Commentaries Topics: Bank of Canada

Commentaries /

The Bank of Canada sounds dovish while cutting rates again, and signaling there’s more to come

The Bank of Canada sounds dovish while cutting rates again, and signaling there’s more to come

Today the Bank of Canada cut its policy rate for the second straight time.

Stephen Tapp

KEY TAKEAWAYS

- Today the Bank of Canada cut its policy rate for the second straight time. The rate now sits to 4.5%. This move that was widely expected. Markets priced in a 89% chance of this rate cut before the announcement.

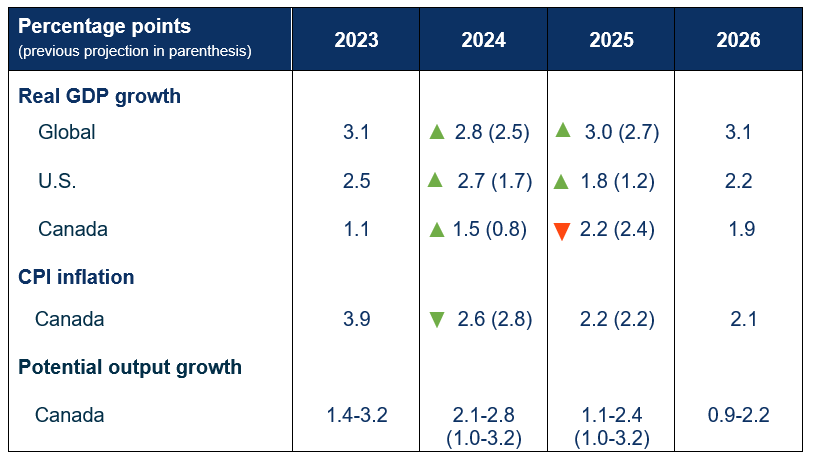

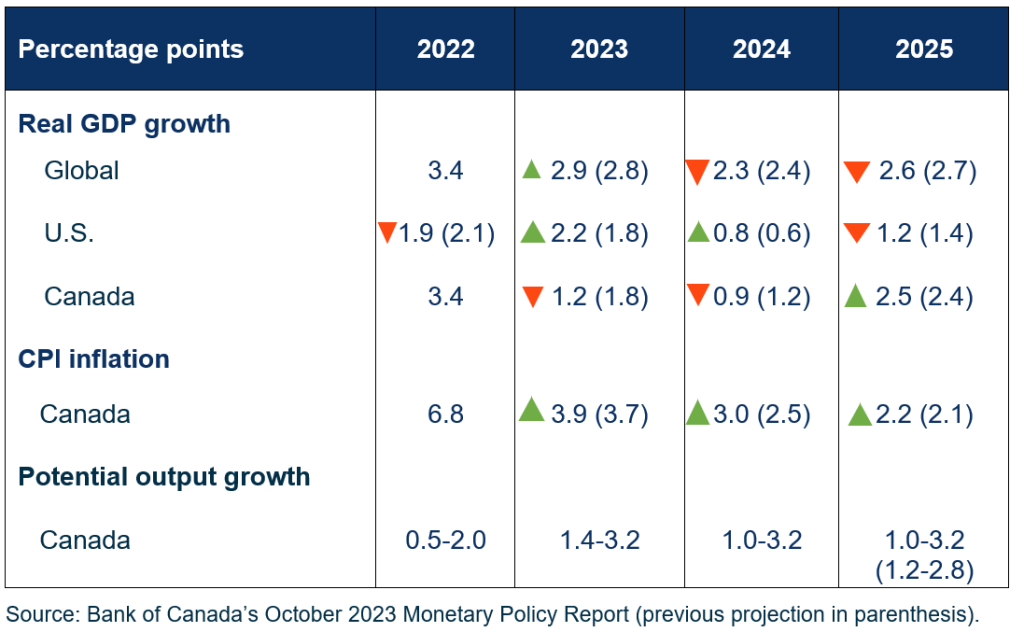

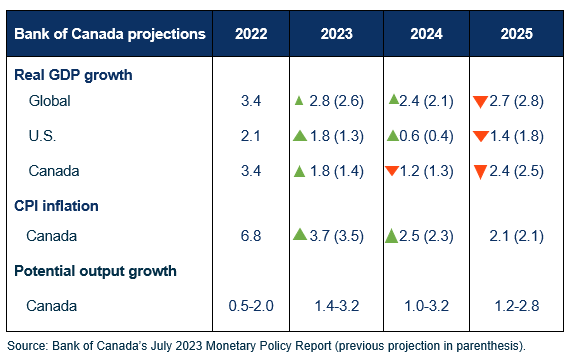

- Global growth unchanged, but U.S. weaker: The Bank’s outlook for the global economy is essentially unchanged, with roughly 3% annual growth expected over the projection. The forecast for U.S. real GDP growth in 2024 was lowered slightly (to 2.3% from 2.7%). Growth in Europe is weak but recovering (revised up to 0.7% from 0.4%). China continues to face slowing growth due to headwinds from its depressed property sector.

- Canada’s economy in excess supply: The Bank’s forecast for Canadian real GDP was revised down this year (to 1.2% from 1.5%). With weak economic growth relative to strong population growth, the Bank sees increased excess supply in Canada’s economy, which should restrain inflation pressures. Consumer spending per capita is soft, and slack in the labour market is growing, with the unemployment rate rising and people taking longer to finding jobs.

- More confidence in inflation returning to target: Given the weak economy, despite revising up its forecast for headline inflation next year (to 2.4% from 2.2%), the Bank is “increasingly confident that the ingredients to bring inflation back to target are in place”. In his press conference, the Governor added, “We need growth to hold up so inflation does not fall too much”. All told, downside risks are an increasing worry for Governing Council.

- Looking ahead: We expect at least two — and possibly three — more rate cuts this year. Markets are currently pricing in a 65% chance of another cut at the Bank’s next rate announcement on September 4. In the U.S., markets expect the Federal Reserve to deliver its first rate cut on September 18.

BANK OF CANADA PROJECTIONS

Other Commentaries

Oct 19, 2022

September 2022 Consumer Price Index data: Food and services prices still rising, no progress on core inflation

Sep 20, 2022

August 2022 Consumer Price Index data: Finally some good news on Canadian inflation.

Aug 16, 2022

July 2022 Consumer Price Index data: Canada’s inflation finally turns a corner with falling gas prices, but core pressures remain

Commentaries /

Going Down: Bank of Canada cuts rate to kick off the easing cycle in the G7

Going Down: Bank of Canada cuts rate to kick off the easing cycle in the G7

Today the Bank of Canada shifted its policy stance, and kicked off the easing cycle among G7 countries, by cutting its overnight rate from 5% to 4.75%.

Stephen Tapp

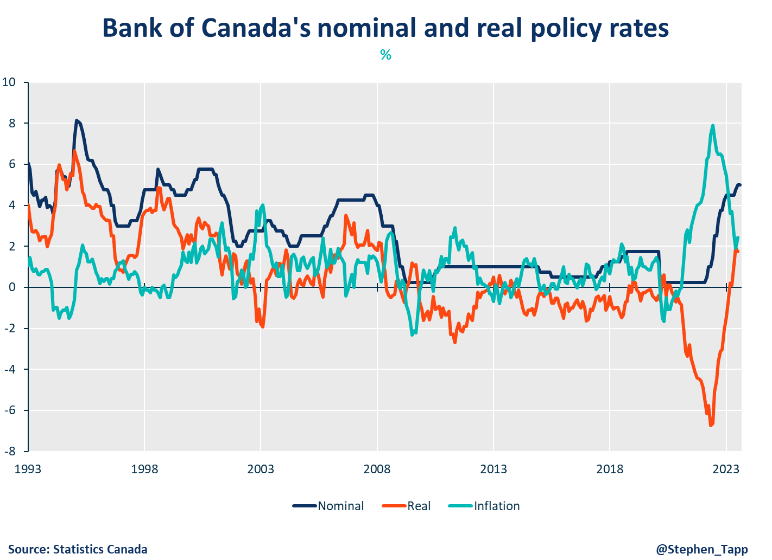

Today the Bank of Canada shifted its policy stance and kicked off the easing cycle among G7 countries by cutting its overnight rate from 5% to 4.75%. This move was the right call and was expected, as financial markets had priced in an 80% chance of a cut.

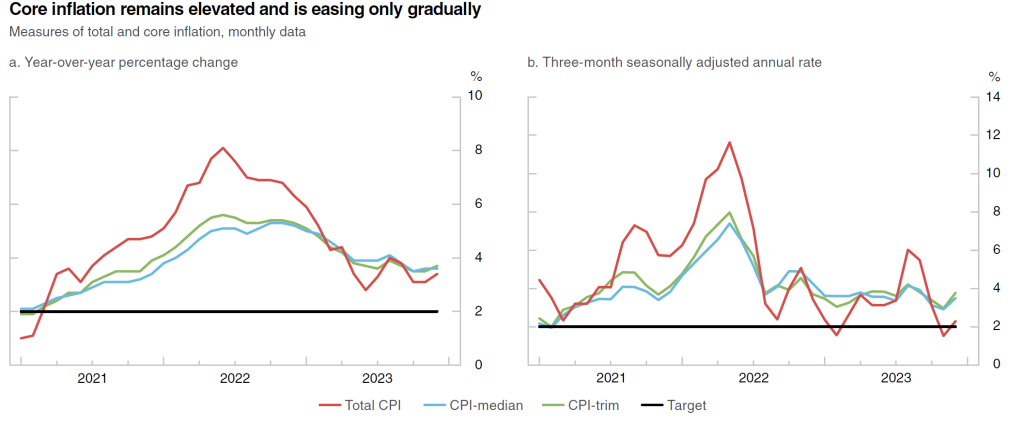

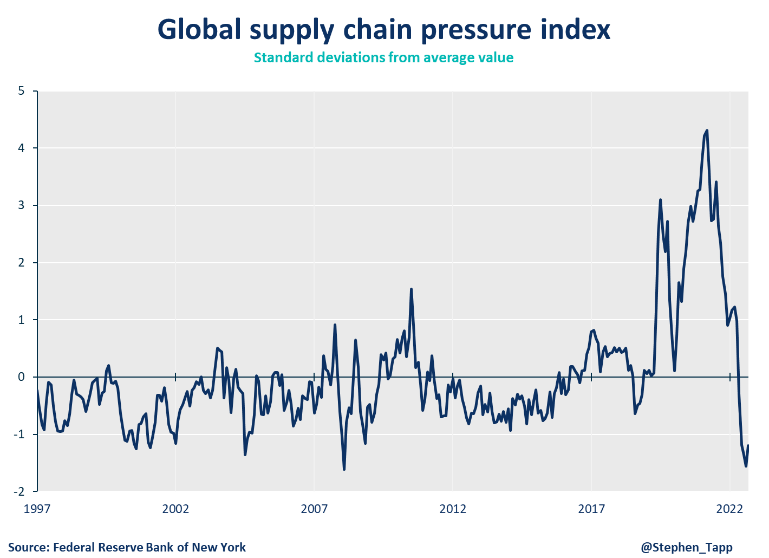

Recent data have confirmed that high interest rates have slowed momentum in underlying inflation —aside from shelter costs —, and have given the supply side of Canada’s economy enough time to catch up to demand. The economy has also revealed its weak fundamentals, including poor productivity and falling real GDP per capita during a population surge. The Bank continues to view the economy as operating below its potential now, and they must be forward-looking in setting policy. The sharp slowdown expected in temporary immigration over the coming year could be a notable drag on headline growth.

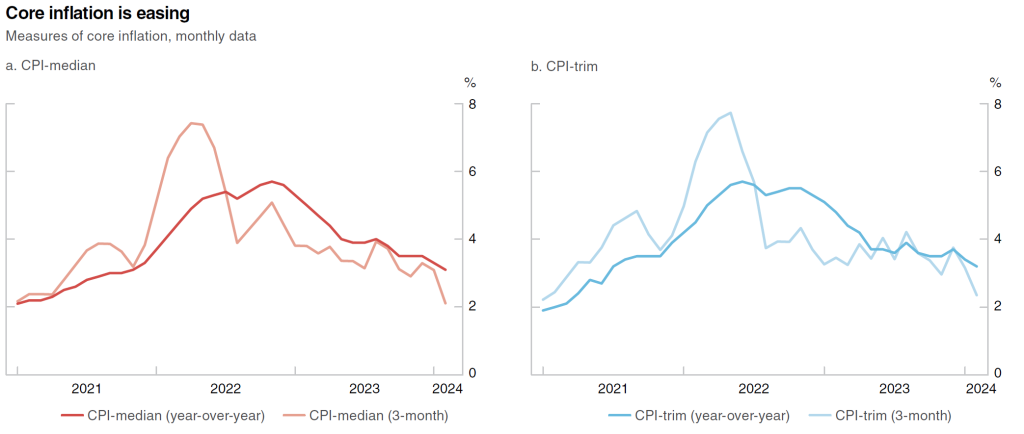

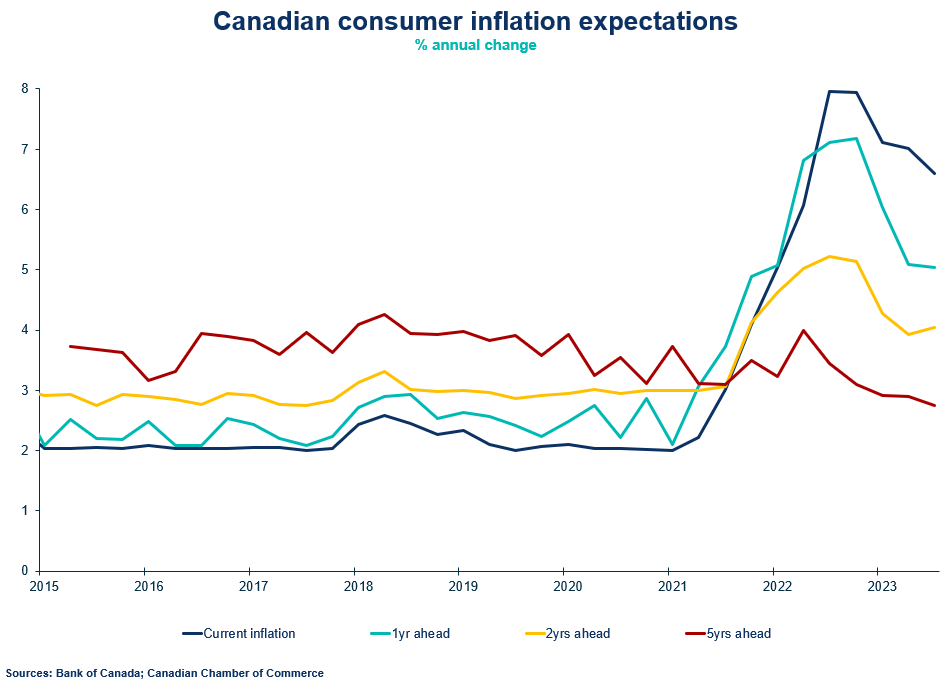

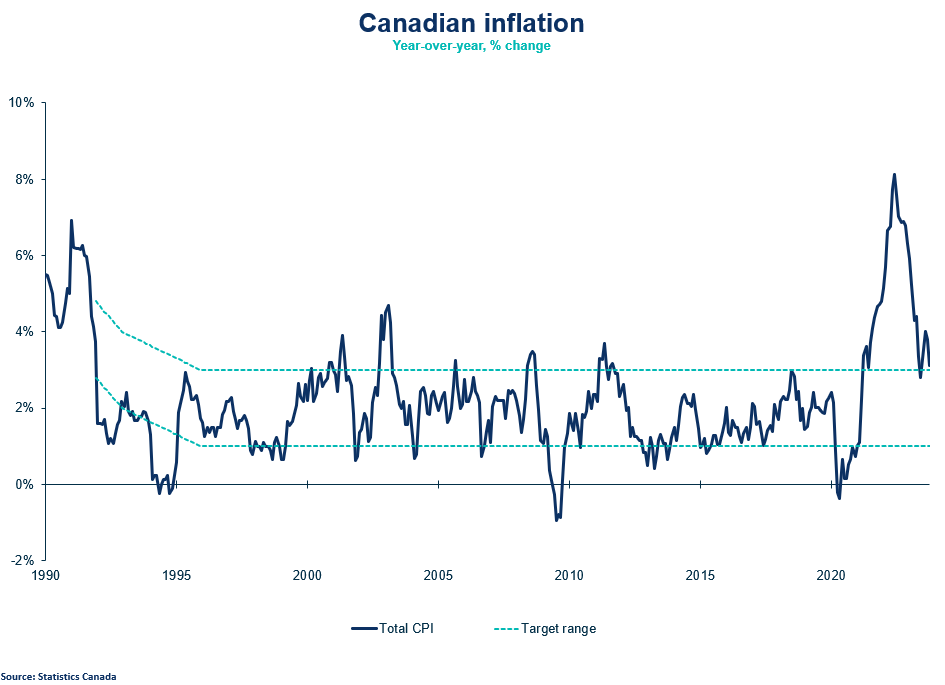

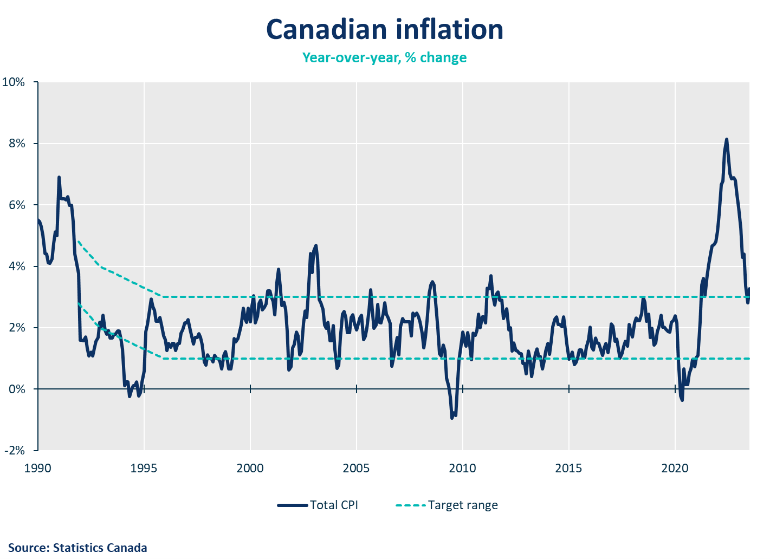

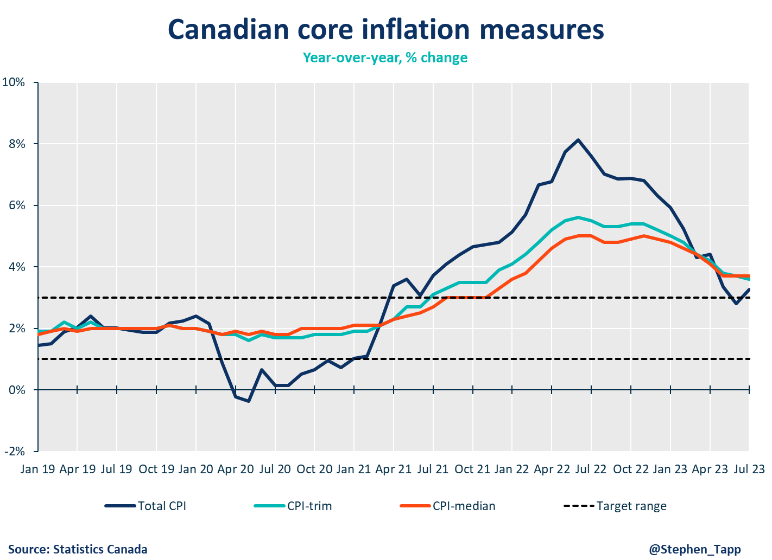

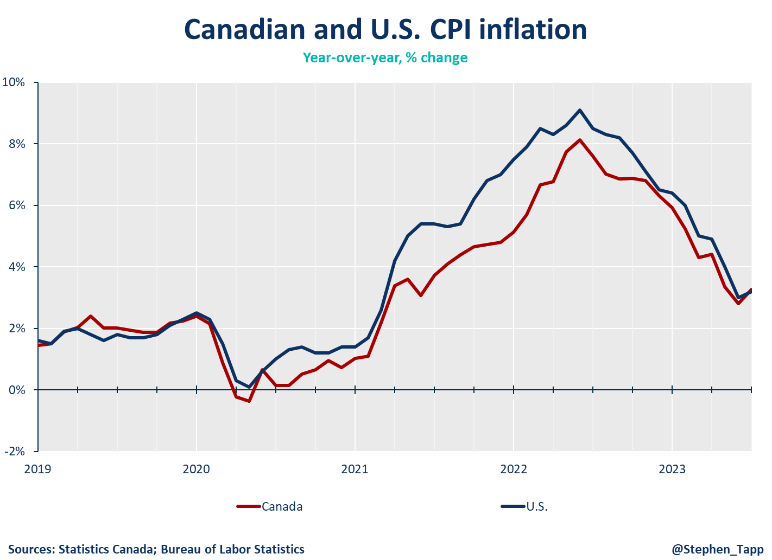

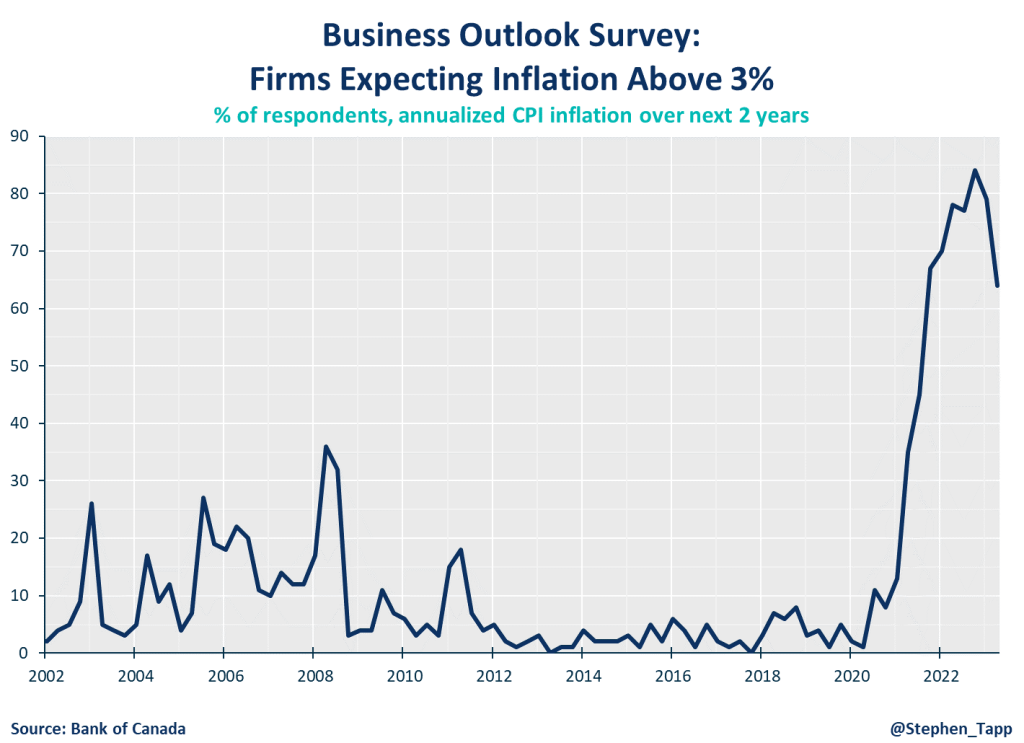

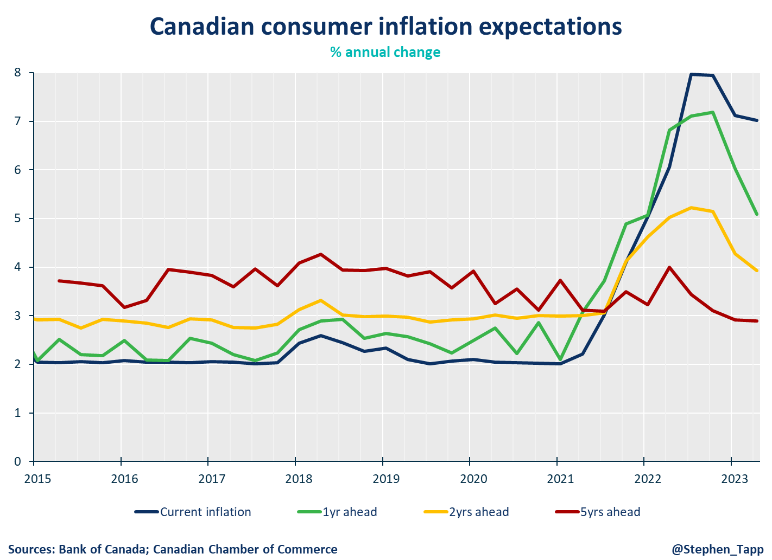

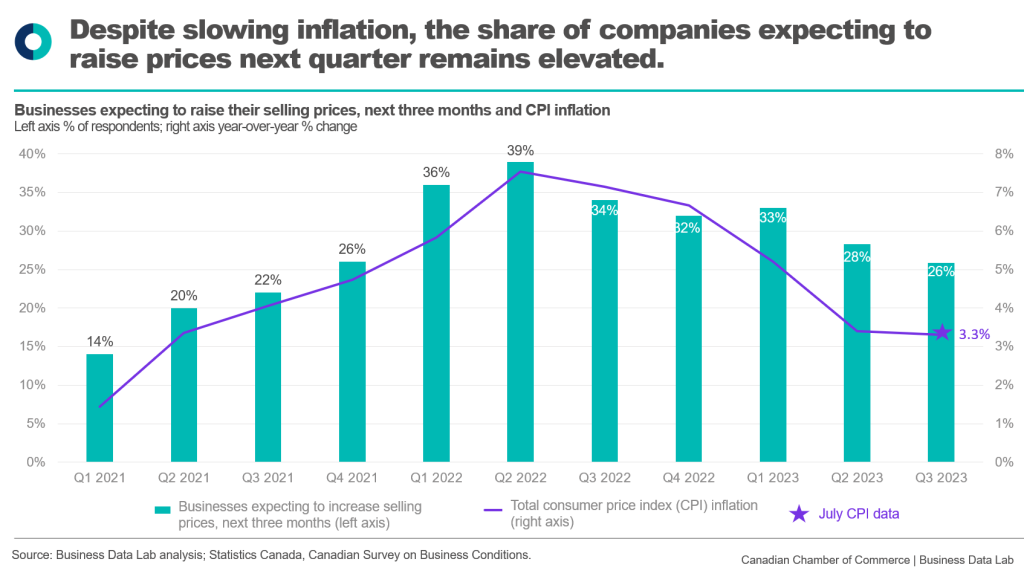

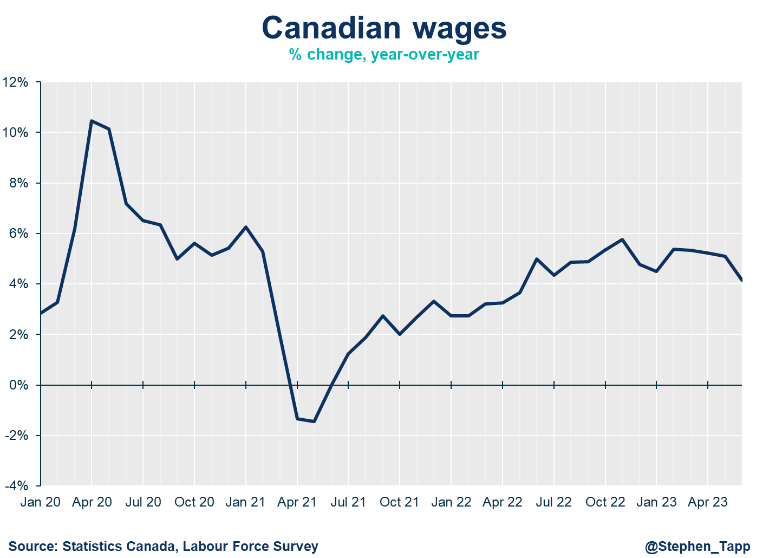

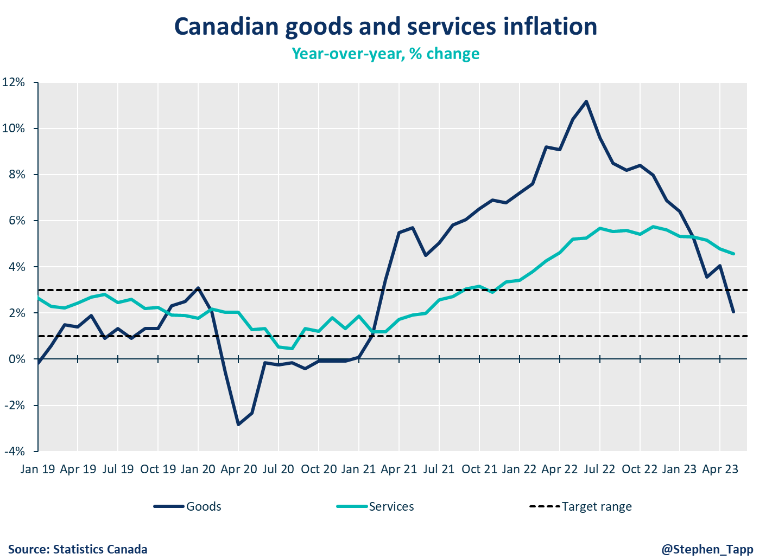

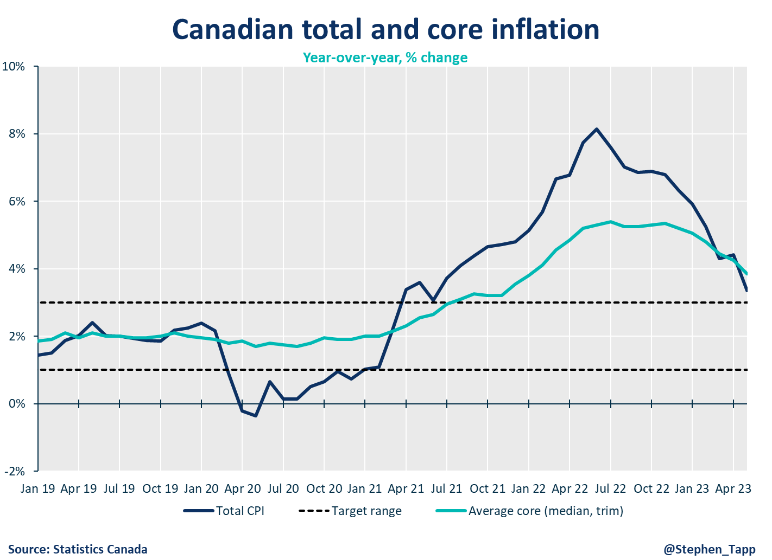

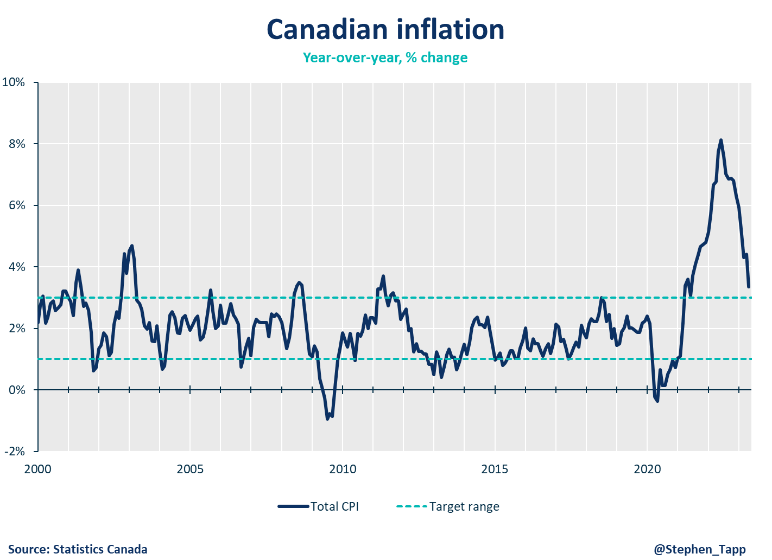

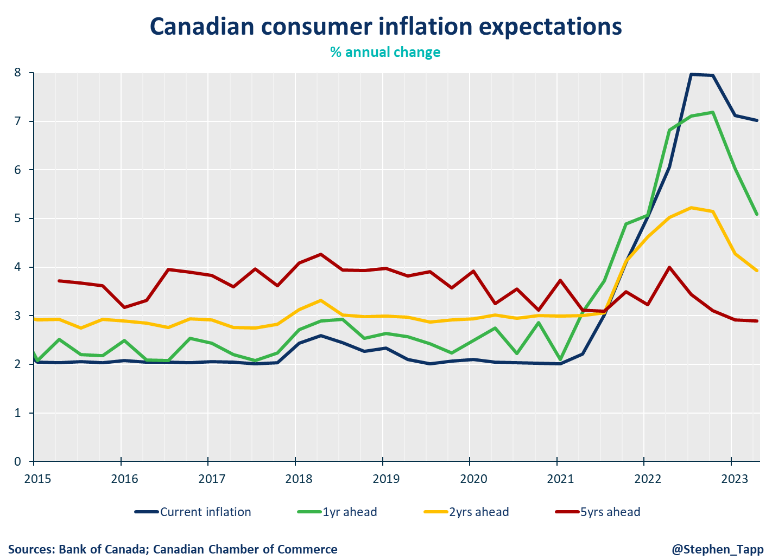

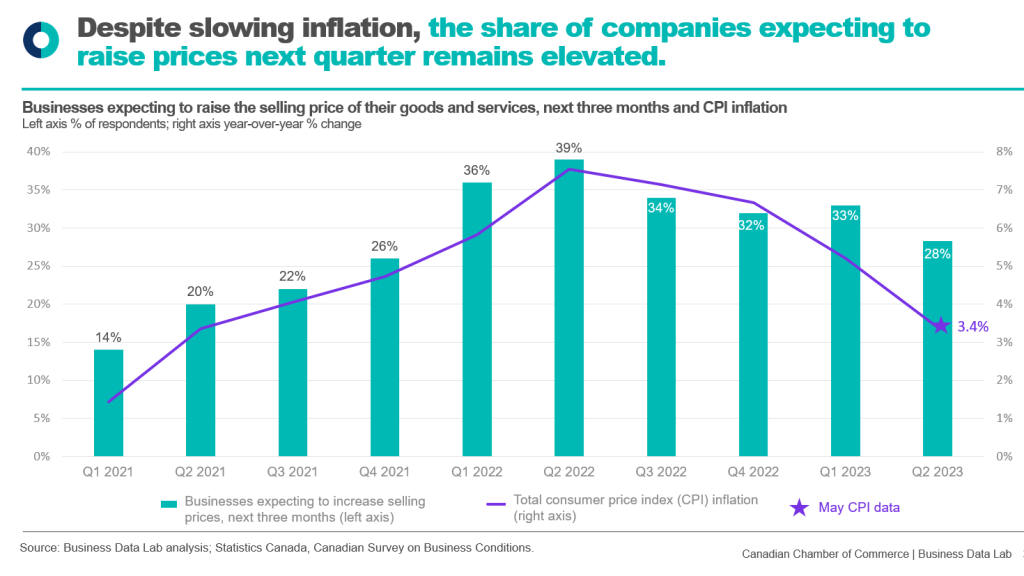

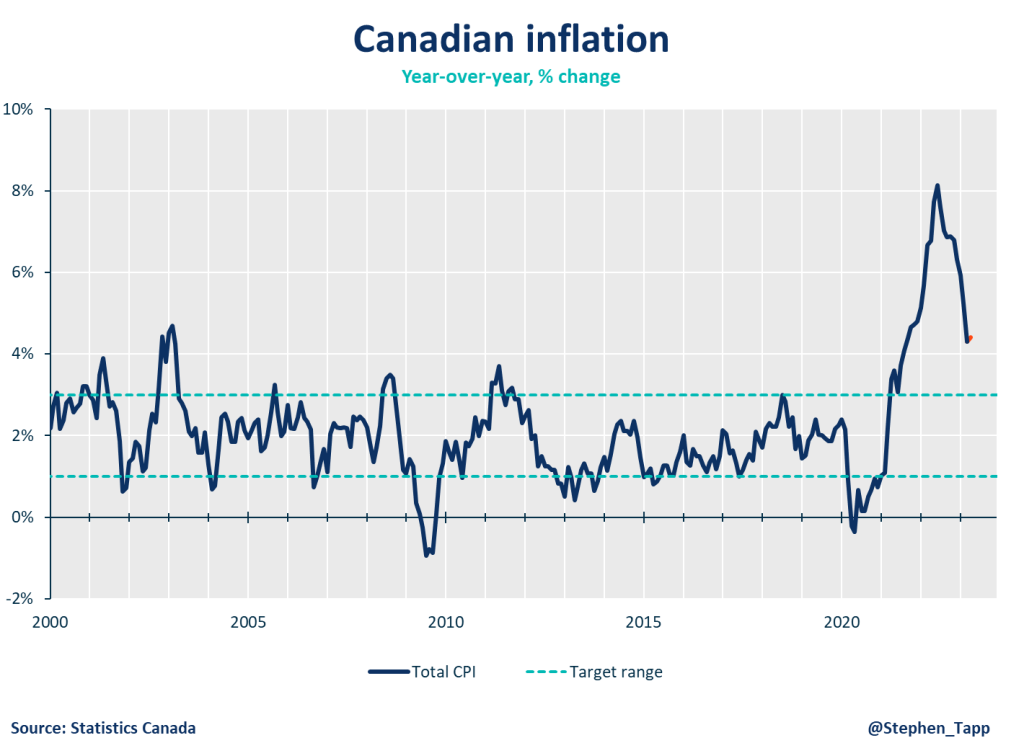

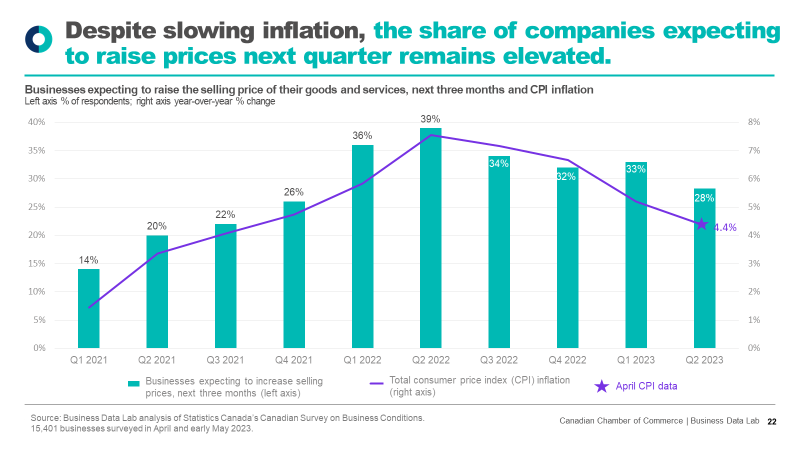

Inflation on an annual basis has fallen back into the Bank’s inflation control band for the first four months of the year, recently undershooting the Bank’s forecasts. Core inflation has also improved significantly in the last two months. Wage pressures are elevated but appear to be moderating. Corporate pricing behaviour continues to normalize, even if it isn’t yet back to normal. Inflation expectations are still higher than the Bank would like, but are moving in the right direction.

All told, the Bank has now seen enough progress in the fight against inflation to offer some modest — but much needed — interest rate relief for Canadian consumers and businesses. With the benefit of hindsight, we can now say that the Bank waited a little too long to start raising rates. Today they moved decisively, avoiding excessive caution and the mistake of waiting too long to ease policy. A “soft landing” remains in sight. There will be more rate cuts to come, with markets already pricing in another cut by September, and the policy rate set to end the year at 4.25%.

South of the border, the strong U.S. economy has kept inflation sticky and will have the Federal Reserve on hold for longer — it currently looks like the Fed’s first rate cut will be in November. The emerging Canada-U.S. interest rate differential should put downward pressure on the Canadian dollar. We will watch closely to see if it falls below 70 cents. While a weaker dollar helps our exports, it also makes imports more expensive, adding inflationary pressure and making the Bank’s job harder.

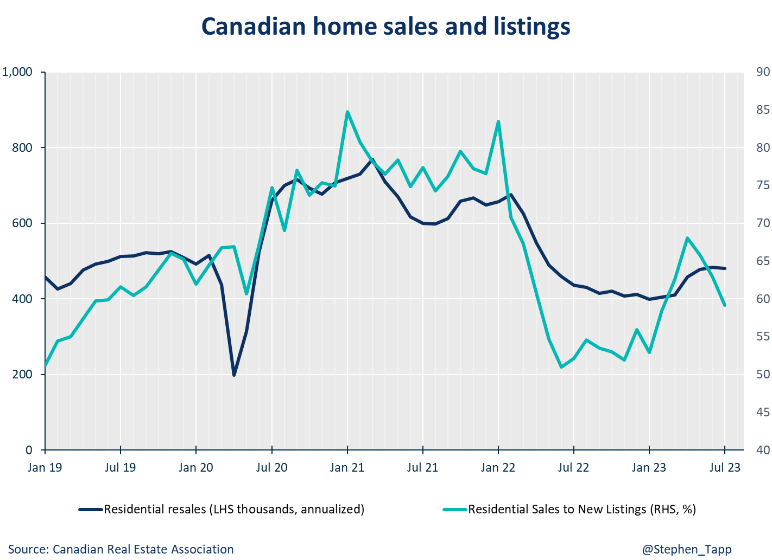

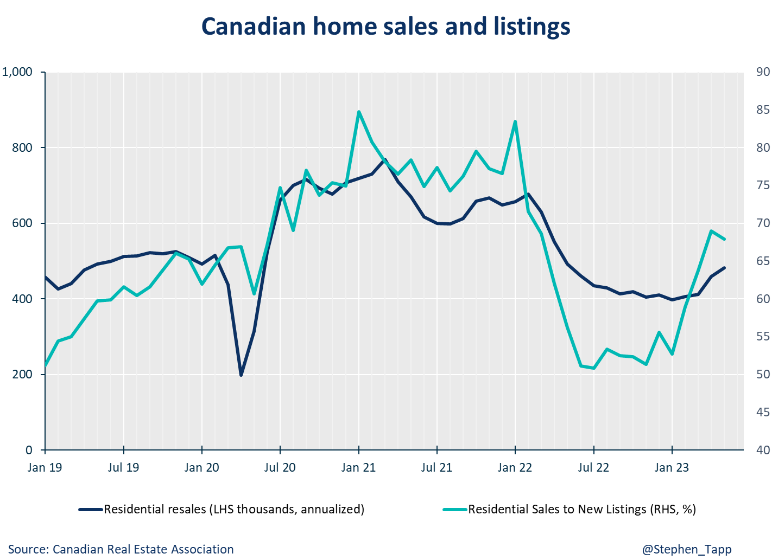

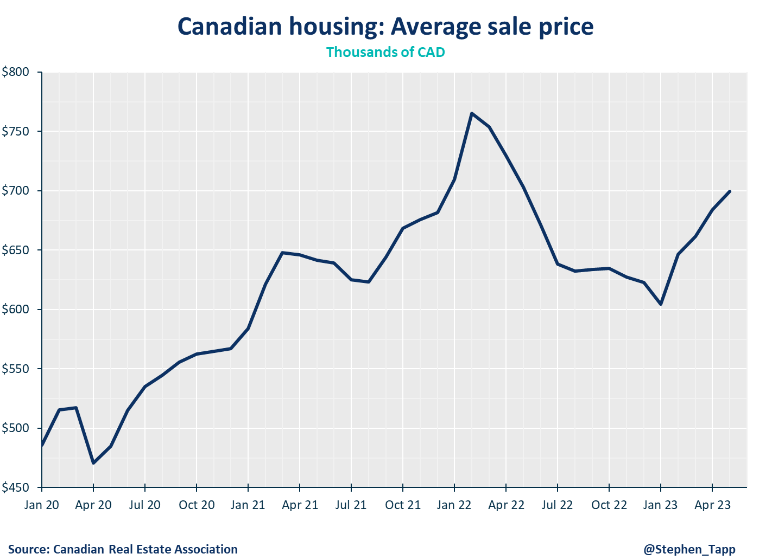

Housing is another key area to watch. Despite the widespread affordability problems, it’s possible that this first rate cut will bring buyers back into the market, and cause shelter costs to stay high.

Other Commentaries

Oct 19, 2022

September 2022 Consumer Price Index data: Food and services prices still rising, no progress on core inflation

Sep 20, 2022

August 2022 Consumer Price Index data: Finally some good news on Canadian inflation.

Aug 16, 2022

July 2022 Consumer Price Index data: Canada’s inflation finally turns a corner with falling gas prices, but core pressures remain

Commentaries /

Bank of Canada waiting to see sustained inflation progress it cuts rates

Bank of Canada waiting to see sustained inflation progress it cuts rates

Today the Bank of Canada held its policy rate at 5% for the sixth consecutive time, a move that was widely expected.

Stephen Tapp

KEY TAKEAWAYS

- Today, the Bank of Canada held its policy rate at 5% for the sixth consecutive time, a move that was widely expected. While the Bank has seen encouraging progress in the fight against inflation and Canadian economic growth in recent months, they are still cautious and would like to see more progress before considering rate cuts.

- Stronger global growth, led by the U.S: The Bank’s outlook for the global economy was revised up, largely reflecting strength in the United States. The forecast for U.S. real GDP growth in 2024 is now a robust 2.7%, up from 1.7% — taken together with the upward revision to U.S. growth next year and the weakening Canadian dollar, this should help Canadian exports. Growth in Europe remains weak, while China faces ongoing headwinds from its property sector.

- Canada’s economy boosted by population growth: The Bank’s forecast for Canadian real GDP was also revised up this year to 1.5% from 0.8%, including a considerable step up for the first quarter. This largely reflects good recent data and faster population growth in 2024 (as weakness in real GDP per capita unfortunately continues). Population growth slows in 2025 due to new limits on non-permanent residents entering Canada.

- Inflation progress continues: After two months of better-than-expected data, the Bank’s inflation forecast was revised down for this year (to 2.6% from 2.8%). The Bank sees inflation falling below 2.5% in the second half of 2024, and getting close to the 2% target by the end of 2025.

- Neutral rate and potential output growth adjustments: Every April the Bank updates its estimate of potential output growth and the “neutral” policy rate. The changes to potential output mostly reflect the population dynamics noted above, which help 2024 and hurt 2025, and are mostly a wash over the projection. The neutral rate (an estimated interest rate that’s seen as neither encouraging or discouraging inflation) was revised up by 0.25%, to a range of 2.25% to 3.25%. This isn’t a big move, but means the Bank could keep interest rates slightly higher over the long-term.

- Looking ahead: The Bank’s next rate announcement is on June 5, with markets currently pricing in a slightly better than even chance (~60%) of a rate cut. The key releases to watch before that date are the Federal Budget (for government spending plan), and the inflation data for March and April. Monetary policy has been working, but Governing Council is just looking for a little more evidence that the downward momentum in inflation is sustained. If the good news on short-run core inflation continues for the next two months, then the Bank will likely cut rates in June. They’re not in a rush, however, and if we get any inflation setbacks — like in the U.S. —then the Bank of Canada will patiently stay in wait-and-see mode.

BANK OF CANADA PROJECTIONS

Other Commentaries

Oct 19, 2022

September 2022 Consumer Price Index data: Food and services prices still rising, no progress on core inflation

Sep 20, 2022

August 2022 Consumer Price Index data: Finally some good news on Canadian inflation.

Aug 16, 2022

July 2022 Consumer Price Index data: Canada’s inflation finally turns a corner with falling gas prices, but core pressures remain

Commentaries /

No big surprises: The Bank of Canada bides its time, still too soon for rate cuts

No big surprises: The Bank of Canada bides its time, still too soon for rate cuts

Today, for the fifth time in a row, the Bank of Canada maintained its policy rate at 5%. Here's what you need to know.

Stephen Tapp

Today, for the fifth time in a row, the Bank of Canada maintained its policy rate at 5%. This move was expected by economists and financial markets. The Bank is now firmly in wait-and-see-more-progress mode before it starts to lower its policy rate.

Canada’s economy

Headline growth in the fourth quarter of 2023 was a bit better than the Bank expected (1% annualized vs. its 0% forecast). That said, there’s still fundamental economic weakness lurking beneath the headlines: growth remains below its long-run potential; business investment is stagnating; and job growth isn’t keeping pace with the population. As the labour market comes back into better balance, wage pressures are beginning to ease.

Inflation

In January year-over-year CPI inflation eased to 2.9%, which is inside the Bank of Canada’s broader inflation control range, and getting closer to its ultimately 2% target.

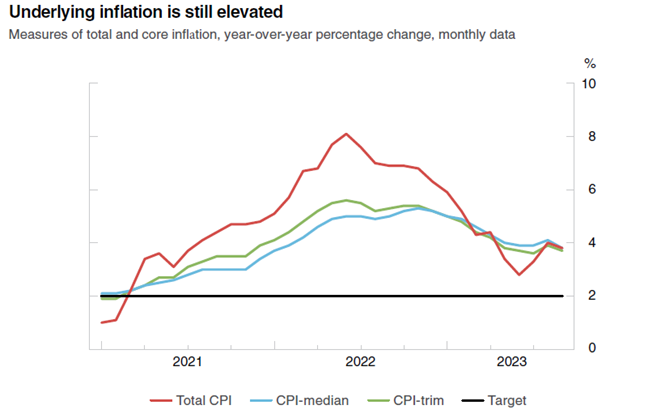

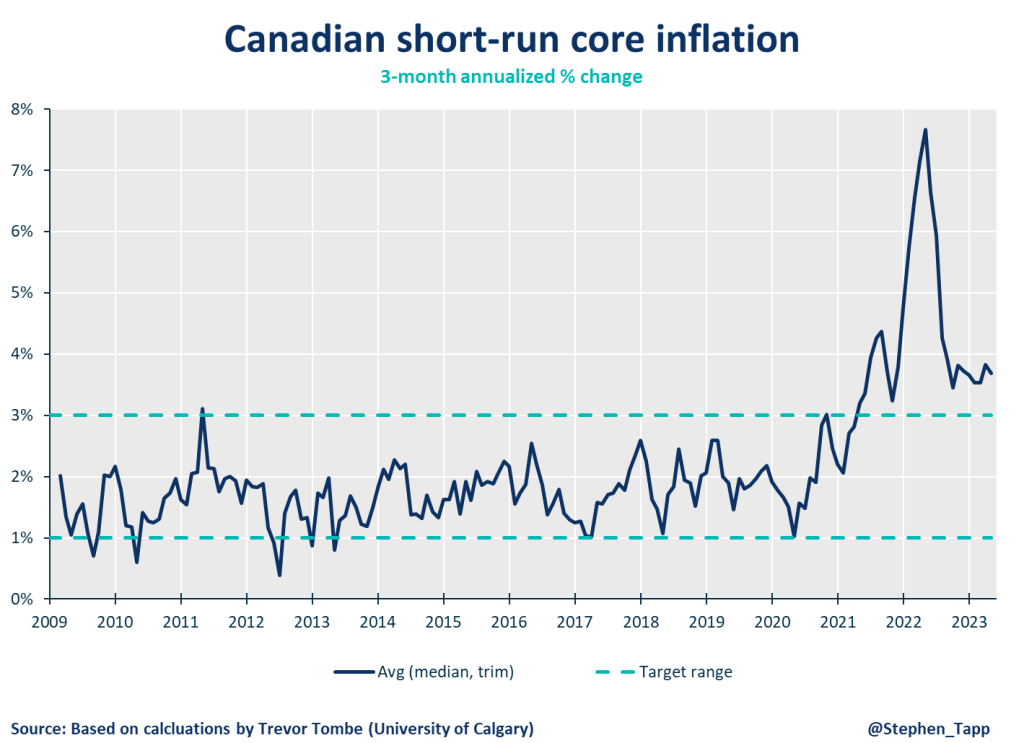

Unfortunately, Governing Council is still worried about “the persistence in underlying inflation” because core inflation measures are still too high —running at 3% to 3.5% (on an annual and quarterly basis). There needs to be “further and sustained easing in core inflation” before the Bank will cut rates.

Elevated shelter costs are another major concern for the Bank. Rate cuts, which are coming eventually, could entice buyers back into the housing market, and sustain these stubborn price pressures.

Looking ahead

The Bank’s business and consumers surveys will be released on April 1, providing additional signals on inflation expectations and corporate pricing behaviour.

On April 10, the Bank will make its next rate announcement and release updated economic projections. Don’t expect a cut then either. Financial markets put the odds of a rate cut at roughly 30% at the April meeting, but the first 0.25% cut is not fully baked until July, and a summer cut is still where the smart money is.

Other Commentaries

Oct 19, 2022

September 2022 Consumer Price Index data: Food and services prices still rising, no progress on core inflation

Sep 20, 2022

August 2022 Consumer Price Index data: Finally some good news on Canadian inflation.

Aug 16, 2022

July 2022 Consumer Price Index data: Canada’s inflation finally turns a corner with falling gas prices, but core pressures remain

Commentaries /

The Bank of Canada shifts from “whether to hike” to “how long to hold”.

The Bank of Canada shifts from “whether to hike” to “how long to hold”.

Today the Bank of Canada maintained its policy rate at 5% for the fourth straight decision. This move was unanimously expected by economists and markets, however, we did learn something today — the Bank dropped its hiking bias and shifted to neutral holding pattern for now.

Stephen Tapp

KEY TAKEAWAYS

- Today the Bank of Canada maintained its policy rate at 5% for the fourth straight decision. This move was unanimously expected by economists and markets, however, we did learn something today — the Bank dropped its hiking bias and shifted to neutral holding pattern for now. This is a first sign that we’re now walking slowly down a new path towards eventual interest rate cuts, rather than more hikes.

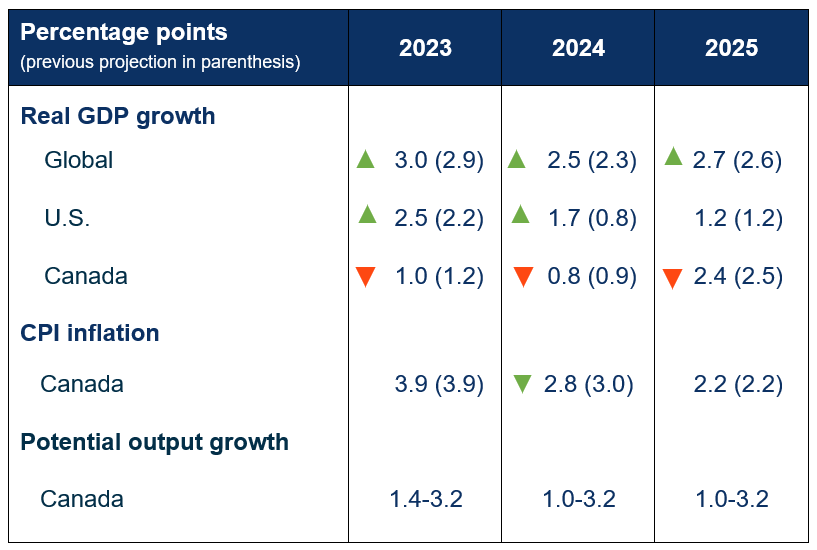

- Global growth: The Bank’s outlook for the global economy is slightly better than in October. This is primarily due to the U.S. economy out-performing expectation. Here, the Bank significantly revised up its forecast U.S. real GDP growth in 2024 to 1.7% from 0.8%.

- Canada’s economy: The Bank’s forecast for Canadian real GDP was largely unchanged, but the Bank now views the economy as operating slightly below its potential (i.e., in “modest excess supply”). Near-term growth is expected to remain essentially flat, with a pickup in the second half of 2024. Once again, the Bank does not expect negative GDP growth, but make no mistake, Canada’s economy is weak, especially when viewed in per capita terms, given that output and employment aren’t keeping pace with strong population growth.

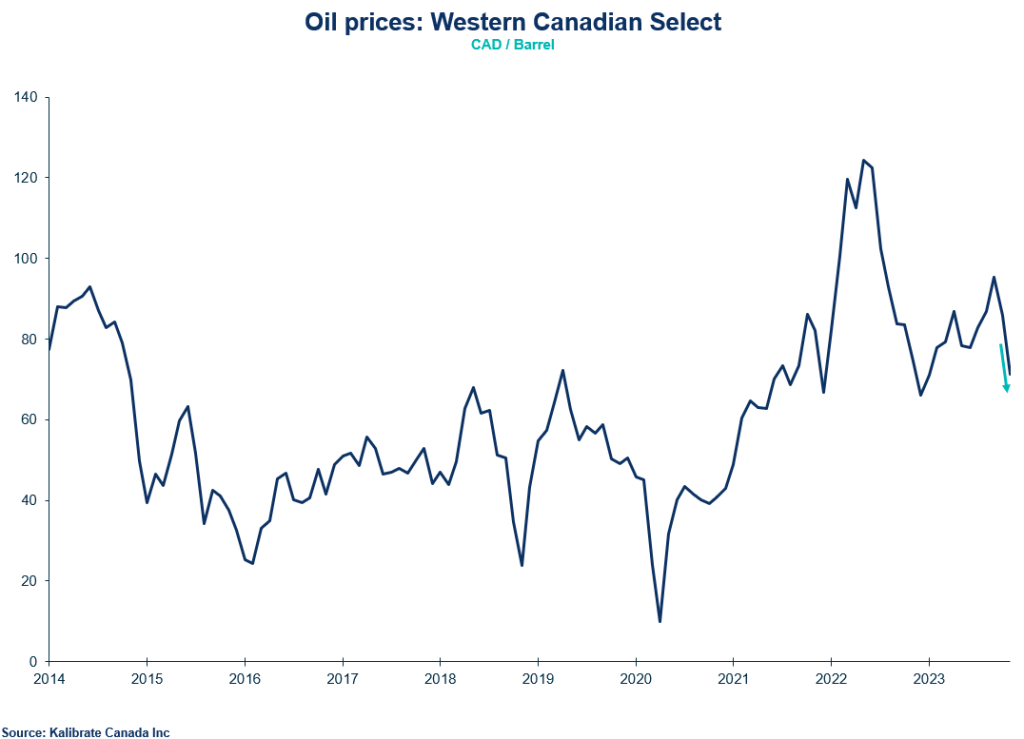

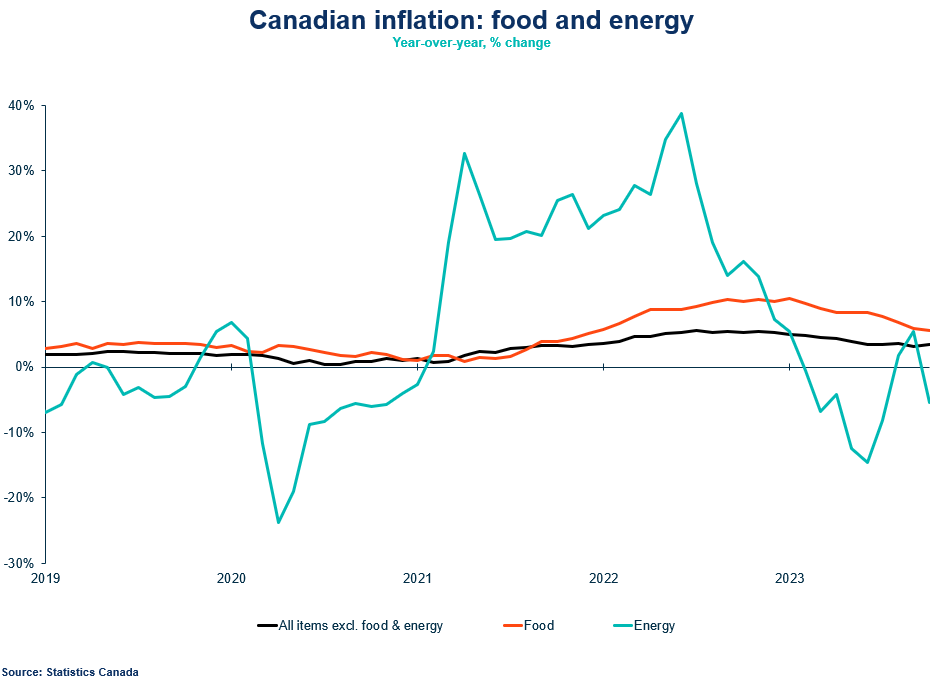

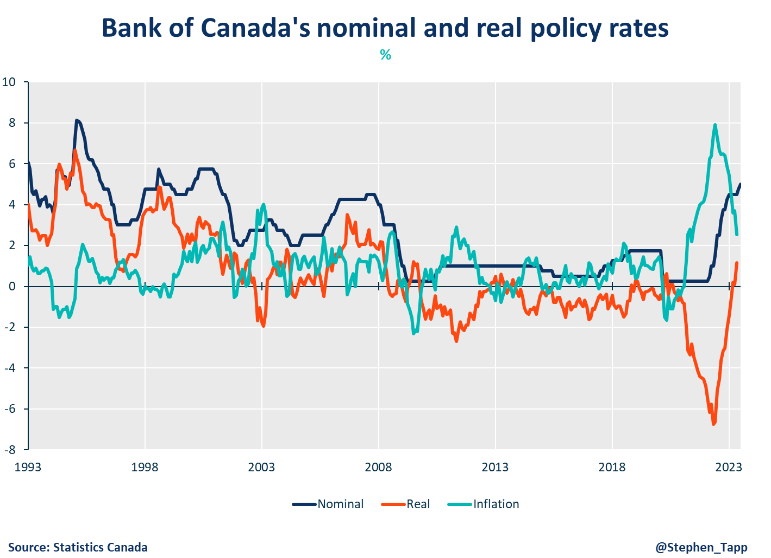

- Inflation: The Bank expects Canada’s headline inflation remaining around 3% for the first half of this year, and easing to around 2.5% in the second half, before returning to the 2% target in 2025. For the annual inflation forecast the picture is slightly improved and revised down by 0.2 percentage points this year, owing to lower oil and gasoline prices.

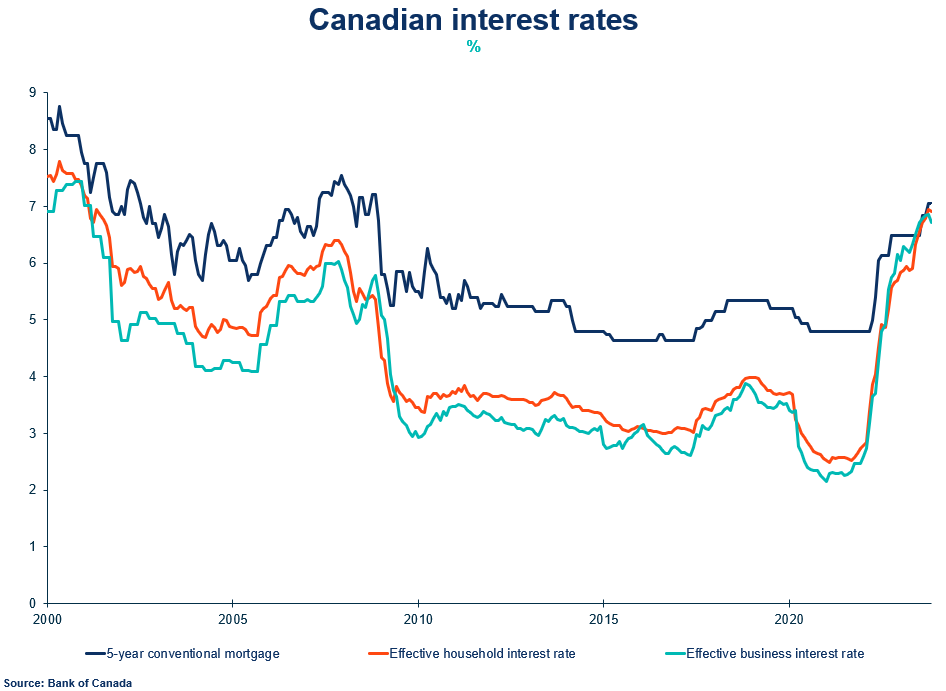

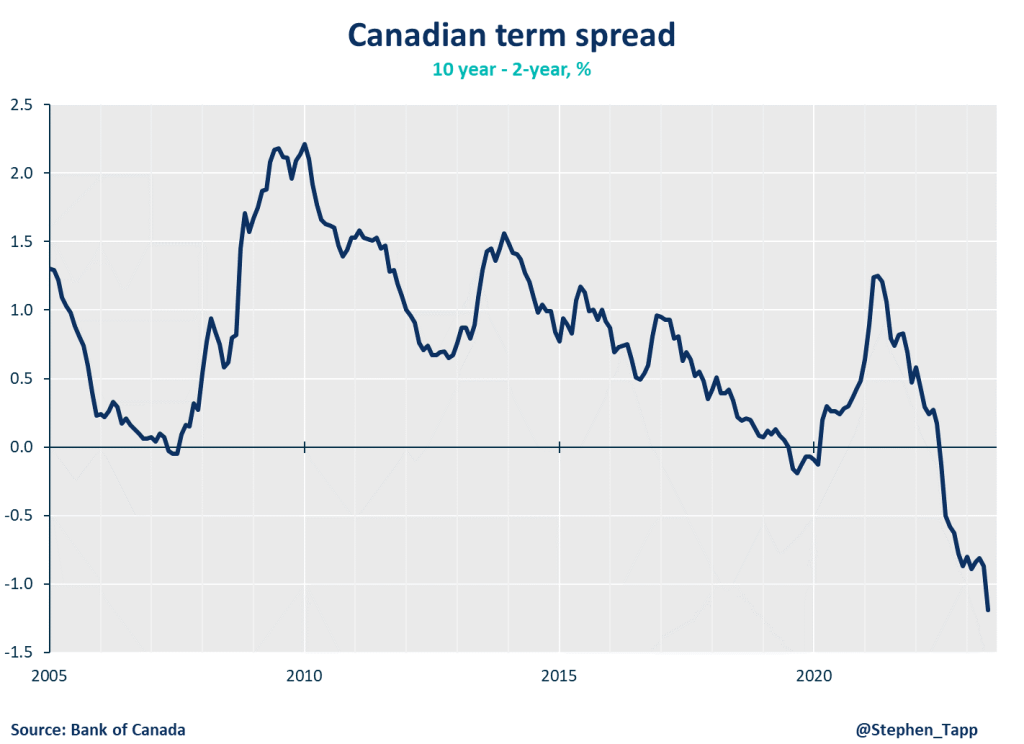

- When will interest rates come down? The core problem: “Governing Council wants to see further and sustained easing in core inflation”, which is still running around 3.5%. The other problematic parts of the inflation picture include shorter-run inflation expectations, still elevated wage growth, as well as the risk that future rate cuts could re-inflate Canada’s already-unaffordable housing market. Financial markets are currently factoring in a better-than-even chance (60%) that the Bank of Canada will cut its policy rate by 0.25% in April. I think this could prove too optimistic, and am leaning towards rate cuts beginning in the summer — unless short-run core inflation quickly and durably falls back into target range (i.e., is under 3% for three consecutive months).

Bank of Canada projections

Other Commentaries

Oct 19, 2022

September 2022 Consumer Price Index data: Food and services prices still rising, no progress on core inflation

Sep 20, 2022

August 2022 Consumer Price Index data: Finally some good news on Canadian inflation.

Aug 16, 2022

July 2022 Consumer Price Index data: Canada’s inflation finally turns a corner with falling gas prices, but core pressures remain

Commentaries /

Despite signs of relief, the Bank of Canada tells us to sit tight as they’re still “concerned” about inflation.

Despite signs of relief, the Bank of Canada tells us to sit tight as they’re still “concerned” about inflation.

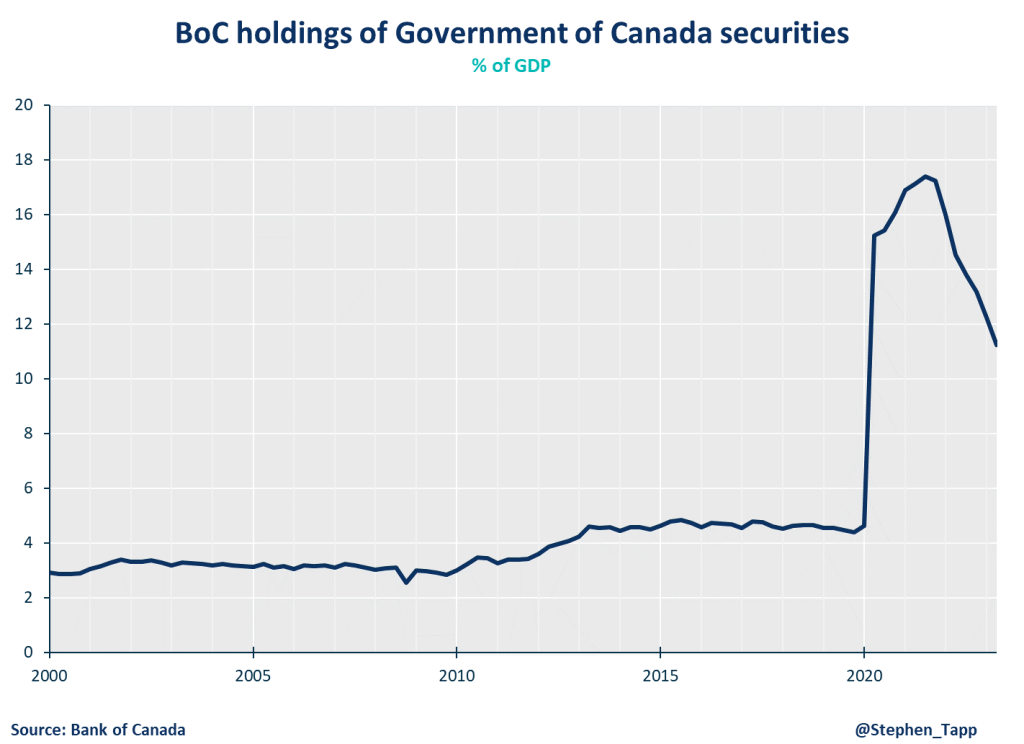

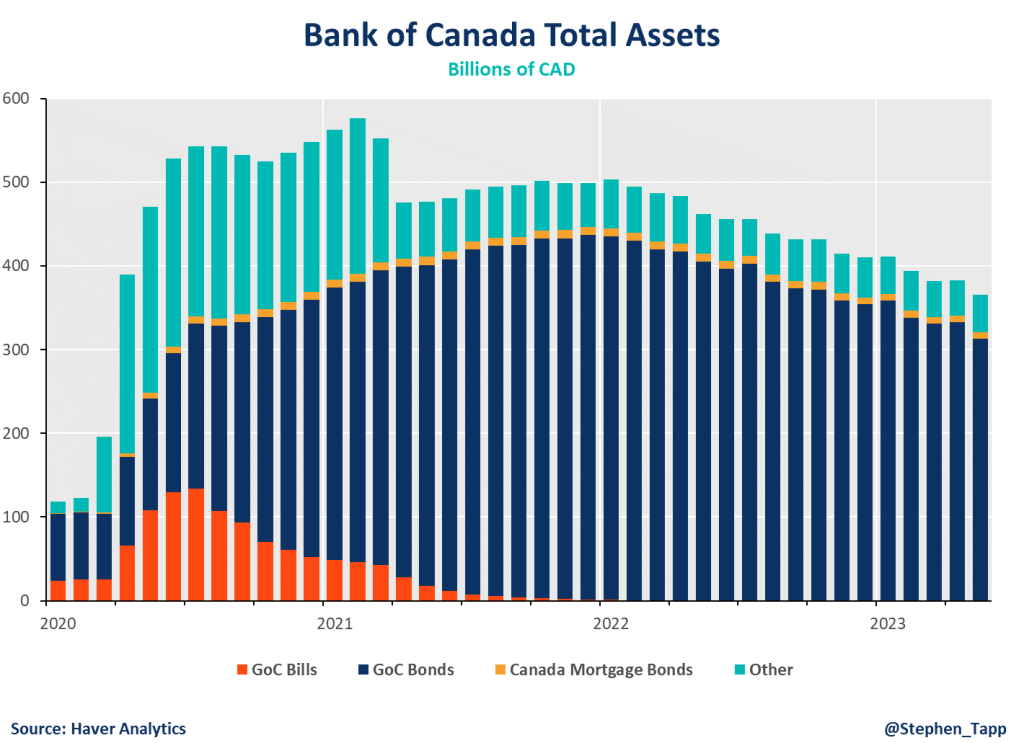

Today the Bank of Canada held its policy rate at 5% and continued quantitative tightening, by allowing maturing assets to roll off its balance sheet.

Andrew DiCapua

Businesses will take some comfort in today’s decision by the Bank of Canada to hold its policy rate. As we move closer to 2024, we’re going to see the discussion shift towards the timing of interest rate cuts, which will surely be a welcome development for many. But any optimism about rate cuts should be cautious, even if market participants are expecting these cuts before the second quarter. Many factors can complicate the timing of cuts, including the persistence of core inflation, the strength of the housing market, and whether first quarter GDP continues negative growth.

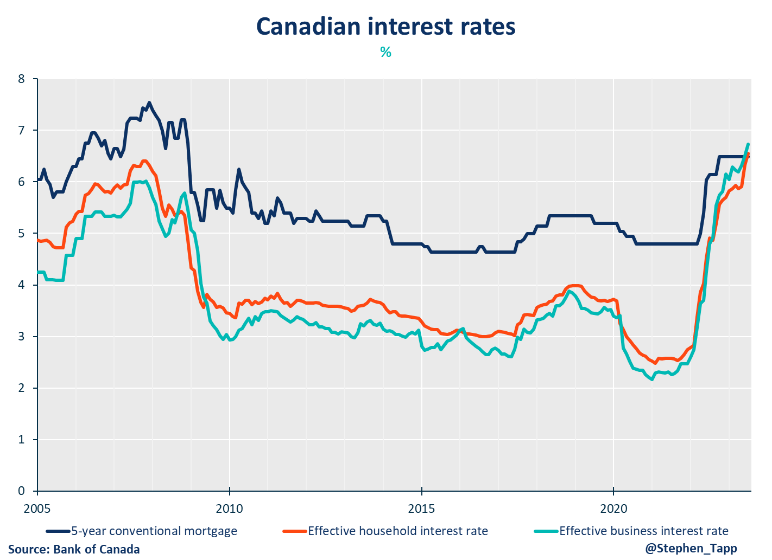

And even if rates were to decline, Canada’s affordability crisis is expected to worsen. Many businesses are reporting rising costs as a key concern, and they’ll need to refinance their debt from multi-decade lows.

What’s even more concerning is that households are being squeezed by significant increases in mortgage interest payments, with nearly $190 billion in renewals expected next year. Payments could increase anywhere from 20 to 50 per cent, depending on the type of mortgage, putting Canadian families under unprecedented pressure, and further restraining spending in the economy.

Andrew DiCapua, Senior Economist, Canadian Chamber of Commerce

KEY TAKEAWAYS

- Today the Bank of Canada held its policy rate at 5% and continued quantitative tightening, by allowing maturing assets to roll off its balance sheet.

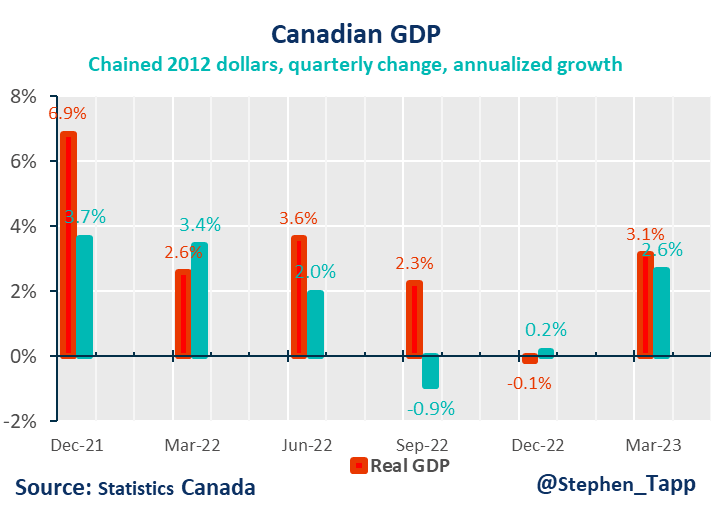

- Governing Council now judges that the Canadian economy is no longer in excess demand. This decision was expected by financial markets after last Thursday’s disappointing data, which showed a surprising contraction in Canada’s GDP in the third quarter (-1.1% annualized, which included upward revisions to previous data, and was well below the +0.2% growth expected). This slowdown is aiding in the easing of price pressures.

- As our Local Spending Tracker highlighted in the November update, consumer spending is slowing in response to higher rates. Real spending declined 1.1% and when accounting for population and inflation, spending fell 3.8% in October. The headline nominal GDP numbers are being supported by high levels of population growth, but digging into the details, the story is much worse. More than three quarters of the cities in our spending tracker are in negative real per person growth territory.

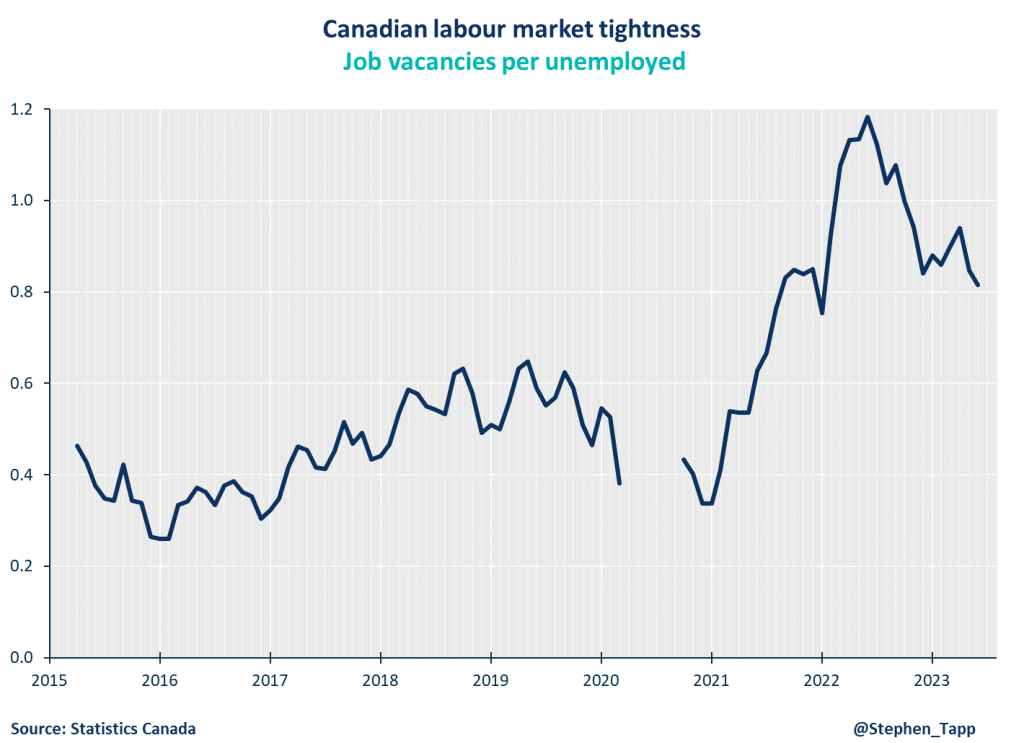

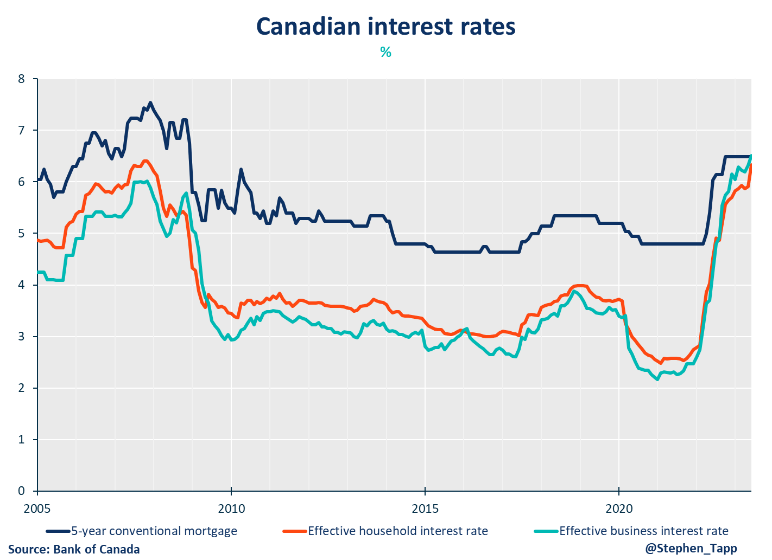

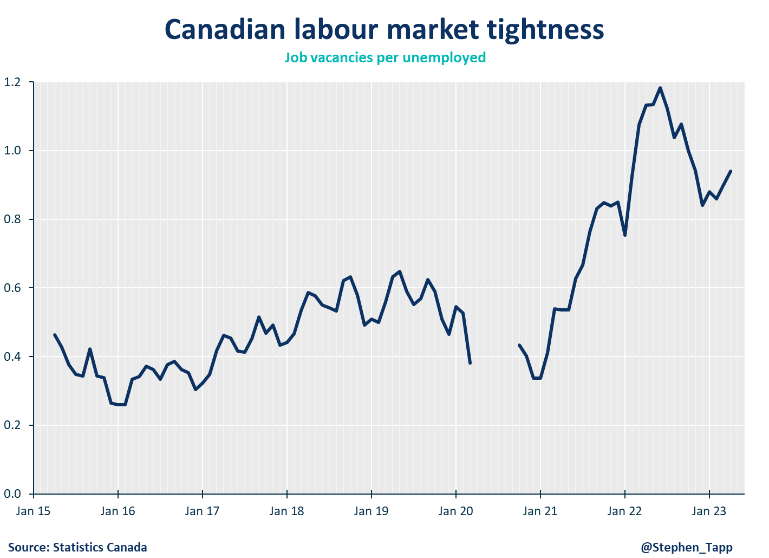

- The labour market is cooling with only 25k net jobs added in November. The unemployment rate increased further to 5.8%, now surpassing the 0.5% change threshold that generally indicates a recession. With the slower economic environment, firms are already slowing hiring and removing job postings, bringing the labour market more into balance. That said, wage growth remains elevated at between 4% and 5%. Given weak labour productivity, this is above the level that’s consistent with the 2% inflation target.

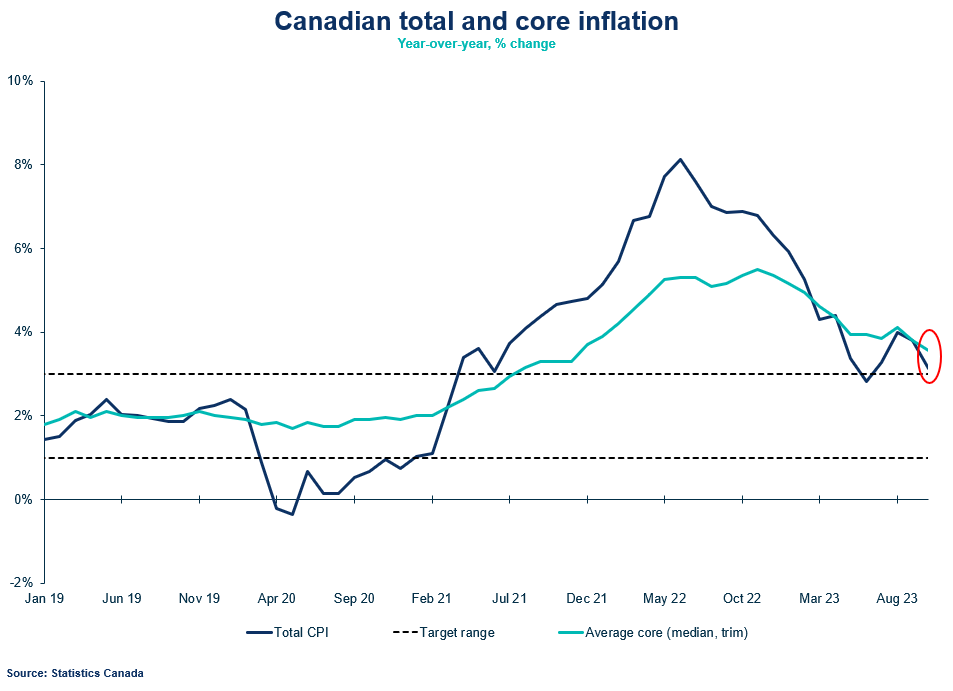

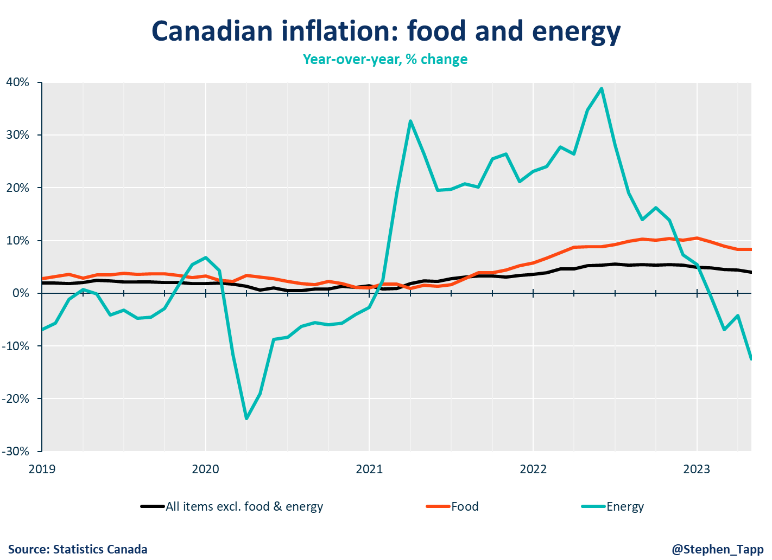

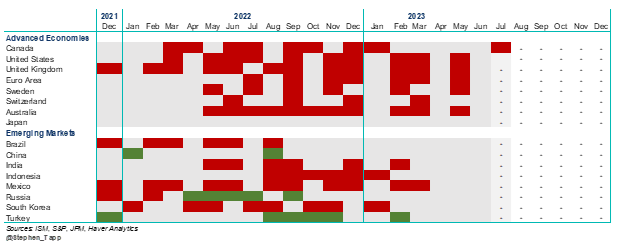

- Inflation remains above target at around 3.1% annualized. The Bank of Canada’s core measures (trim and median) are still running at 3.6% annualized. Recent declines in energy prices ($10 lower than previously assumed) have aided in the retreatment of inflation, but rent and shelter costs are still 3 times higher than target. Services inflation is also a key concern, which is showing up in core measures and remains above 3%.

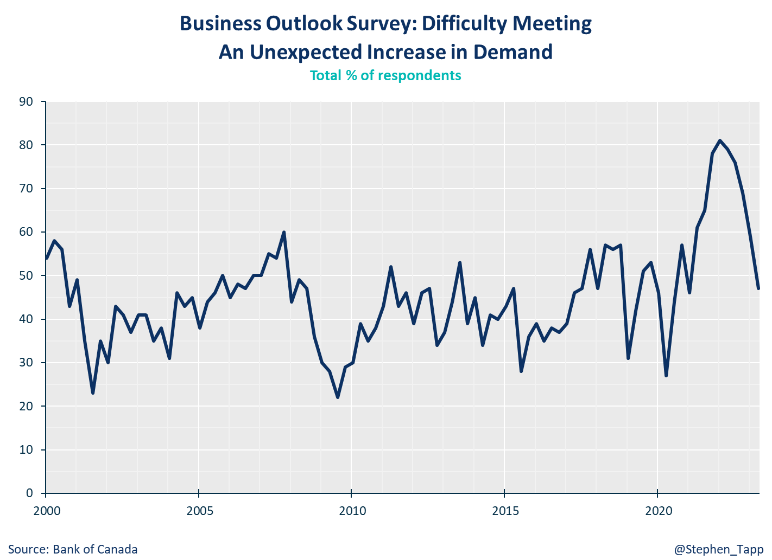

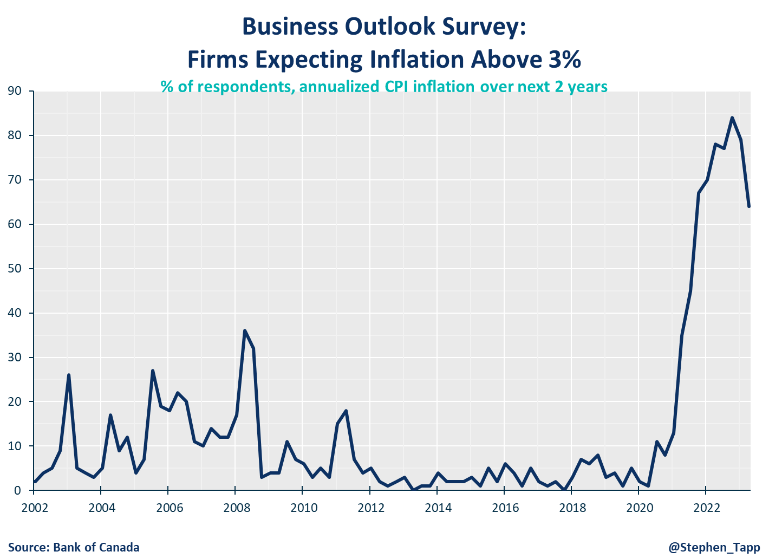

- Governing Council said it was looking for progress on: core inflation, the balance between demand and supply in the economy, inflation expectations, wage growth and corporate pricing behaviour. Although the Bank judges the economy is no longer in excess demand, all other indicators haven’t improved enough since their last decision.

- The Bank maintained it strong posture of “hawkish hold”, as expected. “Governing Council is still concerned about risks to the outlook for inflation and remains prepared to raise the policy rate further if needed.” This messaging is surely to guard against premature speculation that the Bank will consider cutting interest rates anytime soon.

- At the next meeting on January 24th, the Bank will release the January Monetary Policy Report with updated economic projections. As we head into 2024, the conversation will shift to the timing of the Bank of Canada rate cuts. Markets are expecting a rate cut before April. Given the weak economy and risk to household finances posed by higher debt servicing and mortgage renewals, the Bank will need to provide some relief to restore economy activity. Judging how restrictive its policy will need to be in order to balance inflation risks and economic growth, will be a challenge going forward.

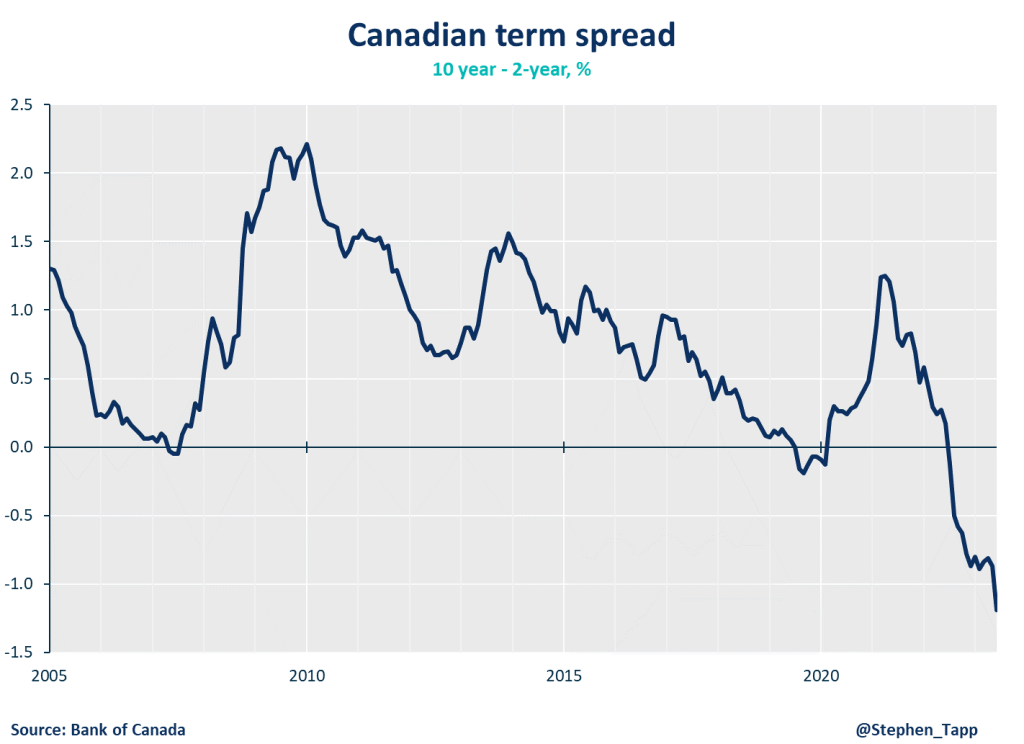

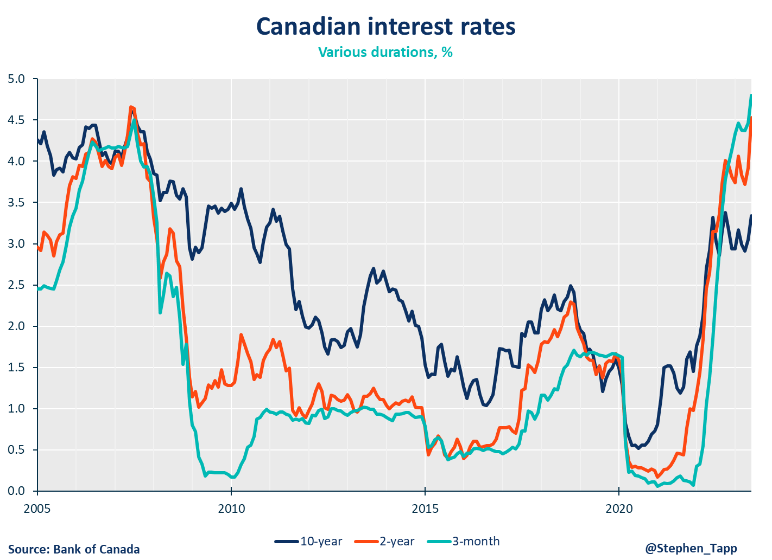

CHARTS

Other Commentaries

Oct 19, 2022

September 2022 Consumer Price Index data: Food and services prices still rising, no progress on core inflation

Sep 20, 2022

August 2022 Consumer Price Index data: Finally some good news on Canadian inflation.

Aug 16, 2022

July 2022 Consumer Price Index data: Canada’s inflation finally turns a corner with falling gas prices, but core pressures remain

Commentaries /

Another “hawkish hold” from the Bank of Canada, leaves the door open for more interest rate hikes.

Another “hawkish hold” from the Bank of Canada, leaves the door open for more interest rate hikes.

The Bank of Canada once again held its policy rate at 5%, which is its highest level since 2001, as the central bank tries to wrestle inflation back to target.

Stephen Tapp

KEY TAKEAWAYS

- Another hawkish hold: The Bank of Canada once again held its policy rate at 5%, which is its highest level since 2001, as the central bank tries to wrestle inflation back to target. This decision was widely expected; financial markets had priced in only a 5% chance of a rate hike today (although that was as high as 43% last week).

- Global growth largely unchanged: The Bank’s overall outlook for the global economy is largely unchanged from July. However, the composition has changed: upward revisions for the “surprisingly robust” U.S. economy, offset downward revisions for China, which reflect stress in the property sector and slower credit growth. The war in Israel and Gaza was cited as a new source of geopolitical uncertainty.

- Canada’s economy slowing down: Despite an improved outlook for the U.S. economy, the Bank revised down its outlook for Canada’s GDP growth in 2023 (to 1.2% from 1.8%) and 2024 (to 0.9% from 1.2%). They cited accumulating evidence that past rate hikes are dampening activity (especially consumer spending and housing), and bringing demand and supply into better balance. The Bank continues to forecast very weak positive growth in Canada over the next year, but no recession.

- Inflation outlook remains problematic: Canada’s headline inflation was 3.8% in September, and core price measures have unfortunately shown only modest progress over the past six months.

- The Bank revised up its forecast for headline CPI inflation over the projection (partly reflecting higher inflation outturns to-date as well as higher oil prices going forward). The Bank now expects inflation to remain around 3.5% through the middle of 2024. The annual averages are not that encouraging, at 3.9% in 2023 and 3.0% in 2024, before gradually getting closer to target in 2025.

- Possibly not the end of this hiking cycle: Governing Council expressed concern that inflation progress has been slow, and that inflation risks have risen, while re-iterating that they will raise rates again if needed.

- They will be seeking progress in several key areas, all of which remain concerning: core inflation; wages; corporate pricing behaviour; and inflation expectations.

- Financial markets are currently factoring in a roughly 40% chance of one more rate hike over the next few meetings in either December and January.

BANK OF CANADA PROJECTIONS

Other Commentaries

Oct 19, 2022

September 2022 Consumer Price Index data: Food and services prices still rising, no progress on core inflation

Sep 20, 2022

August 2022 Consumer Price Index data: Finally some good news on Canadian inflation.

Aug 16, 2022

July 2022 Consumer Price Index data: Canada’s inflation finally turns a corner with falling gas prices, but core pressures remain

Commentaries /

Sputtering economy puts the Bank of Canada on pause

Sputtering economy puts the Bank of Canada on pause

While the Bank held its fire, we should consider this a “hawkish hold,” emphasizing that it will raise interest rates...

Rewa

While the Bank held its fire, we should consider this a “hawkish hold,” emphasizing that it will raise interest rates further, if needed. Even though underlying inflation pressures remain problematic, the abrupt and unexpected contraction in Canada’s economy in the second quarter is for now overshadowing inflation concerns. Leading indicators suggests we could be heading into a mild recession, if we aren’t already there.

Stephen Tapp, Chief Economist, Canadian Chamber of Commerce

KEY TAKEAWAYS

- After two consecutive rate increases over the summer, today the Bank of Canada held its policy rate at 5.0% and continued quantitative tightening, by allowing maturing assets to roll off its balance sheet. These moves were widely expected by financial markets after last Friday’s disappointing data, which showed a surprising contraction in Canada’s GDP in the second quarter (-0.2% annualized, which included downward revisions to previous data, and was well below the +1.2% growth expected).

- As our Local Spending Tracker indicated earlier, consumer spending is finally slowing in response to higher rates. For the overall economy, fast growth in population and prices have flattered headline nominal numbers, but digging into the real numbers reveals a much weaker story: official data now show Canada’s inflation-adjusted household spending per person fell in three of the last four quarters. Real GDP per capita and productivity data have also brought serial disappointments.

- The labour market has also softened with falling labour demand showing up in lower job vacancies. The unemployment rate has recently crept up 0.5 percentage points—which is close to crossing a threshold that often signals a recession is underway. That said, wage growth remains elevated at between 4% and 5%. Given weak labour productivity, this is above the level that’s consistent with the 2% inflation target.

- Inflation remains broad-based and running too hot at around 3.5% annualized. It is still uncomfortably above the top of the Bank of Canada’s inflation control target, both on a year-over-year basis and in shorter-term “core” measures. The Bank emphasized that, “the longer high inflation persists, the greater the risk that elevated inflation becomes entrenched, making it more difficult to restore price stability.”

- In the last announcement, Governing Council said it was looking for progress on: short-run core inflation; wages; corporate pricing behaviour; and inflation expectations. Unfortunately, all these signs remain problematic. However, the abrupt slowdown in Canada’s economy is overshadowing these concerns and suggests we could be heading into a mild recession, if we aren’t already there.

- Overall, the Bank delivered a “hawkish hold”, as expected, stating that “Governing Council remains concerned about the persistence of underlying inflationary pressures, and is prepared to increase the policy interest rate further if needed.”

- We will have to wait until October 25th for the Bank’s next Monetary Policy Report with updated economic projections. Right now, we could be headed for mild “stagflation”, which would be difficult for the BoC, featuring slow or stagnant economic growth, but stubborn inflation that’s slow to return to the 2% target.

CHARTS

Other Commentaries

Oct 19, 2022

September 2022 Consumer Price Index data: Food and services prices still rising, no progress on core inflation

Sep 20, 2022

August 2022 Consumer Price Index data: Finally some good news on Canadian inflation.

Aug 16, 2022

July 2022 Consumer Price Index data: Canada’s inflation finally turns a corner with falling gas prices, but core pressures remain

Commentaries /

July 2023: The Bank of Canada raises its policy rate to 5% as it worries disinflation progress is stalled

July 2023: The Bank of Canada raises its policy rate to 5% as it worries disinflation progress is stalled

The Bank of Canada raised its policy rate by 25 basis points for the second consecutive meeting. It now sits at 5.0%, the highest rate since 2001, as the central bank tries to wrestle inflation back to target.

Rewa

KEY TAKEAWAYS

- The Bank of Canada raised its policy rate by 25 basis points for the second consecutive meeting. It now sits at 5.0%, the highest rate since 2001, as the central bank tries to wrestle inflation back to target. This move was no surprise: most forecasters expected it; and financial markets largely priced it in beforehand (giving it about a 70% chance). The Bank is continuing quantitative tightening, as assets roll off its balance sheet.

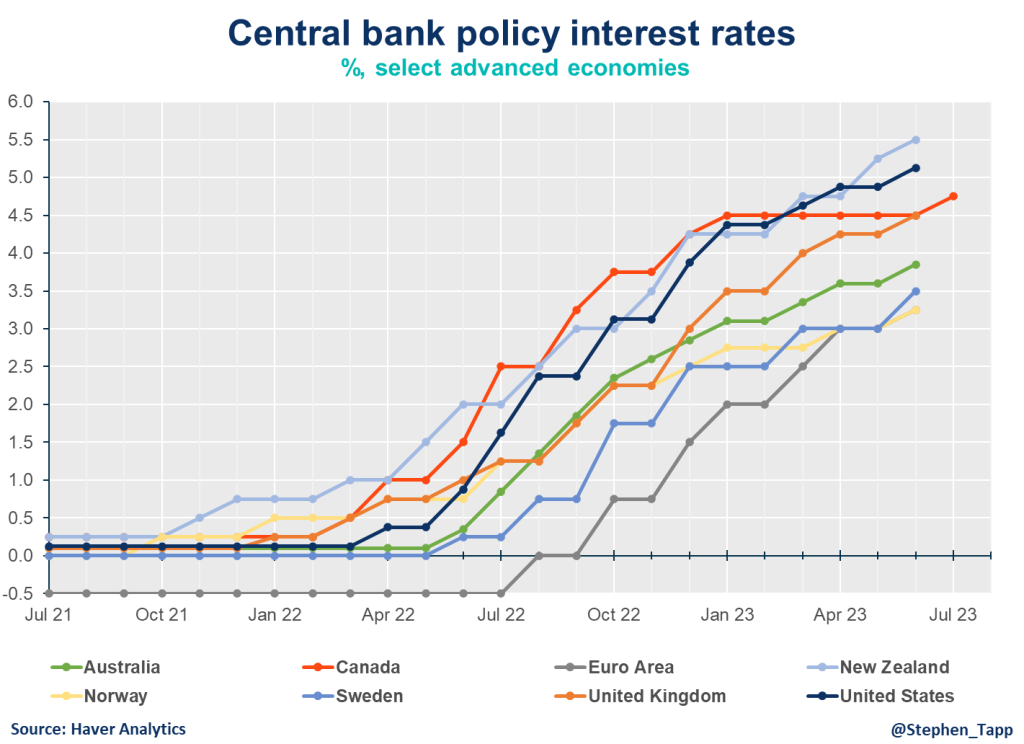

- Stronger-than-expected U.S. economy, more global price pressure: The Bank revised up its near-term outlook for the global economy, led by the U.S., reflecting “surprisingly robust” consumer spending. Despite the slowdown in headline inflation, core inflation pressures — especially for services — remain stubbornly high across many economies, and other central banks are expected to raise rates further.

- Canada holding up better-than-expected: The Bank also revised up its outlook for Canada’s GDP growth this year, citing more persistent excess demand. continued tightness in the labour market, the upturn in housing, and strong population growth coming from immigration. That said, Canada’s growth is expected to be below trend, averaging only 1% over the next 12 months, as the economy adjusts to the lagged effects of higher interest rates. This still represents a “soft landing”, which is more optimistic than expected by most Canadian forecasters.

- Inflation proving more persistent: Canada’s headline inflation slowed to 3.4% in May. However much of this progress is from lower energy prices relative to a year ago. With these “base-year effects” dropping out of future year-over-year calculations, disinflation progress will slow. Indeed, short-run core inflation (3-month annualized rates that remove volatile components, and are a key metric for the Bank) has been running between 3.5% and 4% since last September, raising concerns that progress has stalled.

- The Bank now expects headline CPI inflation to stay around 3% for the next year, before declining gradually to the 2% target by mid-2025, which is six months later than in the last projection.

- Possibly the end of the road: Looking ahead, Governing Council will be looking for more progress on: short-run core inflation dynamics; wages; normalized corporate pricing behaviour; and anchoring of inflation expectations across the economy. All of these signs remain problematic for now. Financial markets are pricing in a roughly 1-in-3 chance of another rate hike in September. If the key metrics above show continued progress, then today’s move to 5% will likely mark the end of this tightening cycle. But there’s little doubt that central banks across advanced economies will continue to tighten financial conditions. And further hikes in Canada will stay on the table, until the Bank is satisfied that inflation will safely return to 2%.

SUMMARY TABLES

CHARTS

Other Commentaries

Oct 19, 2022

September 2022 Consumer Price Index data: Food and services prices still rising, no progress on core inflation

Sep 20, 2022

August 2022 Consumer Price Index data: Finally some good news on Canadian inflation.

Aug 16, 2022

July 2022 Consumer Price Index data: Canada’s inflation finally turns a corner with falling gas prices, but core pressures remain

Commentaries /

June 2023 CPI: Breaking its conditional pause, BoC issues a 25 basis point taking the overnight rate to 4.75%

June 2023 CPI: Breaking its conditional pause, BoC issues a 25 basis point taking the overnight rate to 4.75%

The Bank of Canada increased interest rates once again, after taking a short pause of only a few months.

Rewa

Today, the Bank of Canada increased interest rates once again, after taking a short pause of only a few months. The increase of 25 basis points takes the overnight rate to 4.75%. After two stronger-than-expected reports – by way of April’s inflation increase and Q1 2023’s GDP growth – this decision is not shocking but was not expected until July when the Bank issues its next Monetary Policy Report. As the cumulative impact of past rate hikes continue to slow demand and inflation, this decision is proof that the Bank is resolute in its determination to return inflation to the 2% target

Marwa Abdou, Senior Research Director, Canadian Chamber of Commerce

SUMMARY TABLE

CHARTS

Other Commentaries

Oct 19, 2022

September 2022 Consumer Price Index data: Food and services prices still rising, no progress on core inflation

Sep 20, 2022

August 2022 Consumer Price Index data: Finally some good news on Canadian inflation.

Aug 16, 2022