Commentaries /

December 2022 CPI: The Bank of Canada wants you to know that it’s serious about controlling inflation

December 2022 CPI: The Bank of Canada wants you to know that it’s serious about controlling inflation

Our Chief Economist, Stephen Tapp, shares his thoughts on the Bank of Canada’s decision to raise its policy interest rate today. He says, “The Bank of Canada wants you to know that it’s serious about controlling inflation.”

Stephen Tapp

Key Takeaways

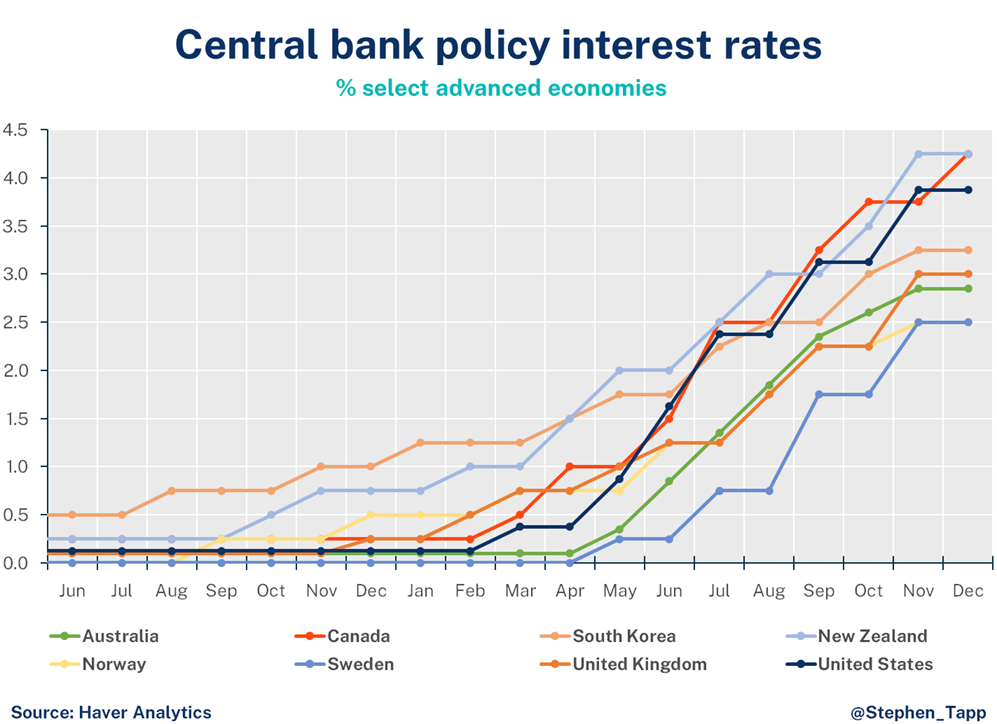

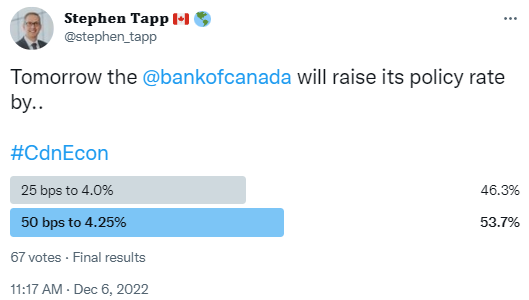

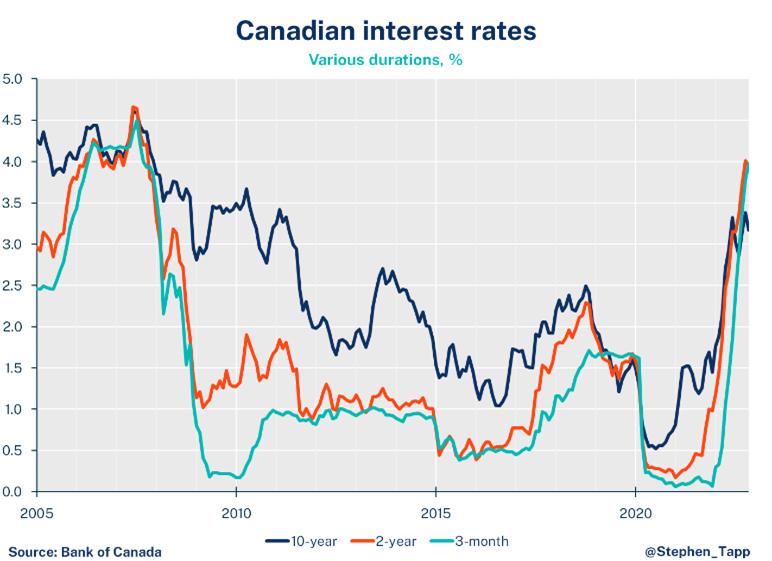

- Today, the Bank of Canada raised its policy interest rate by 50 bps to 4.25%. This decision was a close call. Financial market participants were essentially split on whether the Bank would deliver another 50-basis point hike or drop down to 25 basis points.

- Ultimately, the Bank decided to remain hawkish because:

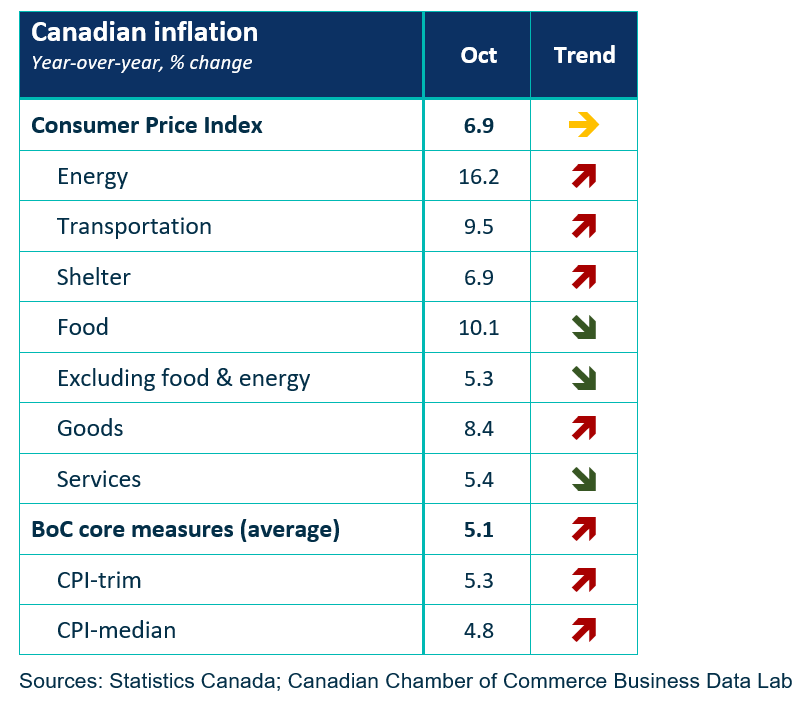

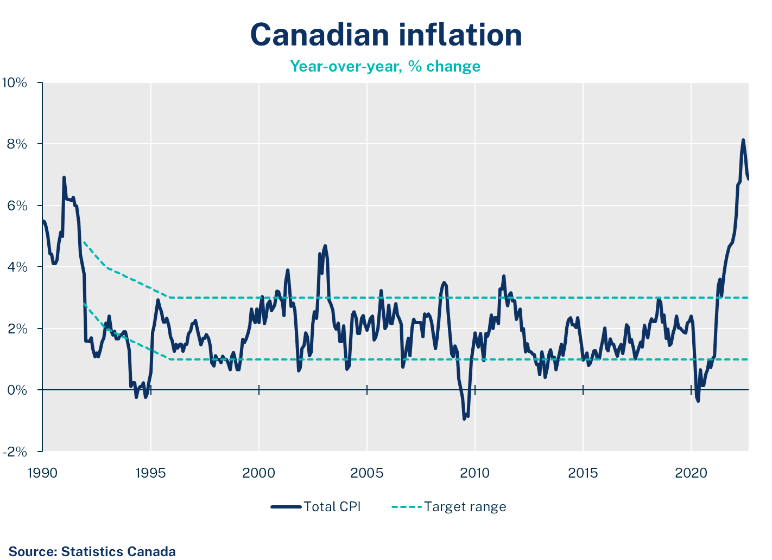

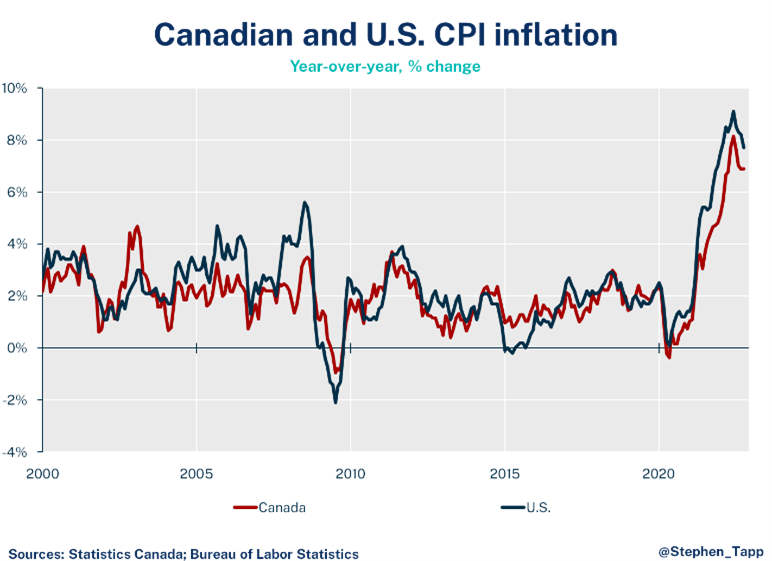

- Headline inflation in Canada is still far too high (6.9% year-over-year in October). Inflation remains broad-based across many frequently purchased goods and services, which makes it highly visible for everyday Canadians.

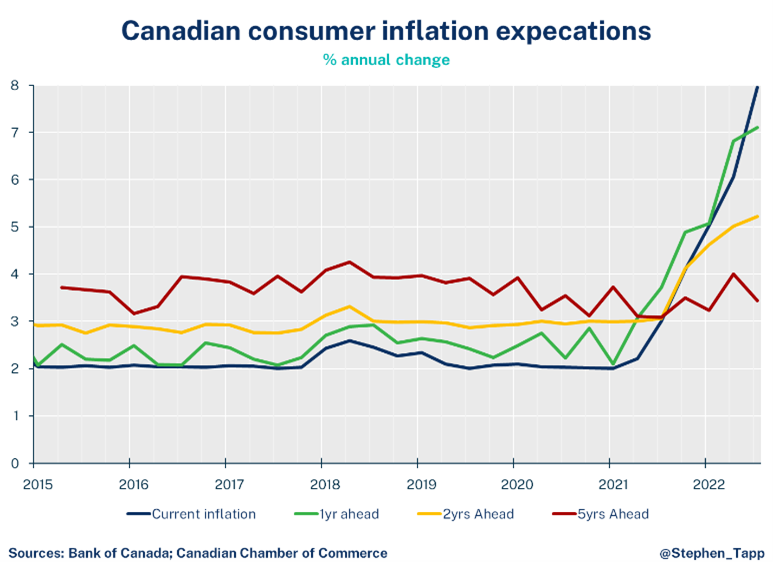

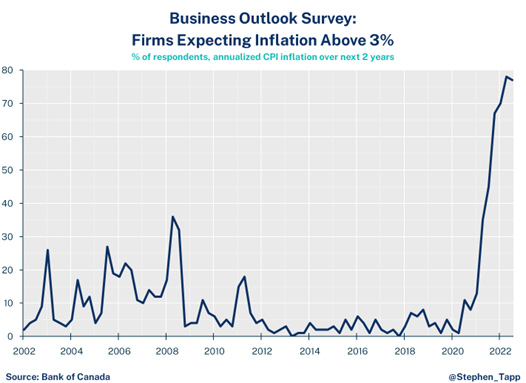

- Inflation expectations are elevated. In the Bank’s latest consumer and business surveys, most respondents expected inflation to remain above the top of the Bank’s inflation control band for the next two years. As the Bank notes, “The longer that consumers and businesses expect inflation to be above the target, the greater the risk that elevated inflation becomes entrenched.”

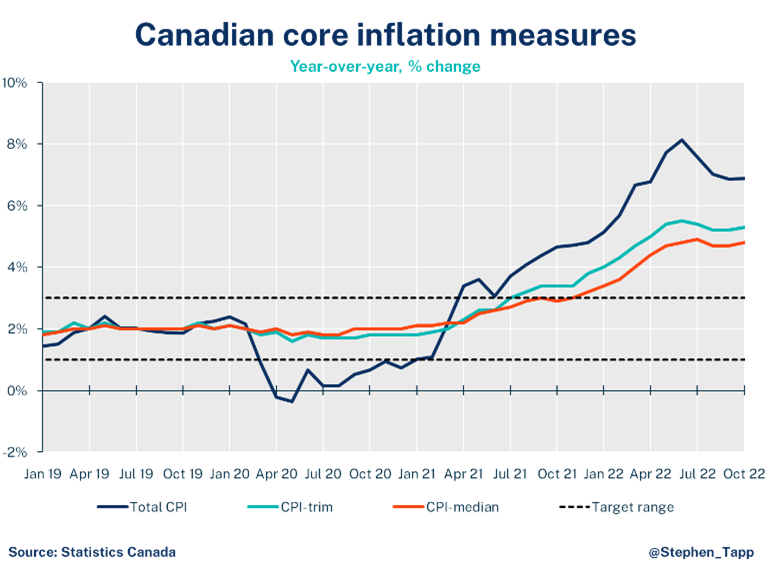

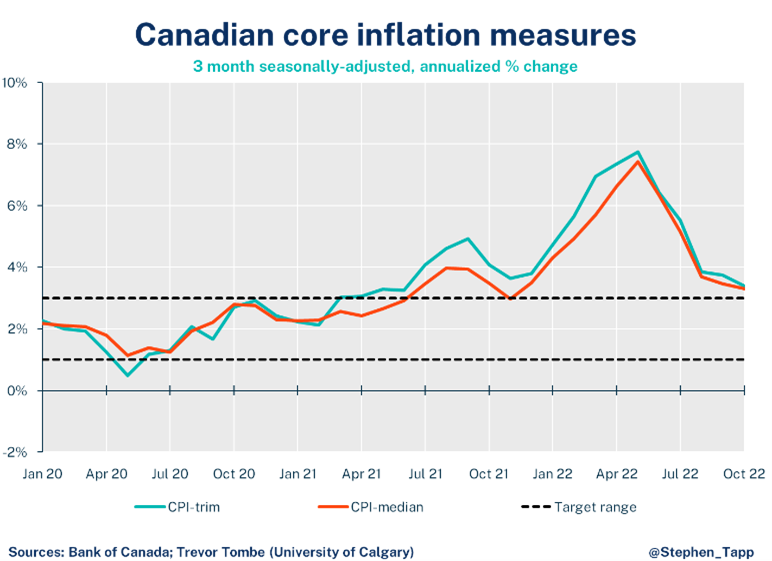

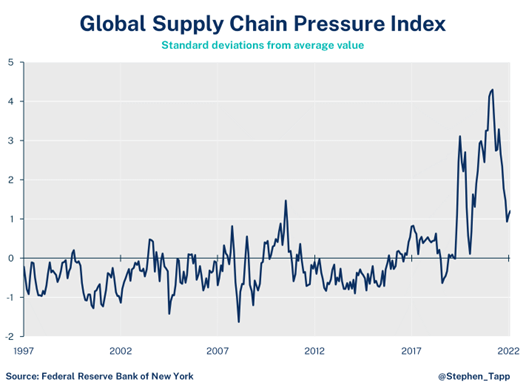

- Core inflation — which tries to measure underlying price pressure — is running above 5% on a year-over-year basis, even if the Bank is focused on more forward-looking, shorter-term core inflation measures, rather than the backward-looking year-over-year rate. The Bank’s shorter-term 3-month annualized core rates slowed to around 3.4% in October, which is a positive sign and suggests price pressures are losing momentum as the global economy slows. However, even if this slower recent core rate was maintained, inflation would remain above the top of the Bank’s target at the end of 2023.

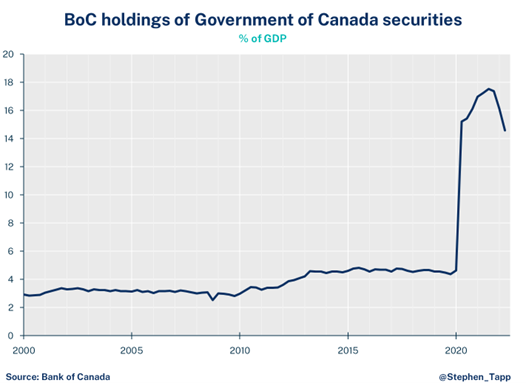

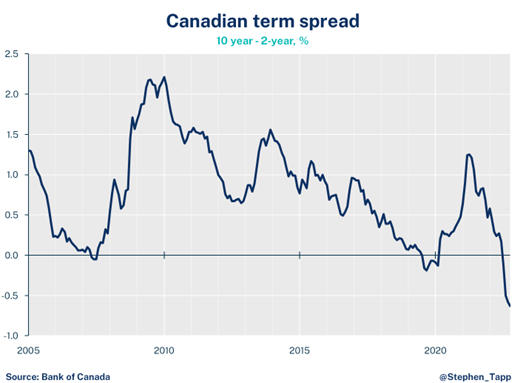

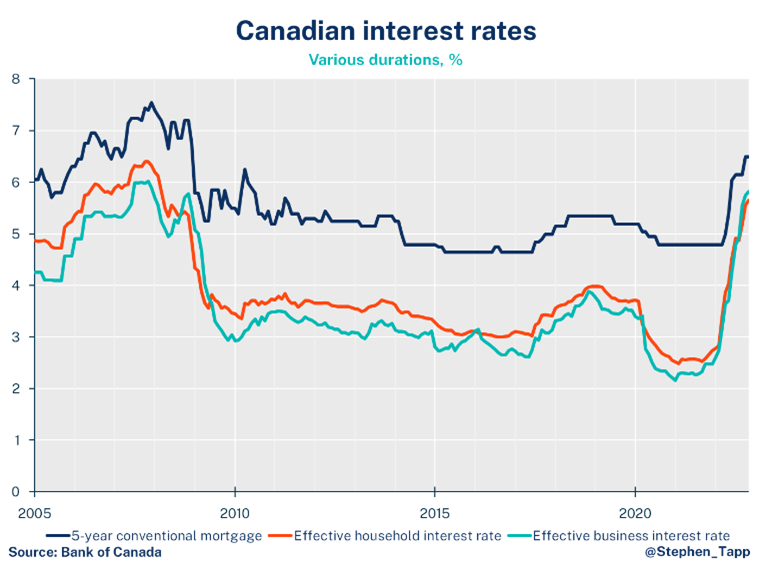

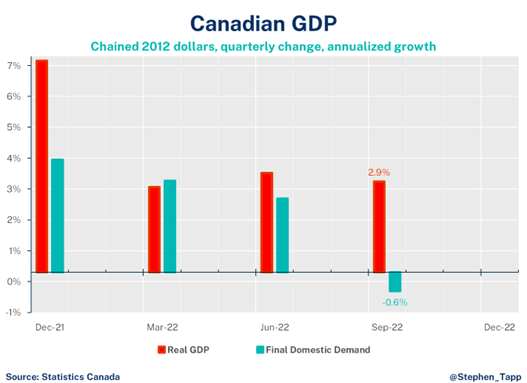

- Terminal rate? By choosing a stronger move today, the Bank’s statement signals they are willing to pause their rate tightening cycle for now to assess the impact that their sharp rise in interest rates is having on the Canadian economy. Rate hikes made earlier in 2022 will continue to slow demand into 2023. Housing markets continue to correct, and final domestic demand fell in the third quarter. The Bank continues to expect economic growth in Canada to stall during 2022Q4 to 2023Q2.

Summary Table

My Twitter followers narrowly made the right call.

For more great #cdnecon content, visit our Business Data Lab.

Other Commentaries

commentaries

Oct 19, 2022

September 2022 Consumer Price Index data: Food and services prices still rising, no progress on core inflation

Our Chief Economist, Stephen Tapp, looks at Canada’s headline inflation, which edged down for the third month in a row. There was no progress on “core” inflation, which held steady at 5%.

commentaries

Sep 20, 2022

August 2022 Consumer Price Index data: Finally some good news on Canadian inflation.

Stephen Tapp, our Chief Economist, looks at Canada’s headline inflation for August, which fell for the second straight month. Core inflation and services measures have also finally started to slow.

commentaries

Aug 16, 2022

July 2022 Consumer Price Index data: Canada’s inflation finally turns a corner with falling gas prices, but core pressures remain

Our Chief Economist, Stephen Tapp, looks at Canada’s headline inflation, which is finally showing signs of cooling off.