Commentaries /

Bank of Canada waiting to see sustained inflation progress it cuts rates

Bank of Canada waiting to see sustained inflation progress it cuts rates

Today the Bank of Canada held its policy rate at 5% for the sixth consecutive time, a move that was widely expected.

Stephen Tapp

KEY TAKEAWAYS

- Today, the Bank of Canada held its policy rate at 5% for the sixth consecutive time, a move that was widely expected. While the Bank has seen encouraging progress in the fight against inflation and Canadian economic growth in recent months, they are still cautious and would like to see more progress before considering rate cuts.

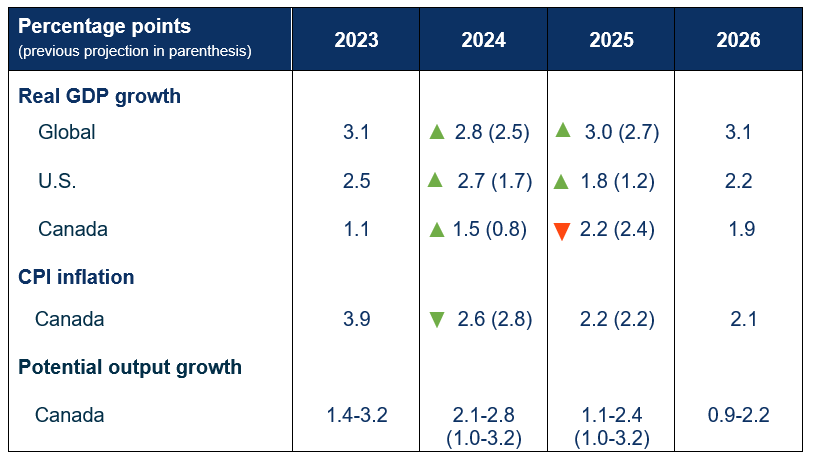

- Stronger global growth, led by the U.S: The Bank’s outlook for the global economy was revised up, largely reflecting strength in the United States. The forecast for U.S. real GDP growth in 2024 is now a robust 2.7%, up from 1.7% — taken together with the upward revision to U.S. growth next year and the weakening Canadian dollar, this should help Canadian exports. Growth in Europe remains weak, while China faces ongoing headwinds from its property sector.

- Canada’s economy boosted by population growth: The Bank’s forecast for Canadian real GDP was also revised up this year to 1.5% from 0.8%, including a considerable step up for the first quarter. This largely reflects good recent data and faster population growth in 2024 (as weakness in real GDP per capita unfortunately continues). Population growth slows in 2025 due to new limits on non-permanent residents entering Canada.

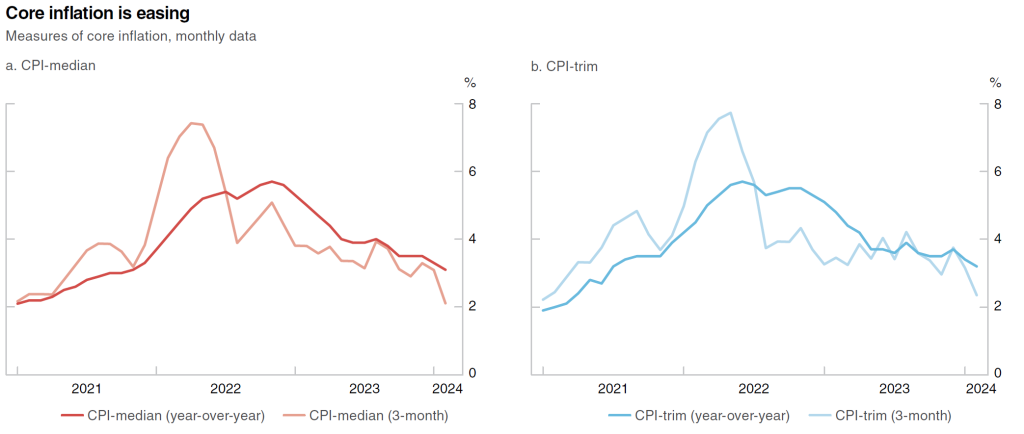

- Inflation progress continues: After two months of better-than-expected data, the Bank’s inflation forecast was revised down for this year (to 2.6% from 2.8%). The Bank sees inflation falling below 2.5% in the second half of 2024, and getting close to the 2% target by the end of 2025.

- Neutral rate and potential output growth adjustments: Every April the Bank updates its estimate of potential output growth and the “neutral” policy rate. The changes to potential output mostly reflect the population dynamics noted above, which help 2024 and hurt 2025, and are mostly a wash over the projection. The neutral rate (an estimated interest rate that’s seen as neither encouraging or discouraging inflation) was revised up by 0.25%, to a range of 2.25% to 3.25%. This isn’t a big move, but means the Bank could keep interest rates slightly higher over the long-term.

- Looking ahead: The Bank’s next rate announcement is on June 5, with markets currently pricing in a slightly better than even chance (~60%) of a rate cut. The key releases to watch before that date are the Federal Budget (for government spending plan), and the inflation data for March and April. Monetary policy has been working, but Governing Council is just looking for a little more evidence that the downward momentum in inflation is sustained. If the good news on short-run core inflation continues for the next two months, then the Bank will likely cut rates in June. They’re not in a rush, however, and if we get any inflation setbacks — like in the U.S. —then the Bank of Canada will patiently stay in wait-and-see mode.

BANK OF CANADA PROJECTIONS

Other Commentaries

commentaries

Oct 19, 2022

September 2022 Consumer Price Index data: Food and services prices still rising, no progress on core inflation

Our Chief Economist, Stephen Tapp, looks at Canada’s headline inflation, which edged down for the third month in a row. There was no progress on “core” inflation, which held steady at 5%.

commentaries

Sep 20, 2022

August 2022 Consumer Price Index data: Finally some good news on Canadian inflation.

Stephen Tapp, our Chief Economist, looks at Canada’s headline inflation for August, which fell for the second straight month. Core inflation and services measures have also finally started to slow.

commentaries

Aug 16, 2022

July 2022 Consumer Price Index data: Canada’s inflation finally turns a corner with falling gas prices, but core pressures remain

Our Chief Economist, Stephen Tapp, looks at Canada’s headline inflation, which is finally showing signs of cooling off.