Commentaries /

January 2023 CPI: Steady progress as inflation continues to slow

January 2023 CPI: Steady progress as inflation continues to slow

It was another step in the right direction as January’s data show inflation is slowly coming back under control.

Mahmoud Khairy

KEY TAKEAWAYS

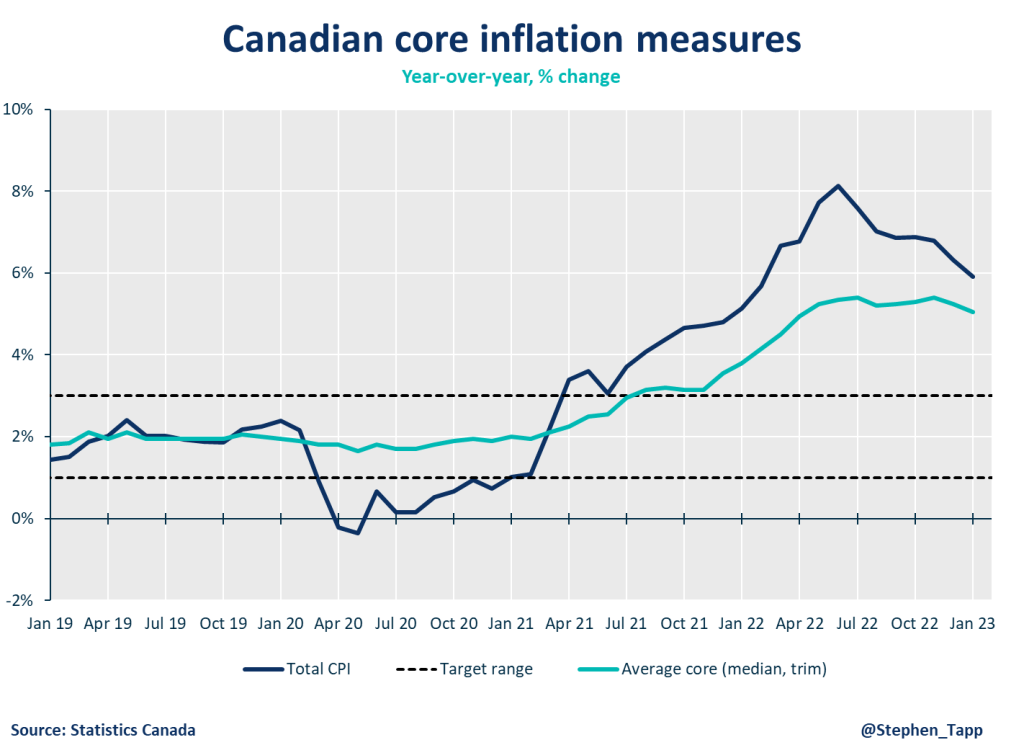

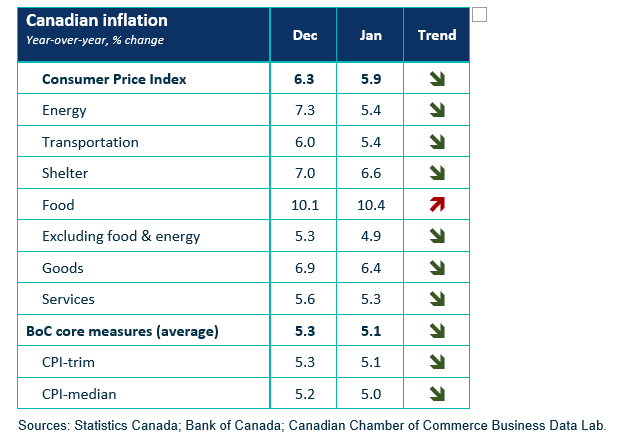

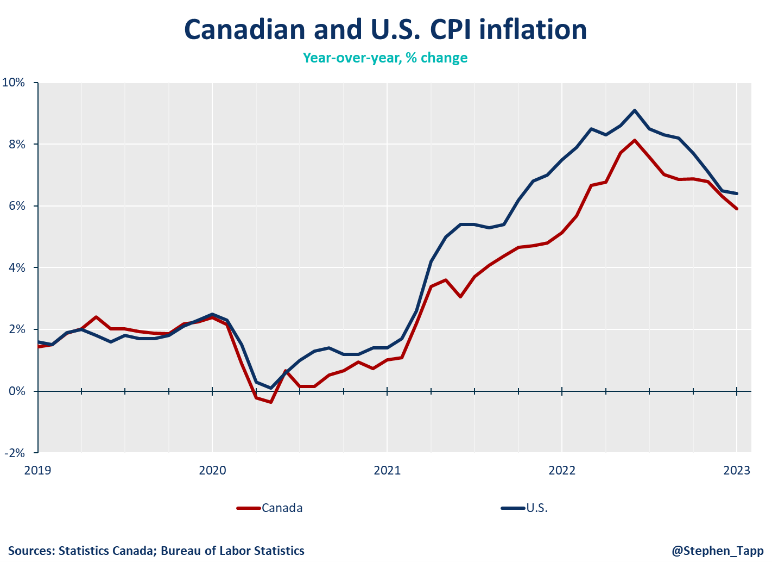

- It was another month of progress in the Bank of Canada’s fight against inflation, as Canada’s headline Consumer Price Index (CPI) inflation grew at a slower pace of 5.9% year-over-year in January, which was better than the market expectation of 6.2%.

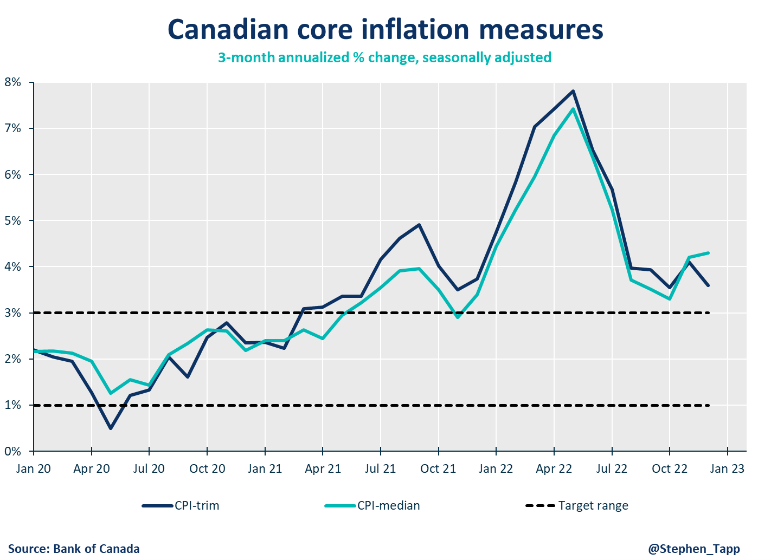

- January’s data also show modest improvements for core inflation. The average of the Bank’s two preferred “core inflation” measures declined to 5.1% year-over-year.

- Note that much of the slowdown in year-over-year inflation number in today’s data — and in the coming months — reflects “base-year effects”. Each month, new price data are being compared against the price level one year ago — and in early 2022, prices spiked up due to supply disruptions and uncertainty after Russia’s invasion of Ukraine.

- Focusing on shorter-run core inflation (3-month annualized rates) right now provides better signals of underlying price pressures; they are around 3.5% — still too high, but much closer to the top of the Bank’s inflation target range.

- Most major components of CPI inflation slowed in January, but food inflation accelerated (to 10.4%), and remains a significant burden for consumers. Both grocery and food from restaurants prices rose, mainly due strong demand and supply constraints.

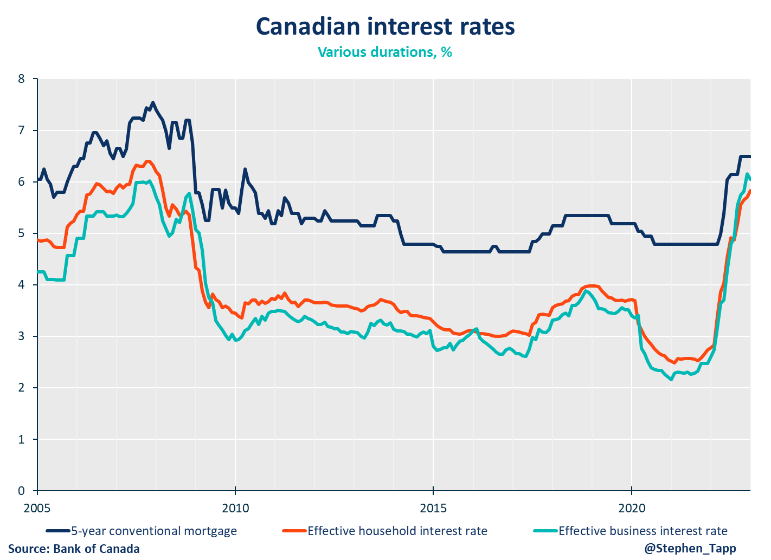

- Shelter cost inflation cooled for the third consecutive month to 6.6% overall (from 7.0% last month). However, there’s mounting upward pressure from rising mortgage rates (+21% yr/yr in January — the largest gain in over 40 years!) given the sharp increase in rates by the Bank of Canada.

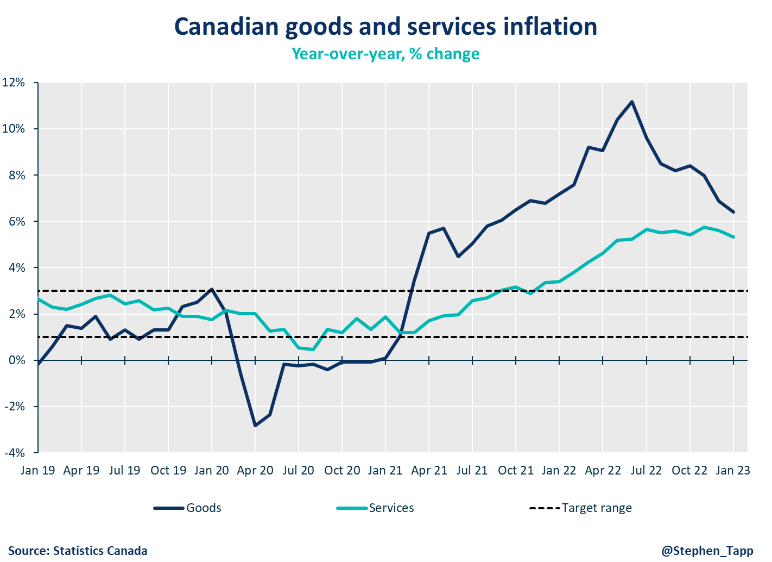

- Price increases for both goods and services slowed to 6.4% and 5.3% respectively. Cellular services prices fell by 8%, as Boxing Day deals extended into January.

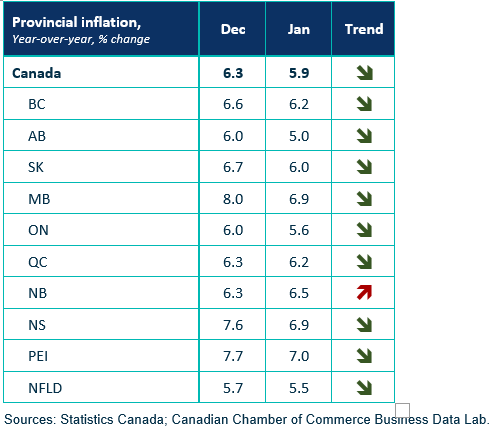

- Gasoline prices are a key driver at provincial level. It was the main reason for inflation slowing in nine of 10 provinces (and also the reason of increased inflation in New Brunswick). Alberta has the lowest inflation rate (5.0%, after electricity prices fell 46% on the month, related to provincial initiatives).

SUMMARY TABLES

INFLATION CHARTS

For more great #cdnecon content, visit our Business Data Lab.

Other Commentaries

commentaries

Oct 19, 2022

September 2022 Consumer Price Index data: Food and services prices still rising, no progress on core inflation

Our Chief Economist, Stephen Tapp, looks at Canada’s headline inflation, which edged down for the third month in a row. There was no progress on “core” inflation, which held steady at 5%.

commentaries

Sep 20, 2022

August 2022 Consumer Price Index data: Finally some good news on Canadian inflation.

Stephen Tapp, our Chief Economist, looks at Canada’s headline inflation for August, which fell for the second straight month. Core inflation and services measures have also finally started to slow.

commentaries

Aug 16, 2022

July 2022 Consumer Price Index data: Canada’s inflation finally turns a corner with falling gas prices, but core pressures remain

Our Chief Economist, Stephen Tapp, looks at Canada’s headline inflation, which is finally showing signs of cooling off.