Commentaries /

December 2022 CPI: No early Christmas present for the Bank of Canada

December 2022 CPI: No early Christmas present for the Bank of Canada

Stephen Tapp, our Chief Economist, shares his take on Canada's headline Consumer Price Index inflation as of December 21.

Stephen Tapp

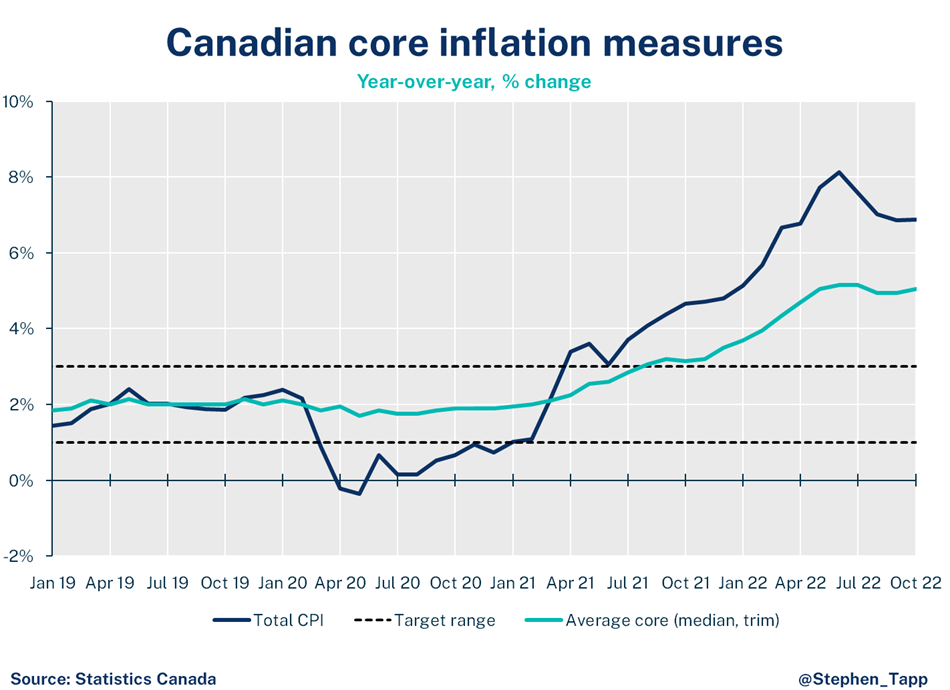

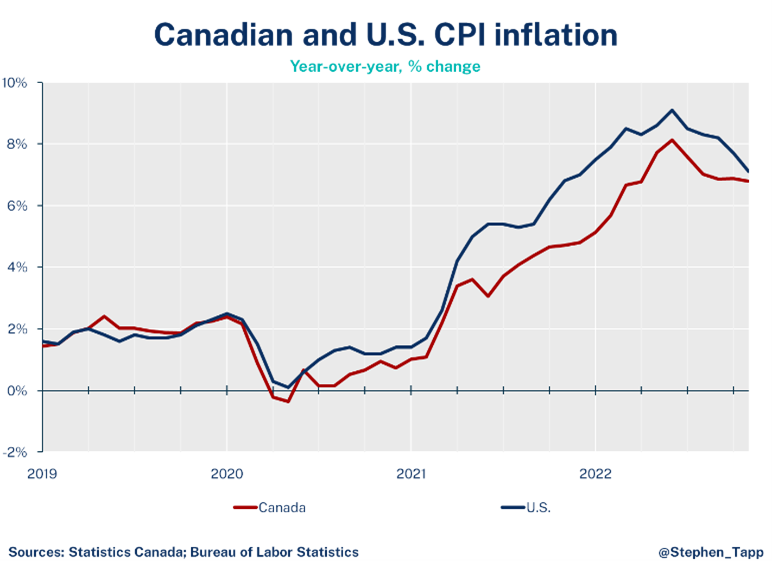

Canada’s headline Consumer Price Index inflation slowed only modestly to 6.8% year-over-year in November. The picture for core inflation worsened, as food, shelter and services price growth accelerated.

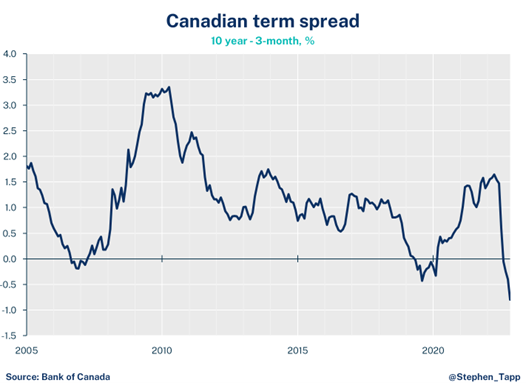

The Bank of Canada’s last announcement signaled a willingness to pause to assess the impact of higher interest rates on the economy. However, if there are not stronger signals in next month’s data that inflation is decelerating, and in the Bank’s upcoming surveys that medium-term inflation expectations are moderating, don’t rule out a 25 basis-point hike in January.

Stephen Tapp, Chief Economist, Canadian Chamber of Commerce

Key Takeaways

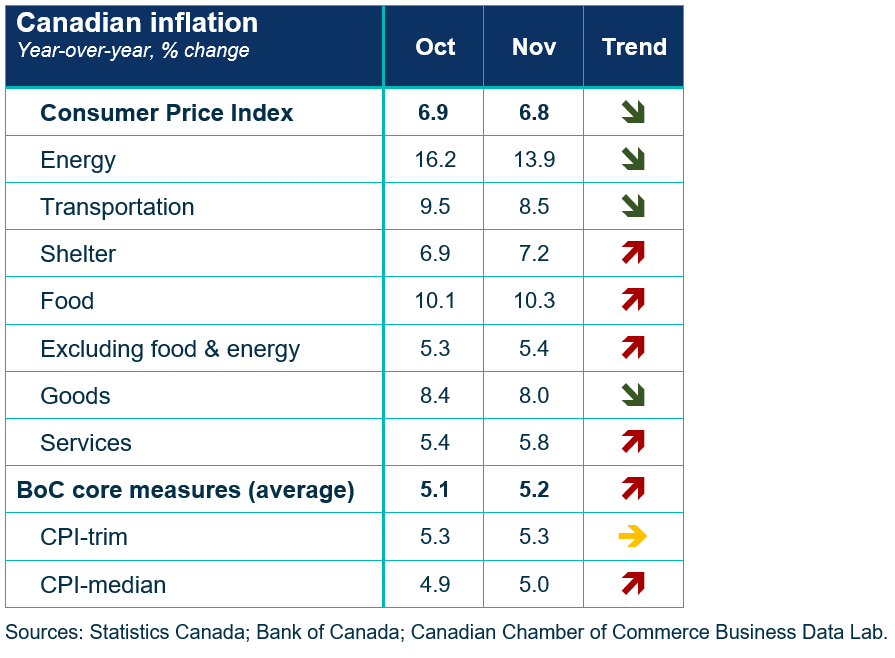

- Canada’s headline Consumer Price Index (CPI) inflation slowed slightly to 6.8% year-over-year in November.

- This is only a modest improvement, and unfortunately, the picture for core inflation worsened.

- The average of the Bank’s two preferred “core inflation” measures rose slightly to 5.2% year-over-year (from 5.1%).

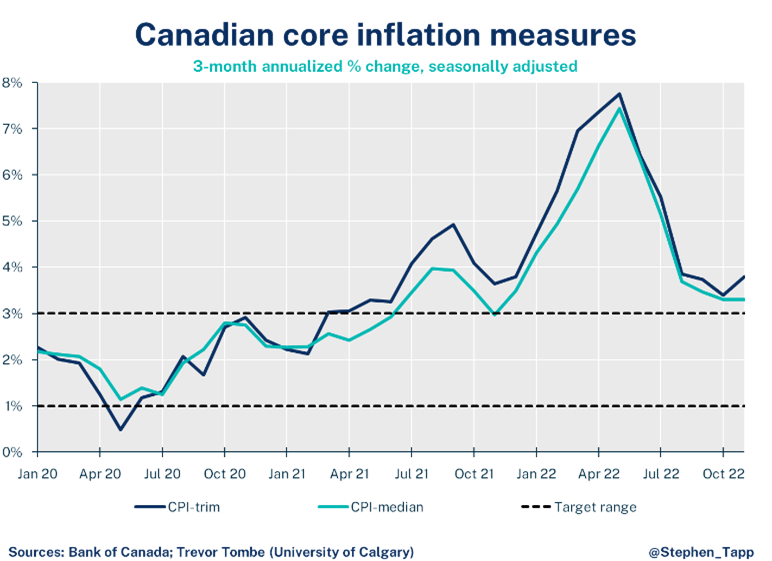

- We know the Bank is focused on short-run dynamics (i.e., forward-looking 3-month annualized measures, rather than backward-looking 12-month year-over-year rates) to get a better sense of underlying momentum in price growth. While these numbers aren’t publicly reported by StatsCan, estimates from Trevor Tombe (University of Calgary) suggest that the average of these two measures also increased in November. Both measures continue to run above the 3% threshold, representing the top of the Bank’s inflation control band.

- Food inflation remains broad-based. Grocery prices rose 11.4% year-over-year in November (up from 11.0% in October) and are a major concern for consumers.

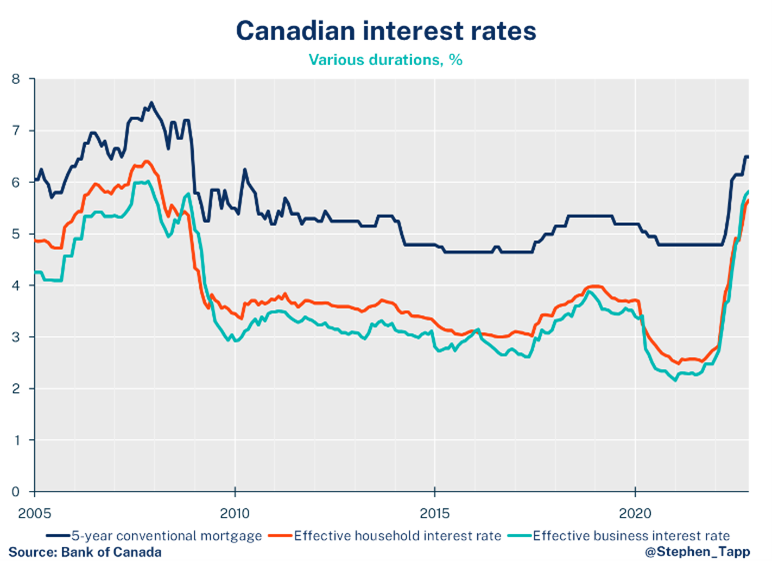

- Shelter costs picked up noticeably to 7.2% (from 6.9% last month) because of rising mortgage rates (up 14.5% given a much higher Bank policy rate) and rents (5.9%, due to increased demand for rentals from those being priced out of owning a house).

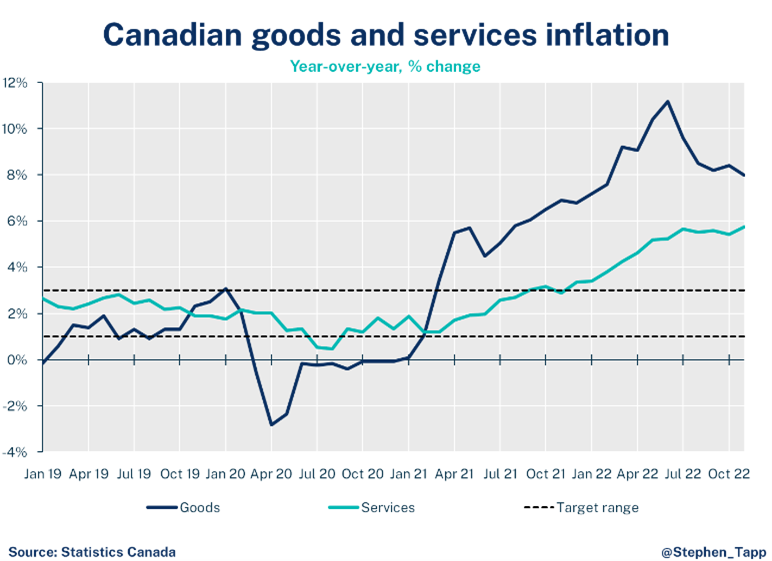

- Price increases for goods slowed to 8.0%, but services inflation accelerated to 5.8%.

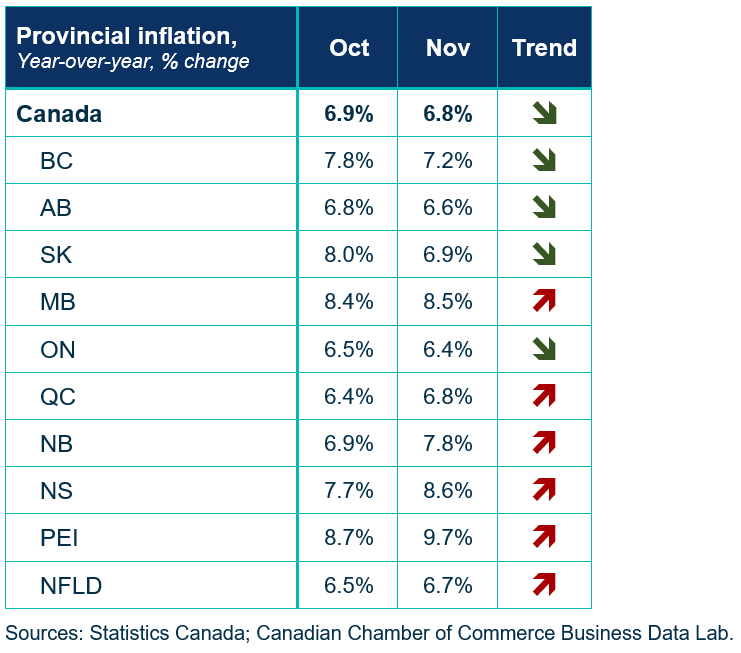

- Inflation increased in six provinces. This month’s increases were concentrated in Atlantic Canada driven by higher fuel oil costs. In November, inflation was highest in Prince Edward Island (9.7%) and lowest in Ontario (6.4%).

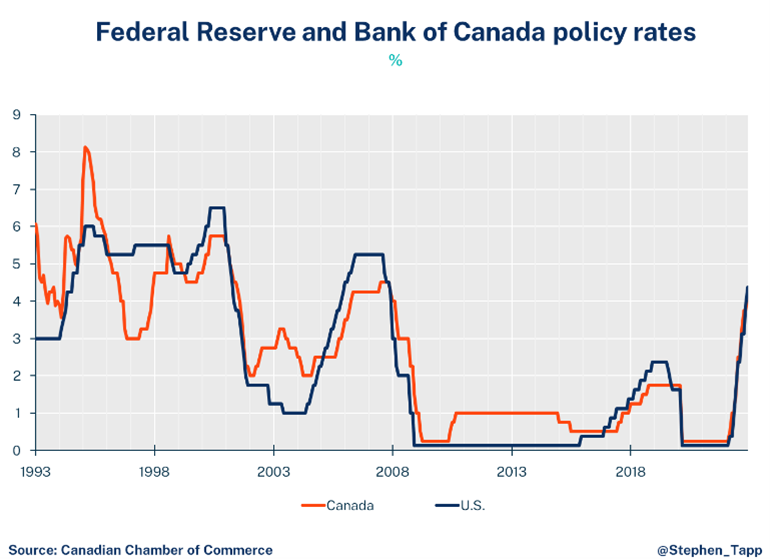

- The Bank of Canada has aggressively raised its policy rate by 4% since March. Their last announcement signaled a willingness to pause to assess the impact of these higher interest rates on the economy. However, if there are not stronger signals in next month’s inflation data and the Bank’s upcoming surveys that inflation is decelerating, don’t rule out a 25 basis-point hike.

Summary Tables

For more great #cdnecon content, visit our Business Data Lab.

Other Commentaries

Oct 19, 2022

September 2022 Consumer Price Index data: Food and services prices still rising, no progress on core inflation

Sep 20, 2022

August 2022 Consumer Price Index data: Finally some good news on Canadian inflation.

Aug 16, 2022