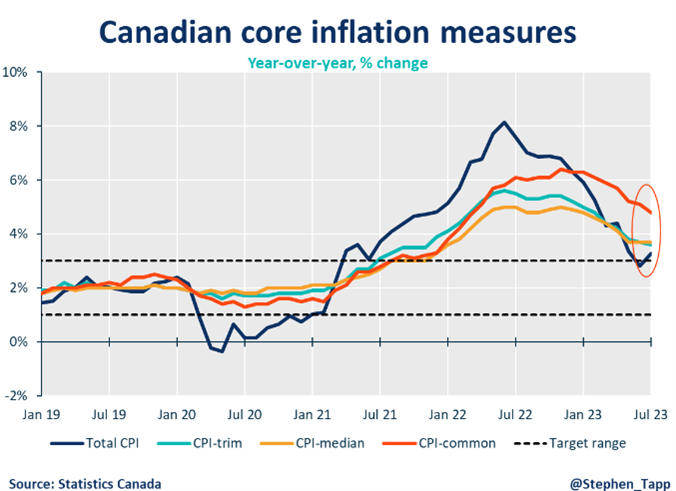

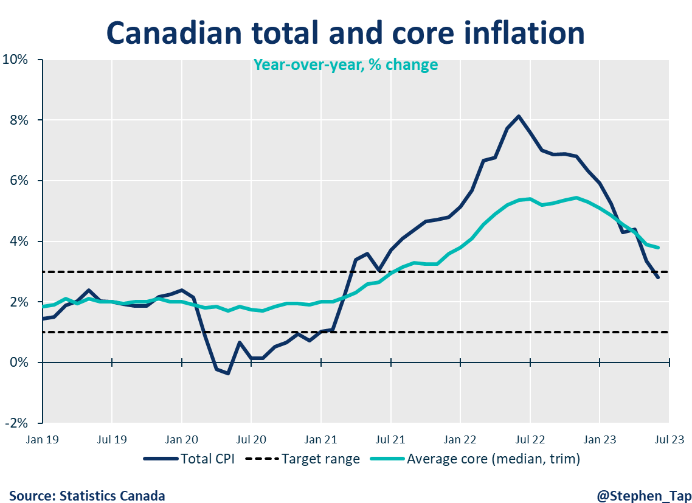

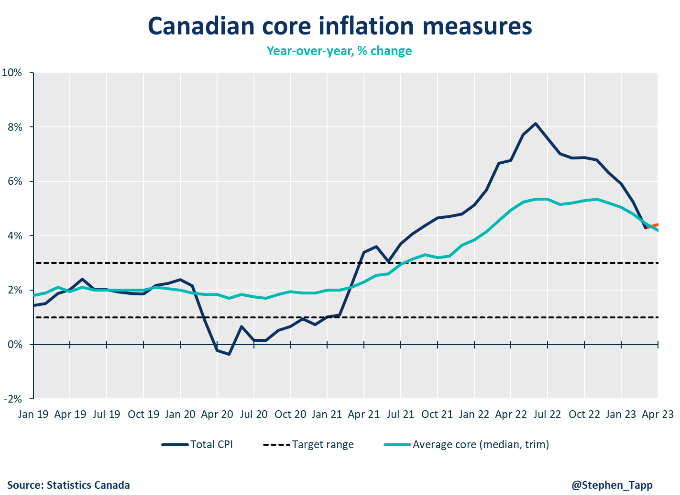

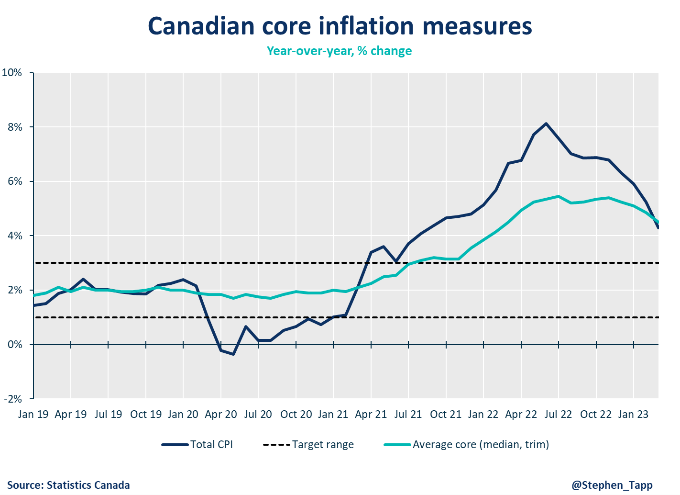

- The Bank of Canada’s core measures of underlying inflation are also heading in the wrong direction, with an average of two core indicators (CPI-median and CPI-trim), growing at 4.0% year-over-year, and 0.4% on a monthly basis.

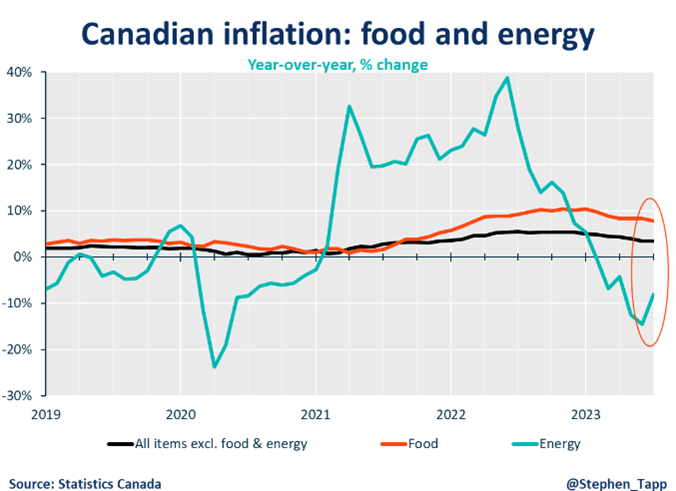

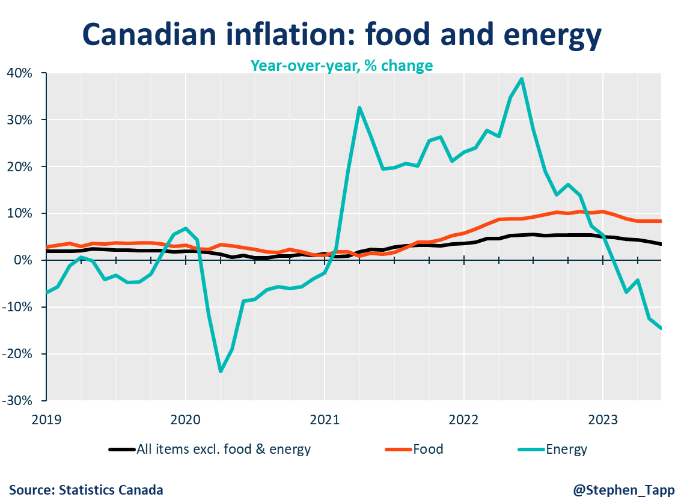

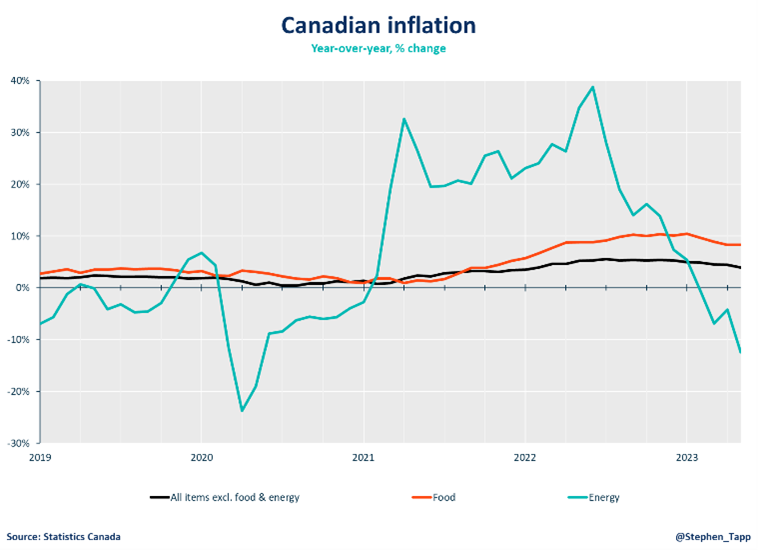

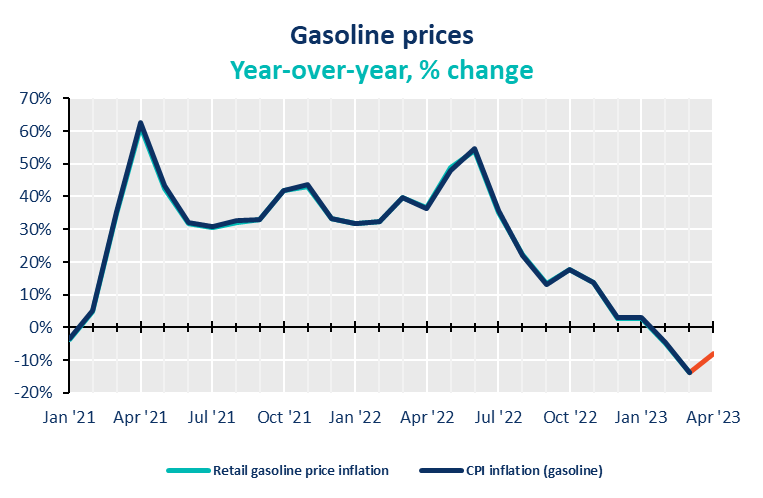

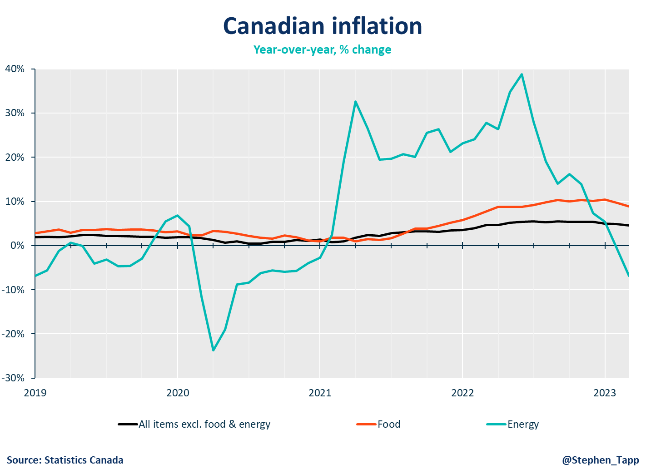

CPI Component

- Gasoline prices rose on a yearly basis for the first time since January 2023, by 0.8%. After a nearly 13% decline in prices in July, a reversal in direction in August drove inflation growth as base effects shift. Excluding food and energy, prices rose 3.6%. Gas prices for the first two weeks in September indicate that prices are expected to stay elevated relative to last year, largely due to reduced global supply, as opposed to strong demand.

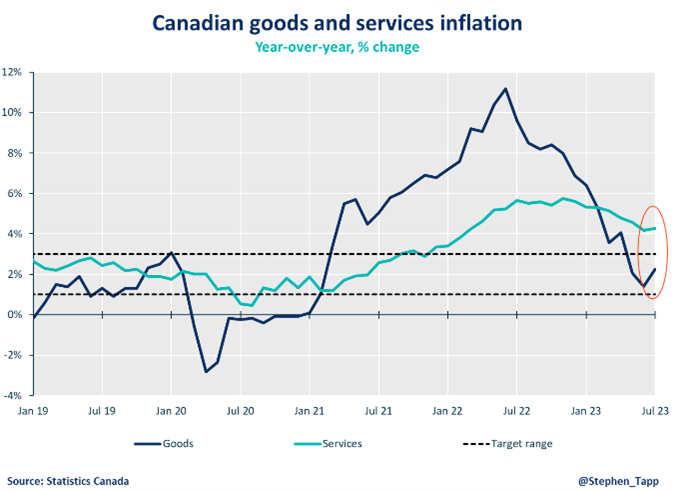

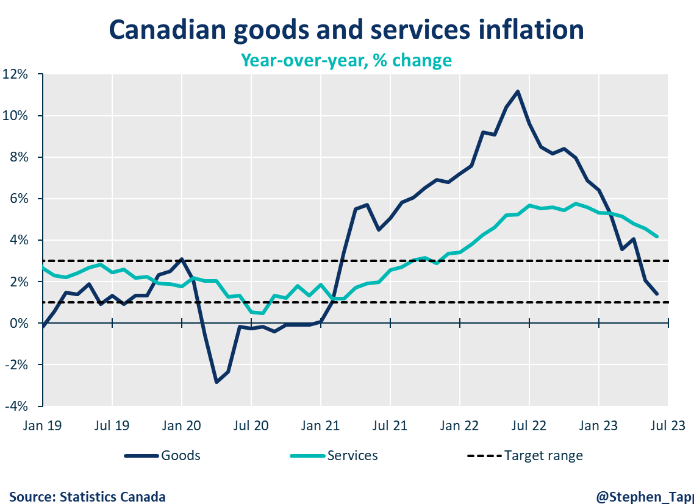

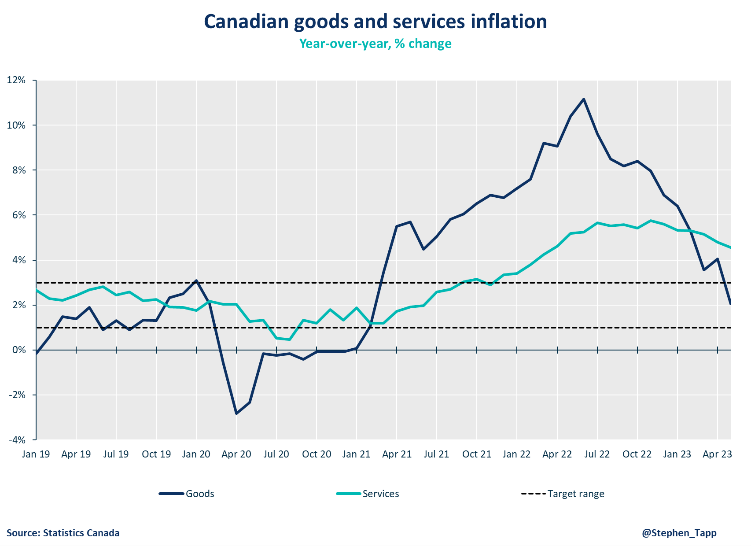

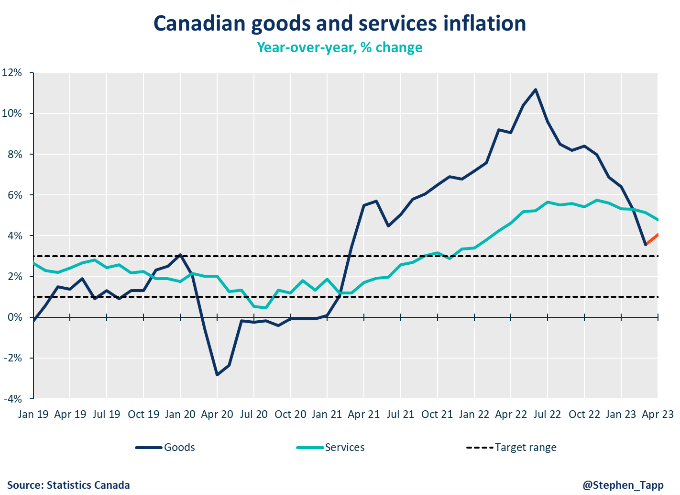

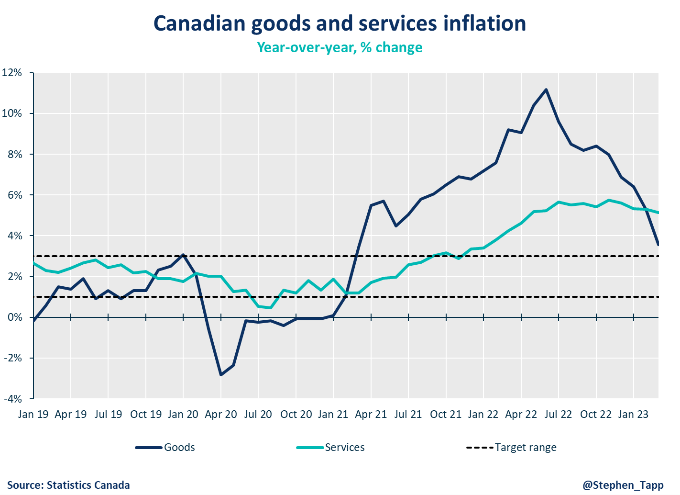

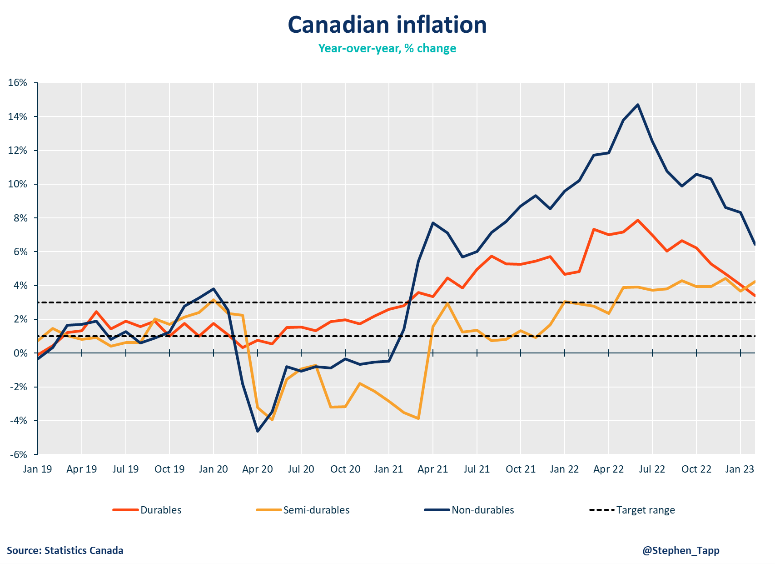

- Goods inflation rebounded in August, growing at 3.7%. Services inflation remains high and grew on an annual basis of 4.3%. This has been consistently high for months and will need to decline further in order to tame wage growth pressures.

- Despite some earlier cooling in the housing market this year, shelter prices were up 6%, primarily driven by rent price index, and further indicating pressure on supply.

- One modest bright spot in the data was a decline in grocery prices to 6.9% growth, from 8.5% in July. That said, food prices continue to grow above headline inflation and will be a continued challenge for affordability.

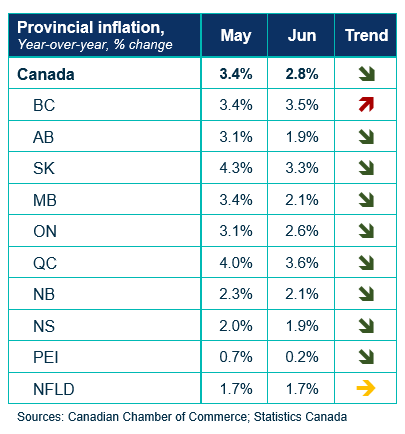

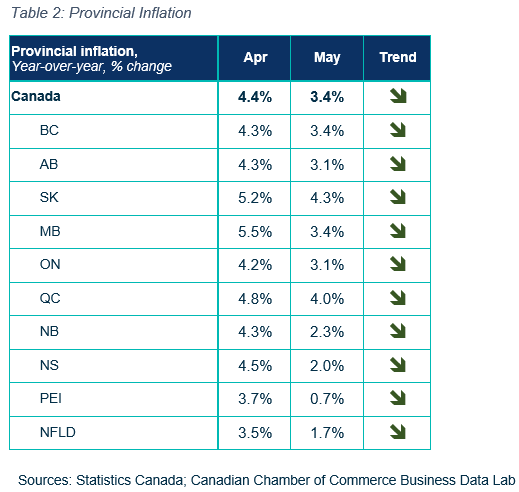

Provincial and regional inflation

- On an annual basis, all provinces experienced upward price pressure in August, but Nova Scotia saw the highest growth at 4.7%. Price growth for gasoline accelerated the most in Alberta, growing by 13%.

SENTIMENT, OUTLOOK AND IMPLICATIONS

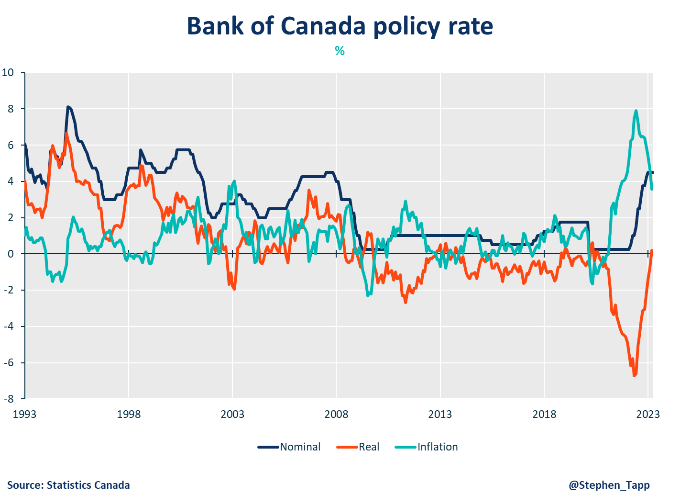

Bank of Canada

- The Bank of Canada’s core measures moved in the wrong direction, now hovering at almost double the Bank’s target of 2%. This will put added pressure on the Bank to raise rates at their next policy meeting on October 25. With another month of inflation data to consider, and the release of their Monetary Policy Report at the next meeting, we will have a better picture on the future path of rates.

- Ultimately, the Bank needs to consider their “higher for longer” policy, and whether another hike will put the Canadian economy in jeopardy.

Inflation expectations

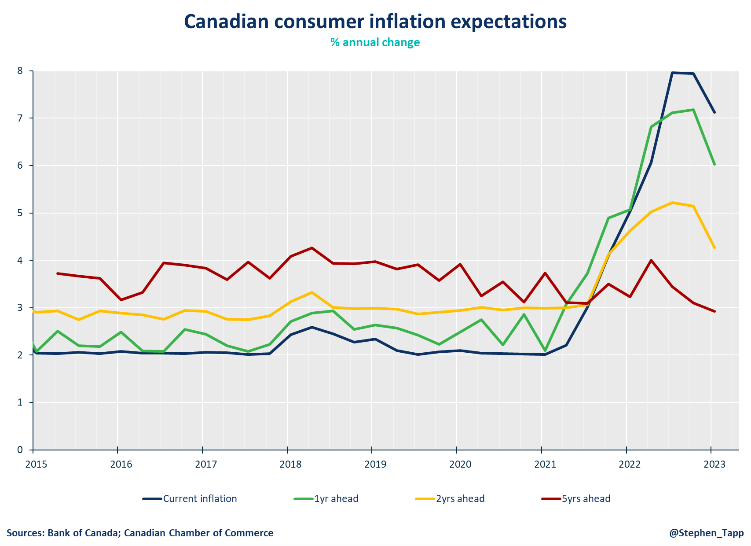

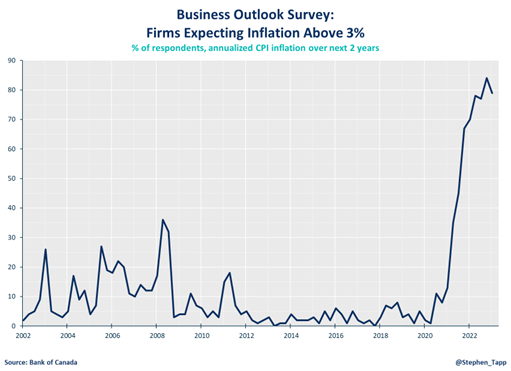

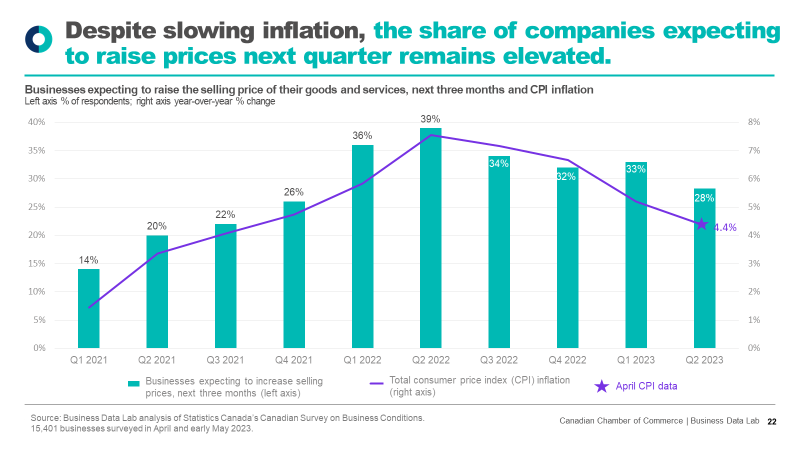

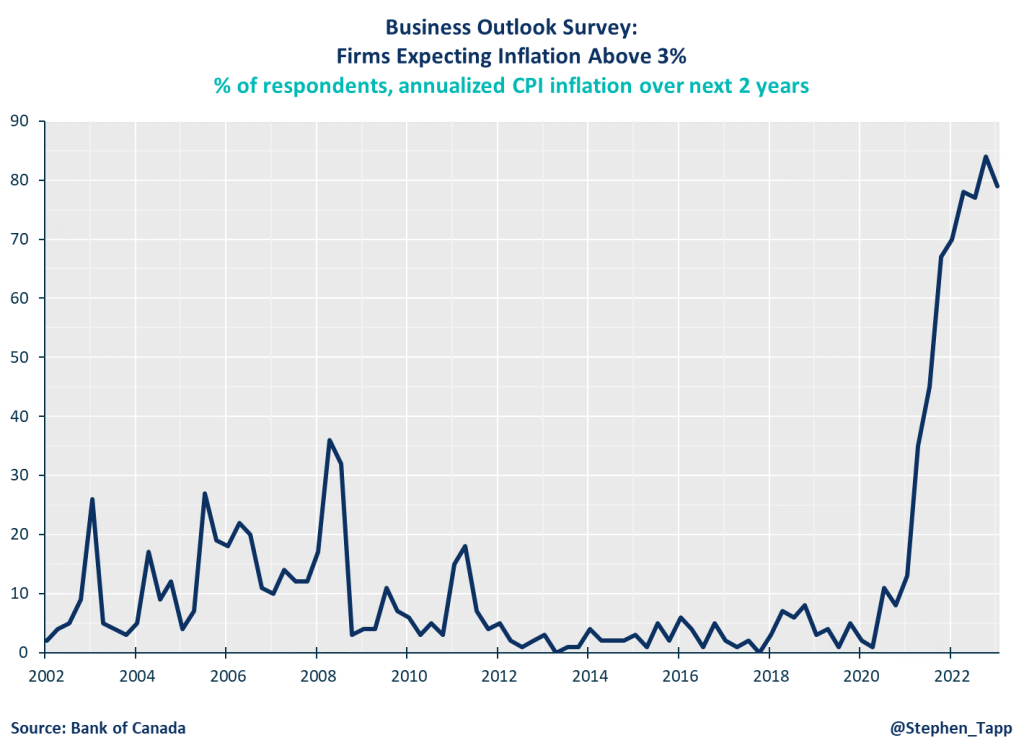

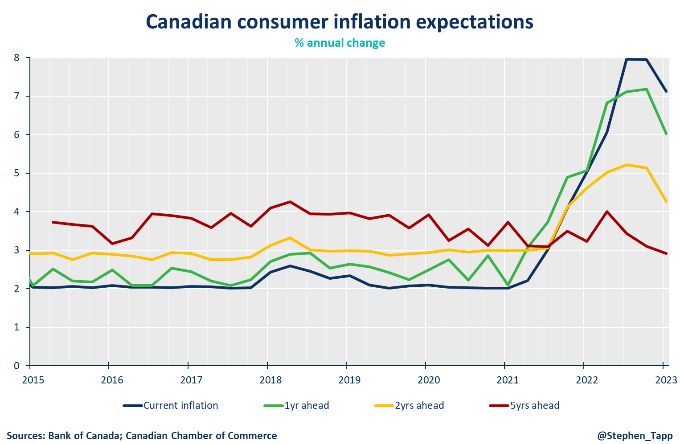

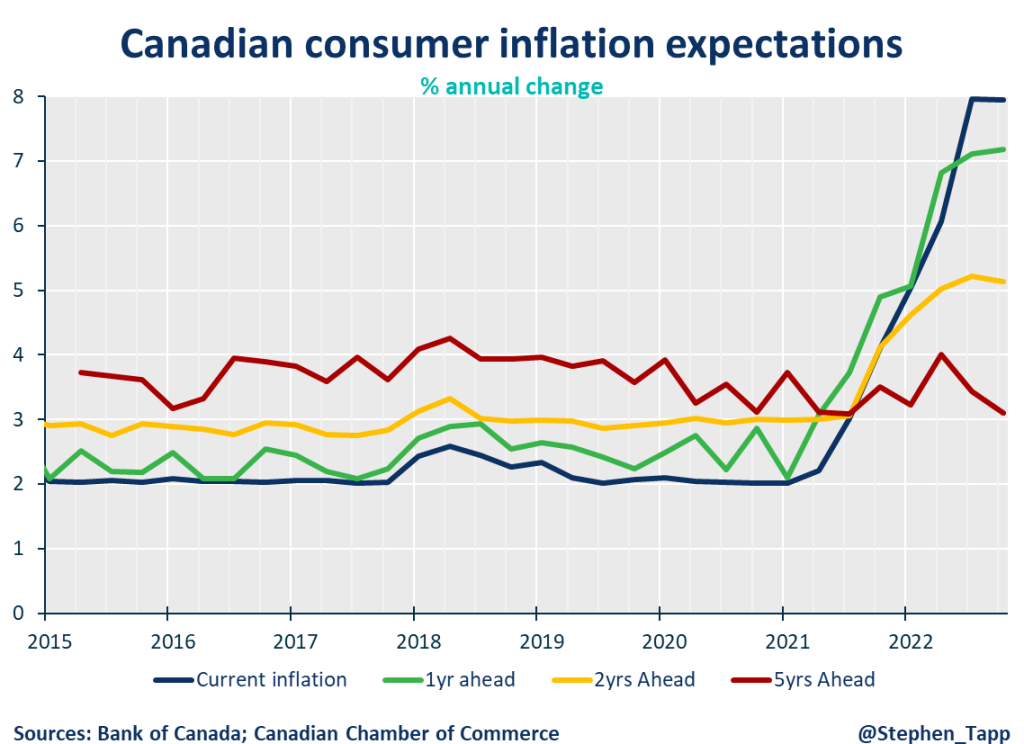

- Despite inflation moving higher over the past two months, various consumer and business surveys reinforce that both input and output price growth is set to slow.

SUMMARY TABLES

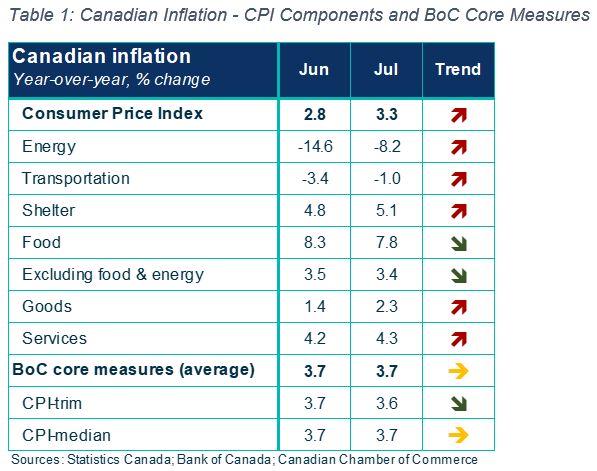

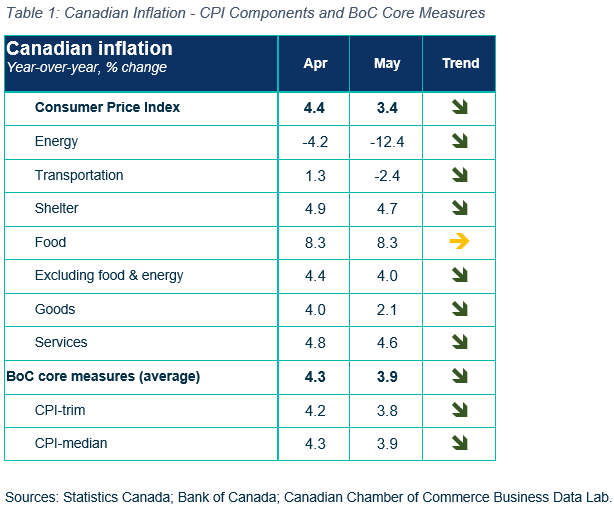

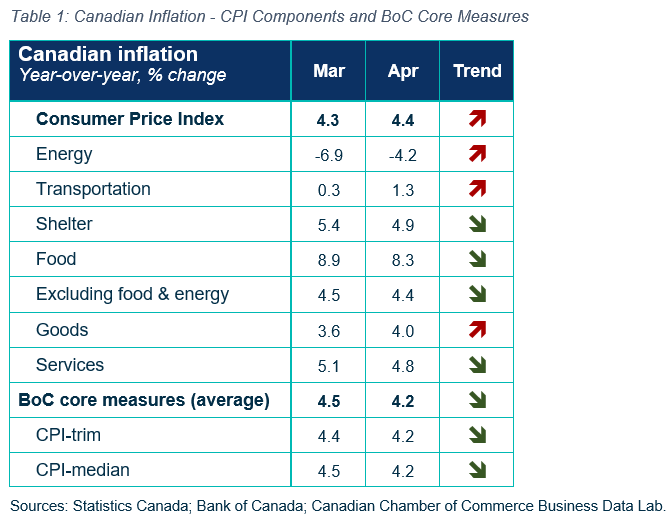

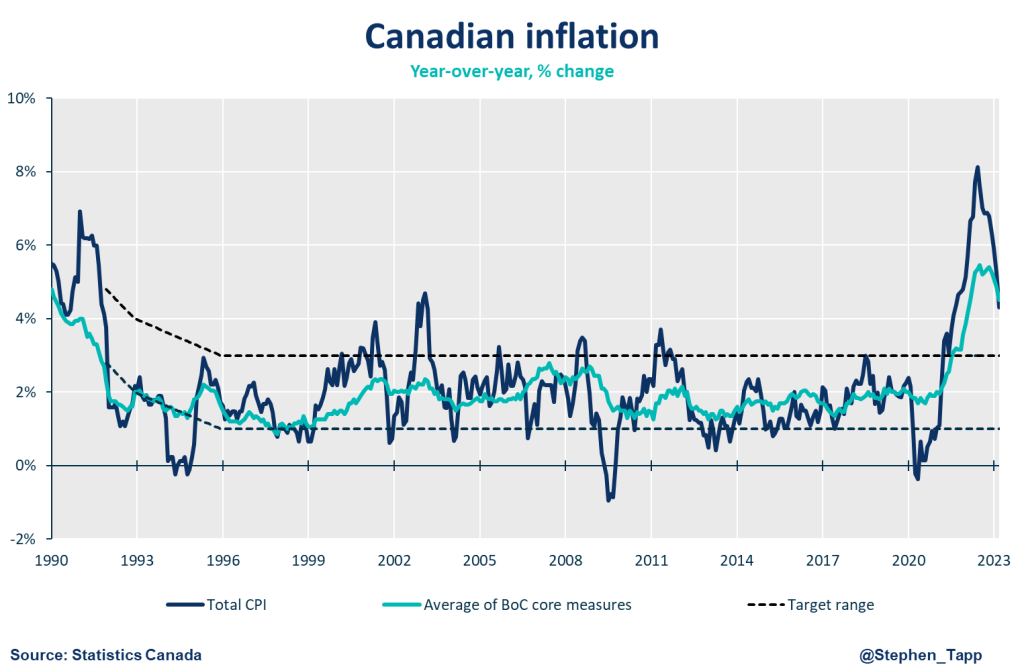

Table 1: Canadian Inflation – CPI Components and BoC Core Measures

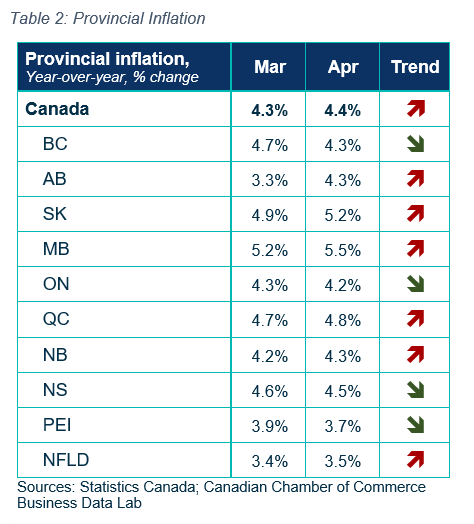

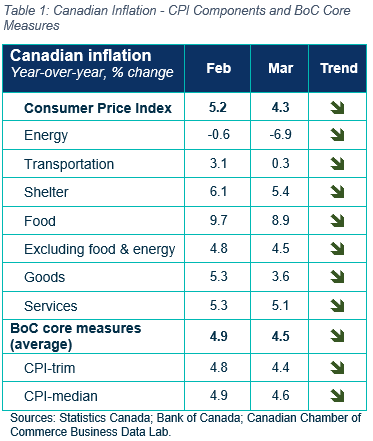

Table 2: Provincial Inflation

CPI CHARTS

Other Commentaries

Oct 19, 2022

September 2022 Consumer Price Index data: Food and services prices still rising, no progress on core inflation

Sep 20, 2022

August 2022 Consumer Price Index data: Finally some good news on Canadian inflation.

Aug 16, 2022

July 2022 Consumer Price Index data: Canada’s inflation finally turns a corner with falling gas prices, but core pressures remain

Commentaries /

July 2023 CPI: Inflation got hotter in July, but it was mostly expected.

July 2023 CPI: Inflation got hotter in July, but it was mostly expected.

After a cooling streak, higher than expected Canada’s headline CPI inflation had an uptick in July to 3.3% (as compared to the anticipated 3.0%) on a year-over-year basis.

Marwa Abdou

As frustrating as today’s headline inflation figure of 3.3% may be – given it was up from 2.8% in June and higher than market expectations – the change of trajectory from recent months was not entirely surprising. So much of the downward momentum and cooling that we’ve seen over the past few months has been overstated progress from soaring gas prices a year ago. While those effects have now peaked – and heftier grocery bills, mortgage interest rate costs and energy prices remaining a pain point for Canadian consumers – we’re now getting a chance to focus on the real work that remains ahead.

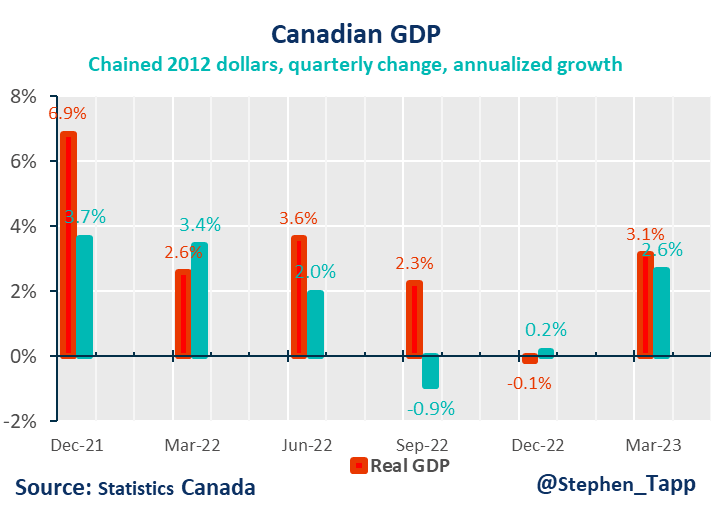

Does this signal another policy hike is in store for Canadians next month? With sluggish progress on the Bank of Canada’s core measures, it’s not entirely out of the question. We might need to see how June’s GDP data fares come on September 1. This will signal whether further tightening is necessary.

Marwa Abdou, Senior Research Director, Canadian Chamber of Commerce

KEY TAKEAWAYS

HEADLINE

- After a cooling streak, higher than expected Canada’s headline CPI inflation had an uptick in July to 3.3% (as compared to the anticipated 3.0%) on a year-over-year basis.

- After a recent steady cooling streak, Canada’s annual inflation rate dropped to a 27-month low of 2.8% in June led by lower energy prices from a year prior when Russia invaded Ukraine. As those effects have peaked, the real work has been making headway on the Bank of Canada’s core measures.

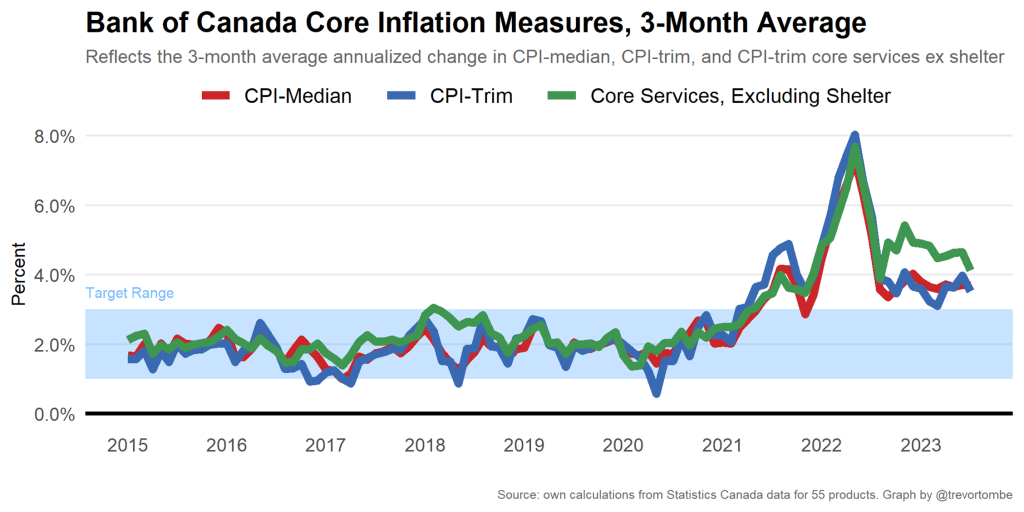

- Overall, there hasn’t been significant progress on core measures. While headline inflation accelerated, the average of two of the Bank of Canada’s core measures of underlying inflation, CPI-median and CPI-trim, came in at 3.7% (unchanged from June) and 3.6% (compared to 3.7%)

CPI COMPONENTS

- Excluding food and energy, prices rose 4.1% compared with a 4.0% rise in June.

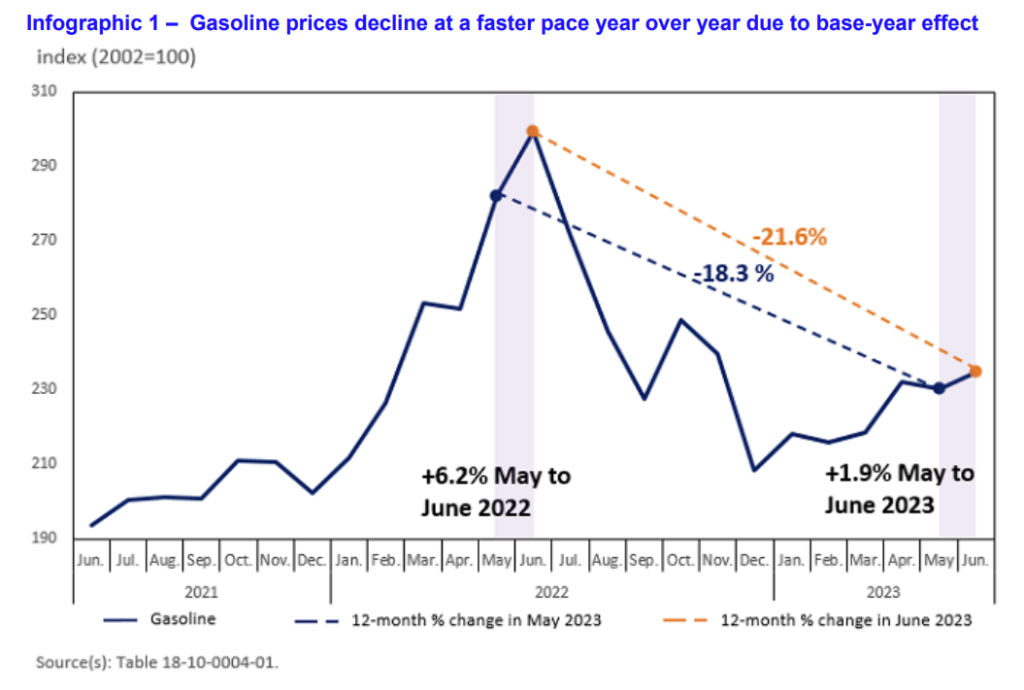

- Though gas prices were still below year-ago levels in July (-12.9%), the decline was smaller than in June (-21.6%). This is also a result of base-year effects and prices remaining nearly unchanged on a month-over-month basis in July.

- One bright spot in the data has been the cooling of prices for travel-related services as compared to last year when COVID restrictions had lifted, and demand peaked post-pandemic. Traveler accommodation prices continued to slow (4.2% vs. 12.9% in June). Prices for travel tours also slowed (1.2% vs. 6.8%). In addition, airfares were down 12.7% compared with last July, after falling by 3.5% in June.

- One major pain point for Canadian consumers has been grocery prices which had been consistently running hot. While prices remain elevated, another ray of light is that we’re seeing a slower pace of growth (8.5% vs 9.1% in June) by way of fresh fruit and, to a lesser extent, baked goods.

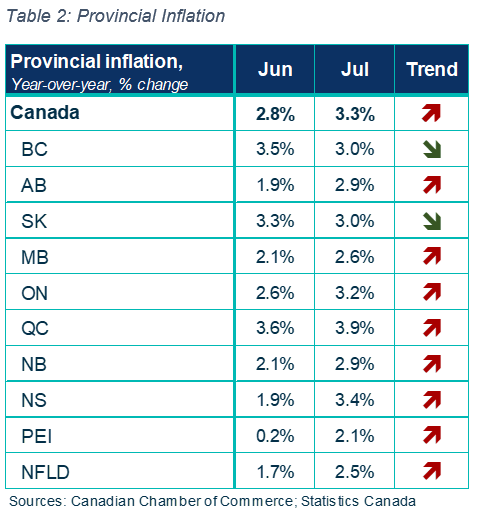

PROVINCIAL INFLATION & REGIONAL NOTES

- On an annual basis, except for Saskatchewan and British Columbia, prices rose at a faster pace in July than in June. Price growth accelerated the most in Prince Edward Island, largely due to acceleration in prices for energy products.

- Another noteworthy highlight is that electricity prices rose significantly in Alberta (+127.8%!) in July.

SENTIMENT, OUTLOOK & IMPLICATIONS

BANK OF CANADA

- While there is glacial progress on the Bank of Canada’s core measures, and we’ve been surprised in the past, my sense is come September we might be still safe from another increase in policy rates. It will also have to factor in the strength of the Canadian economic backdrop – as we await June’s GDP data on September 1.

- We’ve seen signs that the economy is slowing, including the 3-month averages falling slightly. We also know that lagged effects of previous policy rate hikes will take time to continue working their way through the economy.

SUMMARY TABLES

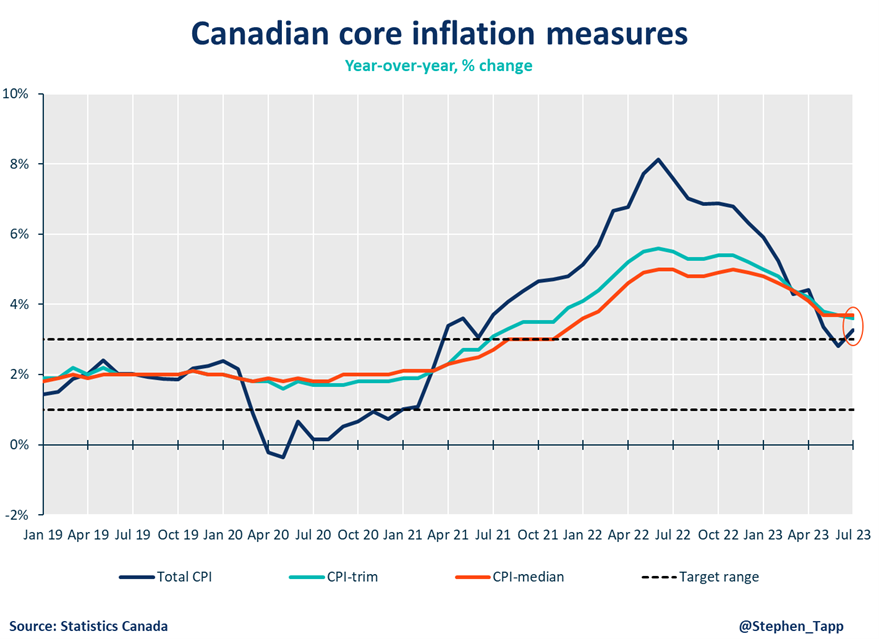

CPI CHARTS

Other Commentaries

Oct 19, 2022

September 2022 Consumer Price Index data: Food and services prices still rising, no progress on core inflation

Sep 20, 2022

August 2022 Consumer Price Index data: Finally some good news on Canadian inflation.

Aug 16, 2022

July 2022 Consumer Price Index data: Canada’s inflation finally turns a corner with falling gas prices, but core pressures remain

Commentaries /

June 2023 CPI: Base effects have peaked, but no real change in core measures

June 2023 CPI: Base effects have peaked, but no real change in core measures

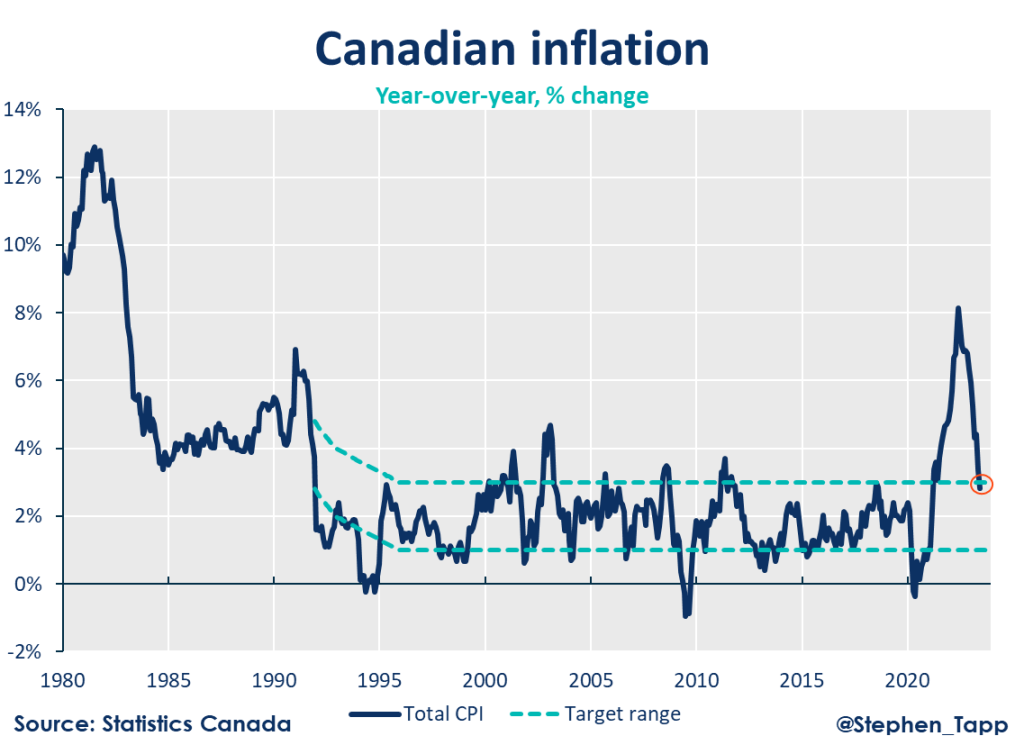

As the first data release since last week’s interest rate announcement, June’s headline inflation reading marks the first time since March 2021 that annual inflation is back within the Bank of Canada’s 1% – 3% control range.

Rewa

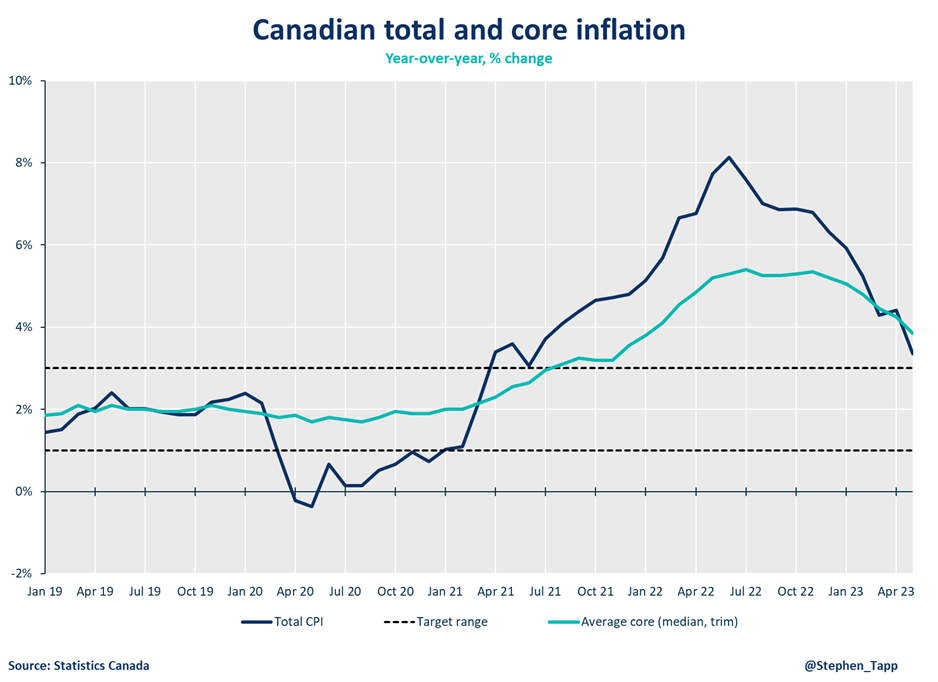

As the first data release following last week’s interest rate announcement, June’s headline inflation reading brings annual inflation back within the Bank of Canada’s control range of 1% to 3% for the first time since March 2021. Still, while the annual changes have slowed, it’s still too early to celebrate since most of the progress is from energy price base-effects from a year ago. Unfortunately, the stickiest and hardest part of the inflation fight is only just beginning.

Marwa Abdou, Senior Research Director, Canadian Chamber of Commerce

KEY TAKEAWAYS

Headline

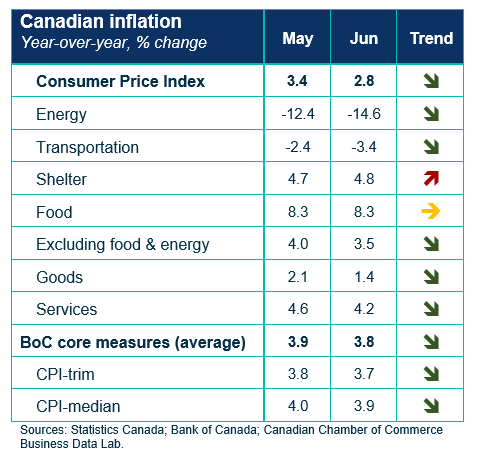

- Exceeding market expectations, Canada’s headline CPI inflation slowed in June to 2.8% on a year-over-year basis, below the anticipated 3.0%. The deceleration is primarily driven by base effects from a year ago, particularly in energy prices following the geopolitical situation between Russia and Ukraine. When excluding food and energy, prices rose by 3.5% compared to 4.0% in May.

- While the headline puts us within the Bank of Canada’s inflation control target range overall, it doesn’t show much meaningful progress on core measures. Although it continues a positive trend with the lowest inflation rate in over two years, excluding gasoline from the calculations pushes inflation up to 4.0%, well above the upper end of the target range.

- Mortgage interest costs and travel expenses continue to place a major dent on consumers’ wallets as the month-over-month CPI rose by 0.1% (compared to +0.4% in May).

CPI Components

- Despite a slowdown in energy price growth, gasoline prices continue to drive down inflation with a 21.6% decline in June (following a drop of 18.3% in May). This reflects the base-year effects when global crude oil demand surged as China eased pandemic-related restrictions.

- Transportation prices also fell by 3.4% in June (following a 2.4% decline in May). Much like energy, we saw base-year effects play out for passenger vehicle prices from a year prior where the sector had suffered from persistent supply chain and inventory challenges. Price increases slowed to +2.4% (compared to +3.2% in May).

- If you are travelling, domestically or internationally, you are also likely to feel the weight of elevated prices. But the good news is that along with travel was also another area where we saw a deceleration in price increases as compared to the previous month (+6.8% vs.+23.4%). Still, this is not shocking as it falls in line with seasonal patterns that peak in July.

- Grocery prices are still running hot (+9.1% yr/yr in June as compared to +9.0% May). Meat (+6.9%), baked goods (+12.9%), and dairy products (+7.4%) accounted for most of the rise.

Provincial inflation

- A bright spot in the monthly report is that inflation slowed in 8 out of 10 provinces. Atlantic provinces continue to lead the way, with Prince Edward Island clocking in the lowest inflation of all (+0.2%). This too reflects those base effects as it had the largest decline in energy prices (-24.1%).

SENTIMENT, OUTLOOK & IMPLICATIONS

Bank of Canada

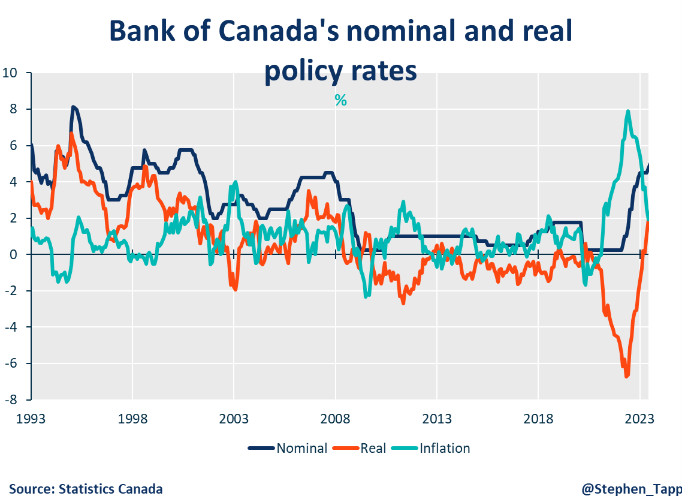

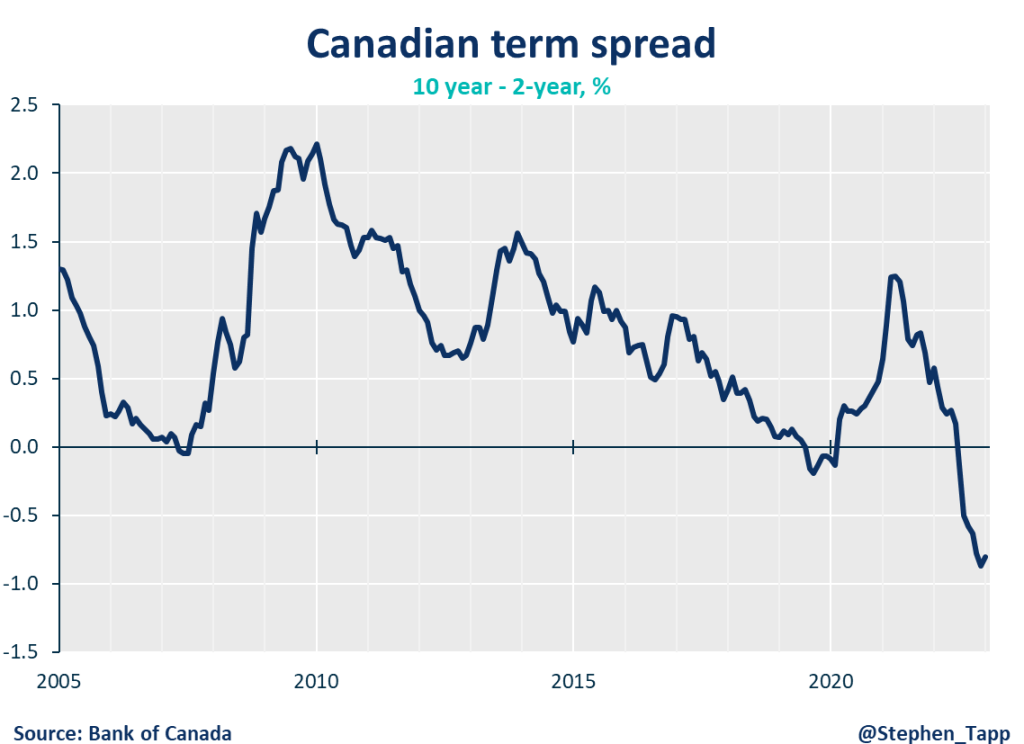

- With last week’s BoC announcement to increase rates to a 22-year high of 5.0%, all eyes are on its two “core inflation” measures. Their average, while continuing to show very modest softening year-over-year, remains well above the target range — 3.8% vs. 3.9% in May. Unfortunately, shorter-term (3-month) core measures increased in June (also matching the 3.8%). Taken together, this indicates stalled progress on underlying inflation pressures, which is a major concern for the Bank.

- The central bank, which cited excess demand, expects inflation to remain around 3% over the next year before dropping to its 2% target by mid-2025, six months later than previously anticipated. Unfortunately, we may have to get used to tight monetary policy, as the lagged effects of previous actions work their way through the economy.

SUMMARY TABLES

CPI CHARTS

Other Commentaries

Oct 19, 2022

September 2022 Consumer Price Index data: Food and services prices still rising, no progress on core inflation

Sep 20, 2022

August 2022 Consumer Price Index data: Finally some good news on Canadian inflation.

Aug 16, 2022

July 2022 Consumer Price Index data: Canada’s inflation finally turns a corner with falling gas prices, but core pressures remain

Commentaries /

May 2023 CPI: Base effects overstate progress on slowing inflation

May 2023 CPI: Base effects overstate progress on slowing inflation

Headline inflation is finally looking better in Canada, down a full percentage point in May to 3.4% year-over-year. However, this...

Business Data Lab

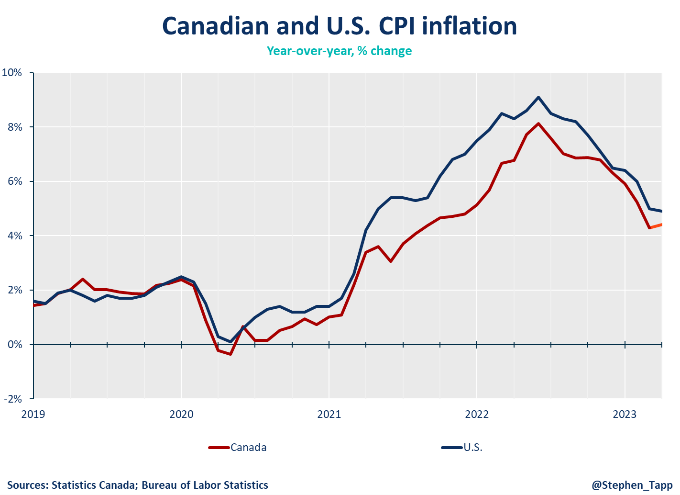

Headline inflation is finally looking better in Canada, down a full percentage point in May to 3.4% year-over-year. However, this progress is mostly a statistical mirage, because global commodity prices spiked last year when Russia invaded Ukraine. The Bank of Canada will not see enough in today’s release to feel confident that inflation will settle back down to 2% without more tightening. Therefore, I’m penciling in another 25 basis point hike in July, pending Friday’s GDP data and new BoC surveys.

Stephen Tapp, Chief Economist, Canadian Chamber of Commerce

KEY TAKEAWAYS

Headline

- As markets expected, Canada’s headline CPI inflation slowed by a full percentage point in May to 3.4% on a year-over-year basis. The deceleration largely reflects lower gas prices, as compared with elevated levels one year ago. While still above the Bank of Canada’s inflation control target range, this is the lowest inflation rate in nearly two years.

- On a month-over-month basis the CPI rose by 0.4%, pushed up by higher costs for mortgage interest and travel.

Key Drivers

- Gas prices were a key driver of the slower headline inflation in May. They were 18% lower, compared with a year earlier when Russia’s invasion of Ukraine caused global price spikes for energy and other commodities.

- Food inflation remains high and problematic for consumers (at 8.3%, unchanged from last month). In this category, grocery prices are up 9%, and restaurant meals picked up further to 6.8%, amid labour shortage and higher costs.

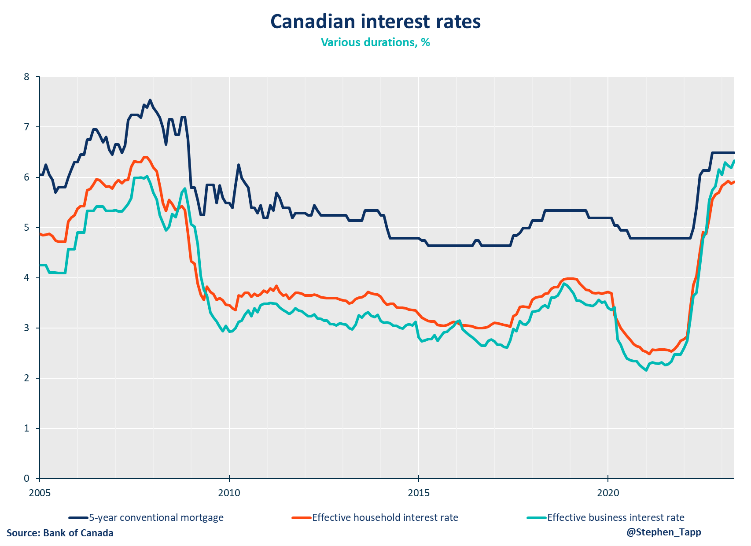

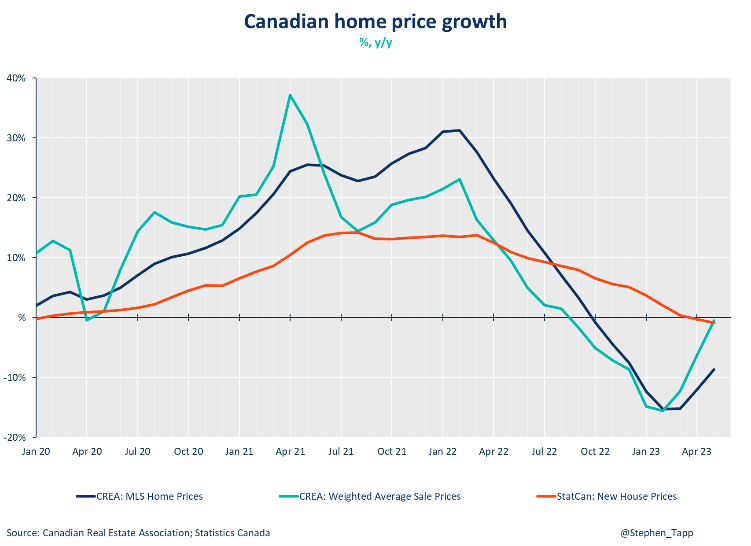

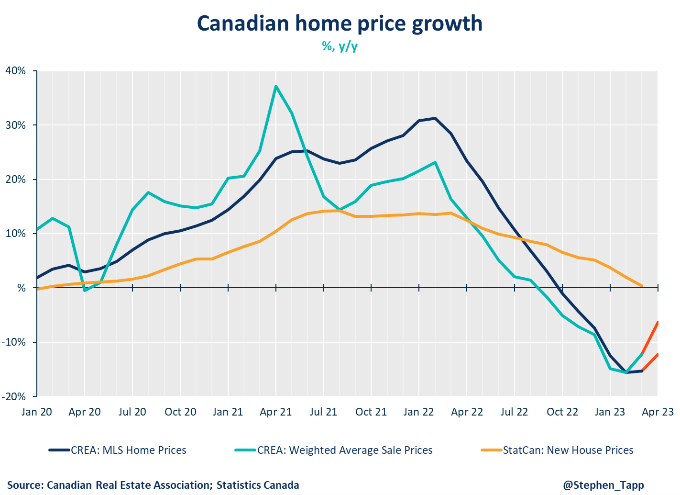

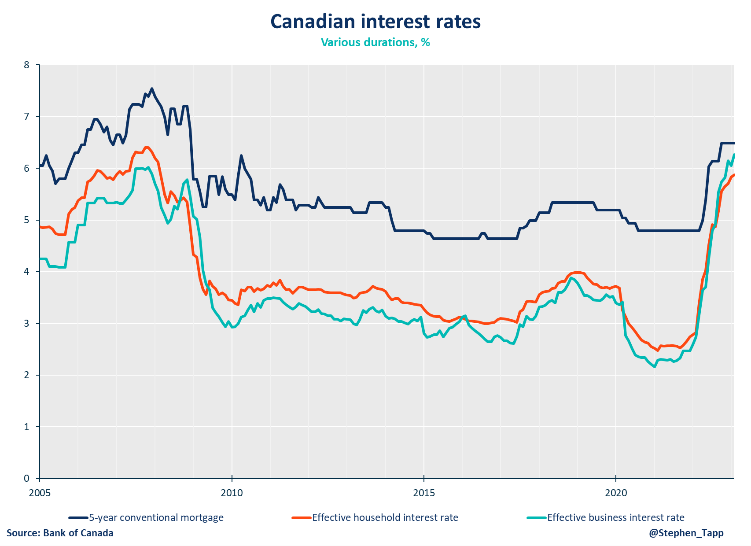

- Mortgage interest costs are up a record 30%, as the Bank of Canada raises rates to control inflation. That said, overall shelter costs decelerated slightly to 4.7%, even as home prices are once again on the rise as the housing market picks up steam.

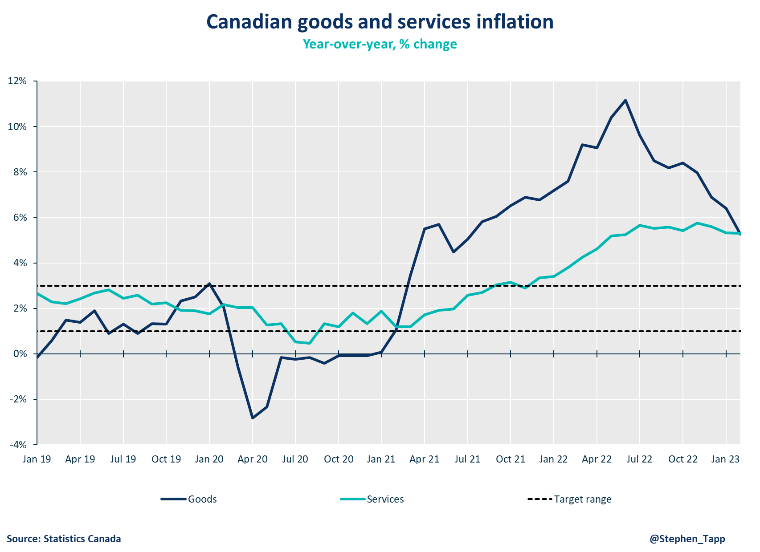

- Services inflation slowed modestly to 4.6% (from 4.8% last month) but remains at worrying levels for the Bank of Canada. Goods inflation showed a bigger improvement slowing to 2.1% (from 4.0%), reflecting an easing of global supply chain problems since last year.

- Inflation slowed in all provinces, particularly in Atlantic provinces due to lower prices for heating fuels.

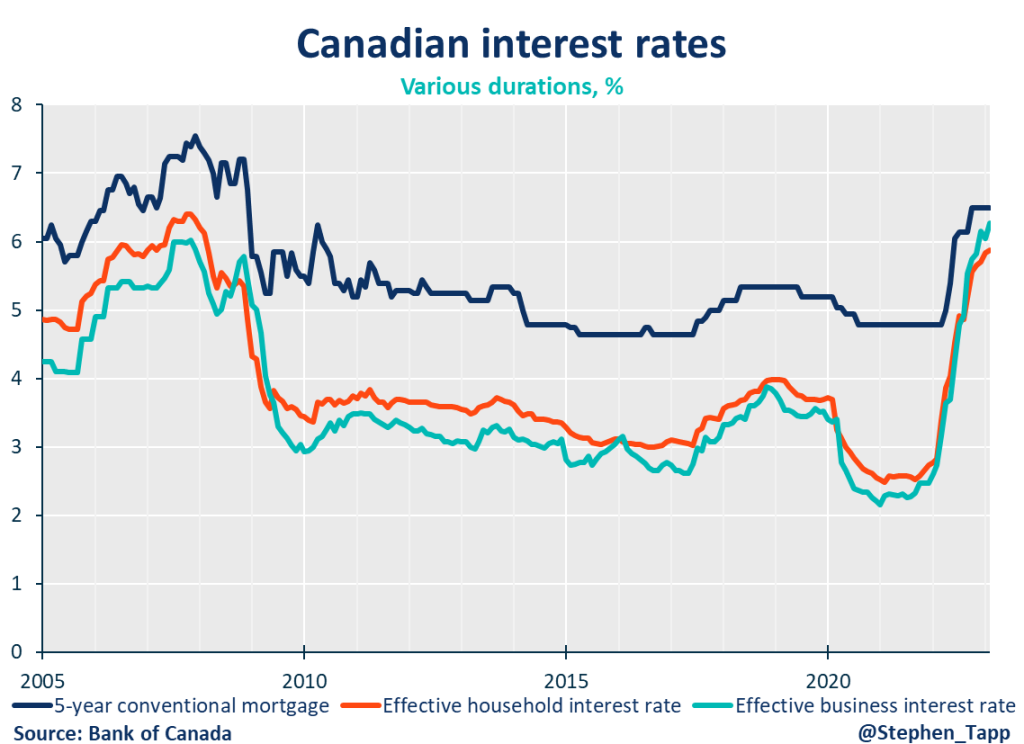

Bank of Canada Interest Rates

- The Bank of Canada’s two “core inflation” measures slowed to 3.9% year-over-year and continue to trend in the right direction.

- Unfortunately, and more consequentially, shorter-term (three-month annualized) core is holding steady around 3.5% or higher.

- This suggests the Bank of Canada will likely deliver another rate hike in July — although it’s too soon to place my bets, given that we will get an important Canadian GDP release and BoC surveys this Friday.

Taken together — and looking past the base-year effects that are overstating the actual progress on slowing down inflation pressures — the risks remain high that inflation will get stuck above the Bank’s target, without tighter monetary policy:

- Short-run core inflation is still too high;

- Wage pressures are sustained in a labour market with falling labour productivity that only started slowing in the last two months;

- There have only been modest improvements for services prices and inflation expectations;

- The housing market is bouncing back to life;

- All this while businesses face broad-based cost pressures, which are preventing pricing behaviour from normalizing

SUMMARY TABLES

INFLATION CHARTS

Other Commentaries

Oct 19, 2022

September 2022 Consumer Price Index data: Food and services prices still rising, no progress on core inflation

Sep 20, 2022

August 2022 Consumer Price Index data: Finally some good news on Canadian inflation.

Aug 16, 2022

July 2022 Consumer Price Index data: Canada’s inflation finally turns a corner with falling gas prices, but core pressures remain

Commentaries /

June 2023 CPI: Breaking its conditional pause, BoC issues a 25 basis point taking the overnight rate to 4.75%

June 2023 CPI: Breaking its conditional pause, BoC issues a 25 basis point taking the overnight rate to 4.75%

The Bank of Canada increased interest rates once again, after taking a short pause of only a few months.

Rewa

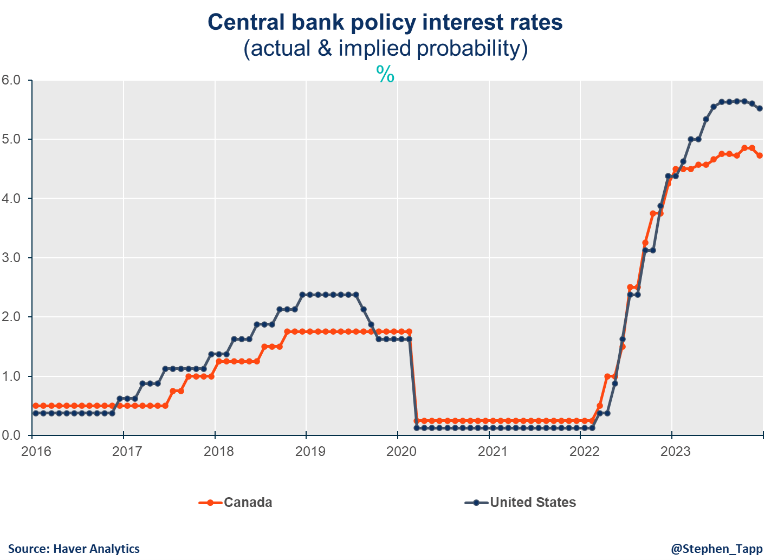

Today, the Bank of Canada increased interest rates once again, after taking a short pause of only a few months. The increase of 25 basis points takes the overnight rate to 4.75%. After two stronger-than-expected reports – by way of April’s inflation increase and Q1 2023’s GDP growth – this decision is not shocking but was not expected until July when the Bank issues its next Monetary Policy Report. As the cumulative impact of past rate hikes continue to slow demand and inflation, this decision is proof that the Bank is resolute in its determination to return inflation to the 2% target

Marwa Abdou, Senior Research Director, Canadian Chamber of Commerce

SUMMARY TABLE

CHARTS

Other Commentaries

Oct 19, 2022

September 2022 Consumer Price Index data: Food and services prices still rising, no progress on core inflation

Sep 20, 2022

August 2022 Consumer Price Index data: Finally some good news on Canadian inflation.

Aug 16, 2022

July 2022 Consumer Price Index data: Canada’s inflation finally turns a corner with falling gas prices, but core pressures remain

Commentaries /

May 2023 CPI: Canada’s inflation surprisingly edges up, breaking its chilly streak

May 2023 CPI: Canada’s inflation surprisingly edges up, breaking its chilly streak

Breaking an 8-month streak of cooling, Canada’s headline inflation edged up to 4.4%. This was higher than market expectations which predicted another drop from March’s 4.3%.

Marwa Abdou

Breaking an 8-month streak of cooling, Canada’s headline inflation edged up to 4.4%. This was higher than market expectations which predicted another drop from March’s 4.3%. The acceleration in this report came by way of an increase in gas prices, rent and mortgage interest rate costs. As it continues to hold its policy rate at 4.5%, this surprising report will keep the Bank of Canada on greater alert, as we await its next announcement in early June.

Marwa Abdou, Senior Research Director, Canadian Chamber of Commerce

KEY TAKEAWAYS

Headline

- Canada’s headline CPI inflation edged up to 4.4% year-over-year in April. This broke an almost three-quarter streak of cooling down from headline peak 8.1% last summer. The slowdown in headline inflation was well above market expectations (4.1%).

- On a month-over-month basis, the CPI rose by 0.7% in April (compared to the 0.5% increase in March).

CPI Components

- One bright spot in this report is that the spread of inflation continues to narrow across goods and services. Price increases for goods rose to 4.0% in April from 3.6% in March, whereas those in services declined to 4.8% from 5.1% a month prior. Still, it’s important to note that all but transportation prices (1.3% up from 0.3%) in the CPI basket are seeing inflation above the BoC’s 1% to 3% target range.

- Another glimmer of light is that grocery (+9.1% yr/yr from 9.7% in March) and food prices (8.3% from +8.9% March) have finally started to loosen their grip on consumers’ wallets.

- The largest contributor to the acceleration of this month’s headline number, gasoline rose prices in April by 6.3% – the largest m/m increase since October 2022. This surge in prices followed OPEC+’s April announcement representing the largest cut since the start of the pandemic and equivalent to 2% of global oil demand.

- While mortgage costs were up by almost 29% yr/yr from April 2022, Canadians are seeing shelter costs decelerate a little – 4.9% yr/yr from 5.4% from last month.

- Average hourly wages are still heating up past annual inflation rate at 5.2% in April. Wage growth has exceeded inflation over the past quarter – a pattern we’ve been avoiding for two years but something that will keep analysts watching for a wage-price spiral.

SENTIMENT, OUTLOOK & IMPLICATIONS

Bank of Canada

- If there is another positive glimmer in healing an additional policy rate hike in early June, it’s that we saw the BoC’s two “core inflation” measures continue to soften to 4.2% vs. 4.5% in March. Progress in these measures remains mission critical to declaring victory in the fight against inflation.

- The Bank expects inflation to dramatically step down to the 3% target range next month. That said, with shorter-term (three-month annualized) core inflation still running above 3.5%, the Bank will be thinking hard about whether additional rate hike(s) are needed to fully bring inflation under control.

SUMMARY TABLES

CPI CHARTS

Other Commentaries

Oct 19, 2022

September 2022 Consumer Price Index data: Food and services prices still rising, no progress on core inflation

Sep 20, 2022

August 2022 Consumer Price Index data: Finally some good news on Canadian inflation.

Aug 16, 2022

July 2022 Consumer Price Index data: Canada’s inflation finally turns a corner with falling gas prices, but core pressures remain

Commentaries /

April 2023 CPI: It’s all about that base!

April 2023 CPI: It’s all about that base!

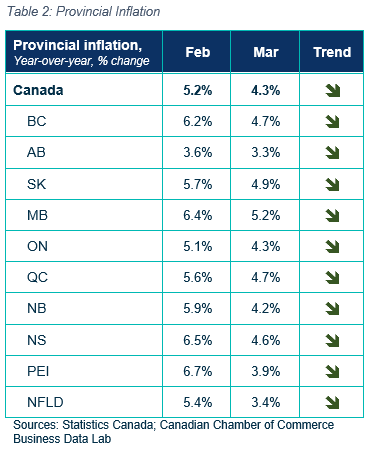

Canada’s inflation edged down for eighth consecutive month in March to 4.3%- the lowest headline since August 2021. While this report at face value is the kind of Spring green shoots that we’ve been anxiously awaiting, this sharp decline is led by falling energy prices and base effects from March of last year when the Russian invasion of Ukraine sent oil prices soaring.

Rewa

Canada’s inflation edged down for the eighth consecutive month in March to 4.3%- the lowest headline since August 2021. While this report at face value is the kind of Spring green shoots that we’ve been anxiously awaiting, this sharp decline is led by falling energy prices and base effects from March of last year when the Russian invasion of Ukraine sent oil prices soaring.

Marwa Abdou, Senior Research Director, Canadian Chamber of Commerce

The broad-based price declines needed are still not here, but there is welcomed and needed reprieve for Canadian businesses and consumers in March’s report, as the pace of price growth is settling down. With its announcement last week, the Bank of Canada is holding the line on further increases for the overnight rate, and it’s clear their strategy is paying off, and inflation is moving along their expectations to decelerate to 3% by Q2 2023.

KEY TAKEAWAYS

Headline

- Canada’s headline CPI inflation geared down to 4.3% year-over-year. This was the lowest headline since August 2021 and a sharp contrast from the 8.1% last summer. The slowdown in headline inflation was in line with market expectations.

- On a month-over-month basis, the CPI rose by 0.5% in March (compared to the 0.4% increase in February) and was even slower on a seasonally adjusted basis (0.1%).

- The spread of inflation is narrowing across goods and services. Price increases for goods sharply slowed (to 3.6% from 5.3% in February). Those in services also edged down modestly (to 5.1% from 5.3% a month prior). Still, more than half of the categories in the CPI basket are still seeing inflation above the BoC’s 1% to 3% target range.

- In March, energy price growth slowed (to 4.5% from 4.8% in February). Gasoline prices continue to be a strong contributor to driving down inflation with a 14% decline in March. This, however, reflects base-year effects from when gasoline rose 12% month over month because of supply uncertainty a year prior when Russia invaded Ukraine.

CPI Components

- Food prices are still running hot (+8.9% yr/yr in March as compared to +9.7% February). As visits to the grocery store are still eating into consumer’s pockets, this welcomed slowdown comes by way of lower produce prices for fresh fruit and vegetables.

- Shelter costs rose 5.4% yr/yr, up by 0.4% from last month. Mortgage interest costs surged 26% in March – the largest yearly increase on record!

- Another noteworthy aspect of this month’s data is that the annual inflation rate was weaker than the growth in average hourly wages (5.3%). This is only the second month that wage growth exceeded inflation in the last two years.

Provincial Inflation

- Another bright spot in the monthly report is that inflation slowed in all 10 provinces. Atlantic provinces New Brunswick (4.2%), Nova Scotia (4.6%), Prince Edward Island (3.9%) and Newfoundland and Labrador (3.4%) saw inflation slow the most.

SENTIMENT, OUTLOOK & IMPLICATIONS

Bank of Canada

- The BoC’s two “core inflation” measures continued to soften – to 4.5% vs. 4.9% in February. Progress in these measures is mission critical to declaring victory in the fight against inflation.

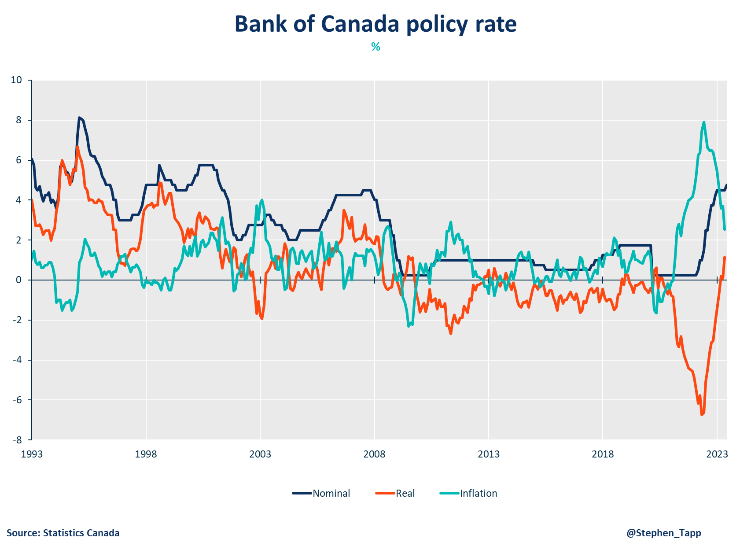

- A significant development since the early pandemic is that inflation is below the Bank’s nominal policy rate, which means that the real policy rate is now in positive territory, finally shifting to encouraging saving over spending.

- Shorter-term (three-month) core inflation measures slowed to the low-3% range on an annualized basis. This is a positive development but remains above the top of the BoC’s inflation control band, suggesting it may be difficult to quickly get inflation back all the way to 2%.

Inflation Expectations

- I am optimistic that, alongside the positive base effects and BoC’s continued quantitative tightening that the headline inflation will continue to decelerate in the coming months.

- On the real-economy side, according to the BoC’s most recent surveys business and consumer inflation expectations are moderating, but the possibility of a recession continues to weigh on their economic outlooks.

- For small businesses, a key question is: to what extent will higher interest rates and slowing consumer spending weigh on business sales growth? This is particularly the case for homeowners that are renewing home loans now at higher rates.

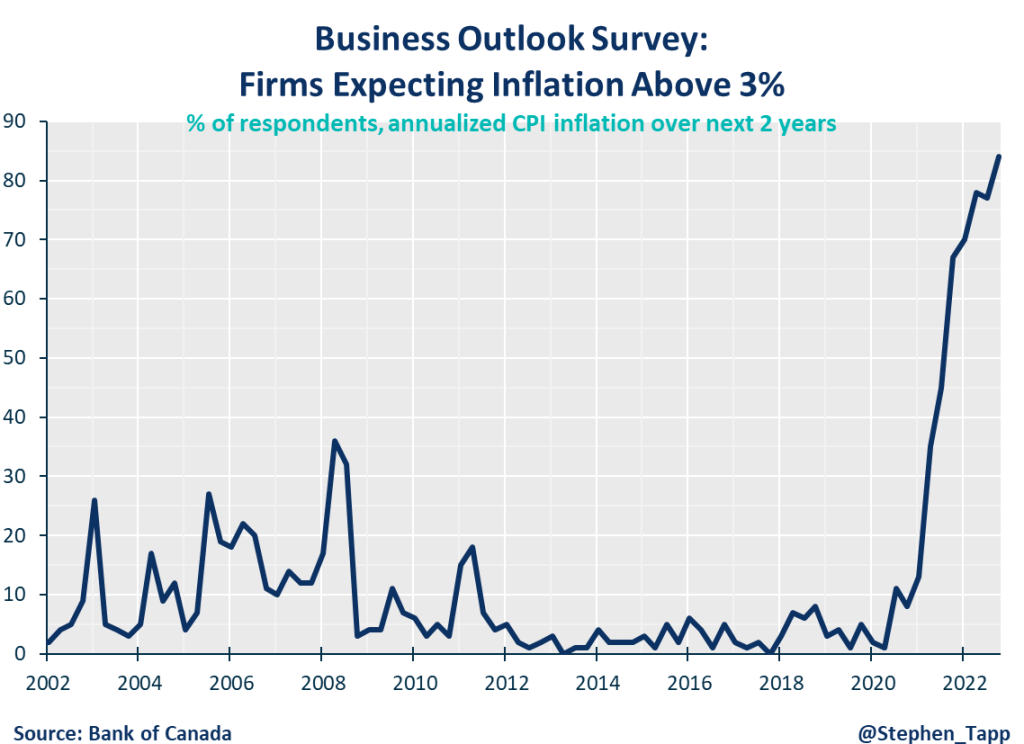

- Canadian firms’ expectations for high inflation are also shaping their price setting, which in turn, may be keeping some underlying momentum in price growth.

SUMMARY TABLES

CPI CHARTS

Other Commentaries

Oct 19, 2022

September 2022 Consumer Price Index data: Food and services prices still rising, no progress on core inflation

Sep 20, 2022

August 2022 Consumer Price Index data: Finally some good news on Canadian inflation.

Aug 16, 2022

July 2022 Consumer Price Index data: Canada’s inflation finally turns a corner with falling gas prices, but core pressures remain

Commentaries /

April 2023 CPI: Progress, but job not done yet: The BoC maintains its policy rate, no longer expects a recession in Canada

April 2023 CPI: Progress, but job not done yet: The BoC maintains its policy rate, no longer expects a recession in Canada

The Bank of Canada held its policy rate at 4.5% and renewed its commitment to bringing inflation back to the 2% target. Though inflation is declining, it remains well above target, and the economy is in excess demand.

Rewa

The Bank of Canada held its policy rate at 4.5% and renewed its commitment to bringing inflation back to the 2% target. Though inflation is declining, it remains well above target, and the economy is in excess demand. The Bank expects Canada’s GDP growth to remain weak in 2023, but is no longer forecasting a recession in Canada.

Mahmoud Khairy, Economist, Canadian Chamber of Commerce

KEY TAKEAWAYS

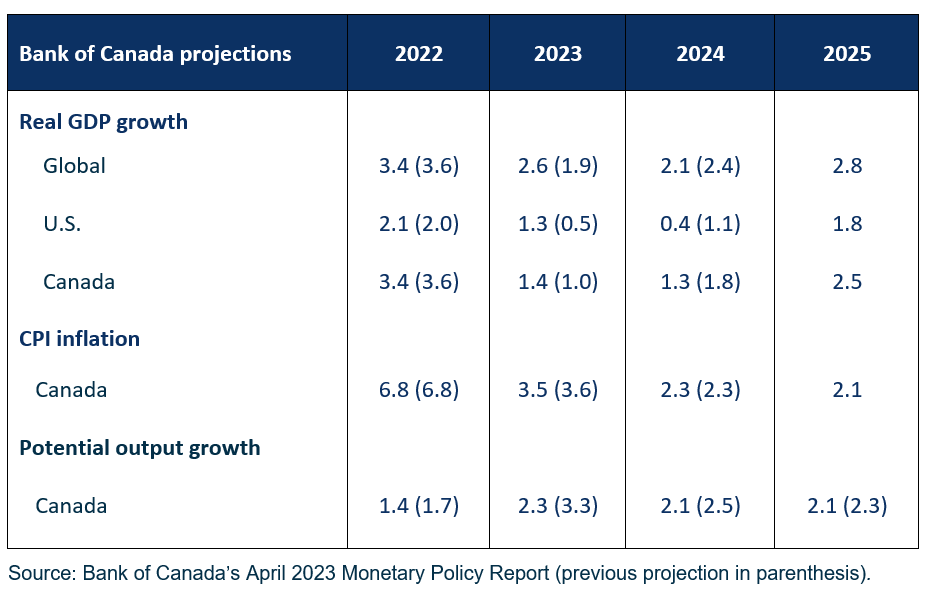

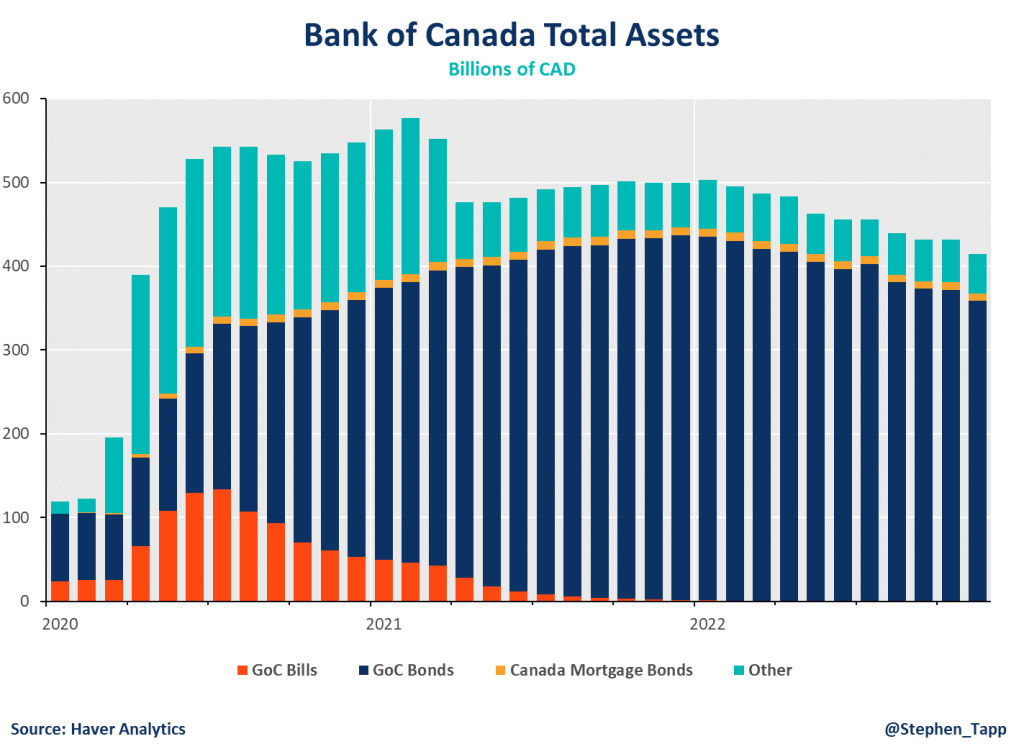

- The Bank of Canada held its policy rate: As expected, the Bank held its policy rate at 4.5%. This was the second consecutive hold during their “conditional pause” period (after previously hiking rates by a cumulative 4.25%). The Bank is also continuing its quantitative tightening policy.

- Global economic outlook better than expected in 2023: Despite tighter monetary policy and banking sector stress in the U.S. and Europe, global economic data have been better than the Bank previously anticipated. The Bank, therefore, revised up its projection for world economic growth (to 2.6% from 1.9%), while revising down 2024 slightly (to 2.1% from 2.4%). That said, the U.S. economy is expected to be weaking in the coming quarters, mainly due to slower consumer spending and tightener credit condition.

- Canada’s economy to grow modestly in 2023: Economic activity clearly slowed down over 2022, but the Bank still sees Canada’s economy as being in a position of “excess demand”. The good news is that with the bounce-back now expected for 2023Q1, the Bank is no longer forecasting a recession in Canada in 2023, and revised up its growth outlook from 1.0% to 1.4%.

- Inflation progress, but job not done: Inflation has declined from its peak of 8.1% last summer to 5.2% most recently. The Bank will be encouraged by this progress and expects inflation to slow to 3% this summer, but the return to 2% could take longer than previously expected — now near the end of 2024.

- The slowdown in inflation so far is largely due to falling prices for energy and other goods. Services prices have only really stabilized and will need to come down further for inflation to return to target. Food inflation remains high, and with a tight labour market, wages are growing at 4-5%, and may only ease slowly with continued labour supply growth.

- The Bank highlighted five key progress indicators that it will be watching: inflation expectations, services inflation, wages, business pricing behavior, and core inflation. Governing Council reiterated that it, “remains prepared to raise the policy rate further if needed” to get inflation back to target. This should send a clearer message to financial markets that they shouldn’t expect the Bank rate to fall in 2023, as was previously priced in.

SUMMARY TABLE

Other Commentaries

Oct 19, 2022

September 2022 Consumer Price Index data: Food and services prices still rising, no progress on core inflation

Sep 20, 2022

August 2022 Consumer Price Index data: Finally some good news on Canadian inflation.

Aug 16, 2022

July 2022 Consumer Price Index data: Canada’s inflation finally turns a corner with falling gas prices, but core pressures remain

Commentaries /

March 2023 CPI: Inflation continues to cool, mainly due to base-year effects

March 2023 CPI: Inflation continues to cool, mainly due to base-year effects

Canada’s headline inflation cooled more than expected in February to 5.2% year-over-year (more than market expectations of 5.4%), with core inflation also slowing to 4.9%.

Mahmoud Khairy

Canada’s headline inflation cooled more than expected in February to 5.2% year-over-year (more than market expectations of 5.4%), with core inflation also slowing to 4.9%. This is largely due to base-year effects, with current prices being compared to elevated levels from a year ago when global commodity prices soared after Russia invaded Ukraine along with supply chain disruptions.

The Bank will welcome the slowdown in inflation, but notwithstanding this progress, there’s still a long way to get back to 2%. They will likely maintain their interest rate pause while they wait for more decisive evidence of slower core inflation.

– Mahmoud Khairy, Economist, Business Data Lab, Canadian Chamber of Commerce

KEY TAKEAWAYS

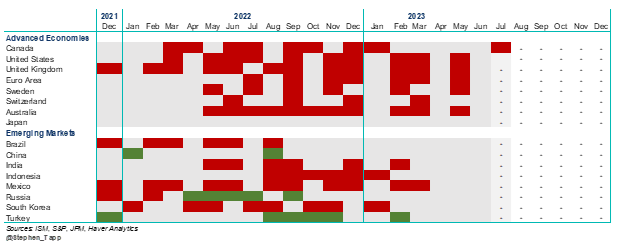

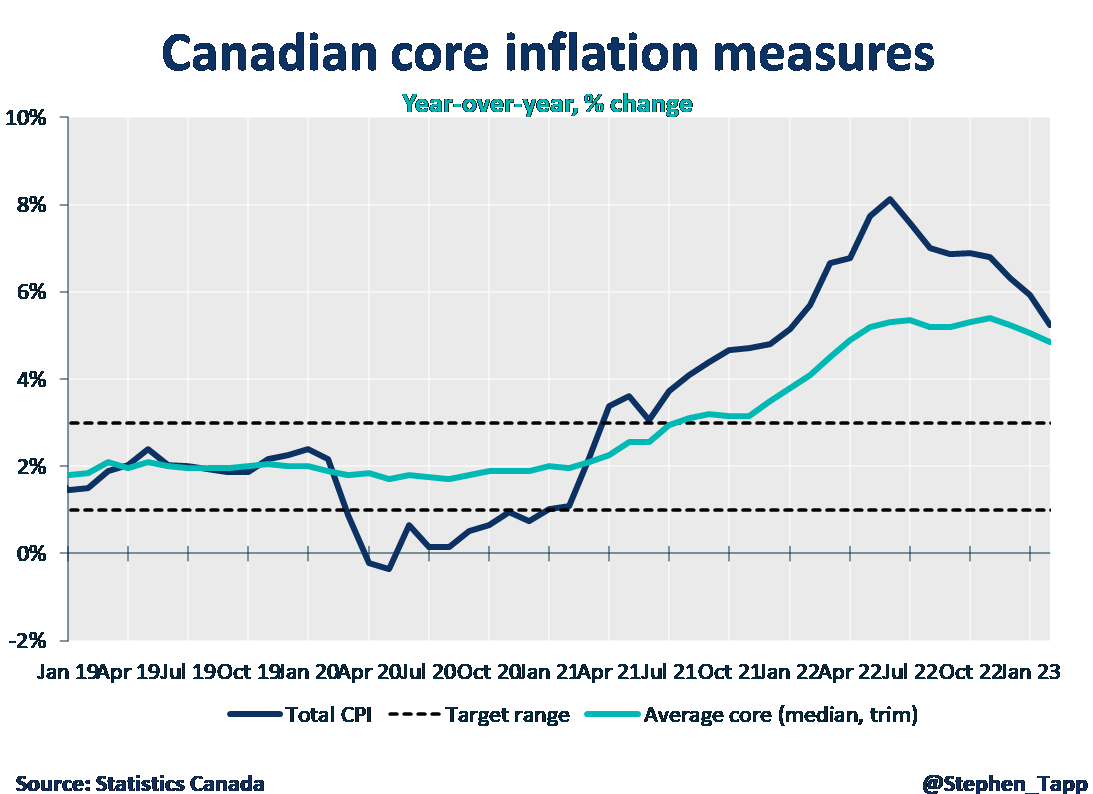

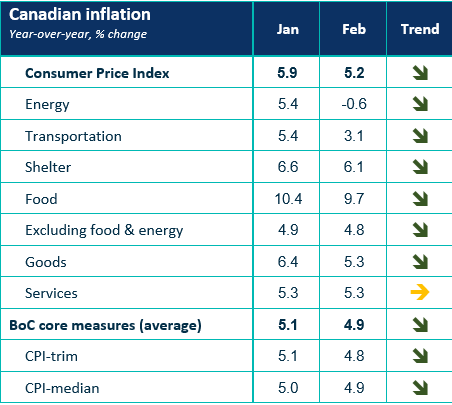

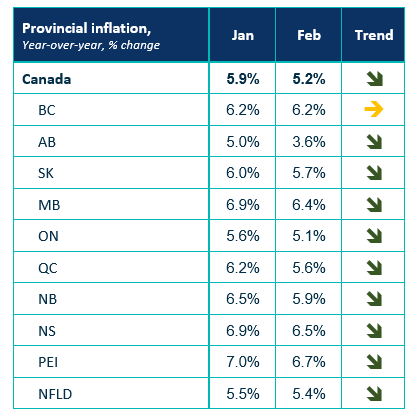

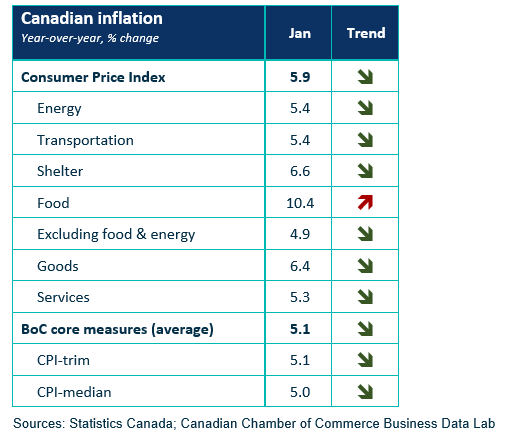

- The Consumer Price Index (CPI) cooled down in February to 5.2% — more than markets expected (5.4%) — in what was the largest deceleration since April 2020. There was also a slight improvement in core inflation, as the average of the Bank of Canada’s preferred core inflation measures declined to 4.9% year-over-year. This notable decline is mainly due to so-called base-year effects; given the sharp rise in global commodity prices last year associated with Russia’s invasion of Ukraine, year-over-year inflation should continue to slow noticeably over the first half of 2023.

- The slowdown in inflation was broad-based across most components; however, food prices continue to be a major burden on consumers.

- Shelter costs cooled for the third straight month to 6.1% (from 6.6%). However, higher interest rates due to the Bank of Canada’s tightening policy has resulted in the biggest increase in mortgage rates since 1982. The mortgage interest cost index rose in February to 23.9% (from 21.2%).

- Goods prices has slowed to 5.2% (from 6.4%), while prices for services remained stable at 5.3%.

- Energy prices were actually down 0.6% on a year-over-year basis — again reflecting base-year effects after the Russian invasion to Ukraine has caused energy prices to spike in early 2022.

- Inflation slowed in all provinces, except British Columbia where prices remained stable due to offsets from higher rents. Alberta had the fasted inflation slowdown because of lower energy prices as well as the national plan to reduce childcare costs.

SUMMARY TABLES

INFLATION CHARTS

Other Commentaries

Oct 19, 2022

September 2022 Consumer Price Index data: Food and services prices still rising, no progress on core inflation

Sep 20, 2022

August 2022 Consumer Price Index data: Finally some good news on Canadian inflation.

Aug 16, 2022

July 2022 Consumer Price Index data: Canada’s inflation finally turns a corner with falling gas prices, but core pressures remain

Commentaries /

March 2023 CPI: The Bank of Canada becomes the first major central bank to pause interest rates hikes… but for how long?

March 2023 CPI: The Bank of Canada becomes the first major central bank to pause interest rates hikes… but for how long?

After one year of aggressively raising interest rates by a total of 4.25%, the Bank of Canada today held its policy rate steady — officially following through on the “conditional pause” in its tightening cycle.

Rewa

After one year of aggressively raising interest rates by a total of 4.25%, the Bank of Canada today held its policy rate steady — officially following through on the “conditional pause” in its tightening cycle.

– Mahmoud Khairy, Economist, Canadian Chamber of Commerce Business Data Lab

KEY TAKEAWAYS

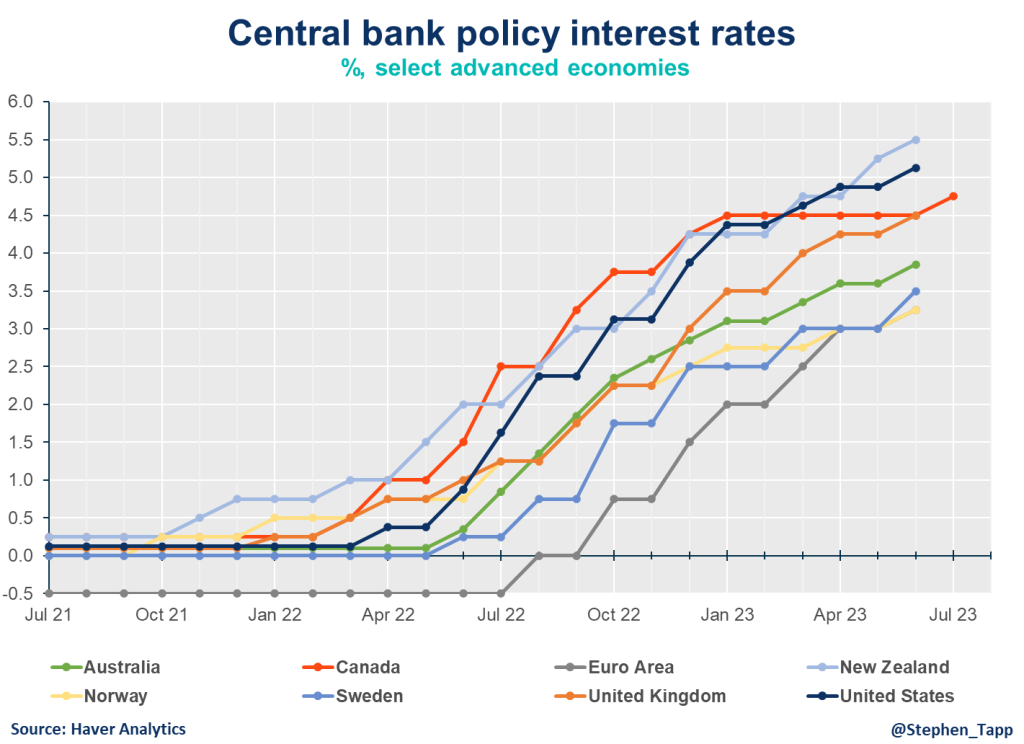

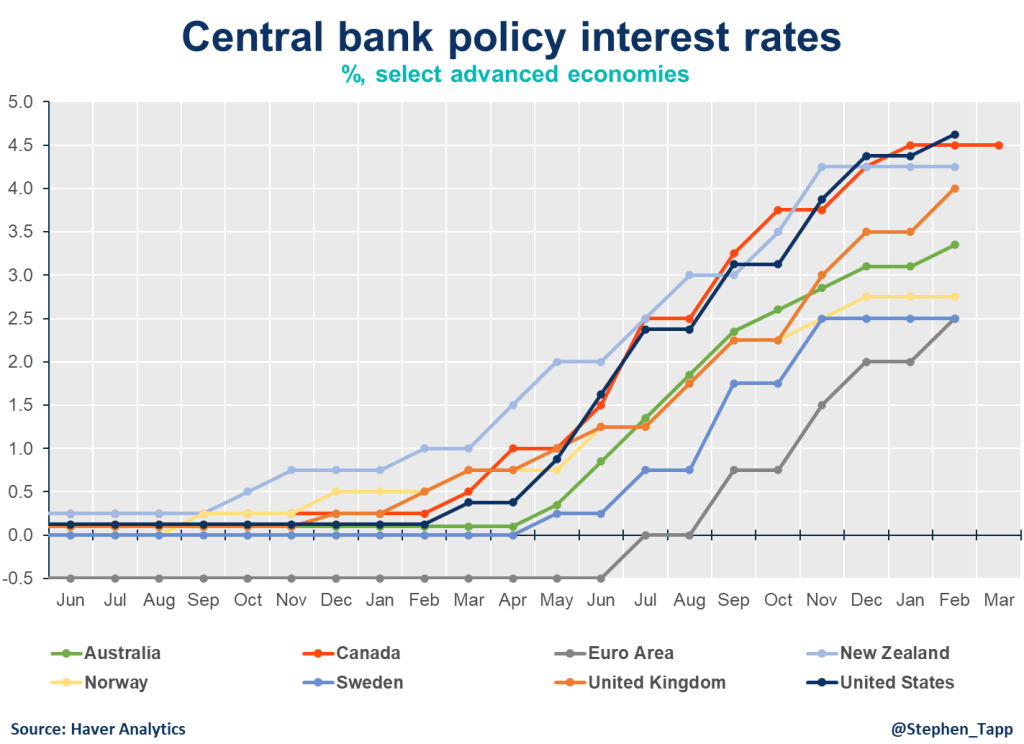

- After eight consecutive rate increases, the Bank of Canada met market expectations and held for the first time in a year for the overnight rate at 4.5%, making it the first major central bank to stop raising interest rates.

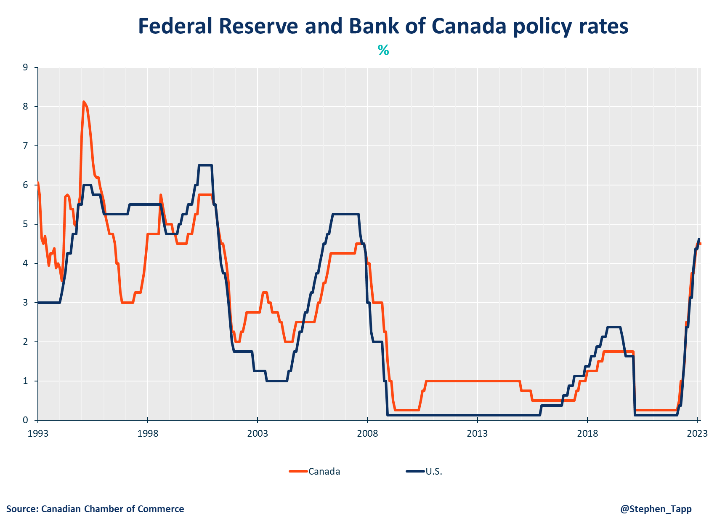

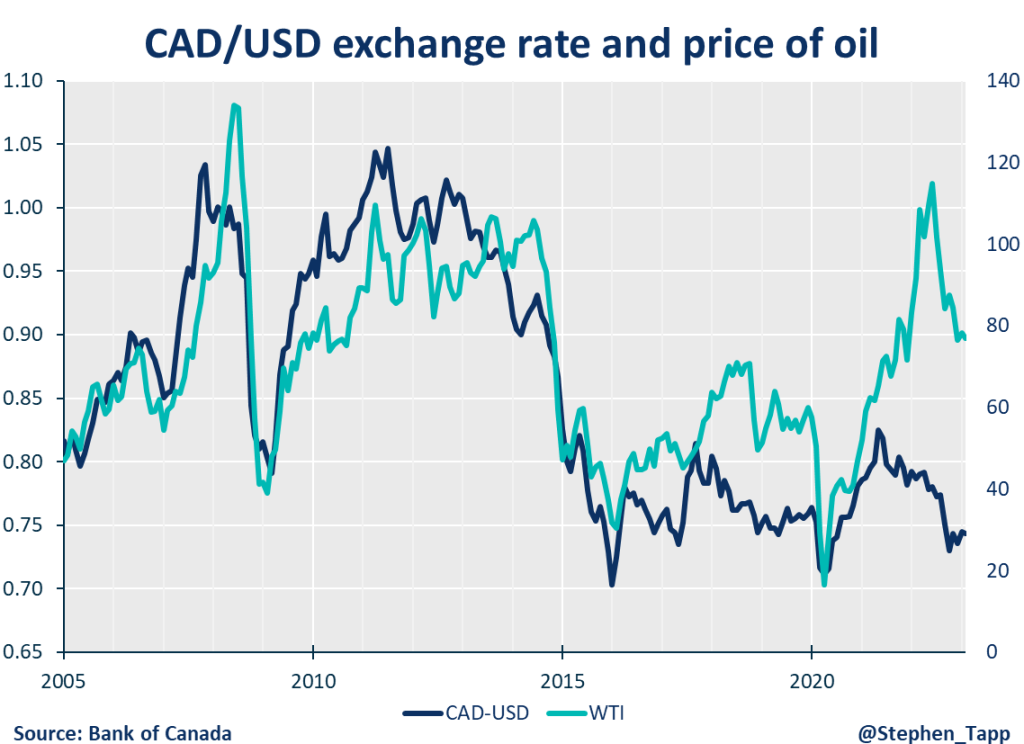

- Despite holding rates today, the Bank’s statement included a hint of hawkish bias by stating that, “Governing Council…is prepared to increase the policy rate further if needed.” Pressure might build on the Bank of Canada over the coming quarters to resume rate hikes. This is because the U.S. Federal Reserve is widely expected to continuing raising rates to a noticeably higher level than Canada. A sustained interest rate differential could put downward pressure on the Canadian dollar, which in turn, would increase the costs of imports and add to Canadian inflation pressures.

- Globally, recent data for the US and Europe have been slightly stronger than the Bank expected, and China’s economic rebound after relaxing its COVID-zero policies presents a new upside risk for commodity prices, and hence inflation.

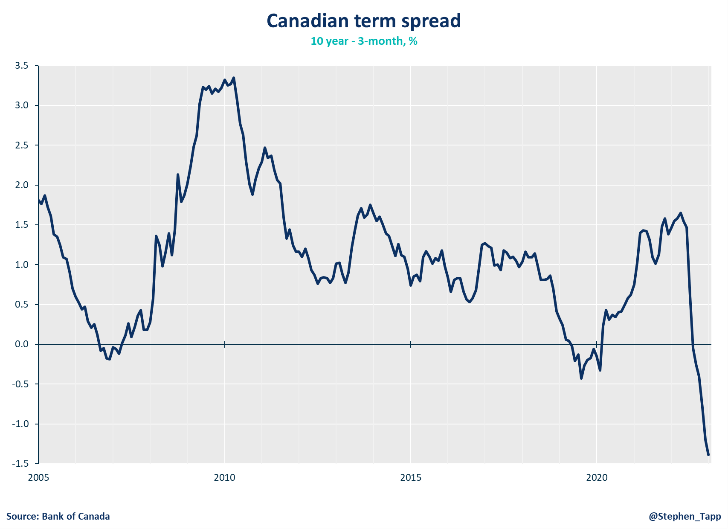

- In Canada, weaker-than-expected GDP growth in the fourth quarter of 2022 will not cause too much concern for the Bank, because it was due mainly to inventories, not underlying domestic demand. While inflation was running at 5.9% in January, the BoC expects it to decline to around 3% in the middle of this year and return to the 2% target in 2024. The labor market remains tight with the unemployment rate near a historic low. Wages are growing at around 4.5%, but labor productivity has been disappointing.

- Though a soft landing in Canada remains possible, it is still too early to clearly know if the economy will avoid a significant rough patch this year. Going forward the BoC will be looking hard at incoming data for evidence that wage growth is moderating; businesses are inclined to raise prices; short-run core inflation is slowing; and finally, inflation expectations are back to the 2% target.

SUMMARY TABLES

Other Commentaries

Oct 19, 2022

September 2022 Consumer Price Index data: Food and services prices still rising, no progress on core inflation

Sep 20, 2022

August 2022 Consumer Price Index data: Finally some good news on Canadian inflation.

Aug 16, 2022