Commentaries /

February 2023 LFS: Smashing market expectations, Canada’s job market grows 10X consensus in January

February 2023 LFS: Smashing market expectations, Canada’s job market grows 10X consensus in January

In stark contrast to recent high-tech layoffs, January’s blockbuster jobs report is proof that there’s still plenty of wind in the sails for Canada’s labour market.

Marwa Abdou

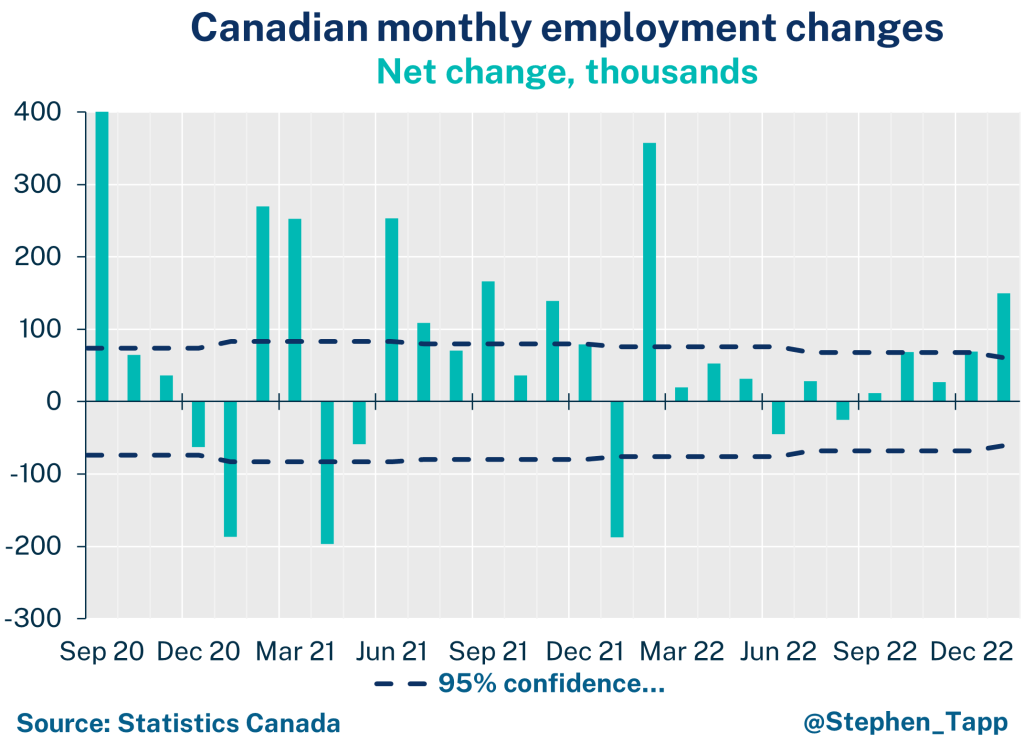

In stark contrast to recent high-tech layoffs, January’s blockbuster jobs report is proof that there’s still plenty of wind in the sails for Canada’s labour market. This was one of the strongest labour reports in a while, with 150K net new jobs added in January – double December’s figure and blowing past the market consensus of modest gains of 15k.

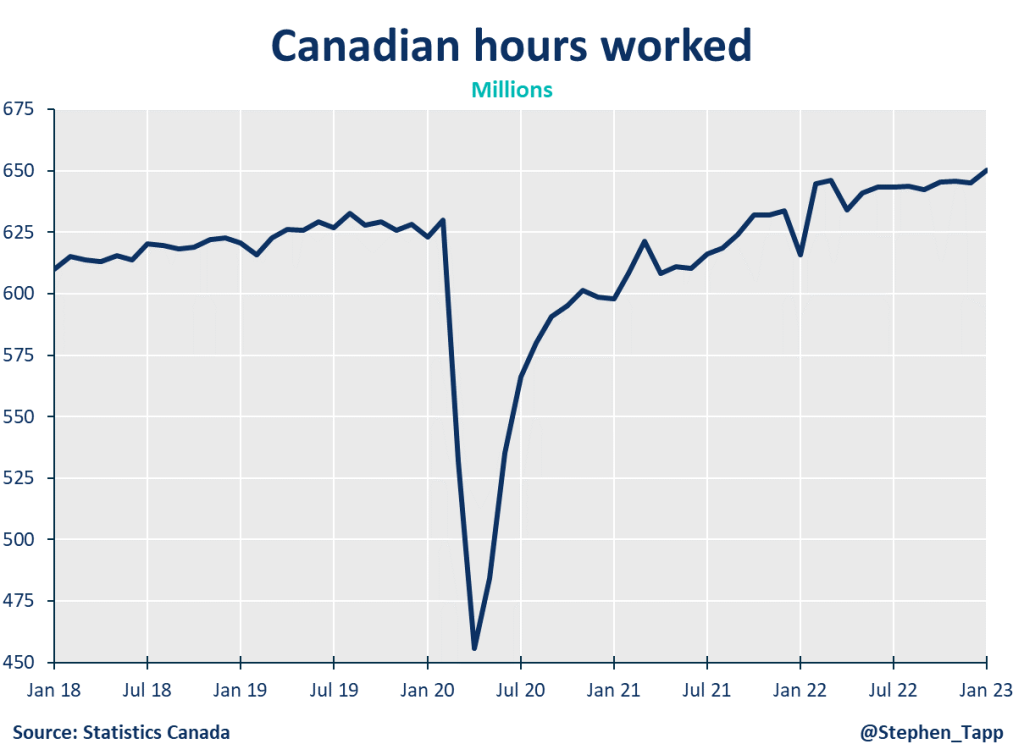

We also can’t ignore the broad-based gains for the fifth month – in both private as well as public sector – were accompanied by an impressive uptick in total hours (+0.8%). The big takeaway from this morning’s data is that calls for a recession in the Q1 2023 will have to wait.

KEY TAKEAWAYS

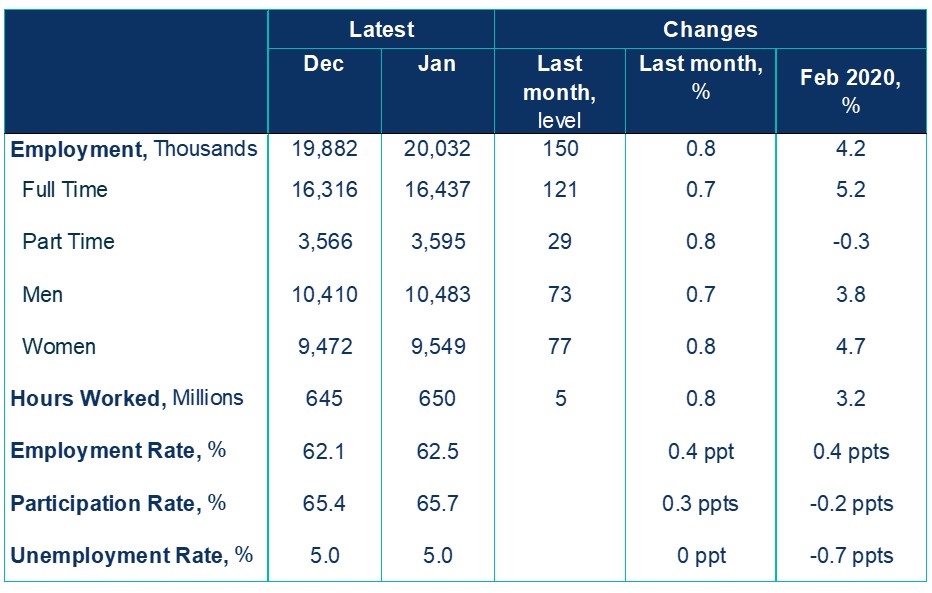

- January’s release reported job gains ten times bigger than market expectations (+15k) with 150K jobs (+0.8%) added to the economy. Broad-based gains were seen in full time (+121K) as well as private sector work (+115K).

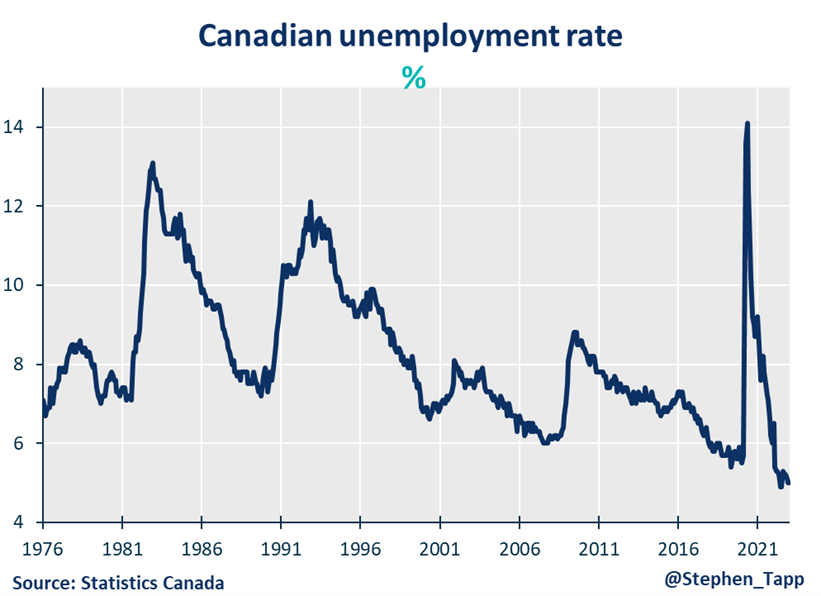

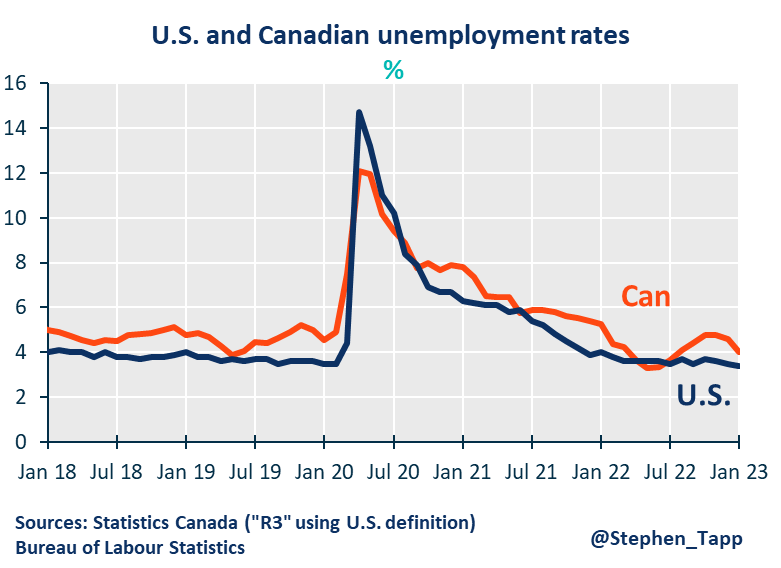

- At 5.0%, Canada’s unemployment rate continues to hover near-record lows of 4.9%. Today’s epic report signals we’re not coming off the boil as quickly as expected, raising more questions about what comes next.

- Employment for the core working ages (25-54) was a key driver of this growth with an impressive uptick in gains of 0.8% (+100K). Employment rate among women was evenly split and is welcomed momentum for this subsector after December’s almost three-decade record high.

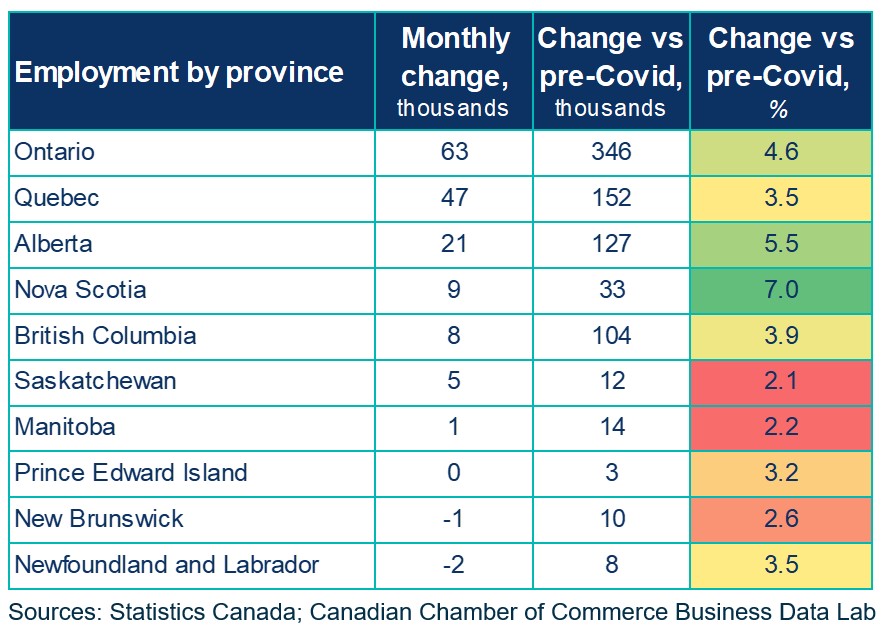

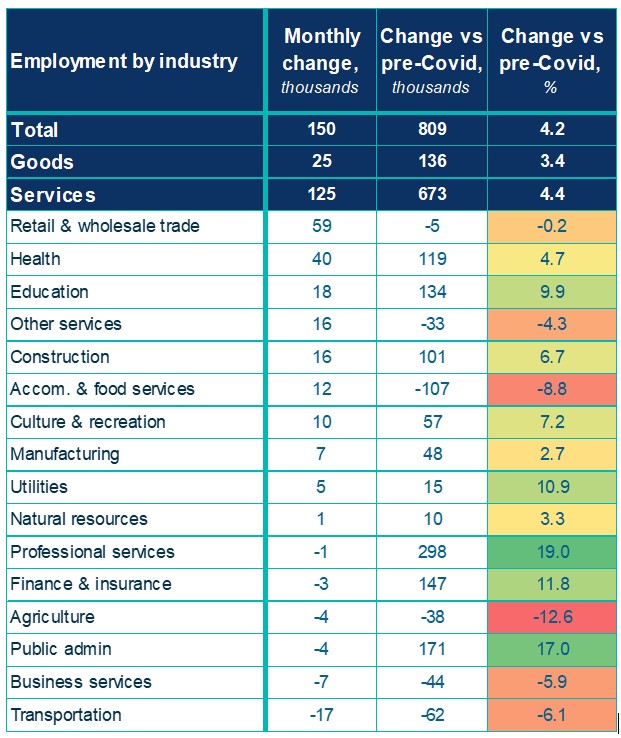

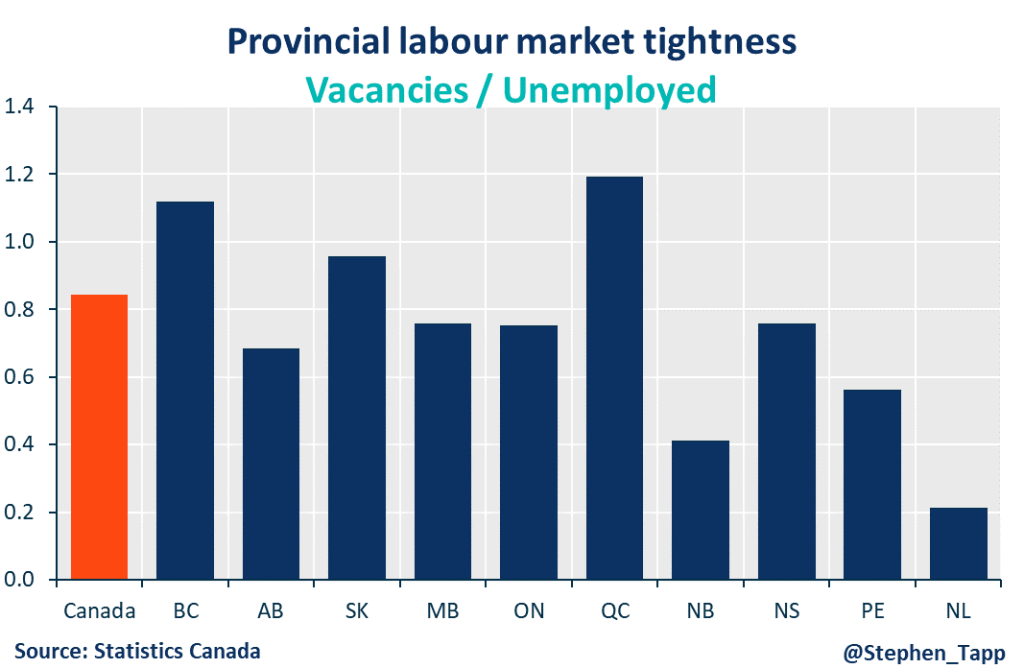

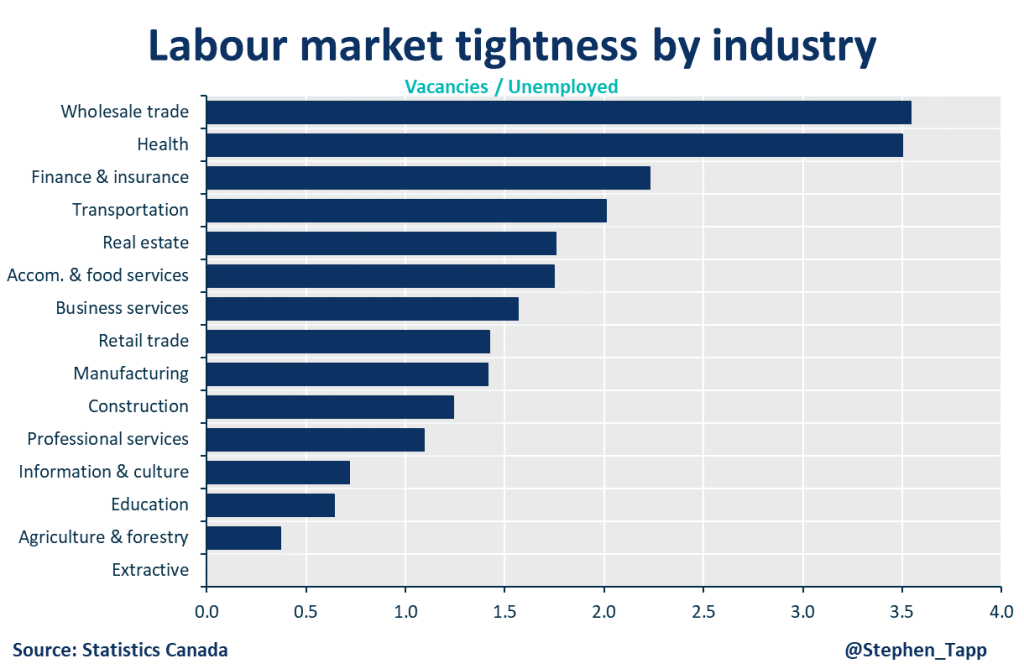

- Provincial employment increased in five provinces including Ontario (+63K), Quebec (+47K) and Alberta (+21K). Growth was also witnessed in several key industries including wholesale and retail trade (+59K), health care and social assistance (+40K); as well as educational services (+18K).

- Hours worked were especially notable after December’s lull as they edged up 0.8%. With a 5.6% year-over-year growth, this figure is an impressive rebound from a year prior when Canada was still in lockdowns with very high absenteeism.

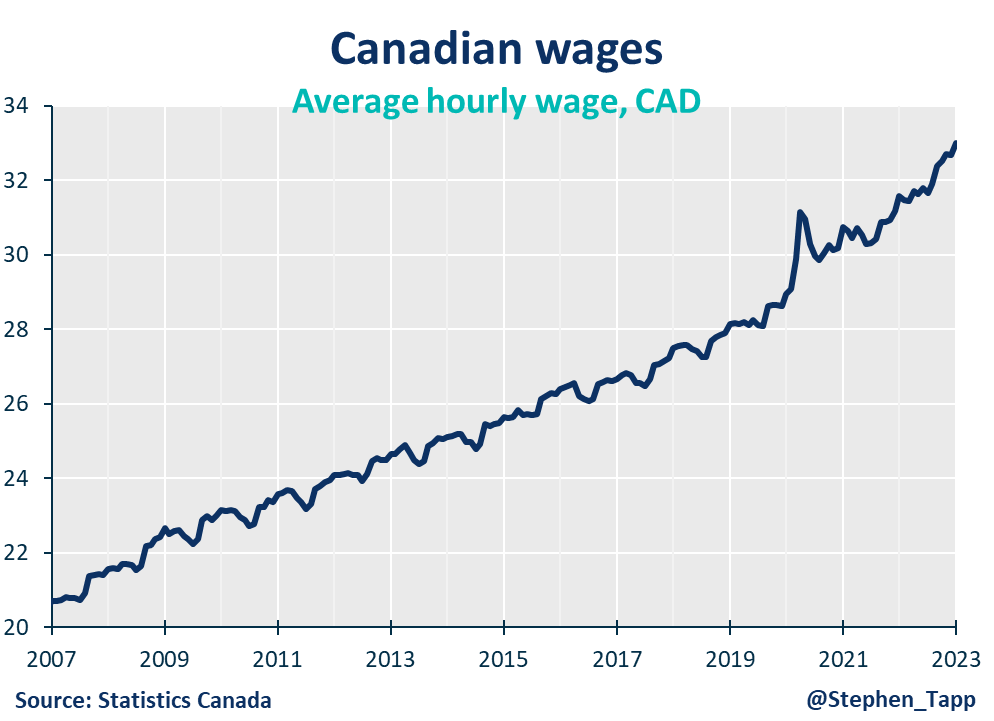

- After months of persistent growth, the increase of 4.5% in average hourly wages slowed down from December’s figure (4.8%), although this partly reflects compositional changes based on comparing with January 2022, when there were fewer low-income jobs due to COVID restrictions. It’s clear that the full effect of BoC’s recent rate hikes hasn’t taken hold yet for the labour market. While trailing behind the latest inflation figures, it’s still well above the BoC’s target of 2%.

- All in all, January’s epic headline data comes after an equally impressive (and surprising!) labour numbers we saw south of the border last week. With January’s BoC’s rate pause, it leaves the door open to what lies ahead in a market that’s expected to be tough on businesses and consumers.

SUMMARY TABLES

Other Commentaries

Oct 19, 2022

September 2022 Consumer Price Index data: Food and services prices still rising, no progress on core inflation

Sep 20, 2022

August 2022 Consumer Price Index data: Finally some good news on Canadian inflation.

Aug 16, 2022