Commentaries /

March 2023 CPI: The Bank of Canada becomes the first major central bank to pause interest rates hikes… but for how long?

March 2023 CPI: The Bank of Canada becomes the first major central bank to pause interest rates hikes… but for how long?

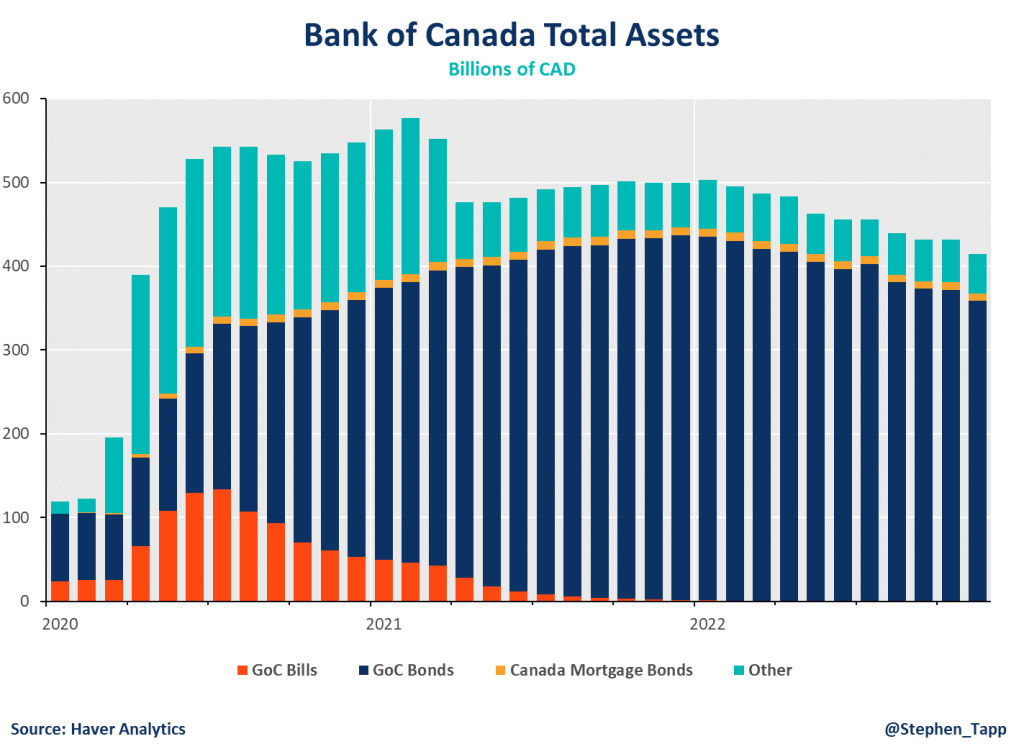

After one year of aggressively raising interest rates by a total of 4.25%, the Bank of Canada today held its policy rate steady — officially following through on the “conditional pause” in its tightening cycle.

Rewa

After one year of aggressively raising interest rates by a total of 4.25%, the Bank of Canada today held its policy rate steady — officially following through on the “conditional pause” in its tightening cycle.

– Mahmoud Khairy, Economist, Canadian Chamber of Commerce Business Data Lab

KEY TAKEAWAYS

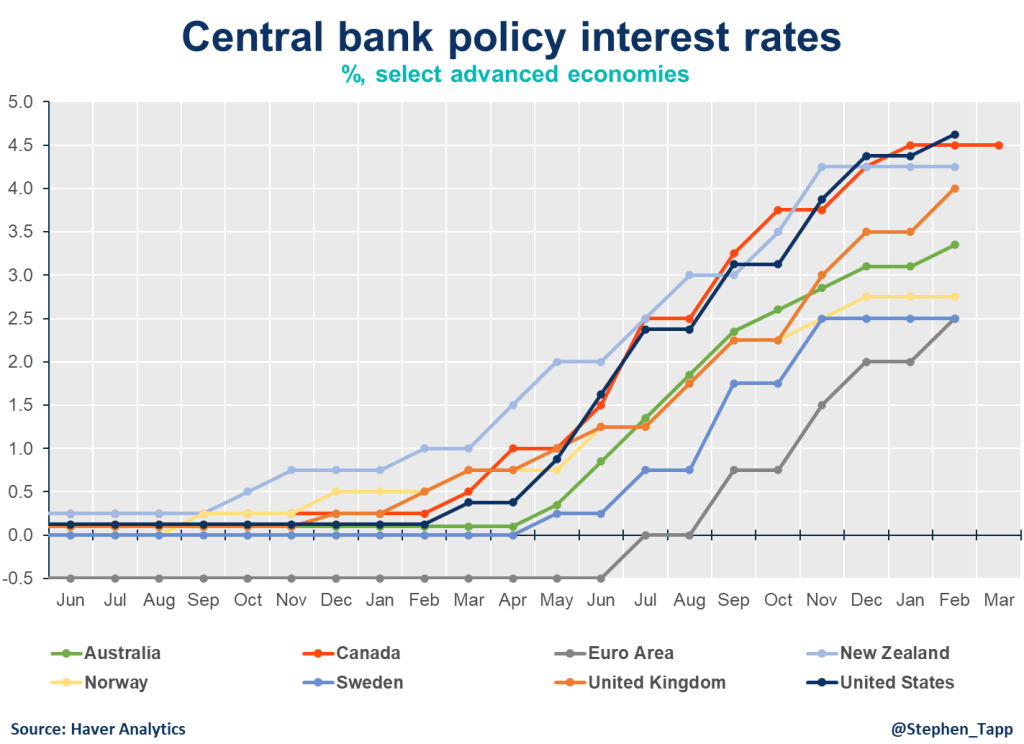

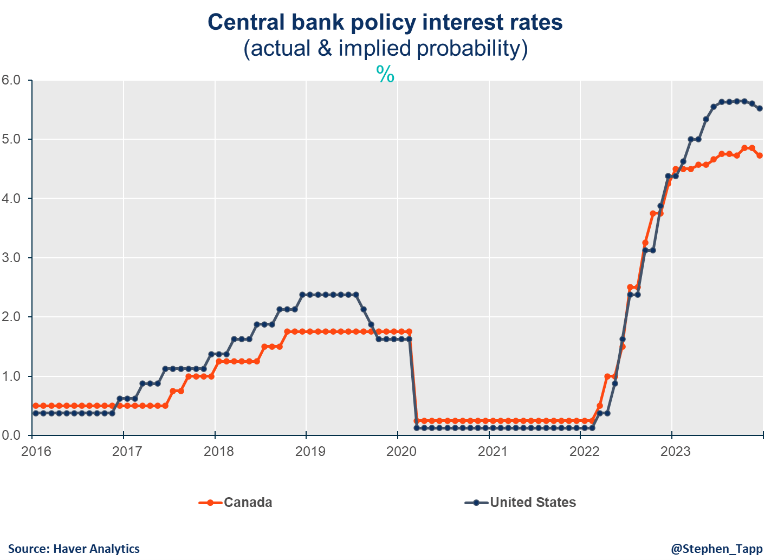

- After eight consecutive rate increases, the Bank of Canada met market expectations and held for the first time in a year for the overnight rate at 4.5%, making it the first major central bank to stop raising interest rates.

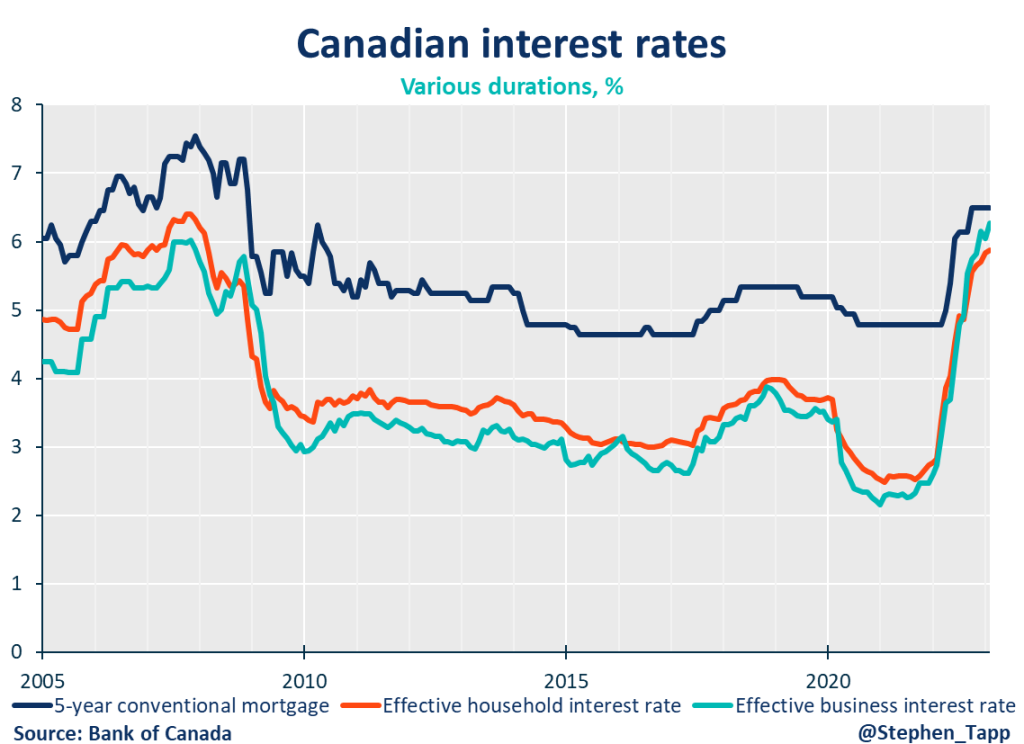

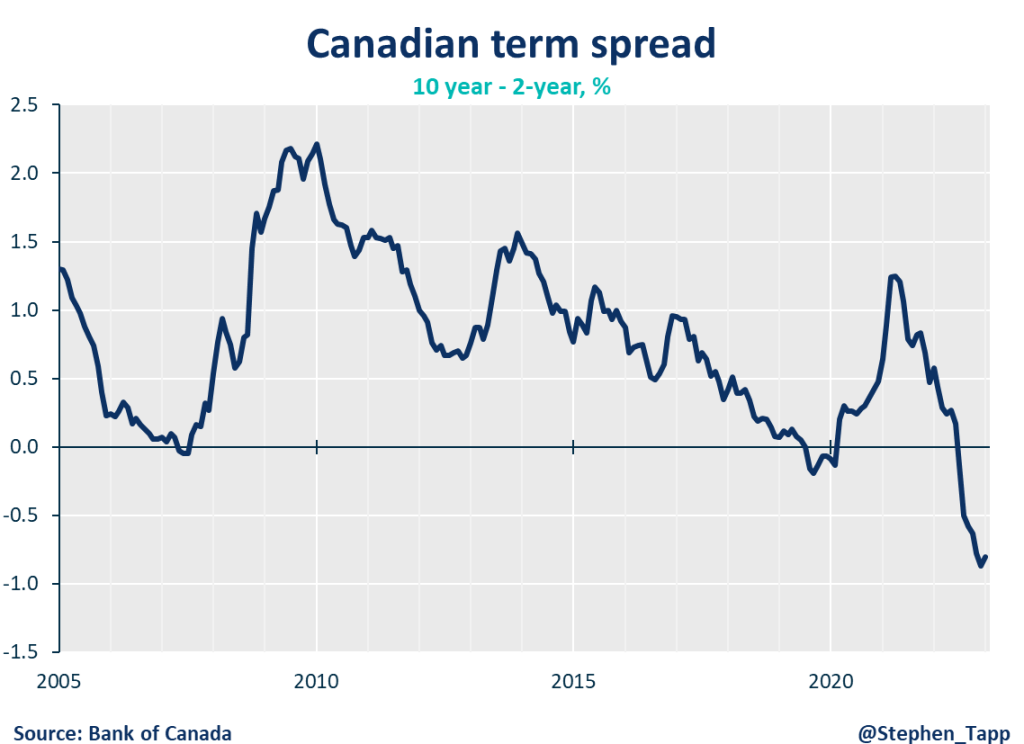

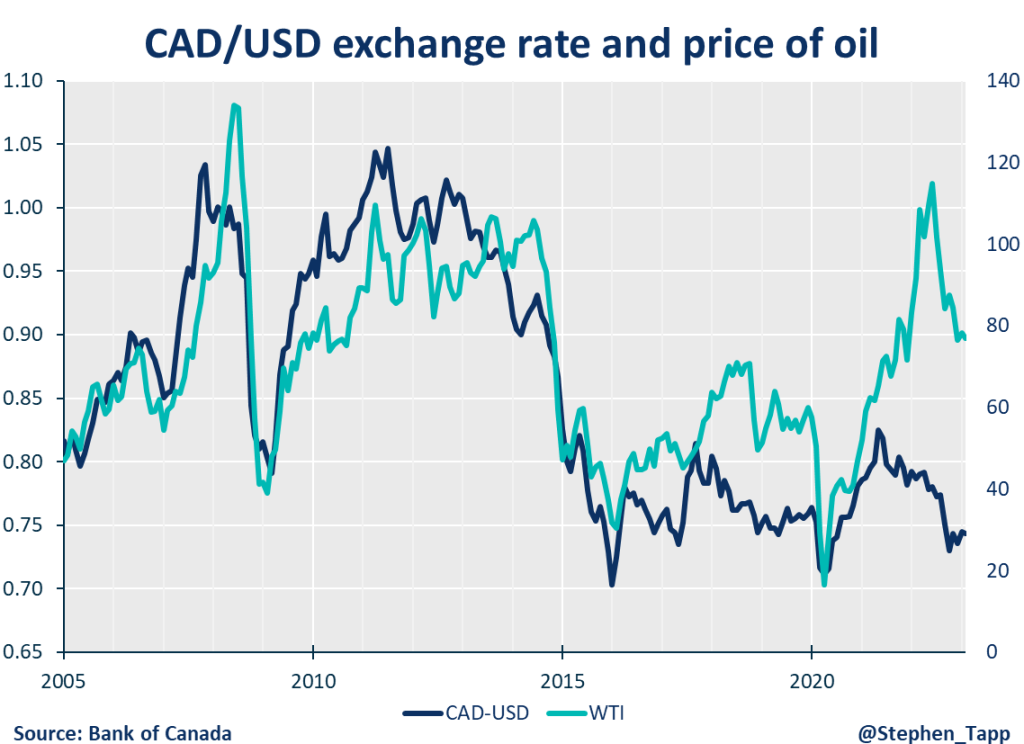

- Despite holding rates today, the Bank’s statement included a hint of hawkish bias by stating that, “Governing Council…is prepared to increase the policy rate further if needed.” Pressure might build on the Bank of Canada over the coming quarters to resume rate hikes. This is because the U.S. Federal Reserve is widely expected to continuing raising rates to a noticeably higher level than Canada. A sustained interest rate differential could put downward pressure on the Canadian dollar, which in turn, would increase the costs of imports and add to Canadian inflation pressures.

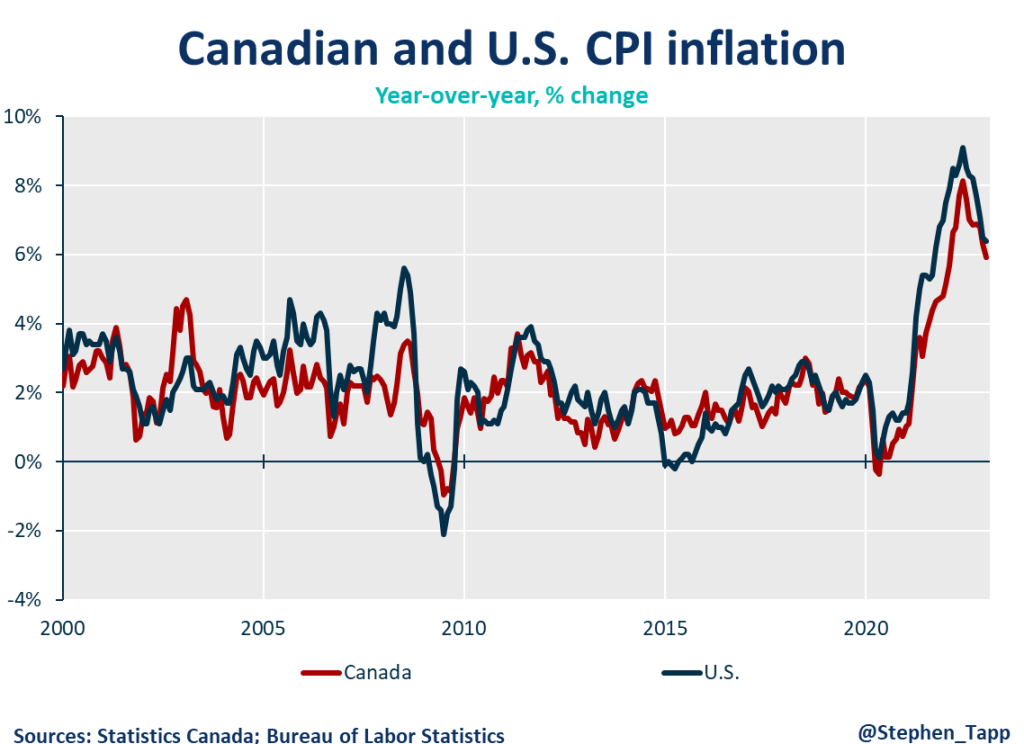

- Globally, recent data for the US and Europe have been slightly stronger than the Bank expected, and China’s economic rebound after relaxing its COVID-zero policies presents a new upside risk for commodity prices, and hence inflation.

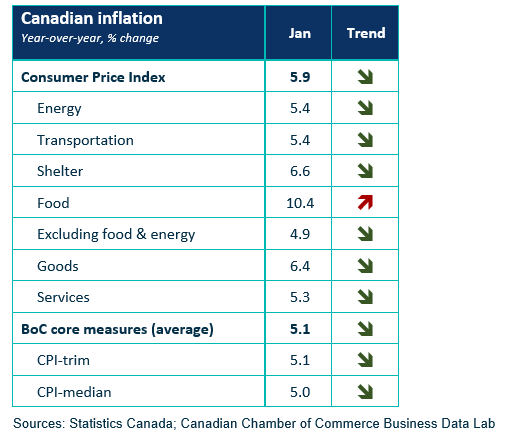

- In Canada, weaker-than-expected GDP growth in the fourth quarter of 2022 will not cause too much concern for the Bank, because it was due mainly to inventories, not underlying domestic demand. While inflation was running at 5.9% in January, the BoC expects it to decline to around 3% in the middle of this year and return to the 2% target in 2024. The labor market remains tight with the unemployment rate near a historic low. Wages are growing at around 4.5%, but labor productivity has been disappointing.

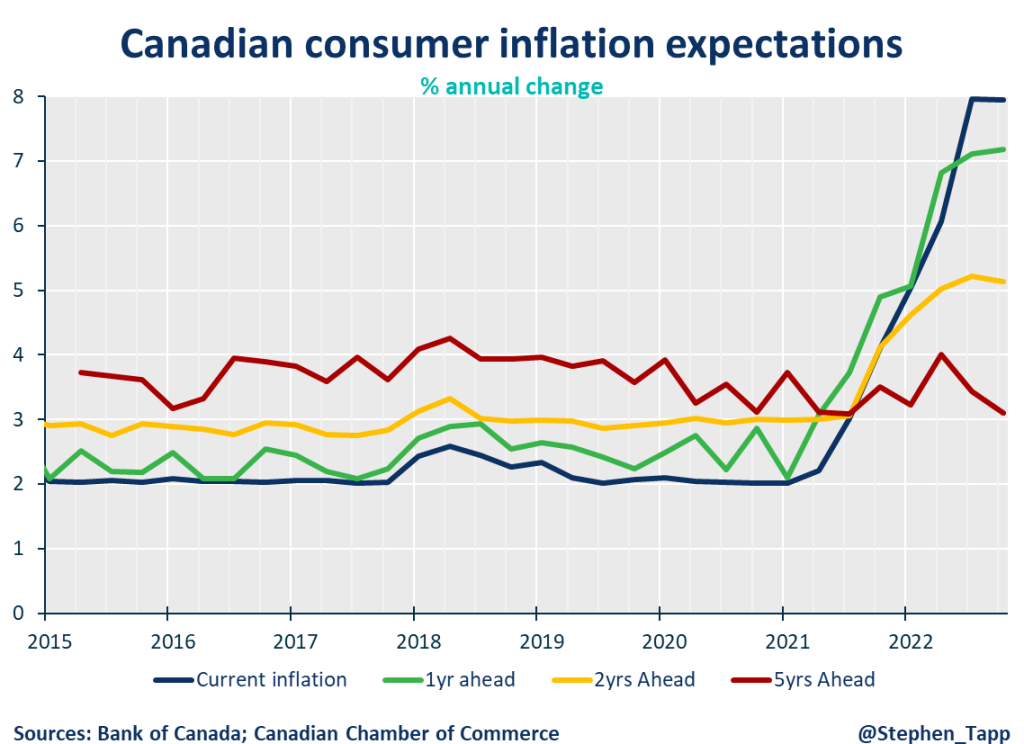

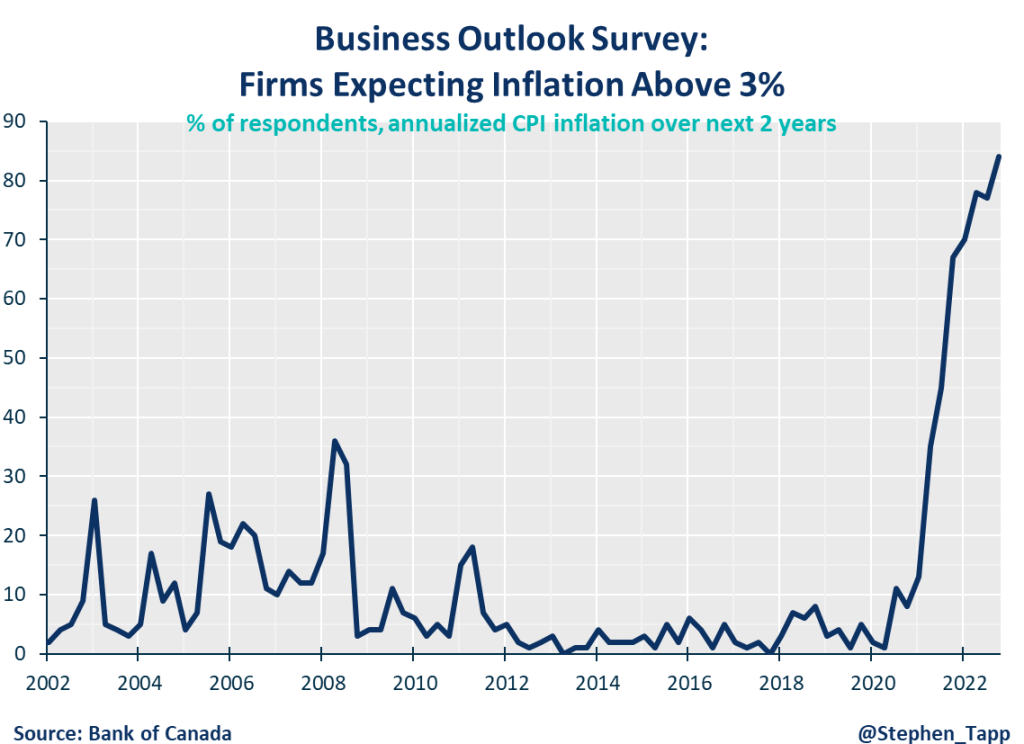

- Though a soft landing in Canada remains possible, it is still too early to clearly know if the economy will avoid a significant rough patch this year. Going forward the BoC will be looking hard at incoming data for evidence that wage growth is moderating; businesses are inclined to raise prices; short-run core inflation is slowing; and finally, inflation expectations are back to the 2% target.

SUMMARY TABLES

Other Commentaries

commentaries

Oct 19, 2022

September 2022 Consumer Price Index data: Food and services prices still rising, no progress on core inflation

Our Chief Economist, Stephen Tapp, looks at Canada’s headline inflation, which edged down for the third month in a row. There was no progress on “core” inflation, which held steady at 5%.

commentaries

Sep 20, 2022

August 2022 Consumer Price Index data: Finally some good news on Canadian inflation.

Stephen Tapp, our Chief Economist, looks at Canada’s headline inflation for August, which fell for the second straight month. Core inflation and services measures have also finally started to slow.

commentaries

Aug 16, 2022

July 2022 Consumer Price Index data: Canada’s inflation finally turns a corner with falling gas prices, but core pressures remain

Our Chief Economist, Stephen Tapp, looks at Canada’s headline inflation, which is finally showing signs of cooling off.