Commentaries /

Consumer Price Index: Core inflation remains stubbornly high

Consumer Price Index: Core inflation remains stubbornly high

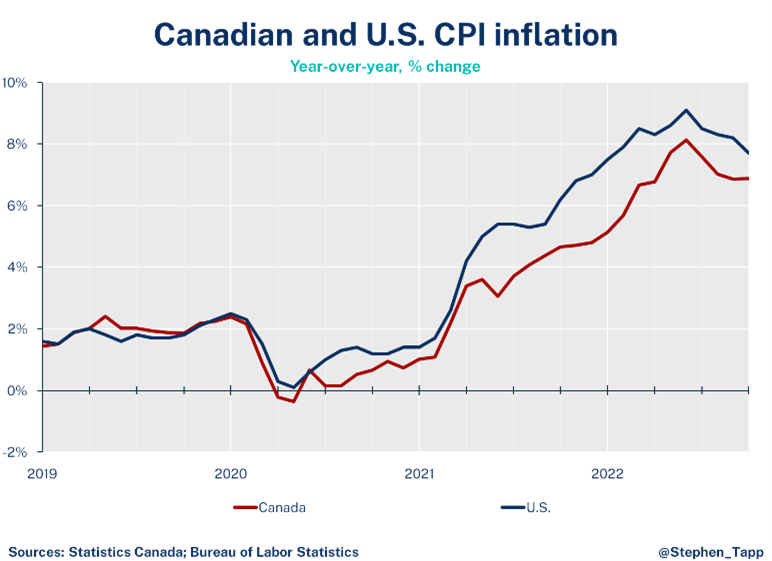

Our Chief Economist, Stephen Tapp, takes a look at Canada’s headline Consumer Price Index (CPI) inflation, which has held steady at 6.9% year-over-year in October.

Stephen Tapp

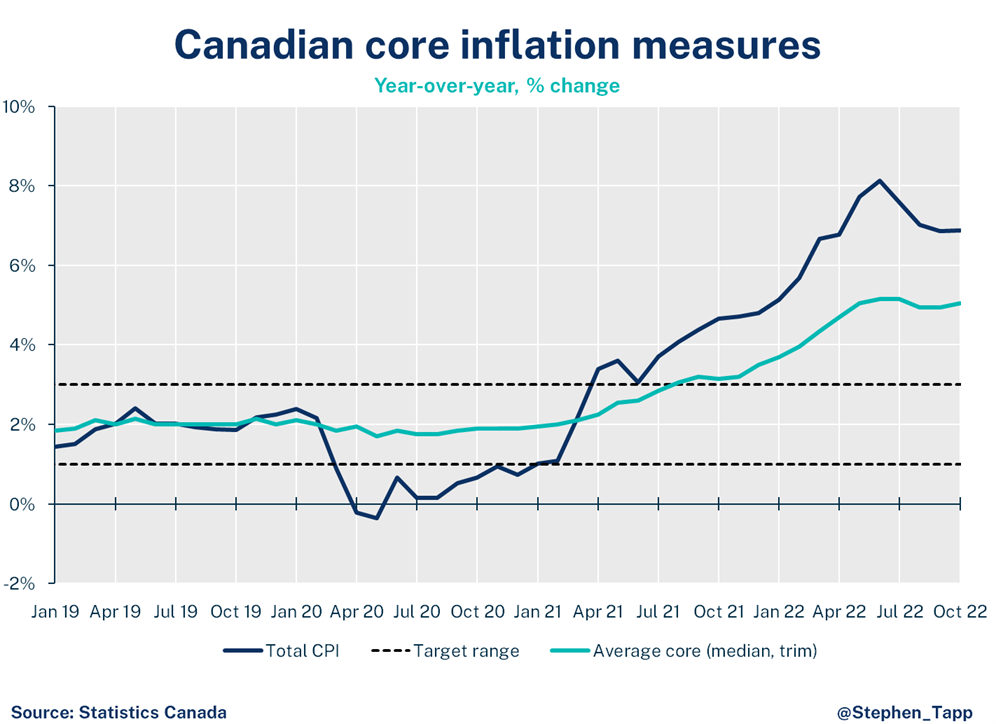

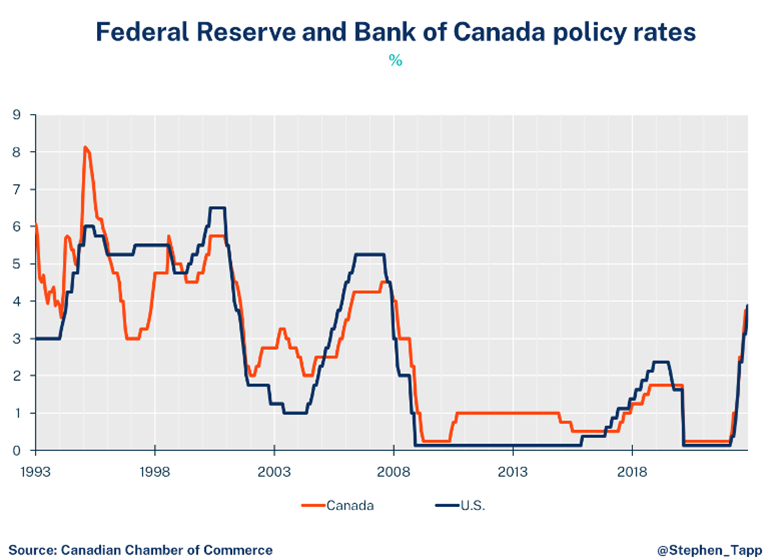

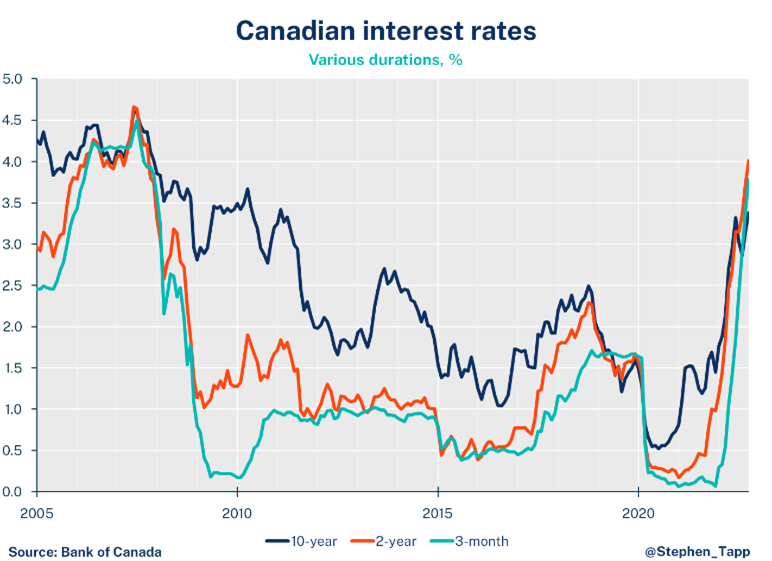

Canada’s headline Consumer Price Index (CPI) inflation held steady at 6.9% year-over-year in October. While some forecasters expected headline inflation to bump back up to 7.0% due to rising gas prices, the Bank of Canada is unlikely to view today’s report as good news in their fight against inflation. Both core inflation measures increased on a year-over-year basis and the weak Canadian dollar is beginning to add inflationary pressure of its own. Expect another interest rate increase in December, with both 25- and 50-basis point options still on the table, which should take the policy rate to at least 4% by the end of the year.

Stephen Tapp, Chief Economist, Canadian Chamber of Commerce

Key Takeaways

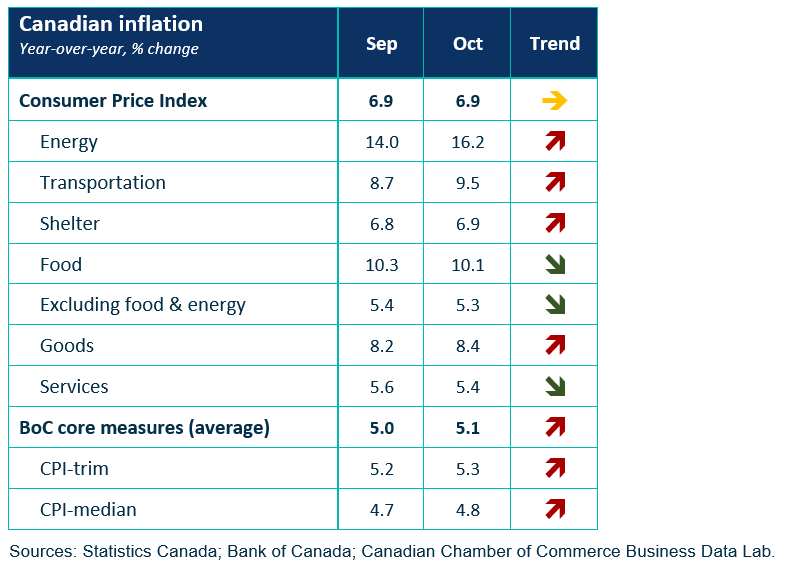

- Canada’s headline Consumer Price Index (CPI) inflation held steady at 6.9% year-over-year in October.

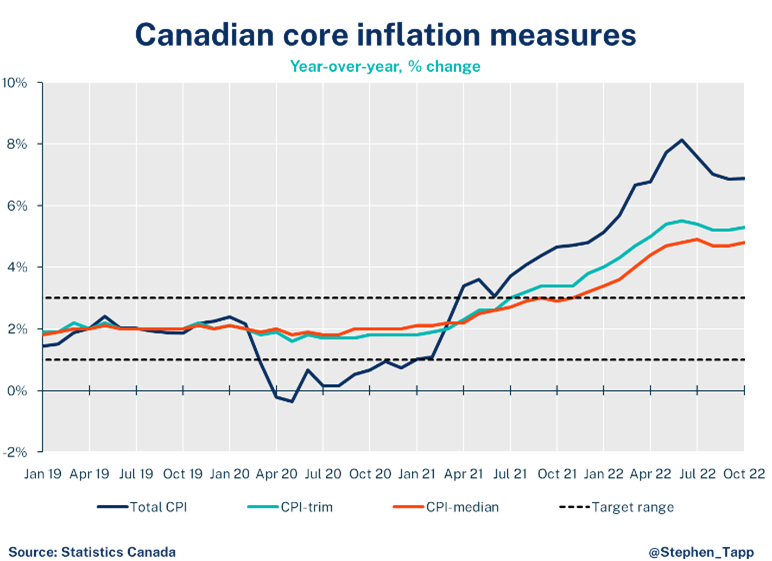

- The average of the Bank of Canada’s two preferred “core inflation” measures rose to 5.1% year-over-year, with both components up by 0.1%. That said, the Bank will be watching shorter-run (i.e., 3-month, rather than 12-month) movements in core to get a better reading on the underlying trends.

- After dragging down headline inflation for several months, gasoline prices reversed course, rising 9% in October (18% year-over-year, after a 13% rise in September). OPEC+ has announced oil production cuts, and the weakening Canadian dollar (strengthening US dollar) is raising domestic prices.

- Food price growth edged down modestly (to 10.1% from 10.3%). Prices for meat, fruits and vegetables grew more slowly, but prices for dairy and eggs continued to rise after their governing boards approved price increases. Grocery prices are up 11% year-over-year and is a key concern for consumers.

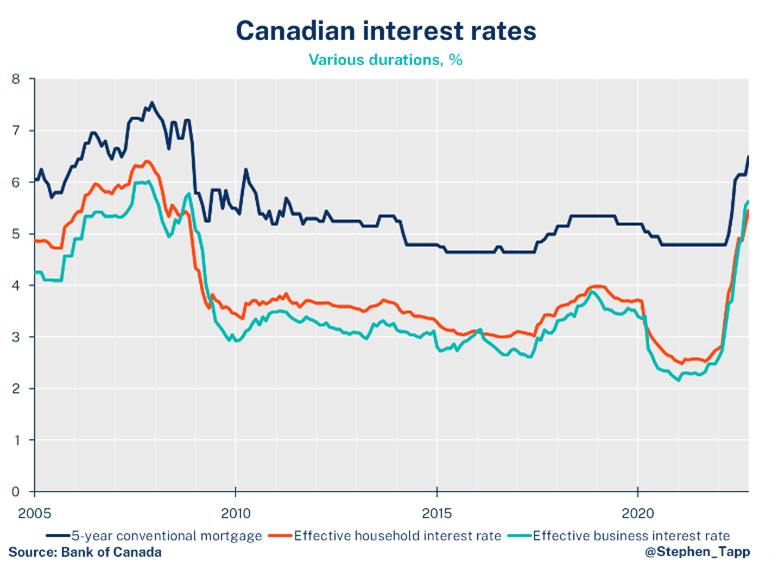

- Shelter costs bumped up to 6.9% (from 6.8% last month). There are opposing forces at play here: sharply rising interest rates are raising mortgage costs (11% year-over-year) and rents continue to rise (5%), while the general cooling of the overall housing market slows inflation for new homes.

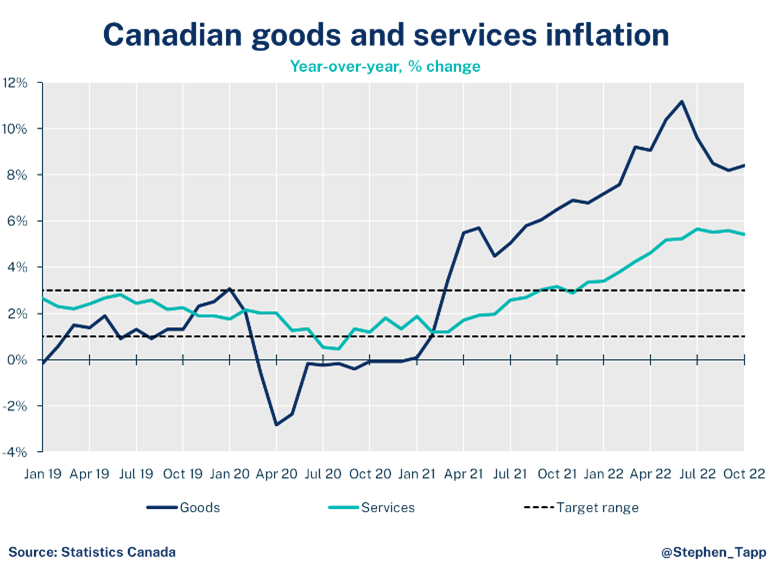

- Price increases for goods kicked back up to 8.4%, while services inflation finally turned the corner in the positive direction, slowing to 5.4%.

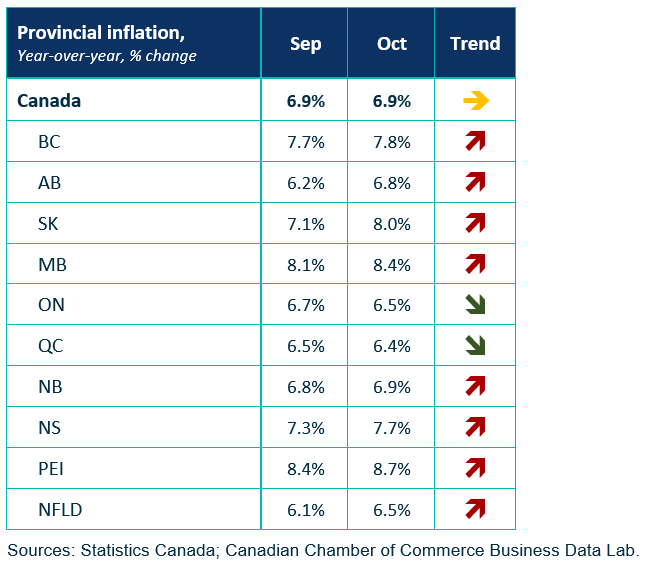

- The inflation rate rose in eight provinces. It is running noticeably hotter in the Prairies and BC but is slowing in Central Canada. In October, inflation was highest in Prince Edward Island (8.7%) and lowest in Quebec (6.4%).

- The Bank of Canada is unlikely to view today’s report as a sign of progress in their fight against inflation. Expect another interest rate increase in December, with both 25- and 50-basis point options still on the table, which should take the policy rate to at least 4% by the end of the year.

Summary Tables

Inflation Charts

For more great #cdnecon content, visit our Business Data Lab.

Other Commentaries

Oct 19, 2022

September 2022 Consumer Price Index data: Food and services prices still rising, no progress on core inflation

Sep 20, 2022

August 2022 Consumer Price Index data: Finally some good news on Canadian inflation.

Aug 16, 2022