Commentaries Topics: Purchasing Managers’ Indices

Commentaries /

April 2023 PMIs: Purchasing Managers’ Indices suggest Canada’s manufacturing sector has started contracting

April 2023 PMIs: Purchasing Managers’ Indices suggest Canada’s manufacturing sector has started contracting

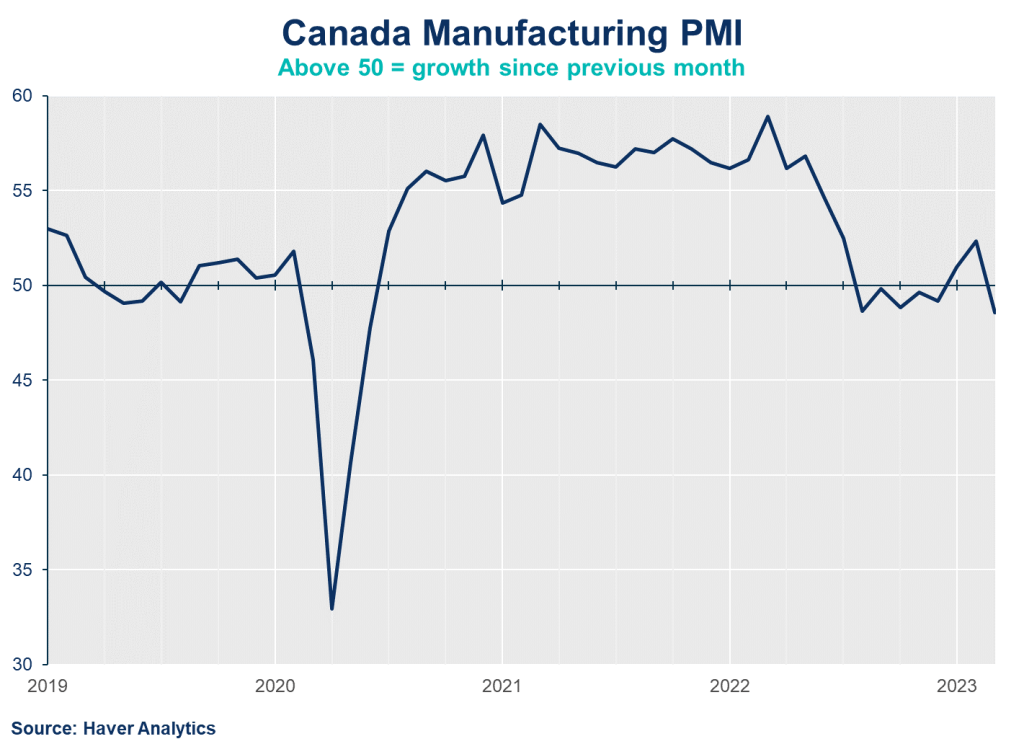

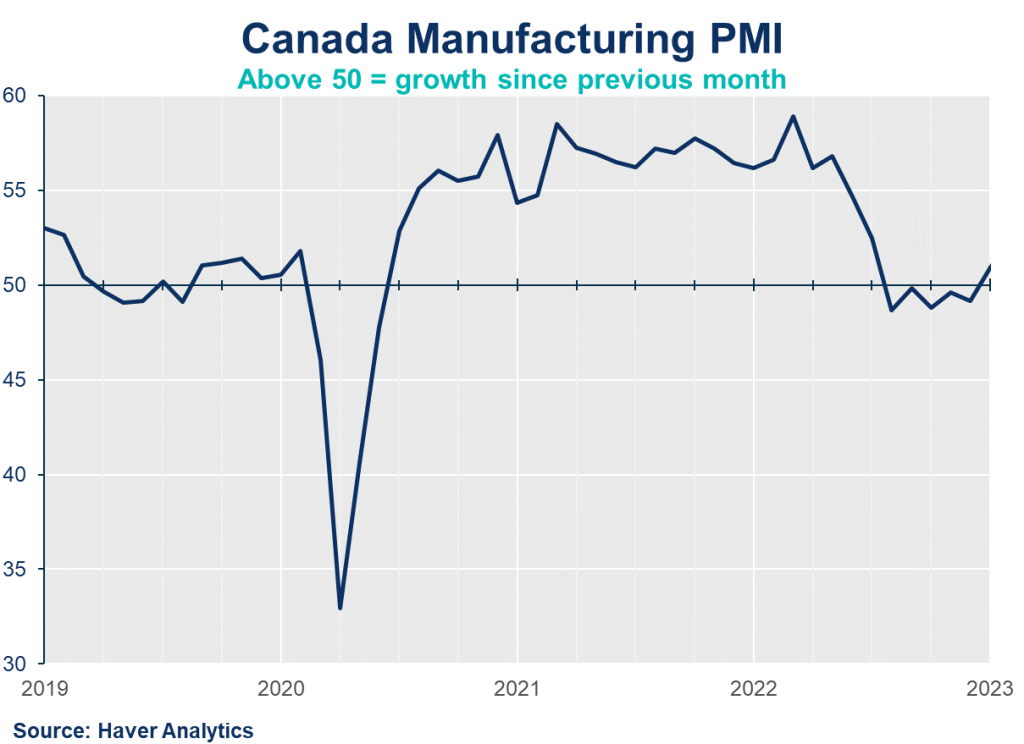

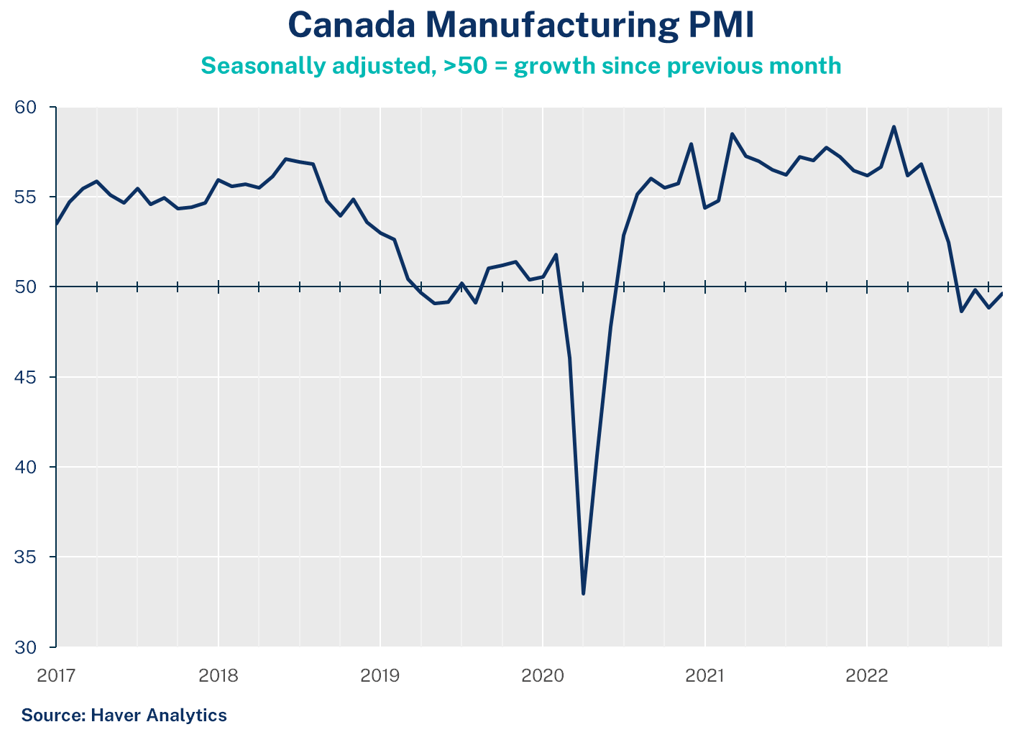

Canada’s Purchasing Manufacturing Index (PMI) results have shifted from a good news story at start of Q1 to issuing an early warning sign as it dropped below the 50-mark to record 48.6.

Mahmoud Khairy

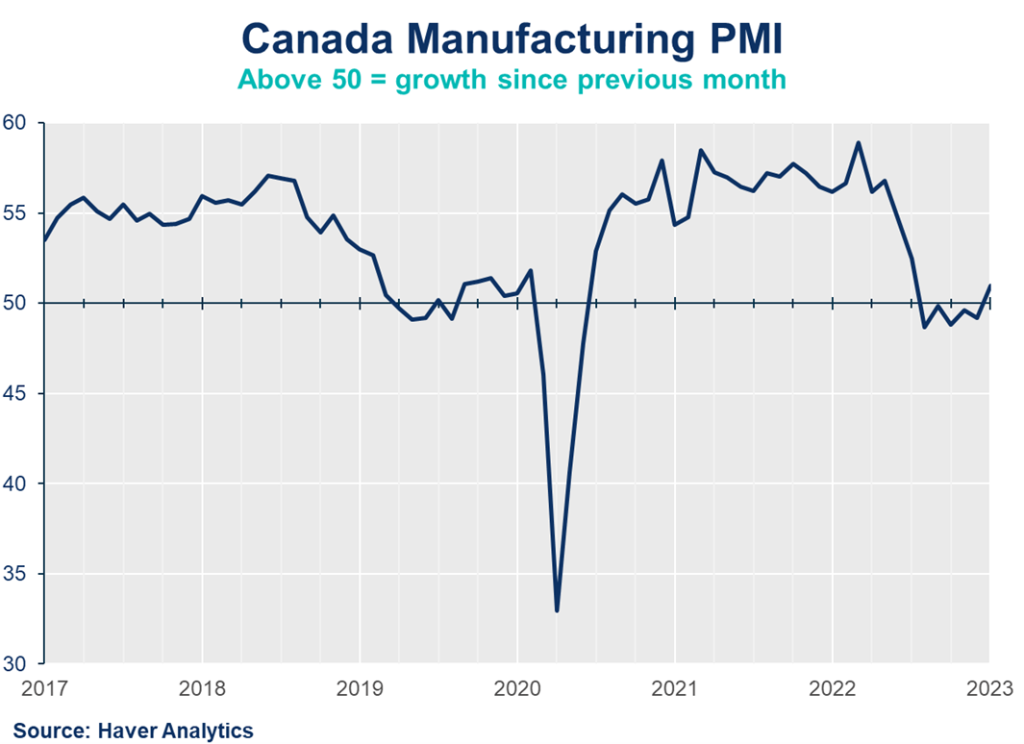

Canada’s Purchasing Manufacturing Index (PMI) results have shifted from a good news story at start of Q1 to issuing an early warning sign as it dropped below the 50-mark to record 48.6 (down from 52.4 in February, and the lowest reading since June 2020). Though supply chains are stabilizing, higher prices, uncertainty and weak demand have taken a toll on new orders and production. It’s not all bad news, as the sector continues to add new jobs in the hopes that the economy will recover over the next 12 months.

Mahmoud Khairy, Economist, Canadian Chamber of Commerce

KEY TAKEAWAYS

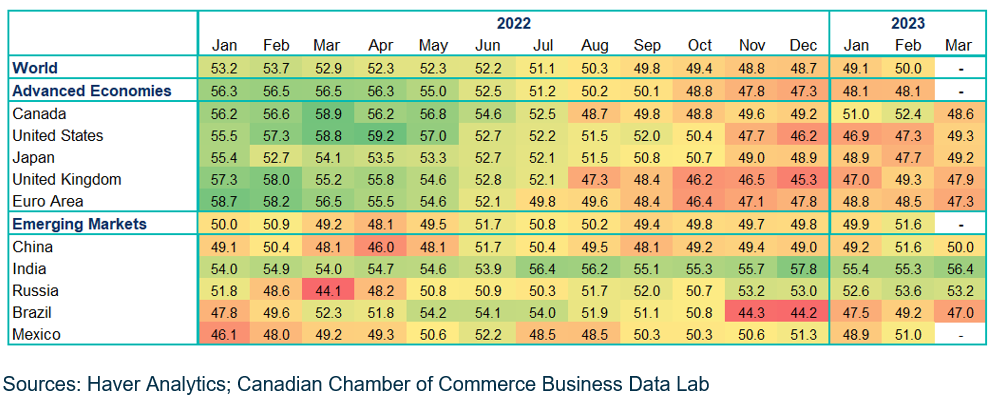

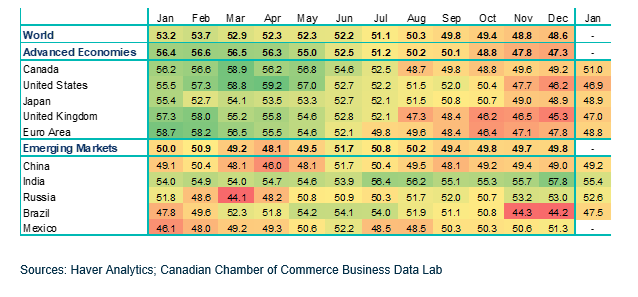

- After a strong start to the first quarter in January and February, Canada’s Purchasing Managers’ Index (PMI) reading of 48.6 fell below the “no-growth” threshold of 50, which suggests that Canada’s manufacturing sector has begun contracting.

- The fall was led by a drop in new orders as well as a modest decline in production.

- High inflation affected both input costs and output prices offsetting easing supply pressures. Softer demand and lower purchasing power encouraged manufacturers to rely on inventories, rather than increase output.

- Interestingly, firms’ labour demand remained strong with companies indicating they will continue to add more staff for the fifth straight month. This suggests some confidence that demand will stabilize, and the economy will recover within the next 12 months.

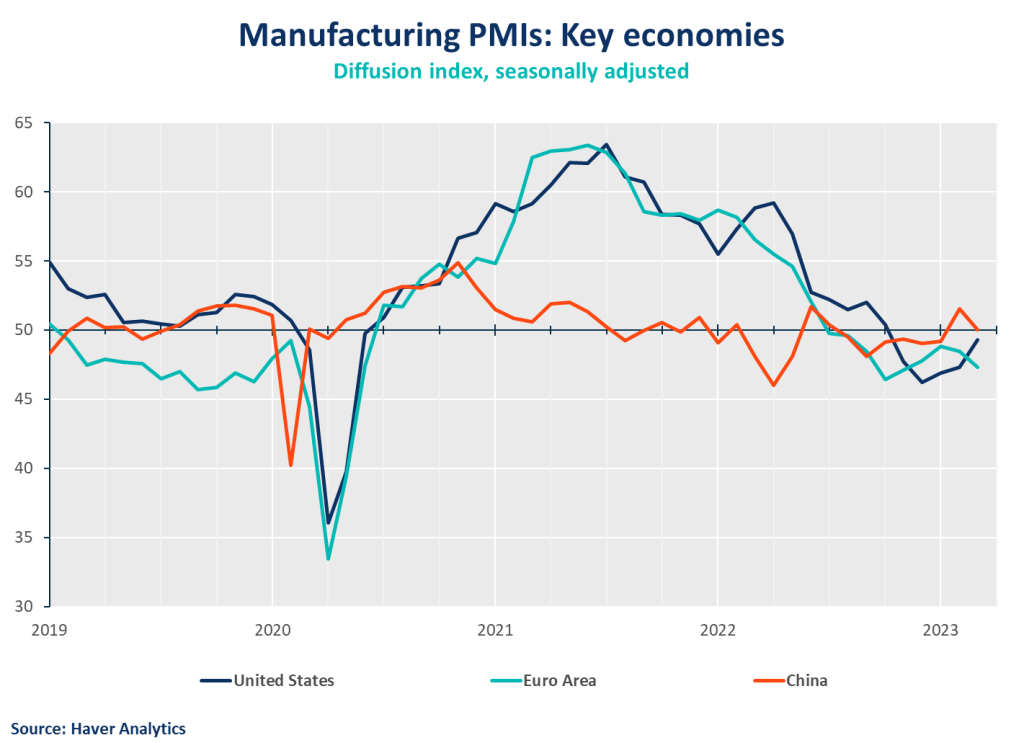

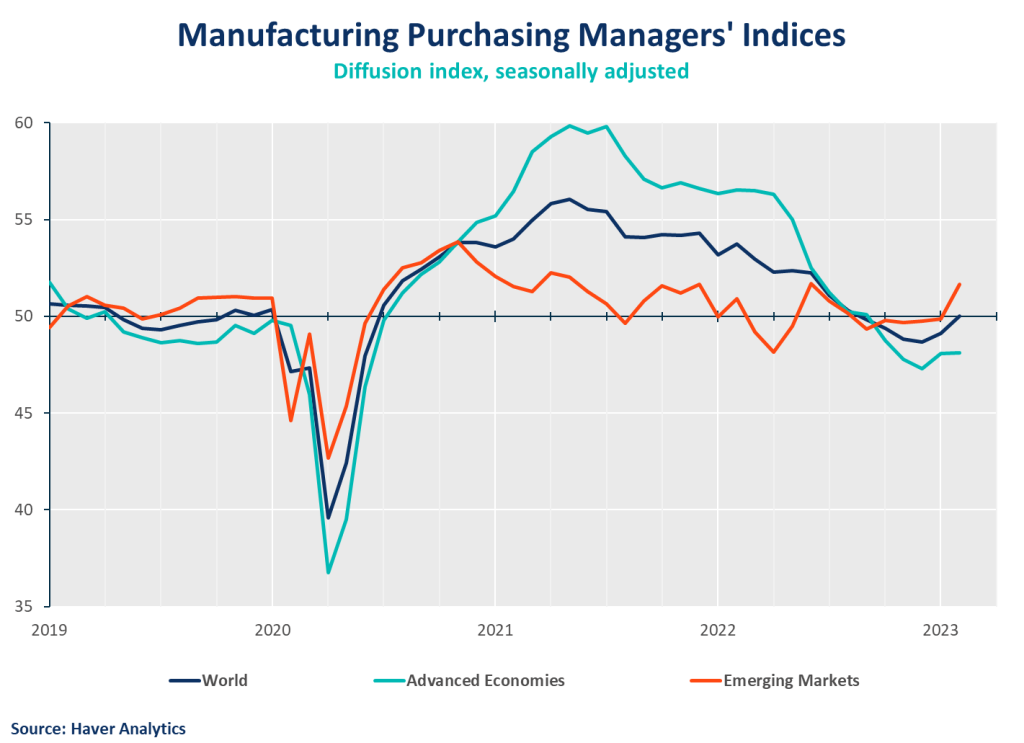

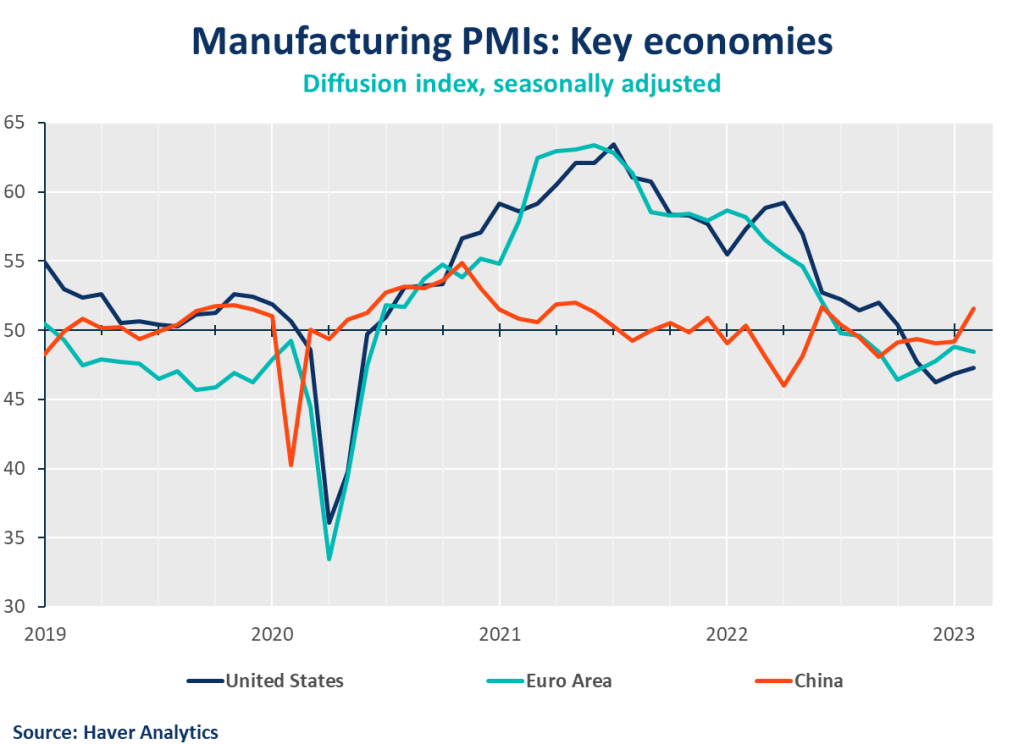

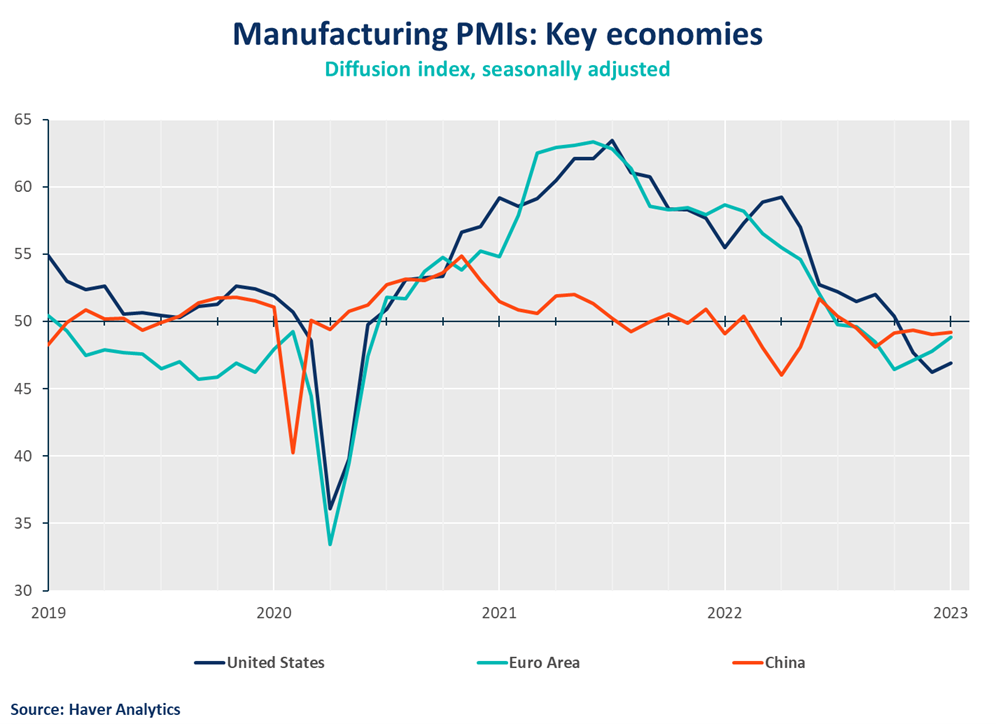

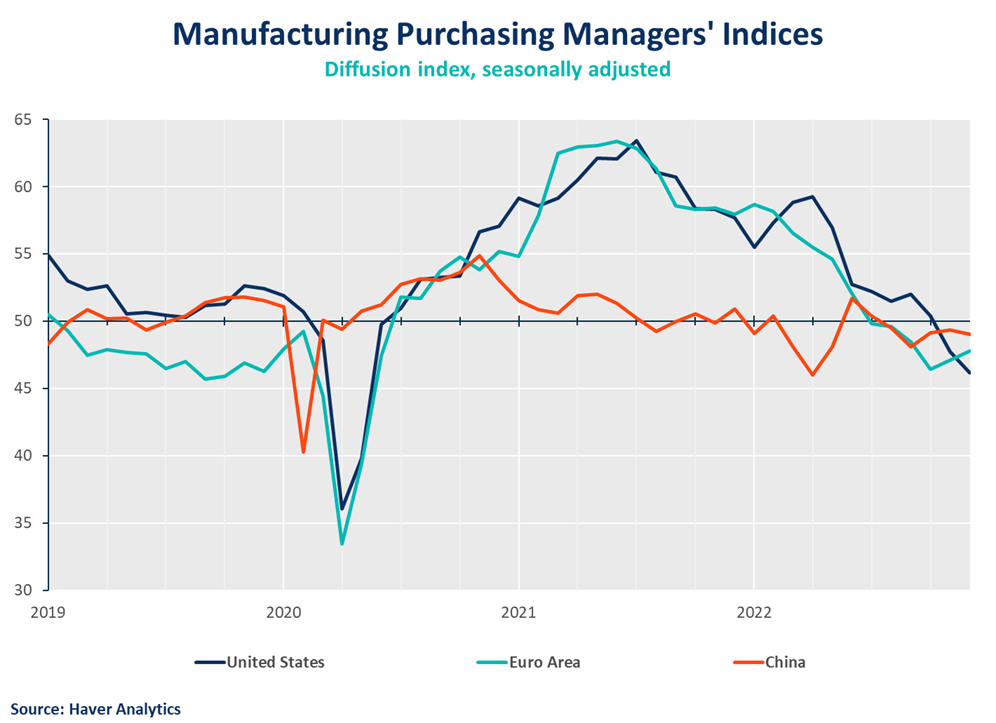

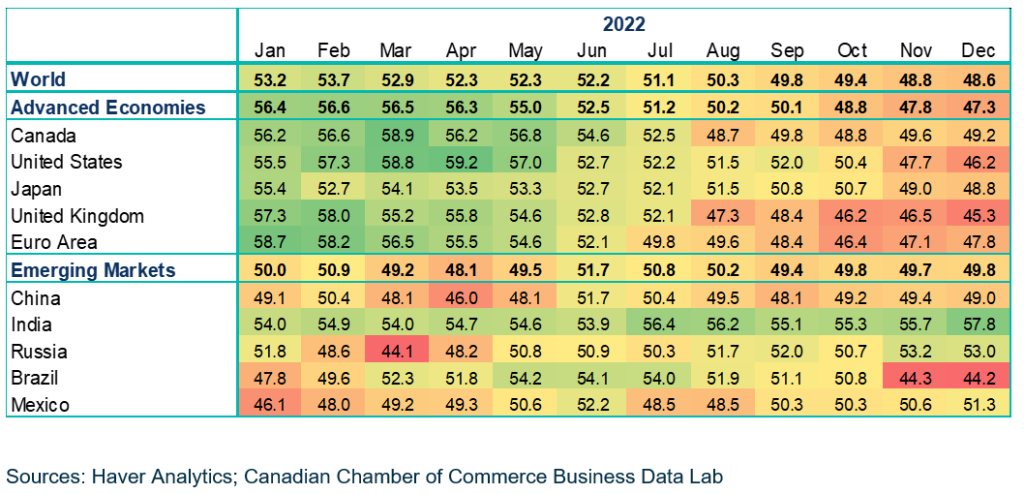

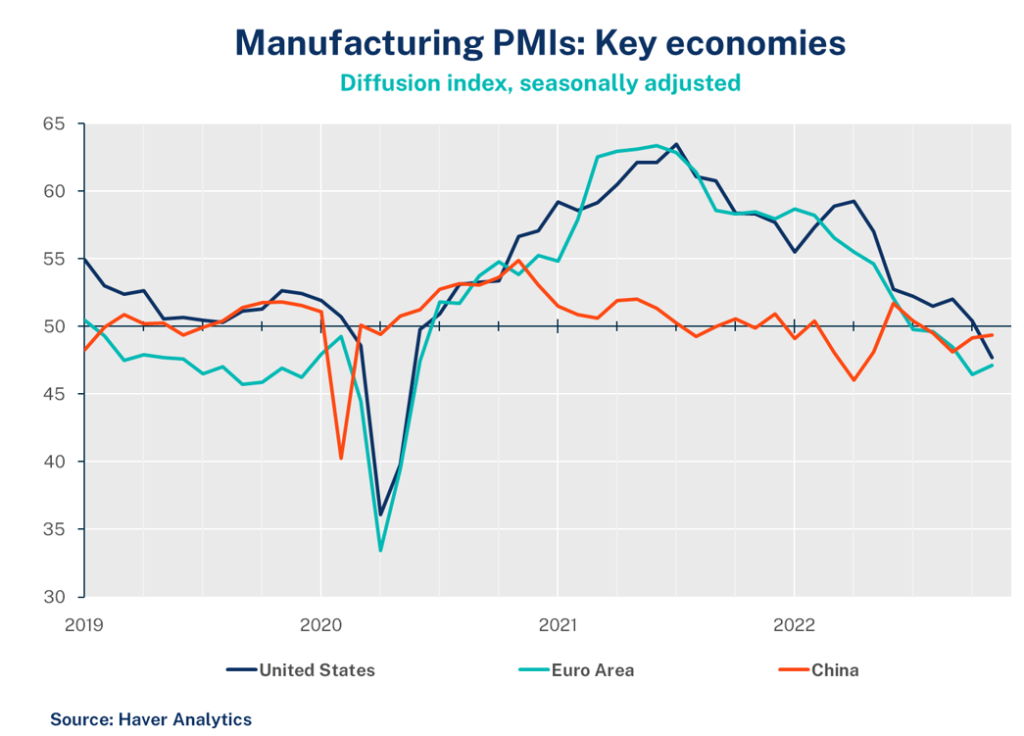

- Looking across advanced economies, Canadian manufacturingis not the only one contracting. All advanced economies are below the 50-line threshold.

- Fluctuations in emerging markets are expected to continue, but they are leading the pack for the time being, with India’s manufacturing sector showing continued expansion. China’s economic rebound appears to have halted after their re-opening from COVID-zero policies, with their PMI stabilizing around the 50-line.

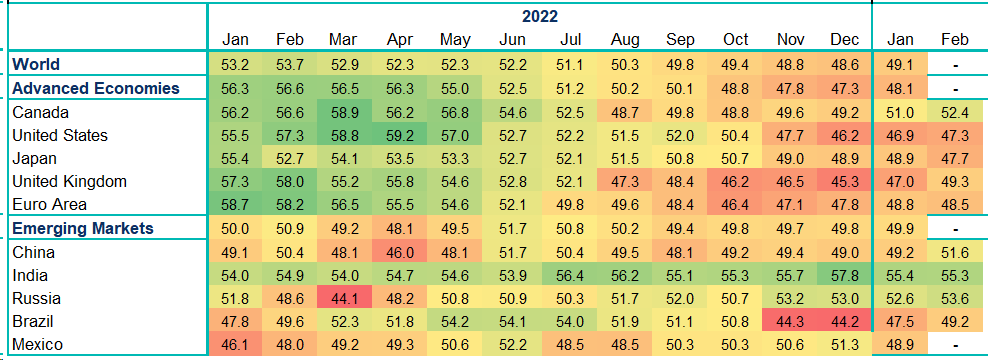

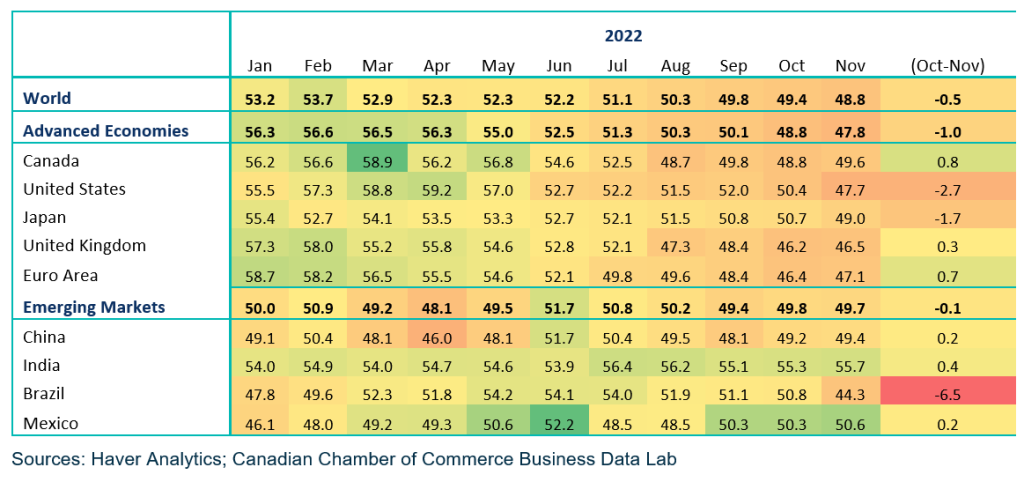

SUMMARY TABLE

Other Commentaries

Oct 19, 2022

September 2022 Consumer Price Index data: Food and services prices still rising, no progress on core inflation

Sep 20, 2022

August 2022 Consumer Price Index data: Finally some good news on Canadian inflation.

Aug 16, 2022

July 2022 Consumer Price Index data: Canada’s inflation finally turns a corner with falling gas prices, but core pressures remain

Commentaries /

March 2023: PMIs: Canadian manufacturers continue to recover

March 2023: PMIs: Canadian manufacturers continue to recover

The good news continues for Canada’s manufacturing sector, as the PMI topped the 50-mark for the second straight month. The increase to 52.4 in February was the highest reading since July. The sector looks to be improving, as supply chains stabilize and inflation pressures ease. Growth in new orders is also welcome news and signals a decent start to the year.

Mahmoud Khairy

The good news continues for Canada’s manufacturing sector, as the PMI topped the 50-mark for the second straight month. The increase to 52.4 in February was the highest reading since July. The sector looks to be improving, as supply chains stabilize and inflation pressures ease. Growth in new orders is also welcome news and signals a decent start to the year.

– Mahmoud Khairy, Economist, Canadian Chamber of Commerce

KEY TAKEAWAYS

- For the second month in a row Canada’s manufacturing Purchasing Managers’ Index (PMI) reported a reading above the no-growth threshold of 50. Rising to 52.4 in February from January’s 51.0, this marks the highest level since July 2022.

- Growth in the manufacturing sector in 2023 continues to be led by domestic demand, as new export orders fell for the third consecutive quarter.

- Firms are drawing down their existing inventories of finished goods, while in tandem adding more jobs to meet increased production demands.

- Looking across advanced economies, Canada is looking like the lone bright spot, as the PMIs in the U.S. and Europe remain below 50.

- China’s economic rebound is showing up in the data, after their decision to lift covid-zero policies. Fluctuations in emerging markets are expected to continue, but they are leading the pack for the time being.

SUMMARY TABLE

Other Commentaries

Oct 19, 2022

September 2022 Consumer Price Index data: Food and services prices still rising, no progress on core inflation

Sep 20, 2022

August 2022 Consumer Price Index data: Finally some good news on Canadian inflation.

Aug 16, 2022

July 2022 Consumer Price Index data: Canada’s inflation finally turns a corner with falling gas prices, but core pressures remain

Commentaries /

January 2023 PMIs: Canadian manufacturers starting the year with a firmer position

January 2023 PMIs: Canadian manufacturers starting the year with a firmer position

Finally, some light for Canada’s manufacturing economy as it finally shows month-to-month growth for the first time after two quarters of sub-par performance. This modest gain for January came in above market expectations and reflects both manufacturing output and demand.

Mahmoud Khairy

#DYK

The Purchasing Managers’ Index measures the direction of economic trends in Canada’s manufacturing sector. The index summarizes whether market conditions are growing, shrinking or staying the same, according to information from purchasing managers across Canada. The PMI is a key leading indicator that provides information about near-term business conditions and gives an advanced sense of Canada’s overall economic health and activity.

Finally, some light for Canada’s manufacturing economy as it finally shows month-to-month growth for the first time after two quarters of sub-par performance. This modest gain for January came in above market expectations and reflects both manufacturing output and demand. It is also lining up with the slight ease Canada is currently seeing in inflationary pressures. With looming recessionary concerns, it’s too early to predict whether the manufacturing sector is in the clear.

Mahmoud Khairy, Economist, Business Data Lab, Canadian Chamber of Commerce

KEY TAKEAWAYS

- Canada’s Manufacturing Purchasing Managers’ Index (PMI) reported a reading of 51.0, signaling a modest return to growth. The figure is up slightly from December’s 49.2 figure.

- This is the first time since July 2022 that we’re seeing the downturn in manufacturing and services moderately perk up above the 50 “no-growth” threshold, indicating an expansion in the sector.

- Still, against a backdrop of sticky inflation and stubborn labour market tightness – even with recent increases in sector employment in Q4 2022 – firms are still working with compressed margins and rising costs. Coupled with muted expectations amidst ongoing recessionary concerns, the January data is too premature to predict a sustained upswing.

- Manufacturing exports remain weak for an eighth consecutive month which is more reason for firms to remain cautious and rely on their existing inventories of finished goods.

- Globally, the manufacturing sector is still lagging but January data offers a silver lining as firms continue to slow output to better match demand. This will be especially important as central banks in both advanced and emerging market economies determine the extent to which they issue or pause policy rate hikes in the coming months.

SUMMARY TABLE

For more great #cdnecon content, visit our Business Data Lab.

Other Commentaries

Oct 19, 2022

September 2022 Consumer Price Index data: Food and services prices still rising, no progress on core inflation

Sep 20, 2022

August 2022 Consumer Price Index data: Finally some good news on Canadian inflation.

Aug 16, 2022

July 2022 Consumer Price Index data: Canada’s inflation finally turns a corner with falling gas prices, but core pressures remain

Commentaries /

December 2022 PMIs: Canadian manufacturers facing challenging operating conditions

December 2022 PMIs: Canadian manufacturers facing challenging operating conditions

Our Economist, Mahmoud Khairy, discusses December 2022's PMIs, which showed a subdued performance.

Mahmoud Khairy

Canada’s PMI closed the year with a subdued performance.

Mahmoud Khairy, Economist, Canadian Chamber of Commerce

High inflation and weakening demand continue to take a toll on the manufacturing sector, where firms are raising recession worries.

Key Takeaways

- In December, Canada’s Manufacturing Purchasing Managers’ Index (PMI) reading of 49.2 signaled a mild contraction, down slightly from 49.6 in November. Canada’s PMI has been below the 50 “no-growth” threshold for five straight months, which suggests weak conditions and negative growth for the sector to start 2023.

- The main factors dragging down the index are output, new orders and purchasing activity, reflecting subdued demand amid persistent uncertainty, as firms are raising fears of recession. On the plus side, employment surprisingly increased (albeit only slightly) reflecting difficulties in recruiting.

- Globally the manufacturing sector has been contracting over the last four months. Advanced economies are a bit worse than emerging markets, but the slowdown is broad-based across countries.

Summary Table

For more great #cdnecon content, visit our Business Data Lab.

Other Commentaries

Oct 19, 2022

September 2022 Consumer Price Index data: Food and services prices still rising, no progress on core inflation

Sep 20, 2022

August 2022 Consumer Price Index data: Finally some good news on Canadian inflation.

Aug 16, 2022

July 2022 Consumer Price Index data: Canada’s inflation finally turns a corner with falling gas prices, but core pressures remain

Commentaries /

November 2022: Purchasing Managers’ Indices (PMIs)

November 2022: Purchasing Managers’ Indices (PMIs)

Canadian manufacturers are facing challenging operating conditions according to our Economist, Mahmoud Khairy.

Mahmoud Khairy

Canadian manufacturers facing challenging operating conditions

The Purchasing Managers’ Index (PMI) offers an accurate leading indicator for business conditions that helps to anticipate changing economic trends. In today’s data, it shows challenging operating conditions for Canada’s manufacturing sector as higher input costs and slowing sales are taking a toll.

Mahmoud Khairy, Economist, Canadian Chamber of Commerce

Key Takeaways

- In November, Canada’s Manufacturing Purchasing Managers’ Index (PMI) reading of 49.6 was a slight improvement compared with the reading of 48.8 in October. Nonetheless, Canada’s PMI remains below the 50 “no-growth” threshold for the fourth consecutive month, which is clearly not good news, and signals weaking conditions and negative growth for the sector to close out 2022.

- Production contracted for the fifth month in a row due to lower new orders in addition to contraction of foreign sales as global uncertainties continue.

- Canada is not alone; these PMI surveys suggest that globally the manufacturing sector has been contracting modestly over the last three months. Advanced economies are faring a bit worse than emerging markets, but the slowdown is broad-based across many countries.

Summary Table

For more great #cdnecon content, visit our Business Data Lab.

Other Commentaries

Oct 19, 2022

September 2022 Consumer Price Index data: Food and services prices still rising, no progress on core inflation

Sep 20, 2022

August 2022 Consumer Price Index data: Finally some good news on Canadian inflation.

Aug 16, 2022