Commentaries /

Despite signs of relief, the Bank of Canada tells us to sit tight as they’re still “concerned” about inflation.

Despite signs of relief, the Bank of Canada tells us to sit tight as they’re still “concerned” about inflation.

Today the Bank of Canada held its policy rate at 5% and continued quantitative tightening, by allowing maturing assets to roll off its balance sheet.

Andrew DiCapua

Businesses will take some comfort in today’s decision by the Bank of Canada to hold its policy rate. As we move closer to 2024, we’re going to see the discussion shift towards the timing of interest rate cuts, which will surely be a welcome development for many. But any optimism about rate cuts should be cautious, even if market participants are expecting these cuts before the second quarter. Many factors can complicate the timing of cuts, including the persistence of core inflation, the strength of the housing market, and whether first quarter GDP continues negative growth.

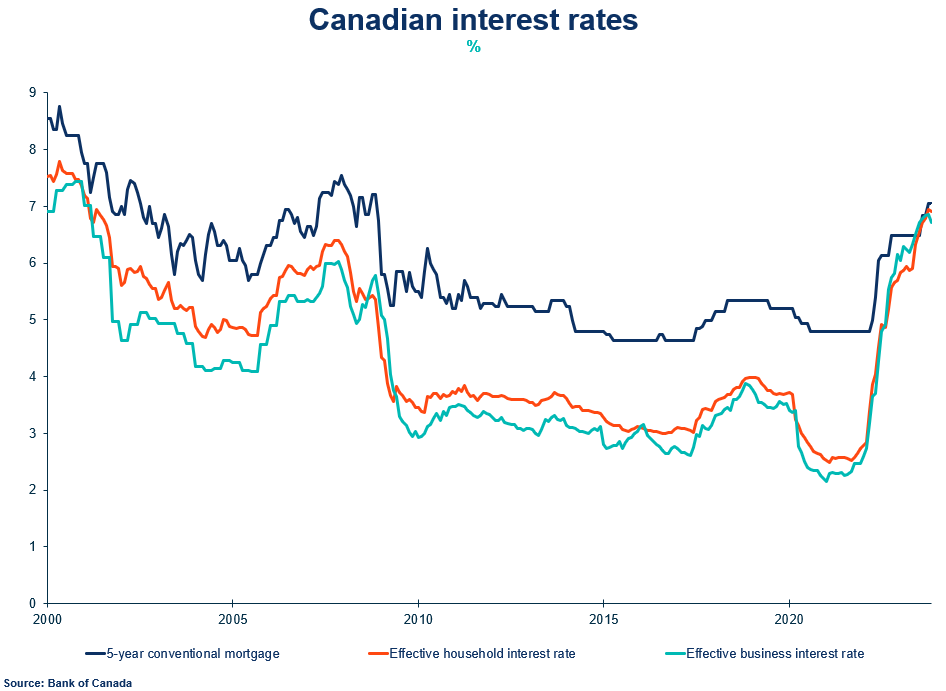

And even if rates were to decline, Canada’s affordability crisis is expected to worsen. Many businesses are reporting rising costs as a key concern, and they’ll need to refinance their debt from multi-decade lows.

What’s even more concerning is that households are being squeezed by significant increases in mortgage interest payments, with nearly $190 billion in renewals expected next year. Payments could increase anywhere from 20 to 50 per cent, depending on the type of mortgage, putting Canadian families under unprecedented pressure, and further restraining spending in the economy.

Andrew DiCapua, Senior Economist, Canadian Chamber of Commerce

KEY TAKEAWAYS

- Today the Bank of Canada held its policy rate at 5% and continued quantitative tightening, by allowing maturing assets to roll off its balance sheet.

- Governing Council now judges that the Canadian economy is no longer in excess demand. This decision was expected by financial markets after last Thursday’s disappointing data, which showed a surprising contraction in Canada’s GDP in the third quarter (-1.1% annualized, which included upward revisions to previous data, and was well below the +0.2% growth expected). This slowdown is aiding in the easing of price pressures.

- As our Local Spending Tracker highlighted in the November update, consumer spending is slowing in response to higher rates. Real spending declined 1.1% and when accounting for population and inflation, spending fell 3.8% in October. The headline nominal GDP numbers are being supported by high levels of population growth, but digging into the details, the story is much worse. More than three quarters of the cities in our spending tracker are in negative real per person growth territory.

- The labour market is cooling with only 25k net jobs added in November. The unemployment rate increased further to 5.8%, now surpassing the 0.5% change threshold that generally indicates a recession. With the slower economic environment, firms are already slowing hiring and removing job postings, bringing the labour market more into balance. That said, wage growth remains elevated at between 4% and 5%. Given weak labour productivity, this is above the level that’s consistent with the 2% inflation target.

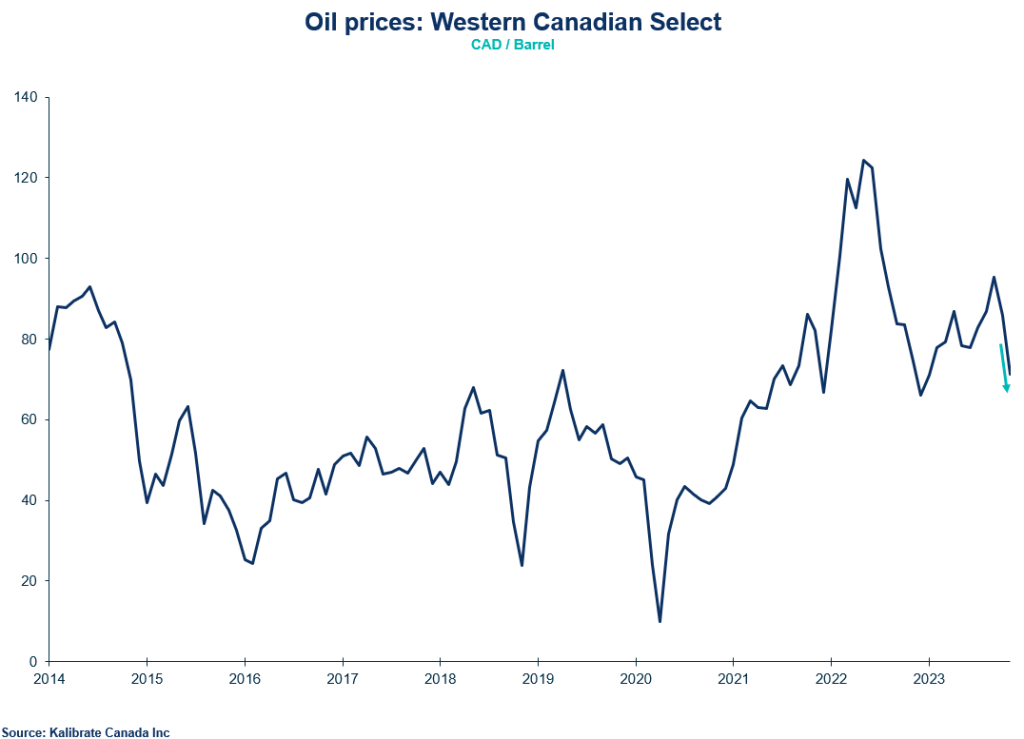

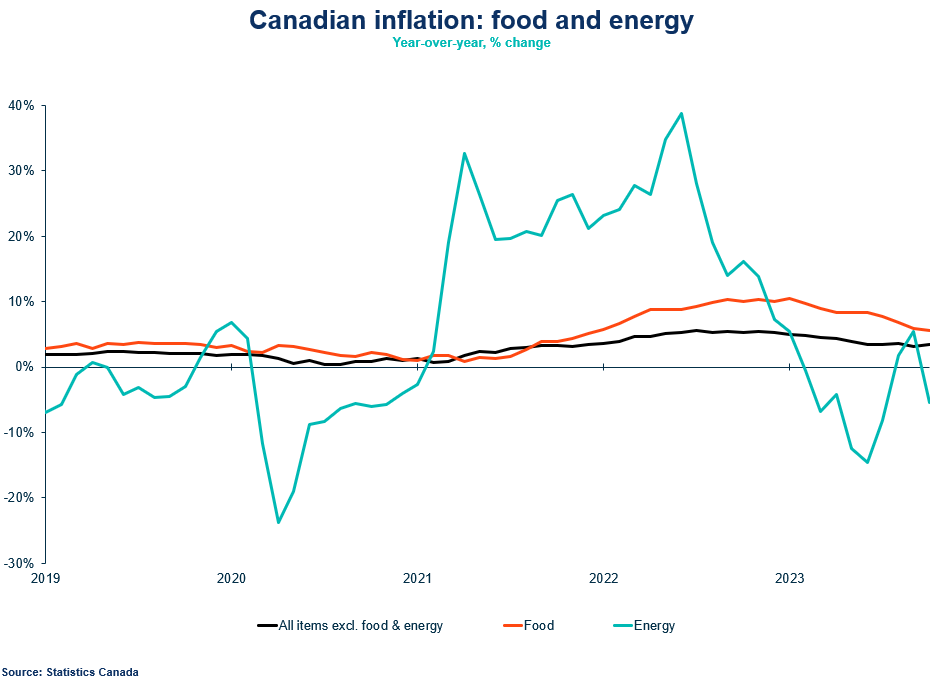

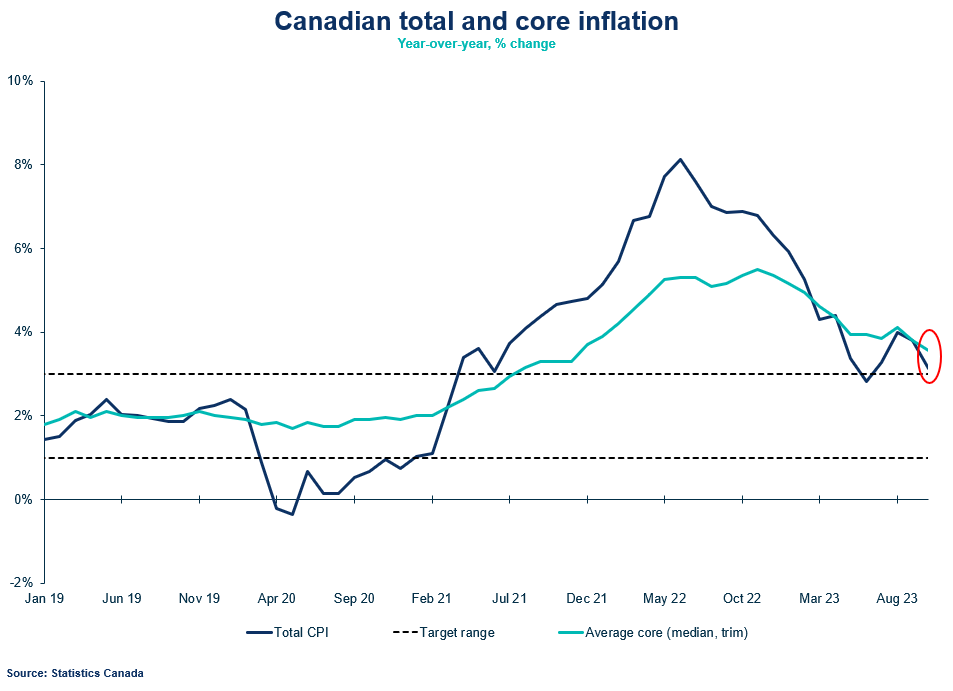

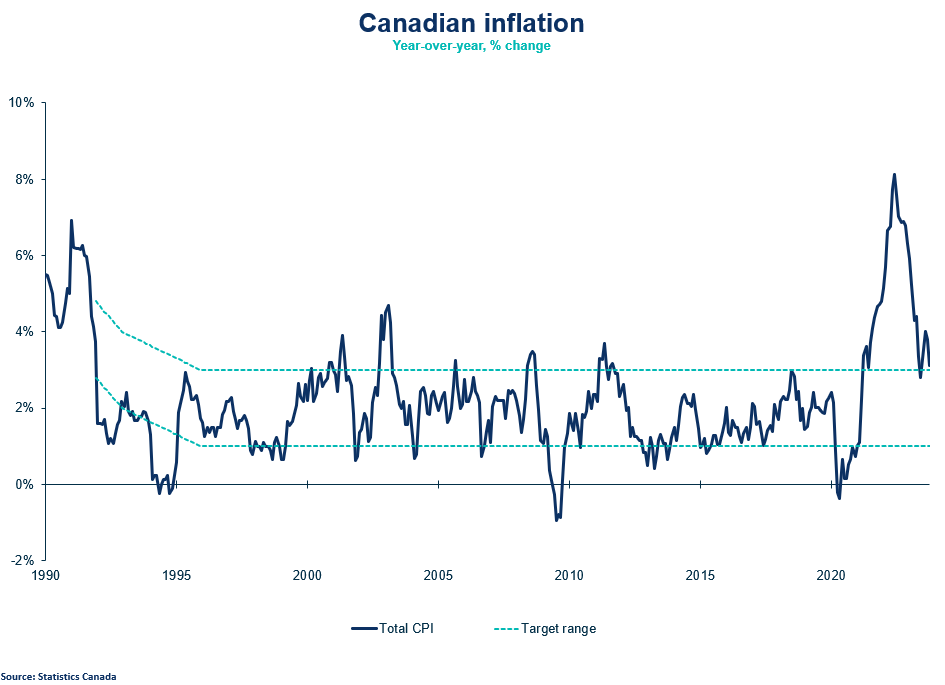

- Inflation remains above target at around 3.1% annualized. The Bank of Canada’s core measures (trim and median) are still running at 3.6% annualized. Recent declines in energy prices ($10 lower than previously assumed) have aided in the retreatment of inflation, but rent and shelter costs are still 3 times higher than target. Services inflation is also a key concern, which is showing up in core measures and remains above 3%.

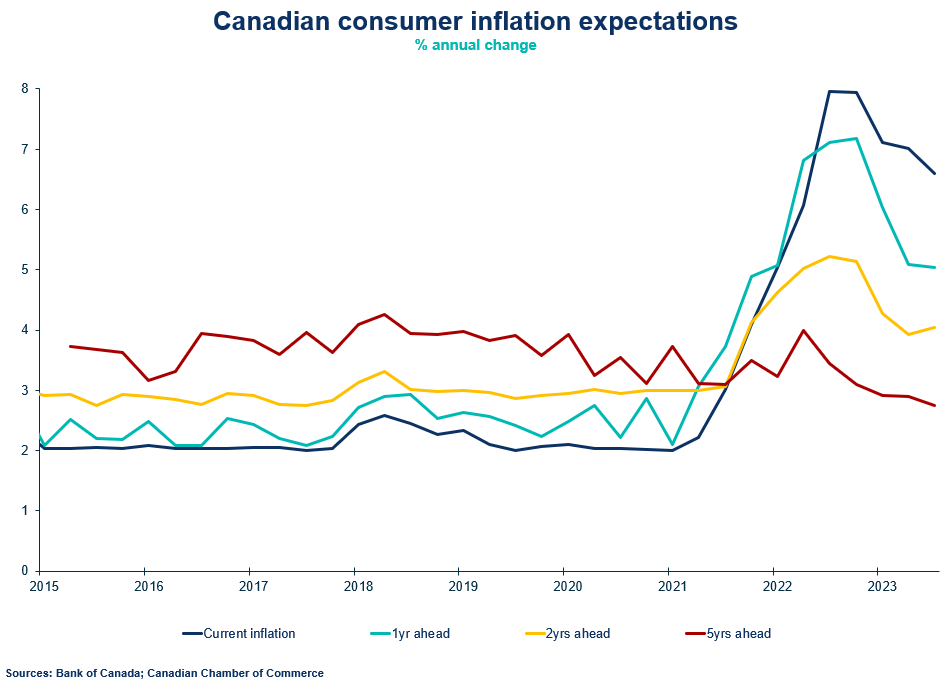

- Governing Council said it was looking for progress on: core inflation, the balance between demand and supply in the economy, inflation expectations, wage growth and corporate pricing behaviour. Although the Bank judges the economy is no longer in excess demand, all other indicators haven’t improved enough since their last decision.

- The Bank maintained it strong posture of “hawkish hold”, as expected. “Governing Council is still concerned about risks to the outlook for inflation and remains prepared to raise the policy rate further if needed.” This messaging is surely to guard against premature speculation that the Bank will consider cutting interest rates anytime soon.

- At the next meeting on January 24th, the Bank will release the January Monetary Policy Report with updated economic projections. As we head into 2024, the conversation will shift to the timing of the Bank of Canada rate cuts. Markets are expecting a rate cut before April. Given the weak economy and risk to household finances posed by higher debt servicing and mortgage renewals, the Bank will need to provide some relief to restore economy activity. Judging how restrictive its policy will need to be in order to balance inflation risks and economic growth, will be a challenge going forward.

CHARTS

Other Commentaries

Oct 19, 2022

September 2022 Consumer Price Index data: Food and services prices still rising, no progress on core inflation

Sep 20, 2022

August 2022 Consumer Price Index data: Finally some good news on Canadian inflation.

Aug 16, 2022