Commentaries /

January 2023 CPI: The Bank is slowing tightening pace, becomes first major central bank to signal pause

January 2023 CPI: The Bank is slowing tightening pace, becomes first major central bank to signal pause

Though inflation shows signs of coming down, it remains triple the target rate as Canada’s economy also remains in excess demand. The 25-basis point hike came with some positive news.

Mahmoud Khairy

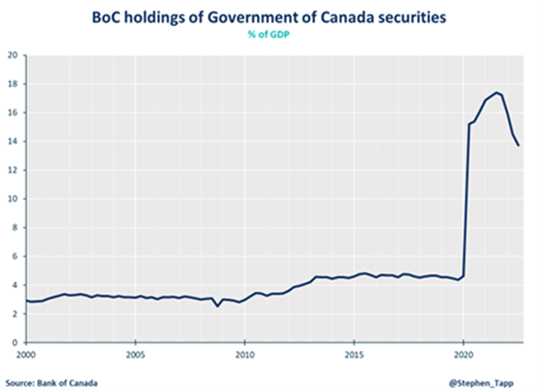

Today’s Bank of Canada announcement marks its eighth interest rate hike bringing it to 4.50%. Though inflation shows signs of coming down, it remains triple the target rate as Canada’s economy also remains in excess demand. The 25-basis point hike came with some positive news – there would be a conditional hold on additional increases in the current cycle – making it the first major central bank to do so. The Bank’s decision reflects confidence that their tightening policy is successfully slowing down the economy as inflation turns a corner alongside lower energy prices and improvements in supply chains.

Mahmoud Khairy, Economist, Business Data Lab, Canadian Chamber of Commerce

KEY TAKEAWAYS

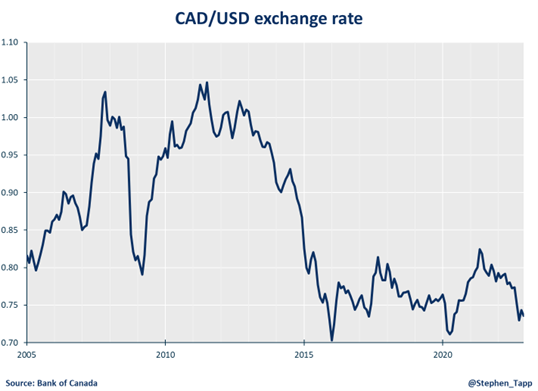

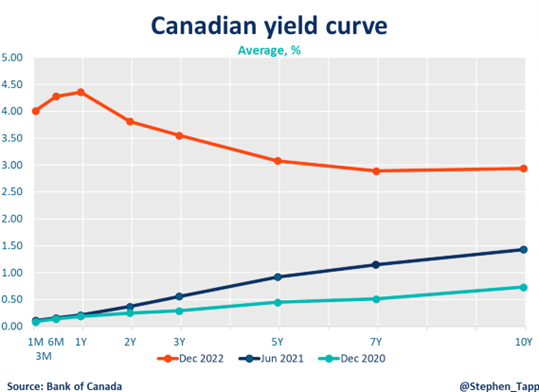

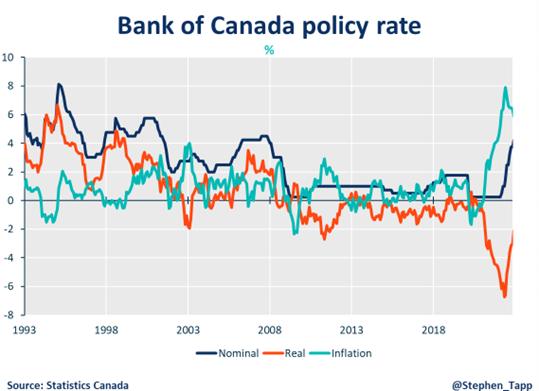

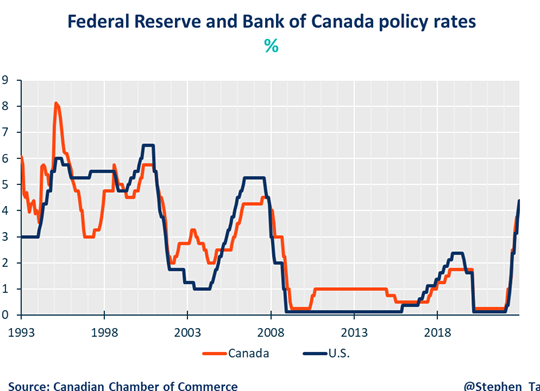

- The Bank of Canada (BOC)’s policy rate is at its peak: Meeting market expectations, the BoC’s modest hike of 25 basis points (0.25%) brought interest rates today to 4.50% becoming the first major central bank to signal pause. With a cumulative record increase of 425 basis points, this brings the policy rate its highest level in over a decade and half. However, inflation is starting to fall as restrictive monetary policy is slowing activity, especially household spending.

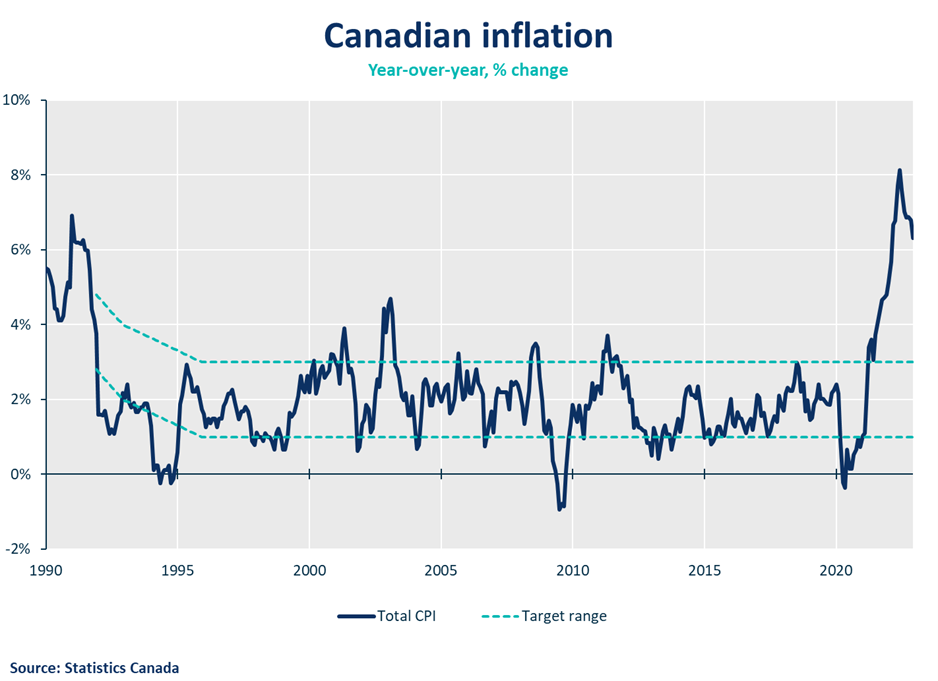

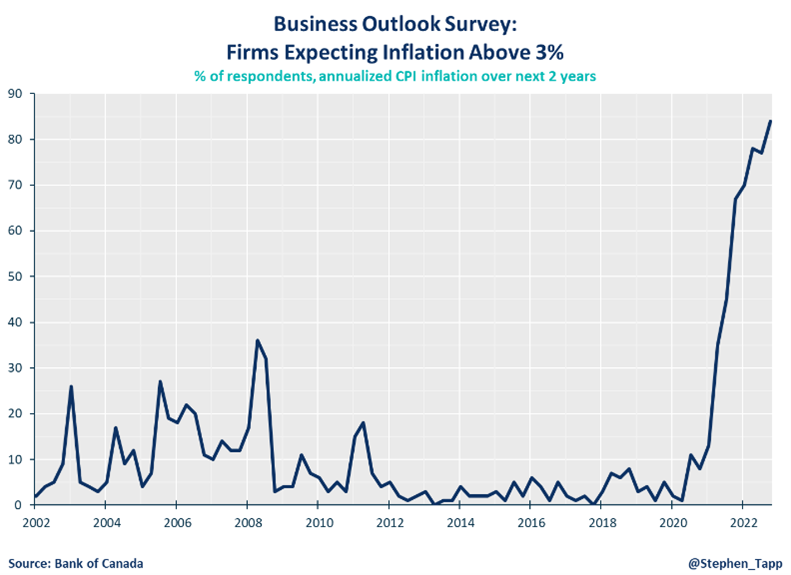

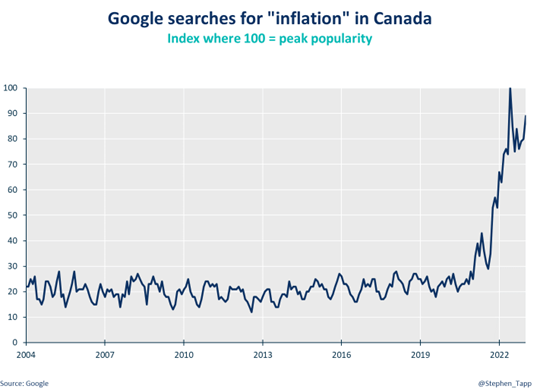

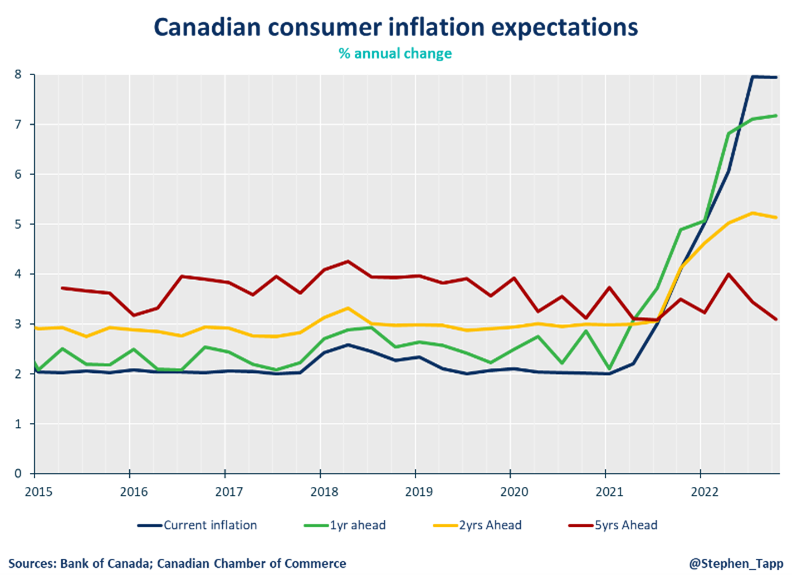

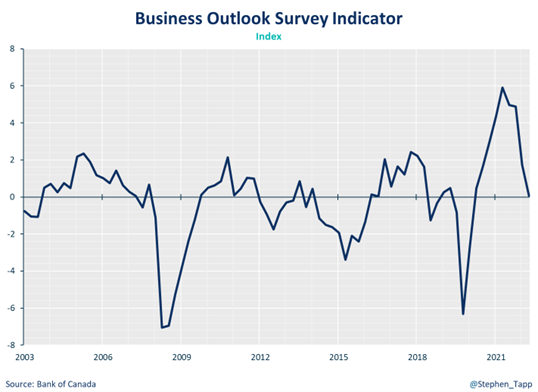

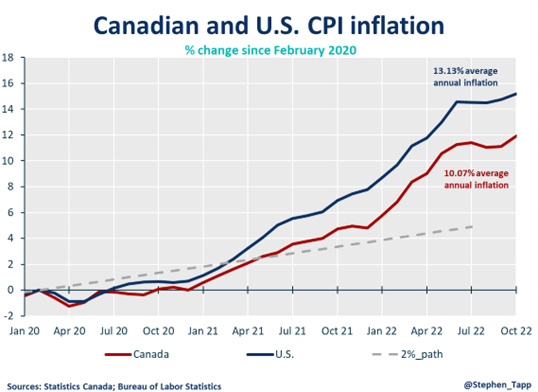

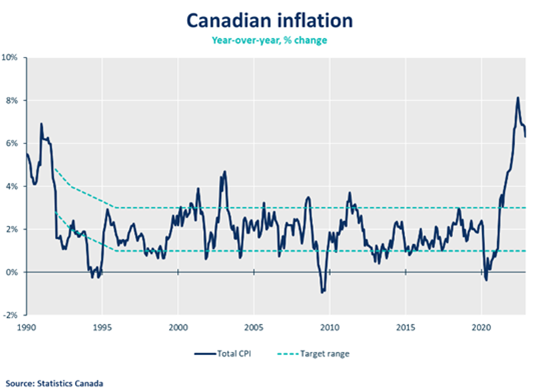

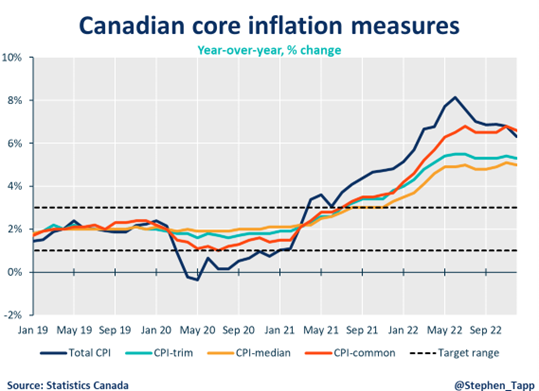

- Although December’s inflation data was welcomed relief, at 6.3% inflation remains too high and well above the BoC’s 2% target. Core inflation has also been sticky and lagging in sustained improvement. The Bank revealed that short-term inflation expectations in Canada have declined as the share of firms expecting large price increases has dropped. Still, it remains above the Bank’s inflation forecast. In contrast, long-term expectations for inflation remain in line with the BoC’s target.

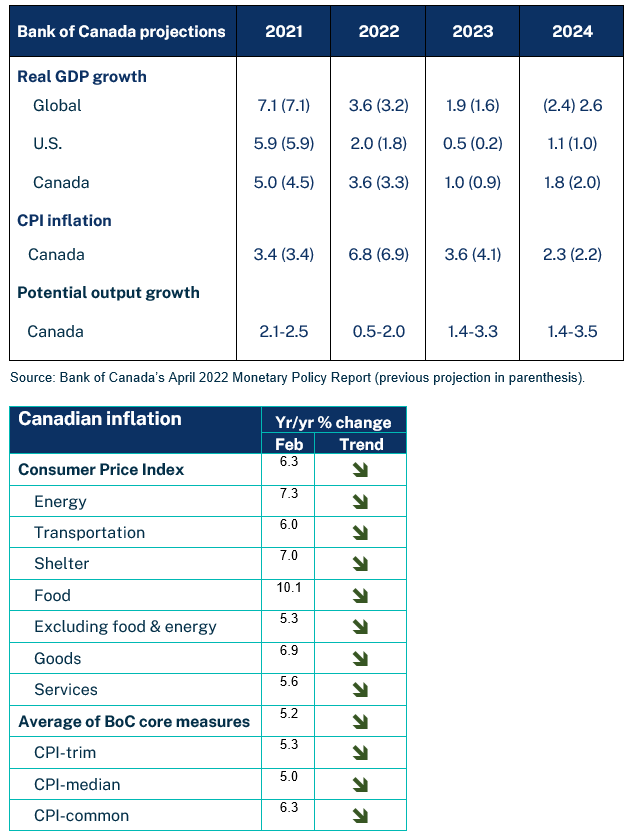

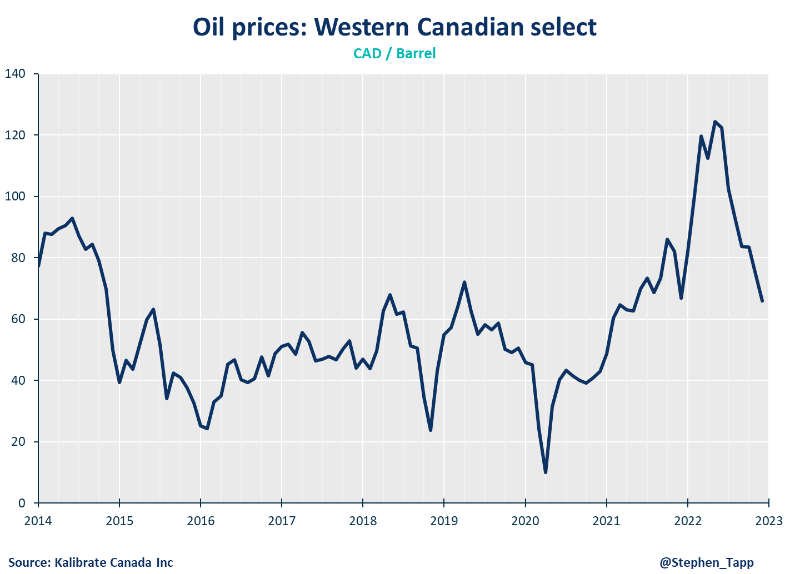

- Canadian inflation is declining from its recent peak: There was a significant downward revision to the Bank’s CPI inflation forecast in 2023. Inflation is now expected to be 3.6% in 2023 and return to the Bank’s 2% target in 2024. Most of this change is attributed to lower energy prices, improvements in global supply chains and the effects of higher interest rates moving through the economy.

- The Bank revised upwards its global economic outlook: In its January Monetary Policy Report (MPR), the BoC revised upwards its economic projection for the global economy in 2023 (from 1.6% to 1.9%); led by stronger activity than initially anticipated, robust consumer spending, a tight labour market, easing of disruptions to commodity prices as well as global trade and an earlier-than-expected change in China’s “zero-COVID” policy. The Bank estimates global growth in 2024 to be lower than previous projections (2.4% from 2.6%).

- Growth in the United States’ economy is still expected to remain flat in 2023 mostly because of rising interest rates and tighter financial conditions. The BoC expected this weak outlook to persist at least through the first half of 2023.

- The Bank’s outlook for Canada’s economic growth has been revised down: Growth in Canada’s economy is now expected to be slightly better-than-anticipated in 2023 (1.0% from October’s projection of 0.9%). Conversely, the BoC revised down its projections for 2024 (1.8% from 2.0%). As such, the overall level of activity is slowing down over the projection. That said, non-energy commodity exports are expected to grow as supply chain restrictions ease. Oil and gas activity is expected to be moderate in 2023 before picking up again in 2024 with the completion of new expansion projects, which will offset slower consumer spending growth as interest rates rise alongside modest foreign demand.

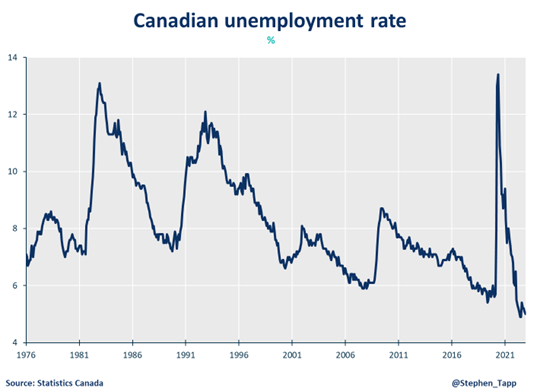

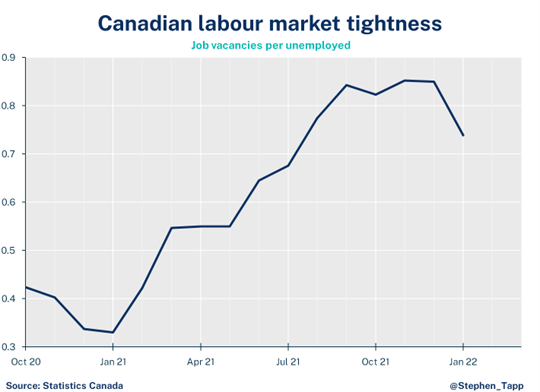

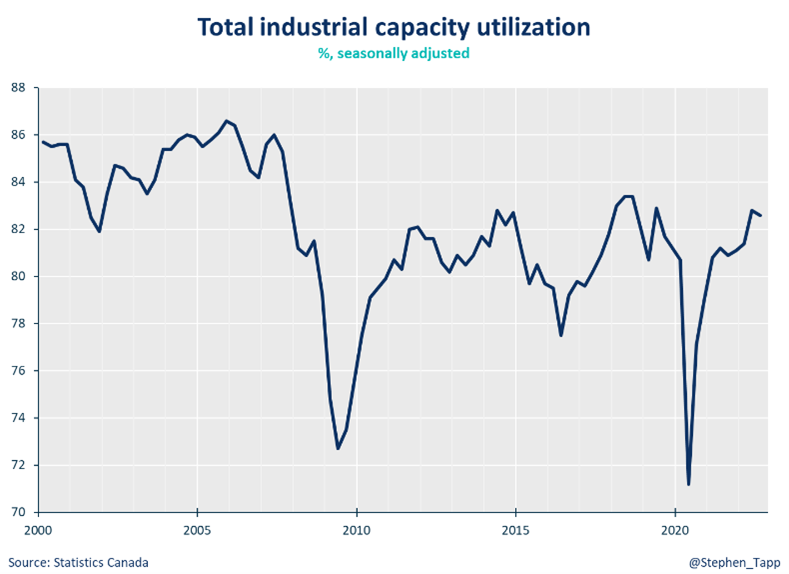

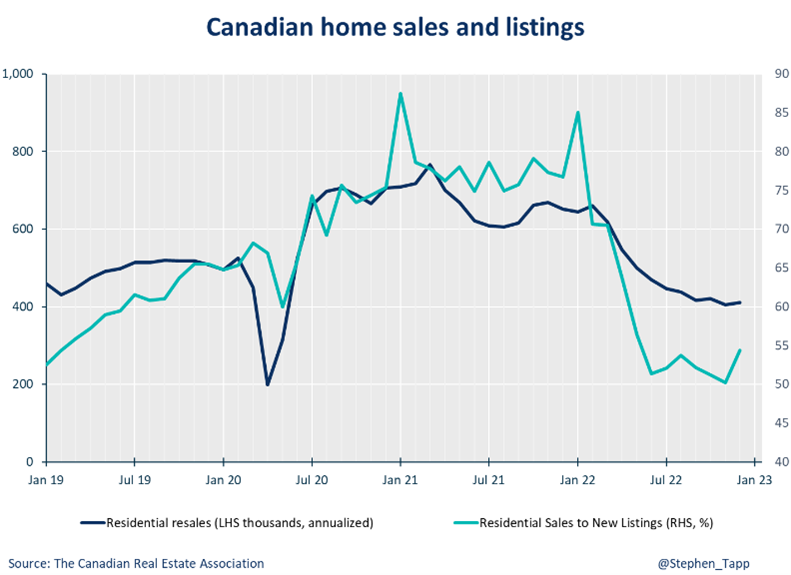

- The pace of economic growth is slowing but demand continues to exceed supply: Canada’s labour market is more resilient than anticipated. The labor market is still tight across a broad range of measures and improvements can already be seen on the supply chain channels. Still, as demand is still outpacing supply, the rise in policy rate is expected to “broaden and moderate” consumer spending on services (especially for housing and big-ticket items) and dampen investment spending in 2023.

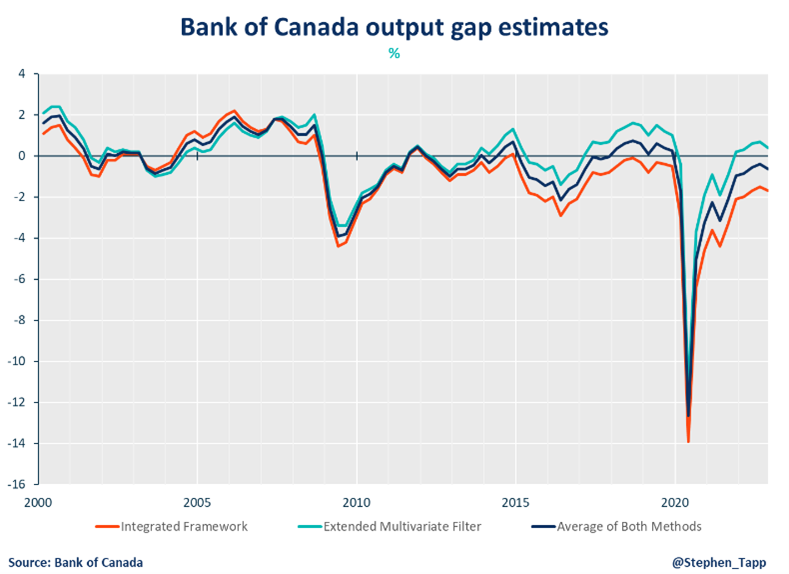

- Accordingly, the BoC is projecting growth to pick up later in 2023, reaching 2.50% in the second half of 2024 as the effect of interest rate increases fade, with the estimate of output gap between 0.5% and 1.5% in the fourth quarter of 2022 and 2023 which is more than was projected in the October MPR’s projection.

SUMMARY TABLES

MONETARY POLICY CHARTS

For more great #cdnecon content, visit our Business Data Lab.

Other Commentaries

Oct 19, 2022

September 2022 Consumer Price Index data: Food and services prices still rising, no progress on core inflation

Sep 20, 2022

August 2022 Consumer Price Index data: Finally some good news on Canadian inflation.

Aug 16, 2022