Commentaries /

Q4 2023 GDP: Pretty good news as the economy holds footing

Q4 2023 GDP: Pretty good news as the economy holds footing

Canada’s economy navigated through a potential rough spot in the fourth quarter, with help from exports and consumer spending on autos, as supply chain backlogs continued to ease.

Andrew DiCapua

Canada’s economy navigated through a potential rough spot in the fourth quarter, with help from exports and consumer spending on autos, as supply chain backlogs continued to ease. Fourth quarter GDP grew 1% at annual rates (slightly above the market consensus of 0.8%), and growth in the third quarter was revised up. Canada also enjoyed a decent start to 2024 in January with the end of Quebec’s public sector strike. With the economy generally holding up, the Bank of Canada has time to hold rates and stay the course into the summer. That said, there are evident signs of underlying weakness in Canada’s economy—notably real per capita consumption, business investment, and housing resales.

Andrew DiCapua, Senior Economist, Canadian Chamber of Commerce

KEY TAKEAWAYS

Headline

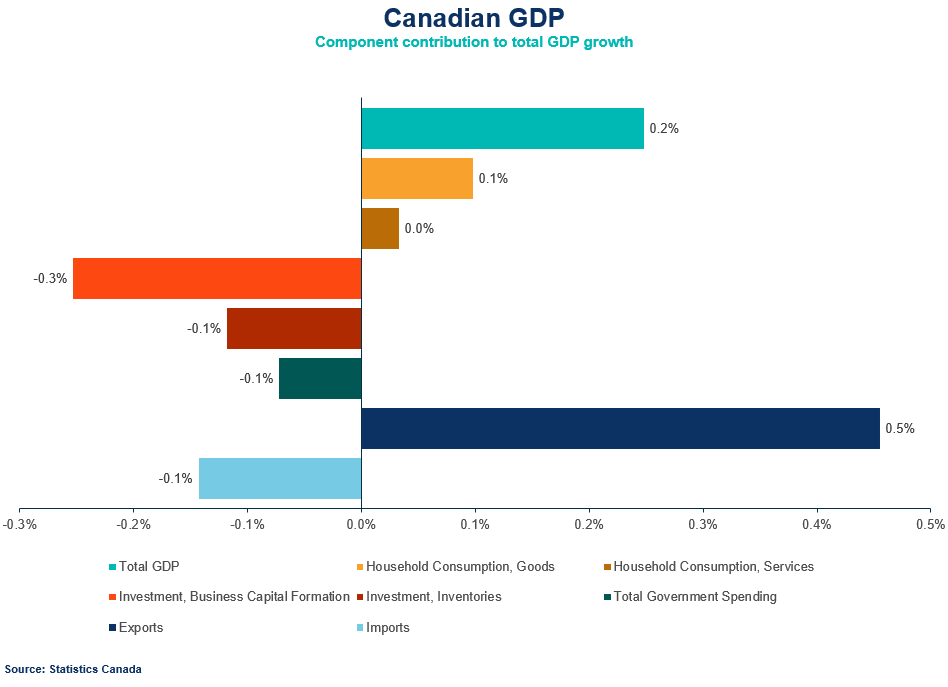

- Canada’s real gross domestic product (GDP) grew by 1% annualized in the third quarter, posting stronger growth than markets expected (+0.8%). This follows upwardly-revised third quarter growth of -0.5% (previously reported at -1.1%). Q4 growth was primarily driven by higher exports and consumer spending, while housing and business investment declined.

- Monthly GDP by industry was flat in December, despite economists expecting 0.2% m/m growth and a strong flash estimate of 0.3%.

Movers and Shakers

- Higher exports and reduced imports contributed to Q4 GDP growth, although a decline in business investment moderated the overall expansion.

- Exports of goods and services rose 1.4%, driven by increased crude oil exports, travel services, and transportation equipment. Conversely, imports declined by 0.4%.

- Final domestic demand (which includes expenditures on final consumption and gross fixed capital formation) decreased by 0.2% in Q4. On an annual basis, real GDP and final domestic demand increased for the third consecutive year, but the growth rate in 2023 was the slowest since 2016.

- Household spending increased by 0.2%, primarily due to higher spending on new trucks and utility vehicles. However, per capita consumption expenditures declined for the third consecutive quarter, and overall growth in household spending slowed to 1.7% in 2023.

- Housing investment declined by 0.4%, marking the sixth decline in the last seven quarters. Business investment also declined for the sixth time in seven quarters, particularly in non-residential structures and machinery and equipment.

- The household saving rate remained stable at 6.2% in Q4. Corporate incomes increased by 2.9%, driven by the gross operating surplus of non-financial corporations.

OUTLOOK AND IMPLICATIONS

With decent fourth quarter growth, and 2024 off to a surprisingly healthy start, the Canadian economy skirted a potential technical recession in 2023. January’s flash estimate of 0.4% m/m puts Q1 2024 GDP on pace to grow 1.8% on an annualized basis, stronger than the Bank of Canada’s January forecast of 0.5% growth in Q1. The economy is holding up, but economic risks remain, with significant risks to real business investment and further weaknesses in the housing sector in the months to come. Early indications from the Business Data Lab show underlying weakness in consumer spending, which should be a drag on economic activity.

It’s unlikely the Bank of Canada will shift their stance on monetary policy, pushing back market expectations from April of this year. With the economy and labour market stable, the Bank has more time to wait and see further progress on inflation measures. Absent of weaker economic activity, the Bank will need to keep rates in restrictive territory for longer.

SUMMARY TABLE

Other Commentaries

Oct 19, 2022

September 2022 Consumer Price Index data: Food and services prices still rising, no progress on core inflation

Sep 20, 2022

August 2022 Consumer Price Index data: Finally some good news on Canadian inflation.

Aug 16, 2022