Blog /

August 2023 GDP: Engine light flashing, brace for a soft-ish recession.

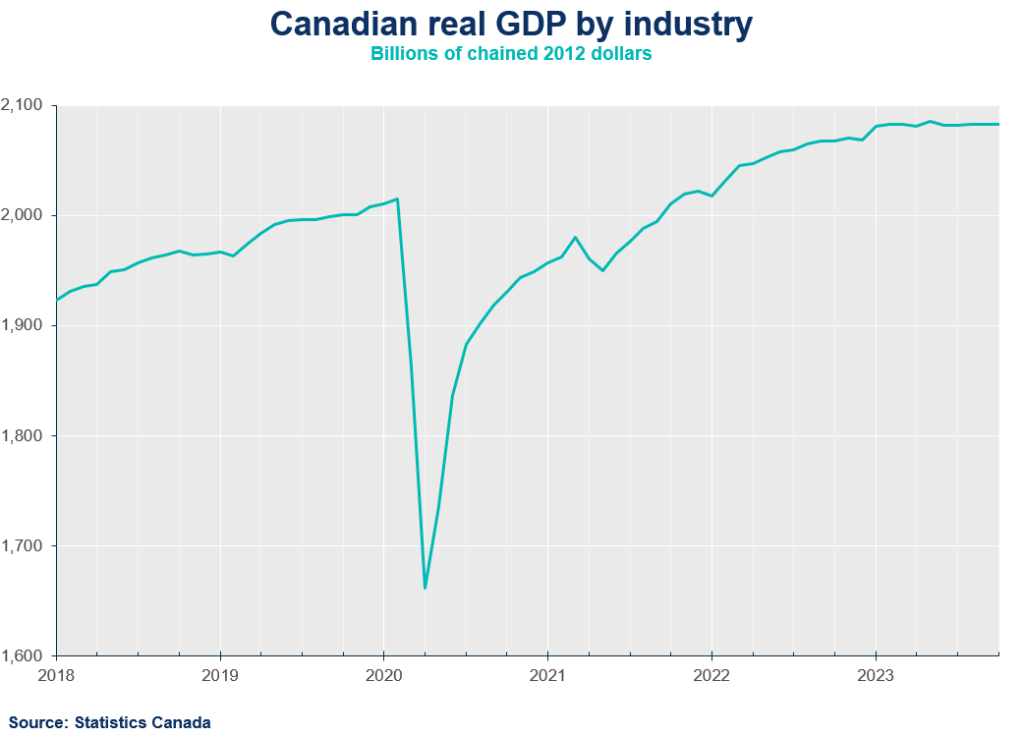

Canada’s real gross domestic product (GDP) was essentially unchanged in August, below market expectations (+0.1%). This is the second month of an economy with no growth, following a summer of strikes, forest fires, and elevated costs.

Andrew DiCapua

The economy is clearly stagnating. With these numbers, you could make the argument that we’re in a technical recession, with the third and fourth quarters now expected to be essentially flat, and weaker than the Bank of Canada’s forecast released last week.

This economic weakness should put a lid on inflation pressures. But we’re dealing with a bit of a mirage, with GDP growth increasingly being fueled by a fast-growing population. That’s concealing a hard truth – that real GDP per person is falling, and poor productivity is expected going forward.

Andrew DiCapua, Senior Economist, Canadian Chamber of Commerce

KEY TAKEAWAYS

Headlines

- Canada’s real gross domestic product (GDP) was essentially unchanged in August, below market expectations (+0.1%). This is the second month of an economy with no growth, following a summer of strikes, forest fires, and elevated costs.

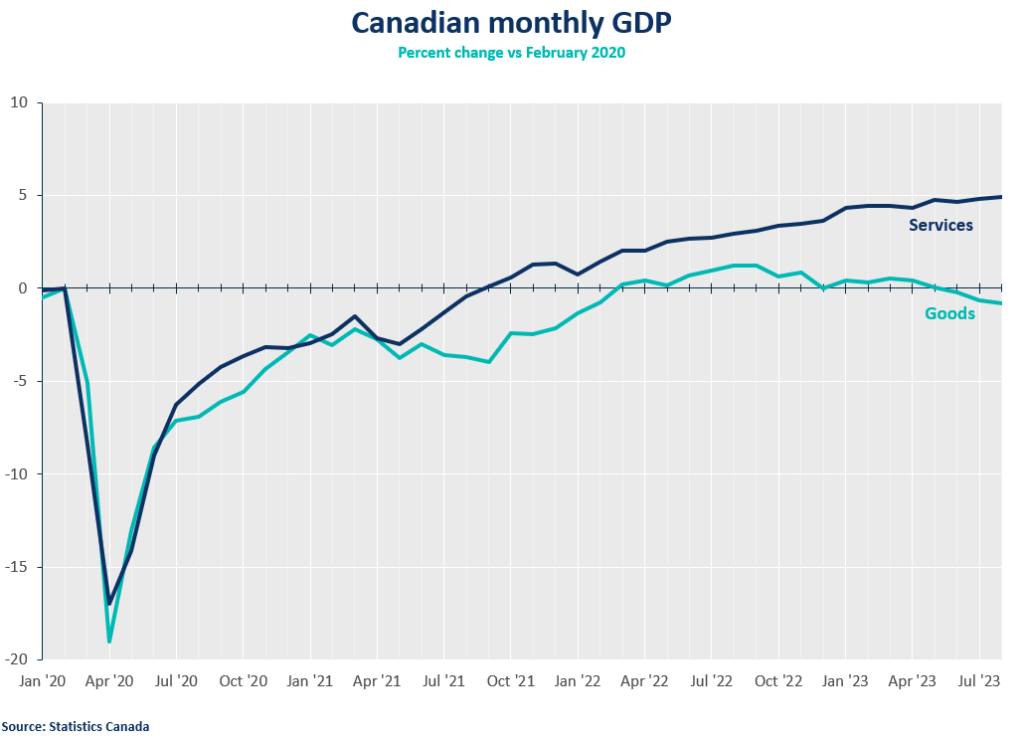

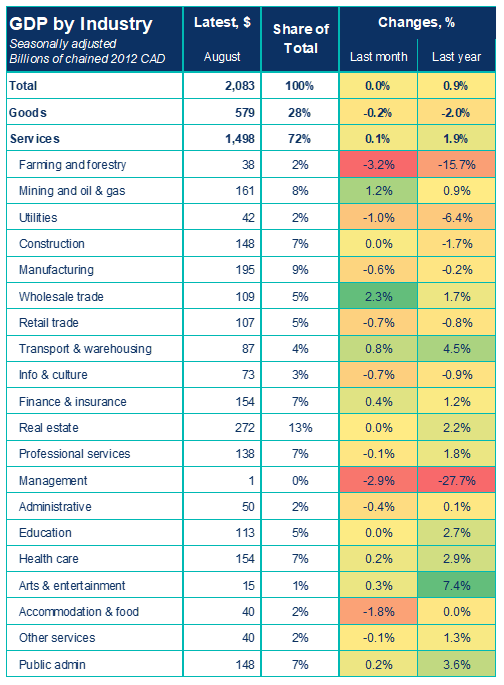

- Output grew in 8 of 20 sectors, led by gains in services, which were up 0.1% on the month, while goods dropped 0.2%.

Movers and Shakers

- Wholesale trade was the largest contributor to August GDP, growing 2.3% m/m. This was also the largest monthly gain since mid-2020 as agricultural supplies and recycle wholesalers led the way.

- Mining, oil and gas extraction saw 1.2% m/m growth—the third consecutive monthly increase as the industry sees higher energy prices and restores output following severe forest fires this summer.

- The manufacturing sector declined in August by 0.6% on the heels of weaker demand. Transportation equipment manufacturing was a bright spot, up in the past four months as semiconductor shortages continue to ease.

- Although services led the monthly gains, accommodation and food services declined 1.8% m/m with food services demand slowing.

- Transportation and warehousing grew by 0.8% m/m, led by air transportation as the seasonally high demand for travel fueled the sector. Water and rail transportation were both up considerably in August as they recovered from the port strike disruptions in July.

- Retail trade contracted 0.7% m/m due to lower sales of motor vehicles and sales at car dealerships. This has been a trend since the beginning of the year as consumers shift spending away from durable goods.

OUTLOOK AND IMPLICATIONS

- StatCan’s flash estimate for September is yet another month of flat growth. The risks that the Canadian economy is in a technical recession have risen. The Q3 GDP is now estimated to grow -0.1% Q/Q at an annual rate. This is weaker than the Bank of Canada’s Monetary Policy Report forecast, which was released last week (0.8%). It’s likely we’ll see near zero growth over the next few quarters, below the Bank’s forecast and could help contain strong price pressures.

- The stalling economy is consistent with what we’ve seen in our spending tracker, which has been flat over recent months. If the Canadian economy grows around 1% this year in real terms, while our population grows at around 3%, this means that real GDP per person is falling at 2%, which highlights to productivity challenges facing the country that could hinder sustained growth over the medium term.

SUMMARY TABLES

CHARTS