Commentaries /

Q2 2024 GDP: Positive surprise with underlying weakness

Q2 2024 GDP: Positive surprise with underlying weakness

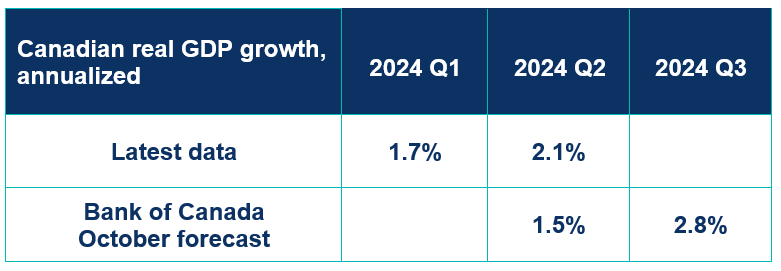

Canada’s real GDP grew by 2.1% annualized in the second quarter, outperforming market expectations

Andrew DiCapua

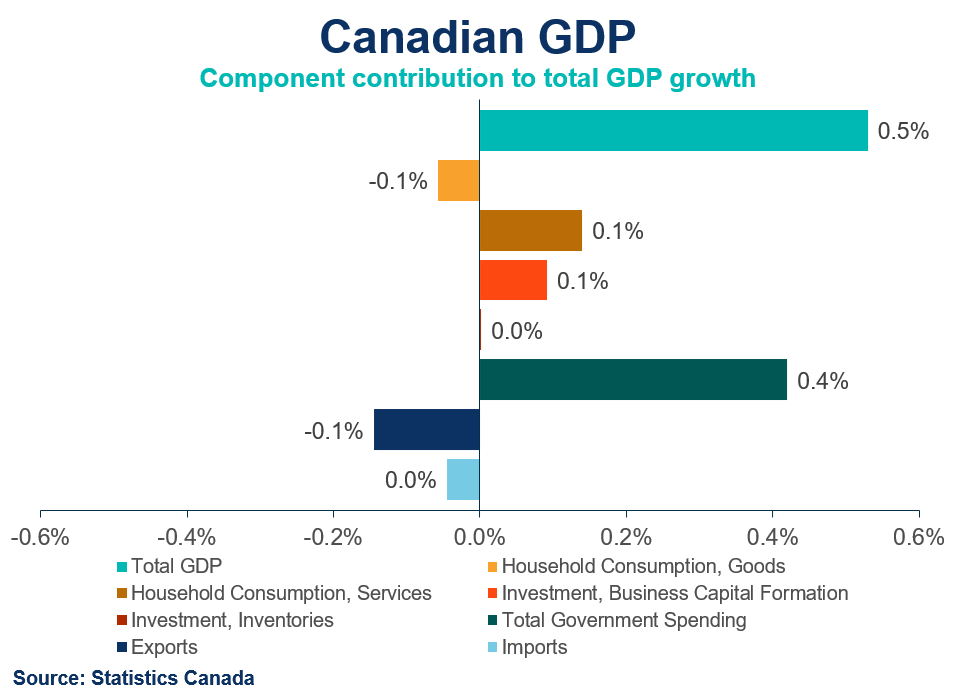

Despite the stronger GDP growth in the second quarter, the underlying reality is less impressive. The growth was largely driven by increased government spending and wage adjustments. While there is a positive note with business investment finally picking up after a year decline, the economy continues to show signs of underlying weakness. Household spending remains muted, and forward GDP estimates from Statistics Canada indicate sluggish growth ahead. This environment likely won’t shift the Bank of Canada’s stance significantly. However, with inflation moderating and the labour market becoming more balanced, we anticipate a 25bps rate cut at next week’s meeting.

- Andrew DiCapua, Senior Economist, Canadian Chamber of Commerce

KEY TAKEAWAYS

Headlines

- Canada’s real gross domestic product (GDP) grew by 2.1% annualized in the second quarter, outperforming market expectations (+1.8%). The stronger-than-expected growth was driven primarily by a 6.7% increase in government expenditure, largely due to wage increases and higher government purchases. Business investment was a positive surprise, growing by 10.3%, with notable spending on machinery and equipment.

- Monthly GDP by industry was revised down for June. Statistics Canada projects flat growth in July, setting the stage for weaker growth in the third quarter.

Movers and Shakers

- The main contributor to second-quarter growth was government spending (+6.7%), primarily due to wage adjustments for government employees and a rebound in purchases by both federal and provincial governments.

- Non-residential investment also surprised positively, growing by 10.3%—the strongest in several quarters. This growth was mainly in aircraft and other transportation equipment, with non-residential structures rising by 2% Q/Q annualized. This could signal that business investment might become a more positive contributor to the economy going forward.

- Exports of goods and services declined by 1.8%, underperforming despite the commencement of the Trans Mountain Pipeline (TMX) operations. Declines in precious metals, passenger vehicles, and refined petroleum products dragged down net trade contributions to growth. Although crude oil and bitumen exports provided some support, it wasn’t enough to offset the overall decline. Conversely, imports edged down by 0.5%.

- Final domestic demand, including expenditures on final consumption and gross fixed capital formation, grew by 2.4% in Q2, down from 3.1% in the first quarter. This growth was driven by government spending.

- Household spending slowed, increasing by only 0.6%, primarily due to higher costs for rent, food, and electricity. Goods spending was particularly weak, with lower sales of new trucks. Per capita consumption declined by 1.6% after a first-quarter rebound of 1.2%, as population growth outpaced GDP growth.

- Households continue to increase their savings, now at 7.2% in the second quarter, as they prepare for upcoming mortgage renewals.

OUTLOOK AND IMPLICATIONS

- While the Canadian economy grew faster than expected in the second quarter, the downward revision of June’s monthly growth and flat growth projections for July suggest a lack of momentum heading into the third quarter. The Bank of Canada had anticipated third-quarter growth of 1.5%, so the 2.1% figure for Q2 is stronger than expected. However, much of this growth was supported by government spending, which the Bank may overlook when assessing underlying economic strength.

- With per capita consumption declining and the consumer sector showing signs of weakness, the economy faces underlying challenges. Given the moderation in inflation and a more balanced labour market, the Bank of Canada might consider a 50bps rate cut in the upcoming meeting. However, we believe they are more likely to proceed with a 25bps cut, providing necessary support to the economy.

SUMMARY TABLES

Other Commentaries

Oct 19, 2022

September 2022 Consumer Price Index data: Food and services prices still rising, no progress on core inflation

Sep 20, 2022

August 2022 Consumer Price Index data: Finally some good news on Canadian inflation.

Aug 16, 2022