Commentaries /

Another “hawkish hold” from the Bank of Canada, leaves the door open for more interest rate hikes.

Another “hawkish hold” from the Bank of Canada, leaves the door open for more interest rate hikes.

The Bank of Canada once again held its policy rate at 5%, which is its highest level since 2001, as the central bank tries to wrestle inflation back to target.

Stephen Tapp

KEY TAKEAWAYS

- Another hawkish hold: The Bank of Canada once again held its policy rate at 5%, which is its highest level since 2001, as the central bank tries to wrestle inflation back to target. This decision was widely expected; financial markets had priced in only a 5% chance of a rate hike today (although that was as high as 43% last week).

- Global growth largely unchanged: The Bank’s overall outlook for the global economy is largely unchanged from July. However, the composition has changed: upward revisions for the “surprisingly robust” U.S. economy, offset downward revisions for China, which reflect stress in the property sector and slower credit growth. The war in Israel and Gaza was cited as a new source of geopolitical uncertainty.

- Canada’s economy slowing down: Despite an improved outlook for the U.S. economy, the Bank revised down its outlook for Canada’s GDP growth in 2023 (to 1.2% from 1.8%) and 2024 (to 0.9% from 1.2%). They cited accumulating evidence that past rate hikes are dampening activity (especially consumer spending and housing), and bringing demand and supply into better balance. The Bank continues to forecast very weak positive growth in Canada over the next year, but no recession.

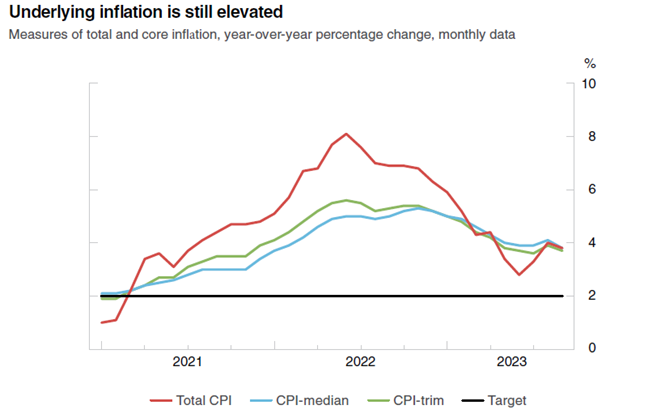

- Inflation outlook remains problematic: Canada’s headline inflation was 3.8% in September, and core price measures have unfortunately shown only modest progress over the past six months.

- The Bank revised up its forecast for headline CPI inflation over the projection (partly reflecting higher inflation outturns to-date as well as higher oil prices going forward). The Bank now expects inflation to remain around 3.5% through the middle of 2024. The annual averages are not that encouraging, at 3.9% in 2023 and 3.0% in 2024, before gradually getting closer to target in 2025.

- Possibly not the end of this hiking cycle: Governing Council expressed concern that inflation progress has been slow, and that inflation risks have risen, while re-iterating that they will raise rates again if needed.

- They will be seeking progress in several key areas, all of which remain concerning: core inflation; wages; corporate pricing behaviour; and inflation expectations.

- Financial markets are currently factoring in a roughly 40% chance of one more rate hike over the next few meetings in either December and January.

BANK OF CANADA PROJECTIONS

Other Commentaries

commentaries

Oct 19, 2022

September 2022 Consumer Price Index data: Food and services prices still rising, no progress on core inflation

Our Chief Economist, Stephen Tapp, looks at Canada’s headline inflation, which edged down for the third month in a row. There was no progress on “core” inflation, which held steady at 5%.

commentaries

Sep 20, 2022

August 2022 Consumer Price Index data: Finally some good news on Canadian inflation.

Stephen Tapp, our Chief Economist, looks at Canada’s headline inflation for August, which fell for the second straight month. Core inflation and services measures have also finally started to slow.

commentaries

Aug 16, 2022

July 2022 Consumer Price Index data: Canada’s inflation finally turns a corner with falling gas prices, but core pressures remain

Our Chief Economist, Stephen Tapp, looks at Canada’s headline inflation, which is finally showing signs of cooling off.