Commentaries /

January 2023 PMIs: Canadian manufacturers starting the year with a firmer position

January 2023 PMIs: Canadian manufacturers starting the year with a firmer position

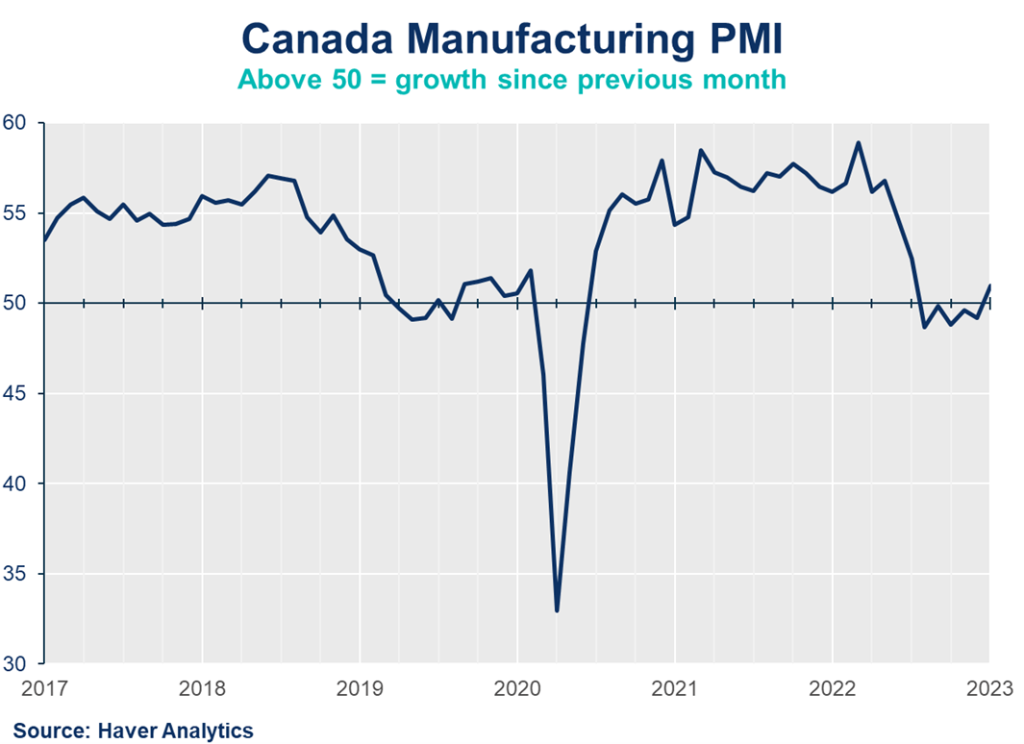

Finally, some light for Canada’s manufacturing economy as it finally shows month-to-month growth for the first time after two quarters of sub-par performance. This modest gain for January came in above market expectations and reflects both manufacturing output and demand.

Mahmoud Khairy

#DYK

The Purchasing Managers’ Index measures the direction of economic trends in Canada’s manufacturing sector. The index summarizes whether market conditions are growing, shrinking or staying the same, according to information from purchasing managers across Canada. The PMI is a key leading indicator that provides information about near-term business conditions and gives an advanced sense of Canada’s overall economic health and activity.

Finally, some light for Canada’s manufacturing economy as it finally shows month-to-month growth for the first time after two quarters of sub-par performance. This modest gain for January came in above market expectations and reflects both manufacturing output and demand. It is also lining up with the slight ease Canada is currently seeing in inflationary pressures. With looming recessionary concerns, it’s too early to predict whether the manufacturing sector is in the clear.

Mahmoud Khairy, Economist, Business Data Lab, Canadian Chamber of Commerce

KEY TAKEAWAYS

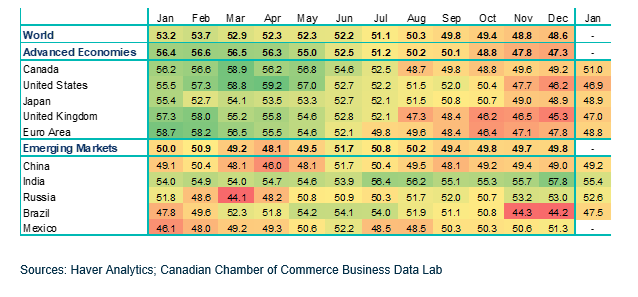

- Canada’s Manufacturing Purchasing Managers’ Index (PMI) reported a reading of 51.0, signaling a modest return to growth. The figure is up slightly from December’s 49.2 figure.

- This is the first time since July 2022 that we’re seeing the downturn in manufacturing and services moderately perk up above the 50 “no-growth” threshold, indicating an expansion in the sector.

- Still, against a backdrop of sticky inflation and stubborn labour market tightness – even with recent increases in sector employment in Q4 2022 – firms are still working with compressed margins and rising costs. Coupled with muted expectations amidst ongoing recessionary concerns, the January data is too premature to predict a sustained upswing.

- Manufacturing exports remain weak for an eighth consecutive month which is more reason for firms to remain cautious and rely on their existing inventories of finished goods.

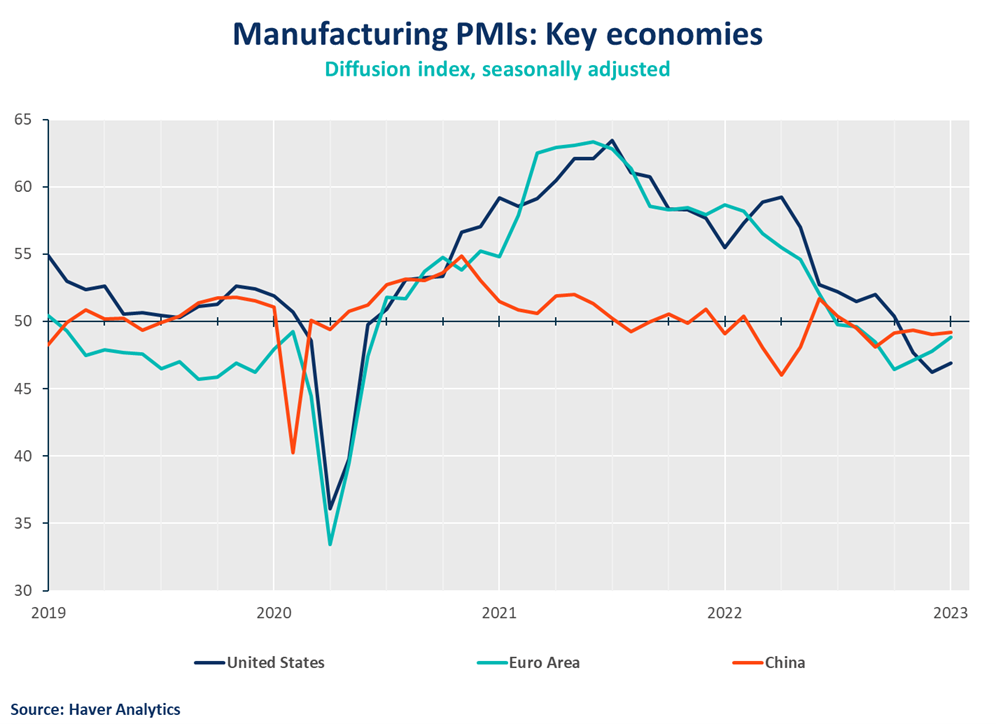

- Globally, the manufacturing sector is still lagging but January data offers a silver lining as firms continue to slow output to better match demand. This will be especially important as central banks in both advanced and emerging market economies determine the extent to which they issue or pause policy rate hikes in the coming months.

SUMMARY TABLE

For more great #cdnecon content, visit our Business Data Lab.

Other Commentaries

Oct 19, 2022

September 2022 Consumer Price Index data: Food and services prices still rising, no progress on core inflation

Sep 20, 2022

August 2022 Consumer Price Index data: Finally some good news on Canadian inflation.

Aug 16, 2022