Commentaries /

Sputtering economy puts the Bank of Canada on pause

Sputtering economy puts the Bank of Canada on pause

While the Bank held its fire, we should consider this a “hawkish hold,” emphasizing that it will raise interest rates...

Rewa

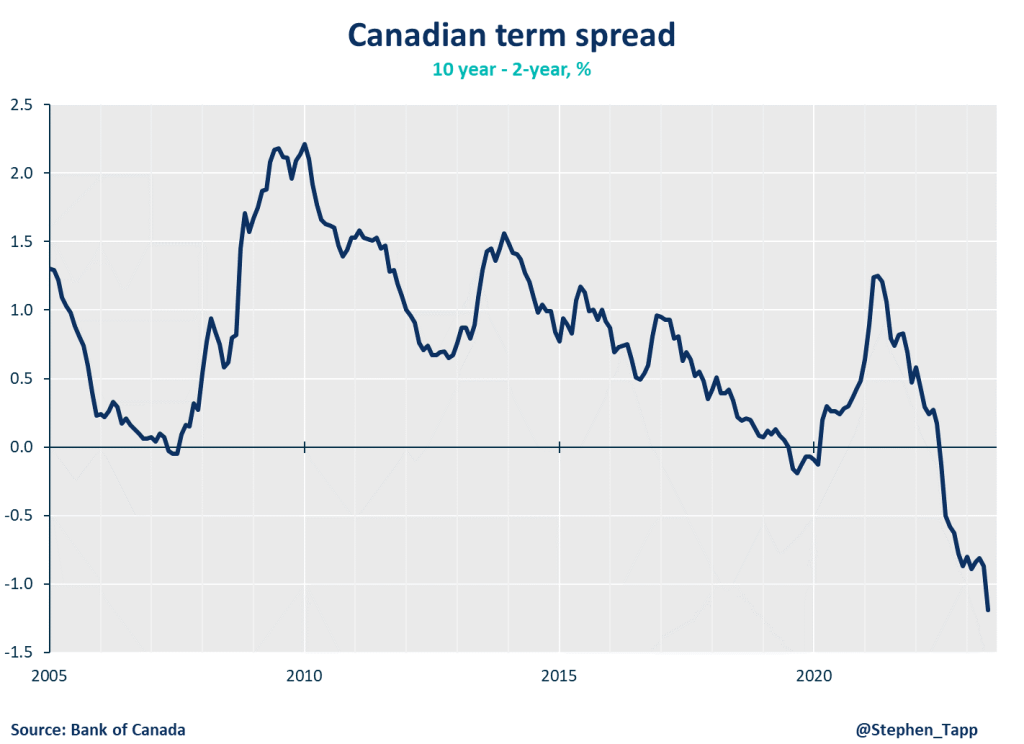

While the Bank held its fire, we should consider this a “hawkish hold,” emphasizing that it will raise interest rates further, if needed. Even though underlying inflation pressures remain problematic, the abrupt and unexpected contraction in Canada’s economy in the second quarter is for now overshadowing inflation concerns. Leading indicators suggests we could be heading into a mild recession, if we aren’t already there.

Stephen Tapp, Chief Economist, Canadian Chamber of Commerce

KEY TAKEAWAYS

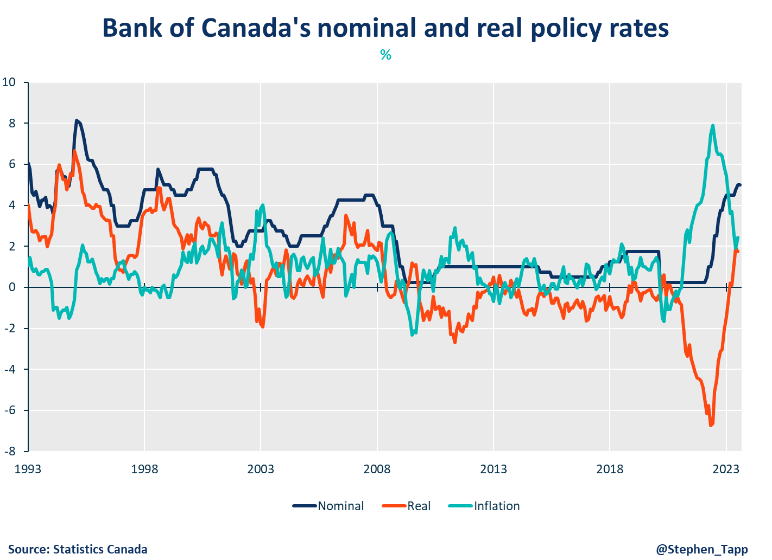

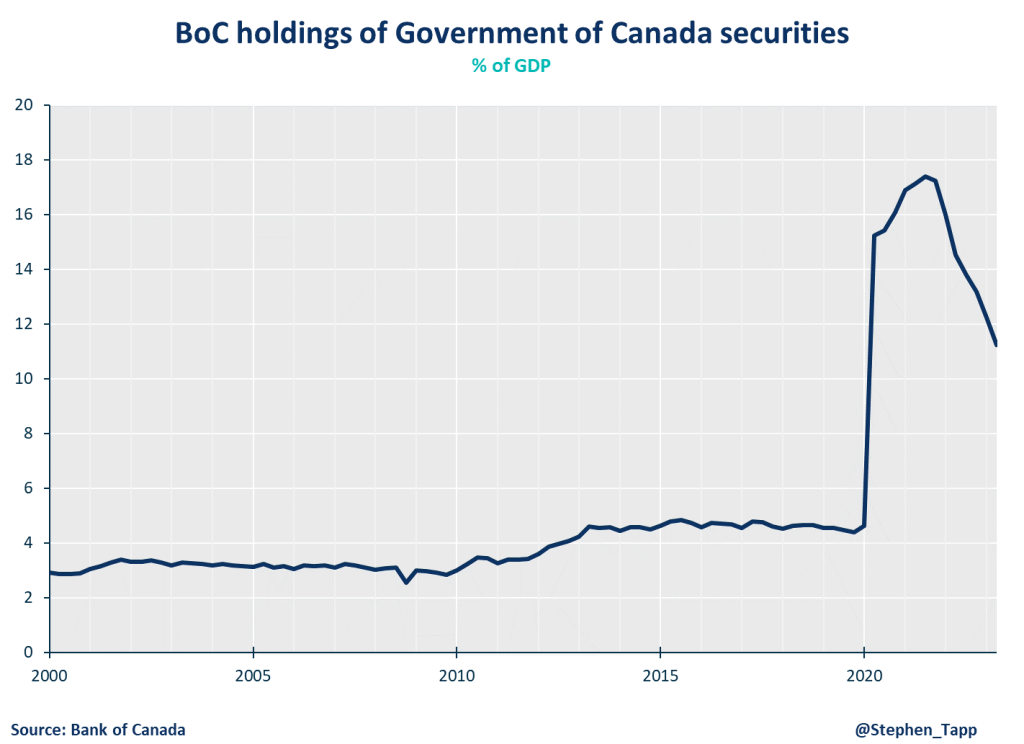

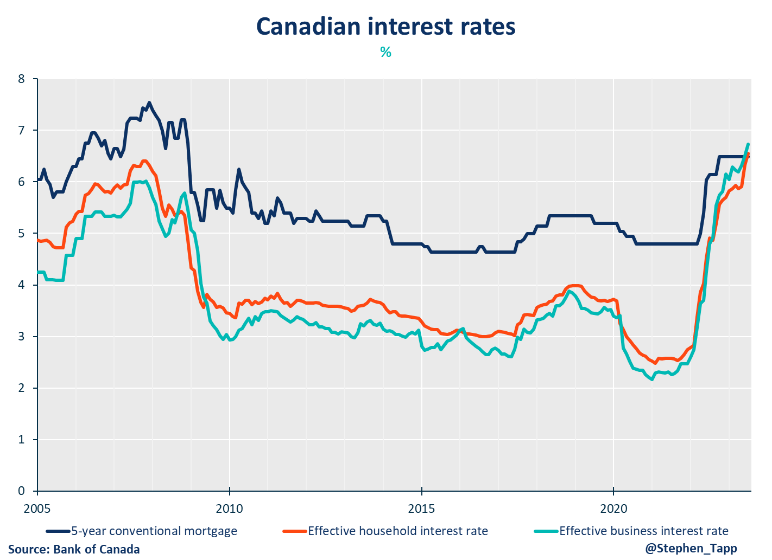

- After two consecutive rate increases over the summer, today the Bank of Canada held its policy rate at 5.0% and continued quantitative tightening, by allowing maturing assets to roll off its balance sheet. These moves were widely expected by financial markets after last Friday’s disappointing data, which showed a surprising contraction in Canada’s GDP in the second quarter (-0.2% annualized, which included downward revisions to previous data, and was well below the +1.2% growth expected).

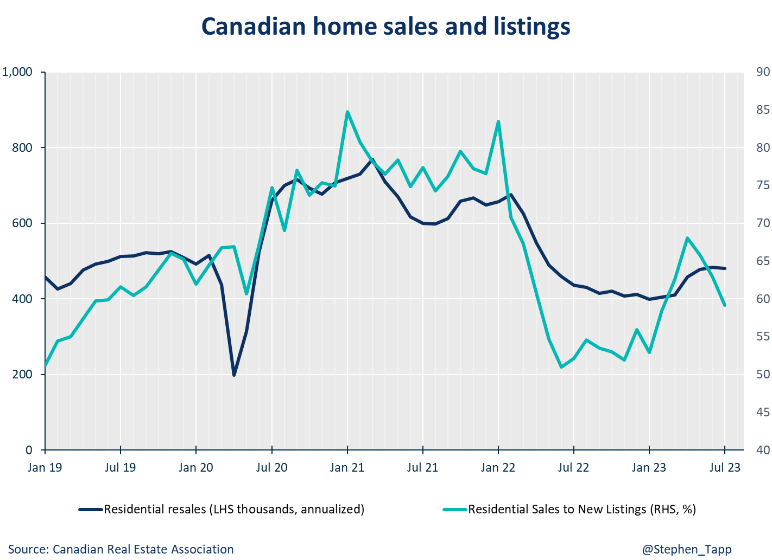

- As our Local Spending Tracker indicated earlier, consumer spending is finally slowing in response to higher rates. For the overall economy, fast growth in population and prices have flattered headline nominal numbers, but digging into the real numbers reveals a much weaker story: official data now show Canada’s inflation-adjusted household spending per person fell in three of the last four quarters. Real GDP per capita and productivity data have also brought serial disappointments.

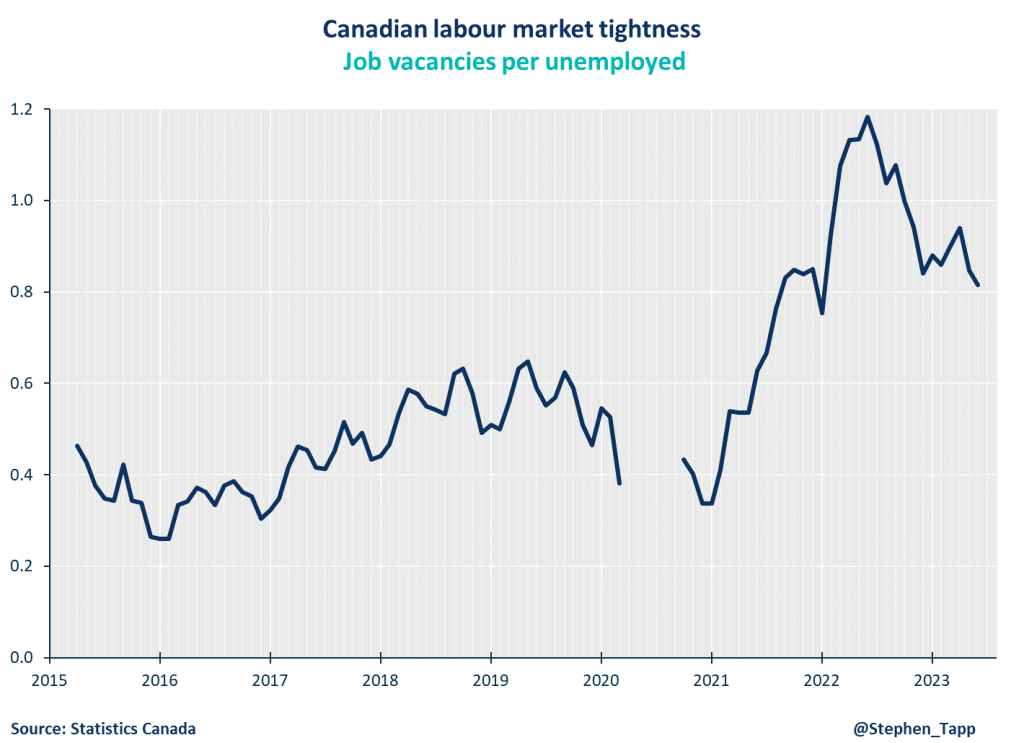

- The labour market has also softened with falling labour demand showing up in lower job vacancies. The unemployment rate has recently crept up 0.5 percentage points—which is close to crossing a threshold that often signals a recession is underway. That said, wage growth remains elevated at between 4% and 5%. Given weak labour productivity, this is above the level that’s consistent with the 2% inflation target.

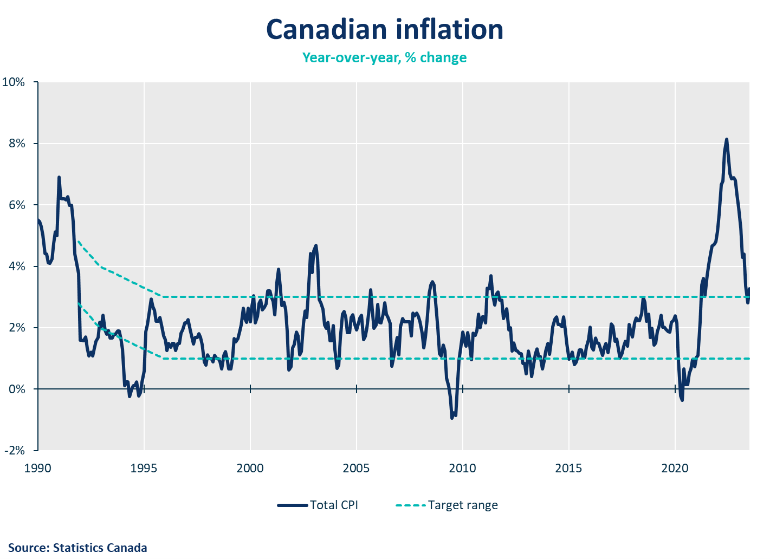

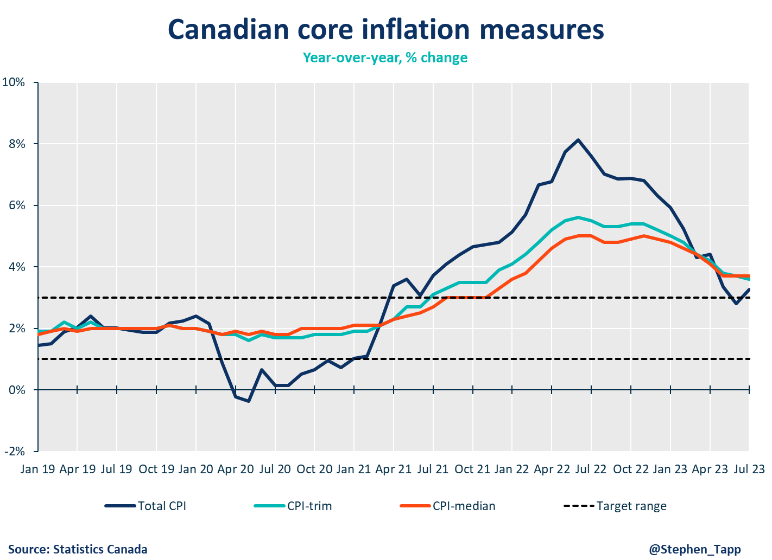

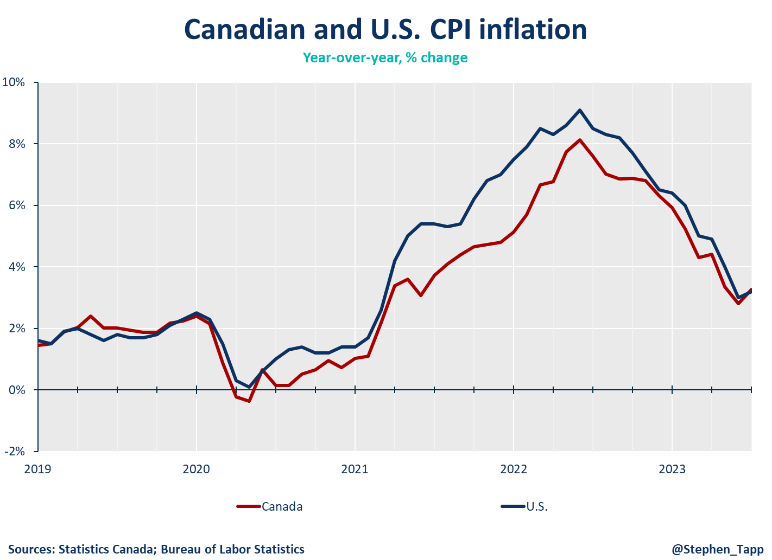

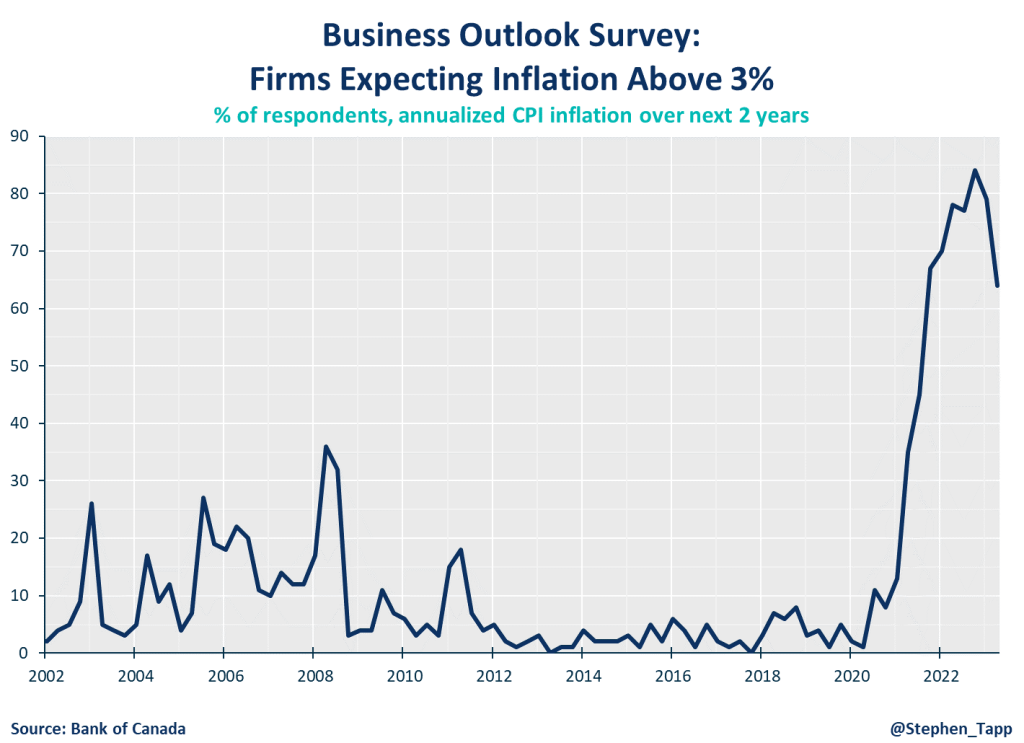

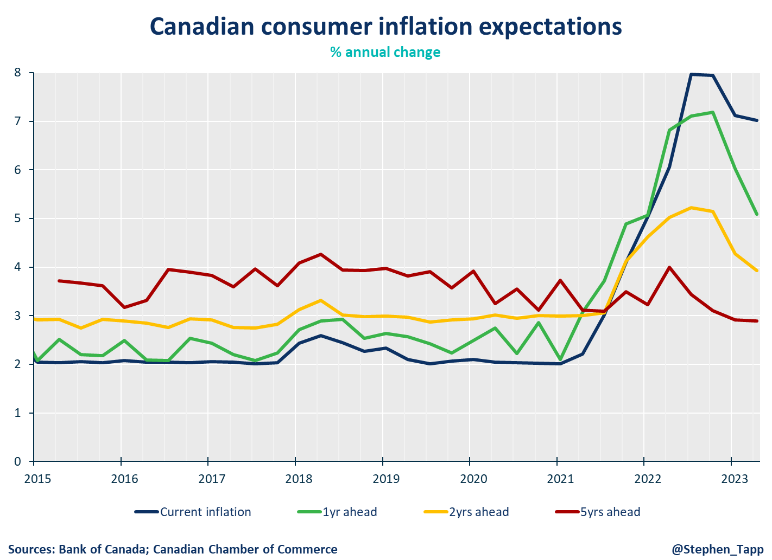

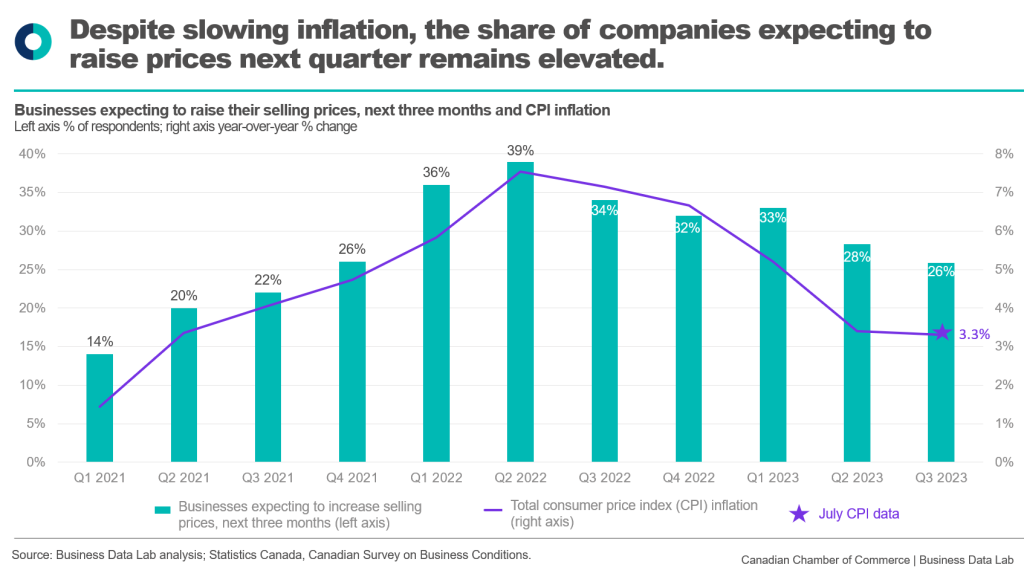

- Inflation remains broad-based and running too hot at around 3.5% annualized. It is still uncomfortably above the top of the Bank of Canada’s inflation control target, both on a year-over-year basis and in shorter-term “core” measures. The Bank emphasized that, “the longer high inflation persists, the greater the risk that elevated inflation becomes entrenched, making it more difficult to restore price stability.”

- In the last announcement, Governing Council said it was looking for progress on: short-run core inflation; wages; corporate pricing behaviour; and inflation expectations. Unfortunately, all these signs remain problematic. However, the abrupt slowdown in Canada’s economy is overshadowing these concerns and suggests we could be heading into a mild recession, if we aren’t already there.

- Overall, the Bank delivered a “hawkish hold”, as expected, stating that “Governing Council remains concerned about the persistence of underlying inflationary pressures, and is prepared to increase the policy interest rate further if needed.”

- We will have to wait until October 25th for the Bank’s next Monetary Policy Report with updated economic projections. Right now, we could be headed for mild “stagflation”, which would be difficult for the BoC, featuring slow or stagnant economic growth, but stubborn inflation that’s slow to return to the 2% target.

CHARTS

Other Commentaries

commentaries

Oct 19, 2022

September 2022 Consumer Price Index data: Food and services prices still rising, no progress on core inflation

Our Chief Economist, Stephen Tapp, looks at Canada’s headline inflation, which edged down for the third month in a row. There was no progress on “core” inflation, which held steady at 5%.

commentaries

Sep 20, 2022

August 2022 Consumer Price Index data: Finally some good news on Canadian inflation.

Stephen Tapp, our Chief Economist, looks at Canada’s headline inflation for August, which fell for the second straight month. Core inflation and services measures have also finally started to slow.

commentaries

Aug 16, 2022

July 2022 Consumer Price Index data: Canada’s inflation finally turns a corner with falling gas prices, but core pressures remain

Our Chief Economist, Stephen Tapp, looks at Canada’s headline inflation, which is finally showing signs of cooling off.