Commentaries Topics: Consumer Price Index

Commentaries /

March 2023 CPI: The Bank of Canada becomes the first major central bank to pause interest rates hikes… but for how long?

March 2023 CPI: The Bank of Canada becomes the first major central bank to pause interest rates hikes… but for how long?

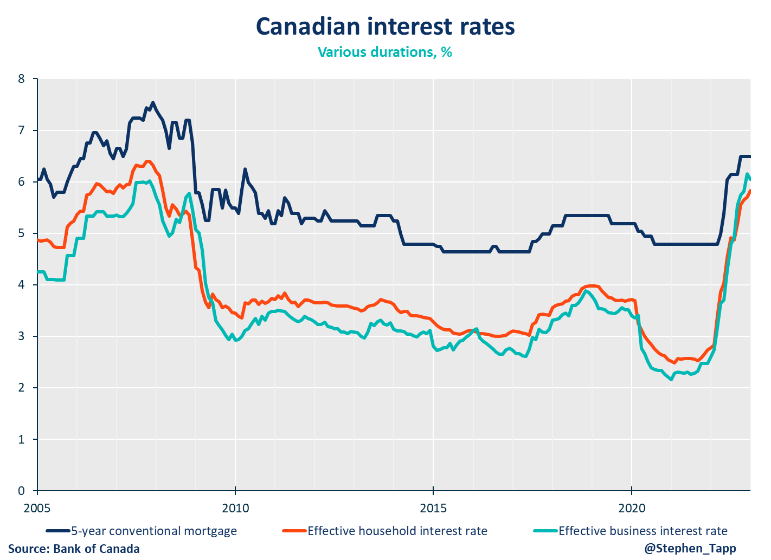

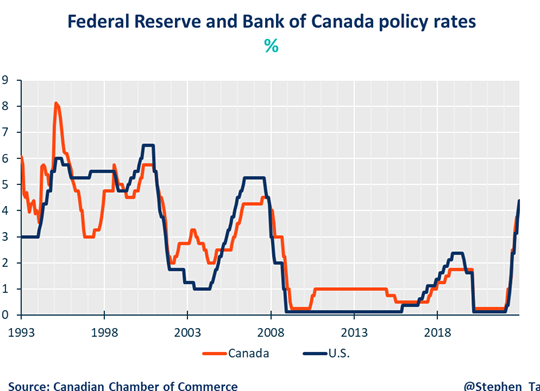

After one year of aggressively raising interest rates by a total of 4.25%, the Bank of Canada today held its policy rate steady — officially following through on the “conditional pause” in its tightening cycle.

Rewa

After one year of aggressively raising interest rates by a total of 4.25%, the Bank of Canada today held its policy rate steady — officially following through on the “conditional pause” in its tightening cycle.

– Mahmoud Khairy, Economist, Canadian Chamber of Commerce Business Data Lab

KEY TAKEAWAYS

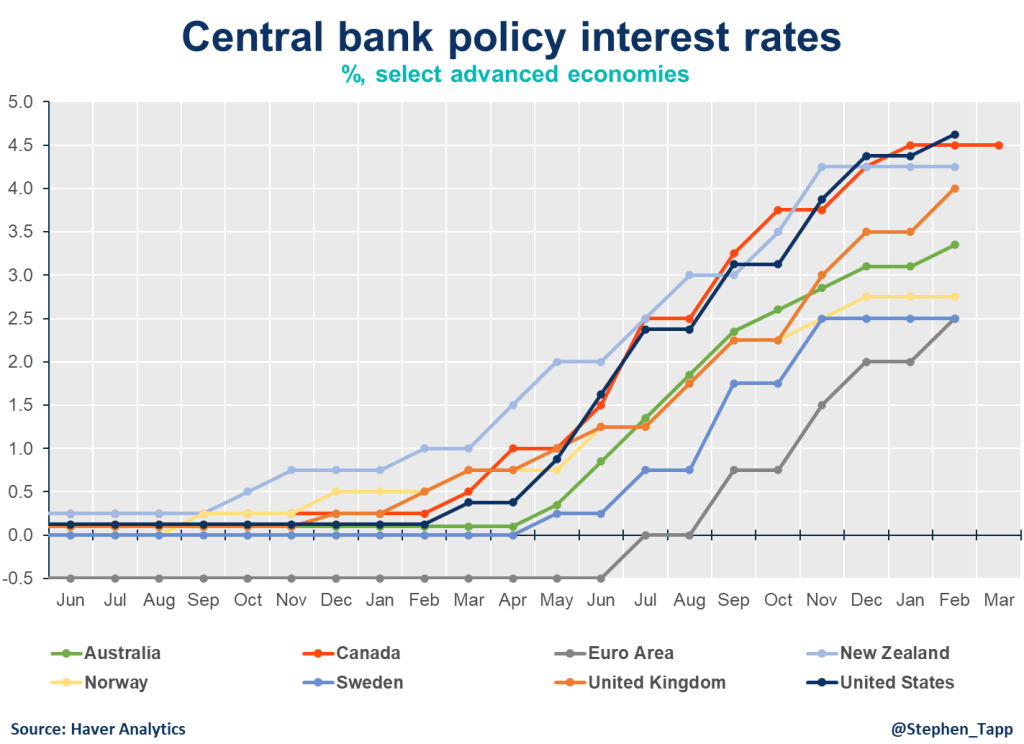

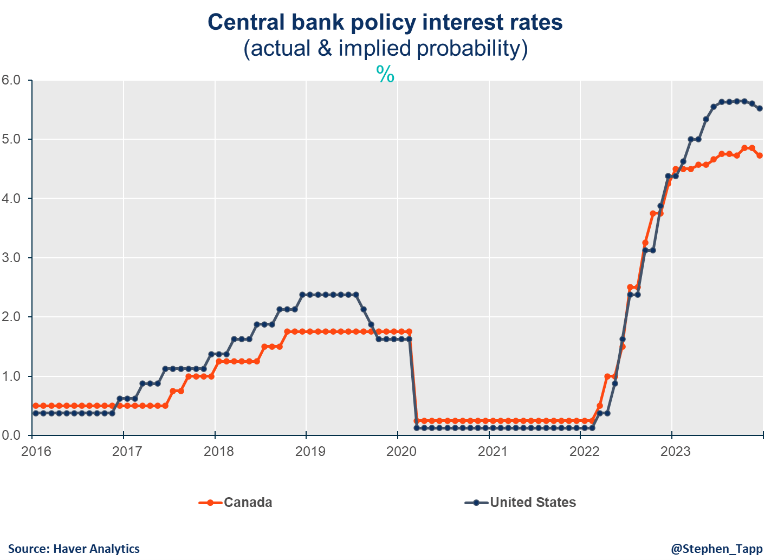

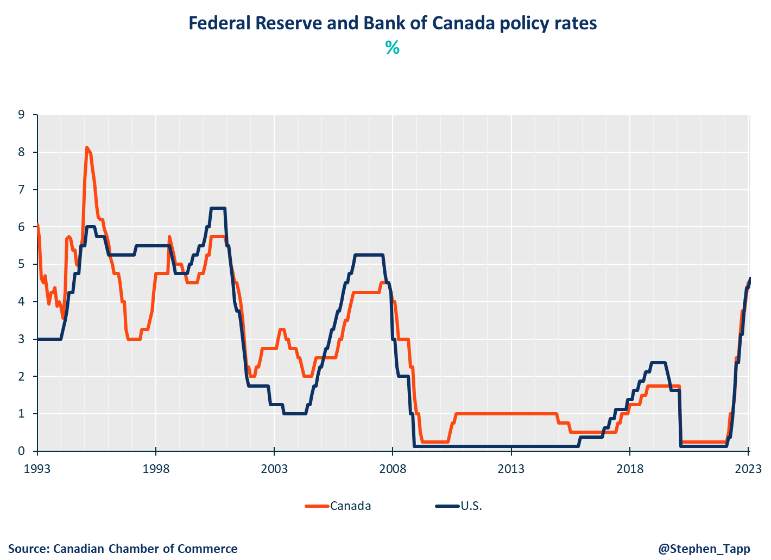

- After eight consecutive rate increases, the Bank of Canada met market expectations and held for the first time in a year for the overnight rate at 4.5%, making it the first major central bank to stop raising interest rates.

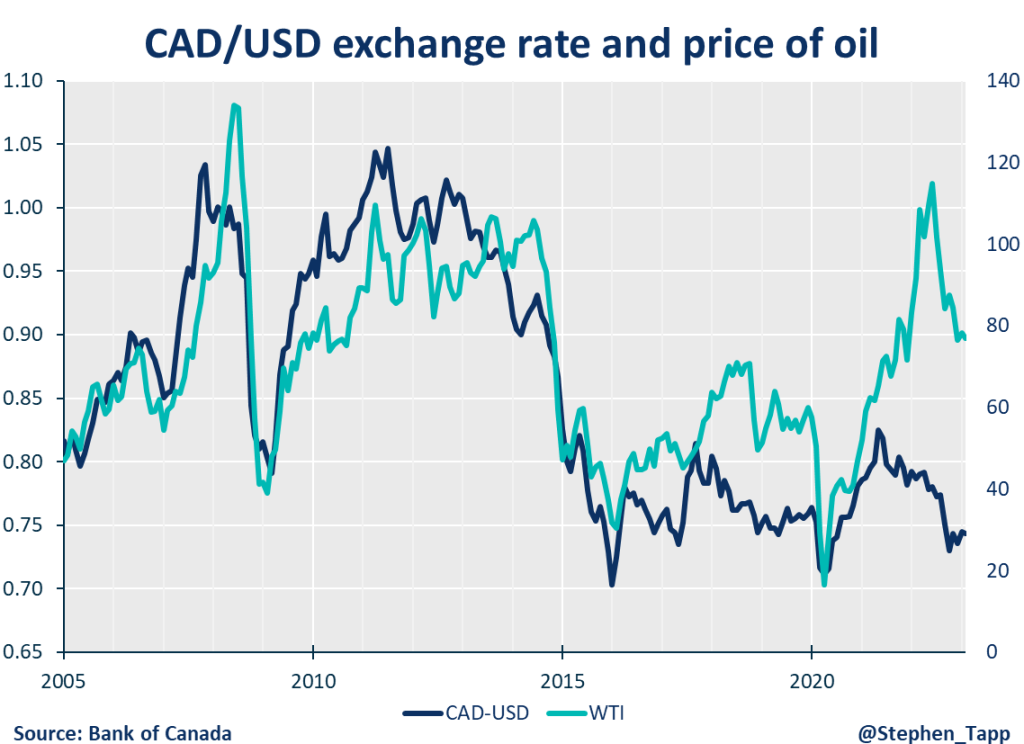

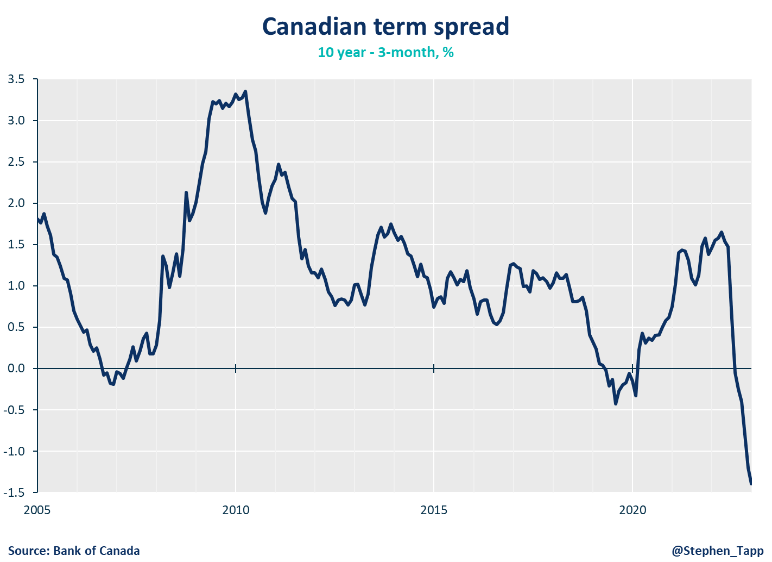

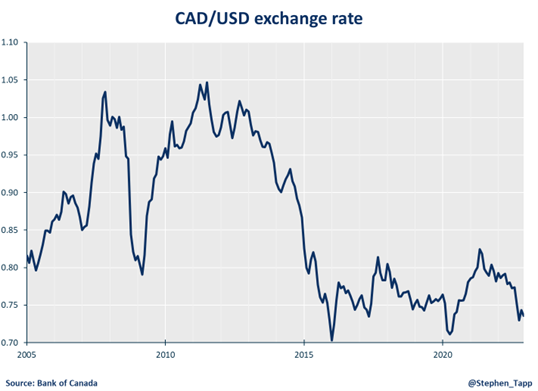

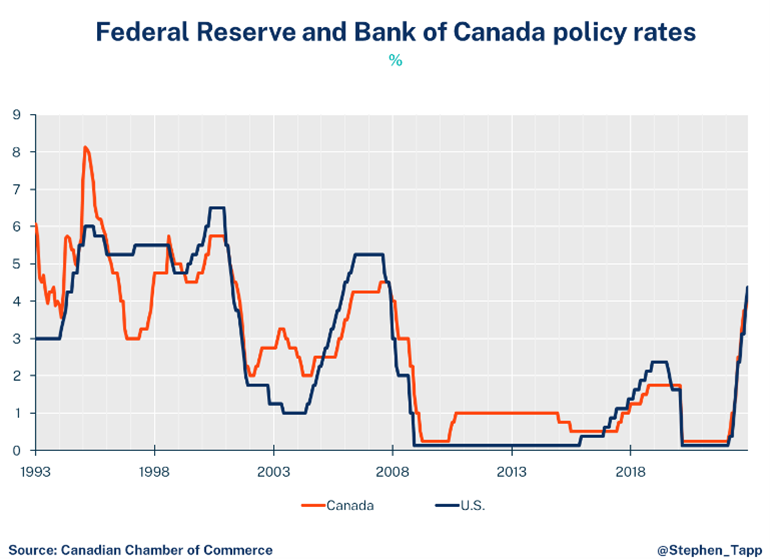

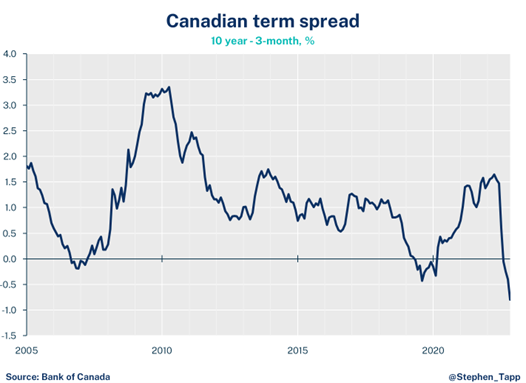

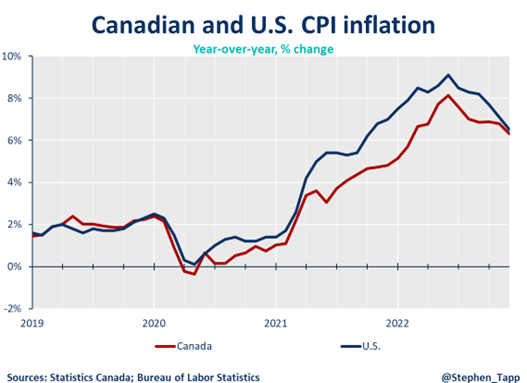

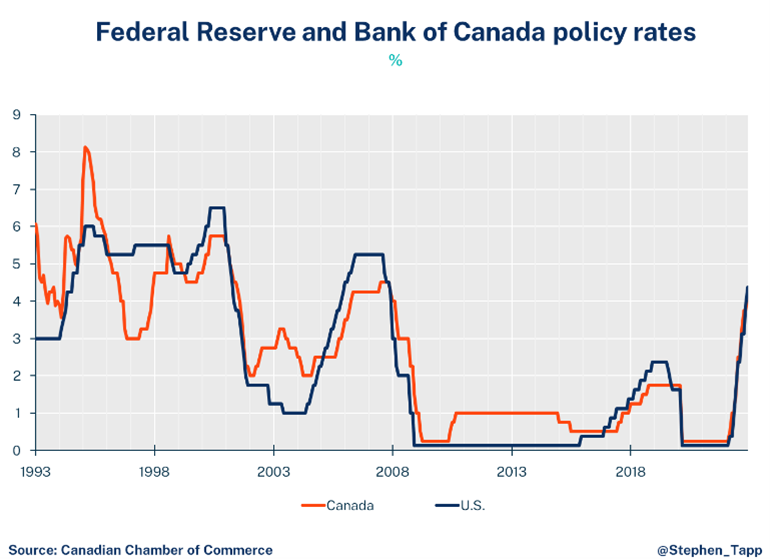

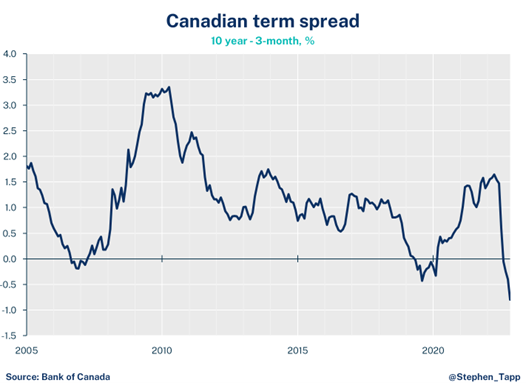

- Despite holding rates today, the Bank’s statement included a hint of hawkish bias by stating that, “Governing Council…is prepared to increase the policy rate further if needed.” Pressure might build on the Bank of Canada over the coming quarters to resume rate hikes. This is because the U.S. Federal Reserve is widely expected to continuing raising rates to a noticeably higher level than Canada. A sustained interest rate differential could put downward pressure on the Canadian dollar, which in turn, would increase the costs of imports and add to Canadian inflation pressures.

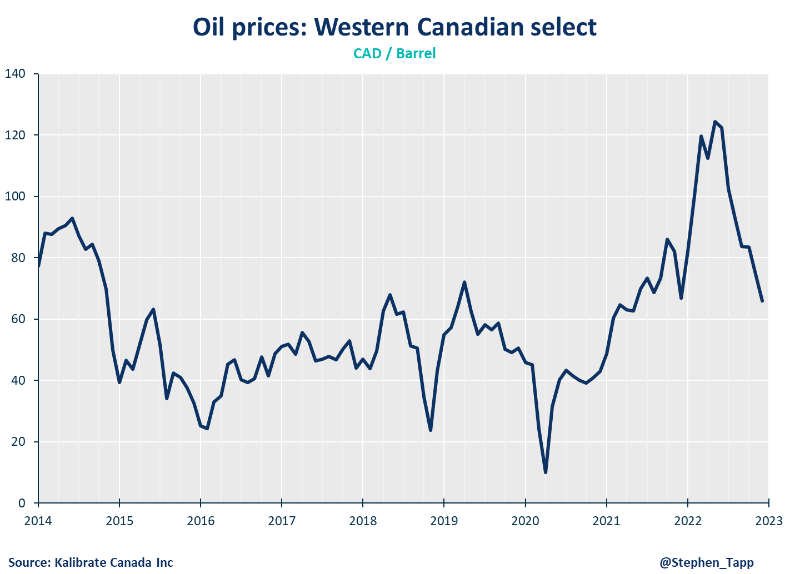

- Globally, recent data for the US and Europe have been slightly stronger than the Bank expected, and China’s economic rebound after relaxing its COVID-zero policies presents a new upside risk for commodity prices, and hence inflation.

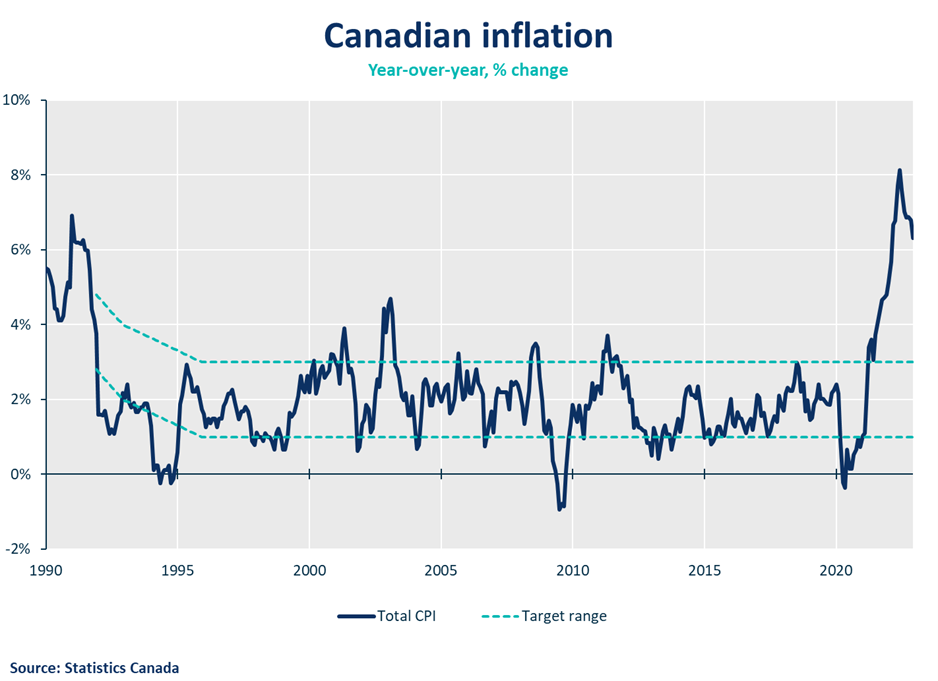

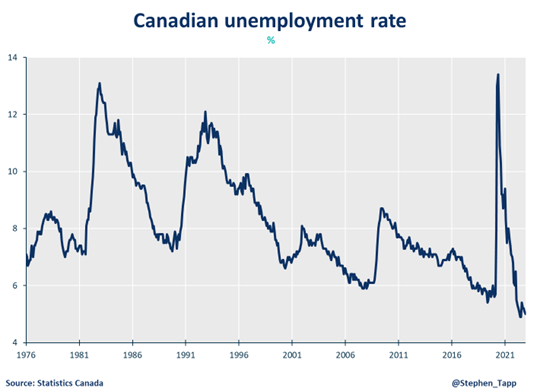

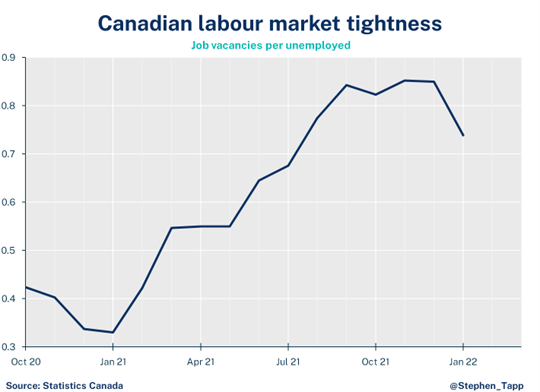

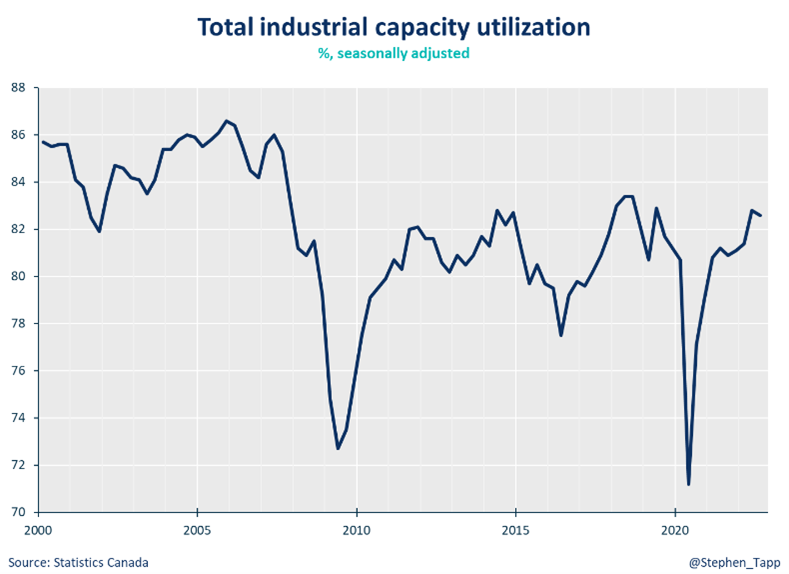

- In Canada, weaker-than-expected GDP growth in the fourth quarter of 2022 will not cause too much concern for the Bank, because it was due mainly to inventories, not underlying domestic demand. While inflation was running at 5.9% in January, the BoC expects it to decline to around 3% in the middle of this year and return to the 2% target in 2024. The labor market remains tight with the unemployment rate near a historic low. Wages are growing at around 4.5%, but labor productivity has been disappointing.

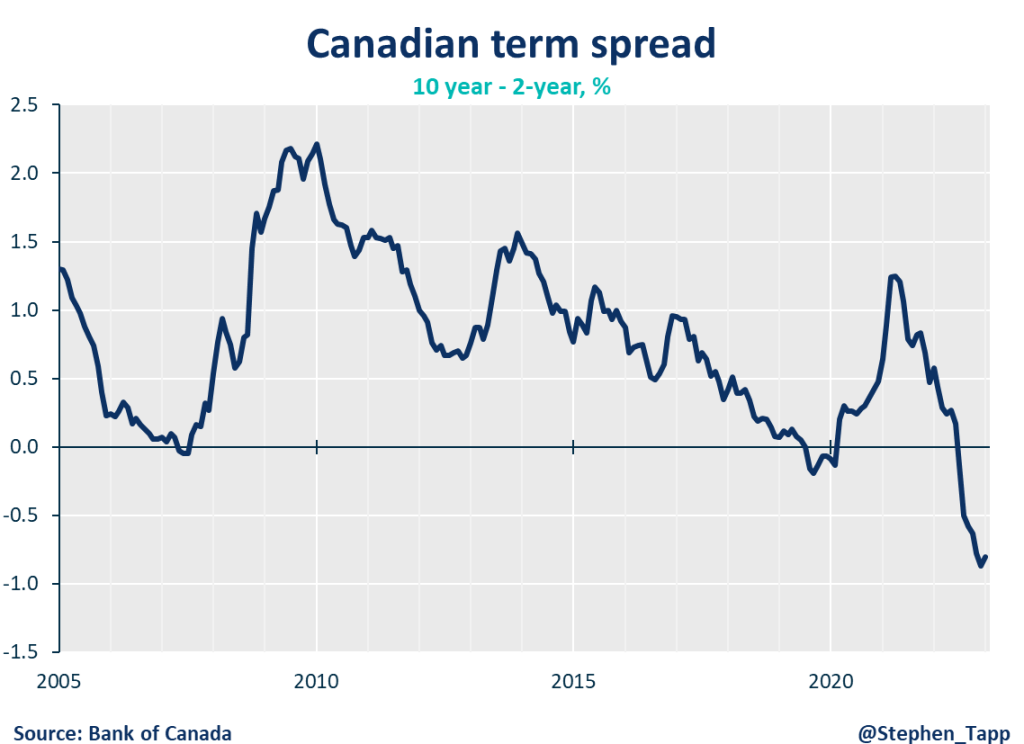

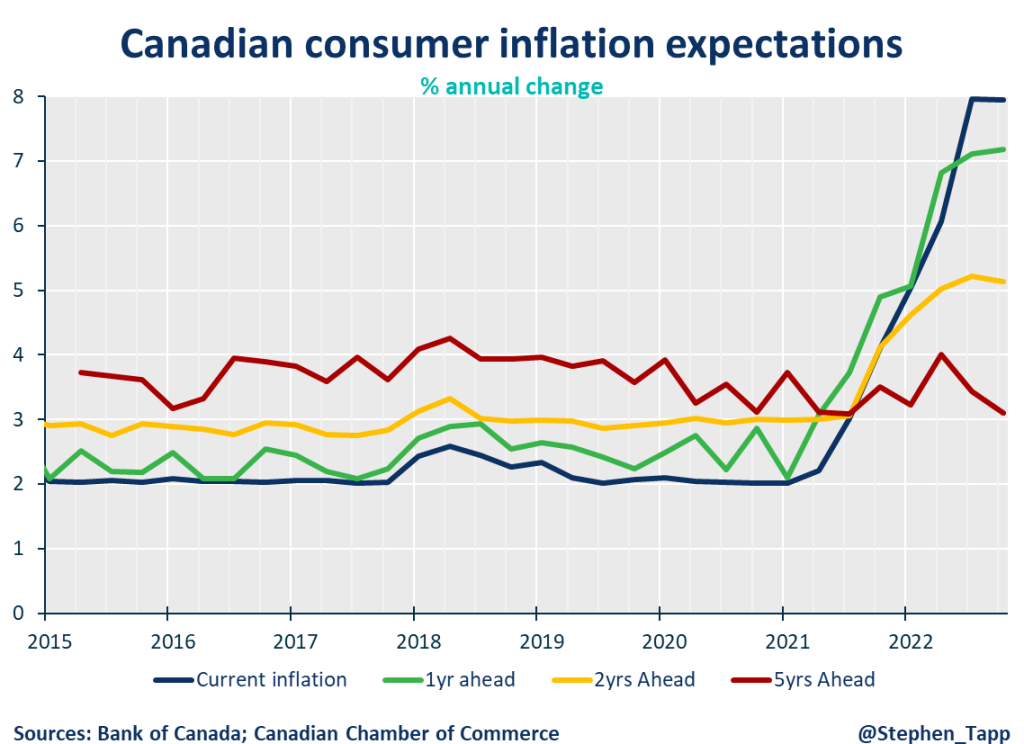

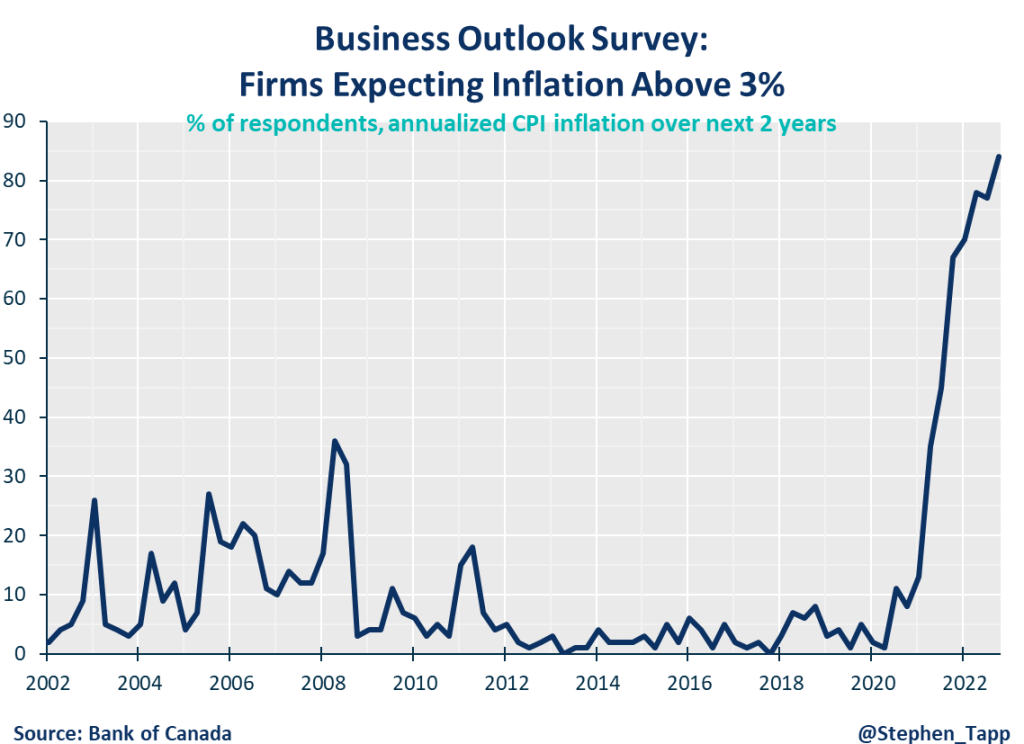

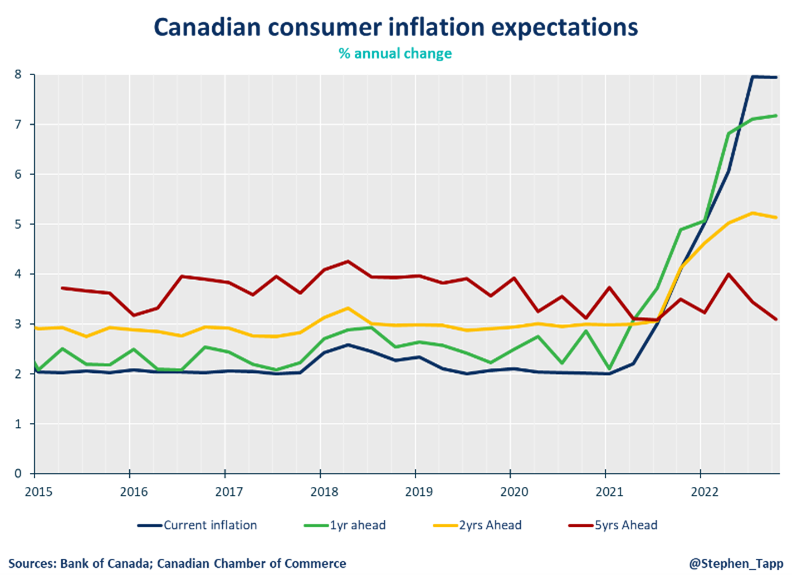

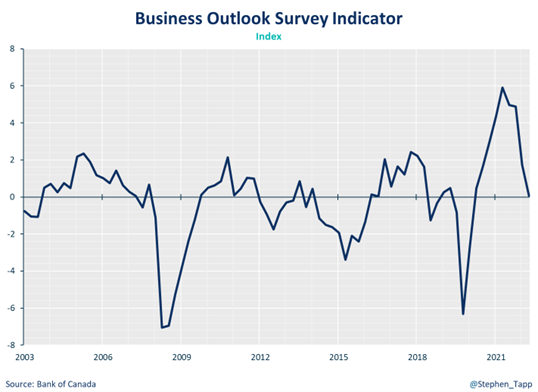

- Though a soft landing in Canada remains possible, it is still too early to clearly know if the economy will avoid a significant rough patch this year. Going forward the BoC will be looking hard at incoming data for evidence that wage growth is moderating; businesses are inclined to raise prices; short-run core inflation is slowing; and finally, inflation expectations are back to the 2% target.

SUMMARY TABLES

Other Commentaries

Oct 19, 2022

September 2022 Consumer Price Index data: Food and services prices still rising, no progress on core inflation

Sep 20, 2022

August 2022 Consumer Price Index data: Finally some good news on Canadian inflation.

Aug 16, 2022

July 2022 Consumer Price Index data: Canada’s inflation finally turns a corner with falling gas prices, but core pressures remain

Commentaries /

January 2023 CPI: Steady progress as inflation continues to slow

January 2023 CPI: Steady progress as inflation continues to slow

It was another step in the right direction as January’s data show inflation is slowly coming back under control.

Mahmoud Khairy

KEY TAKEAWAYS

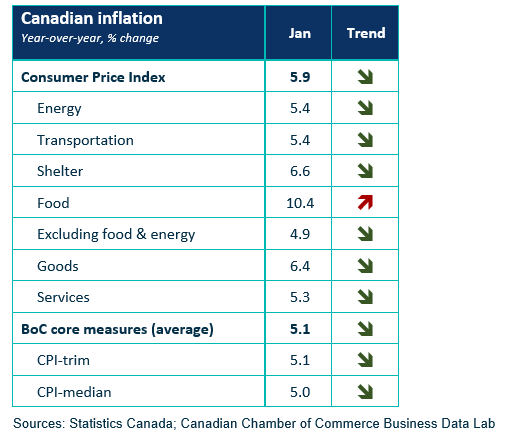

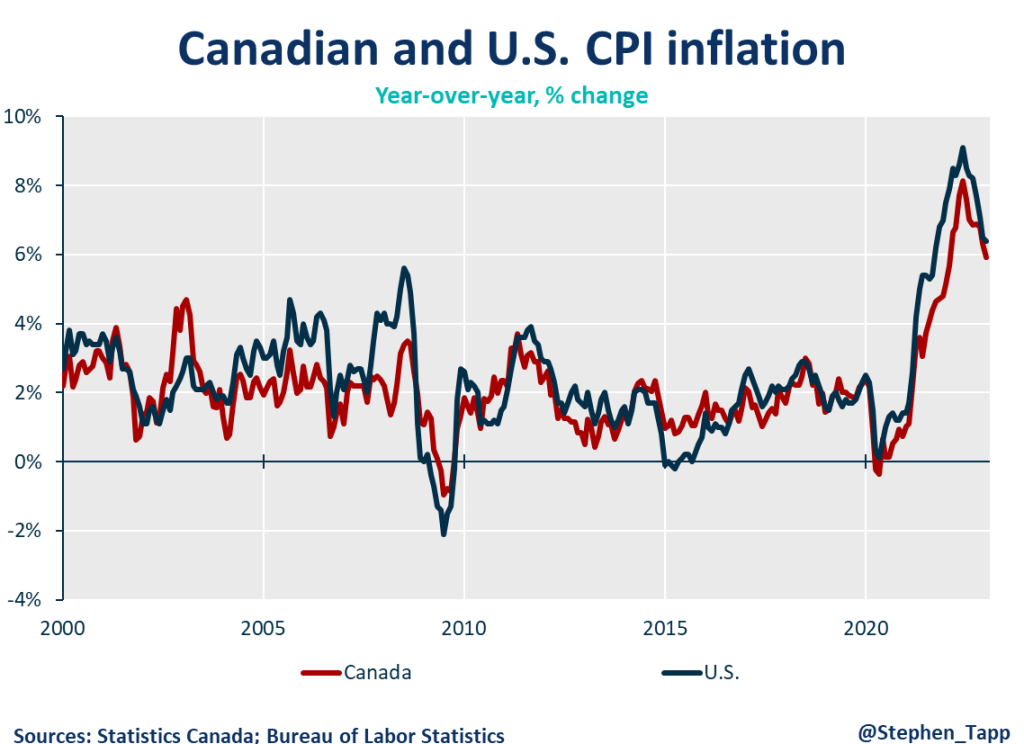

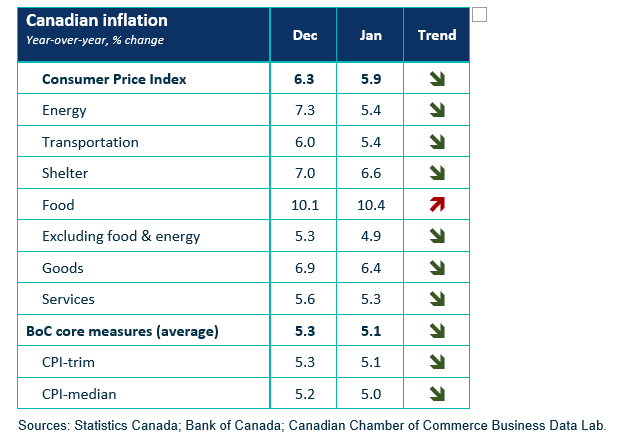

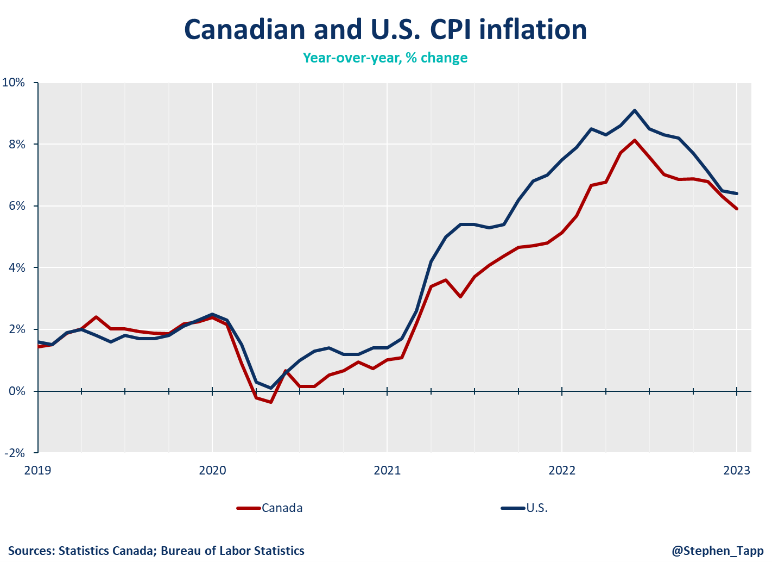

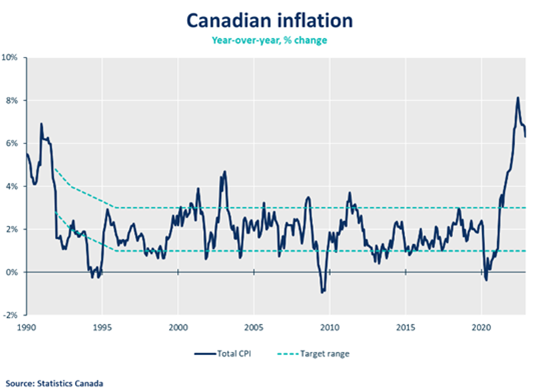

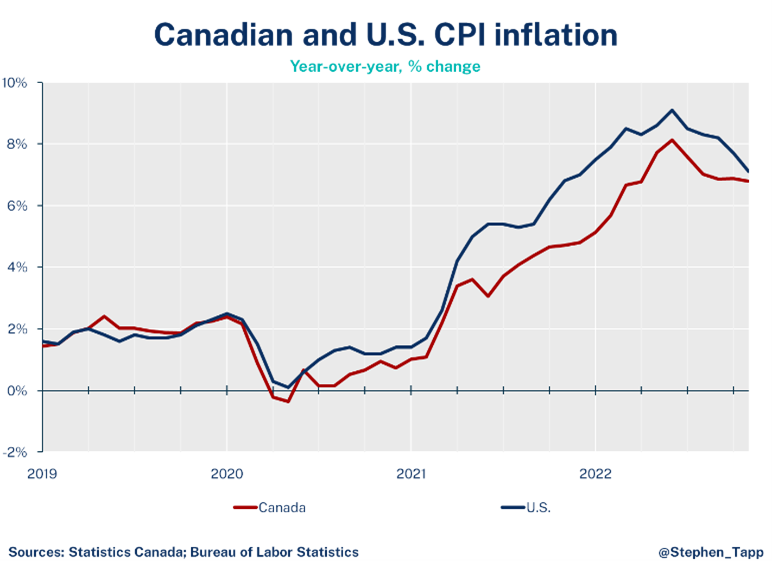

- It was another month of progress in the Bank of Canada’s fight against inflation, as Canada’s headline Consumer Price Index (CPI) inflation grew at a slower pace of 5.9% year-over-year in January, which was better than the market expectation of 6.2%.

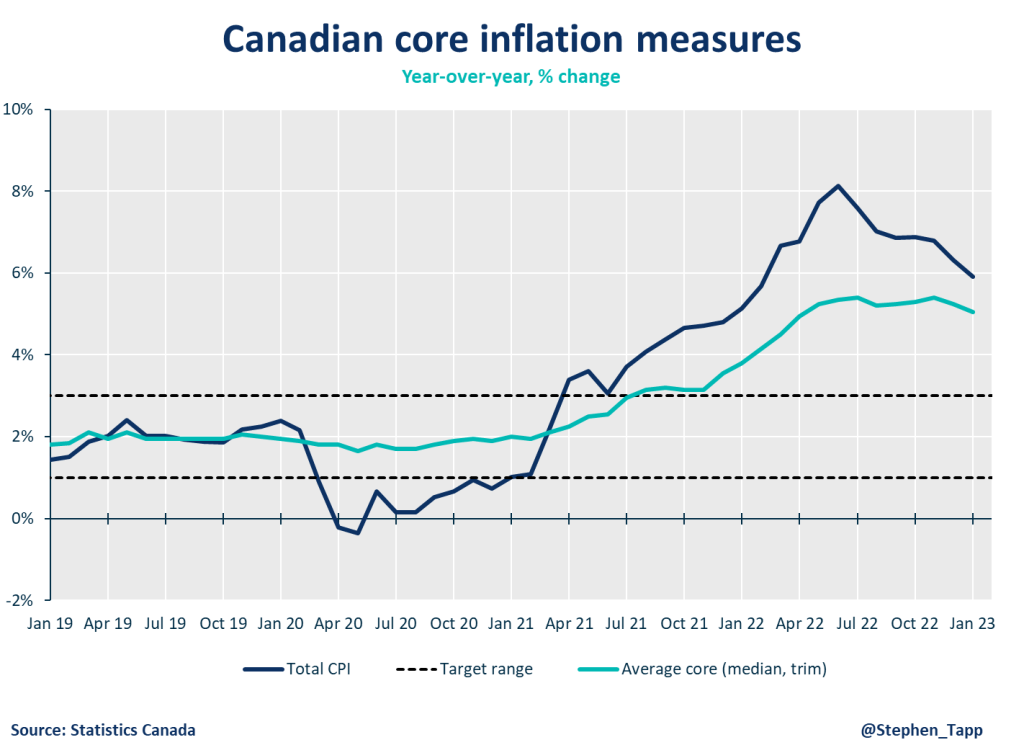

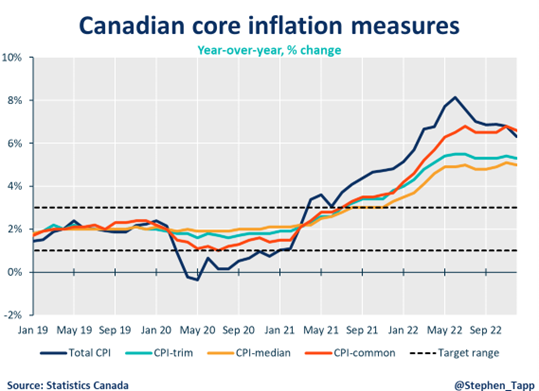

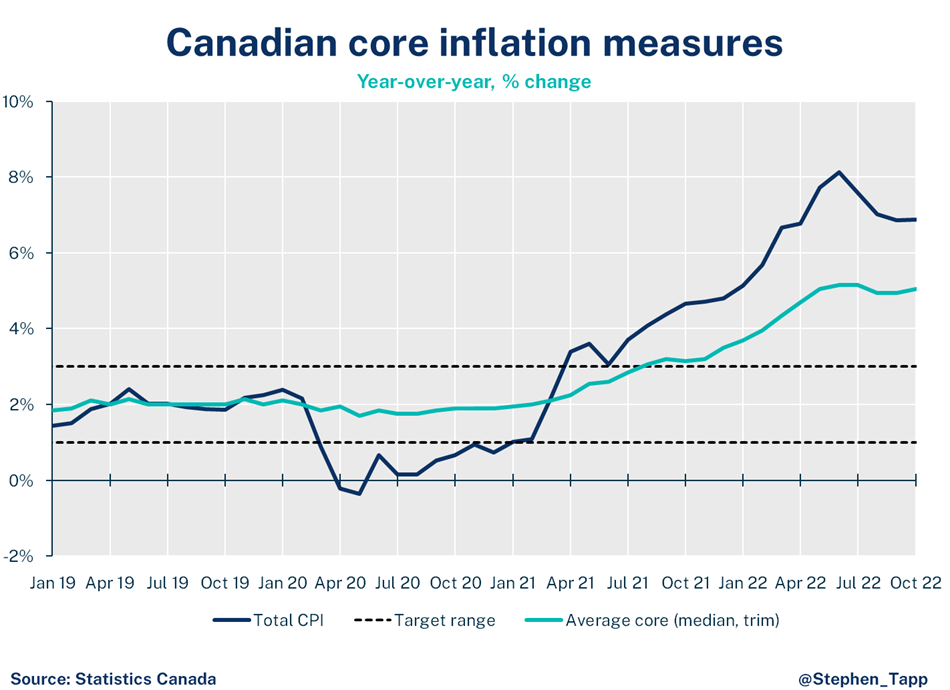

- January’s data also show modest improvements for core inflation. The average of the Bank’s two preferred “core inflation” measures declined to 5.1% year-over-year.

- Note that much of the slowdown in year-over-year inflation number in today’s data — and in the coming months — reflects “base-year effects”. Each month, new price data are being compared against the price level one year ago — and in early 2022, prices spiked up due to supply disruptions and uncertainty after Russia’s invasion of Ukraine.

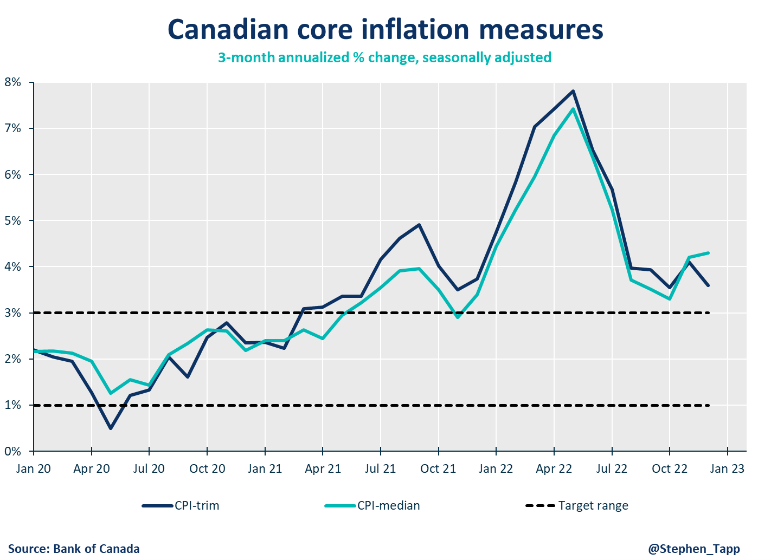

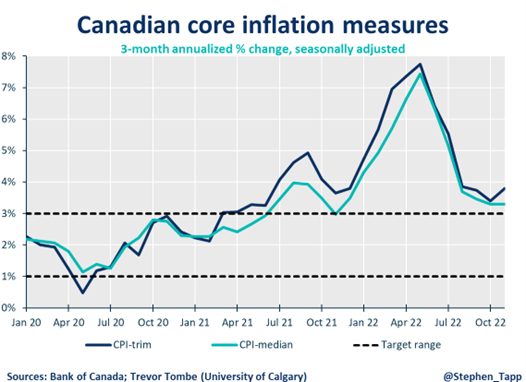

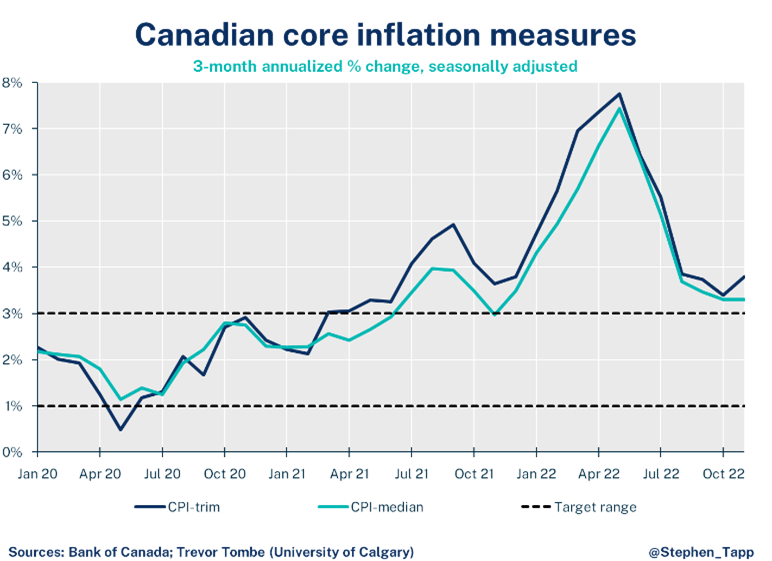

- Focusing on shorter-run core inflation (3-month annualized rates) right now provides better signals of underlying price pressures; they are around 3.5% — still too high, but much closer to the top of the Bank’s inflation target range.

- Most major components of CPI inflation slowed in January, but food inflation accelerated (to 10.4%), and remains a significant burden for consumers. Both grocery and food from restaurants prices rose, mainly due strong demand and supply constraints.

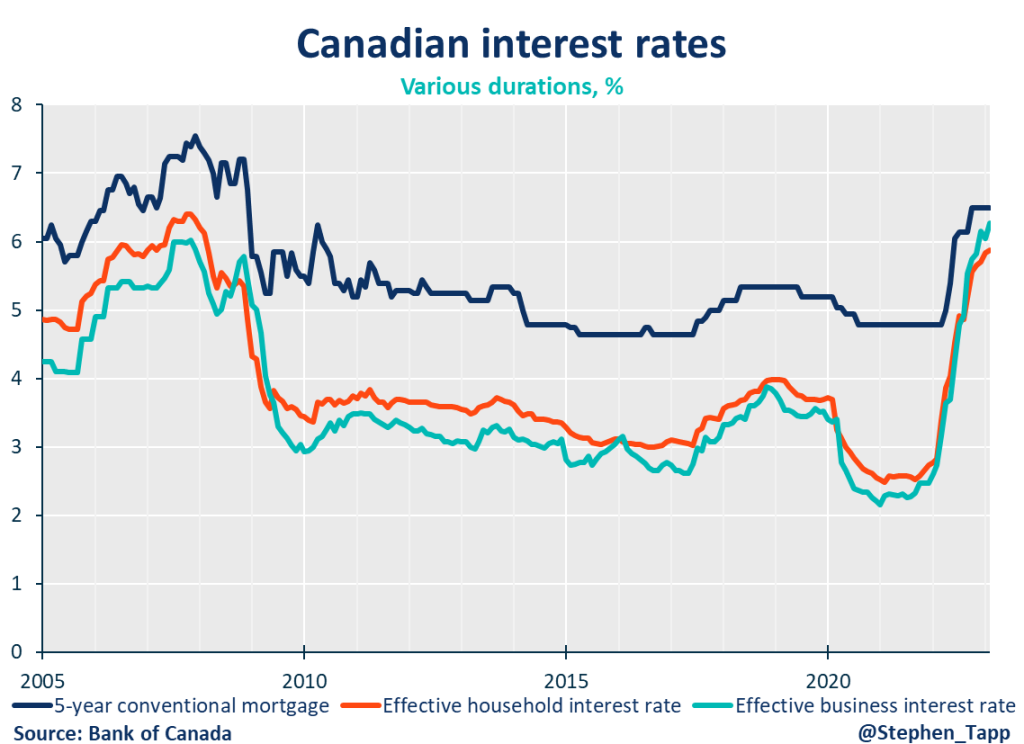

- Shelter cost inflation cooled for the third consecutive month to 6.6% overall (from 7.0% last month). However, there’s mounting upward pressure from rising mortgage rates (+21% yr/yr in January — the largest gain in over 40 years!) given the sharp increase in rates by the Bank of Canada.

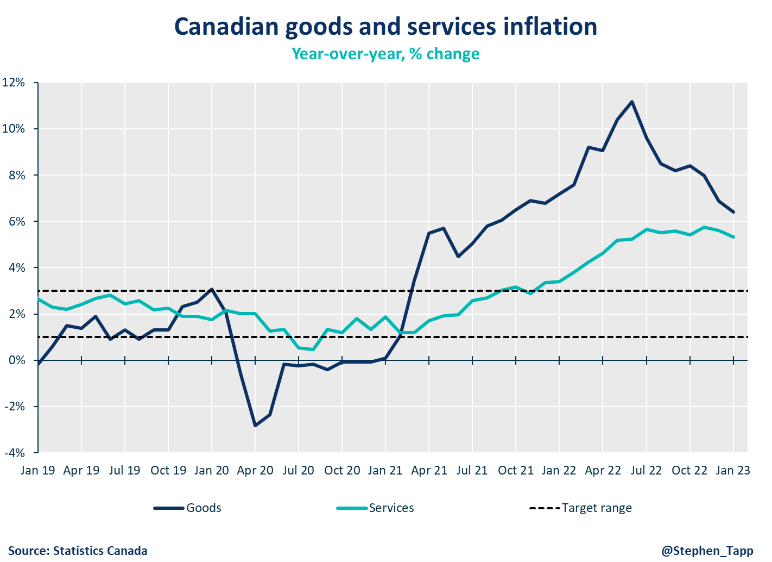

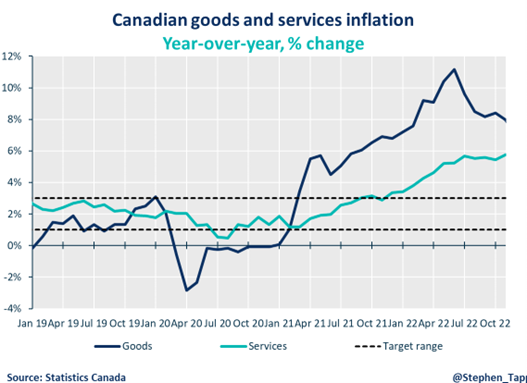

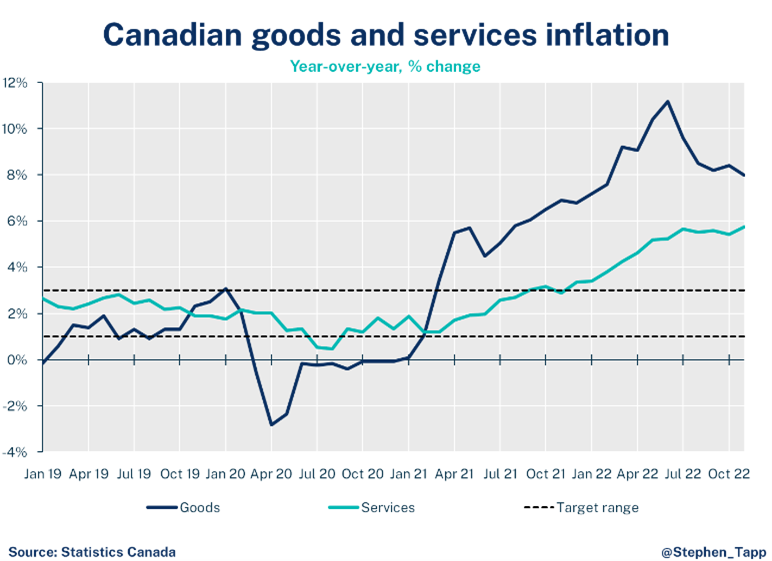

- Price increases for both goods and services slowed to 6.4% and 5.3% respectively. Cellular services prices fell by 8%, as Boxing Day deals extended into January.

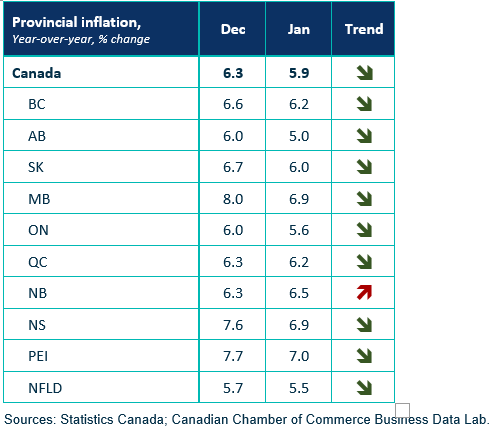

- Gasoline prices are a key driver at provincial level. It was the main reason for inflation slowing in nine of 10 provinces (and also the reason of increased inflation in New Brunswick). Alberta has the lowest inflation rate (5.0%, after electricity prices fell 46% on the month, related to provincial initiatives).

SUMMARY TABLES

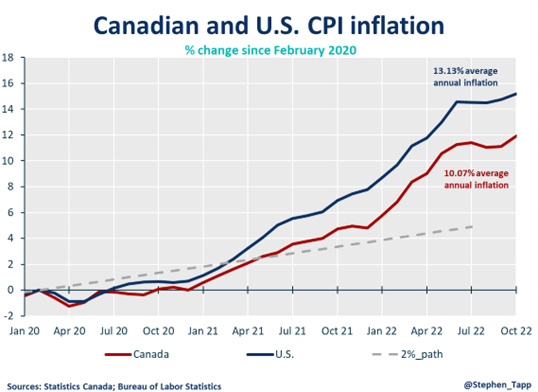

INFLATION CHARTS

For more great #cdnecon content, visit our Business Data Lab.

Other Commentaries

Oct 19, 2022

September 2022 Consumer Price Index data: Food and services prices still rising, no progress on core inflation

Sep 20, 2022

August 2022 Consumer Price Index data: Finally some good news on Canadian inflation.

Aug 16, 2022

July 2022 Consumer Price Index data: Canada’s inflation finally turns a corner with falling gas prices, but core pressures remain

Commentaries /

January 2023 CPI: The Bank is slowing tightening pace, becomes first major central bank to signal pause

January 2023 CPI: The Bank is slowing tightening pace, becomes first major central bank to signal pause

Though inflation shows signs of coming down, it remains triple the target rate as Canada’s economy also remains in excess demand. The 25-basis point hike came with some positive news.

Mahmoud Khairy

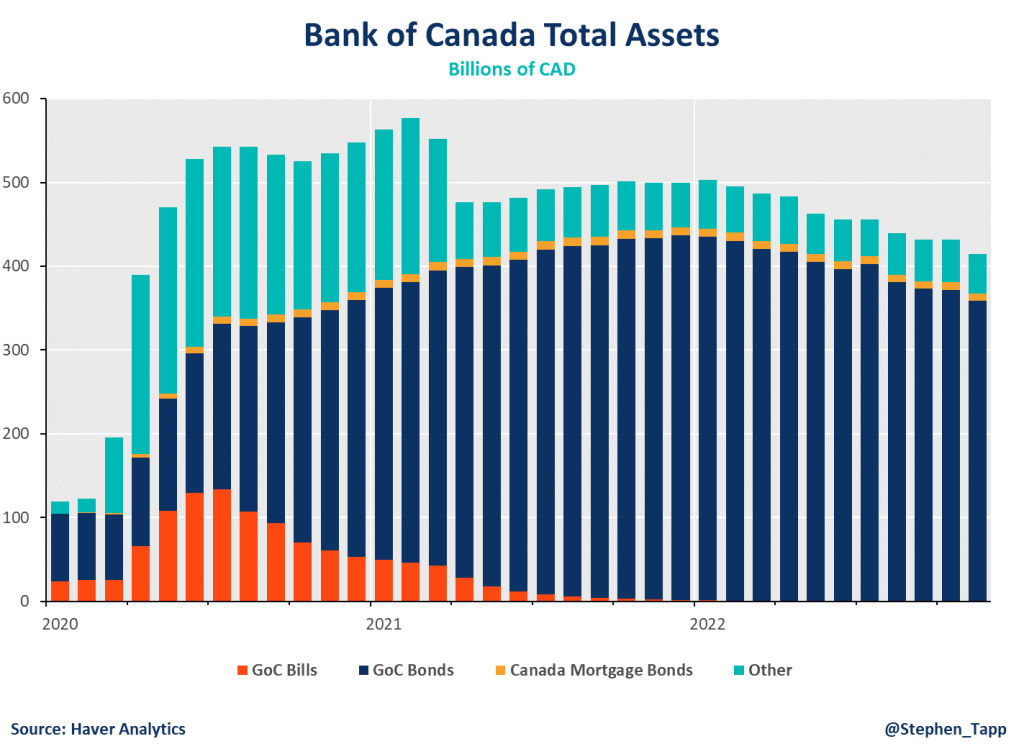

Today’s Bank of Canada announcement marks its eighth interest rate hike bringing it to 4.50%. Though inflation shows signs of coming down, it remains triple the target rate as Canada’s economy also remains in excess demand. The 25-basis point hike came with some positive news – there would be a conditional hold on additional increases in the current cycle – making it the first major central bank to do so. The Bank’s decision reflects confidence that their tightening policy is successfully slowing down the economy as inflation turns a corner alongside lower energy prices and improvements in supply chains.

Mahmoud Khairy, Economist, Business Data Lab, Canadian Chamber of Commerce

KEY TAKEAWAYS

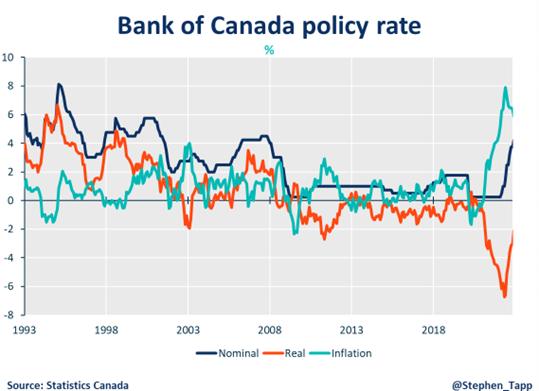

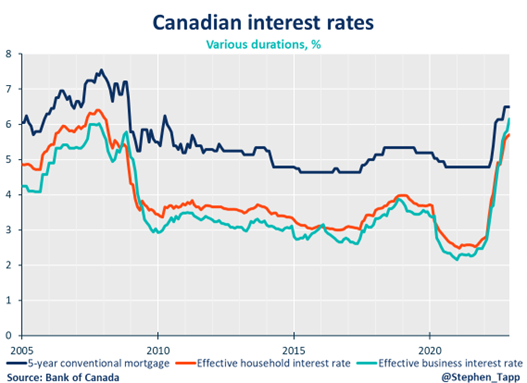

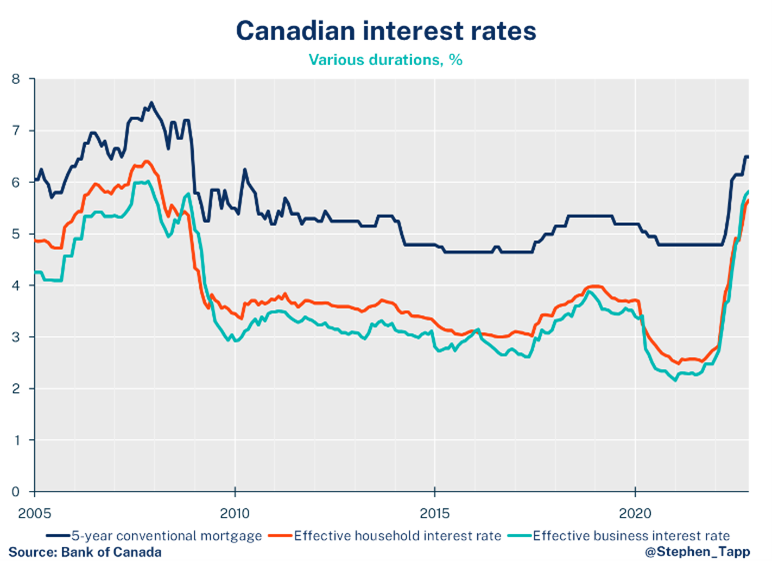

- The Bank of Canada (BOC)’s policy rate is at its peak: Meeting market expectations, the BoC’s modest hike of 25 basis points (0.25%) brought interest rates today to 4.50% becoming the first major central bank to signal pause. With a cumulative record increase of 425 basis points, this brings the policy rate its highest level in over a decade and half. However, inflation is starting to fall as restrictive monetary policy is slowing activity, especially household spending.

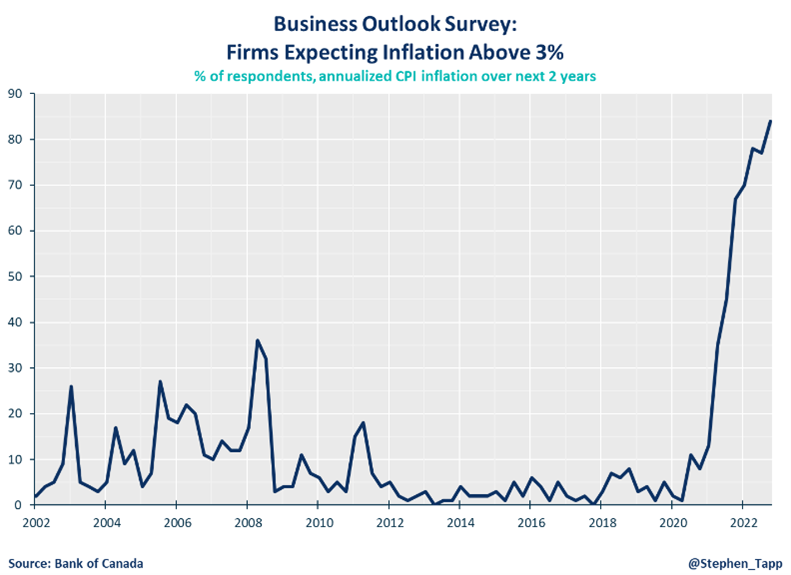

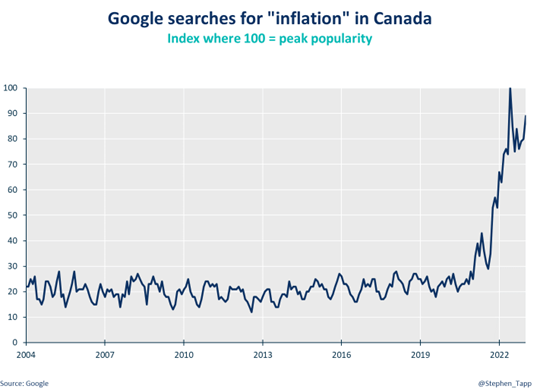

- Although December’s inflation data was welcomed relief, at 6.3% inflation remains too high and well above the BoC’s 2% target. Core inflation has also been sticky and lagging in sustained improvement. The Bank revealed that short-term inflation expectations in Canada have declined as the share of firms expecting large price increases has dropped. Still, it remains above the Bank’s inflation forecast. In contrast, long-term expectations for inflation remain in line with the BoC’s target.

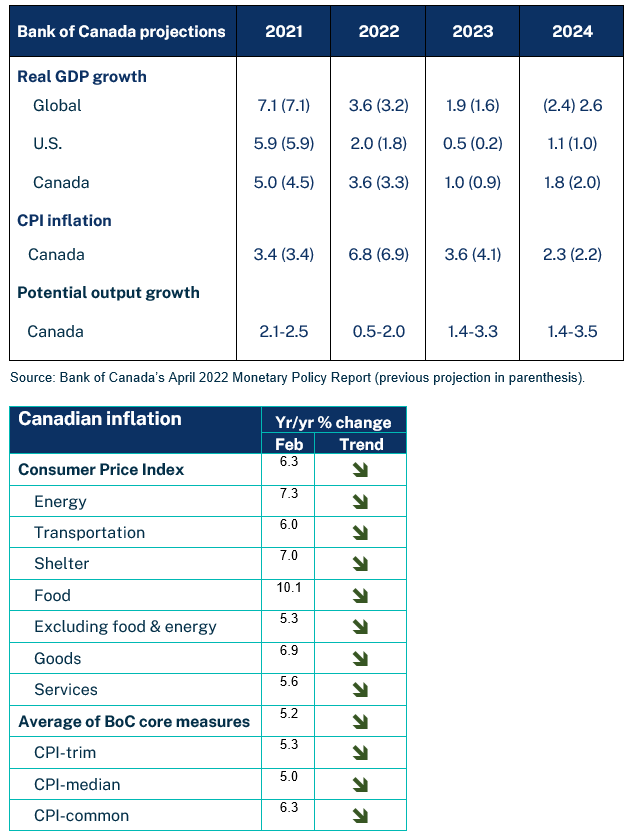

- Canadian inflation is declining from its recent peak: There was a significant downward revision to the Bank’s CPI inflation forecast in 2023. Inflation is now expected to be 3.6% in 2023 and return to the Bank’s 2% target in 2024. Most of this change is attributed to lower energy prices, improvements in global supply chains and the effects of higher interest rates moving through the economy.

- The Bank revised upwards its global economic outlook: In its January Monetary Policy Report (MPR), the BoC revised upwards its economic projection for the global economy in 2023 (from 1.6% to 1.9%); led by stronger activity than initially anticipated, robust consumer spending, a tight labour market, easing of disruptions to commodity prices as well as global trade and an earlier-than-expected change in China’s “zero-COVID” policy. The Bank estimates global growth in 2024 to be lower than previous projections (2.4% from 2.6%).

- Growth in the United States’ economy is still expected to remain flat in 2023 mostly because of rising interest rates and tighter financial conditions. The BoC expected this weak outlook to persist at least through the first half of 2023.

- The Bank’s outlook for Canada’s economic growth has been revised down: Growth in Canada’s economy is now expected to be slightly better-than-anticipated in 2023 (1.0% from October’s projection of 0.9%). Conversely, the BoC revised down its projections for 2024 (1.8% from 2.0%). As such, the overall level of activity is slowing down over the projection. That said, non-energy commodity exports are expected to grow as supply chain restrictions ease. Oil and gas activity is expected to be moderate in 2023 before picking up again in 2024 with the completion of new expansion projects, which will offset slower consumer spending growth as interest rates rise alongside modest foreign demand.

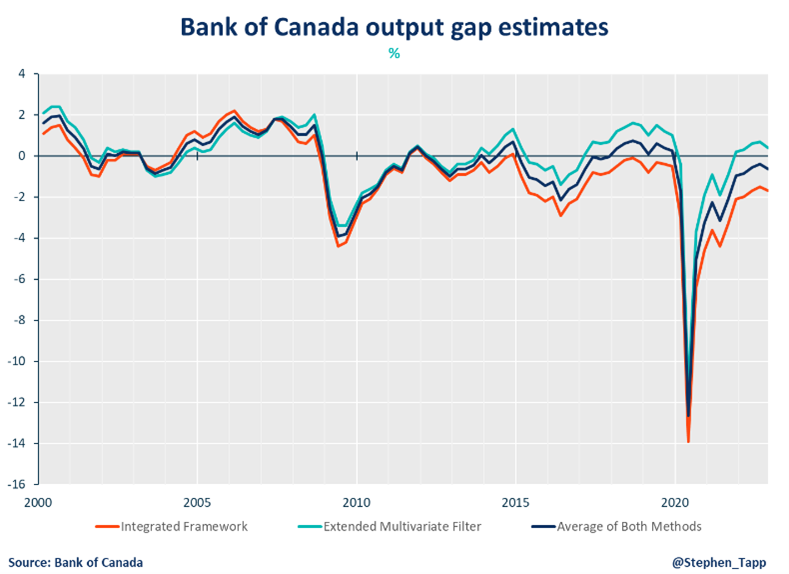

- The pace of economic growth is slowing but demand continues to exceed supply: Canada’s labour market is more resilient than anticipated. The labor market is still tight across a broad range of measures and improvements can already be seen on the supply chain channels. Still, as demand is still outpacing supply, the rise in policy rate is expected to “broaden and moderate” consumer spending on services (especially for housing and big-ticket items) and dampen investment spending in 2023.

- Accordingly, the BoC is projecting growth to pick up later in 2023, reaching 2.50% in the second half of 2024 as the effect of interest rate increases fade, with the estimate of output gap between 0.5% and 1.5% in the fourth quarter of 2022 and 2023 which is more than was projected in the October MPR’s projection.

SUMMARY TABLES

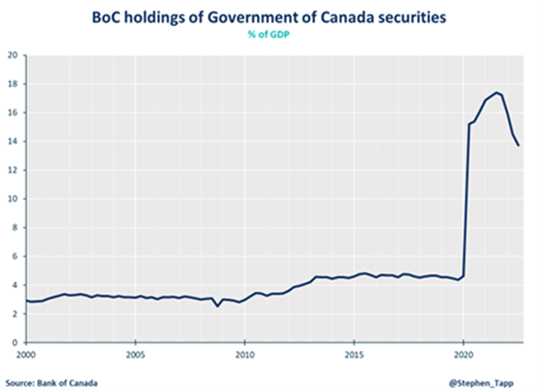

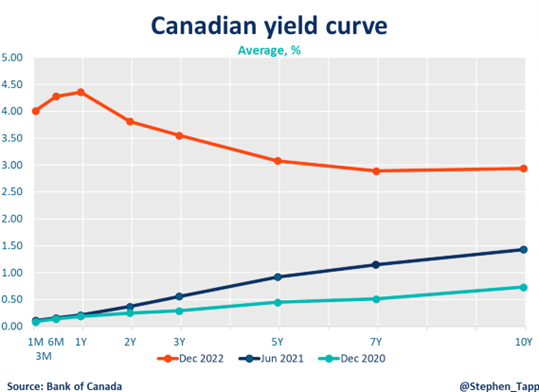

MONETARY POLICY CHARTS

For more great #cdnecon content, visit our Business Data Lab.

Other Commentaries

Oct 19, 2022

September 2022 Consumer Price Index data: Food and services prices still rising, no progress on core inflation

Sep 20, 2022

August 2022 Consumer Price Index data: Finally some good news on Canadian inflation.

Aug 16, 2022

July 2022 Consumer Price Index data: Canada’s inflation finally turns a corner with falling gas prices, but core pressures remain

Commentaries /

December 2022 CPI: Start the new year with some good news

December 2022 CPI: Start the new year with some good news

Canada’s headline Consumer Price Index inflation slowed to 6.3% year-over-year in December. The picture for core inflation remained the same, as food, shelter and services price growth were modestly improved.

Mahmoud Khairy

Canada’s headline Consumer Price Index inflation slowed to 6.3% year-over-year in December. The picture for core inflation remained the same, as food, shelter and services price growth were modestly improved.

The Bank of Canada has aggressively raised its policy rate by 4% since March. Their last announcement signaled a willingness to pause to assess the impact of these higher interest rates on the economy. However, given December’s stronger job gains and still elevated inflation expectations in the Bank’s business and consumer surveys, we expect the Bank of Canada to raise rates one last time next week — by 25 basis points, to end their tightening cycle at 4.5%.

Mahmoud Khairy, Economist, Business Data Lab, Canadian Chamber of Commerce

KEY TAKEAWAYS

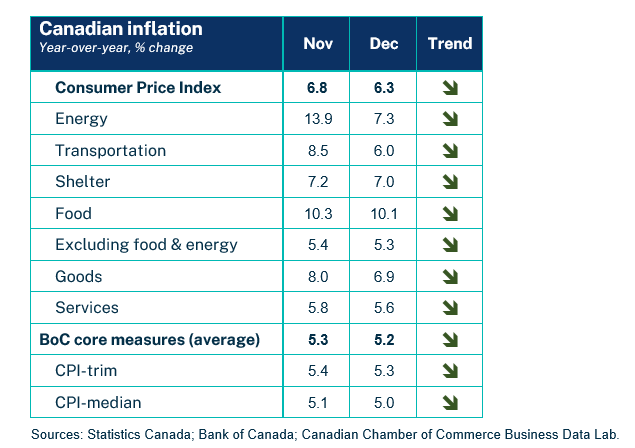

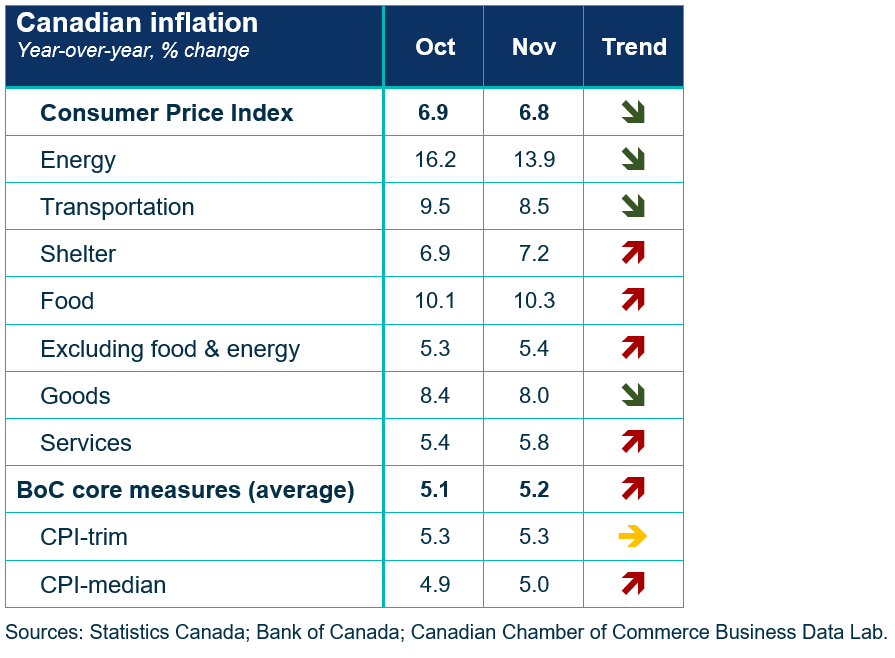

- Canada’s headline Consumer Price Index (CPI) inflation grew at a slower pace to 6.3% year-over-year in December.

- This is a noticeable improvement, and unfortunately, the picture for core inflation remains the same.

- The average of the Bank’s two preferred “core inflation” measures remained stable at 5.2% year-over-year.

- Food inflation remains broad-based. Grocery prices rose 11.0% year-over-year in December (down from 11.4% in October) and remains a major concern for consumers.

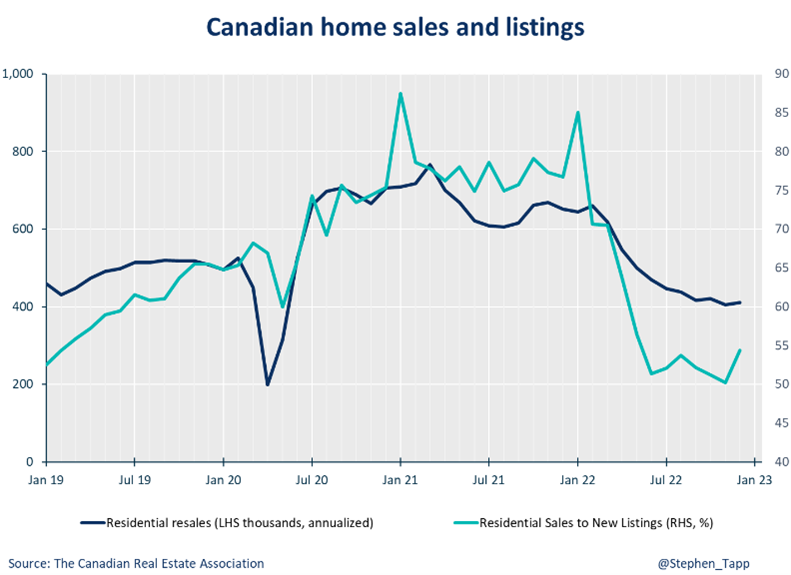

- Shelter costs slowed down noticeably to 7.0% (from 7.2% last month) as housing market shows signs of cooling. However, rising mortgage rates (up 18.0% from 14.5% in November given a much higher Bank policy rate) and rents (5.8%, due to increased demand for rentals from those being priced out of owning a house) continue to put upward pressure on the CPI.

- Price increases for both goods and services slowed significantly to 6.9% and 5.6% respectively.

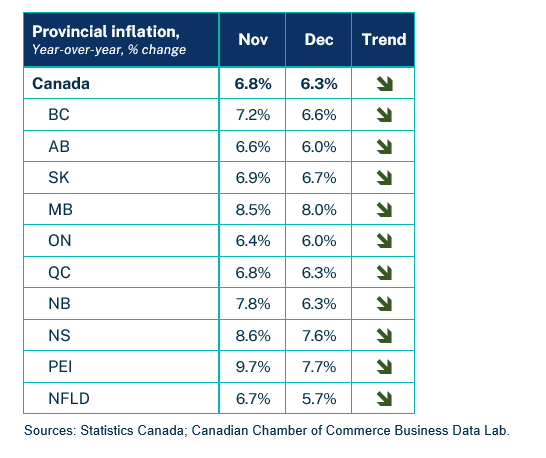

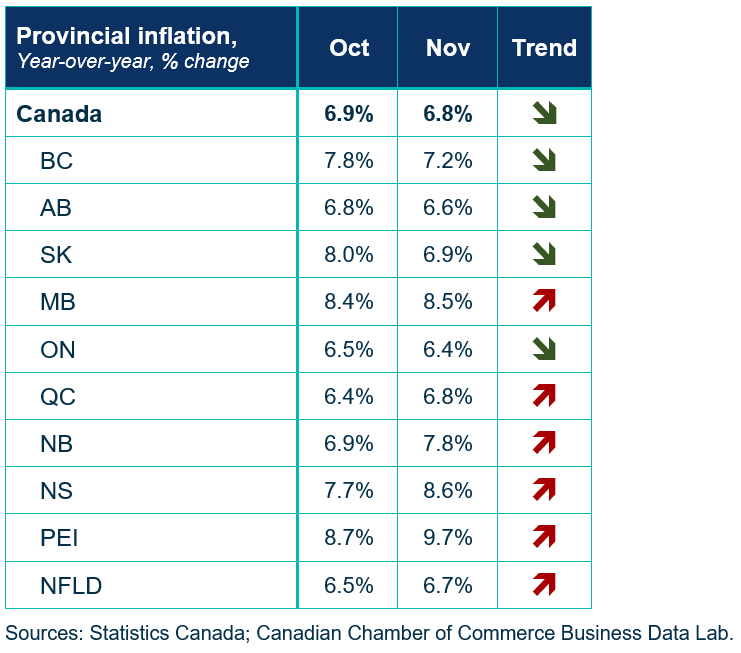

- Inflation decreased in all provinces. This month’s decrease was the most in Atlantic Canada driven by lower furnace fuel oil prices. In December, inflation was highest in Manitoba (8.0%) and lowest in Newfoundland and Labrador (5.7%).

- The Bank of Canada has aggressively raised its policy rate by 4% since March. Their last announcement signaled a willingness to pause to assess the impact of these higher interest rates on the economy. However, given December’s stronger job gains and still elevated inflation expectations in the Bank’s business and consumer surveys, we expect the Bank of Canada to raise rates one last time next week — by 25 basis points, to end their tightening cycle at 4.5%.

SUMMARY TABLES

INFLATION CHARTS

For more great #cdnecon content, visit our Business Data Lab.

Other Commentaries

Oct 19, 2022

September 2022 Consumer Price Index data: Food and services prices still rising, no progress on core inflation

Sep 20, 2022

August 2022 Consumer Price Index data: Finally some good news on Canadian inflation.

Aug 16, 2022

July 2022 Consumer Price Index data: Canada’s inflation finally turns a corner with falling gas prices, but core pressures remain

Commentaries /

December 2022 CPI: No early Christmas present for the Bank of Canada

December 2022 CPI: No early Christmas present for the Bank of Canada

Stephen Tapp, our Chief Economist, shares his take on Canada's headline Consumer Price Index inflation as of December 21.

Stephen Tapp

Canada’s headline Consumer Price Index inflation slowed only modestly to 6.8% year-over-year in November. The picture for core inflation worsened, as food, shelter and services price growth accelerated.

The Bank of Canada’s last announcement signaled a willingness to pause to assess the impact of higher interest rates on the economy. However, if there are not stronger signals in next month’s data that inflation is decelerating, and in the Bank’s upcoming surveys that medium-term inflation expectations are moderating, don’t rule out a 25 basis-point hike in January.

Stephen Tapp, Chief Economist, Canadian Chamber of Commerce

Key Takeaways

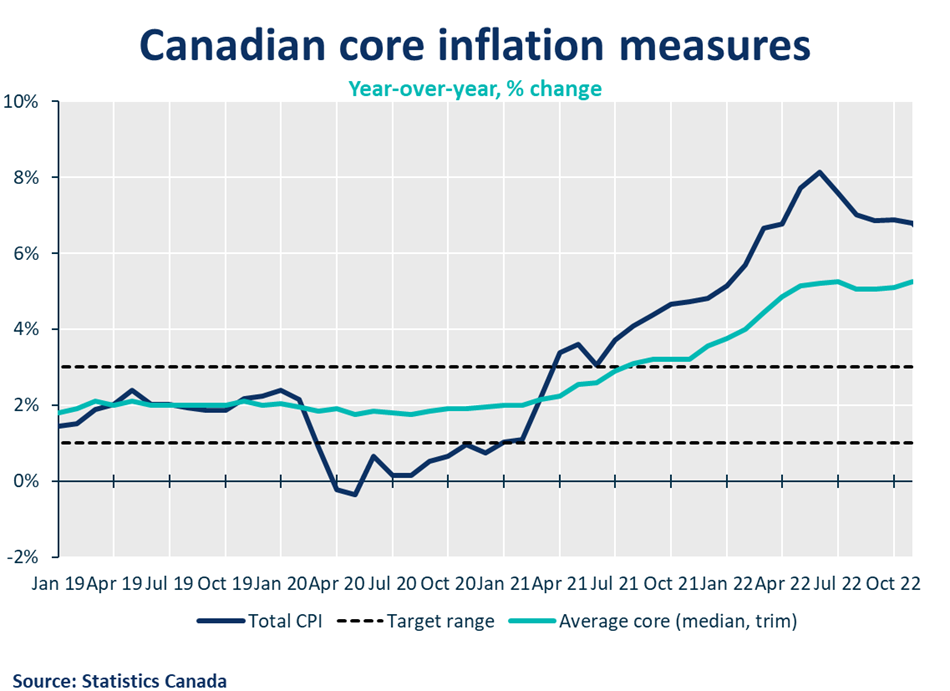

- Canada’s headline Consumer Price Index (CPI) inflation slowed slightly to 6.8% year-over-year in November.

- This is only a modest improvement, and unfortunately, the picture for core inflation worsened.

- The average of the Bank’s two preferred “core inflation” measures rose slightly to 5.2% year-over-year (from 5.1%).

- We know the Bank is focused on short-run dynamics (i.e., forward-looking 3-month annualized measures, rather than backward-looking 12-month year-over-year rates) to get a better sense of underlying momentum in price growth. While these numbers aren’t publicly reported by StatsCan, estimates from Trevor Tombe (University of Calgary) suggest that the average of these two measures also increased in November. Both measures continue to run above the 3% threshold, representing the top of the Bank’s inflation control band.

- Food inflation remains broad-based. Grocery prices rose 11.4% year-over-year in November (up from 11.0% in October) and are a major concern for consumers.

- Shelter costs picked up noticeably to 7.2% (from 6.9% last month) because of rising mortgage rates (up 14.5% given a much higher Bank policy rate) and rents (5.9%, due to increased demand for rentals from those being priced out of owning a house).

- Price increases for goods slowed to 8.0%, but services inflation accelerated to 5.8%.

- Inflation increased in six provinces. This month’s increases were concentrated in Atlantic Canada driven by higher fuel oil costs. In November, inflation was highest in Prince Edward Island (9.7%) and lowest in Ontario (6.4%).

- The Bank of Canada has aggressively raised its policy rate by 4% since March. Their last announcement signaled a willingness to pause to assess the impact of these higher interest rates on the economy. However, if there are not stronger signals in next month’s inflation data and the Bank’s upcoming surveys that inflation is decelerating, don’t rule out a 25 basis-point hike.

Summary Tables

For more great #cdnecon content, visit our Business Data Lab.

Other Commentaries

Oct 19, 2022

September 2022 Consumer Price Index data: Food and services prices still rising, no progress on core inflation

Sep 20, 2022

August 2022 Consumer Price Index data: Finally some good news on Canadian inflation.

Aug 16, 2022