Commentaries /

April 2023 CPI: Progress, but job not done yet: The BoC maintains its policy rate, no longer expects a recession in Canada

April 2023 CPI: Progress, but job not done yet: The BoC maintains its policy rate, no longer expects a recession in Canada

The Bank of Canada held its policy rate at 4.5% and renewed its commitment to bringing inflation back to the 2% target. Though inflation is declining, it remains well above target, and the economy is in excess demand.

Rewa

The Bank of Canada held its policy rate at 4.5% and renewed its commitment to bringing inflation back to the 2% target. Though inflation is declining, it remains well above target, and the economy is in excess demand. The Bank expects Canada’s GDP growth to remain weak in 2023, but is no longer forecasting a recession in Canada.

Mahmoud Khairy, Economist, Canadian Chamber of Commerce

KEY TAKEAWAYS

- The Bank of Canada held its policy rate: As expected, the Bank held its policy rate at 4.5%. This was the second consecutive hold during their “conditional pause” period (after previously hiking rates by a cumulative 4.25%). The Bank is also continuing its quantitative tightening policy.

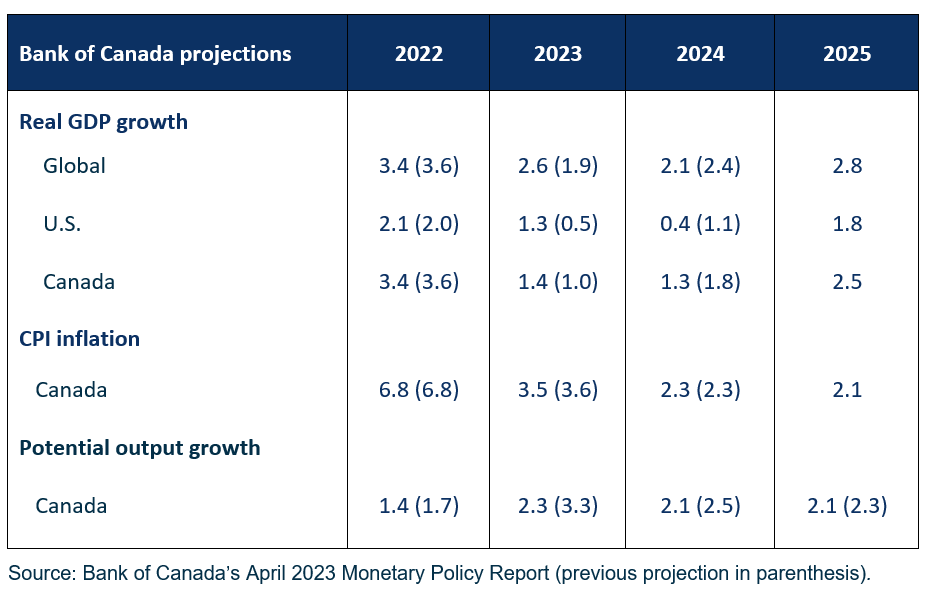

- Global economic outlook better than expected in 2023: Despite tighter monetary policy and banking sector stress in the U.S. and Europe, global economic data have been better than the Bank previously anticipated. The Bank, therefore, revised up its projection for world economic growth (to 2.6% from 1.9%), while revising down 2024 slightly (to 2.1% from 2.4%). That said, the U.S. economy is expected to be weaking in the coming quarters, mainly due to slower consumer spending and tightener credit condition.

- Canada’s economy to grow modestly in 2023: Economic activity clearly slowed down over 2022, but the Bank still sees Canada’s economy as being in a position of “excess demand”. The good news is that with the bounce-back now expected for 2023Q1, the Bank is no longer forecasting a recession in Canada in 2023, and revised up its growth outlook from 1.0% to 1.4%.

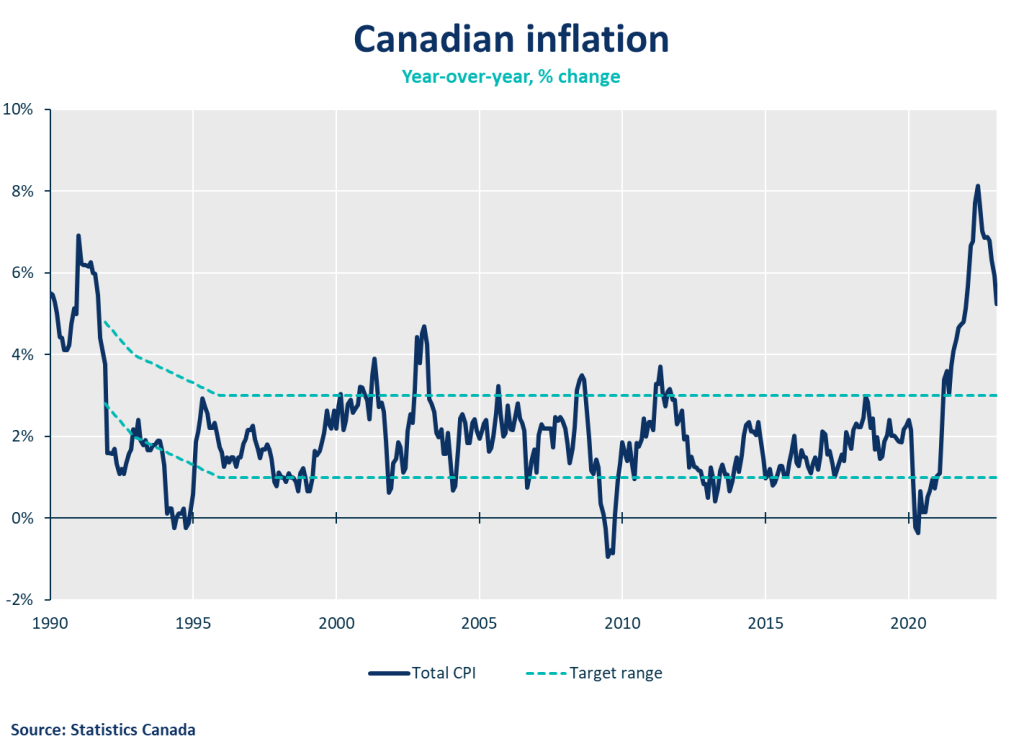

- Inflation progress, but job not done: Inflation has declined from its peak of 8.1% last summer to 5.2% most recently. The Bank will be encouraged by this progress and expects inflation to slow to 3% this summer, but the return to 2% could take longer than previously expected — now near the end of 2024.

- The slowdown in inflation so far is largely due to falling prices for energy and other goods. Services prices have only really stabilized and will need to come down further for inflation to return to target. Food inflation remains high, and with a tight labour market, wages are growing at 4-5%, and may only ease slowly with continued labour supply growth.

- The Bank highlighted five key progress indicators that it will be watching: inflation expectations, services inflation, wages, business pricing behavior, and core inflation. Governing Council reiterated that it, “remains prepared to raise the policy rate further if needed” to get inflation back to target. This should send a clearer message to financial markets that they shouldn’t expect the Bank rate to fall in 2023, as was previously priced in.

SUMMARY TABLE

Other Commentaries

commentaries

Oct 19, 2022

September 2022 Consumer Price Index data: Food and services prices still rising, no progress on core inflation

Our Chief Economist, Stephen Tapp, looks at Canada’s headline inflation, which edged down for the third month in a row. There was no progress on “core” inflation, which held steady at 5%.

commentaries

Sep 20, 2022

August 2022 Consumer Price Index data: Finally some good news on Canadian inflation.

Stephen Tapp, our Chief Economist, looks at Canada’s headline inflation for August, which fell for the second straight month. Core inflation and services measures have also finally started to slow.

commentaries

Aug 16, 2022

July 2022 Consumer Price Index data: Canada’s inflation finally turns a corner with falling gas prices, but core pressures remain

Our Chief Economist, Stephen Tapp, looks at Canada’s headline inflation, which is finally showing signs of cooling off.