Commentaries /

April 2023 PMIs: Purchasing Managers’ Indices suggest Canada’s manufacturing sector has started contracting

April 2023 PMIs: Purchasing Managers’ Indices suggest Canada’s manufacturing sector has started contracting

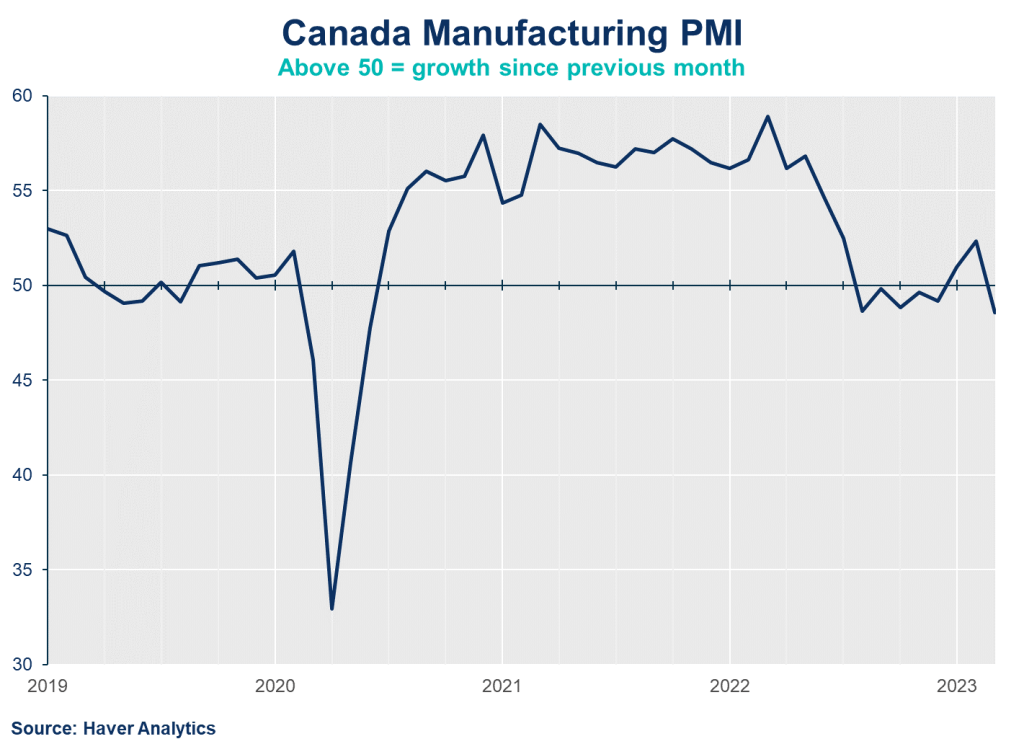

Canada’s Purchasing Manufacturing Index (PMI) results have shifted from a good news story at start of Q1 to issuing an early warning sign as it dropped below the 50-mark to record 48.6.

Mahmoud Khairy

Canada’s Purchasing Manufacturing Index (PMI) results have shifted from a good news story at start of Q1 to issuing an early warning sign as it dropped below the 50-mark to record 48.6 (down from 52.4 in February, and the lowest reading since June 2020). Though supply chains are stabilizing, higher prices, uncertainty and weak demand have taken a toll on new orders and production. It’s not all bad news, as the sector continues to add new jobs in the hopes that the economy will recover over the next 12 months.

Mahmoud Khairy, Economist, Canadian Chamber of Commerce

KEY TAKEAWAYS

- After a strong start to the first quarter in January and February, Canada’s Purchasing Managers’ Index (PMI) reading of 48.6 fell below the “no-growth” threshold of 50, which suggests that Canada’s manufacturing sector has begun contracting.

- The fall was led by a drop in new orders as well as a modest decline in production.

- High inflation affected both input costs and output prices offsetting easing supply pressures. Softer demand and lower purchasing power encouraged manufacturers to rely on inventories, rather than increase output.

- Interestingly, firms’ labour demand remained strong with companies indicating they will continue to add more staff for the fifth straight month. This suggests some confidence that demand will stabilize, and the economy will recover within the next 12 months.

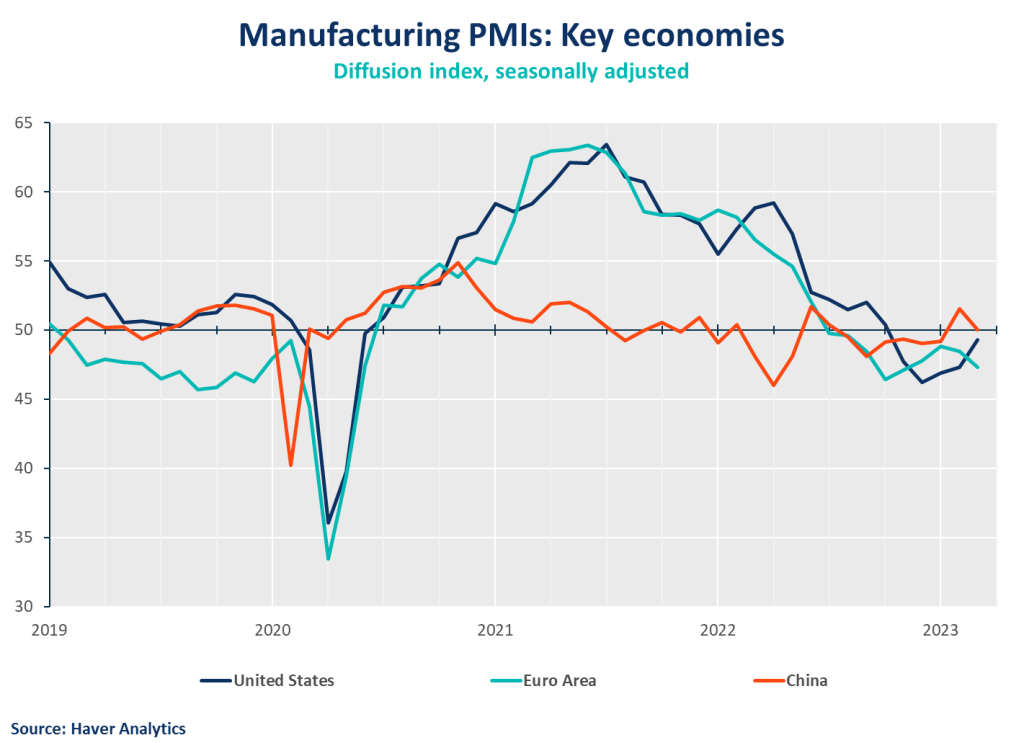

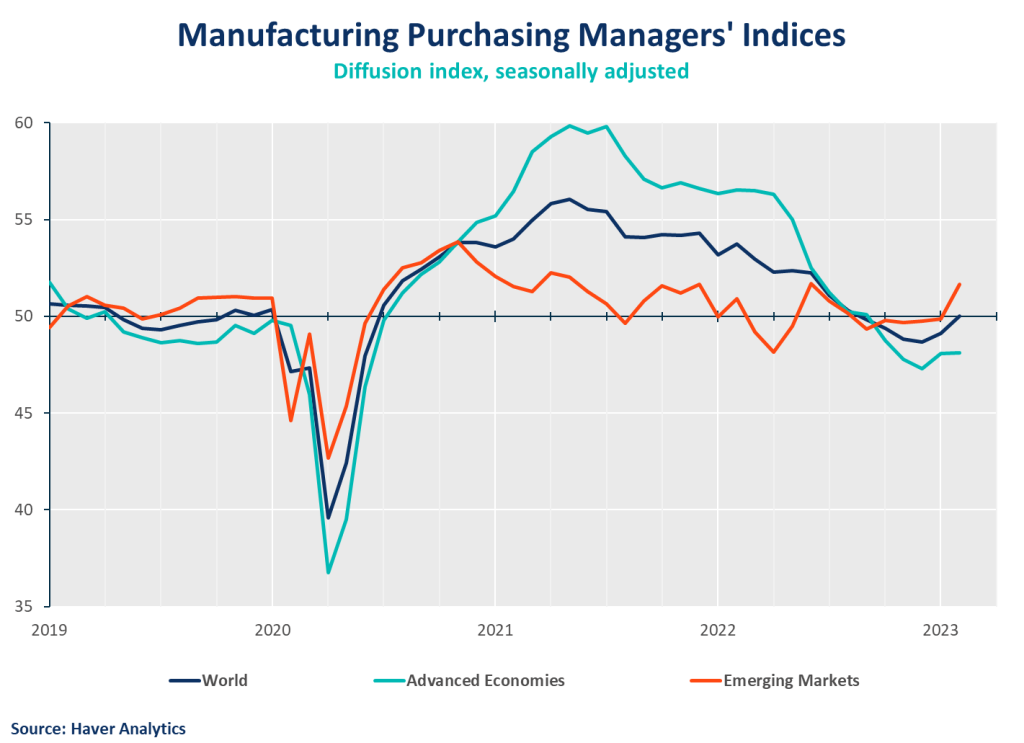

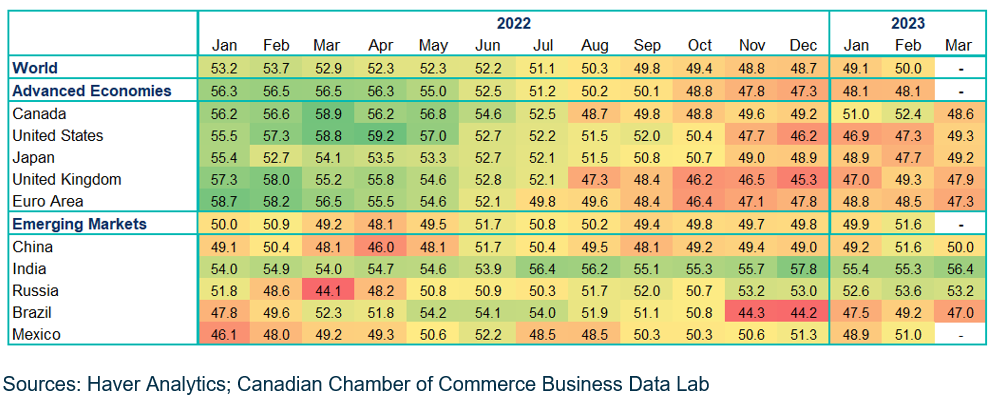

- Looking across advanced economies, Canadian manufacturingis not the only one contracting. All advanced economies are below the 50-line threshold.

- Fluctuations in emerging markets are expected to continue, but they are leading the pack for the time being, with India’s manufacturing sector showing continued expansion. China’s economic rebound appears to have halted after their re-opening from COVID-zero policies, with their PMI stabilizing around the 50-line.

SUMMARY TABLE

Other Commentaries

Oct 19, 2022

September 2022 Consumer Price Index data: Food and services prices still rising, no progress on core inflation

Sep 20, 2022

August 2022 Consumer Price Index data: Finally some good news on Canadian inflation.

Aug 16, 2022