Commentaries /

November 2022 GDP by industry: Canadian output is clearly slowing down but it’s too early to see recession

November 2022 GDP by industry: Canadian output is clearly slowing down but it’s too early to see recession

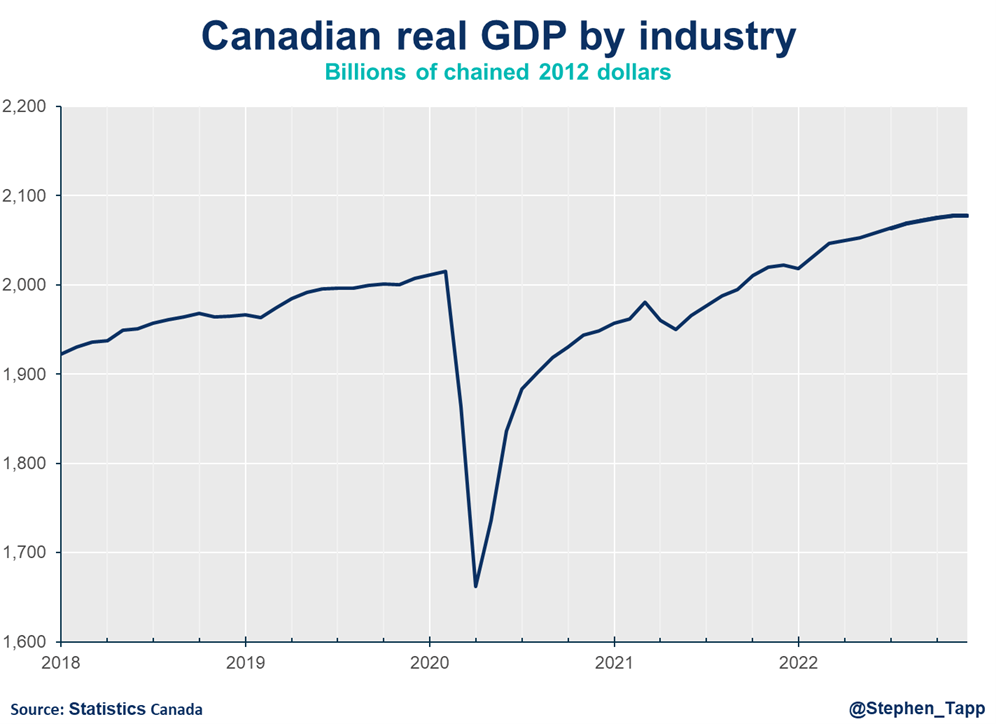

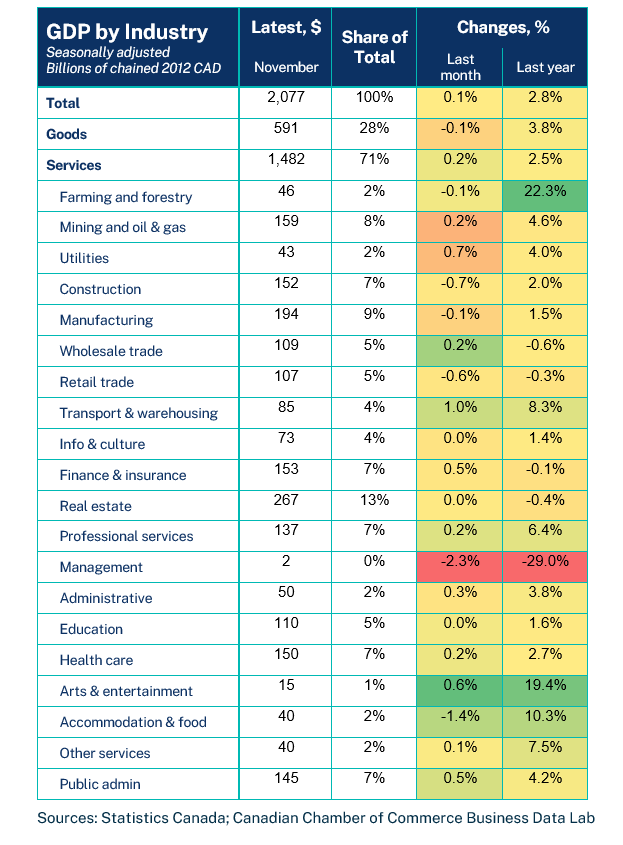

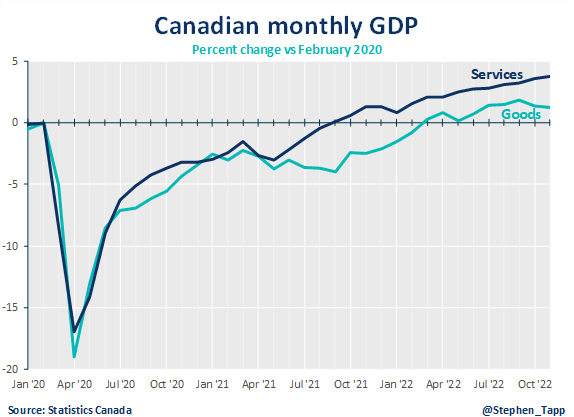

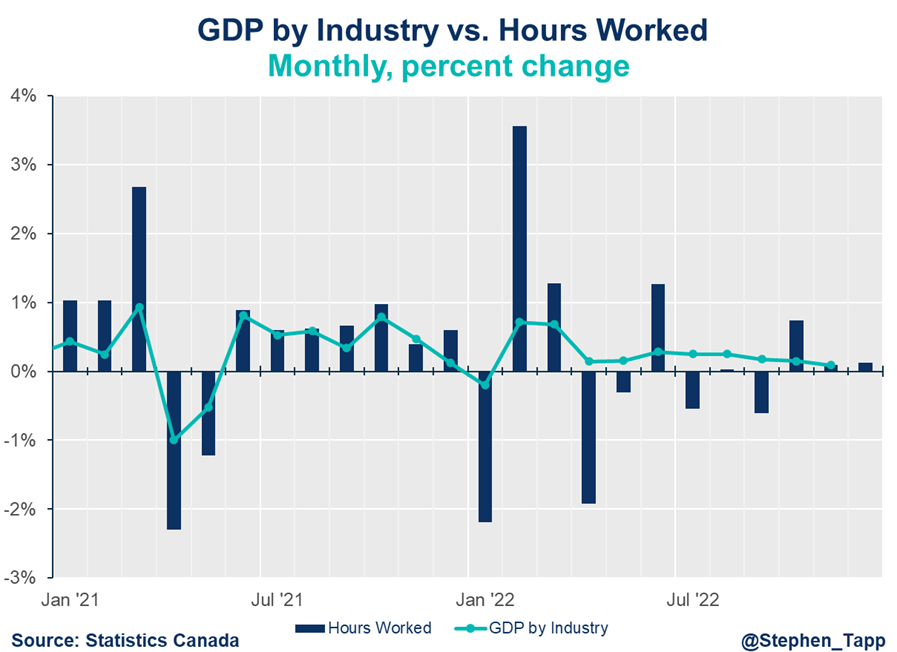

Today’s GDP data show Canada’s economy is clearly slowing down with a modest 0.1% uptick in November driven by services and aided by the easing of international travel restrictions. Statistics Canada’s advanced estimate shows no change in December, putting annualized real GDP growth on pace for 1.6% in Q4.