Commentaries /

June 2023 CPI: Base effects have peaked, but no real change in core measures

June 2023 CPI: Base effects have peaked, but no real change in core measures

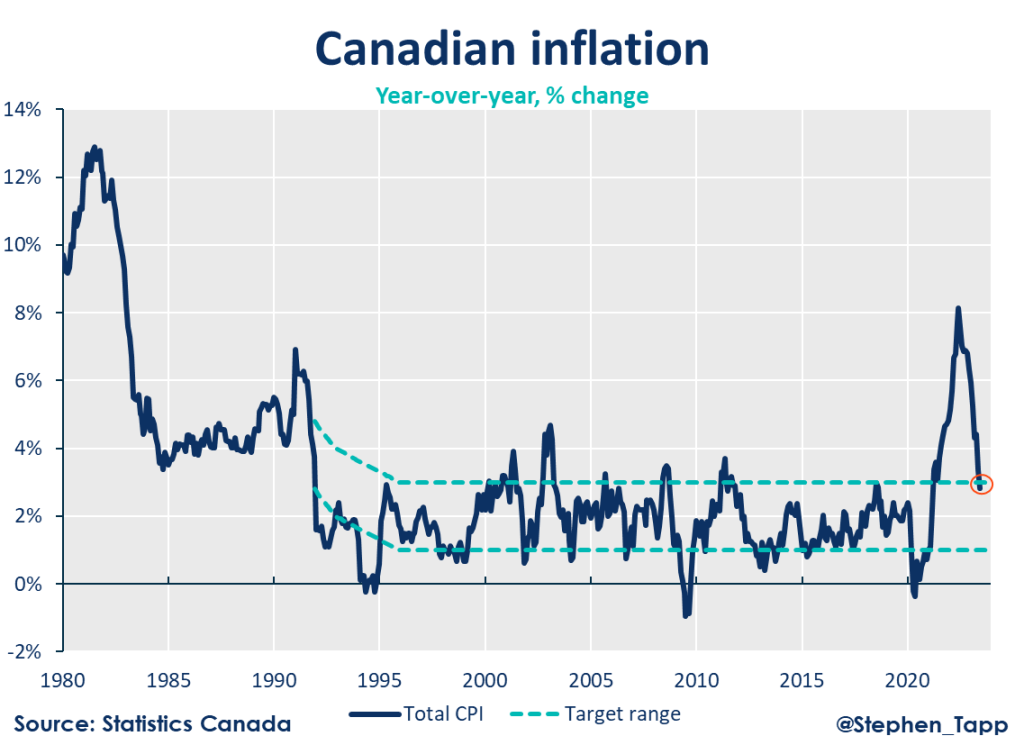

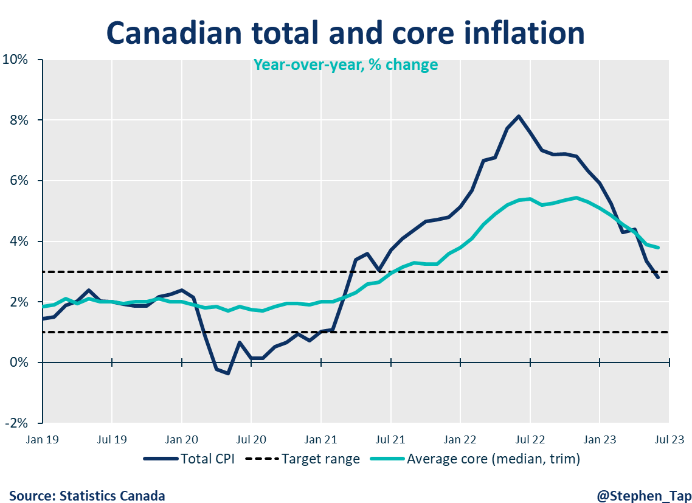

As the first data release since last week’s interest rate announcement, June’s headline inflation reading marks the first time since March 2021 that annual inflation is back within the Bank of Canada’s 1% – 3% control range.

Rewa

As the first data release following last week’s interest rate announcement, June’s headline inflation reading brings annual inflation back within the Bank of Canada’s control range of 1% to 3% for the first time since March 2021. Still, while the annual changes have slowed, it’s still too early to celebrate since most of the progress is from energy price base-effects from a year ago. Unfortunately, the stickiest and hardest part of the inflation fight is only just beginning.

Marwa Abdou, Senior Research Director, Canadian Chamber of Commerce

KEY TAKEAWAYS

Headline

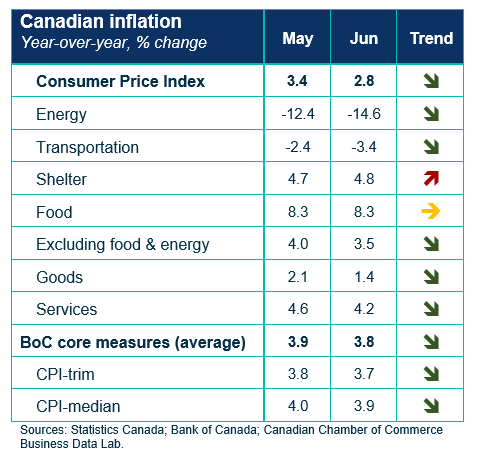

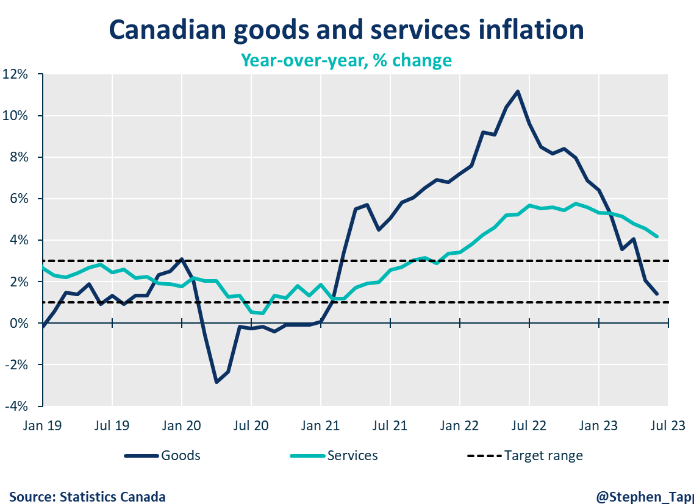

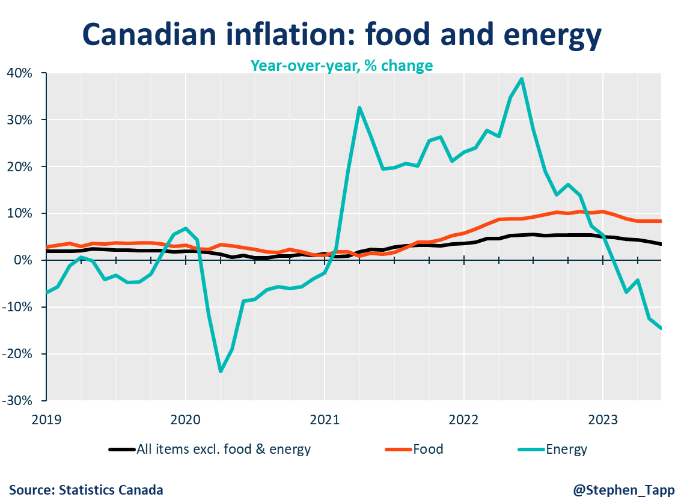

- Exceeding market expectations, Canada’s headline CPI inflation slowed in June to 2.8% on a year-over-year basis, below the anticipated 3.0%. The deceleration is primarily driven by base effects from a year ago, particularly in energy prices following the geopolitical situation between Russia and Ukraine. When excluding food and energy, prices rose by 3.5% compared to 4.0% in May.

- While the headline puts us within the Bank of Canada’s inflation control target range overall, it doesn’t show much meaningful progress on core measures. Although it continues a positive trend with the lowest inflation rate in over two years, excluding gasoline from the calculations pushes inflation up to 4.0%, well above the upper end of the target range.

- Mortgage interest costs and travel expenses continue to place a major dent on consumers’ wallets as the month-over-month CPI rose by 0.1% (compared to +0.4% in May).

CPI Components

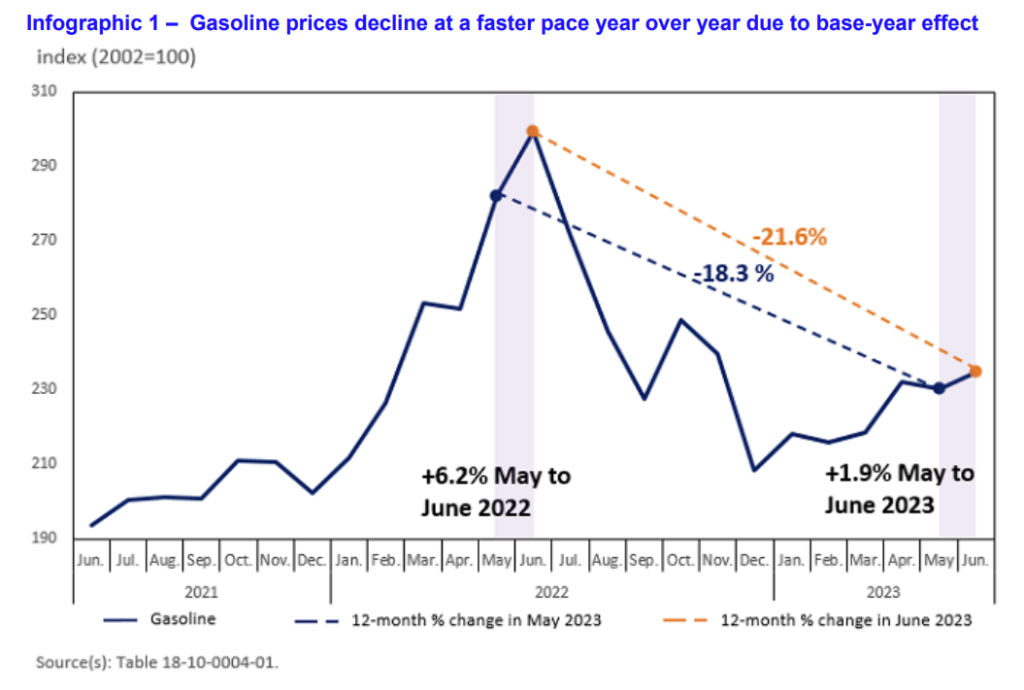

- Despite a slowdown in energy price growth, gasoline prices continue to drive down inflation with a 21.6% decline in June (following a drop of 18.3% in May). This reflects the base-year effects when global crude oil demand surged as China eased pandemic-related restrictions.

- Transportation prices also fell by 3.4% in June (following a 2.4% decline in May). Much like energy, we saw base-year effects play out for passenger vehicle prices from a year prior where the sector had suffered from persistent supply chain and inventory challenges. Price increases slowed to +2.4% (compared to +3.2% in May).

- If you are travelling, domestically or internationally, you are also likely to feel the weight of elevated prices. But the good news is that along with travel was also another area where we saw a deceleration in price increases as compared to the previous month (+6.8% vs.+23.4%). Still, this is not shocking as it falls in line with seasonal patterns that peak in July.

- Grocery prices are still running hot (+9.1% yr/yr in June as compared to +9.0% May). Meat (+6.9%), baked goods (+12.9%), and dairy products (+7.4%) accounted for most of the rise.

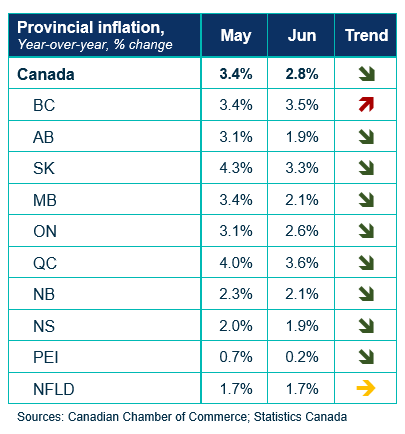

Provincial inflation

- A bright spot in the monthly report is that inflation slowed in 8 out of 10 provinces. Atlantic provinces continue to lead the way, with Prince Edward Island clocking in the lowest inflation of all (+0.2%). This too reflects those base effects as it had the largest decline in energy prices (-24.1%).

SENTIMENT, OUTLOOK & IMPLICATIONS

Bank of Canada

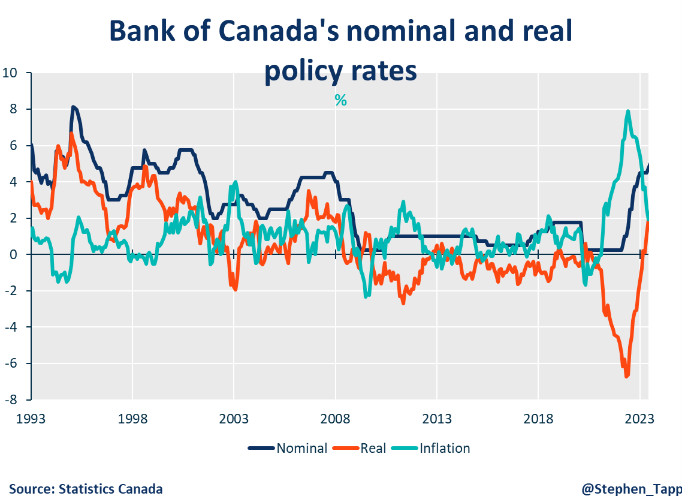

- With last week’s BoC announcement to increase rates to a 22-year high of 5.0%, all eyes are on its two “core inflation” measures. Their average, while continuing to show very modest softening year-over-year, remains well above the target range — 3.8% vs. 3.9% in May. Unfortunately, shorter-term (3-month) core measures increased in June (also matching the 3.8%). Taken together, this indicates stalled progress on underlying inflation pressures, which is a major concern for the Bank.

- The central bank, which cited excess demand, expects inflation to remain around 3% over the next year before dropping to its 2% target by mid-2025, six months later than previously anticipated. Unfortunately, we may have to get used to tight monetary policy, as the lagged effects of previous actions work their way through the economy.

SUMMARY TABLES

CPI CHARTS

Other Commentaries

Oct 19, 2022

September 2022 Consumer Price Index data: Food and services prices still rising, no progress on core inflation

Sep 20, 2022

August 2022 Consumer Price Index data: Finally some good news on Canadian inflation.

Aug 16, 2022