Commentaries /

July 2023 GDP: Losing momentum as the resilient economy hits summer challenges.

July 2023 GDP: Losing momentum as the resilient economy hits summer challenges.

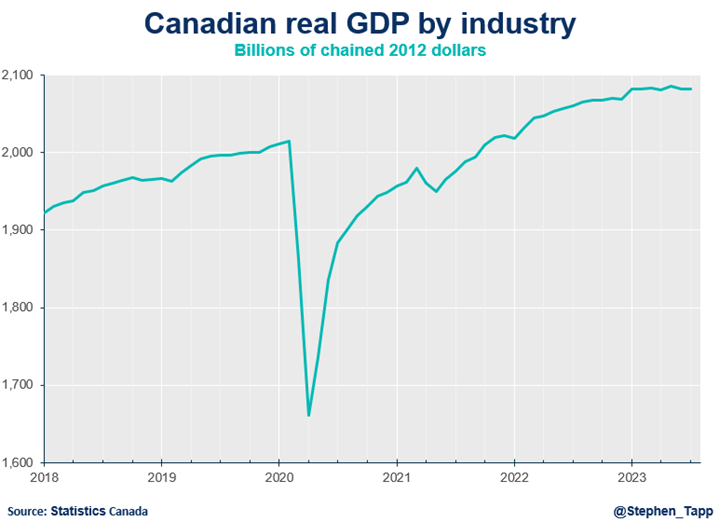

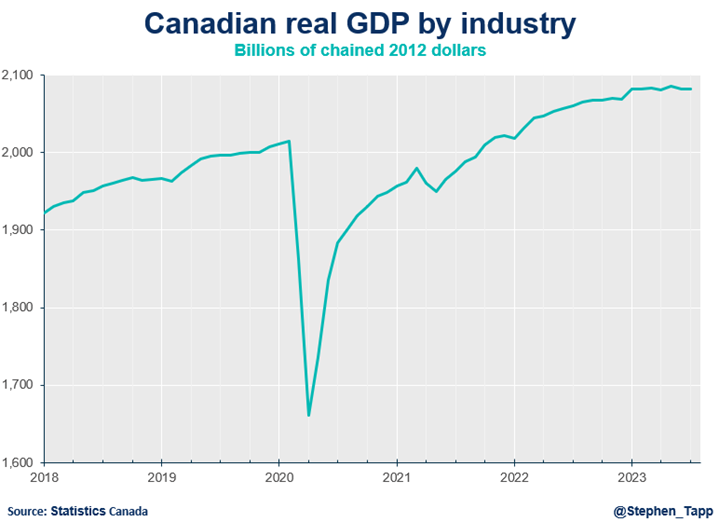

Canada’s GDP was flat in July, in line with the advanced estimate, but slightly below market expectations. A challenging summer...

Andrew DiCapua

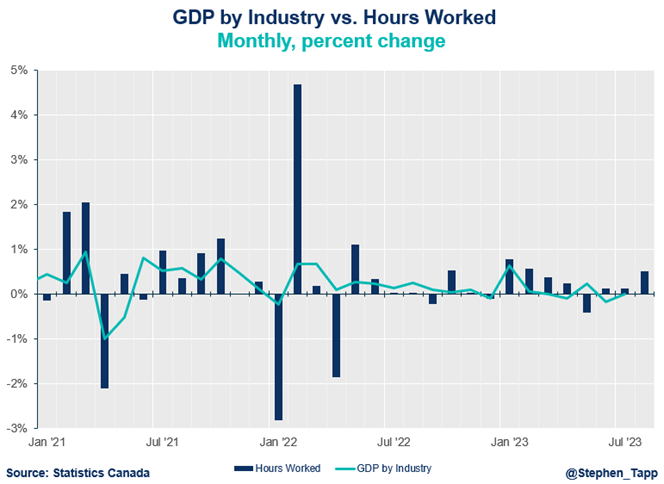

Canada’s GDP was flat in July, in line with the advanced estimate, but slightly below market expectations. A challenging summer tested Canada’s economy with the port strike and extensive forest fires. While some sectors quickly rebounded from those disruptions, it’s becoming clearer that the manufacturing sector is slowing as recession risks are rising. Overall growth is likely to stall in the third quarter, and our economy’s resilience will be tested in the months ahead.

Andrew DiCapua, Senior Economist, Canadian Chamber of Commerce

KEY TAKEAWAYS

Headlines

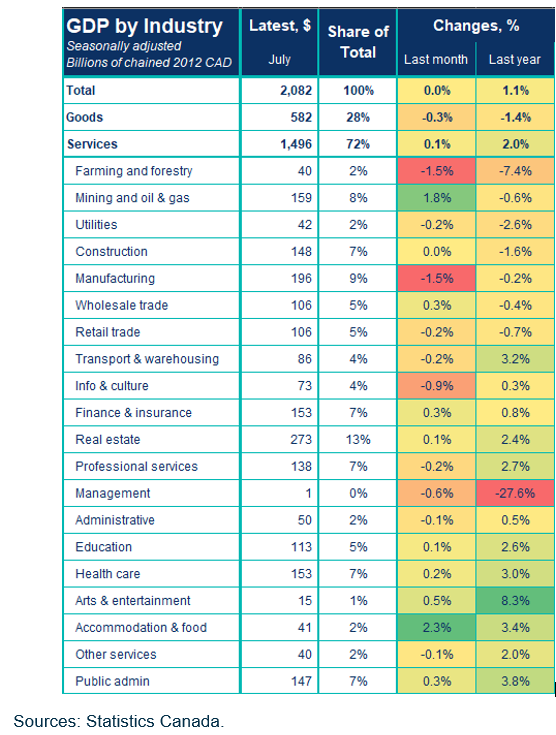

- Canada’s real gross domestic product (GDP) was essentially unchanged in July, slightly below market expectations (+0.1%).

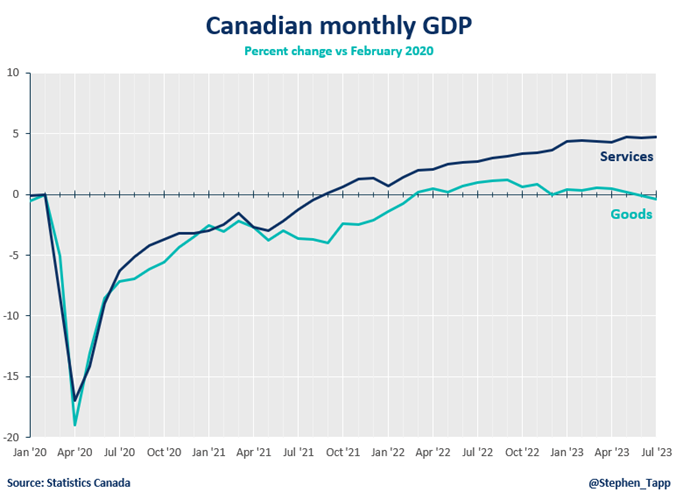

- Output grew in 9 of 20 sectors, led by gains in services, which were up 0.1% in July, while goods dropped 0.3%).

Movers and Shakers

- Manufacturing posted its largest decline (-1.5% in July) since April 2021. It’s the second monthly contraction, on lower inventories and shipment blockages in the plastics and rubber products subsector (-8%).

- As expected, the port strike in Western Canada in July had a negative impact on monthly GDP. The transportation and warehousing sector contracted 0.2% in July. Water transportation was most affected as shipments were unable to be processed at the port.

- Forest fires had previously disrupted production in Canada’s energy sector, some of which experienced a bounce back in production in July. Mining, oil and gas rebounded (+1.8%), and accommodation and food services grew 2.3% as RV and camping activities picked up.

OUTLOOK AND IMPLICATIONS

- StatCan’s flash estimate for August sees a modest gain of +0.1%. This would partly improve on the flat-lined July, but the Canadian economy is stalling out, and will likely experience weak, flat or mildly negative growth over the next few quarters. Factoring in rapid population growth, this already feels like a recession for many households and businesses, even if it doesn’t yet meet the technical definition.

SUMMARY TABLE

CHARTS

Other Commentaries

commentaries

Oct 19, 2022

September 2022 Consumer Price Index data: Food and services prices still rising, no progress on core inflation

Our Chief Economist, Stephen Tapp, looks at Canada’s headline inflation, which edged down for the third month in a row. There was no progress on “core” inflation, which held steady at 5%.

commentaries

Sep 20, 2022

August 2022 Consumer Price Index data: Finally some good news on Canadian inflation.

Stephen Tapp, our Chief Economist, looks at Canada’s headline inflation for August, which fell for the second straight month. Core inflation and services measures have also finally started to slow.

commentaries

Aug 16, 2022

July 2022 Consumer Price Index data: Canada’s inflation finally turns a corner with falling gas prices, but core pressures remain

Our Chief Economist, Stephen Tapp, looks at Canada’s headline inflation, which is finally showing signs of cooling off.