Commentaries /

LFS March 2024: Unemployment rate hits two-year high

LFS March 2024: Unemployment rate hits two-year high

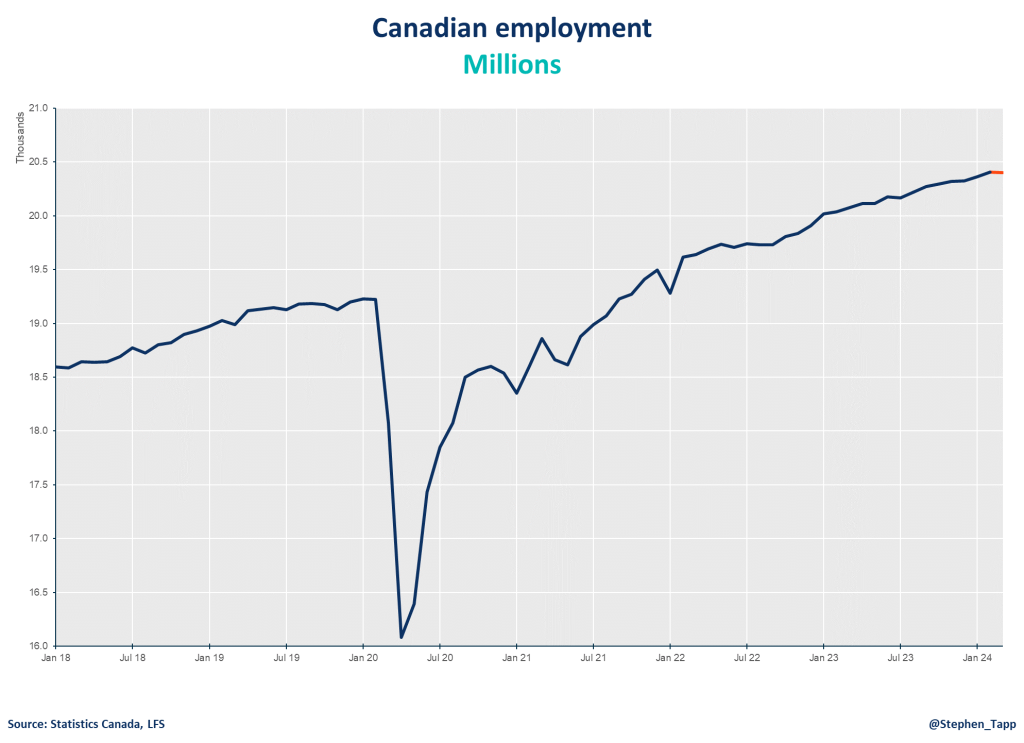

Following decent growth in January and February, Canadian employment saw little change in March 2024.

Marwa Abdou

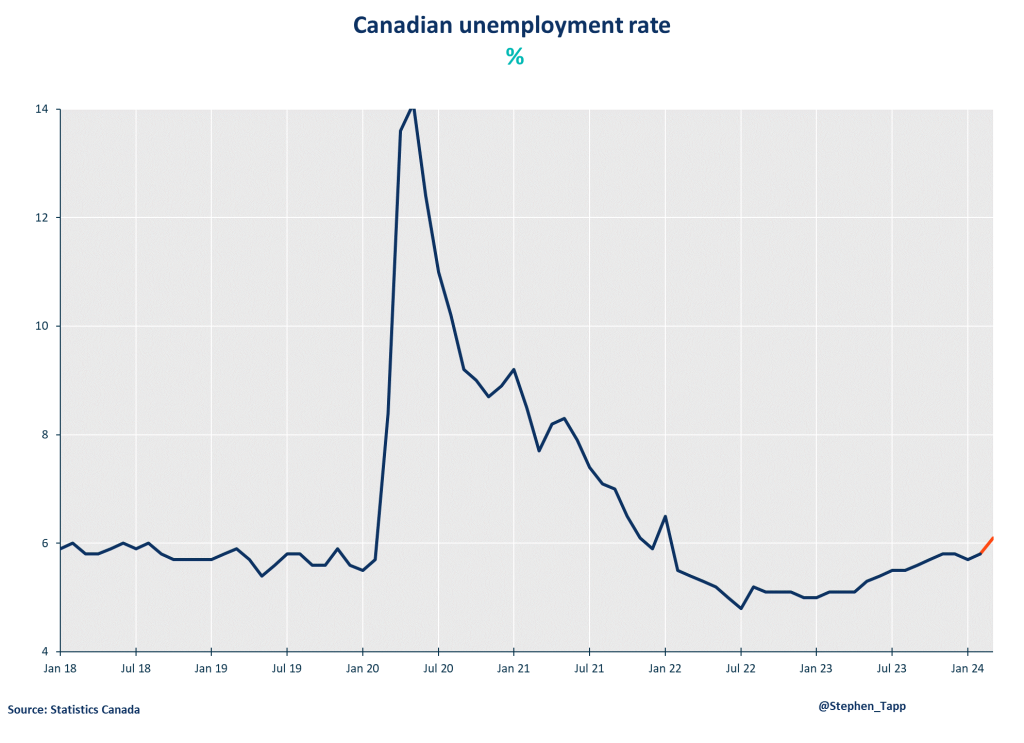

Though job growth came to a grinding halt in March, the main headline was the unemployment rate breaking the 6% threshold for the first time in more than two years. These numbers signal that population growth continues to run ahead of labour demand. As the Bank of Canada continues to assess how much the economy is weakening under high interest rates, this report signals growing slack in the labour market, which might just test patience in terms of rate cuts.

Marwa Abdou, Senior Research Director, Canadian Chamber of Commerce

KEY TAKEAWAYS

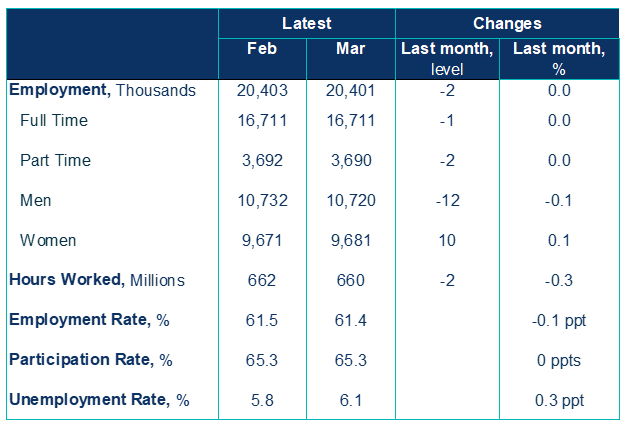

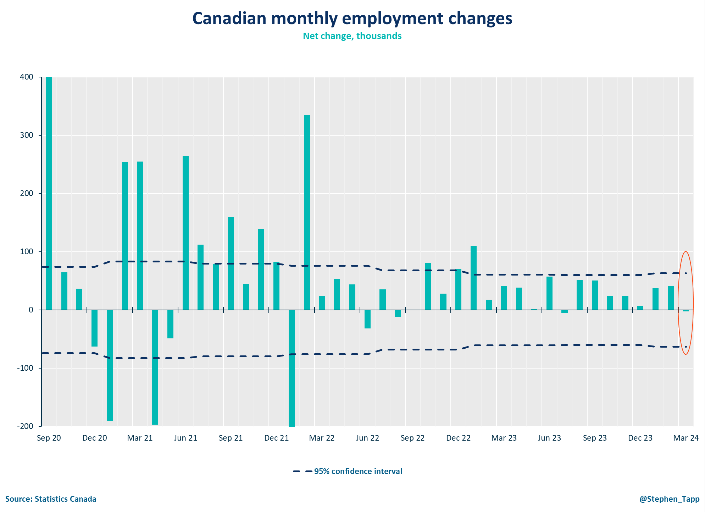

- Following decent growth in January and February, Canadian employment saw little change in March (-2,200; -0.0%).

- The unemployment rate surpassed market expectations, edging up 0.3 percentage points to 6.1% from 5.8% in February. This is the rate’s largest increase since summer 2022, the first time above the 6% threshold since Jan 2022 during COVID lockdowns and brings the cumulative increase over the past year to 1.0 ppts.

- The rise in unemployment was driven by the increase of 60K (+4.8%) of job seekers or on temporary layoffs. Unemployment was particularly up among youth where the unemployment rate rose 1.0 ppts in the month to 12.6% – the highest since September 2016 excluding the pandemic. Over the last year, the unemployment rate also increased more for core-aged Black Canadians by 3.9 ppts to 10.8%.

- Total hours worked were virtually unchanged in March, but rose 0.7% for the first quarter, which suggests decent headline GDP growth to start the year.

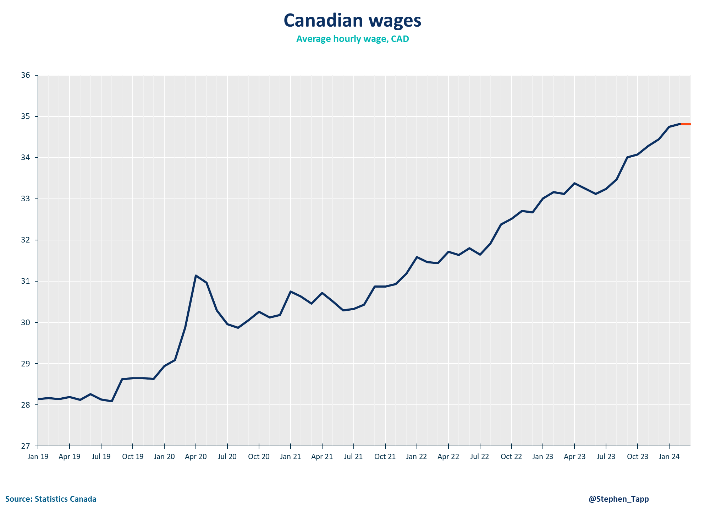

- Average hourly wages rose 5.1% (+$1.69 to $34.81) year-over-year, following an increase of 5.0% in February.

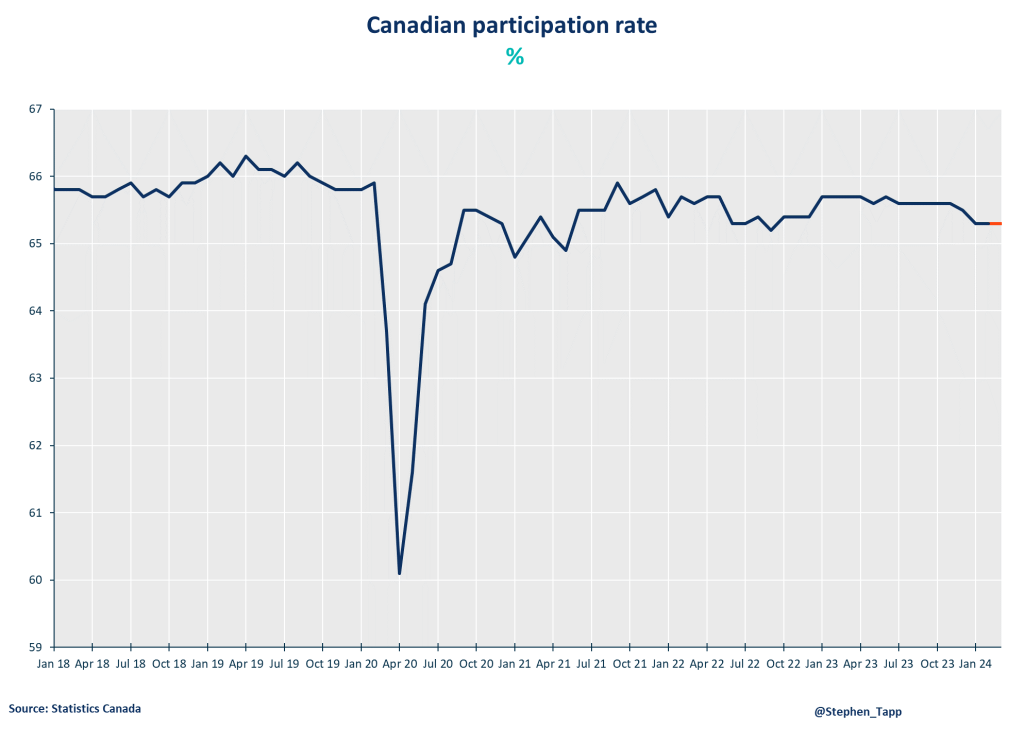

- Youth labour market conditions (aged 15 to 24) have weakened — particularly for females — over the past year as their participation rate fell 3.0 ppts to 62.7%.

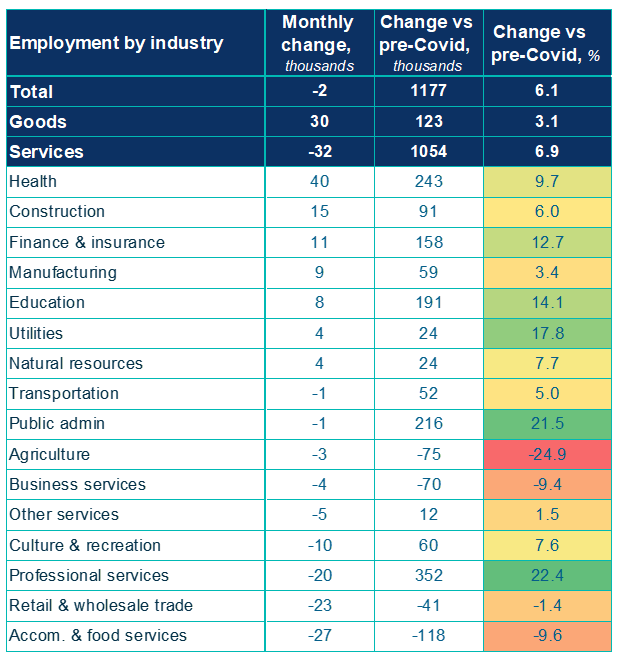

- Employment declines were seen in three industries led by accommodation and food services (-27K; -2.4%), wholesale and retail trade (-23K; -0.8%) as well as professional services (-20K; +1.0%). There were increases in health care and social assistance (+40K; +1.5%) and construction (+15K, +1.0%).

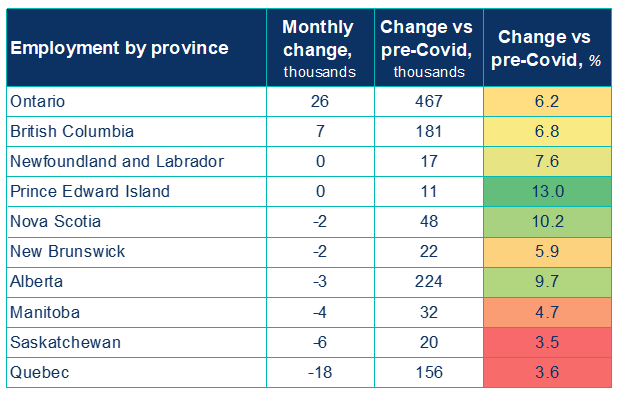

- Regionally, provincial employment declines occurred in Quebec (-18K; -0.4%), Saskatchewan (-6K; -1.0%) and Manitoba (-4.3K; -0.6%). This while Ontario posted its second increase this quarter (+26K, +0.3%).

SUMMARY TABLES

CHARTS

Other Commentaries

commentaries

Oct 19, 2022

September 2022 Consumer Price Index data: Food and services prices still rising, no progress on core inflation

Our Chief Economist, Stephen Tapp, looks at Canada’s headline inflation, which edged down for the third month in a row. There was no progress on “core” inflation, which held steady at 5%.

commentaries

Sep 20, 2022

August 2022 Consumer Price Index data: Finally some good news on Canadian inflation.

Stephen Tapp, our Chief Economist, looks at Canada’s headline inflation for August, which fell for the second straight month. Core inflation and services measures have also finally started to slow.

commentaries

Aug 16, 2022

July 2022 Consumer Price Index data: Canada’s inflation finally turns a corner with falling gas prices, but core pressures remain

Our Chief Economist, Stephen Tapp, looks at Canada’s headline inflation, which is finally showing signs of cooling off.