Commentaries /

October 2023 LFS: From “running down a dream” to “running out of steam”

October 2023 LFS: From “running down a dream” to “running out of steam”

Much like the rest of Canada’s economy, the labour market is slowing down.

Stephen Tapp

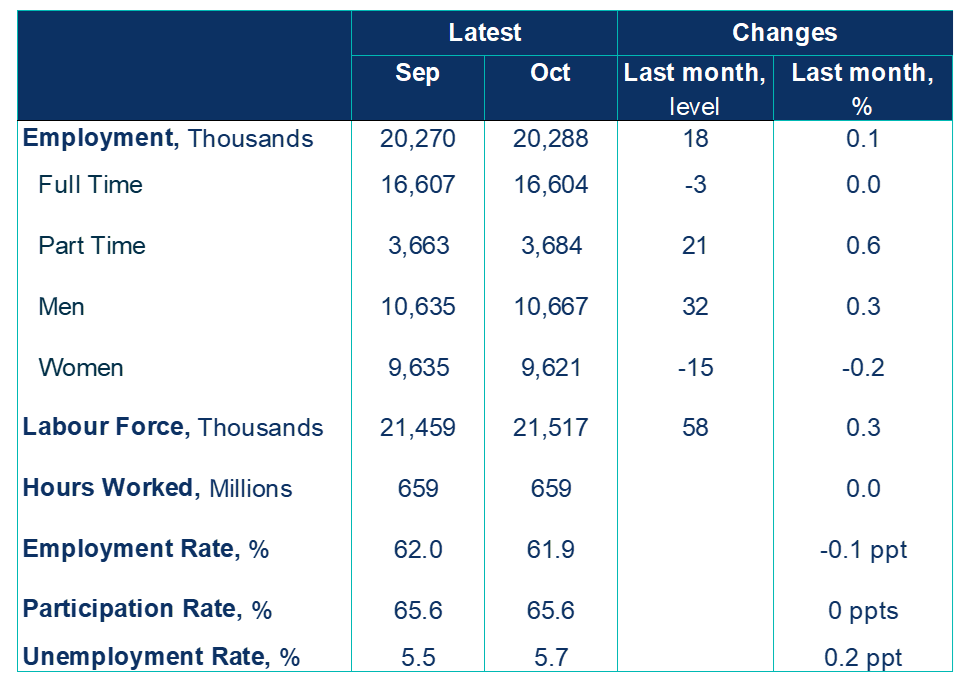

Much like the rest of Canada’s economy, the labour market is slowing down. Modest employment growth of 17,500 net new jobs in October, came in largely as expected, however this has failed to keep pace with the rapid population growth experienced over the course of the year. Hours worked have stagnated in recent months alongside disappointing GDP numbers.

Stephen Tapp, Chief Economist, Canadian Chamber of Commerce

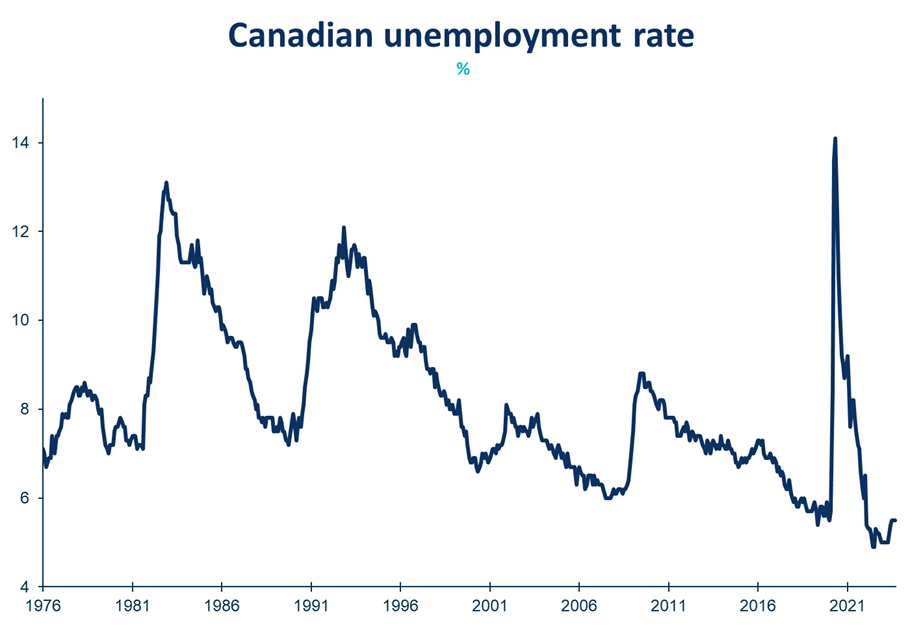

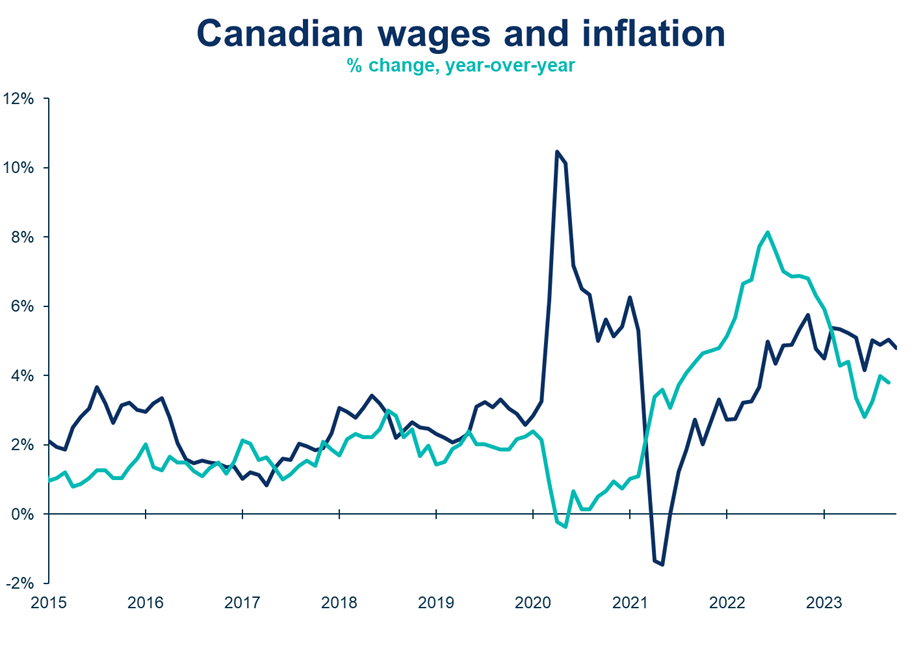

The unemployment rate continues to slowly creep up, and now stands at 5.7% — certainly not a cause for alarm yet, but a clear signal that as labour demand/job vacancies decline and immigration adds to labour supply, the labour market continues to loosen up and rebalance. That said, market conditions are still tighter than usual, which is why wages (4.8% year-over-year) continue to run ahead of inflation (3.8%). All told, the recent string of weak data should keep the Bank of Canada on hold at its next meeting in December.

KEY TAKEAWAYS

- Employment grew modestly by 17,500 net jobs in October, largelyin line with market expectations (+25,000).

- Hours worked were largely unchanged on the month, consistentwithstagnating output.

- Average hourly wages remain strong andcontinue to grow faster than inflation, rising 4.8% year-over-year in October, slightly slower than a month earlier.

- Over the first 10 months of the year, employment growth (28,000 on average per month) has not kept pace with rapid population growth (85,000).

- The unemployment rate rose to 5.7% (a little worse than the market expected, 5.6%). As job vacancies decline and immigration adds to labour supply, the labour market continues to loosen up.

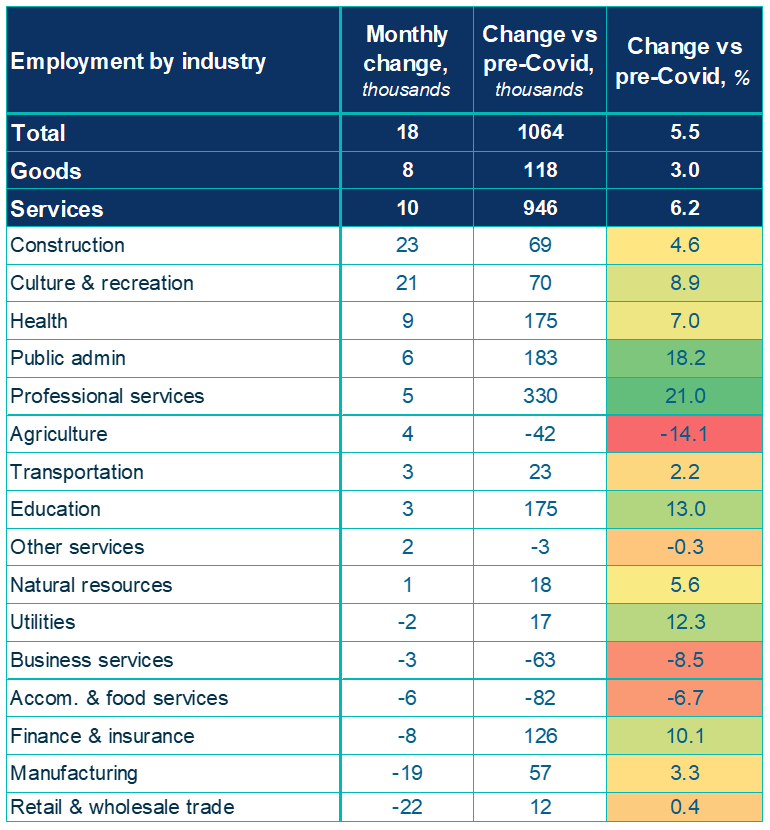

- By industry, gains in October occurred in construction (+23,000; +1.5%) and information, culture and recreation (+21,000; +2.5%). Employment fell in wholesale and retail trade (-22,000; -0.7%) and manufacturing (-19,000; -1.0%).

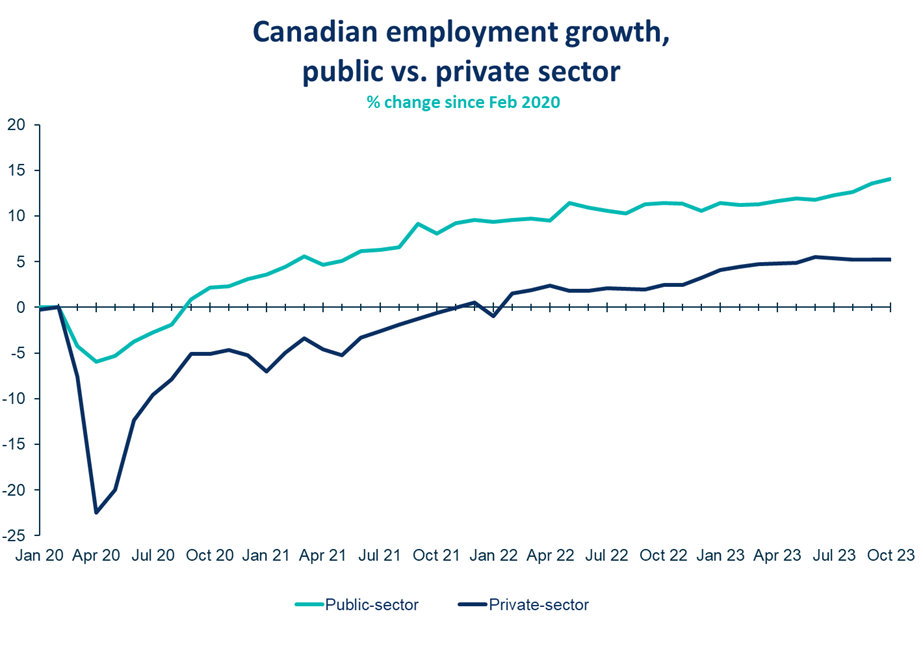

- Full-time work was stable (-3k), while part-time work was up slightly (21k). Employment in the public sector continues to grow (+19k), while private-sector employment is down over the past four months.

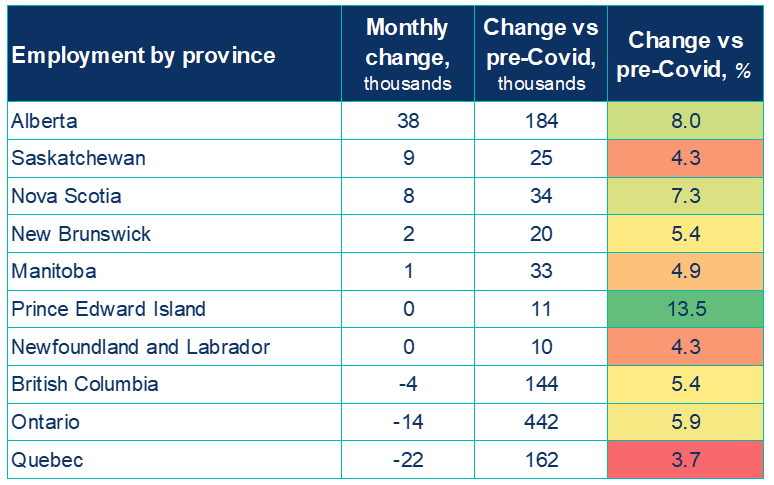

- Employment increased in four provinces in October (AB, SK, NS, NB). Alberta led the way (+38,000; +1.5%), while Quebec saw a decline (-22,000; -0.5%).

SUMMARY TABLES

Sources: Statistics Canada; Canadian Chamber of Commerce Business Data Lab

Sources: Statistics Canada; Canadian Chamber of Commerce Business Data Lab

LABOUR CHARTS

Other Commentaries

Oct 19, 2022

September 2022 Consumer Price Index data: Food and services prices still rising, no progress on core inflation

Sep 20, 2022

August 2022 Consumer Price Index data: Finally some good news on Canadian inflation.

Aug 16, 2022