Commentaries Topics: Labour Force Survey

Commentaries /

Labour Force Survey June 2024: Summer job market stumbles amid rising unemployment and wage growth

Labour Force Survey June 2024: Summer job market stumbles amid rising unemployment and wage growth

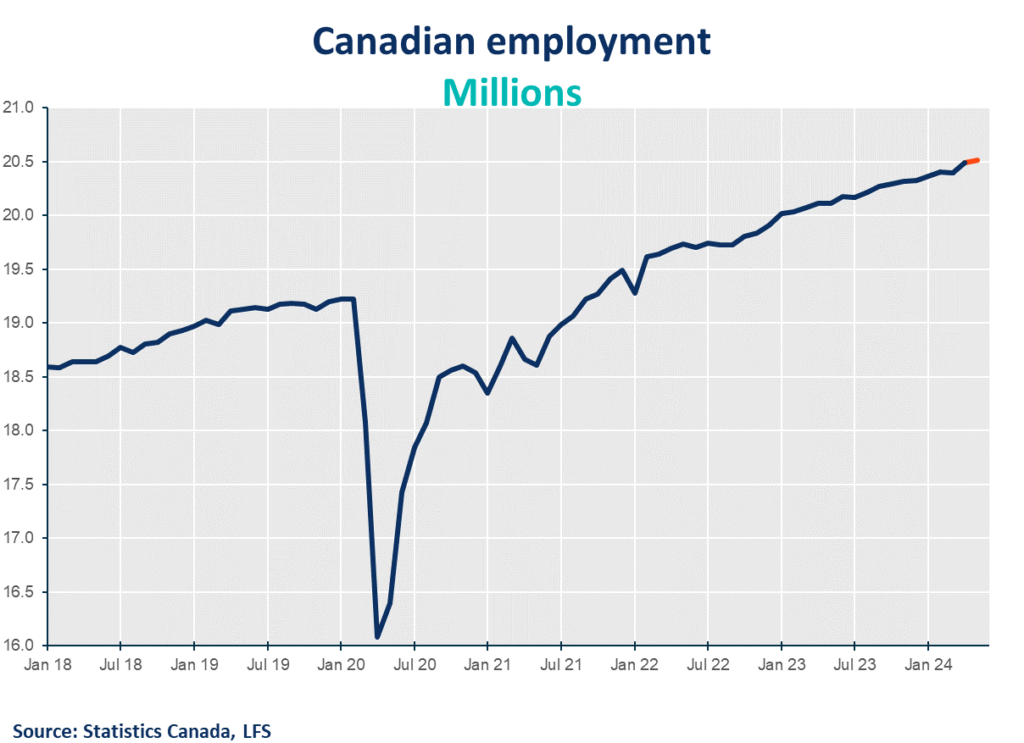

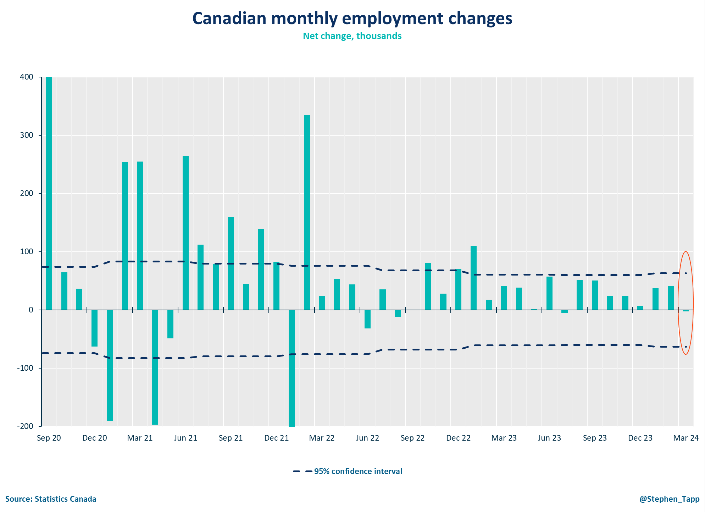

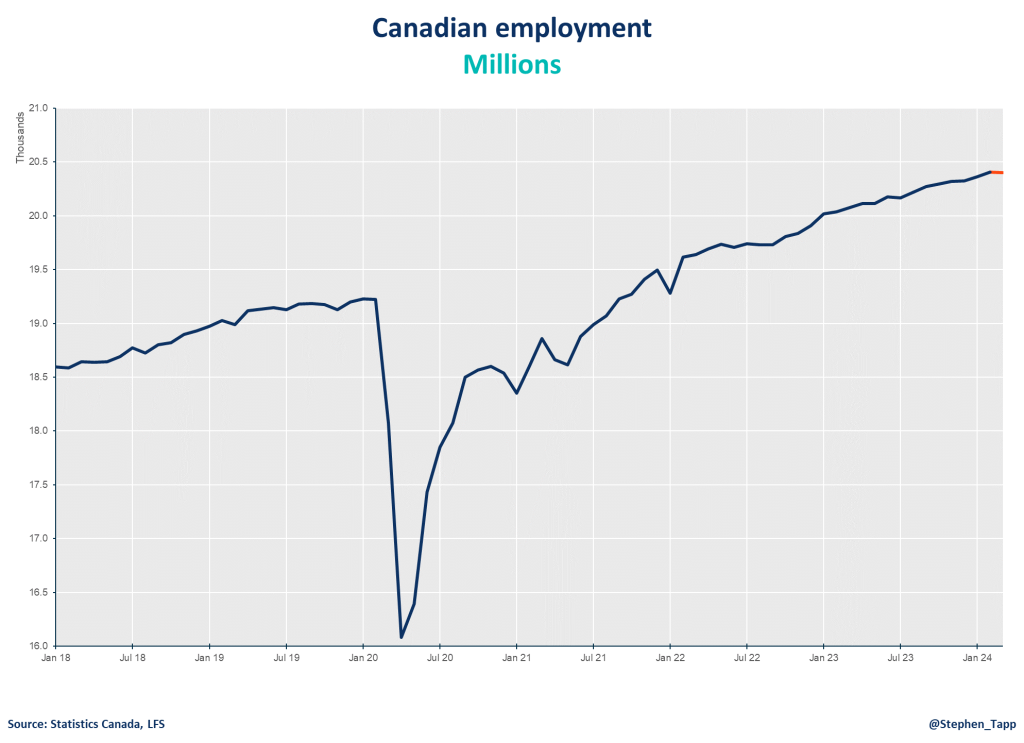

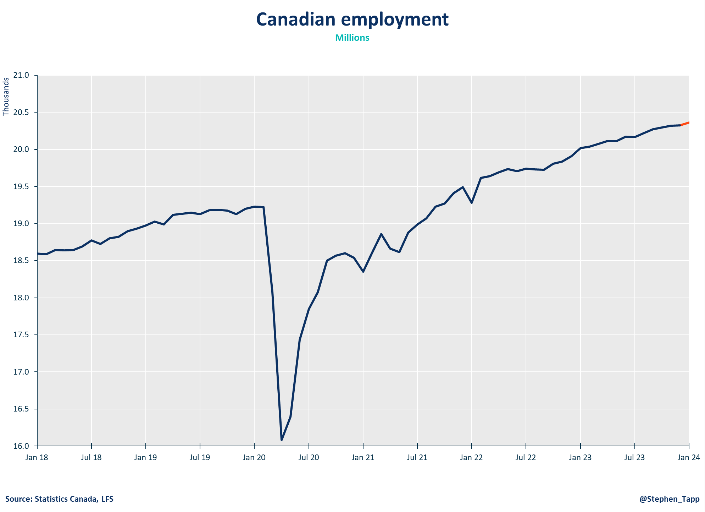

Following two months of decent growth, Canadian employment saw little change in June (-1.4K), significantly below the expected gain of 25k jobs.

Andrew DiCapua

Job growth was disappointing for June. The acceleration in wage growth is concerning and reinforces the cautious stance the Bank will take at their next meeting. They’re in a serious dilemma with both the unemployment rate and wages rising. Today’s report doesn’t bode well for markets hoping a faster cutting cycle from the Bank, which unfortunately could put economic progress in the first half of this year at risk.

Andrew DiCapua, Senior Economist, Canadian Chamber of Commerce

KEY TAKEAWAYS

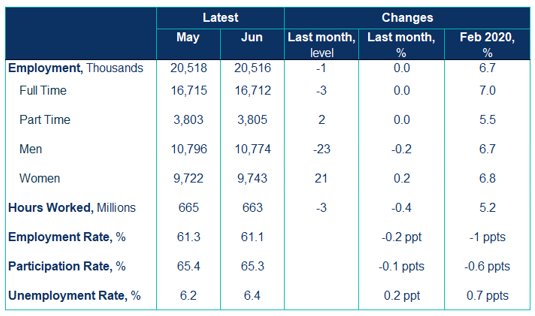

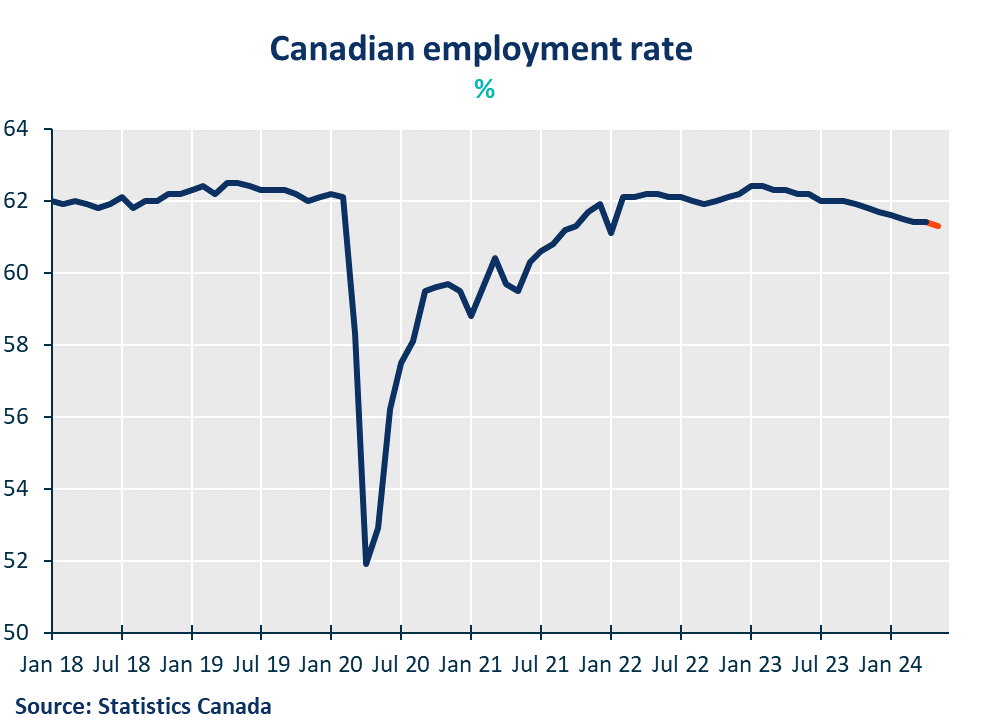

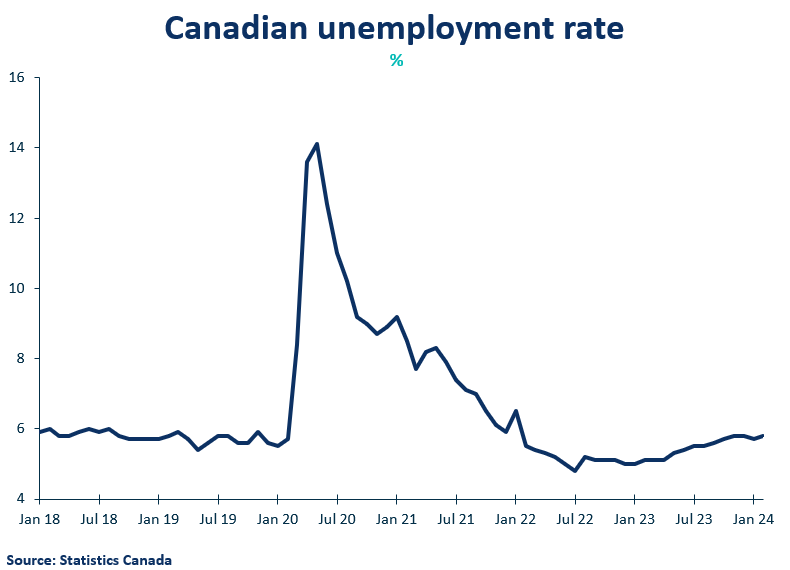

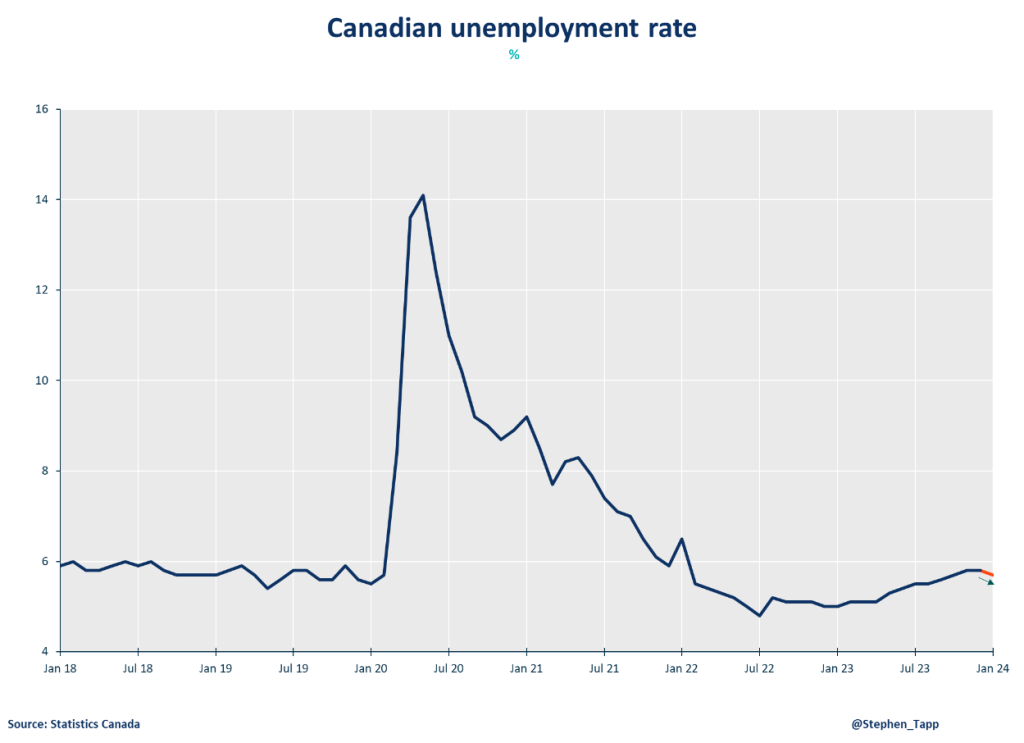

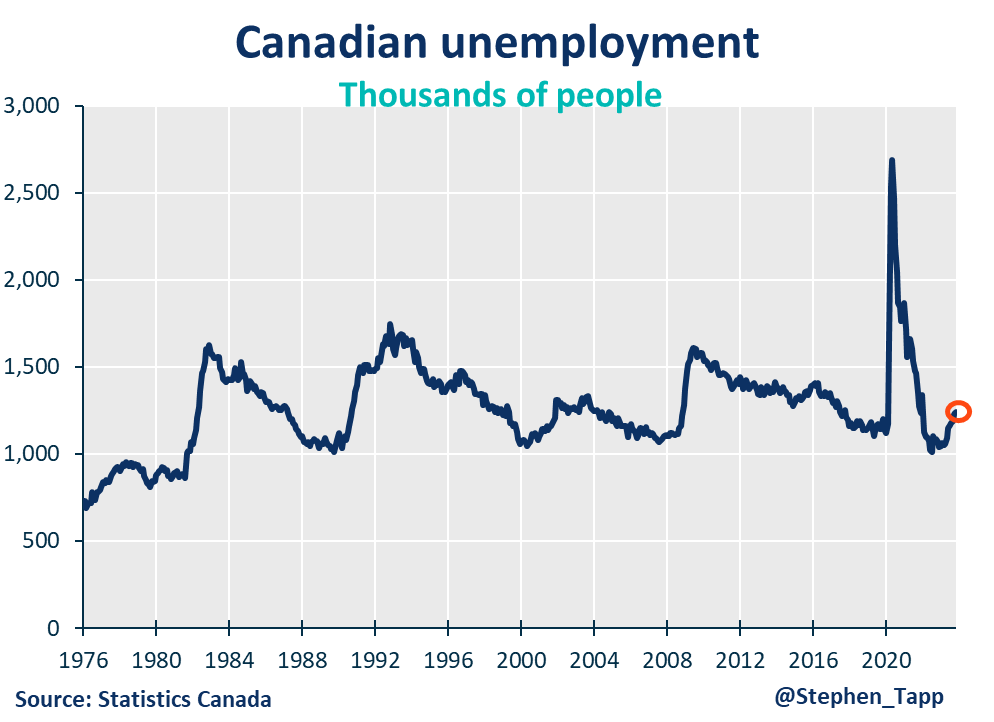

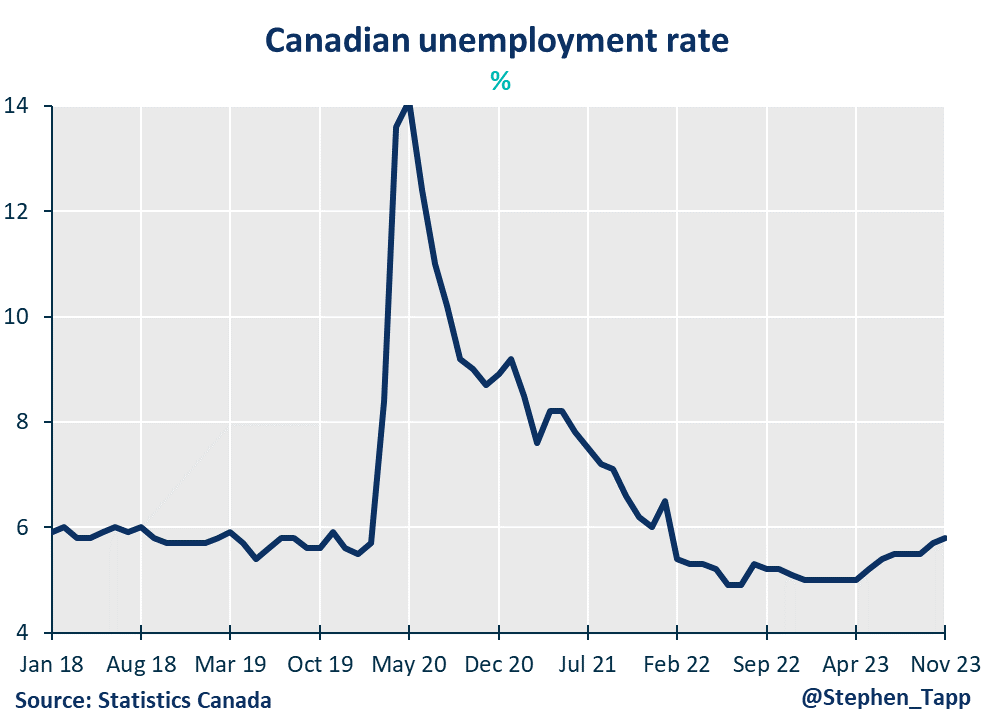

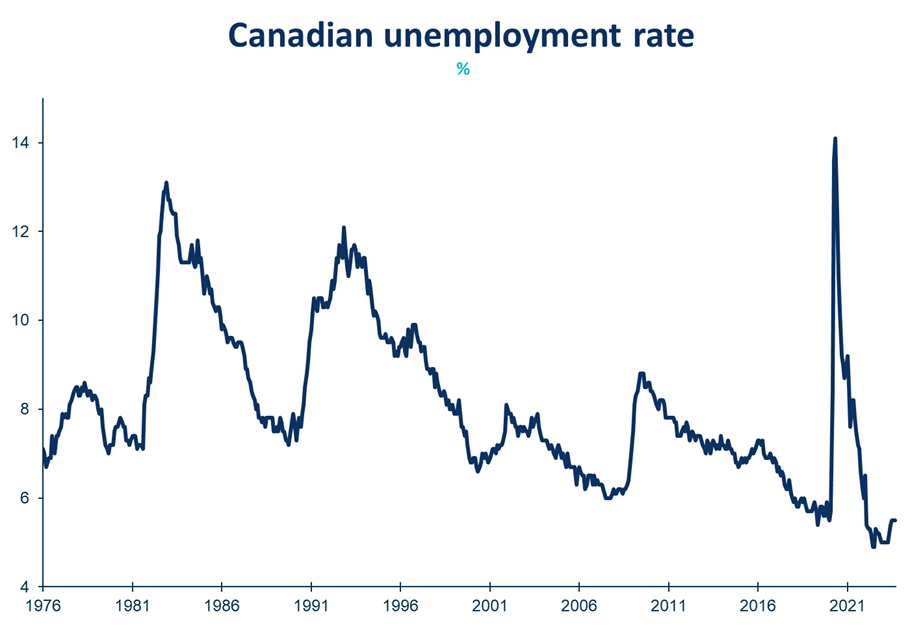

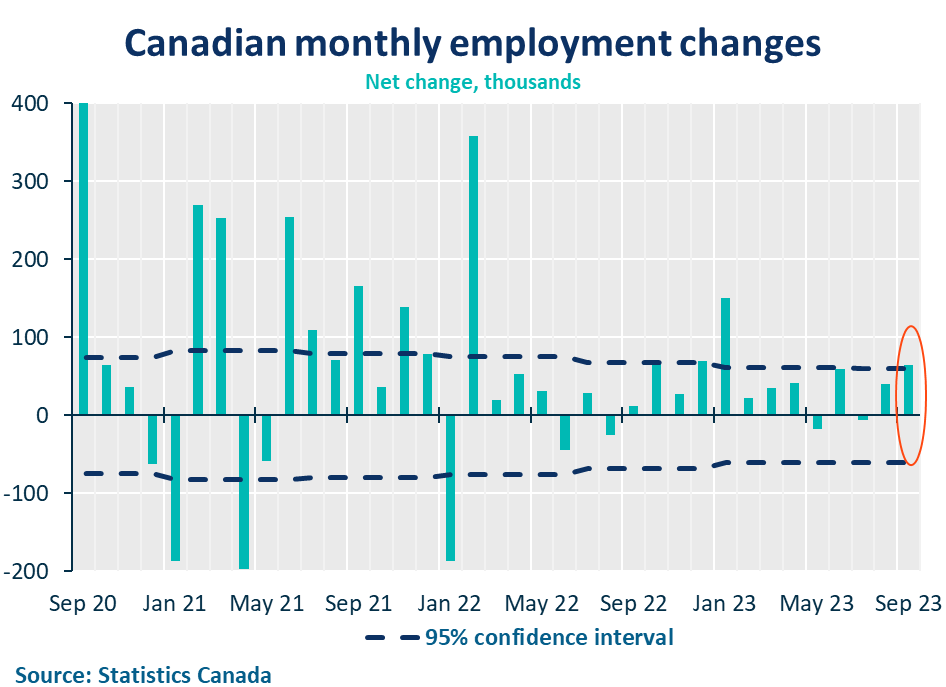

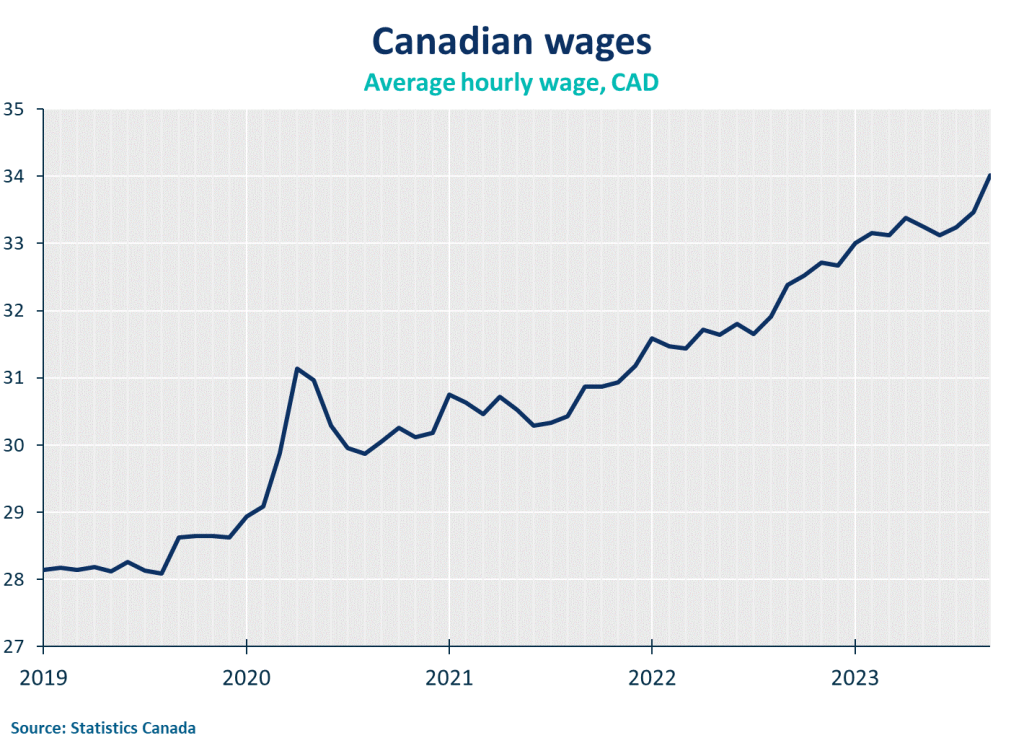

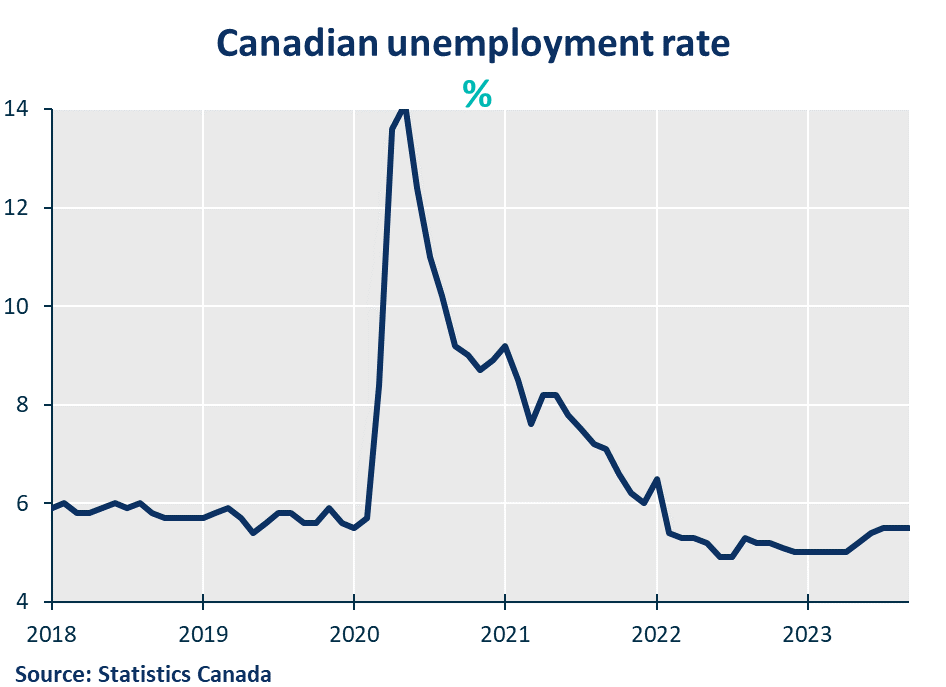

- Following two months of decent growth, Canadian employment saw little change in June (-1.4K), significantly below the expected gain of 25k jobs. However, the rise in the unemployment rate to 6.4% met expectations. The labour market shows signs of slowing, with average job gains over the past six months dropping to 32K.

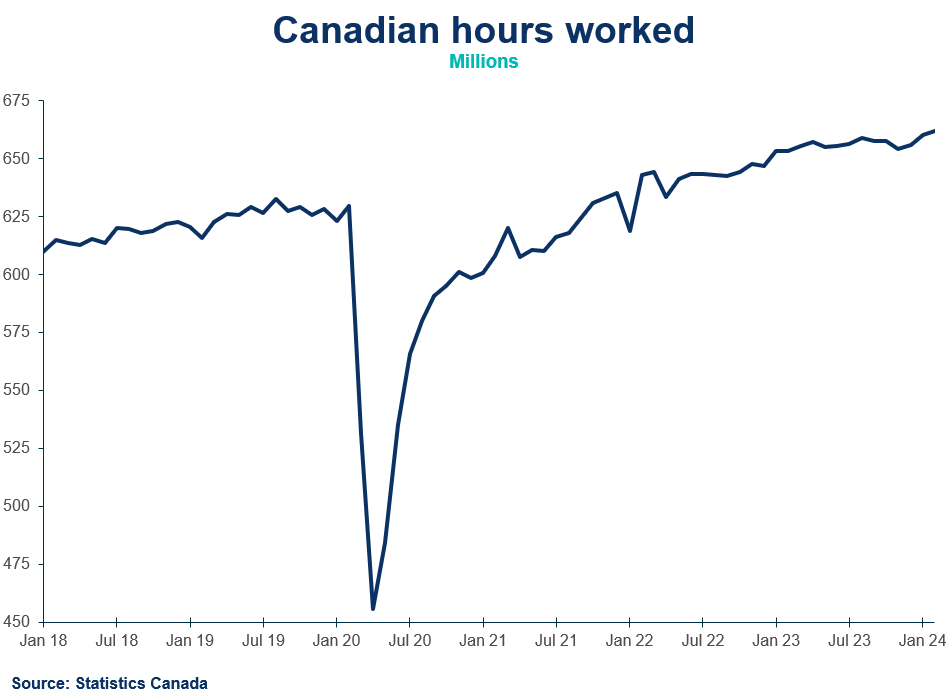

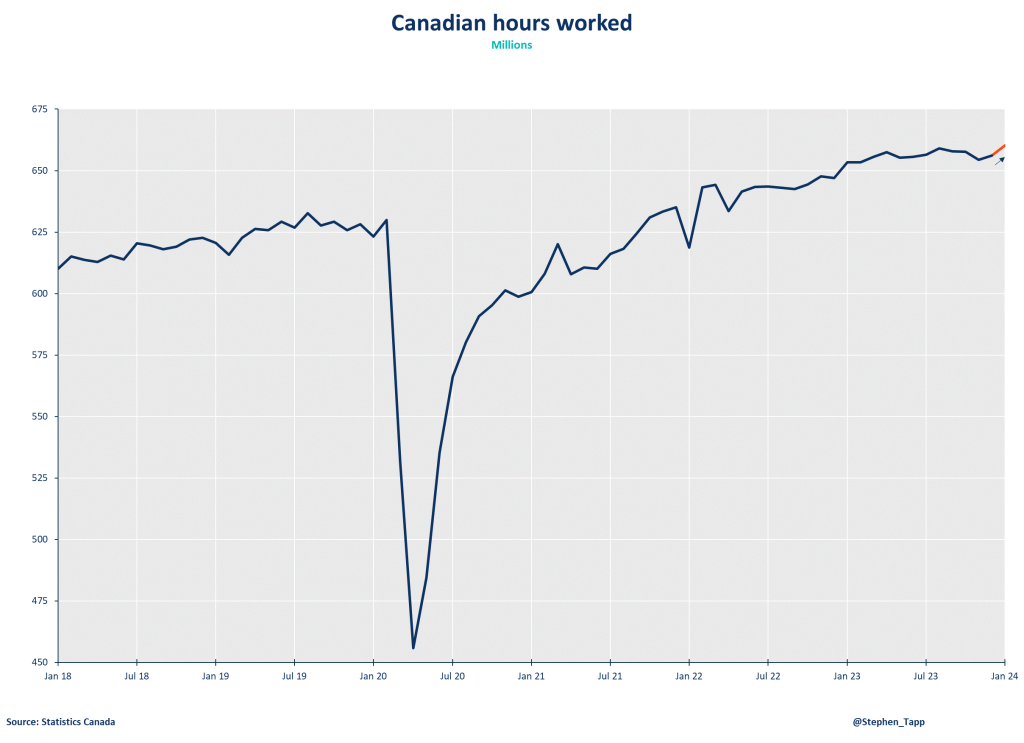

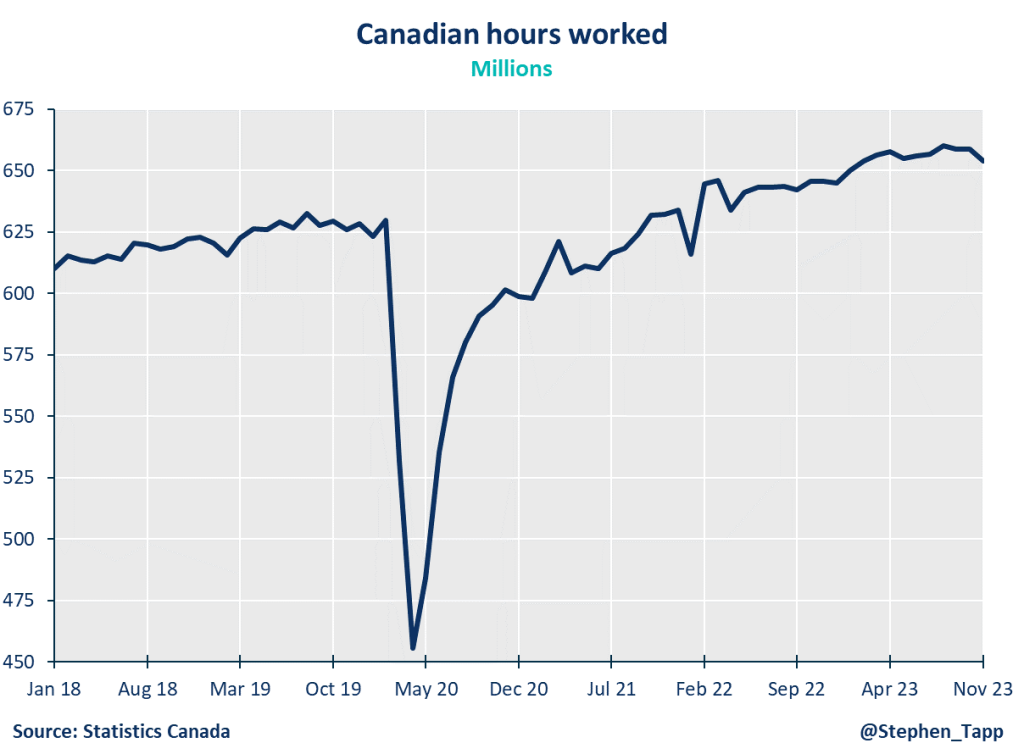

- Total hours worked decreased by 0.4%, despite a 1.1% increase from a year earlier. Second-quarter hours worked rose at an annual rate of 2.2%, suggesting sustained economic momentum from earlier in the year.

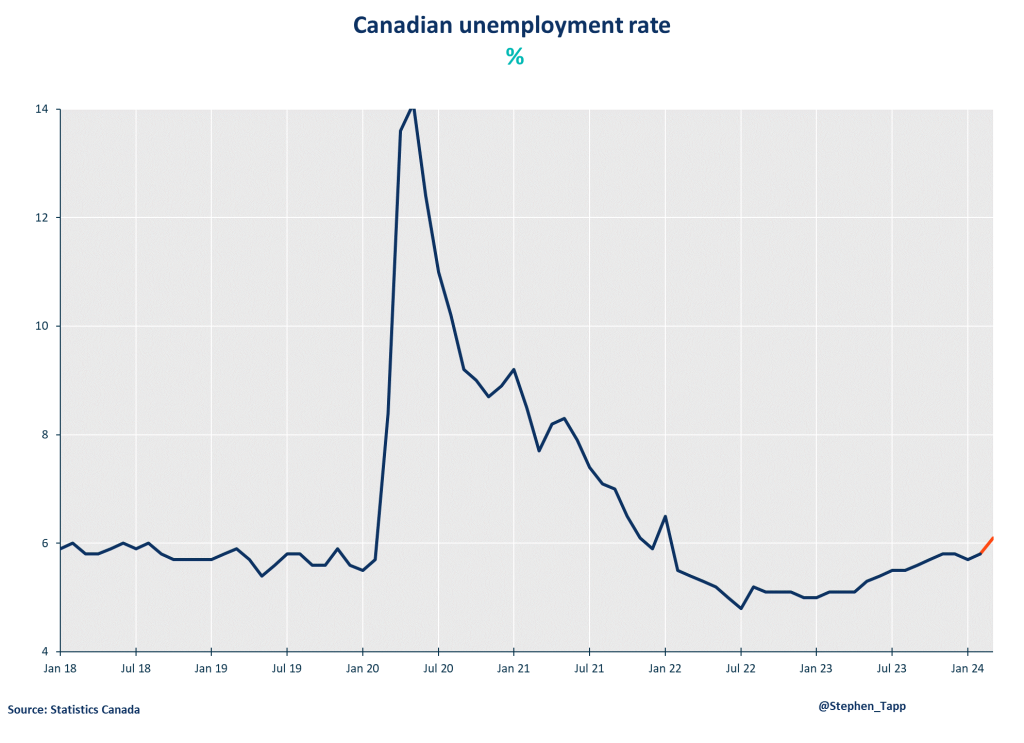

- The unemployment rate increased by 0.2 percentage points to 6.4%. Amid strong population growth, the labour market continues to weaken, with diminishing hiring demand posing challenges for job seekers, particularly younger workers entering the market.

- Job growth in June was driven by part-time employment (+1.9K), while full-time employment saw a decline (-3.4K), underscoring ongoing trends where part-time roles outpace full-time positions.

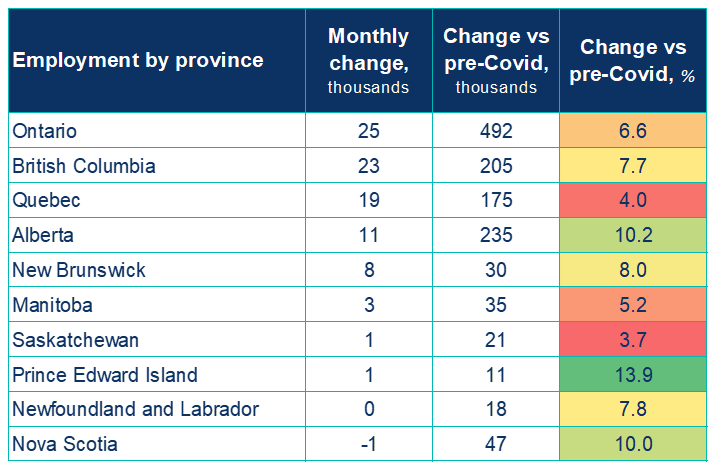

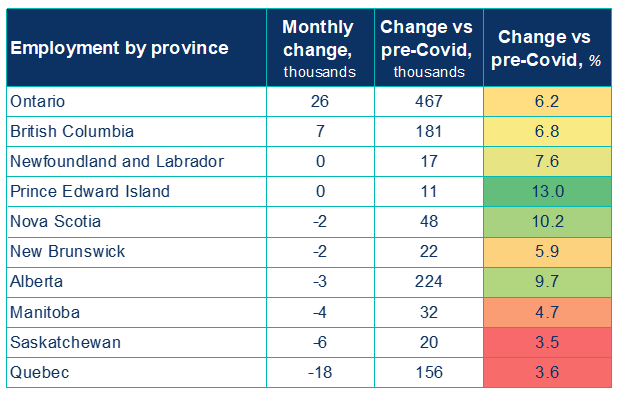

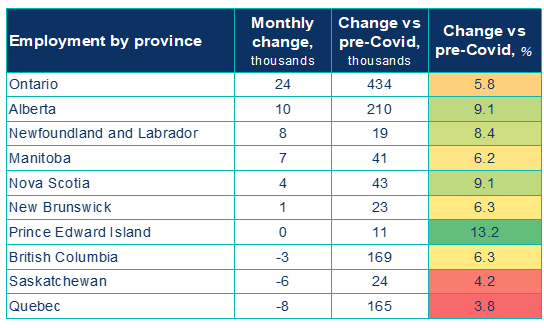

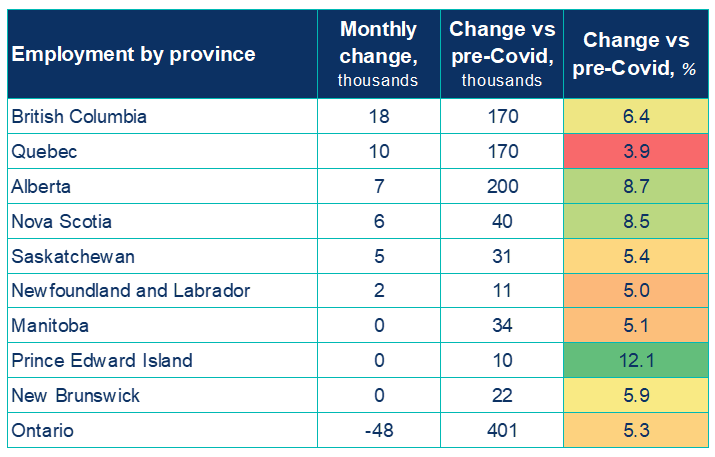

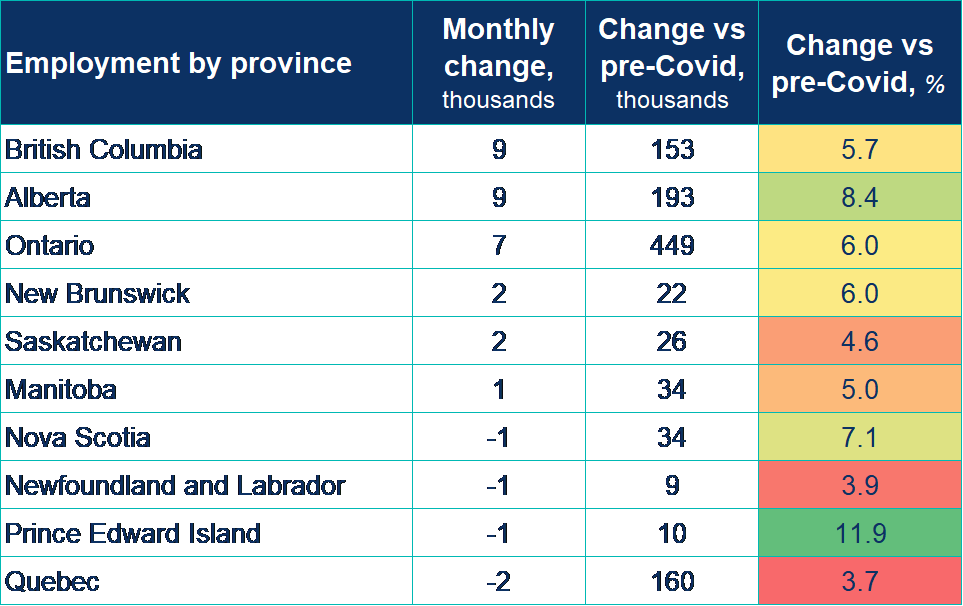

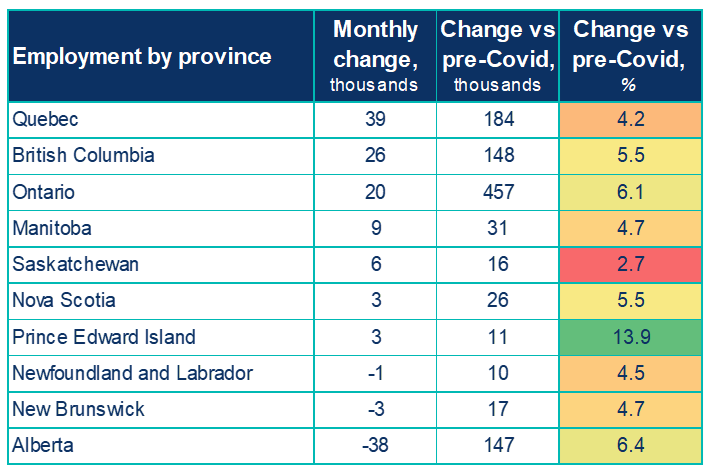

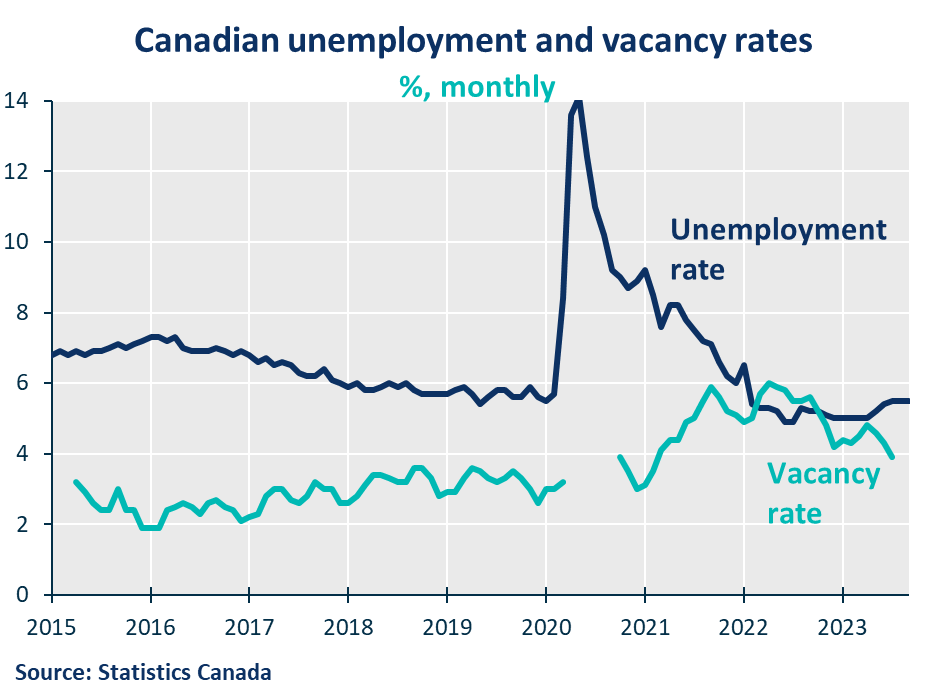

- Ontario and Alberta led job growth in June, while Quebec and British Columbia reported the largest declines in employment.

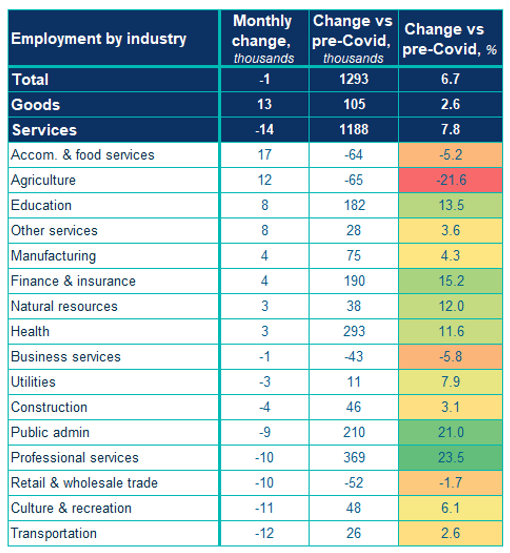

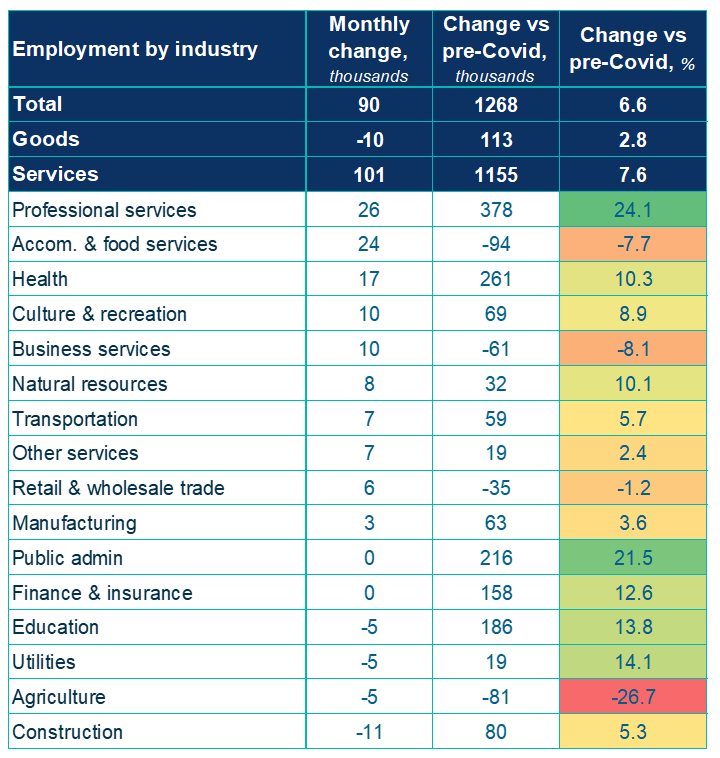

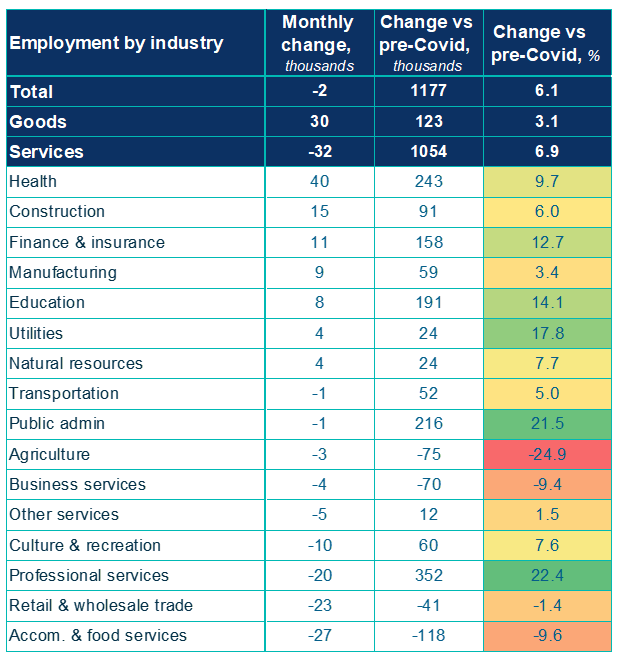

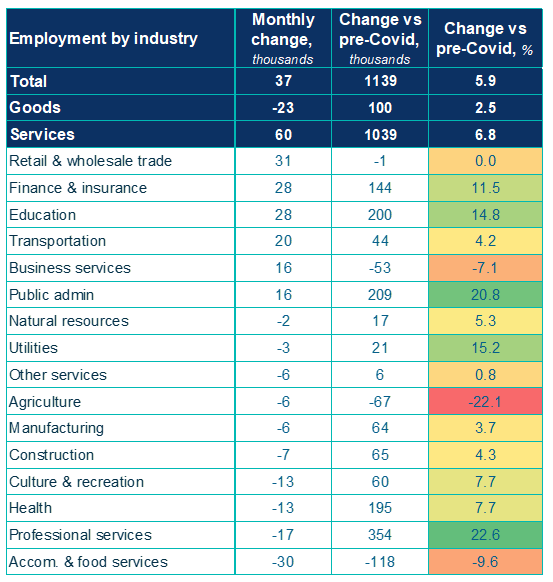

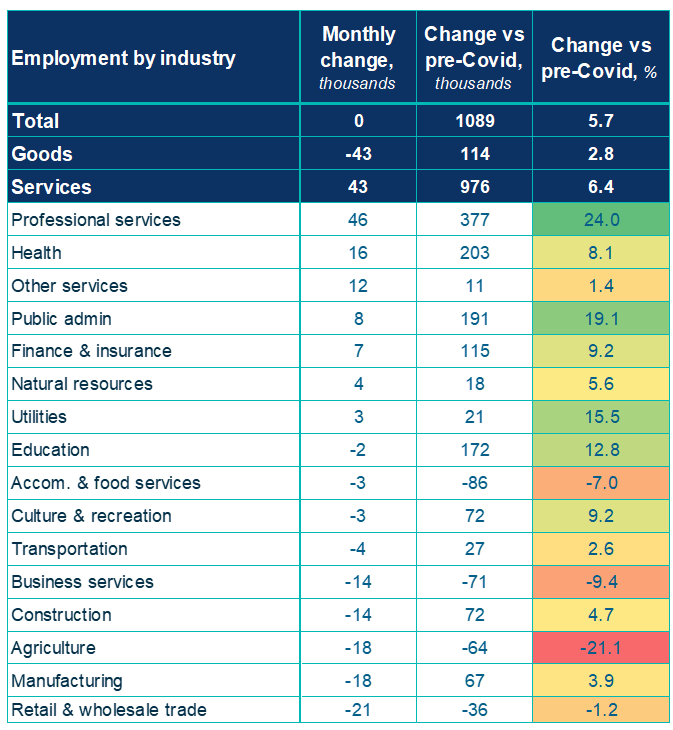

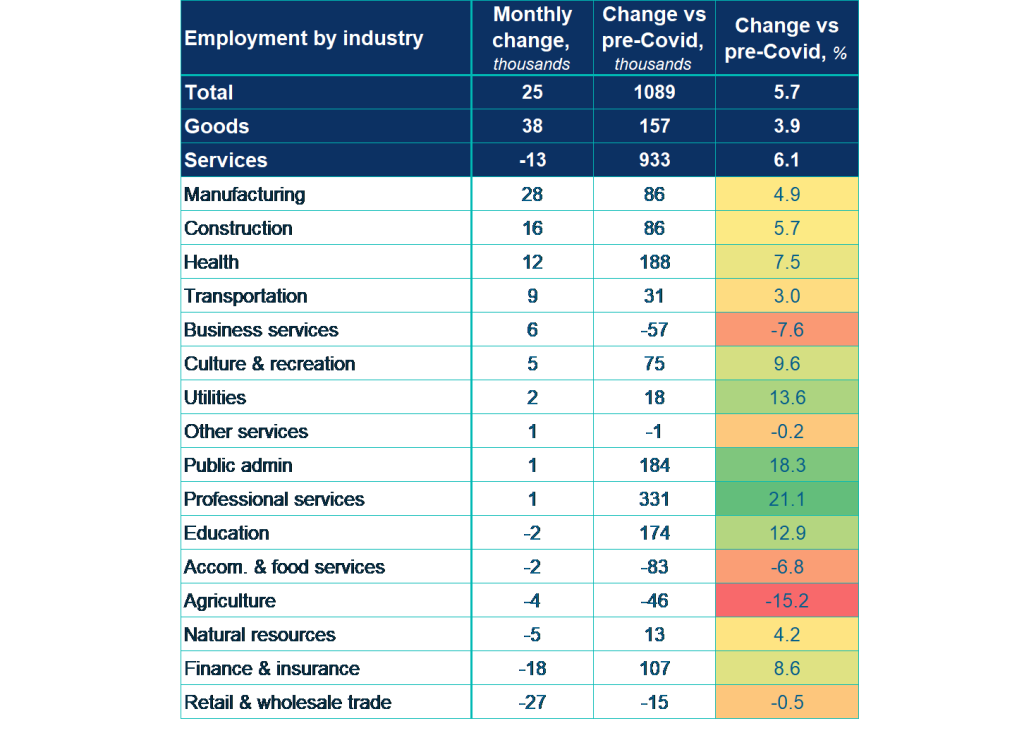

- Job gains were concentrated in sectors such as accommodation and food services, agriculture, and education, which have struggled with labour disruptions post-pandemic. Conversely, declines were noted in transportation, culture and recreation, and retail and wholesale. Eight sectors saw declines while seven reported gains.

- Youth employment faced significant challenges, with employment among young men (aged 15-24) decreasing by 13,000 jobs, resulting in an overall youth unemployment rate of 13.5%, the highest since 2014, excluding pandemic years.

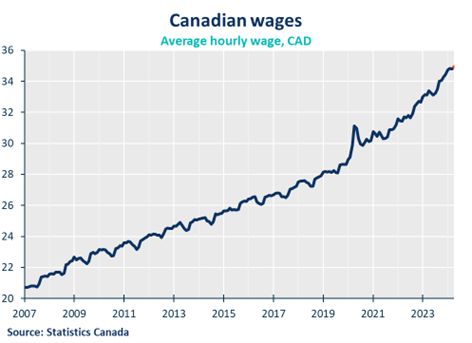

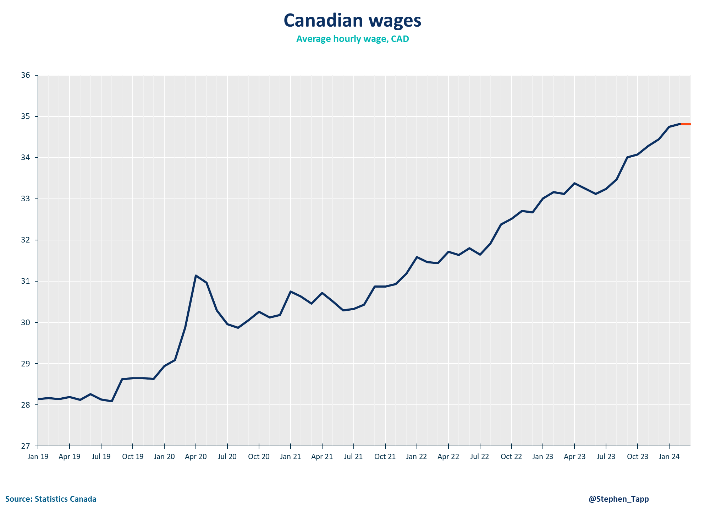

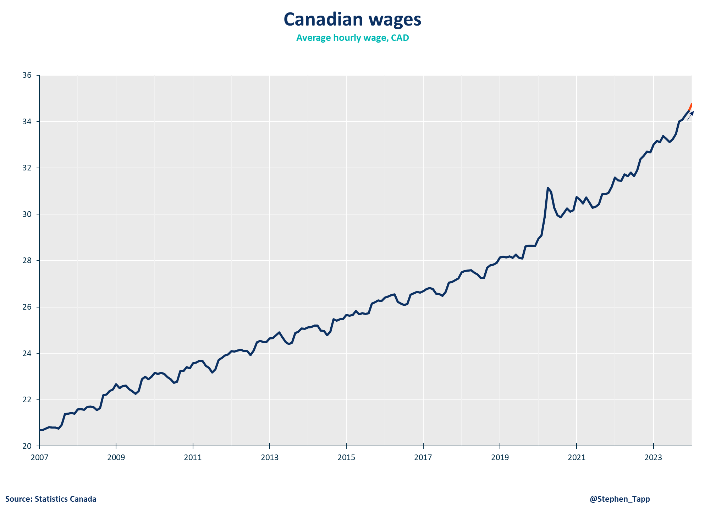

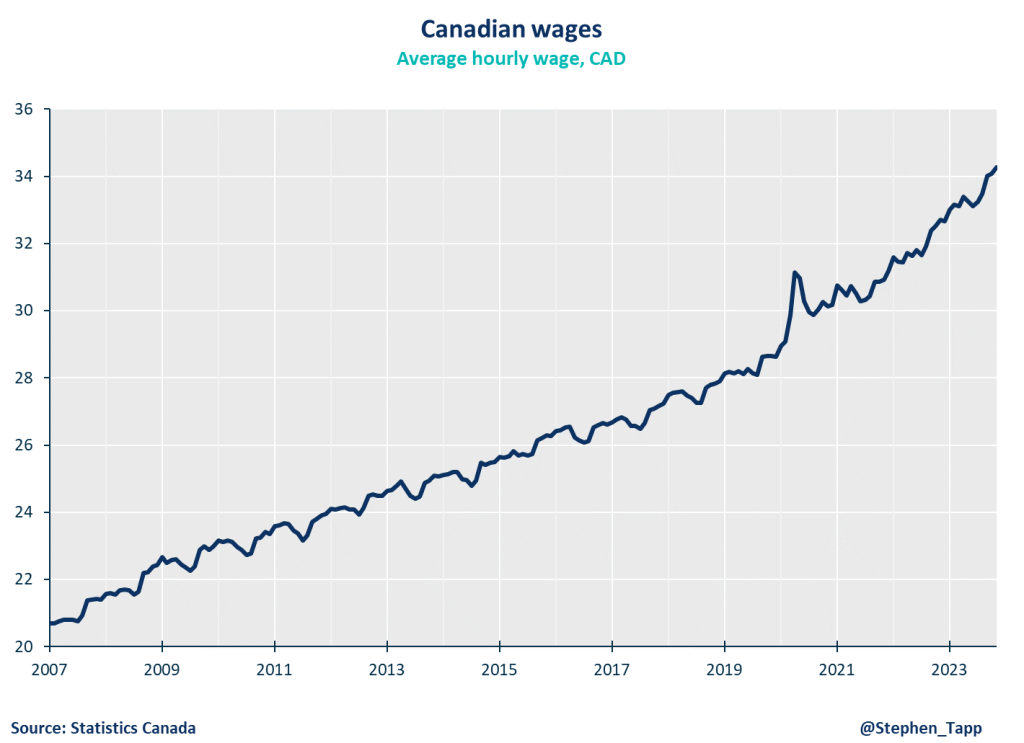

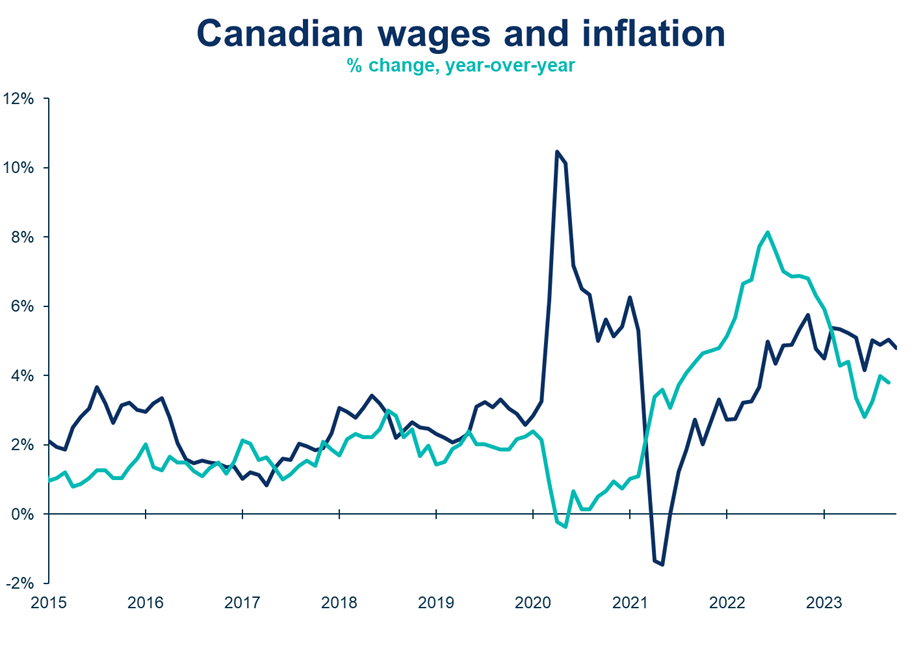

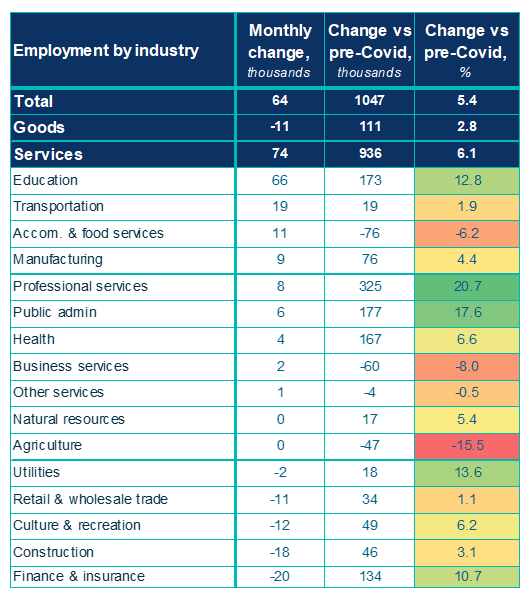

- Average hourly wage growth accelerated to 5.4% year-over-year in June, up from 5.1% in May. This increase, alongside a rising unemployment rate, indicates persistent wage pressures in sectors experiencing labour shortages.

Implications

- The labour market’s weakening trend is expected to continue as population growth outpaces job creation. Unemployment is projected to approach 7% by year-end, potentially prompting a rate cut by the Bank of Canada in July, with markets indicating a 58% probability. The upcoming CPI report on July 16 will be crucial in guiding the Bank’s decision.

- Recent job gains primarily benefit sectors grappling with labour shortages and disruptions, likely leading to further labour market challenges in the near term.

SUMMARY TABLES

CHARTS

Other Commentaries

Oct 19, 2022

September 2022 Consumer Price Index data: Food and services prices still rising, no progress on core inflation

Sep 20, 2022

August 2022 Consumer Price Index data: Finally some good news on Canadian inflation.

Aug 16, 2022

July 2022 Consumer Price Index data: Canada’s inflation finally turns a corner with falling gas prices, but core pressures remain

Commentaries /

LFS May 2024: Unemployment rate continues to rise as the job market weakens

LFS May 2024: Unemployment rate continues to rise as the job market weakens

May’s job report came in line with market expectations, confirming that Canada’s labour market is cooling down.

Marwa Abdou

May’s job report came in line with market expectations, confirming that Canada’s labour market is cooling down. The unemployment rate ticked up to 6.2%, with only a modest 27,000 jobs added (versus a consensus of 22,000) following April’s strong gain. The market is showing some major frailties: unemployment is up amongst all major demographic groups, especially youth, and job growth was wholly in part-time positions, as Canadians face a slower time finding work.

This was the first major release after the Bank of Canada kicked off the easing cycle earlier this week. The acceleration in average hourly wages to 5.1% (from 4.7%) is one area of concern that the Bank will be keeping a close eye on. Given our perennially weak labour productivity performance, if wages remain elevated, that could slow the pace of future rate cuts.

Marwa Abdou, Senior Research Director, Canadian Chamber of Commerce

KEY TAKEAWAYS

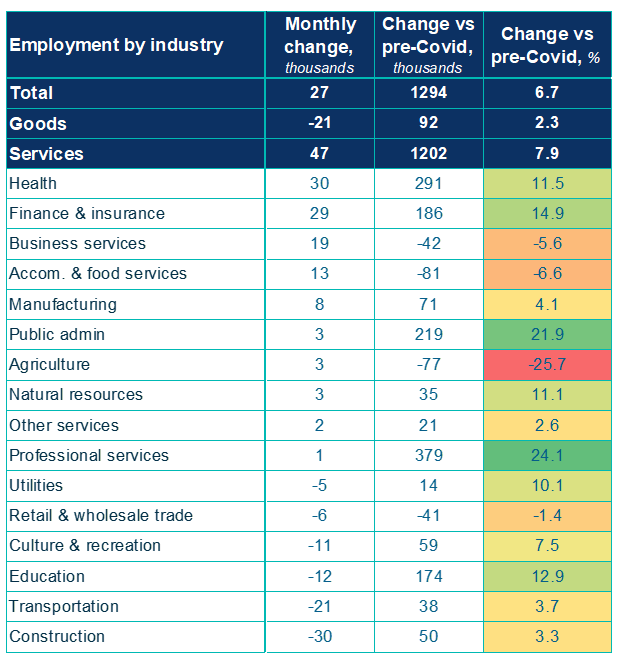

- Continuing its softening streak, Canadian employment was little changed in May (+27K, 0.1%) following a big jump in April (+90K).

- Total hours worked also were unchanged but are up by 1.6% from a year earlier.

- The unemployment rate ticked slightly up by 0.1 percentage point (ppt) to 6.2%. The labour market continues to weaken, in the context of strong population growth. Hiring demand is slowing and people are facing increasing challenges finding work. This move also continues the upward trend in the unemployment rate from April 2023, which is up a cumulative 1.1 ppts over the last 13 months.

- Part-time employment increased (62K, +1.7%) while full-time employment contracted (-36K; -0.2%). As part-time employment continues to outpace full-time employment growth this is weighing on hours worked. Involuntary part time work has also increased.

- By sector, job gains were concentrated in health care and social assistance (30K, +1.1%) and finance, insurance, real estate and leasing (+29K; +2.0%). This was offset by declines in construction (30K, -1.9%) and transportation and warehousing (-21K; -1.9%).

- Youth employment (ages 15 to 24) is one area where the market remains quite frail as May’s employment rate was unchanged (55.6%) and has been on a major downward trend after reaching a recent high of 59.4% in March 2023. Youth unemployment was also the largest recorded increase across all major demographic groups – all of which recorded up ticked unemployment rates. This in large part has to do with increased competition in the market as the share of millennials and generation Z in the country’s population is increasing, while the reverse is true for baby boomers and generation X.

- Average hourly wage growth increased 5.1% on a year-over-year basis following April’s figures (4.7%).

SUMMARY TABLES

CHARTS

Other Commentaries

Oct 19, 2022

September 2022 Consumer Price Index data: Food and services prices still rising, no progress on core inflation

Sep 20, 2022

August 2022 Consumer Price Index data: Finally some good news on Canadian inflation.

Aug 16, 2022

July 2022 Consumer Price Index data: Canada’s inflation finally turns a corner with falling gas prices, but core pressures remain

Commentaries /

LFS April 2024: Jobs gains blowing past expectations as unemployment holds steady

LFS April 2024: Jobs gains blowing past expectations as unemployment holds steady

An impressive increase in Canada’s employment of 90K jobs, while the unemployment rate held simultaneously steady at its two-year peak.

Business Data Lab

An impressive increase in Canada’s employment of 90K jobs, while the unemployment rate held simultaneously steady at its two-year peak of 6.1%, makes this one of the strongest data releases in recent months. As employment figures continue edging higher, it remains outpaced by the rapid growth of the country’s labour force. Wage growth is showing signs of slowing down but these numbers do not guarantee that the Bank of Canada will issue a rate cut in June. The likelihood of a rate cut in July may increase pending CPI data.

KEY TAKEWAYS

- While the unemployment rate held steady at its two-year peak from March at 6.1%, slightly below market expectations (6.2%), employment had an impressive growth of 90K (+0.4%) net jobs in April, far exceeding advance estimates (+25K).

- In contrast to a year earlier, unemployment rates were higher among all major demographic groups, particularly amongst racialized groups. The largest among youth (+2.9%) – excluding 2020 and 2021, during the COVID-19 pandemic, this marks the highest level since July 2016 (almost 8 years!). The unemployment rate rose for core-aged Black Canadians, South Asians, and Chinese Canadians.

- Employment gains were driven by part-time work (+50K; +1.4%) – this was up by 2.9% (104K) from a year prior (April 2023) as compared to full-time employment which also saw an annual uptick of 1.7% (+273K).

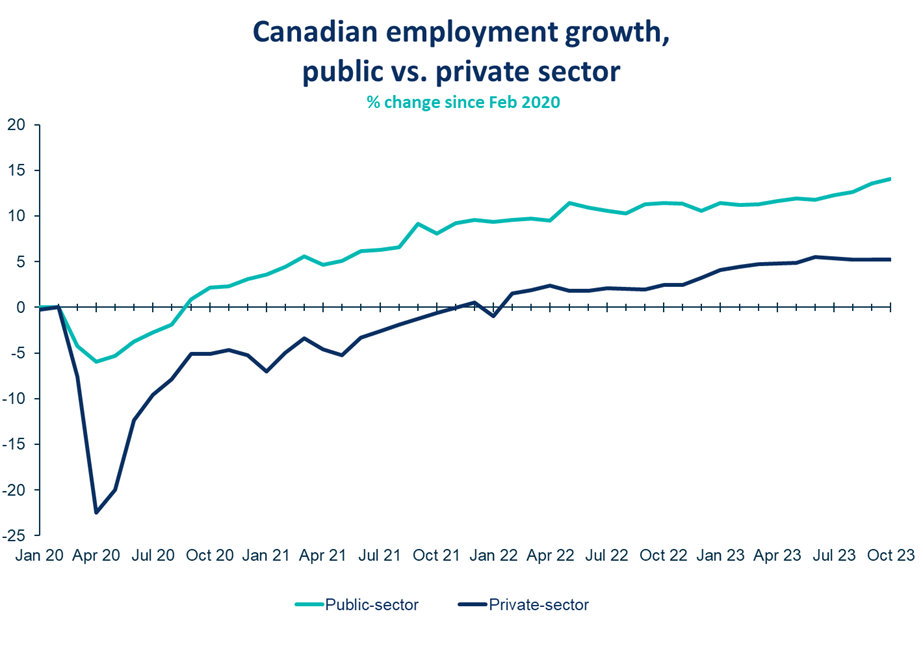

- The bump in employment was among core-aged (25 to 54 years old) men (+41K; +0.6%) – for the third consecutive month – and women (+27K; +0.4%) as well as mostly in the private sector. Employment in the sector rose in April (+50K, +0.4%) following a four-month little-change streak.

- Total hours worked increased in April by 0.8%, up by 1.2% from a year prior which bodes well for Q2 GDP.

- Average hourly wages rose 4.7% (+$1.57 to $34.95) year-over-year, following an increase of 5.0% in February.

- Employment increases were notable in professional, scientific and technical services (+26K; +1.3%), accommodation and food services (+24K; +2.2%), health care and social assistance (+17K; +0.6%) and natural resources (+7.7K; +2.3%), where in contrast we saw modest decline in utilities (-5K; -3.1%).

- Employment increased in eight provinces in April except for Newfoundland and Labrador as well as Nova Scotia.

SUMMARY TABLES

Sources: Statistics Canada; Canadian Chamber of Commerce Business Data Lab

Sources: Statistics Canada; Canadian Chamber of Commerce Business Data Lab

MORE LABOUR CHARTS

Other Commentaries

Oct 19, 2022

September 2022 Consumer Price Index data: Food and services prices still rising, no progress on core inflation

Sep 20, 2022

August 2022 Consumer Price Index data: Finally some good news on Canadian inflation.

Aug 16, 2022

July 2022 Consumer Price Index data: Canada’s inflation finally turns a corner with falling gas prices, but core pressures remain

Commentaries /

LFS March 2024: Unemployment rate hits two-year high

LFS March 2024: Unemployment rate hits two-year high

Following decent growth in January and February, Canadian employment saw little change in March 2024.

Marwa Abdou

Though job growth came to a grinding halt in March, the main headline was the unemployment rate breaking the 6% threshold for the first time in more than two years. These numbers signal that population growth continues to run ahead of labour demand. As the Bank of Canada continues to assess how much the economy is weakening under high interest rates, this report signals growing slack in the labour market, which might just test patience in terms of rate cuts.

Marwa Abdou, Senior Research Director, Canadian Chamber of Commerce

KEY TAKEAWAYS

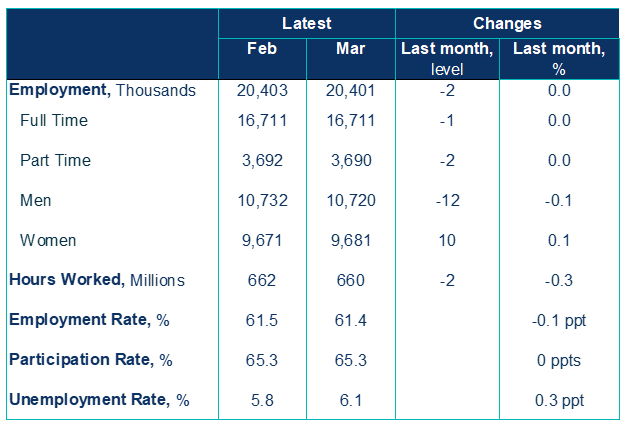

- Following decent growth in January and February, Canadian employment saw little change in March (-2,200; -0.0%).

- The unemployment rate surpassed market expectations, edging up 0.3 percentage points to 6.1% from 5.8% in February. This is the rate’s largest increase since summer 2022, the first time above the 6% threshold since Jan 2022 during COVID lockdowns and brings the cumulative increase over the past year to 1.0 ppts.

- The rise in unemployment was driven by the increase of 60K (+4.8%) of job seekers or on temporary layoffs. Unemployment was particularly up among youth where the unemployment rate rose 1.0 ppts in the month to 12.6% – the highest since September 2016 excluding the pandemic. Over the last year, the unemployment rate also increased more for core-aged Black Canadians by 3.9 ppts to 10.8%.

- Total hours worked were virtually unchanged in March, but rose 0.7% for the first quarter, which suggests decent headline GDP growth to start the year.

- Average hourly wages rose 5.1% (+$1.69 to $34.81) year-over-year, following an increase of 5.0% in February.

- Youth labour market conditions (aged 15 to 24) have weakened — particularly for females — over the past year as their participation rate fell 3.0 ppts to 62.7%.

- Employment declines were seen in three industries led by accommodation and food services (-27K; -2.4%), wholesale and retail trade (-23K; -0.8%) as well as professional services (-20K; +1.0%). There were increases in health care and social assistance (+40K; +1.5%) and construction (+15K, +1.0%).

- Regionally, provincial employment declines occurred in Quebec (-18K; -0.4%), Saskatchewan (-6K; -1.0%) and Manitoba (-4.3K; -0.6%). This while Ontario posted its second increase this quarter (+26K, +0.3%).

SUMMARY TABLES

CHARTS

Other Commentaries

Oct 19, 2022

September 2022 Consumer Price Index data: Food and services prices still rising, no progress on core inflation

Sep 20, 2022

August 2022 Consumer Price Index data: Finally some good news on Canadian inflation.

Aug 16, 2022

July 2022 Consumer Price Index data: Canada’s inflation finally turns a corner with falling gas prices, but core pressures remain

Commentaries /

LFS February 2024: Unemployment rate edges higher despite job growth

LFS February 2024: Unemployment rate edges higher despite job growth

Canada’s labour market is on track for decent job growth in the first quarter, but the headline number isn’t the whole story.

Andrew DiCapua

Canada’s labour market is on track for decent job growth in the first quarter, but the headline number isn’t the whole story. With a declining employment rate, the economy is unable to absorb a fast-rising population into the workforce. The sectors that are growing in recent months have been as a result of labour actions or gaining back the workers who left the industry and who face acute shortages, like accommodation and food services. There were some good numbers as hours worked rose 0.3% on the month, which is a signal that the first quarter is maintaining momentum from the fourth quarter. A further normalization of wages, moderating to 5% growth in February, is also welcome news, trending in the right direction to ease core inflationary pressures.

Andrew DiCapua, Senior Economist, Canadian Chamber of Commerce

KEY TAKEAWAYS

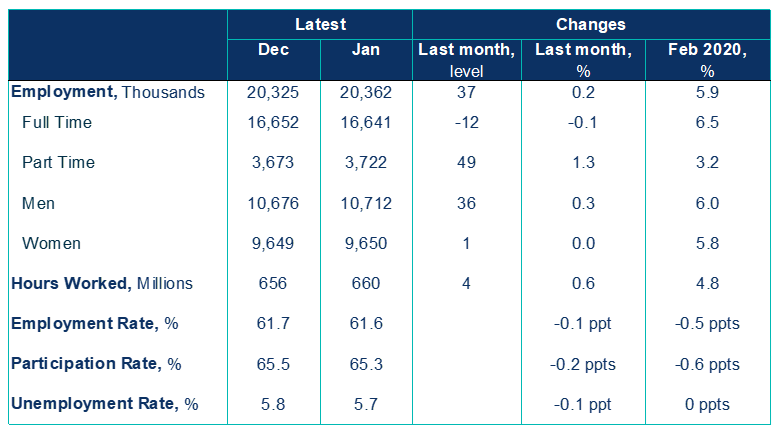

- On the back of stronger-than-expected job numbers in January, Canadian employment increased by 41K in February (exceeding market expectations for a gain in 20k jobs).

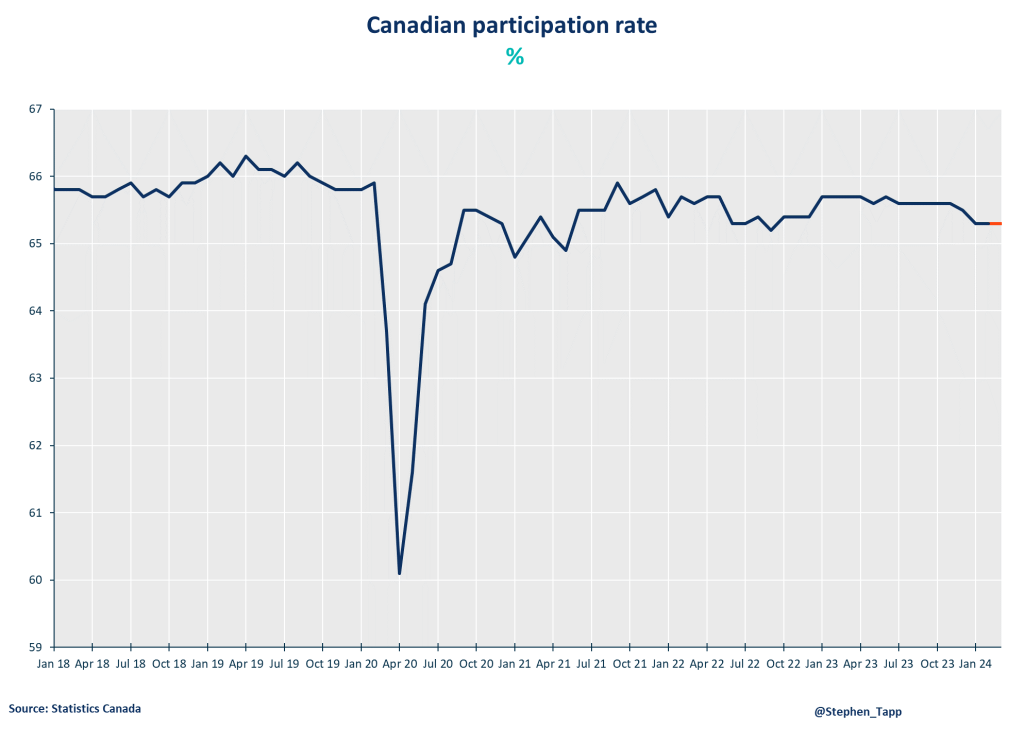

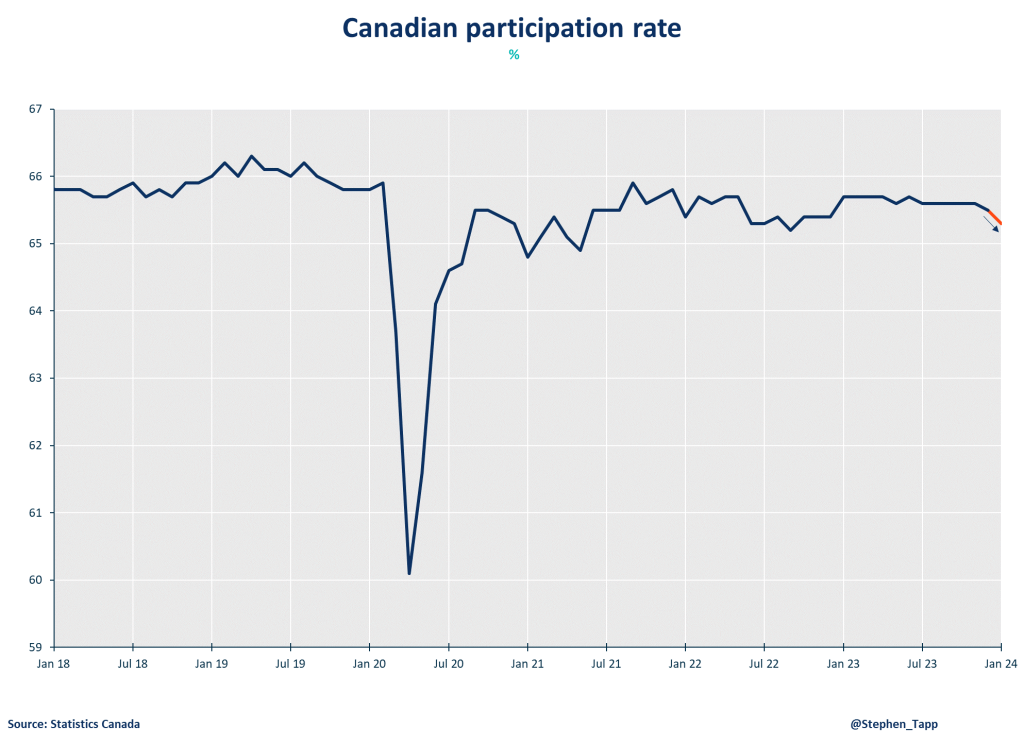

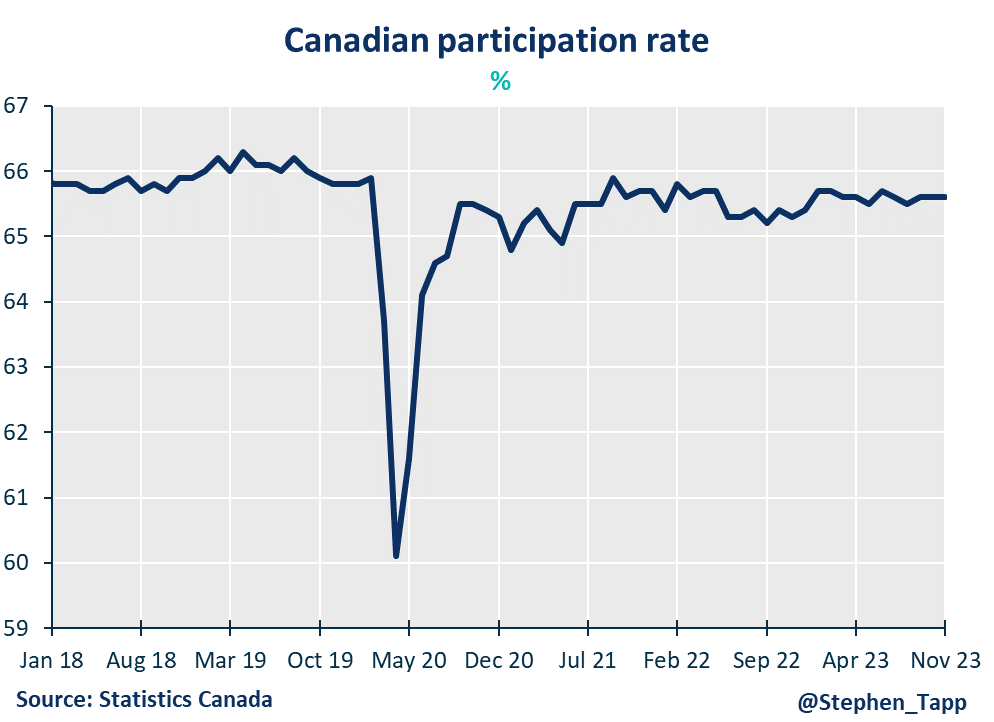

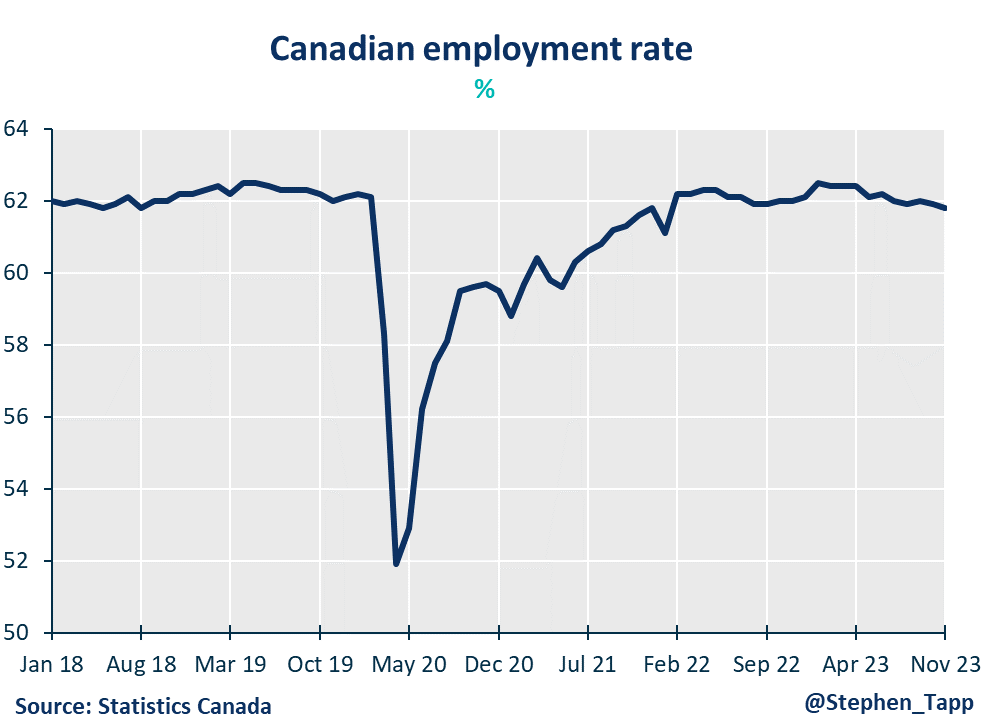

- The unemployment rate rose 0.1 percentage points to 5.8%, following a similar declinein January. The employment rate declined for the fifth consecutive month, down to 61.5%, driven by a decline in labour force participation. This continues one of the longest slumps in the participation rate since its peak in February 2023 (62.4%). The Canadian economy still can’t absorb the higher population growth (+0.3% m/m), with a declining participation rate and employment growth (+0.2% m/m).

- Total hours worked rose 0.3% on the month, and 1.3% on a year-over-year basis. This may keep GDP growth stable in Q1 2024, borrowing momentum from the last quarter.

- Average hourly wages rose 5% on a year-over-year basis, following an increase of 5.3% in January. The Bank of Canada will want this to slow further, as services inflation continues to keep core measures above target. Though, recent wage data from the Survey on Employment, Payrolls, and Hours indicates a further dampening of wage pressures, now running under 3%.

- Employment gains were spread across several services industries, led by accommodation and food services (+26K; +2.4%), professional services (+18K; +0.9%), other services (+11K; +1.4%), as well as construction (+11K; +0.7%). There were also declines in other industries, led by education (-17K; -1.1%), and wholesale and retail trade (-17K; -0.6%).

- Regionally, provincial employment increased in Alberta (+17K; +0.7%), Quebec (+8.8K; 0.2%), and Ontario (+6.7K; +0.1%). Manitoba (-5.3K; -0.7%) and Newfoundland and Labrador (-1.8K; -0.7%) saw declines.

CHARTS

Other Commentaries

Oct 19, 2022

September 2022 Consumer Price Index data: Food and services prices still rising, no progress on core inflation

Sep 20, 2022

August 2022 Consumer Price Index data: Finally some good news on Canadian inflation.

Aug 16, 2022

July 2022 Consumer Price Index data: Canada’s inflation finally turns a corner with falling gas prices, but core pressures remain

Commentaries /

LFS January 2024: A warmer start to the year than anticipated but winter is still coming

LFS January 2024: A warmer start to the year than anticipated but winter is still coming

Following a flat streak in the last quarter of 2023, Canada’s labour market kicked off the new year a little better than expected.

Marwa Abdou

Following a flat streak in the last quarter of 2023, Canada’s labour market kicked off the new year a little better than expected. January saw the unemployment rate at 5.7%, surpassing expectations of 5.9%, with a 37K job increase. While this marks the first decline in over a year (since December 2022), the growth was primarily in part-time and public sector roles. As immigration rates from last year’s historic pace moderate, labour supply will continue to be dominant driver. Despite robust wage growth at 5.3% year-over-year, which is higher than ideal, this trend is expected to moderate in response to the ongoing impact of interest rate adjustments rippling through the economy, even if on a delayed schedule.

Marwa Abdou, Senior Research Director, Canadian Chamber of commerce

KEY TAKEAWAYS

- After three months of little change, Canadian employment increased by 37K in January (exceeding market expectations for 15k).

- The unemployment rate edged down 0.1 percentage points to 5.7% – the first decline since December 2022. However, this was driven by a drop in labour force participation. The employment rate continues to decline (down 0.1 ppts to 61.6%) because job growth (+0.2%) is not keeping pace with rapid population growth (+0.4%.)

- The good news is that total hours worked rose 0.6% on the month, which should bode well for GDP growth staying the positive territory in Q1 2024.

- Average hourly wages rose 5.3% (+$1.74 to $34.75) following an increase of 5.4% in December 2023, with faster growth in the upper end of the distribution.

- Youth labour market conditions (aged 15 to 24) look to have weakened — particularly for females — over the past year as their participation rate fell 3.0 ppts to 62.7%.

- Employment gains were spread across several industries in the services-producing sector, led by wholesale and retail trade (+31K; +1.1%) as well as finance, insurance, real estate, rental and leasing (+28K; +2.1%). There were also declines in other industries, led by accommodation and food services (-30K; -2.7%).

- Regionally, provincial employment increases occurred in Ontario (+24K; +0.3%), Newfoundland and Labrador (+7.5K; +3.2%), Manitoba (+6.9K; +1.0%) and Nova Scotia (+3.7K; +0.7%). Saskatchewan saw a decline (-6.2; -1.0%).

SUMMARY TABLES

CHARTS

Other Commentaries

Oct 19, 2022

September 2022 Consumer Price Index data: Food and services prices still rising, no progress on core inflation

Sep 20, 2022

August 2022 Consumer Price Index data: Finally some good news on Canadian inflation.

Aug 16, 2022

July 2022 Consumer Price Index data: Canada’s inflation finally turns a corner with falling gas prices, but core pressures remain

Commentaries /

LFS December 2023: The labour market stalls in the final hour of 2023, signals underlying concerns

LFS December 2023: The labour market stalls in the final hour of 2023, signals underlying concerns

The momentum in the labour market is weakening alongside the fastest population growth in more than 50 years.

Andrew DiCapua

The momentum in the labour market is weakening alongside the fastest population growth in more than 50 years. With essentially flat job growth in December, the Canadian labour market ends 2023 with over 5% wage growth and an unemployment rate steady at 5.8%. Although hours worked rose for the month, this will be a drag on fourth quarter GDP as we round out the year. This signals to the Bank of Canada that the guise of a strong labour market is cracking amid strong labour force gains. With wages accelerating, the Bank was wise to not celebrate at their last meeting, possibly delaying their intentions to begin rate cuts.

Andrew DiCapua, Senior Economist, Canadian Chamber of Commerce

KEY TAKEAWAYS

- Canada’s labour market slowed in the last month of the year with employment unchanged in December, against expectation of net 15k job growth. The participation rate declined by 0.2 percentage points to 65.4%, mostly due to youth participation.

- Population growth continues to accelerate at around 3%, resulting in an expansion of the labour force by 527k people, compared to only 479k people, with employment growth of 2.4% for 2023 YoY.

- The unemployment rate held steady at 5.8%, after increasing in the past five of seven months.

- Total hours worked increased by 0.4% MoM and by 1.7% YoY in December with more than one-third of Quebec public sector employees working in educational services losing hours due to a strike.

- Wages increased by 5.4% YoY and won’t be well-received by the Bank of Canada, as they look to the timing of 2024 rate cuts.

- By gender, employment among core-aged men (25-54) increased by 0.4% (+25k jobs). Young women (15-24) experienced a 1% increase in employment (+13k jobs), while older men (55+) saw a 1.1% decline (-27k jobs).

- By industry, December was concentrated in professional, scientific, and technical services (+2.4%), health care and social assistance (+0.6%), and “other services” (+1.5%). Declines were observed in wholesale and retail trade (-0.7%) and manufacturing (-1.0%).

- By province, employment increased in six provinces with Ontario experiencing the largest decline of 0.6% (-48,000 jobs).

- The decline in full-time jobs (-24k) was offset by the increases in part-time work (+24k). Statistics Canada noted that in December, 135,000 Canadians provided ride or taxi services through an app, an increase of 48% since 2022.

SUMMARY TABLES

CHARTS

Other Commentaries

Oct 19, 2022

September 2022 Consumer Price Index data: Food and services prices still rising, no progress on core inflation

Sep 20, 2022

August 2022 Consumer Price Index data: Finally some good news on Canadian inflation.

Aug 16, 2022

July 2022 Consumer Price Index data: Canada’s inflation finally turns a corner with falling gas prices, but core pressures remain

Commentaries /

LFS November 2023: Weaknesses in Canada’s economy prevail as unemployment edges higher

LFS November 2023: Weaknesses in Canada’s economy prevail as unemployment edges higher

Despite job growth exceeding both trend and market expectations at 25K, the report is indicative of the continuing loss of momentum and broader weakness in Canada’s economy.

Marwa Abdou

Despite job growth exceeding both trend and market expectations at 25K, the report is indicative of the continuing loss of momentum and broader weakness in Canada’s economy. All in all, as we near the end of a tumultuous year, the contrast from its beginning is stark, with a cumulative increase of 0.8 percentage points in unemployment since April 2023 (from 5.0%). Still, given the remarkable streak of low unemployment and tightness that had sustained for the better part of the year, it has cushioned us for a picture that more “decent” than bleak.

Marwa Abdou, Senior Research Director, Canadian Chamber of Commerce

KEY TAKEAWAYS

- Continuing its cooling streak, unemployment rate ticked 0.1% higher in November at 5.8% y-o-y as Canadian employment was up by a modest 25K net new jobs.

- Total hours worked fell 0.7% but were up 1.7% y-o-y. Average hourly wages also rose 4.8% as price pressures persist. This was also like the increase recorded in October. Wage growth has remained between 4-5% for most of the year and is showing signs of decline.

- With the slowdown in hiring demand coupled with the country’s ballooning population growth fueling labour supply, were seeing that the absorption of labour has continued to slow – in other words outpacing labour demand.

- By industry, we saw gains in jobs in manufacturing (+28k; +1.6%) as well as construction (+16K; +1.0%) while wholesale and retail trade (-27k; -0.9%) and finance and insurance (-18K; -1.3%) shed jobs.

- By gender, there were some notable gains and losses. Full-time employment increased amongst core-aged (25 to 54 years) women (+34K; 0.6%) while it was offset by decline in part-time work for the same group (-21K; +2.1%)Thiswhile, the employment rate for core-aged men continued its five-month downward streak from June (a total of 0.9 percentage points from 88.2% to 87.3%).

- The survey also reported that, compared with a year ago, unemployed people were more likely to have been laid off – more than two-thirds (68.7%) of those who had worked in November 2022 had been laid off by last month.

- Regionally, provincial employment had a modest increase for the second month in New Brunswick (+2.4K; +0.6%). The slight decline in Prince Edward Island (+1.3K; +1.4%) came as a break from a four-month steady streak of increases (June to September) and an abrupt no-growth October. We also saw little change in Quebec and Ontario.

SUMMARY TABLES

MORE LABOUR CHARTS

Other Commentaries

Oct 19, 2022

September 2022 Consumer Price Index data: Food and services prices still rising, no progress on core inflation

Sep 20, 2022

August 2022 Consumer Price Index data: Finally some good news on Canadian inflation.

Aug 16, 2022

July 2022 Consumer Price Index data: Canada’s inflation finally turns a corner with falling gas prices, but core pressures remain

Commentaries /

October 2023 LFS: From “running down a dream” to “running out of steam”

October 2023 LFS: From “running down a dream” to “running out of steam”

Much like the rest of Canada’s economy, the labour market is slowing down.

Stephen Tapp

Much like the rest of Canada’s economy, the labour market is slowing down. Modest employment growth of 17,500 net new jobs in October, came in largely as expected, however this has failed to keep pace with the rapid population growth experienced over the course of the year. Hours worked have stagnated in recent months alongside disappointing GDP numbers.

Stephen Tapp, Chief Economist, Canadian Chamber of Commerce

The unemployment rate continues to slowly creep up, and now stands at 5.7% — certainly not a cause for alarm yet, but a clear signal that as labour demand/job vacancies decline and immigration adds to labour supply, the labour market continues to loosen up and rebalance. That said, market conditions are still tighter than usual, which is why wages (4.8% year-over-year) continue to run ahead of inflation (3.8%). All told, the recent string of weak data should keep the Bank of Canada on hold at its next meeting in December.

KEY TAKEAWAYS

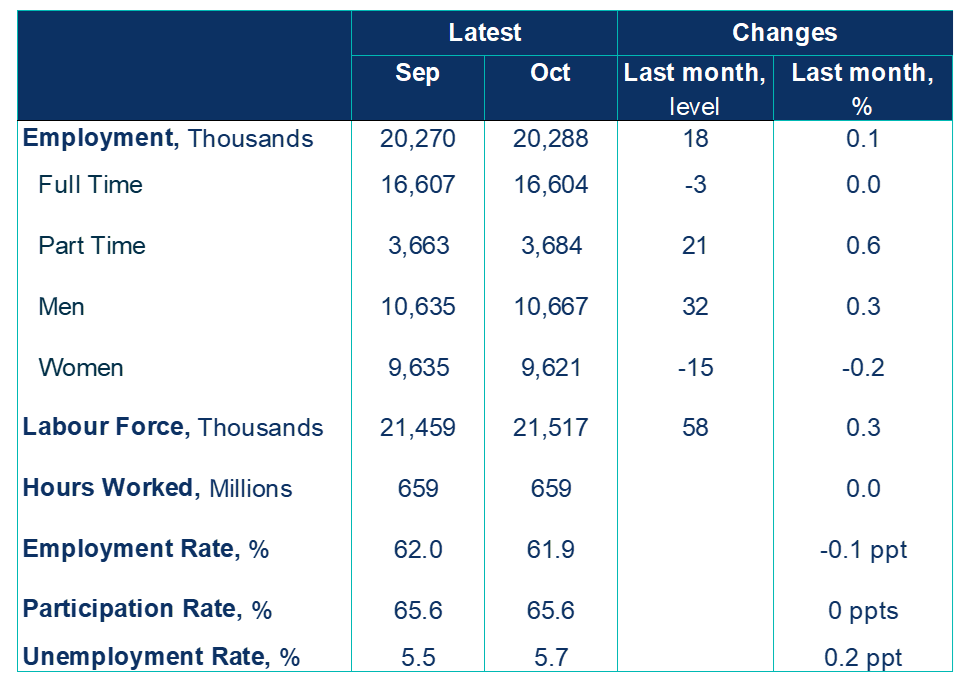

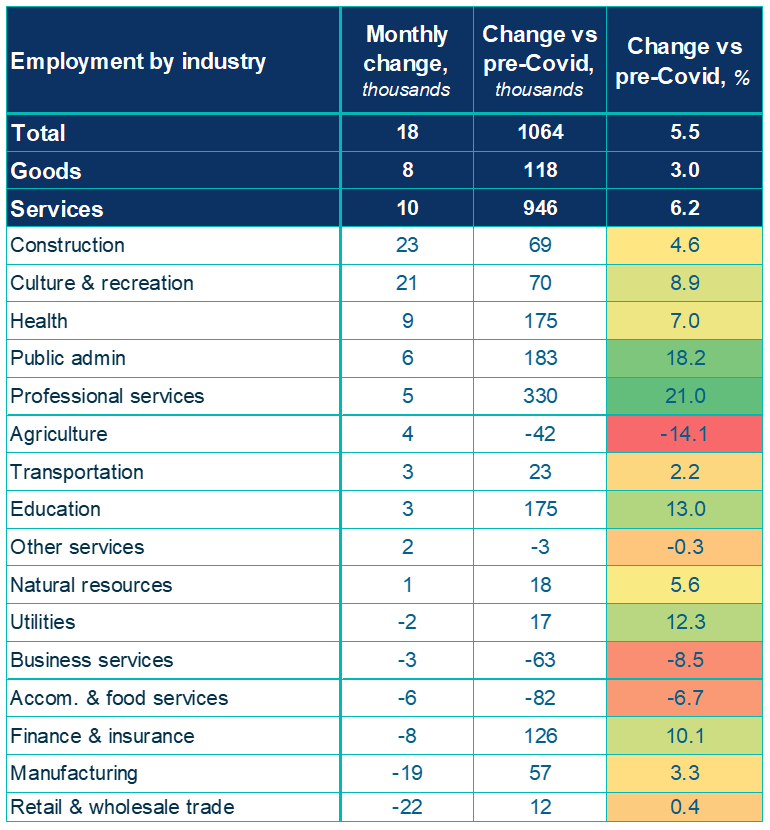

- Employment grew modestly by 17,500 net jobs in October, largelyin line with market expectations (+25,000).

- Hours worked were largely unchanged on the month, consistentwithstagnating output.

- Average hourly wages remain strong andcontinue to grow faster than inflation, rising 4.8% year-over-year in October, slightly slower than a month earlier.

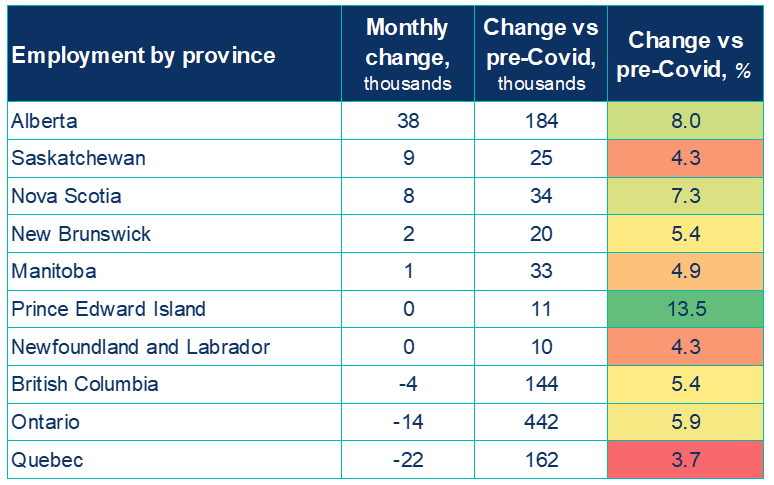

- Over the first 10 months of the year, employment growth (28,000 on average per month) has not kept pace with rapid population growth (85,000).

- The unemployment rate rose to 5.7% (a little worse than the market expected, 5.6%). As job vacancies decline and immigration adds to labour supply, the labour market continues to loosen up.

- By industry, gains in October occurred in construction (+23,000; +1.5%) and information, culture and recreation (+21,000; +2.5%). Employment fell in wholesale and retail trade (-22,000; -0.7%) and manufacturing (-19,000; -1.0%).

- Full-time work was stable (-3k), while part-time work was up slightly (21k). Employment in the public sector continues to grow (+19k), while private-sector employment is down over the past four months.

- Employment increased in four provinces in October (AB, SK, NS, NB). Alberta led the way (+38,000; +1.5%), while Quebec saw a decline (-22,000; -0.5%).

SUMMARY TABLES

Sources: Statistics Canada; Canadian Chamber of Commerce Business Data Lab

Sources: Statistics Canada; Canadian Chamber of Commerce Business Data Lab

LABOUR CHARTS

Other Commentaries

Oct 19, 2022

September 2022 Consumer Price Index data: Food and services prices still rising, no progress on core inflation

Sep 20, 2022

August 2022 Consumer Price Index data: Finally some good news on Canadian inflation.

Aug 16, 2022

July 2022 Consumer Price Index data: Canada’s inflation finally turns a corner with falling gas prices, but core pressures remain

Commentaries /

Labour Force Survey September 2023: Canada’s job market is giving forecasters a run for their money.

Labour Force Survey September 2023: Canada’s job market is giving forecasters a run for their money.

September’s jobs report blew past market expectations of 20K net gains. But the impressive headline number is concentrated in part-time work and in very few sectors.

Andrew DiCapua

September’s jobs report blew past market expectations of 20K net gains. But the impressive headline number is concentrated in part-time work and in very few sectors. Labour force population also outpaced recent job gains, further bringing the tight labour market more into balance, and hopefully alleviating the strain on high wage growth. With hours worked essentially unchanged this month, there will be little impact on gross domestic product (GDP) in September, leaving the possibility of a contraction in the third quarter still on the table.

Andrew DiCapua, Senior Economist, Business Data Lab, Canadian Chamber of Commerce

KEY TAKEAWAYS

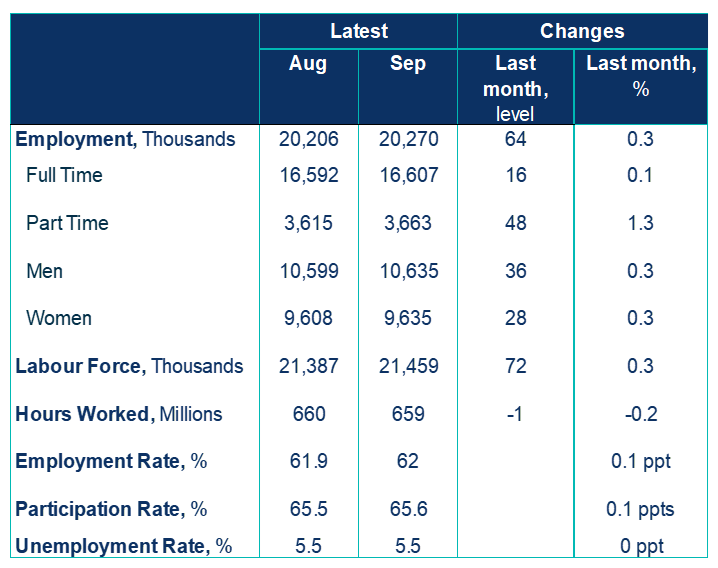

- The labour market maintained its robust momentum, at least for now. Employment grew by 64K jobs in September, following a substantial gain of 40k jobs in August. This was well above market expectations of 20K jobs.

- Total hours worked were essentially unchanged and rose by 2.6% year-over-year. Average hourly wages stayed elevated on an annual basis, rising 5% in September, but slowed on the month. Wage growth edged up in the third quarter, which will be of concern to the Bank of Canada.

- Labour force population has outpaced employment growth over the past few months, with an additional 72,000 individuals joining the workforce in September. The unemployment rate now holds steady at 5.5% for the third consecutive month. But, as vacancies decline and recent growth in immigration adds to labour supply, the labour market is moving closer to balance.

- By industry, gains were concentrated in the education sector (+66K; +4.5%) largely due to the start of the school year. Transportation and warehousing also saw considerable gains (+19K; +1.8%). Meanwhile, financial services (-20K; -1.4%) and construction (-18K; -1.1%) sectors witnessed job losses. Despite the headline growth number, seven sectors reported flat or negative growth on the month.

- In September, employment increased amongst both core-aged (25 to 54 years) men (+32K; +0.5%) and women (+37K; +0.6%). Part-time work grew 1.3%, overshadowing the modest employment gains in full-time work, which grew merely 0.1%.

- Regionally, provincial employment was led by Quebec (+39K; +0.9%), British Columbia (+26K; +0.9%), and Ontario (+20K; +0.3%). Alberta shed jobs in September, offsetting the gains of the previous two months (-38K; -1.5%).

SUMMARY TABLES

LABOUR CHARTS

Other Commentaries

Oct 19, 2022

September 2022 Consumer Price Index data: Food and services prices still rising, no progress on core inflation

Sep 20, 2022

August 2022 Consumer Price Index data: Finally some good news on Canadian inflation.

Aug 16, 2022