Commentaries /

The Bank of Canada shifts from “whether to hike” to “how long to hold”.

The Bank of Canada shifts from “whether to hike” to “how long to hold”.

Today the Bank of Canada maintained its policy rate at 5% for the fourth straight decision. This move was unanimously expected by economists and markets, however, we did learn something today — the Bank dropped its hiking bias and shifted to neutral holding pattern for now.

Stephen Tapp

KEY TAKEAWAYS

- Today the Bank of Canada maintained its policy rate at 5% for the fourth straight decision. This move was unanimously expected by economists and markets, however, we did learn something today — the Bank dropped its hiking bias and shifted to neutral holding pattern for now. This is a first sign that we’re now walking slowly down a new path towards eventual interest rate cuts, rather than more hikes.

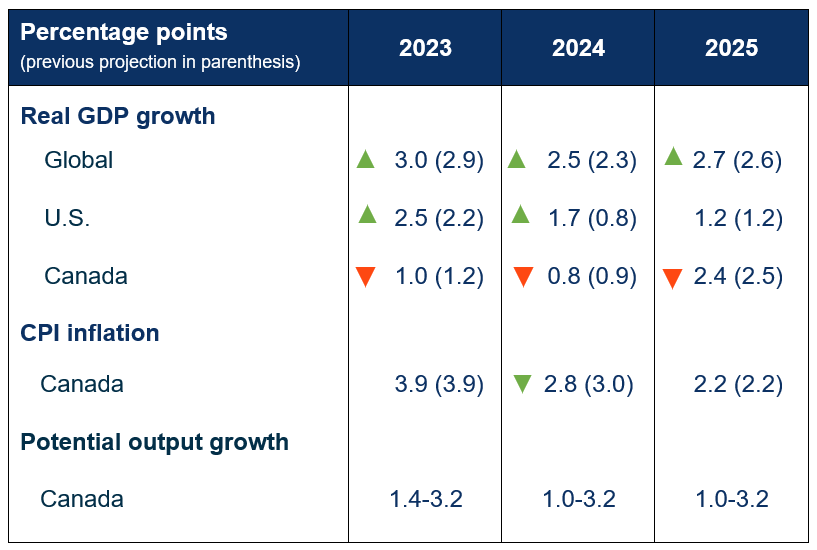

- Global growth: The Bank’s outlook for the global economy is slightly better than in October. This is primarily due to the U.S. economy out-performing expectation. Here, the Bank significantly revised up its forecast U.S. real GDP growth in 2024 to 1.7% from 0.8%.

- Canada’s economy: The Bank’s forecast for Canadian real GDP was largely unchanged, but the Bank now views the economy as operating slightly below its potential (i.e., in “modest excess supply”). Near-term growth is expected to remain essentially flat, with a pickup in the second half of 2024. Once again, the Bank does not expect negative GDP growth, but make no mistake, Canada’s economy is weak, especially when viewed in per capita terms, given that output and employment aren’t keeping pace with strong population growth.

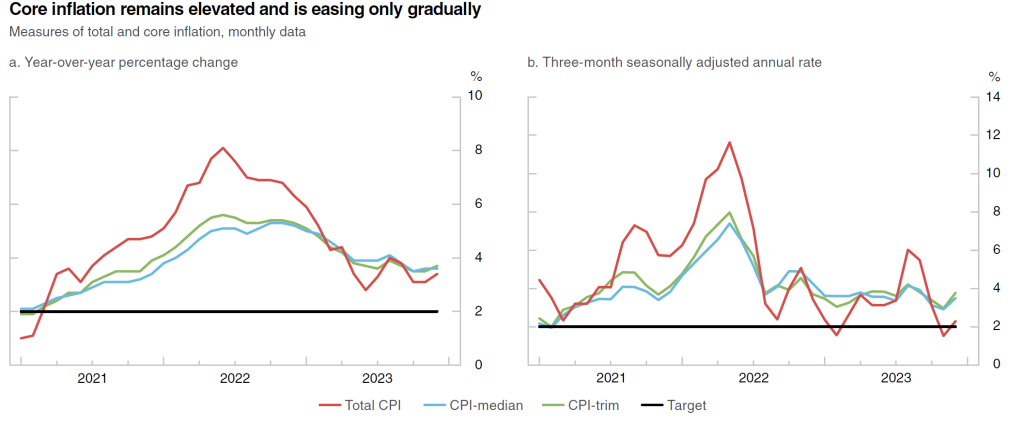

- Inflation: The Bank expects Canada’s headline inflation remaining around 3% for the first half of this year, and easing to around 2.5% in the second half, before returning to the 2% target in 2025. For the annual inflation forecast the picture is slightly improved and revised down by 0.2 percentage points this year, owing to lower oil and gasoline prices.

- When will interest rates come down? The core problem: “Governing Council wants to see further and sustained easing in core inflation”, which is still running around 3.5%. The other problematic parts of the inflation picture include shorter-run inflation expectations, still elevated wage growth, as well as the risk that future rate cuts could re-inflate Canada’s already-unaffordable housing market. Financial markets are currently factoring in a better-than-even chance (60%) that the Bank of Canada will cut its policy rate by 0.25% in April. I think this could prove too optimistic, and am leaning towards rate cuts beginning in the summer — unless short-run core inflation quickly and durably falls back into target range (i.e., is under 3% for three consecutive months).

Bank of Canada projections

Other Commentaries

commentaries

Oct 19, 2022

September 2022 Consumer Price Index data: Food and services prices still rising, no progress on core inflation

Our Chief Economist, Stephen Tapp, looks at Canada’s headline inflation, which edged down for the third month in a row. There was no progress on “core” inflation, which held steady at 5%.

commentaries

Sep 20, 2022

August 2022 Consumer Price Index data: Finally some good news on Canadian inflation.

Stephen Tapp, our Chief Economist, looks at Canada’s headline inflation for August, which fell for the second straight month. Core inflation and services measures have also finally started to slow.

commentaries

Aug 16, 2022

July 2022 Consumer Price Index data: Canada’s inflation finally turns a corner with falling gas prices, but core pressures remain

Our Chief Economist, Stephen Tapp, looks at Canada’s headline inflation, which is finally showing signs of cooling off.