Commentaries /

March 2023 CPI: Inflation continues to cool, mainly due to base-year effects

March 2023 CPI: Inflation continues to cool, mainly due to base-year effects

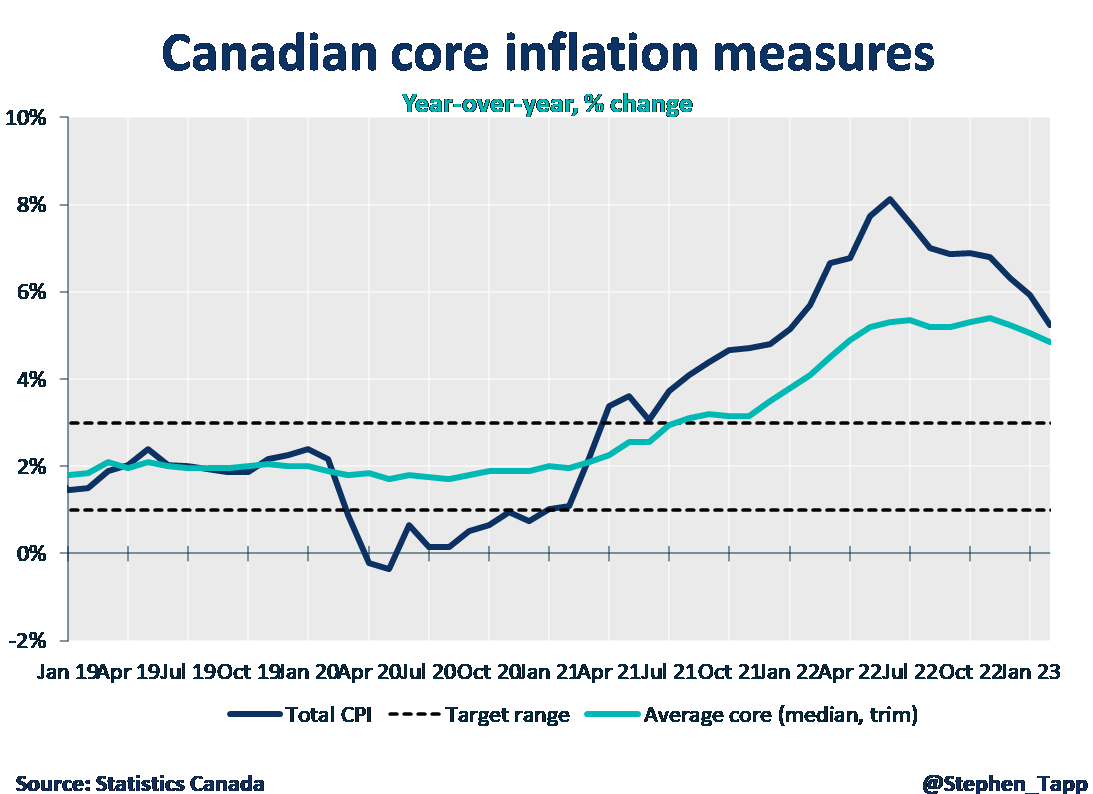

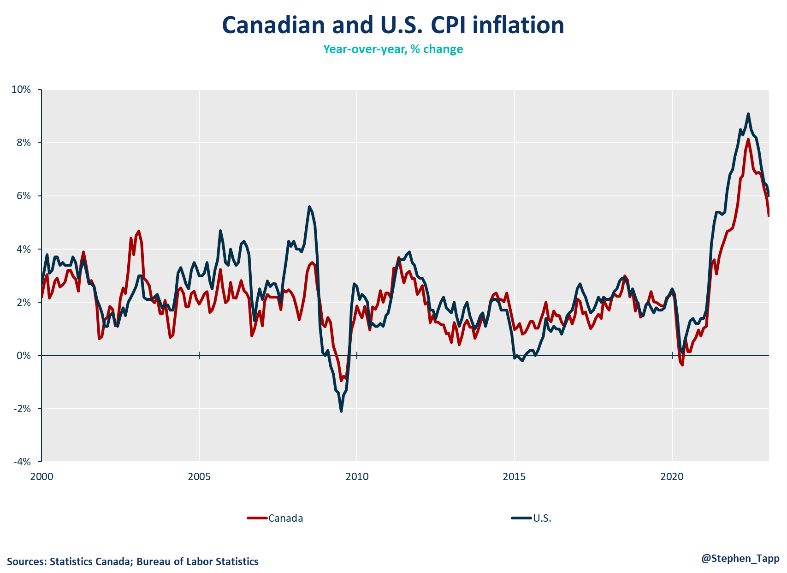

Canada’s headline inflation cooled more than expected in February to 5.2% year-over-year (more than market expectations of 5.4%), with core inflation also slowing to 4.9%.

Mahmoud Khairy

Canada’s headline inflation cooled more than expected in February to 5.2% year-over-year (more than market expectations of 5.4%), with core inflation also slowing to 4.9%. This is largely due to base-year effects, with current prices being compared to elevated levels from a year ago when global commodity prices soared after Russia invaded Ukraine along with supply chain disruptions.

The Bank will welcome the slowdown in inflation, but notwithstanding this progress, there’s still a long way to get back to 2%. They will likely maintain their interest rate pause while they wait for more decisive evidence of slower core inflation.

– Mahmoud Khairy, Economist, Business Data Lab, Canadian Chamber of Commerce

KEY TAKEAWAYS

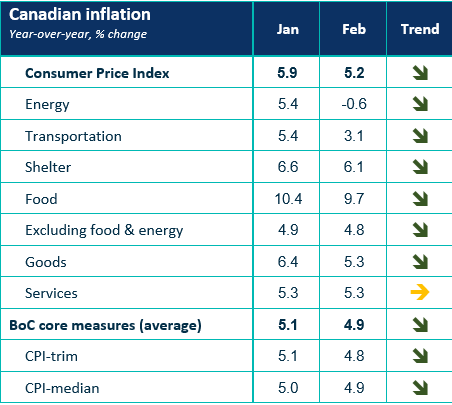

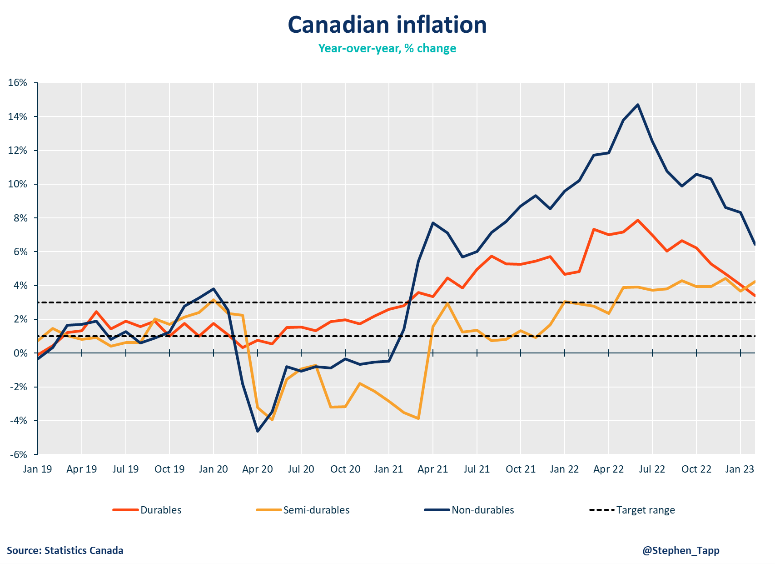

- The Consumer Price Index (CPI) cooled down in February to 5.2% — more than markets expected (5.4%) — in what was the largest deceleration since April 2020. There was also a slight improvement in core inflation, as the average of the Bank of Canada’s preferred core inflation measures declined to 4.9% year-over-year. This notable decline is mainly due to so-called base-year effects; given the sharp rise in global commodity prices last year associated with Russia’s invasion of Ukraine, year-over-year inflation should continue to slow noticeably over the first half of 2023.

- The slowdown in inflation was broad-based across most components; however, food prices continue to be a major burden on consumers.

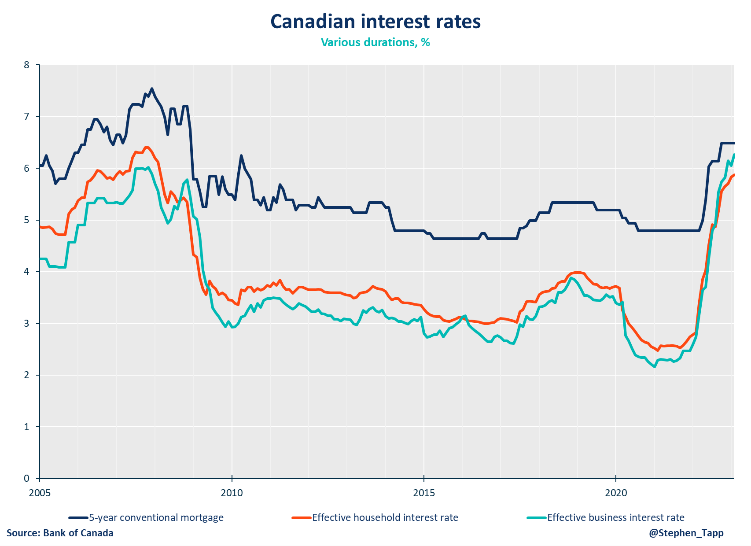

- Shelter costs cooled for the third straight month to 6.1% (from 6.6%). However, higher interest rates due to the Bank of Canada’s tightening policy has resulted in the biggest increase in mortgage rates since 1982. The mortgage interest cost index rose in February to 23.9% (from 21.2%).

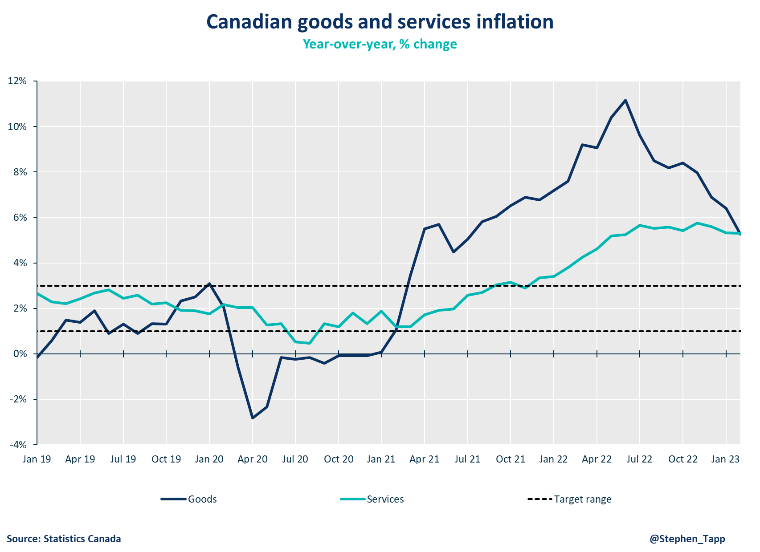

- Goods prices has slowed to 5.2% (from 6.4%), while prices for services remained stable at 5.3%.

- Energy prices were actually down 0.6% on a year-over-year basis — again reflecting base-year effects after the Russian invasion to Ukraine has caused energy prices to spike in early 2022.

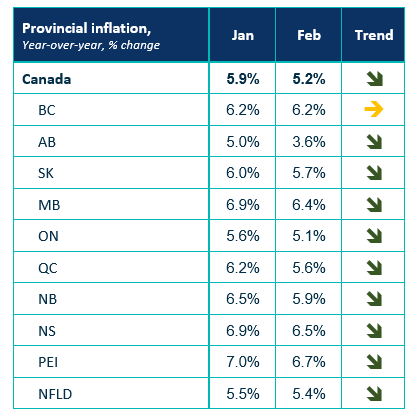

- Inflation slowed in all provinces, except British Columbia where prices remained stable due to offsets from higher rents. Alberta had the fasted inflation slowdown because of lower energy prices as well as the national plan to reduce childcare costs.

SUMMARY TABLES

INFLATION CHARTS

Other Commentaries

Oct 19, 2022

September 2022 Consumer Price Index data: Food and services prices still rising, no progress on core inflation

Sep 20, 2022

August 2022 Consumer Price Index data: Finally some good news on Canadian inflation.

Aug 16, 2022