Commentaries /

January 2024 GDP: Strong start to the year, driven by temporary factors

January 2024 GDP: Strong start to the year, driven by temporary factors

Our Senior Economist, Andrew DiCapua, shares his key takeaways from January 2024's GDP release

Andrew DiCapua

January’s stronger-than-expected growth, boosted by temporary factors like the rebound in educational services and manufacturing, provides strong momentum for Canada’s economy in the first quarter (now on a 3.5% pace annualized). The robust expansion, notably exceeding the Bank of Canada’s forecast of 0.5%, provides some respite, and is delaying market expectations for a June rate cut. The surge in sectors such as utilities amid severe weather conditions underscores that while these temporary factors keep the Canadian economy afloat, there are no strong underlying signs of sustained growth amidst a backdrop of declining inflation.

Andrew DiCapua, Senior Economist, Canadian Chamber of Commerce

KEY TAKEAWAYS

Headline

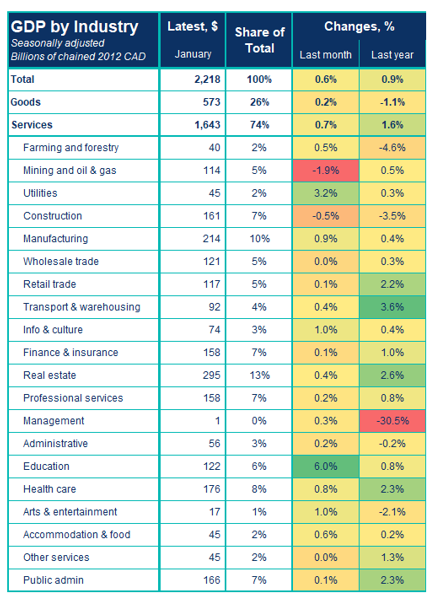

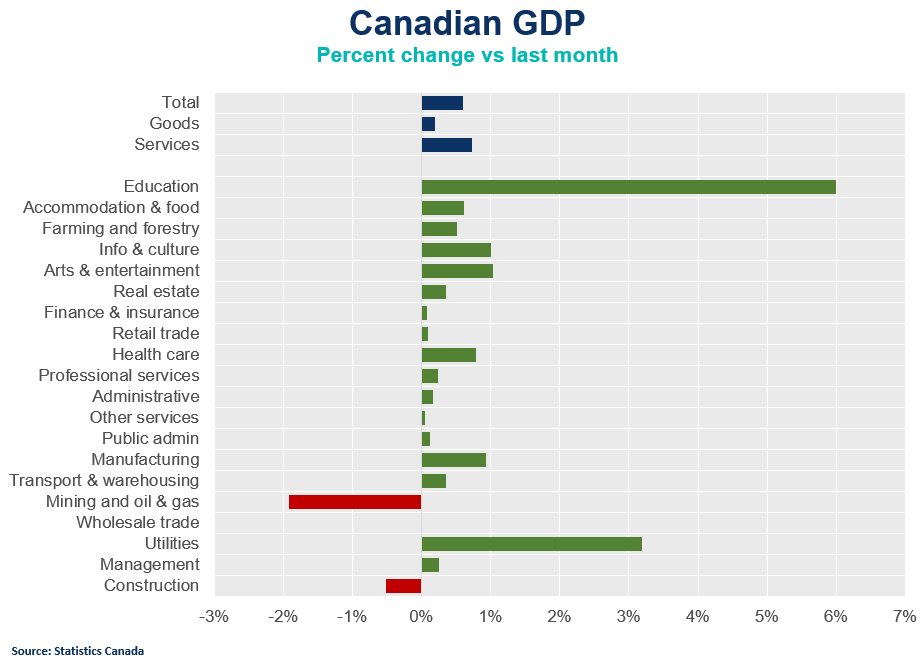

- Real gross domestic product increased by 0.6% in January 2024 (above the consensus forecasts of 0.4%). Services-producing industries grew by 0.7%, primarily driven by a rebound in educational services following the resolution of public sector strikes in Quebec. Goods-producing industries saw a modest increase of 0.2%, with notable rebounds in the utilities and manufacturing sectors.

Movers and Shakers

- The public sector, including educational services, health care and social assistance, and public administration, saw a significant increase of 1.9% in January, reversing two consecutive months of declines. Educational services, particularly elementary and secondary schools, rebounded by 6.0% after being affected by strikes in Quebec and Saskatchewan. Health care and social assistance also rose by 0.8%, marking the highest growth rate since October 2020.

- Manufacturing fully recovered December’s decline, growing by 0.9% in January. Durable goods manufacturing drove growth, with motor vehicle manufacturing and parts experiencing notable rebounds.

- Severe winter conditions led to a surge in activity in the utilities sector, which grew by 3.2% in January, driven by electric power generation and natural gas distribution.

- The real estate sector (+0.4%) grew for the third consecutive month, as housing activity picked up in the Greater Toronto Area and surrounding markets. This is some initial evidence that some markets have renewed optimism anticipating lower interest rates.

- Information and cultural services increased by 1.0%, with the motion picture and sound recording industry contributing significantly to the growth.

OUTLOOK AND IMPLICATIONS

- The advanced estimate for real GDP in February 2024 suggests a further increase of 0.4%, indicating continued momentum. Another strong indication that the Canadian economy is holding its footing. The first quarter is on track to post strong growth, 3.5% annualized. This is much stronger than the Bank of Canada’s January forecast of 0.5% annualized in the first quarter. Overall, while the economy is showing resilience and recovering from recent challenges, such as labor actions and severe weather conditions, the outsized contribution of temporary factors is not expected to last.

- This is an upside risk to the Bank of Canada’s forecast, however, if inflation continues to slow, the Bank will stay the course in waiting for the right moment to cut rates.

SUMMARY TABLES AND CHARTS

Other Commentaries

Oct 19, 2022

September 2022 Consumer Price Index data: Food and services prices still rising, no progress on core inflation

Sep 20, 2022

August 2022 Consumer Price Index data: Finally some good news on Canadian inflation.

Aug 16, 2022