Commentaries /

July 2023: The Bank of Canada raises its policy rate to 5% as it worries disinflation progress is stalled

July 2023: The Bank of Canada raises its policy rate to 5% as it worries disinflation progress is stalled

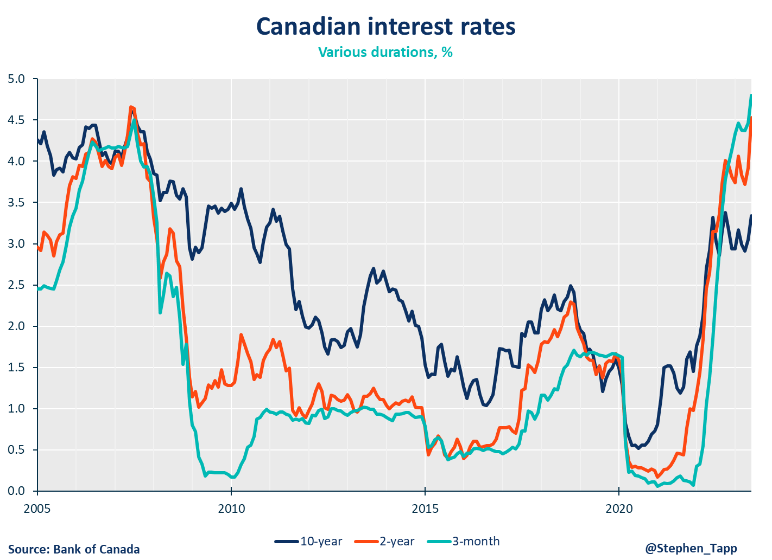

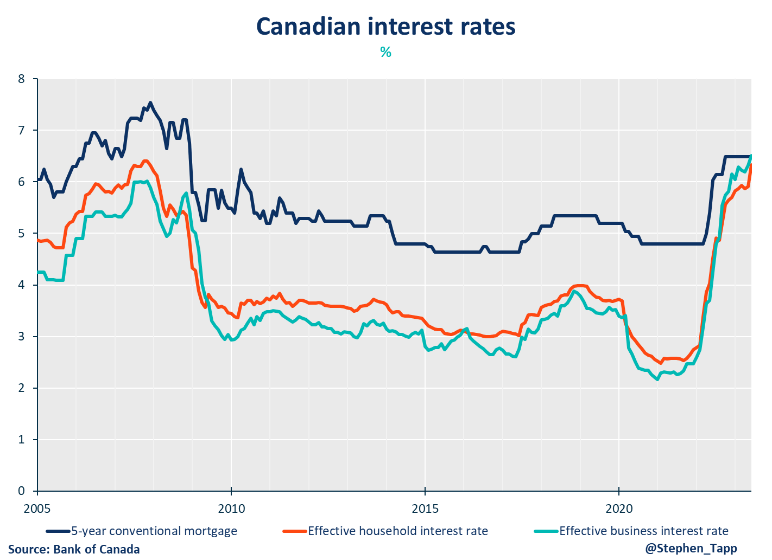

The Bank of Canada raised its policy rate by 25 basis points for the second consecutive meeting. It now sits at 5.0%, the highest rate since 2001, as the central bank tries to wrestle inflation back to target.

Rewa

KEY TAKEAWAYS

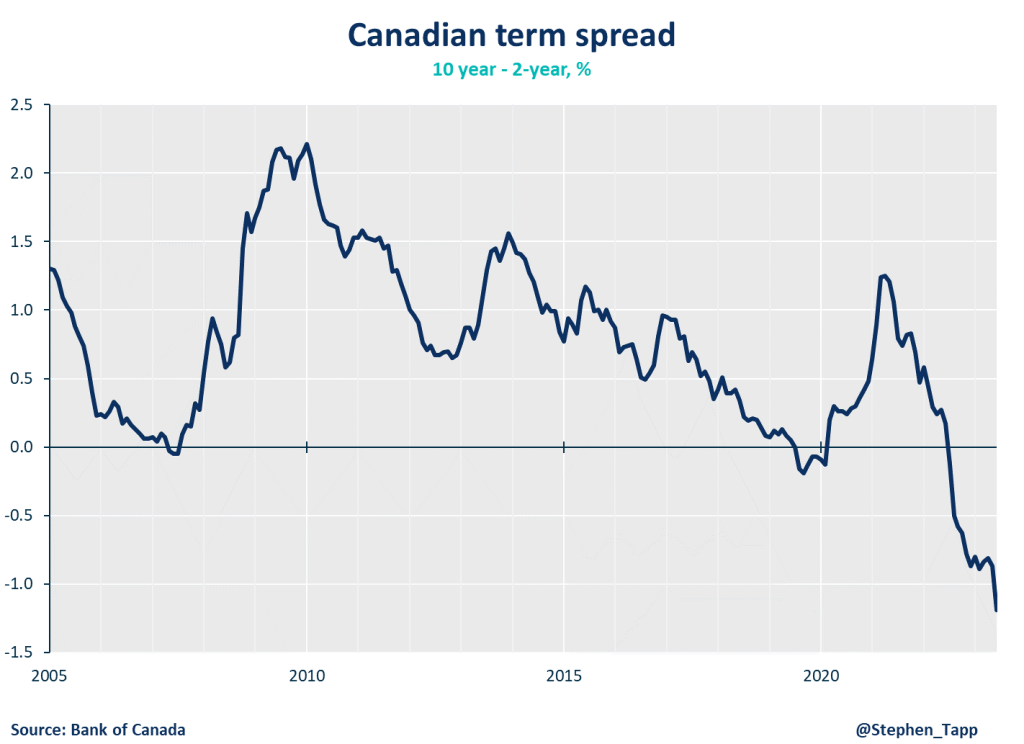

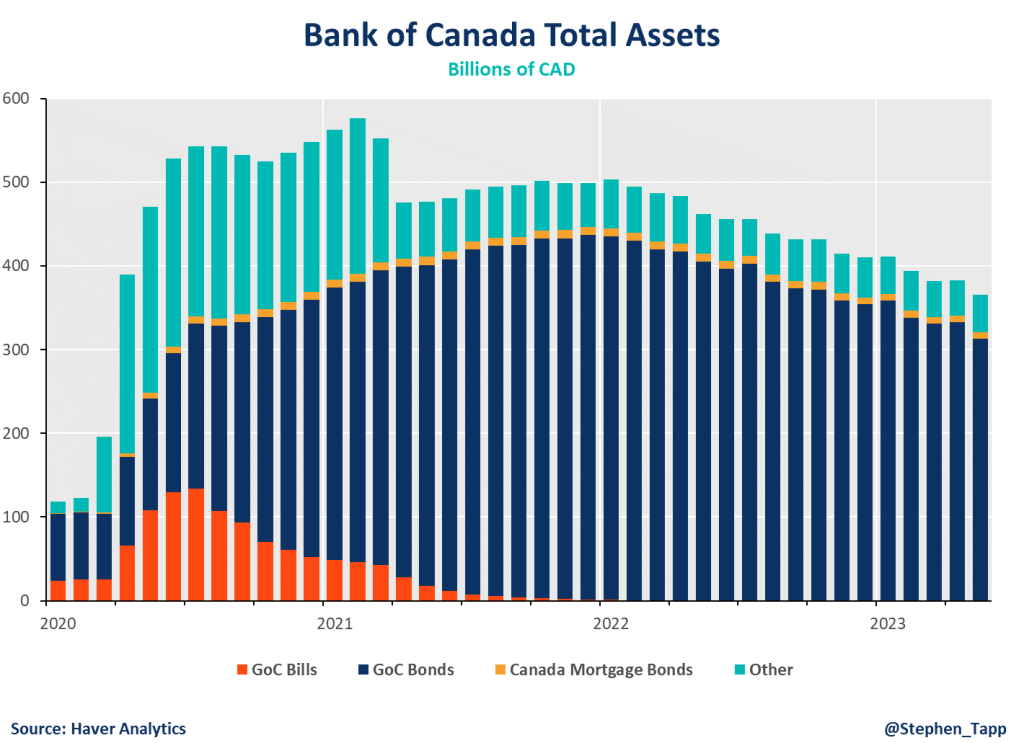

- The Bank of Canada raised its policy rate by 25 basis points for the second consecutive meeting. It now sits at 5.0%, the highest rate since 2001, as the central bank tries to wrestle inflation back to target. This move was no surprise: most forecasters expected it; and financial markets largely priced it in beforehand (giving it about a 70% chance). The Bank is continuing quantitative tightening, as assets roll off its balance sheet.

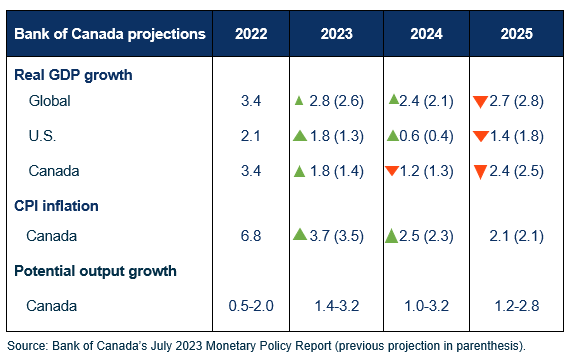

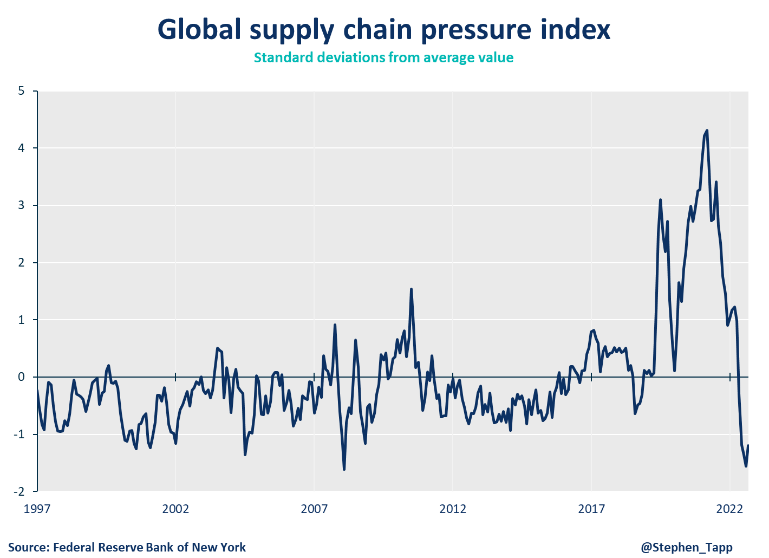

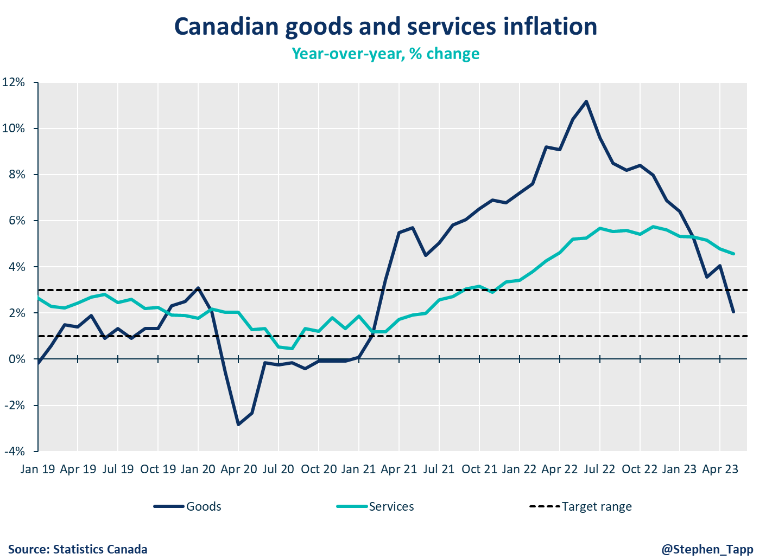

- Stronger-than-expected U.S. economy, more global price pressure: The Bank revised up its near-term outlook for the global economy, led by the U.S., reflecting “surprisingly robust” consumer spending. Despite the slowdown in headline inflation, core inflation pressures — especially for services — remain stubbornly high across many economies, and other central banks are expected to raise rates further.

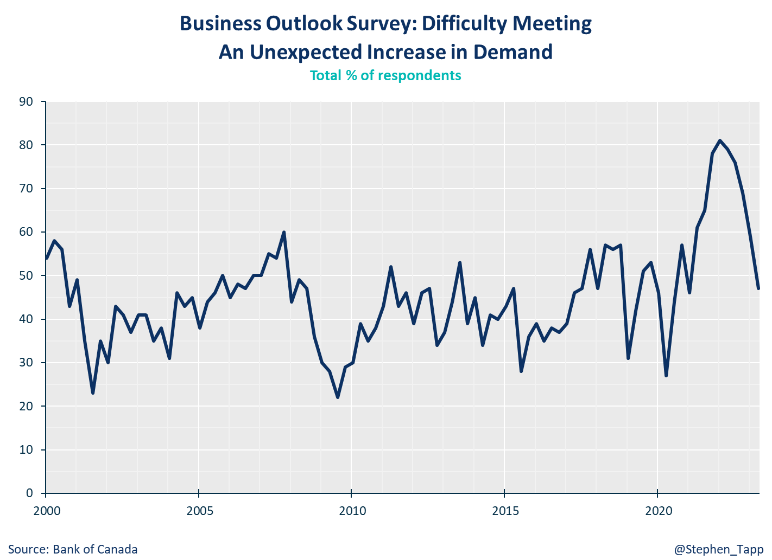

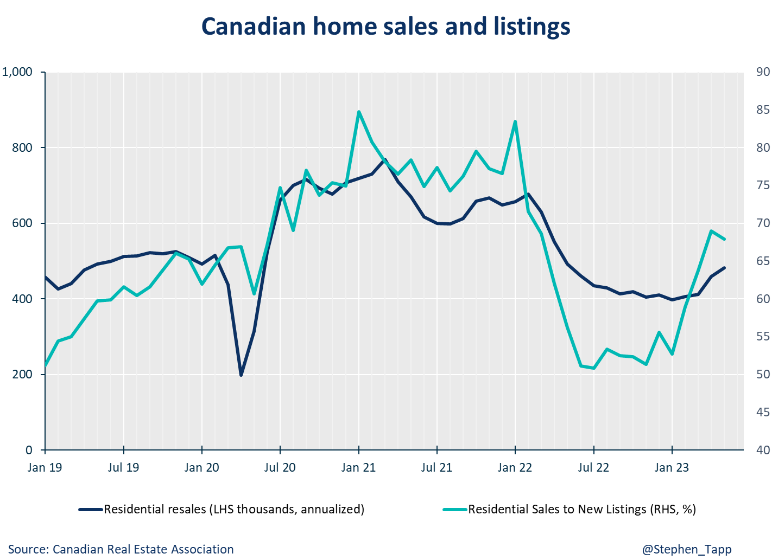

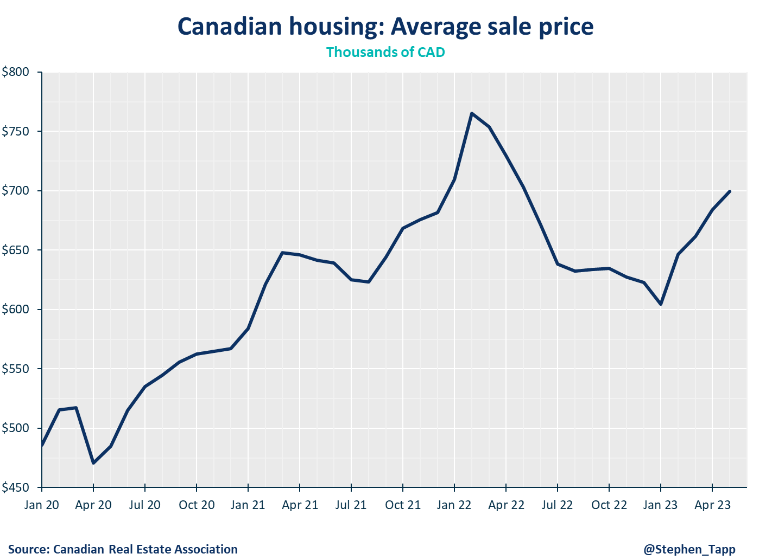

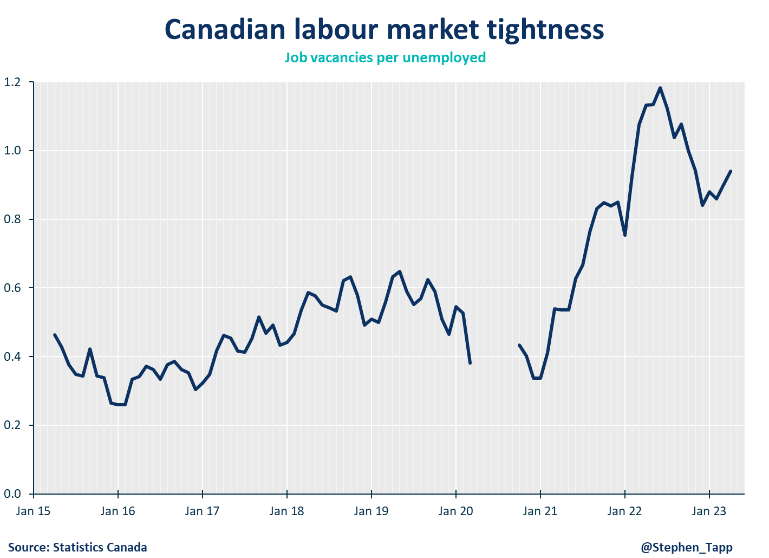

- Canada holding up better-than-expected: The Bank also revised up its outlook for Canada’s GDP growth this year, citing more persistent excess demand. continued tightness in the labour market, the upturn in housing, and strong population growth coming from immigration. That said, Canada’s growth is expected to be below trend, averaging only 1% over the next 12 months, as the economy adjusts to the lagged effects of higher interest rates. This still represents a “soft landing”, which is more optimistic than expected by most Canadian forecasters.

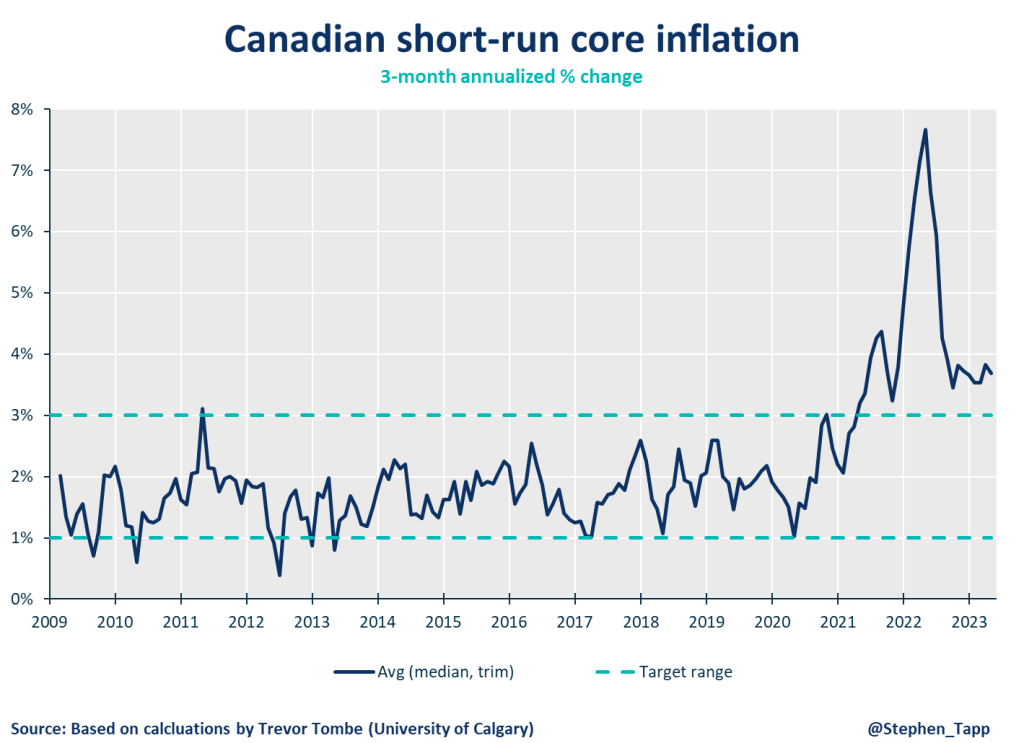

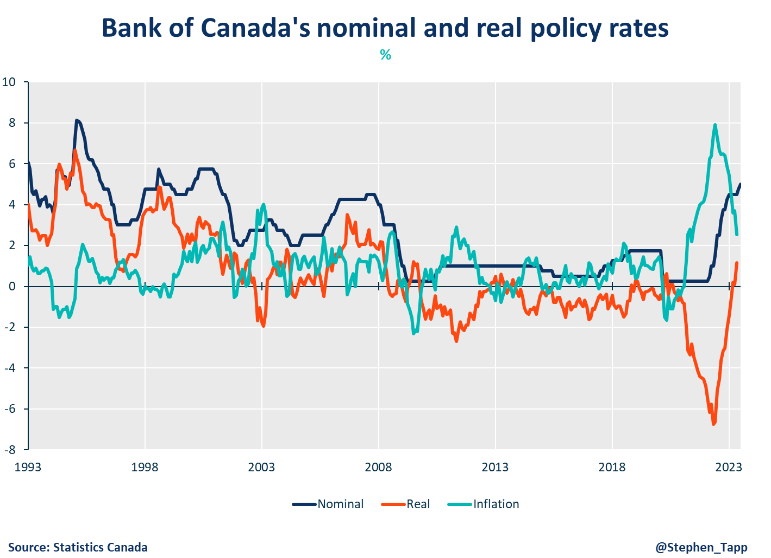

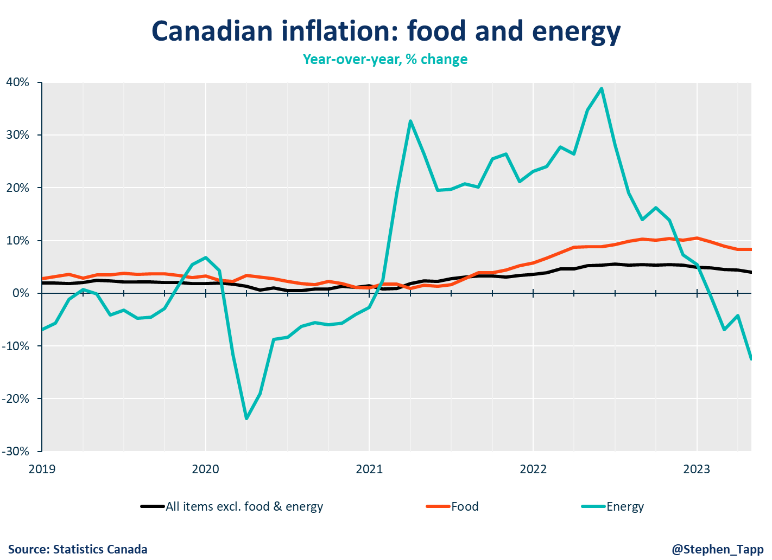

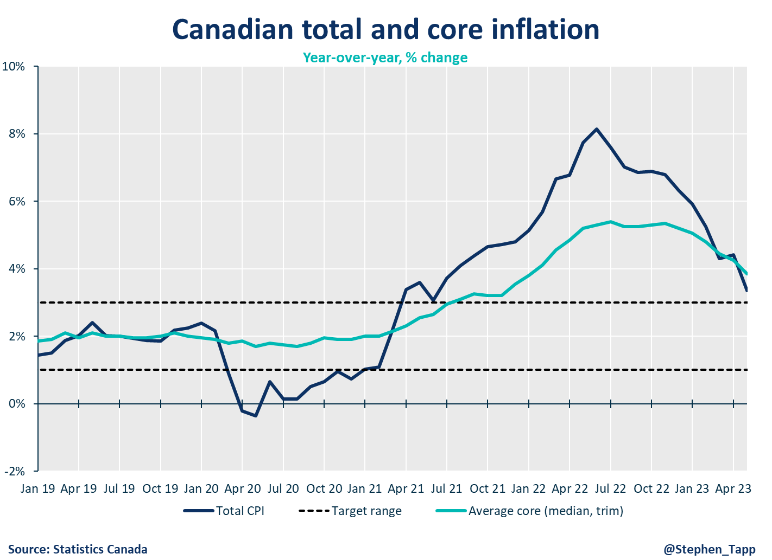

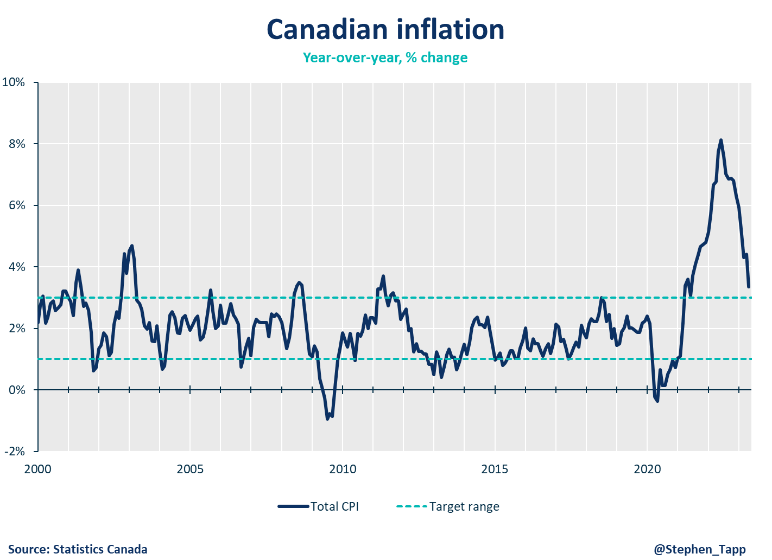

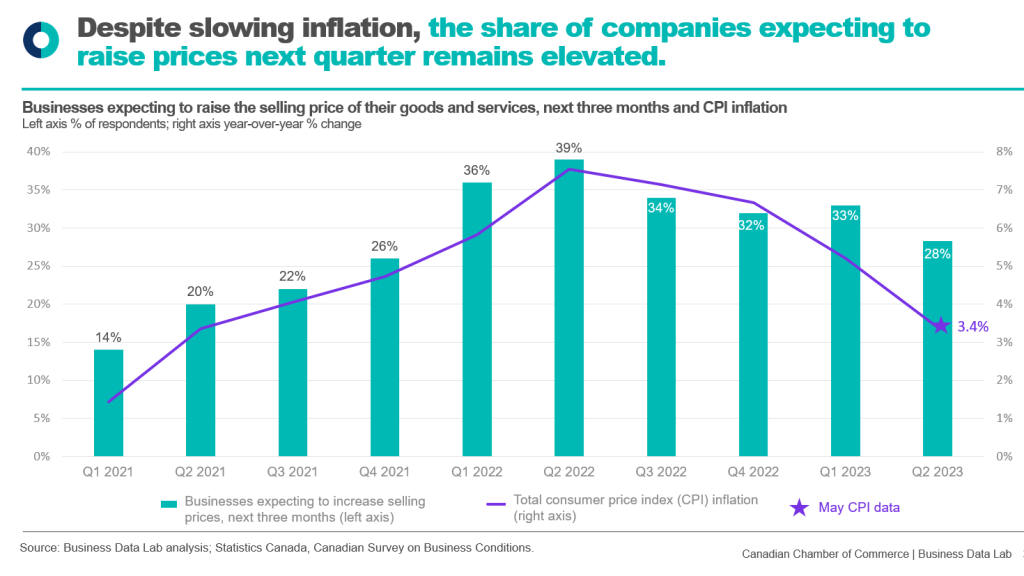

- Inflation proving more persistent: Canada’s headline inflation slowed to 3.4% in May. However much of this progress is from lower energy prices relative to a year ago. With these “base-year effects” dropping out of future year-over-year calculations, disinflation progress will slow. Indeed, short-run core inflation (3-month annualized rates that remove volatile components, and are a key metric for the Bank) has been running between 3.5% and 4% since last September, raising concerns that progress has stalled.

- The Bank now expects headline CPI inflation to stay around 3% for the next year, before declining gradually to the 2% target by mid-2025, which is six months later than in the last projection.

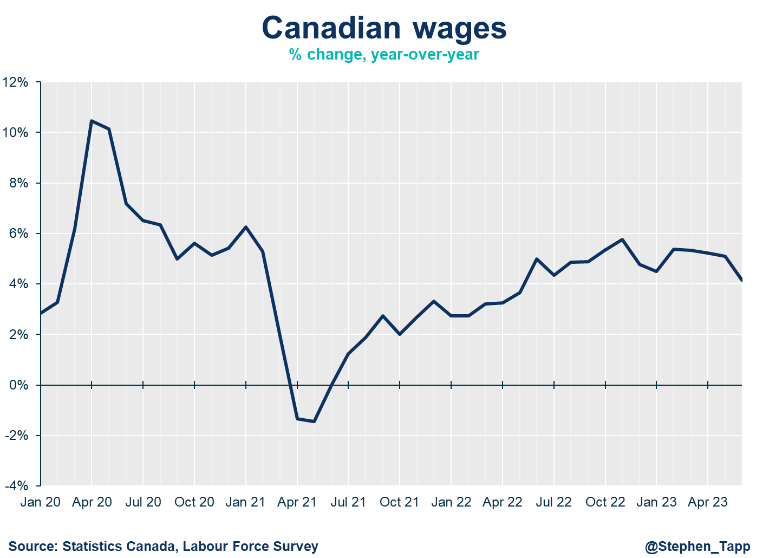

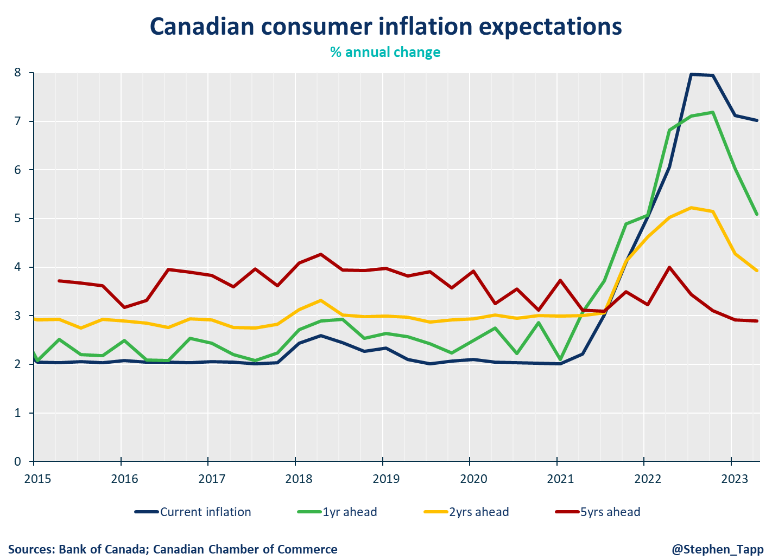

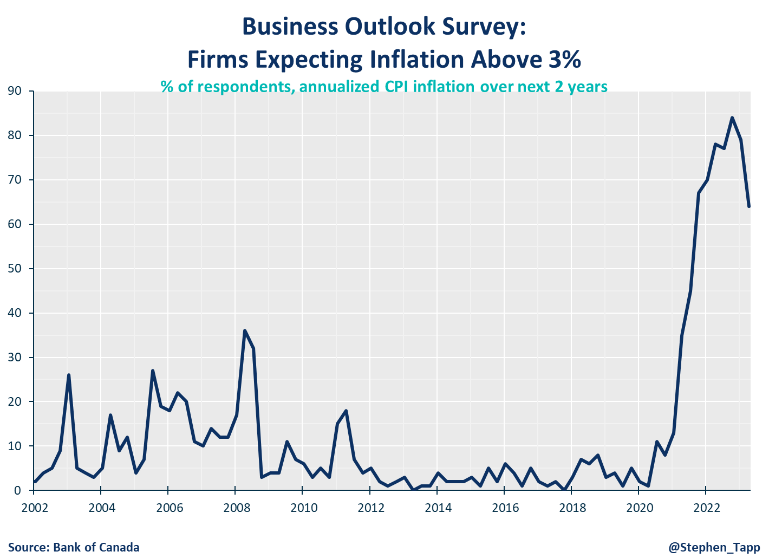

- Possibly the end of the road: Looking ahead, Governing Council will be looking for more progress on: short-run core inflation dynamics; wages; normalized corporate pricing behaviour; and anchoring of inflation expectations across the economy. All of these signs remain problematic for now. Financial markets are pricing in a roughly 1-in-3 chance of another rate hike in September. If the key metrics above show continued progress, then today’s move to 5% will likely mark the end of this tightening cycle. But there’s little doubt that central banks across advanced economies will continue to tighten financial conditions. And further hikes in Canada will stay on the table, until the Bank is satisfied that inflation will safely return to 2%.

SUMMARY TABLES

CHARTS

Other Commentaries

commentaries

Oct 19, 2022

September 2022 Consumer Price Index data: Food and services prices still rising, no progress on core inflation

Our Chief Economist, Stephen Tapp, looks at Canada’s headline inflation, which edged down for the third month in a row. There was no progress on “core” inflation, which held steady at 5%.

commentaries

Sep 20, 2022

August 2022 Consumer Price Index data: Finally some good news on Canadian inflation.

Stephen Tapp, our Chief Economist, looks at Canada’s headline inflation for August, which fell for the second straight month. Core inflation and services measures have also finally started to slow.

commentaries

Aug 16, 2022

July 2022 Consumer Price Index data: Canada’s inflation finally turns a corner with falling gas prices, but core pressures remain

Our Chief Economist, Stephen Tapp, looks at Canada’s headline inflation, which is finally showing signs of cooling off.