Commentaries Topics: Gross Domestic Product

Commentaries /

April 2024 GDP: The Canadian economy is slowing, but there’s a bit more gas left

April 2024 GDP: The Canadian economy is slowing, but there’s a bit more gas left

The Canadian economy grew as expected in April, driven by key sectors like services for oil and gas extraction.

Andrew DiCapua

The Canadian economy grew as expected in April, driven by key sectors like services for oil and gas extraction. Anticipated growth in the coming months could be bolstered by the opening of the Trans Mountain pipeline. Despite resilience in the first half of the year, the economy is on track for 1.7% annualized growth in the second quarter, slightly above the Bank of Canada’s forecast. We’ll have to monitor incoming inflation data closely, but this suggests that the economy may need more time to decelerate for the Bank’s comfort.

Andrew DiCapua, Senior Economist, Canadian Chamber of Commerce

KEY TAKEAWAYS

Headlines

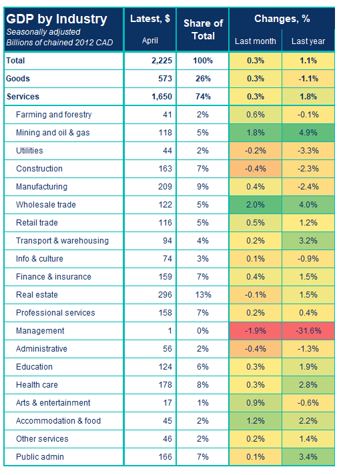

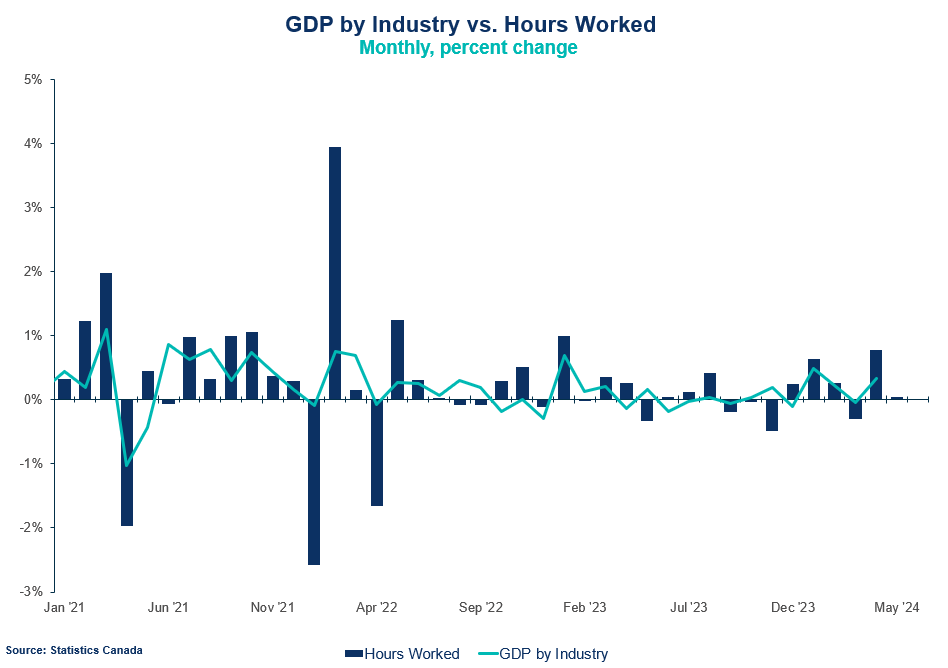

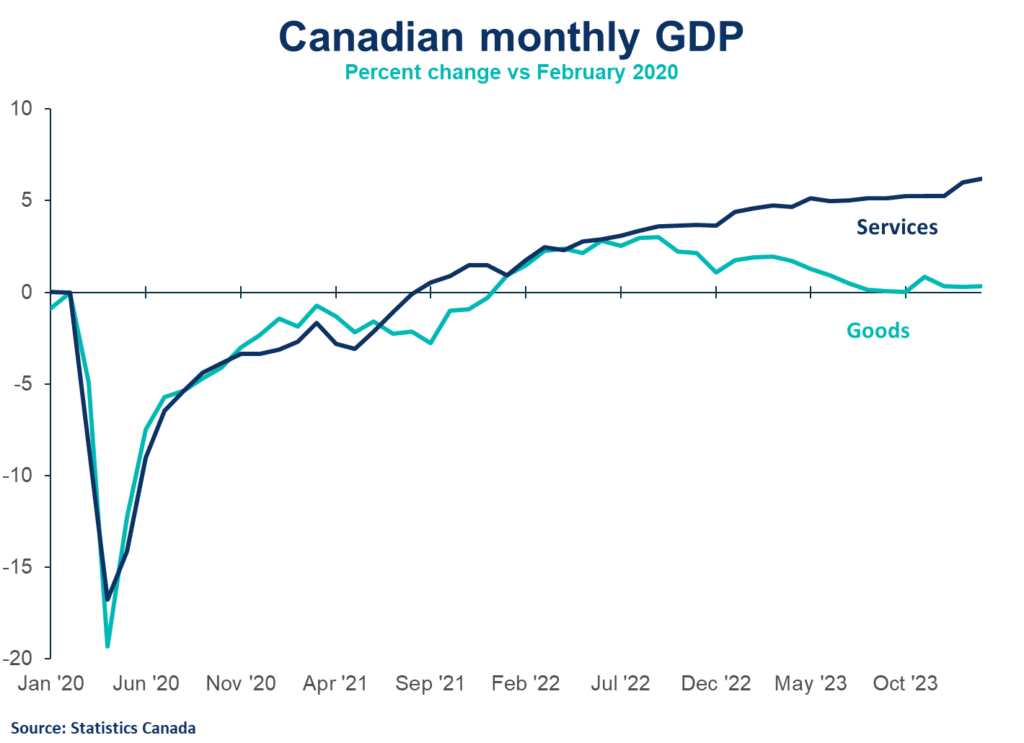

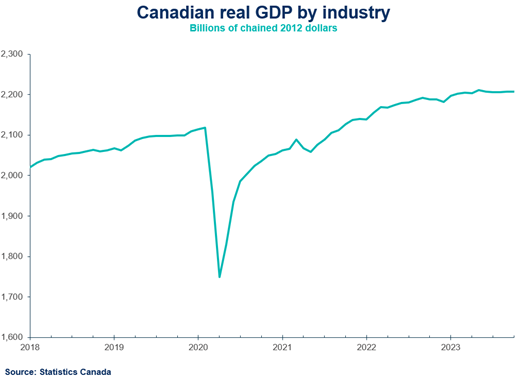

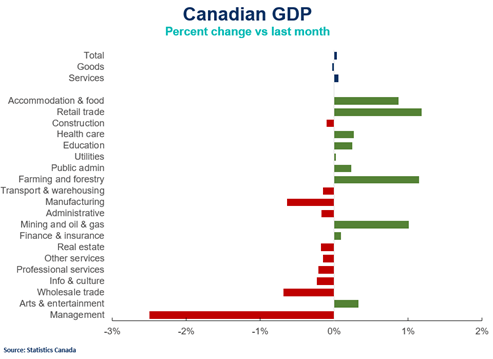

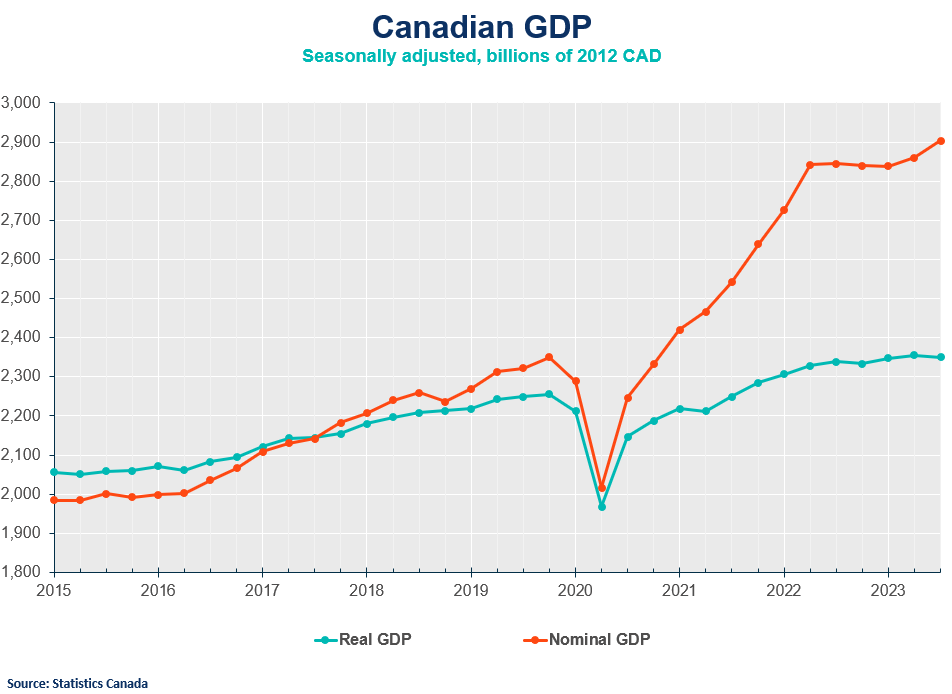

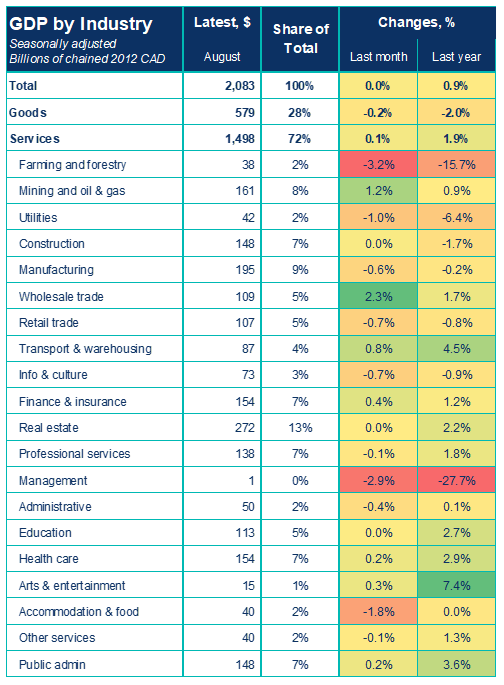

Real gross domestic product rose 0.3% in April, on pace with consensus forecasts. Growth was broad-based across sectors and both goods and services grew at 0.3% m/m. This sets up the second quarter for a good start, but the Canadian economy is slowing from the strong first quarter.

Movers and shakers

- 15 out of 20 sectors experienced growth, notably wholesale trade, manufacturing, and mining, oil and gas.

- The manufacturing sector expanded by 0.4%, driven by durable goods, particularly transportation equipment manufacturing.

- Wholesale trade expanded by 2%, led by motor vehicle parts and personal goods.

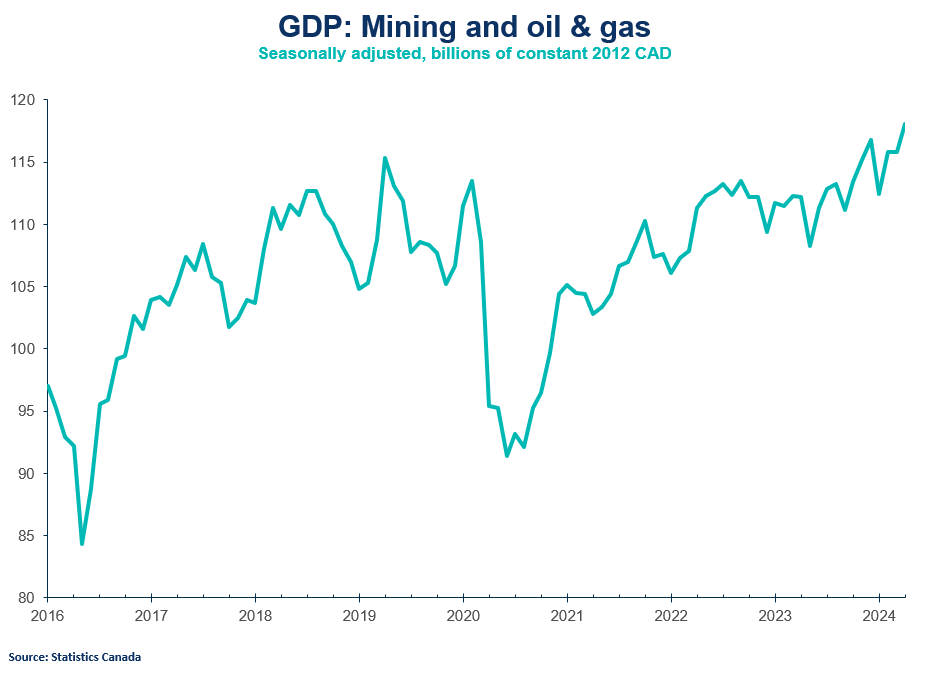

- Mining and oil & gas increased by 1.8%, with strong performance in support activities and oil sands extraction. This is expected to be work in the lead up to the opening of the Trans Mountain pipeline that opened in May.

- The services-producing industries rose by 0.3%, with notable contributions from transportation and warehousing, and professional, scientific, and technical services.

- Notably construction declined by 0.4%, with residential building construction contracting by 2.3%. Utilities also experienced negative growth, declining 2.7%, influenced by warmer than usual weather reducing heating demand.

OUTLOOK AND IMPLICATIONS

The advanced estimate for real GDP in May is 0.1%. This puts the second quarter on track to grow by roughly 1.7% annualized, which is slightly higher than the Bank of Canada’s April forecast of 1.5%. We’ll need to pay attention to inflation data next month to assess implications for monetary policy. Nonetheless, the second quarter is poised to be decent growth, following a stronger first quarter.

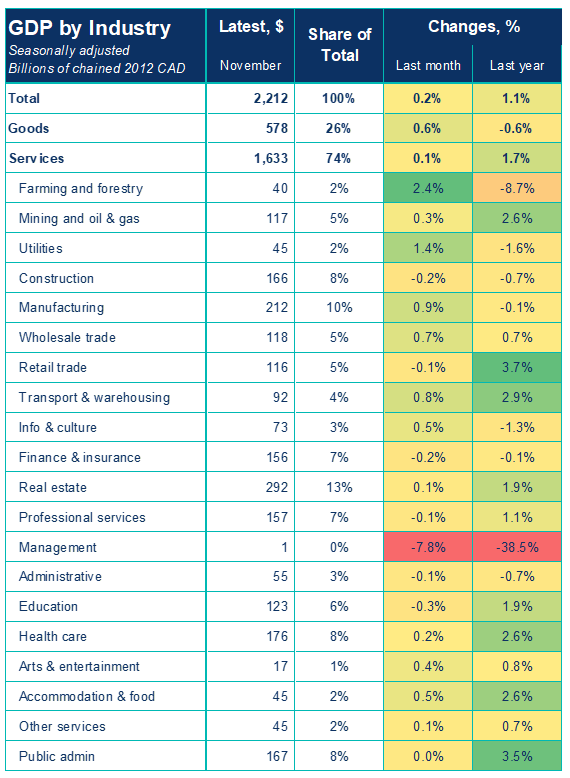

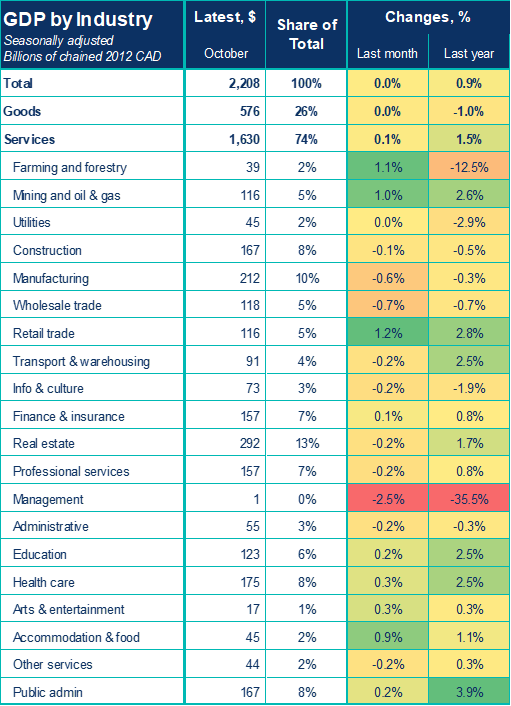

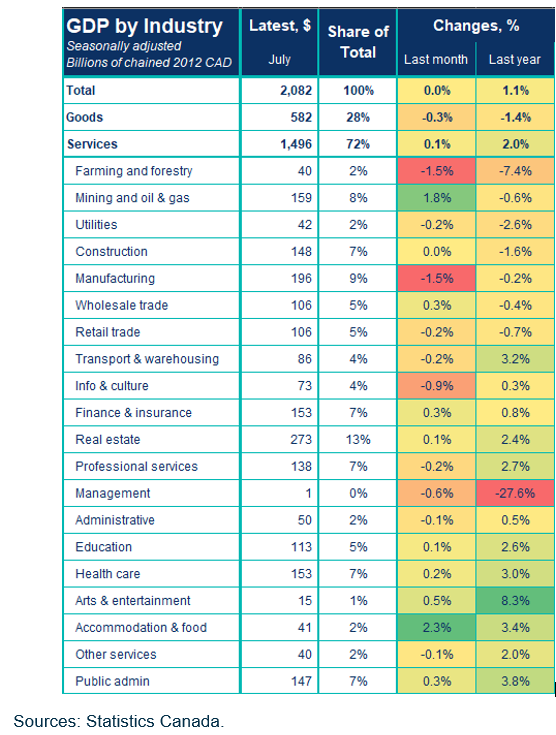

SUMMARY TABLE

CHARTS

Other Commentaries

Oct 19, 2022

September 2022 Consumer Price Index data: Food and services prices still rising, no progress on core inflation

Sep 20, 2022

August 2022 Consumer Price Index data: Finally some good news on Canadian inflation.

Aug 16, 2022

July 2022 Consumer Price Index data: Canada’s inflation finally turns a corner with falling gas prices, but core pressures remain

Commentaries /

Q1 2024 GDP: Solid GDP growth undershoots Bank’s high expectations

Q1 2024 GDP: Solid GDP growth undershoots Bank’s high expectations

The Canadian economy grew at a slower pace than anticipated in the first quarter, despite stronger consumer spending and renewed investment growth following previous declines.

Andrew DiCapua

The Canadian economy grew at a slower pace than anticipated in the first quarter, despite stronger consumer spending and renewed investment growth following previous declines.

With fourth quarter GDP revised downward, overall growth is weaker than the Bank of Canada’s recent forecast. However, stronger domestic demand might prompt the Bank to hold off on policy changes, as April GDP is expected to grow modestly, supported by positive hours worked and retail sales. This puts the Bank in a tough spot, but with moderating inflation and tepid growth, there are many reasons to consider a rate cut in June.

Andrew DiCapua, Senior Economist, Canadian Chamber of Commerce

KEY TAKEAWAYS

Headlines

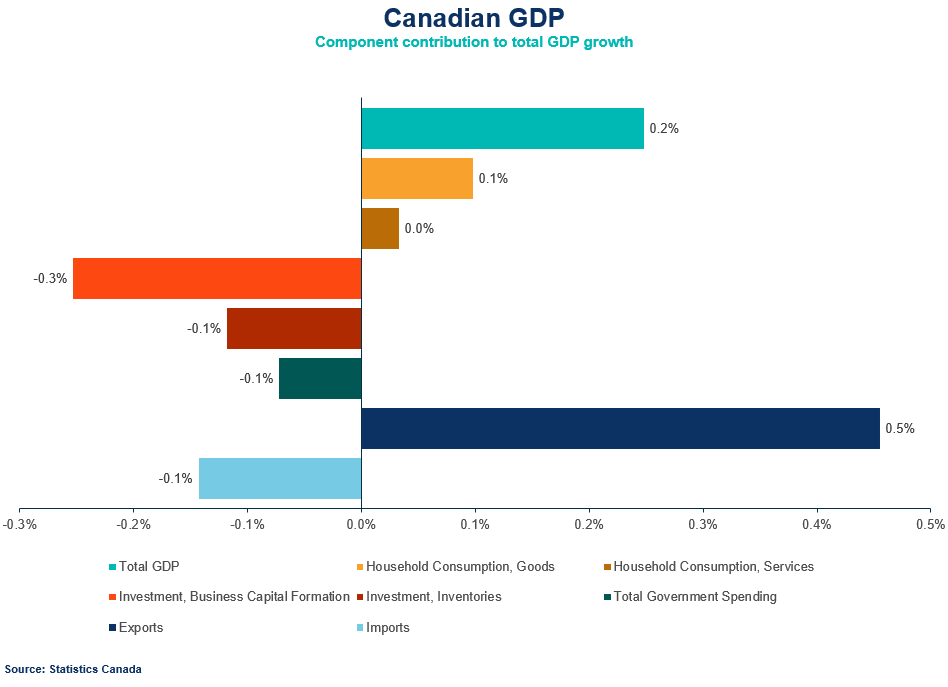

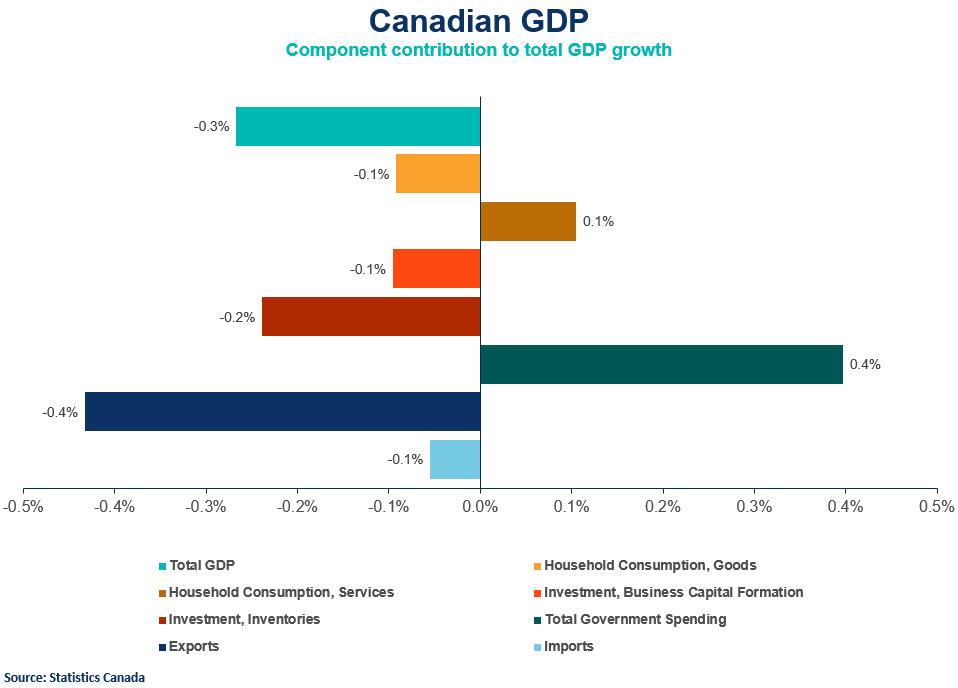

- Canada’s real gross domestic product (GDP) grew by 1.7% annualized in the first quarter, posting weaker than expected growth than markets expected (+2.2%). The fourth quarter 2023 GDP growth rate was revised down as well from previously 1% to 0.2% annualized. The first quarter of 2024 was driven by stronger household spending (+0.7%).

- Monthly GDP by industry was flat in March, in line with expectations and the flash estimate. Statistics Canada projects a stronger 0.3% growth in April.

Movers and Shakers

- Exports of goods and services rose 0.5%, driven by increased exports of precious metals and other commodities. Lower trade of passenger vehicles and crude oil softened the net trade contribution to growth. Conversely, imports edged up 0.4%.

- Final domestic demand (which includes expenditures on final consumption and gross fixed capital formation) grew by 0.7% in Q4, outpacing overall GDP growth of 0.4%.

- Household spending increased by 0.7%, primarily due to higher spending on services like rent, telecommunications, and air travel. Goods spending was supported by new trucks and utility vehicles. Per capita consumption reversed its decline in recent quarters, rising slightly possibly indicating an upward trend as population growth slows.

- Housing investment increased by 0.3%, sparking new housing construction growth. Business investment reversed its decline and grew at a solid pace (+0.8%) in the first quarter on engineering structures in the oil and gas sector. Stronger investment growth in machinery and equipment (+1.6%) also boosted Q1 GDP.

- Investment in inventories was a drag on GDP growth, declining 0.4% in Q1 as businesses across most sectors limit inventory growth.

- The household saving rate reached its peak in nearly two years at 7% in Q1, as households use high interest rates to park their cash.

OUTLOOK AND IMPLICATIONS

- With decent first-quarter growth, the Canadian economy seems to be on solid footing with a strong rebound in final domestic demand. April’s flash estimate of 0.3% m/m positions second-quarter GDP to grow around 1.9% on an annualized basis, stronger than the Bank of Canada’s April forecast of 1.5% growth in Q2. With per capita consumption on an upward trend, further insight into the strength of the consumer will unfold in the coming months. Stronger hours worked in the April Labour Force Survey and retail sales estimates point to a good start to the second quarter.

- Even though the Bank of Canada has many reasons to begin lowering interest rates and declare mission accomplished amid the backdrop of inflation moderating to target, their data dependency could hold them back from a rate cut next week. We believe interest rates are in such a restrictive position that the Bank has little evidence to support holding. Markets are pricing in a June rate cut as near certainty potentially moving the Bank’s hand to lower rates at a slow and measured pace to sustain growth.

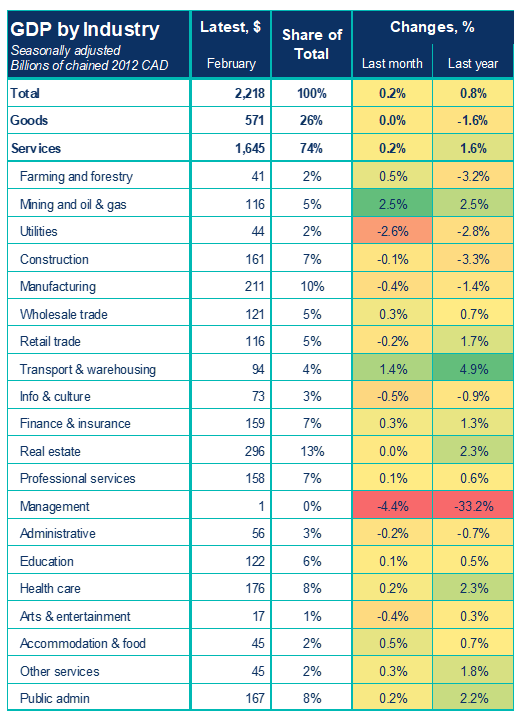

SUMMARY TABLE

Other Commentaries

Oct 19, 2022

September 2022 Consumer Price Index data: Food and services prices still rising, no progress on core inflation

Sep 20, 2022

August 2022 Consumer Price Index data: Finally some good news on Canadian inflation.

Aug 16, 2022

July 2022 Consumer Price Index data: Canada’s inflation finally turns a corner with falling gas prices, but core pressures remain

Commentaries /

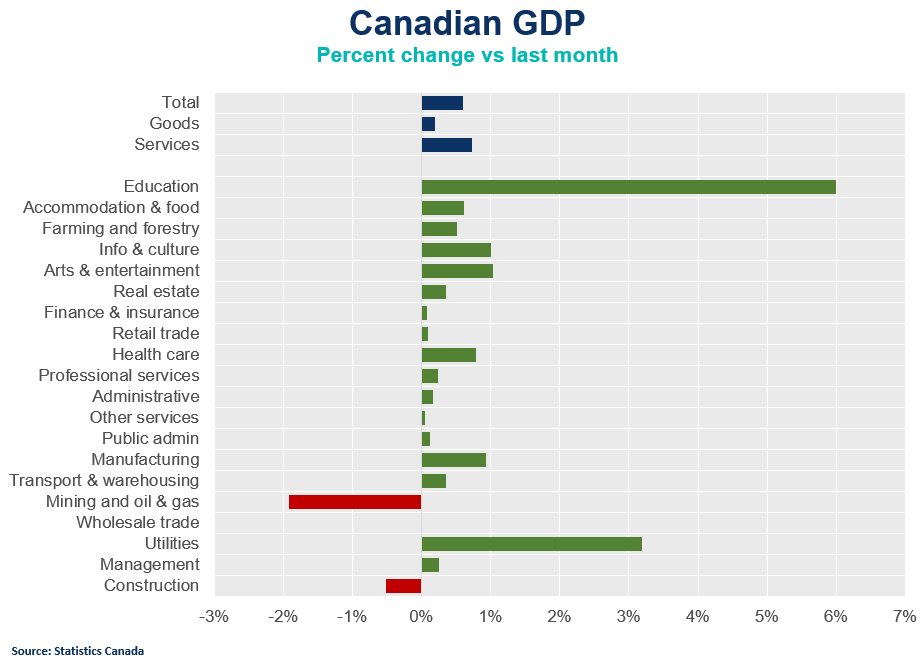

February 2024 GDP: Canada on pace for decent growth in the first quarter, but momentum is slowing

February 2024 GDP: Canada on pace for decent growth in the first quarter, but momentum is slowing

Canada’s real GDP is on pace for annualized growth of about 2.5% in the first quarter of the year.

Business Data Lab

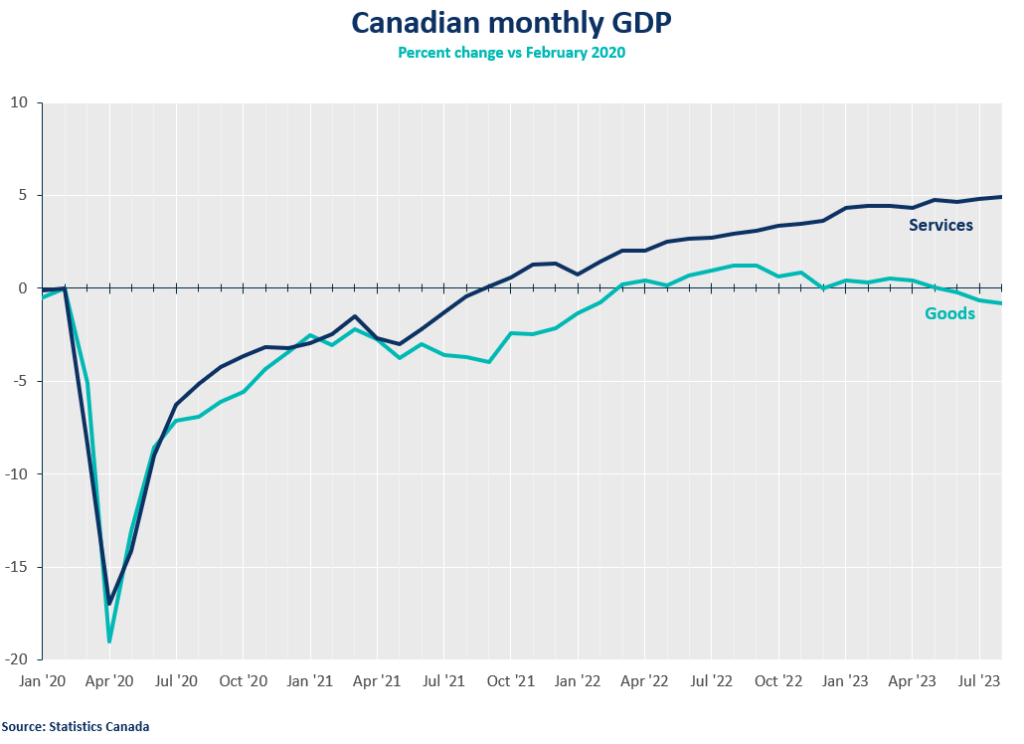

Canada’s real GDP is on pace for annualized growth of about 2.5% in the first quarter of the year. This is certainly a better performance than most had expected a few months ago. That said, growth has been choppy due to several temporary factors, such as extreme weather and strikes that have buffeted several sectors.

Stephen Tapp, Chief Economist, Canadian Chamber of Commerce

Looking through the noise in the monthly data, the overall picture is that momentum is slowing in Canada’s economy and inflation coming under control. The good news is that interest rate cuts are coming from the Bank of Canada this summer. The only question is whether they’ll arrive in June or July — which is basically a coin toss at this point, and will come down to the next release of inflation data in late May

KEY TAKEAWAYS

Headline

- Real gross domestic product rose 0.2% in February, slightly below the consensus forecast of 0.3%. This comes on the heels of January’s exceptionally strong growth of 0.5% — which was temporarily boosted by the return of public sector educational workers in Quebec at the end of a strike. Services rose 0.2% in February, while the goods sectors were essentially flat.

Movers and Shakers

- Overall, 12 of 20 sectors increased on the month.

- Strength was led by mining, oil and gas (+2.5%), and transportation and warehousing (+1.4%) — both sectors benefited from rebounds in February, which followed extreme cold in January that hampered production. Public sector output (+0.2%) continued to recover following the earlier Quebec strike.

- Weakness was felt in the utilities sectors, which declined by 2.6%, but it too had been significantly impacted in January by cold weather that temporarily boosted demand. Auto production (-2.9%) was hurt by plant shutdowns for retooling.

OUTLOOK AND IMPLICATIONS

- The advanced estimate for real GDP in March is essentially flat. This puts the first quarter on track to grow by roughly 2.5% annualized, which is close to the Bank of Canada’s latest forecast of 2.8%.

Other Commentaries

Oct 19, 2022

September 2022 Consumer Price Index data: Food and services prices still rising, no progress on core inflation

Sep 20, 2022

August 2022 Consumer Price Index data: Finally some good news on Canadian inflation.

Aug 16, 2022

July 2022 Consumer Price Index data: Canada’s inflation finally turns a corner with falling gas prices, but core pressures remain

Commentaries /

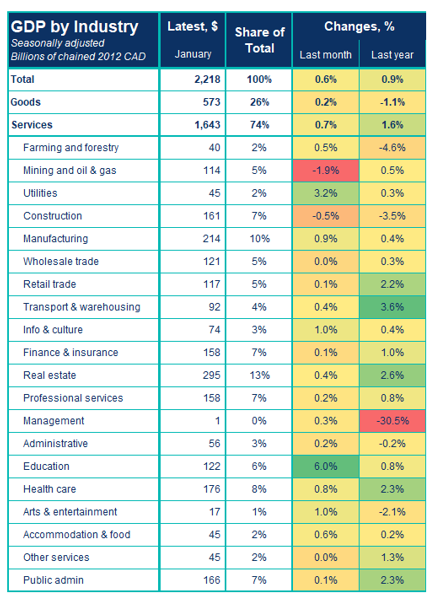

January 2024 GDP: Strong start to the year, driven by temporary factors

January 2024 GDP: Strong start to the year, driven by temporary factors

Our Senior Economist, Andrew DiCapua, shares his key takeaways from January 2024's GDP release

Andrew DiCapua

January’s stronger-than-expected growth, boosted by temporary factors like the rebound in educational services and manufacturing, provides strong momentum for Canada’s economy in the first quarter (now on a 3.5% pace annualized). The robust expansion, notably exceeding the Bank of Canada’s forecast of 0.5%, provides some respite, and is delaying market expectations for a June rate cut. The surge in sectors such as utilities amid severe weather conditions underscores that while these temporary factors keep the Canadian economy afloat, there are no strong underlying signs of sustained growth amidst a backdrop of declining inflation.

Andrew DiCapua, Senior Economist, Canadian Chamber of Commerce

KEY TAKEAWAYS

Headline

- Real gross domestic product increased by 0.6% in January 2024 (above the consensus forecasts of 0.4%). Services-producing industries grew by 0.7%, primarily driven by a rebound in educational services following the resolution of public sector strikes in Quebec. Goods-producing industries saw a modest increase of 0.2%, with notable rebounds in the utilities and manufacturing sectors.

Movers and Shakers

- The public sector, including educational services, health care and social assistance, and public administration, saw a significant increase of 1.9% in January, reversing two consecutive months of declines. Educational services, particularly elementary and secondary schools, rebounded by 6.0% after being affected by strikes in Quebec and Saskatchewan. Health care and social assistance also rose by 0.8%, marking the highest growth rate since October 2020.

- Manufacturing fully recovered December’s decline, growing by 0.9% in January. Durable goods manufacturing drove growth, with motor vehicle manufacturing and parts experiencing notable rebounds.

- Severe winter conditions led to a surge in activity in the utilities sector, which grew by 3.2% in January, driven by electric power generation and natural gas distribution.

- The real estate sector (+0.4%) grew for the third consecutive month, as housing activity picked up in the Greater Toronto Area and surrounding markets. This is some initial evidence that some markets have renewed optimism anticipating lower interest rates.

- Information and cultural services increased by 1.0%, with the motion picture and sound recording industry contributing significantly to the growth.

OUTLOOK AND IMPLICATIONS

- The advanced estimate for real GDP in February 2024 suggests a further increase of 0.4%, indicating continued momentum. Another strong indication that the Canadian economy is holding its footing. The first quarter is on track to post strong growth, 3.5% annualized. This is much stronger than the Bank of Canada’s January forecast of 0.5% annualized in the first quarter. Overall, while the economy is showing resilience and recovering from recent challenges, such as labor actions and severe weather conditions, the outsized contribution of temporary factors is not expected to last.

- This is an upside risk to the Bank of Canada’s forecast, however, if inflation continues to slow, the Bank will stay the course in waiting for the right moment to cut rates.

SUMMARY TABLES AND CHARTS

Other Commentaries

Oct 19, 2022

September 2022 Consumer Price Index data: Food and services prices still rising, no progress on core inflation

Sep 20, 2022

August 2022 Consumer Price Index data: Finally some good news on Canadian inflation.

Aug 16, 2022

July 2022 Consumer Price Index data: Canada’s inflation finally turns a corner with falling gas prices, but core pressures remain

Commentaries /

Q4 2023 GDP: Pretty good news as the economy holds footing

Q4 2023 GDP: Pretty good news as the economy holds footing

Canada’s economy navigated through a potential rough spot in the fourth quarter, with help from exports and consumer spending on autos, as supply chain backlogs continued to ease.

Andrew DiCapua

Canada’s economy navigated through a potential rough spot in the fourth quarter, with help from exports and consumer spending on autos, as supply chain backlogs continued to ease. Fourth quarter GDP grew 1% at annual rates (slightly above the market consensus of 0.8%), and growth in the third quarter was revised up. Canada also enjoyed a decent start to 2024 in January with the end of Quebec’s public sector strike. With the economy generally holding up, the Bank of Canada has time to hold rates and stay the course into the summer. That said, there are evident signs of underlying weakness in Canada’s economy—notably real per capita consumption, business investment, and housing resales.

Andrew DiCapua, Senior Economist, Canadian Chamber of Commerce

KEY TAKEAWAYS

Headline

- Canada’s real gross domestic product (GDP) grew by 1% annualized in the third quarter, posting stronger growth than markets expected (+0.8%). This follows upwardly-revised third quarter growth of -0.5% (previously reported at -1.1%). Q4 growth was primarily driven by higher exports and consumer spending, while housing and business investment declined.

- Monthly GDP by industry was flat in December, despite economists expecting 0.2% m/m growth and a strong flash estimate of 0.3%.

Movers and Shakers

- Higher exports and reduced imports contributed to Q4 GDP growth, although a decline in business investment moderated the overall expansion.

- Exports of goods and services rose 1.4%, driven by increased crude oil exports, travel services, and transportation equipment. Conversely, imports declined by 0.4%.

- Final domestic demand (which includes expenditures on final consumption and gross fixed capital formation) decreased by 0.2% in Q4. On an annual basis, real GDP and final domestic demand increased for the third consecutive year, but the growth rate in 2023 was the slowest since 2016.

- Household spending increased by 0.2%, primarily due to higher spending on new trucks and utility vehicles. However, per capita consumption expenditures declined for the third consecutive quarter, and overall growth in household spending slowed to 1.7% in 2023.

- Housing investment declined by 0.4%, marking the sixth decline in the last seven quarters. Business investment also declined for the sixth time in seven quarters, particularly in non-residential structures and machinery and equipment.

- The household saving rate remained stable at 6.2% in Q4. Corporate incomes increased by 2.9%, driven by the gross operating surplus of non-financial corporations.

OUTLOOK AND IMPLICATIONS

With decent fourth quarter growth, and 2024 off to a surprisingly healthy start, the Canadian economy skirted a potential technical recession in 2023. January’s flash estimate of 0.4% m/m puts Q1 2024 GDP on pace to grow 1.8% on an annualized basis, stronger than the Bank of Canada’s January forecast of 0.5% growth in Q1. The economy is holding up, but economic risks remain, with significant risks to real business investment and further weaknesses in the housing sector in the months to come. Early indications from the Business Data Lab show underlying weakness in consumer spending, which should be a drag on economic activity.

It’s unlikely the Bank of Canada will shift their stance on monetary policy, pushing back market expectations from April of this year. With the economy and labour market stable, the Bank has more time to wait and see further progress on inflation measures. Absent of weaker economic activity, the Bank will need to keep rates in restrictive territory for longer.

SUMMARY TABLE

Other Commentaries

Oct 19, 2022

September 2022 Consumer Price Index data: Food and services prices still rising, no progress on core inflation

Sep 20, 2022

August 2022 Consumer Price Index data: Finally some good news on Canadian inflation.

Aug 16, 2022

July 2022 Consumer Price Index data: Canada’s inflation finally turns a corner with falling gas prices, but core pressures remain

Commentaries /

November 2023 GDP: A surprisingly strong temporary rebound

November 2023 GDP: A surprisingly strong temporary rebound

With this monthly surprise and a strong December flash estimate, the Canadian economy is likely to grow 1.2% annualized in the fourth quarter, ending the year with 1.5% growth in 2023. This is well above the Bank of Canada’s recent forecast of essentially no growth in the fourth quarter.

Andrew DiCapua

The Canadian economy bounced back in November, but let’s not get too excited.

After three consecutive months of no growth – during which sectors like manufacturing and transportation faced headwinds – some sectors have started to grow again due to rebounds in activity following maintenance shutdowns and the resolution of the St. Lawrence Seaway labour strike. With this monthly surprise and a strong December flash estimate, the Canadian economy is likely to grow 1.2% annualized in the fourth quarter, ending the year with 1.5% growth in 2023. This is well above the Bank of Canada’s recent forecast of essentially no growth in the fourth quarter. The resilience of the Canadian economy and persistence of consumer spending will continue into December based on the Chamber’s spending tracker data. This makes us confident that we’ll end the year on a positive note.

Andrew DiCapua, Senior Economist, Business Data Lab, Canadian Chamber of Commerce

KEY TAKEAWAYS

Headlines

- Canada’s real gross domestic product (GDP) grew 0.2% in November. This was stronger than markets expected (+0.1% and advanced flash estimate from StatCan).

- This represents a rebound in activity, following three months of a stalling economy. Although positive, this should not be conflated with an economy set to grow.

- Output grew in 13 of 20 sectors, led by gains in goods, which were up 0.6% on the month, while services grew a merely 0.1%.

Movers and Shakers

- The manufacturing sector accelerated on the month, increasing by 0.9% in November. This was led by a chemical manufacturing rebound following facility maintenance. Non-durable goods manufacturing, particularly textiles and paper led the gains.

- Wholesale trade rebounded 0.7%, following declines last month of similar magnitude, with personal household goods and motor vehicles accelerating on the month.

- Transportation and warehousing increased 0.8% in November, rebounding from the impacts of the St. Lawrence Seaway strike. Both rail and truck transportation helped boost November data.

- The mining, quarrying, and oil and gas extraction sector grew by 0.3% in November. Oil and gas extraction led the increase as a result of strong oil sands extraction growth (+3.8%) following maintenance competition of synthetic oil upgrading facilities.

OUTLOOK AND IMPLICATIONS

- StatCan’s flash estimate for December is for growth of +0.3%. Taking this into account, 2023 is on pace to grow by +1.2% q/q annualized.

- Given the fourth quarter is expected to be much stronger than Bank of Canada’s Monetary Policy Report forecast of 0% for 2023 Q4, all eyes will be on Q1 2024 growth, where the Bank is expecting 0.5% growth.

SUMMARY TABLE

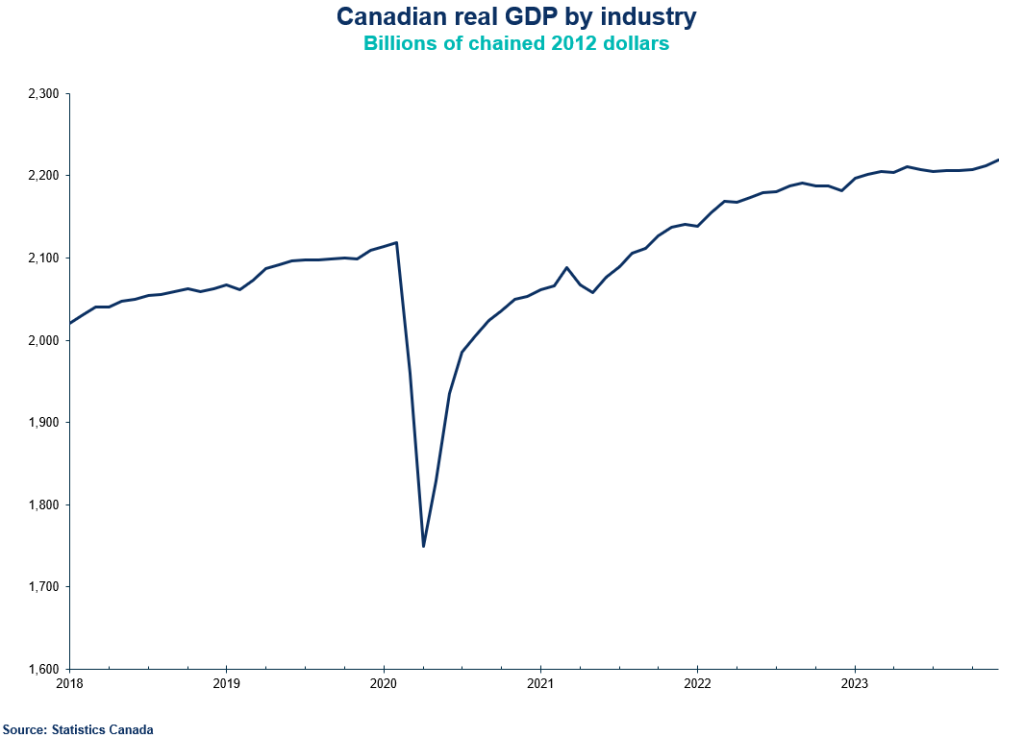

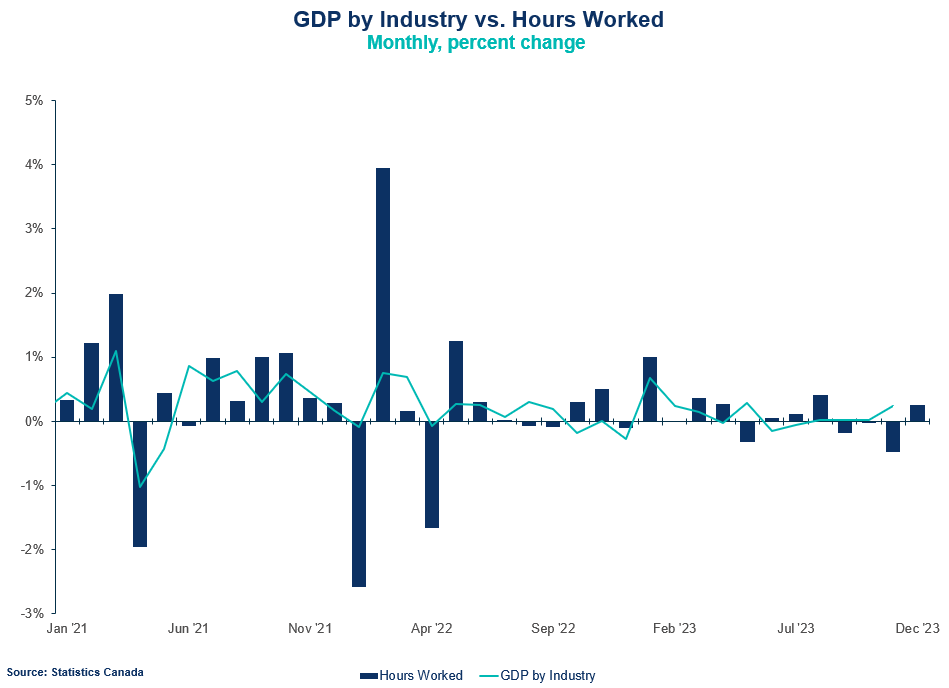

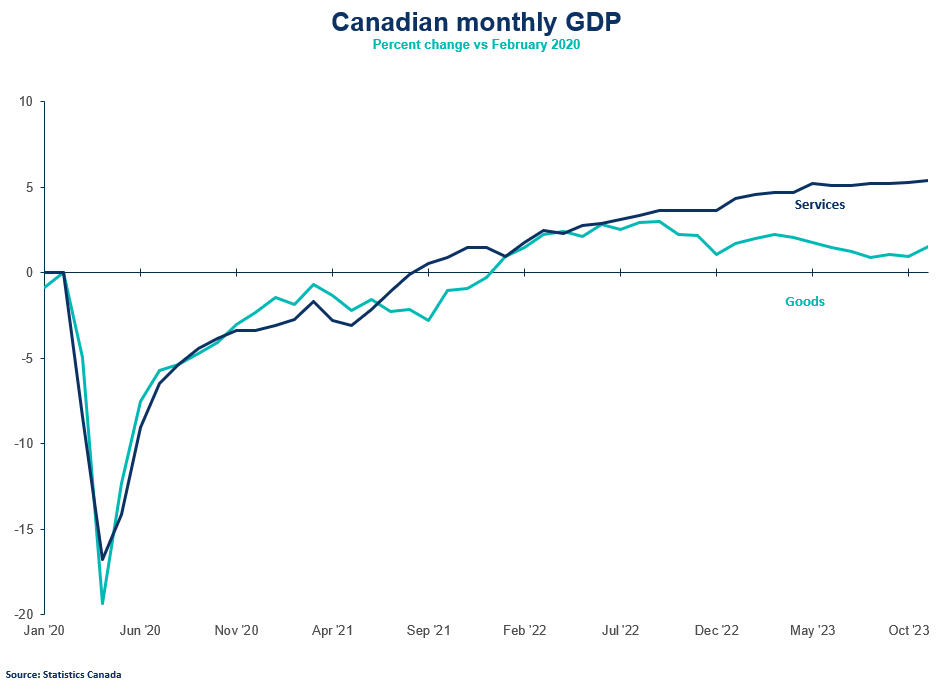

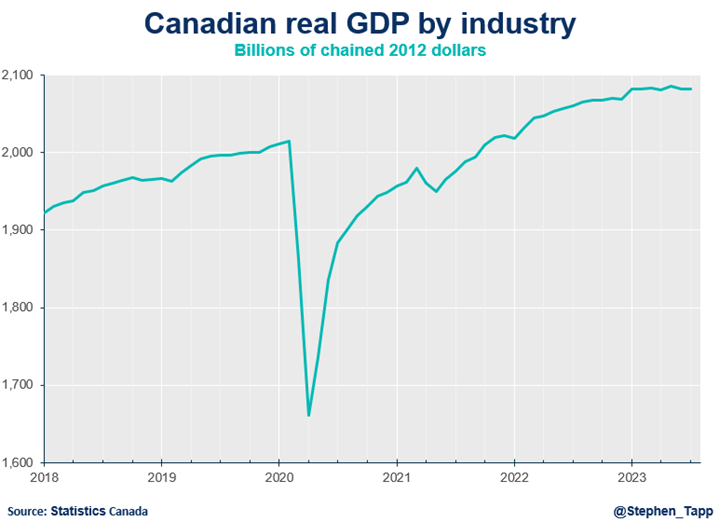

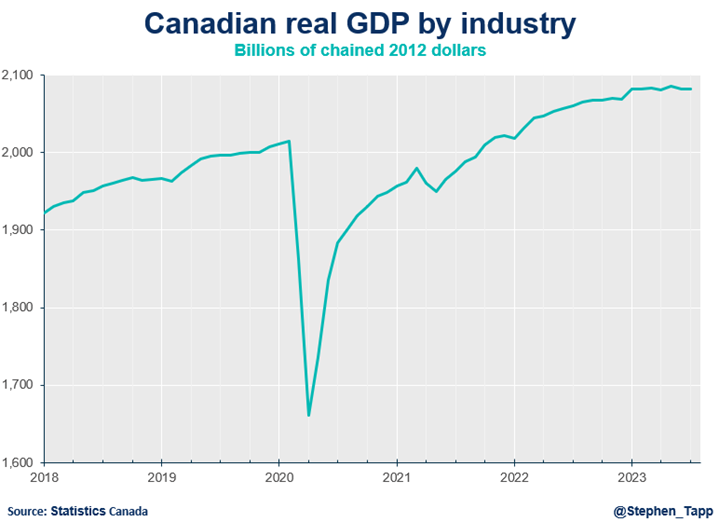

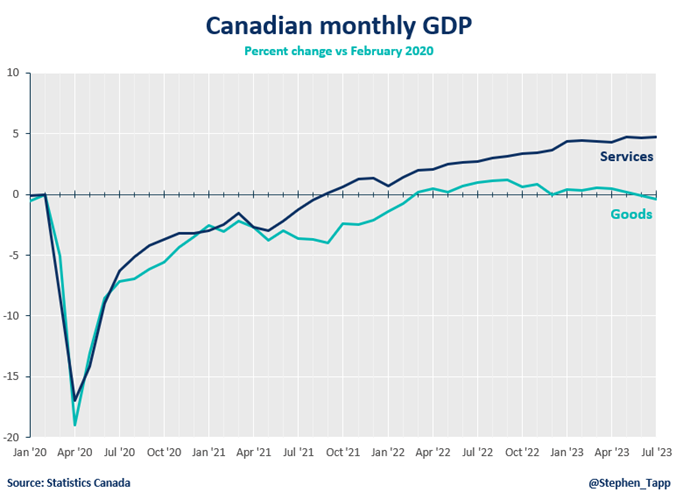

CHARTS

Other Commentaries

Oct 19, 2022

September 2022 Consumer Price Index data: Food and services prices still rising, no progress on core inflation

Sep 20, 2022

August 2022 Consumer Price Index data: Finally some good news on Canadian inflation.

Aug 16, 2022

July 2022 Consumer Price Index data: Canada’s inflation finally turns a corner with falling gas prices, but core pressures remain

Commentaries /

October 2023 GDP: It’s beginning to look like a recession-free Christmas

October 2023 GDP: It’s beginning to look like a recession-free Christmas

The Canadian economy continues to show signs of weakness. We've now seen three consecutive months of virtually no growth, as key sectors like manufacturing and real estate face notable headwinds.

Andrew DiCapua

The Canadian economy continues to show signs of weakness. We’ve now seen three consecutive months of virtually no growth, as key sectors like manufacturing and real estate face notable headwinds. Retail trade grew, but not enough to offset the broader slowdown in other sectors. The St. Lawrence Seaway labour strike in October also brought pain for the transportation sector. Things could go from bad to worse if there is yet another strike at the Port of Montreal to start the New Year.

All in all, we expect the Canadian economy to grow modestly in the fourth quarter (it’s currently on pace for annualized growth of 0.5% for Q4), thereby avoiding a technical recession. The good news is that two-thirds of businesses are optimistic about the future in the latest CSBC survey, despite continuing to face significant operating challenges. Nonetheless, downside risks remain in the near term for Canada’s economy.

Andrew DiCapua, Senior Economist, Business Data Lab

KEY TAKEAWAYS

Headlines

- Canada’s real gross domestic product (GDP) was essentially unchanged in October, below market expectations (+0.2%). This represents the third month in a row of an economy with no growth.

- Output grew in 10 of 20 sectors, led by gains in services once again, which were up 0.1% on the month, while goods was flat.

Movers and Shakers

- The manufacturing sector contracted for the fourth time in five months, declining by 0.6% in October. Durable goods manufacturing, particularly machinery and transportation equipment, contributed to the decline.

- Wholesale trade contracted by 0.7% for the second straight month, with machinery, equipment, and supplies wholesaling leading the decline. Building material and supplies wholesaling was the only subsector that expanded, reflecting higher lumber and millwork.

- The transportation and warehousing sector declined by 0.2%, influenced by the St. Lawrence Seaway strike. Water transportation contracted significantly, while air transportation and pipeline transportation mitigated the overall decline.

- Retail trade exhibited growth, increasing by 1.2% in October, marking the largest growth rate since January 2023. Clothing, general merchandise stores, and health and personal care stores contributed to this growth.

- The mining, quarrying, and oil and gas extraction sector grew by 1.0% in October after two monthly declines. Metal ore mining and non-metallic mineral mining experienced notable increases, while oil sands extraction contracted.

- Activity at the offices of real estate agents and brokers declined for the fourth month in a row, dropping by 6.8% in October.

OUTLOOK AND IMPLICATIONS

- StatCan’s flash estimate for November is for growth of +0.1%. Taking this into account, the fourth quarter is estimated to grow +0.5% at annual rates. Even if the economy stalls again, it’s unlikely that we’ll enter a technical recession in the fourth quarter. Although weaker thank the Bank of Canada’s Monetary Policy Report forecast of +0.8%, the risks of a slowing economy are higher with core inflation remaining higher than expected in the past few months.

- One silver lining is that our Q4 Survey on Canadian Business Conditions shows that two-thirds of Canadian businesses are optimistic about the outlook for next year, though down from the last quarter.

Summary Table

Source: Statistics Canada.

Charts

Sources: Statistics Canada; Bank of Canada; Canadian Chamber of Commerce Business Data Lab.

Other Commentaries

Oct 19, 2022

September 2022 Consumer Price Index data: Food and services prices still rising, no progress on core inflation

Sep 20, 2022

August 2022 Consumer Price Index data: Finally some good news on Canadian inflation.

Aug 16, 2022

July 2022 Consumer Price Index data: Canada’s inflation finally turns a corner with falling gas prices, but core pressures remain

Commentaries /

Q3 2023 GDP: A mixed bag—revisions add nuance to Canada’s third quarter economic contraction

Q3 2023 GDP: A mixed bag—revisions add nuance to Canada’s third quarter economic contraction

The Canadian economy contracted by 1.1% at annual rates in the third quarter. Consumer spending is stagnating and businesses are adjusting their operations amid this slow growth environment.

Andrew DiCapua

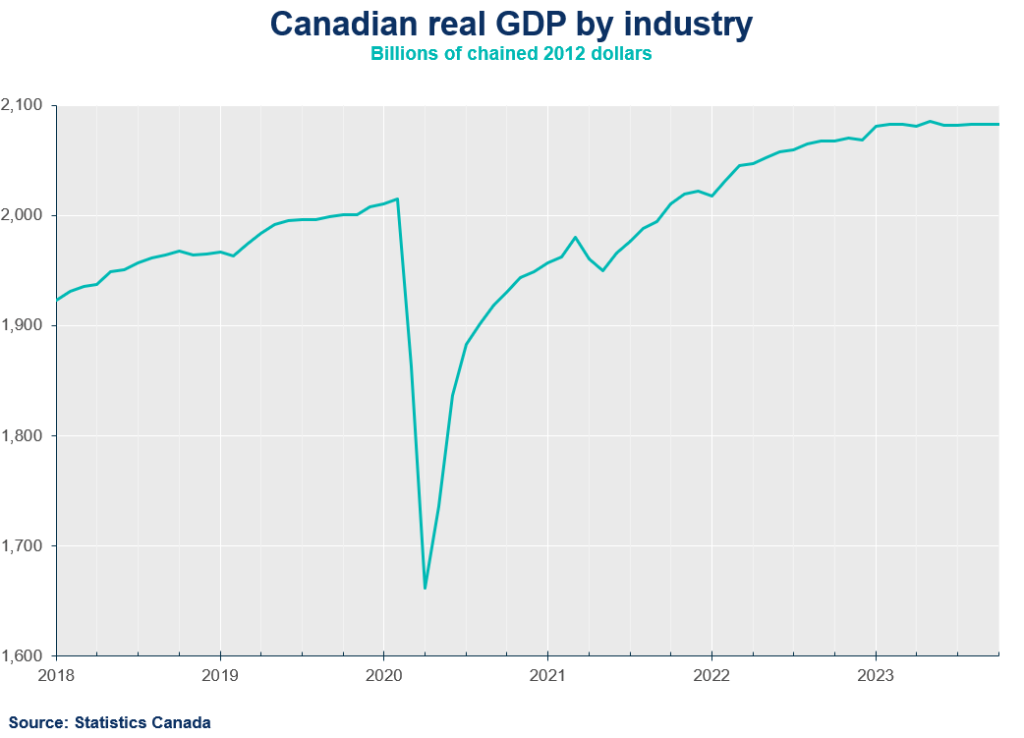

The Canadian economy contracted by 1.1% at annual rates in the third quarter. Consumer spending is stagnating and businesses are adjusting their operations amid this slow growth environment. The upward revisions to the second quarter partially tapered today’s negative growth. With decent flash estimate for October, we’re now on pace to end 2023 on better footing than previously anticipated. All together, we’re not out of the woods yet. Higher interest rates, in addition to a challenging global economic environment and sluggish consumers, will make for a precarious 2024.

Andrew DiCapua, Senior Economist, Canadian Chamber of Commerce

KEY TAKEAWAYS

Headlines

- Canada’s real gross domestic product (GDP) fell by 1.1% annualized in the third quarter, well below market expectations (+0.2%). However, this follows an upwardly-revised second quarter growth of 1.4% (previously reported at -0.2%). The decline was driven by lower exports and slower inventory accumulation, although government spending and housing increased.

- Monthly GDP by industry grew by a modest 0.1% in September led by manufacturing and construction.

Movers and Shakers

- Exports fell by 1.3%, mainly due to a significant drop (25%) in refined petroleum energy products. Imports edged down by 0.2%, with declines in various sectors such as clothing, footwear, and electronics.

- Slower inventory accumulation in the third quarter, the smallest since 2021, had a downward impact on GDP growth. Manufacturers drew down inventories, notably in non-durable goods, while retail inventories increased.

- Housing investment increased by 2%, marking the first positive growth since early 2022. The rise was driven by a 6.5% increase in new construction, particularly of apartments.

- Household consumption remained unchanged, with durable goods increasing by 1.0% and services by 0.3%. Non-durable (-0.4%) and semi-durable (-2.8%) goods spending declined.

- Business investment in non-residential structures declined 2% in the third quarter.

- Compensation of employees rose 1.3%, driven by increased average earnings and employment, with notable growth in professional and personal services. Household savings also increased in the third quarter, with the saving rate reaching 5.1% as household disposable income growth (+1%, boosted by July’s federal grocery rebate) surpassed the rise in spending (+0.8%).

OUTLOOK AND IMPLICATIONS

- StatCan’s flash estimate for October of 0.2% suggests that the fourth quarter is off to a surprisingly healthy start. For now, it looks like the Canadian economy could skirt a technical recession in 2023. Fourth quarter GDP is now on pace to grow around 1% at annual rates, in line with the Bank of Canada’s latest forecast (+0.8%). We’re still not out of the woods, as economic risks rise, we can’t rule out zero or negative growth over the next few quarters, and a generally weak performance in Canada and abroad.

- The Bank of Canada will view today’s data as further evidence that the economy is weak, which over time, should help bring inflation back to target. While it’s all but assure the BoC will continue holding rates for a while, it’s still too early for the Bank to talk about cutting rates.

SUMMARY TABLE

GDP CHART

Other Commentaries

Oct 19, 2022

September 2022 Consumer Price Index data: Food and services prices still rising, no progress on core inflation

Sep 20, 2022

August 2022 Consumer Price Index data: Finally some good news on Canadian inflation.

Aug 16, 2022

July 2022 Consumer Price Index data: Canada’s inflation finally turns a corner with falling gas prices, but core pressures remain

Commentaries /

August 2023 GDP: Engine light flashing, brace for a soft-ish recession.

August 2023 GDP: Engine light flashing, brace for a soft-ish recession.

Canada’s real gross domestic product (GDP) was essentially unchanged in August, below market expectations (+0.1%). This is the second month of an economy with no growth, following a summer of strikes, forest fires, and elevated costs.

Andrew DiCapua

The economy is clearly stagnating. With these numbers, you could make the argument that we’re in a technical recession, with the third and fourth quarters now expected to be essentially flat, and weaker than the Bank of Canada’s forecast released last week.

This economic weakness should put a lid on inflation pressures. But we’re dealing with a bit of a mirage, with GDP growth increasingly being fueled by a fast-growing population. That’s concealing a hard truth – that real GDP per person is falling, and poor productivity is expected going forward.

Andrew DiCapua, Senior Economist, Canadian Chamber of Commerce

KEY TAKEAWAYS

Headlines

- Canada’s real gross domestic product (GDP) was essentially unchanged in August, below market expectations (+0.1%). This is the second month of an economy with no growth, following a summer of strikes, forest fires, and elevated costs.

- Output grew in 8 of 20 sectors, led by gains in services, which were up 0.1% on the month, while goods dropped 0.2%.

Movers and Shakers

- Wholesale trade was the largest contributor to August GDP, growing 2.3% m/m. This was also the largest monthly gain since mid-2020 as agricultural supplies and recycle wholesalers led the way.

- Mining, oil and gas extraction saw 1.2% m/m growth—the third consecutive monthly increase as the industry sees higher energy prices and restores output following severe forest fires this summer.

- The manufacturing sector declined in August by 0.6% on the heels of weaker demand. Transportation equipment manufacturing was a bright spot, up in the past four months as semiconductor shortages continue to ease.

- Although services led the monthly gains, accommodation and food services declined 1.8% m/m with food services demand slowing.

- Transportation and warehousing grew by 0.8% m/m, led by air transportation as the seasonally high demand for travel fueled the sector. Water and rail transportation were both up considerably in August as they recovered from the port strike disruptions in July.

- Retail trade contracted 0.7% m/m due to lower sales of motor vehicles and sales at car dealerships. This has been a trend since the beginning of the year as consumers shift spending away from durable goods.

OUTLOOK AND IMPLICATIONS

- StatCan’s flash estimate for September is yet another month of flat growth. The risks that the Canadian economy is in a technical recession have risen. The Q3 GDP is now estimated to grow -0.1% Q/Q at an annual rate. This is weaker than the Bank of Canada’s Monetary Policy Report forecast, which was released last week (0.8%). It’s likely we’ll see near zero growth over the next few quarters, below the Bank’s forecast and could help contain strong price pressures.

- The stalling economy is consistent with what we’ve seen in our spending tracker, which has been flat over recent months. If the Canadian economy grows around 1% this year in real terms, while our population grows at around 3%, this means that real GDP per person is falling at 2%, which highlights to productivity challenges facing the country that could hinder sustained growth over the medium term.

SUMMARY TABLES

CHARTS

Other Commentaries

Oct 19, 2022

September 2022 Consumer Price Index data: Food and services prices still rising, no progress on core inflation

Sep 20, 2022

August 2022 Consumer Price Index data: Finally some good news on Canadian inflation.

Aug 16, 2022

July 2022 Consumer Price Index data: Canada’s inflation finally turns a corner with falling gas prices, but core pressures remain

Commentaries /

July 2023 GDP: Losing momentum as the resilient economy hits summer challenges.

July 2023 GDP: Losing momentum as the resilient economy hits summer challenges.

Canada’s GDP was flat in July, in line with the advanced estimate, but slightly below market expectations. A challenging summer...

Andrew DiCapua

Canada’s GDP was flat in July, in line with the advanced estimate, but slightly below market expectations. A challenging summer tested Canada’s economy with the port strike and extensive forest fires. While some sectors quickly rebounded from those disruptions, it’s becoming clearer that the manufacturing sector is slowing as recession risks are rising. Overall growth is likely to stall in the third quarter, and our economy’s resilience will be tested in the months ahead.

Andrew DiCapua, Senior Economist, Canadian Chamber of Commerce

KEY TAKEAWAYS

Headlines

- Canada’s real gross domestic product (GDP) was essentially unchanged in July, slightly below market expectations (+0.1%).

- Output grew in 9 of 20 sectors, led by gains in services, which were up 0.1% in July, while goods dropped 0.3%).

Movers and Shakers

- Manufacturing posted its largest decline (-1.5% in July) since April 2021. It’s the second monthly contraction, on lower inventories and shipment blockages in the plastics and rubber products subsector (-8%).

- As expected, the port strike in Western Canada in July had a negative impact on monthly GDP. The transportation and warehousing sector contracted 0.2% in July. Water transportation was most affected as shipments were unable to be processed at the port.

- Forest fires had previously disrupted production in Canada’s energy sector, some of which experienced a bounce back in production in July. Mining, oil and gas rebounded (+1.8%), and accommodation and food services grew 2.3% as RV and camping activities picked up.

OUTLOOK AND IMPLICATIONS

- StatCan’s flash estimate for August sees a modest gain of +0.1%. This would partly improve on the flat-lined July, but the Canadian economy is stalling out, and will likely experience weak, flat or mildly negative growth over the next few quarters. Factoring in rapid population growth, this already feels like a recession for many households and businesses, even if it doesn’t yet meet the technical definition.

SUMMARY TABLE

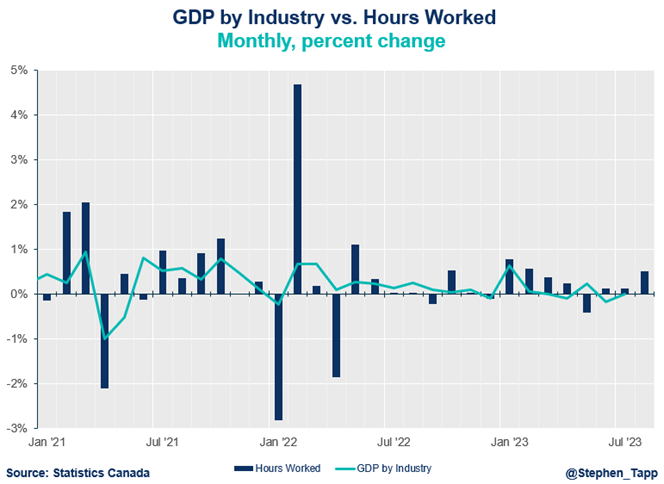

CHARTS

Other Commentaries

Oct 19, 2022

September 2022 Consumer Price Index data: Food and services prices still rising, no progress on core inflation

Sep 20, 2022

August 2022 Consumer Price Index data: Finally some good news on Canadian inflation.

Aug 16, 2022