Commentaries /

Labour Force Survey September 2023: Canada’s job market is giving forecasters a run for their money.

Labour Force Survey September 2023: Canada’s job market is giving forecasters a run for their money.

September’s jobs report blew past market expectations of 20K net gains. But the impressive headline number is concentrated in part-time work and in very few sectors.

Andrew DiCapua

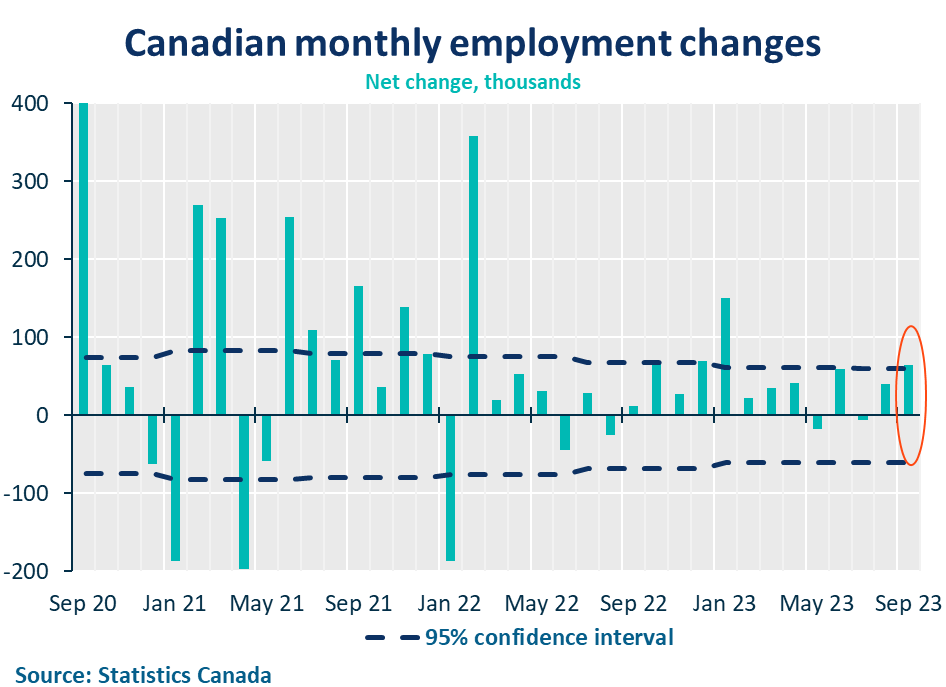

September’s jobs report blew past market expectations of 20K net gains. But the impressive headline number is concentrated in part-time work and in very few sectors. Labour force population also outpaced recent job gains, further bringing the tight labour market more into balance, and hopefully alleviating the strain on high wage growth. With hours worked essentially unchanged this month, there will be little impact on gross domestic product (GDP) in September, leaving the possibility of a contraction in the third quarter still on the table.

Andrew DiCapua, Senior Economist, Business Data Lab, Canadian Chamber of Commerce

KEY TAKEAWAYS

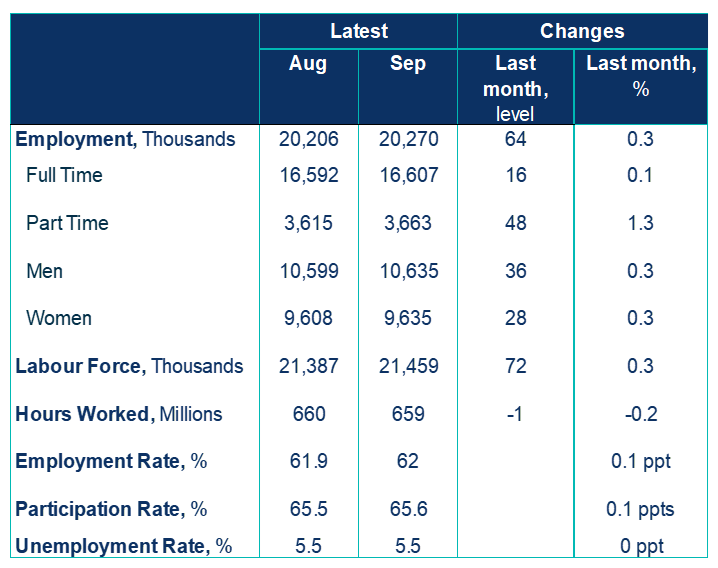

- The labour market maintained its robust momentum, at least for now. Employment grew by 64K jobs in September, following a substantial gain of 40k jobs in August. This was well above market expectations of 20K jobs.

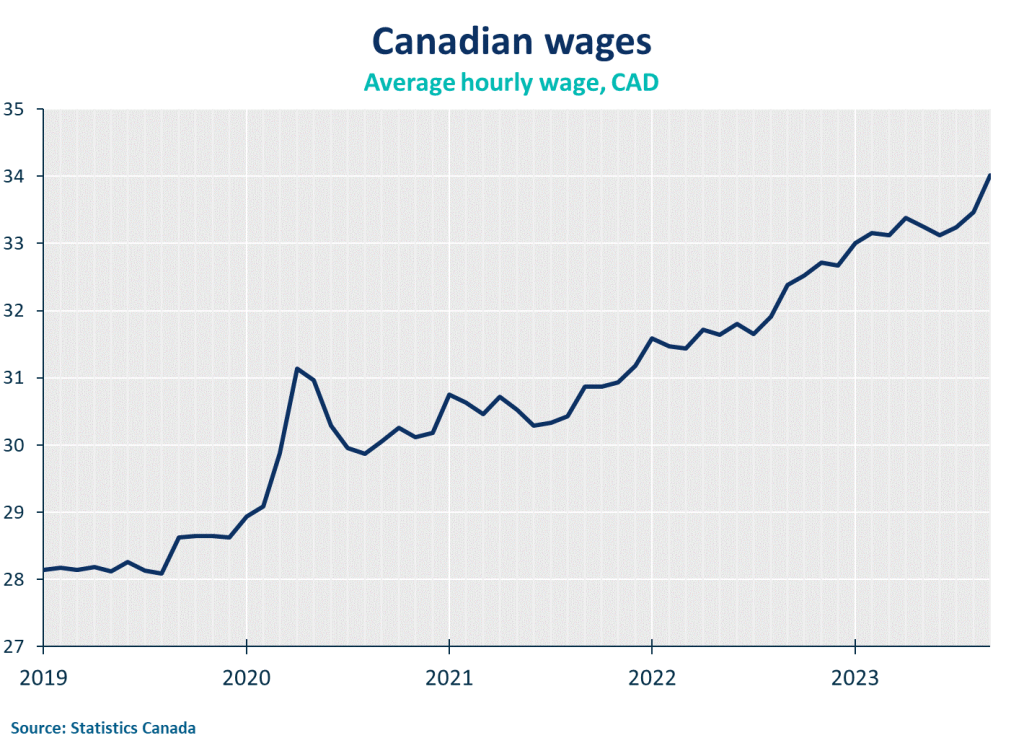

- Total hours worked were essentially unchanged and rose by 2.6% year-over-year. Average hourly wages stayed elevated on an annual basis, rising 5% in September, but slowed on the month. Wage growth edged up in the third quarter, which will be of concern to the Bank of Canada.

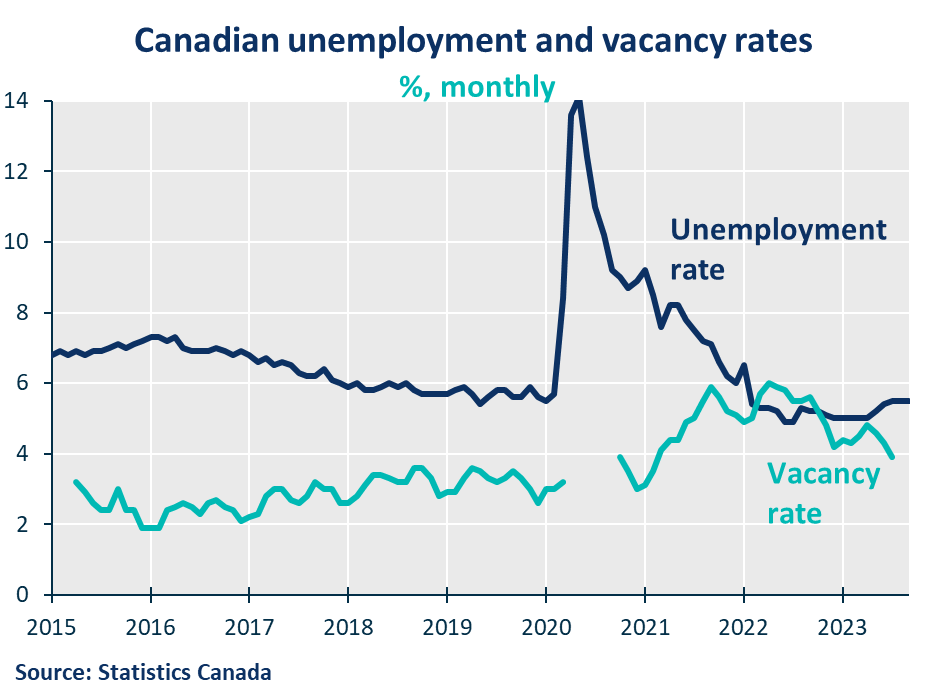

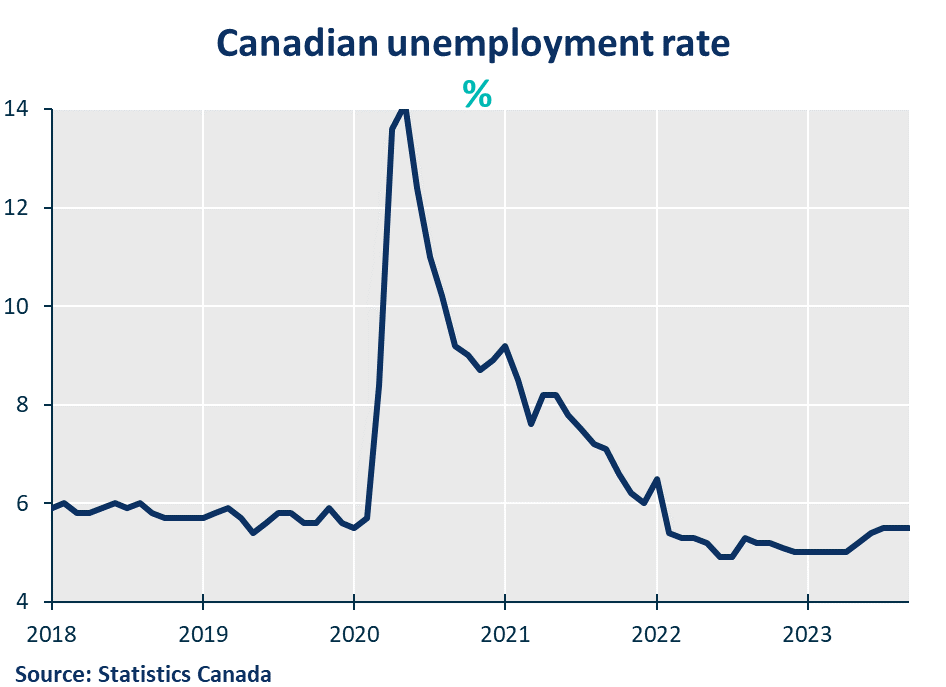

- Labour force population has outpaced employment growth over the past few months, with an additional 72,000 individuals joining the workforce in September. The unemployment rate now holds steady at 5.5% for the third consecutive month. But, as vacancies decline and recent growth in immigration adds to labour supply, the labour market is moving closer to balance.

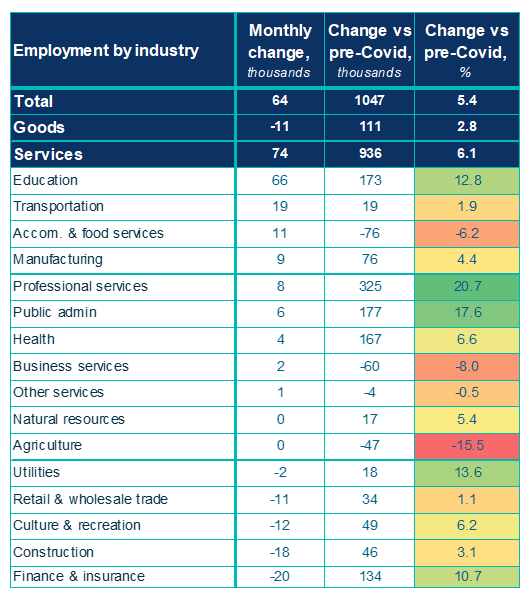

- By industry, gains were concentrated in the education sector (+66K; +4.5%) largely due to the start of the school year. Transportation and warehousing also saw considerable gains (+19K; +1.8%). Meanwhile, financial services (-20K; -1.4%) and construction (-18K; -1.1%) sectors witnessed job losses. Despite the headline growth number, seven sectors reported flat or negative growth on the month.

- In September, employment increased amongst both core-aged (25 to 54 years) men (+32K; +0.5%) and women (+37K; +0.6%). Part-time work grew 1.3%, overshadowing the modest employment gains in full-time work, which grew merely 0.1%.

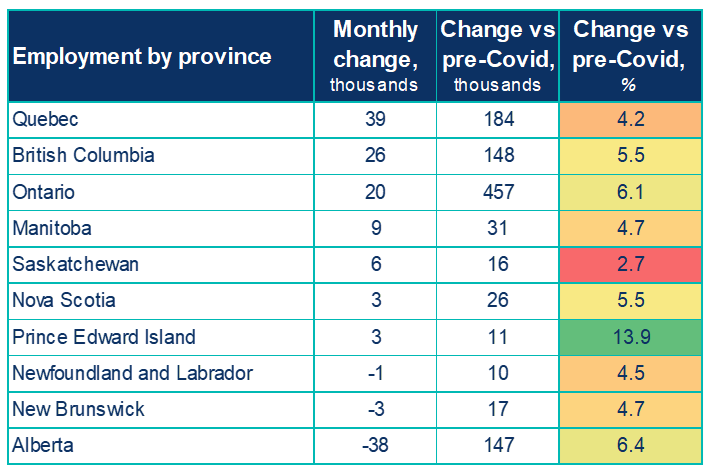

- Regionally, provincial employment was led by Quebec (+39K; +0.9%), British Columbia (+26K; +0.9%), and Ontario (+20K; +0.3%). Alberta shed jobs in September, offsetting the gains of the previous two months (-38K; -1.5%).

SUMMARY TABLES

LABOUR CHARTS

Other Commentaries

Oct 19, 2022

September 2022 Consumer Price Index data: Food and services prices still rising, no progress on core inflation

Sep 20, 2022

August 2022 Consumer Price Index data: Finally some good news on Canadian inflation.

Aug 16, 2022