Commentaries /

LFS February 2024: Unemployment rate edges higher despite job growth

LFS February 2024: Unemployment rate edges higher despite job growth

Canada’s labour market is on track for decent job growth in the first quarter, but the headline number isn’t the whole story.

Andrew DiCapua

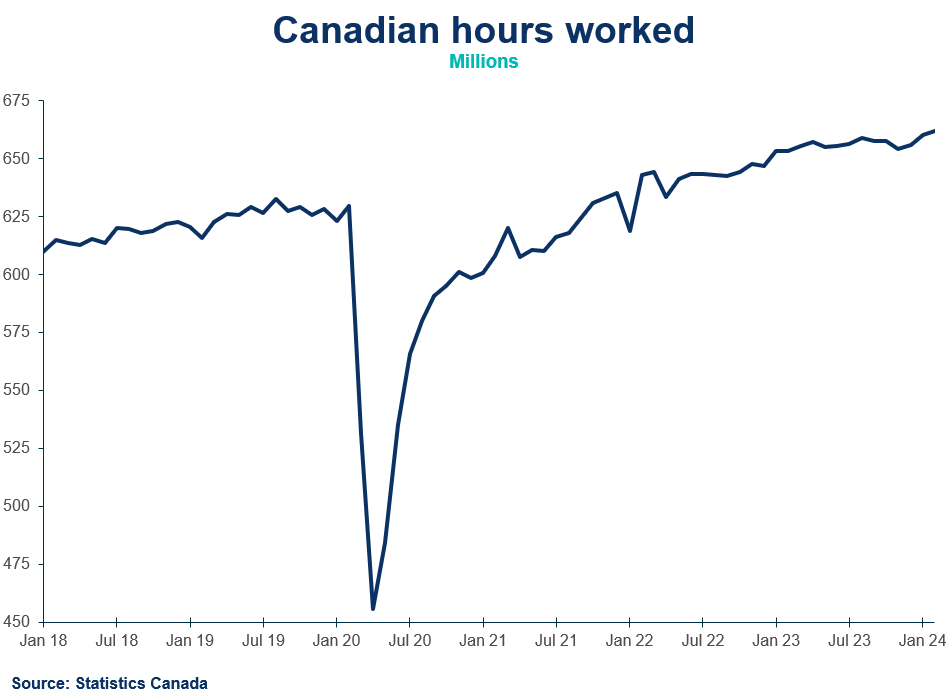

Canada’s labour market is on track for decent job growth in the first quarter, but the headline number isn’t the whole story. With a declining employment rate, the economy is unable to absorb a fast-rising population into the workforce. The sectors that are growing in recent months have been as a result of labour actions or gaining back the workers who left the industry and who face acute shortages, like accommodation and food services. There were some good numbers as hours worked rose 0.3% on the month, which is a signal that the first quarter is maintaining momentum from the fourth quarter. A further normalization of wages, moderating to 5% growth in February, is also welcome news, trending in the right direction to ease core inflationary pressures.

Andrew DiCapua, Senior Economist, Canadian Chamber of Commerce

KEY TAKEAWAYS

- On the back of stronger-than-expected job numbers in January, Canadian employment increased by 41K in February (exceeding market expectations for a gain in 20k jobs).

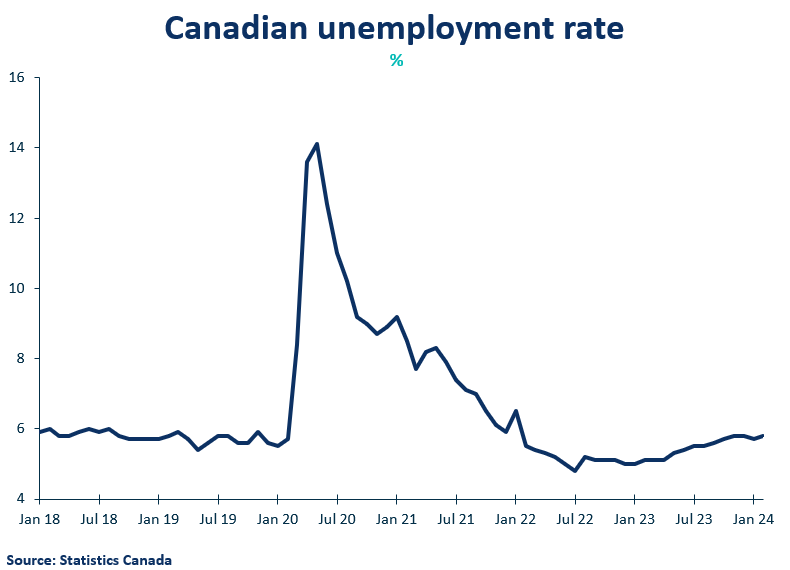

- The unemployment rate rose 0.1 percentage points to 5.8%, following a similar declinein January. The employment rate declined for the fifth consecutive month, down to 61.5%, driven by a decline in labour force participation. This continues one of the longest slumps in the participation rate since its peak in February 2023 (62.4%). The Canadian economy still can’t absorb the higher population growth (+0.3% m/m), with a declining participation rate and employment growth (+0.2% m/m).

- Total hours worked rose 0.3% on the month, and 1.3% on a year-over-year basis. This may keep GDP growth stable in Q1 2024, borrowing momentum from the last quarter.

- Average hourly wages rose 5% on a year-over-year basis, following an increase of 5.3% in January. The Bank of Canada will want this to slow further, as services inflation continues to keep core measures above target. Though, recent wage data from the Survey on Employment, Payrolls, and Hours indicates a further dampening of wage pressures, now running under 3%.

- Employment gains were spread across several services industries, led by accommodation and food services (+26K; +2.4%), professional services (+18K; +0.9%), other services (+11K; +1.4%), as well as construction (+11K; +0.7%). There were also declines in other industries, led by education (-17K; -1.1%), and wholesale and retail trade (-17K; -0.6%).

- Regionally, provincial employment increased in Alberta (+17K; +0.7%), Quebec (+8.8K; 0.2%), and Ontario (+6.7K; +0.1%). Manitoba (-5.3K; -0.7%) and Newfoundland and Labrador (-1.8K; -0.7%) saw declines.

CHARTS

Other Commentaries

Oct 19, 2022

September 2022 Consumer Price Index data: Food and services prices still rising, no progress on core inflation

Sep 20, 2022

August 2022 Consumer Price Index data: Finally some good news on Canadian inflation.

Aug 16, 2022