Commentaries /

LFS December 2023: The labour market stalls in the final hour of 2023, signals underlying concerns

LFS December 2023: The labour market stalls in the final hour of 2023, signals underlying concerns

The momentum in the labour market is weakening alongside the fastest population growth in more than 50 years.

Andrew DiCapua

The momentum in the labour market is weakening alongside the fastest population growth in more than 50 years. With essentially flat job growth in December, the Canadian labour market ends 2023 with over 5% wage growth and an unemployment rate steady at 5.8%. Although hours worked rose for the month, this will be a drag on fourth quarter GDP as we round out the year. This signals to the Bank of Canada that the guise of a strong labour market is cracking amid strong labour force gains. With wages accelerating, the Bank was wise to not celebrate at their last meeting, possibly delaying their intentions to begin rate cuts.

Andrew DiCapua, Senior Economist, Canadian Chamber of Commerce

KEY TAKEAWAYS

- Canada’s labour market slowed in the last month of the year with employment unchanged in December, against expectation of net 15k job growth. The participation rate declined by 0.2 percentage points to 65.4%, mostly due to youth participation.

- Population growth continues to accelerate at around 3%, resulting in an expansion of the labour force by 527k people, compared to only 479k people, with employment growth of 2.4% for 2023 YoY.

- The unemployment rate held steady at 5.8%, after increasing in the past five of seven months.

- Total hours worked increased by 0.4% MoM and by 1.7% YoY in December with more than one-third of Quebec public sector employees working in educational services losing hours due to a strike.

- Wages increased by 5.4% YoY and won’t be well-received by the Bank of Canada, as they look to the timing of 2024 rate cuts.

- By gender, employment among core-aged men (25-54) increased by 0.4% (+25k jobs). Young women (15-24) experienced a 1% increase in employment (+13k jobs), while older men (55+) saw a 1.1% decline (-27k jobs).

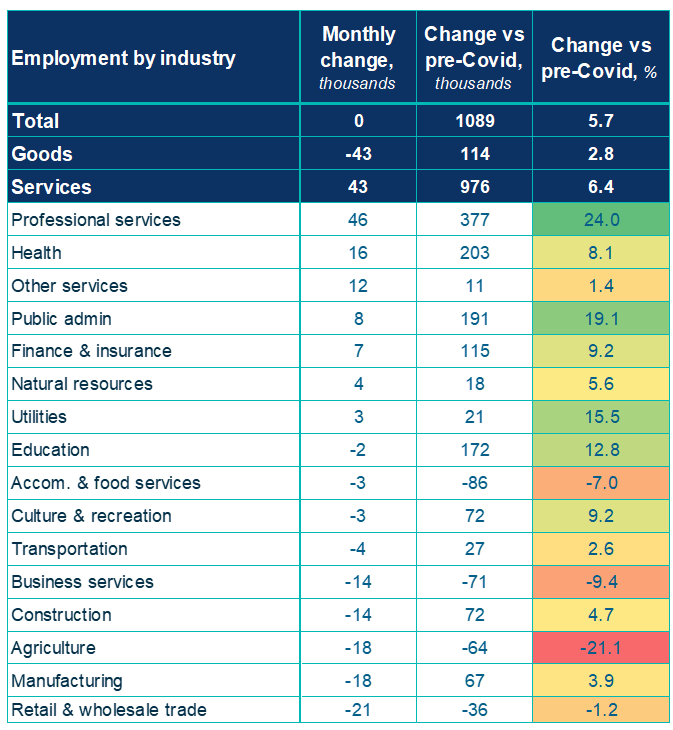

- By industry, December was concentrated in professional, scientific, and technical services (+2.4%), health care and social assistance (+0.6%), and “other services” (+1.5%). Declines were observed in wholesale and retail trade (-0.7%) and manufacturing (-1.0%).

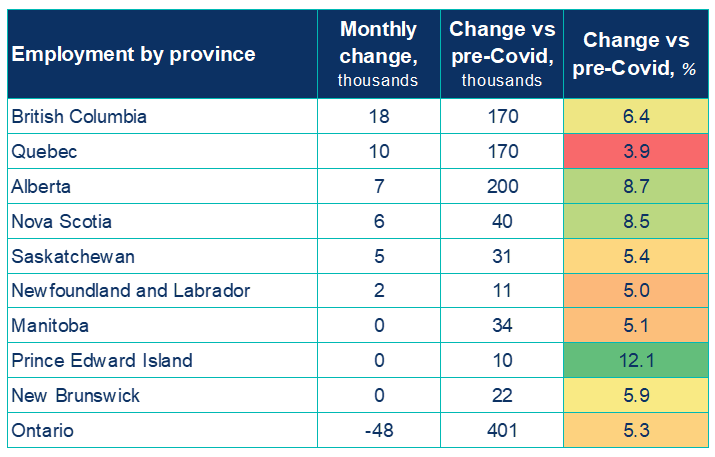

- By province, employment increased in six provinces with Ontario experiencing the largest decline of 0.6% (-48,000 jobs).

- The decline in full-time jobs (-24k) was offset by the increases in part-time work (+24k). Statistics Canada noted that in December, 135,000 Canadians provided ride or taxi services through an app, an increase of 48% since 2022.

SUMMARY TABLES

CHARTS

Other Commentaries

Oct 19, 2022

September 2022 Consumer Price Index data: Food and services prices still rising, no progress on core inflation

Sep 20, 2022

August 2022 Consumer Price Index data: Finally some good news on Canadian inflation.

Aug 16, 2022