Commentaries /

October 2023 GDP: It’s beginning to look like a recession-free Christmas

October 2023 GDP: It’s beginning to look like a recession-free Christmas

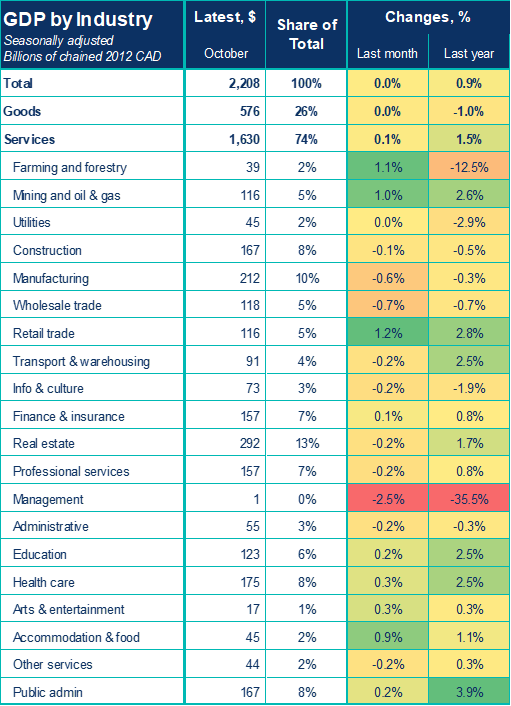

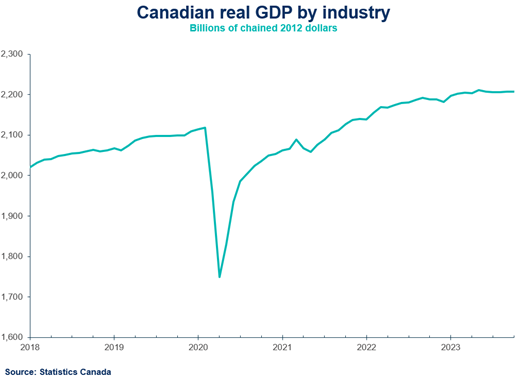

The Canadian economy continues to show signs of weakness. We've now seen three consecutive months of virtually no growth, as key sectors like manufacturing and real estate face notable headwinds.

Andrew DiCapua

The Canadian economy continues to show signs of weakness. We’ve now seen three consecutive months of virtually no growth, as key sectors like manufacturing and real estate face notable headwinds. Retail trade grew, but not enough to offset the broader slowdown in other sectors. The St. Lawrence Seaway labour strike in October also brought pain for the transportation sector. Things could go from bad to worse if there is yet another strike at the Port of Montreal to start the New Year.

All in all, we expect the Canadian economy to grow modestly in the fourth quarter (it’s currently on pace for annualized growth of 0.5% for Q4), thereby avoiding a technical recession. The good news is that two-thirds of businesses are optimistic about the future in the latest CSBC survey, despite continuing to face significant operating challenges. Nonetheless, downside risks remain in the near term for Canada’s economy.

Andrew DiCapua, Senior Economist, Business Data Lab

KEY TAKEAWAYS

Headlines

- Canada’s real gross domestic product (GDP) was essentially unchanged in October, below market expectations (+0.2%). This represents the third month in a row of an economy with no growth.

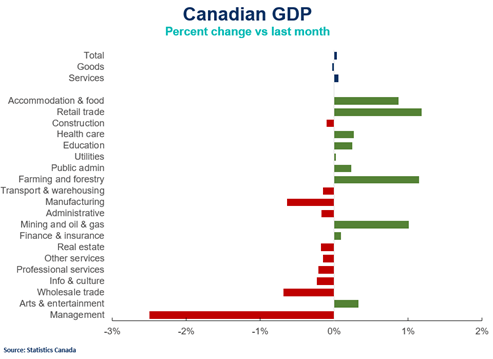

- Output grew in 10 of 20 sectors, led by gains in services once again, which were up 0.1% on the month, while goods was flat.

Movers and Shakers

- The manufacturing sector contracted for the fourth time in five months, declining by 0.6% in October. Durable goods manufacturing, particularly machinery and transportation equipment, contributed to the decline.

- Wholesale trade contracted by 0.7% for the second straight month, with machinery, equipment, and supplies wholesaling leading the decline. Building material and supplies wholesaling was the only subsector that expanded, reflecting higher lumber and millwork.

- The transportation and warehousing sector declined by 0.2%, influenced by the St. Lawrence Seaway strike. Water transportation contracted significantly, while air transportation and pipeline transportation mitigated the overall decline.

- Retail trade exhibited growth, increasing by 1.2% in October, marking the largest growth rate since January 2023. Clothing, general merchandise stores, and health and personal care stores contributed to this growth.

- The mining, quarrying, and oil and gas extraction sector grew by 1.0% in October after two monthly declines. Metal ore mining and non-metallic mineral mining experienced notable increases, while oil sands extraction contracted.

- Activity at the offices of real estate agents and brokers declined for the fourth month in a row, dropping by 6.8% in October.

OUTLOOK AND IMPLICATIONS

- StatCan’s flash estimate for November is for growth of +0.1%. Taking this into account, the fourth quarter is estimated to grow +0.5% at annual rates. Even if the economy stalls again, it’s unlikely that we’ll enter a technical recession in the fourth quarter. Although weaker thank the Bank of Canada’s Monetary Policy Report forecast of +0.8%, the risks of a slowing economy are higher with core inflation remaining higher than expected in the past few months.

- One silver lining is that our Q4 Survey on Canadian Business Conditions shows that two-thirds of Canadian businesses are optimistic about the outlook for next year, though down from the last quarter.

Summary Table

Source: Statistics Canada.

Charts

Sources: Statistics Canada; Bank of Canada; Canadian Chamber of Commerce Business Data Lab.

Other Commentaries

Oct 19, 2022

September 2022 Consumer Price Index data: Food and services prices still rising, no progress on core inflation

Sep 20, 2022

August 2022 Consumer Price Index data: Finally some good news on Canadian inflation.

Aug 16, 2022