Commentaries /

May 2024 GDP: The Canadian economy beats expectations in May.

May 2024 GDP: The Canadian economy beats expectations in May.

Real GDP rose 0.2% in May, exceeding consensus forecasts of 0.1%.

Andrew DiCapua

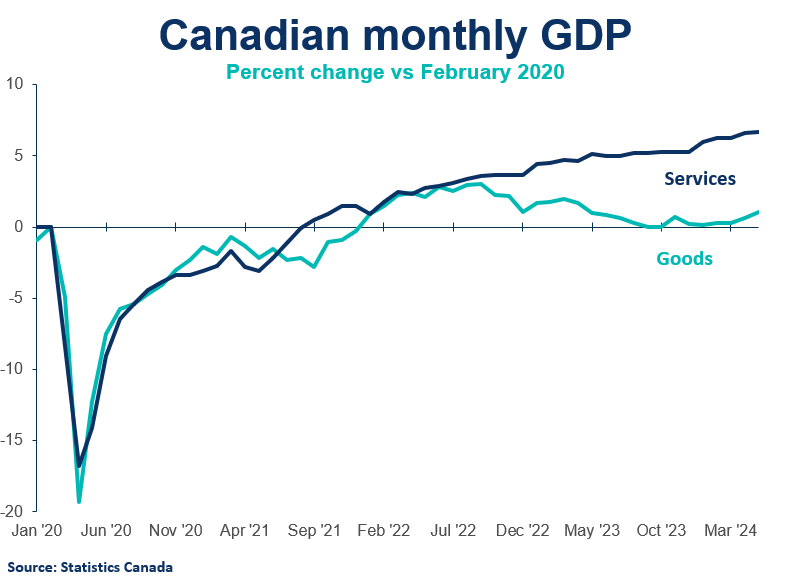

The Canadian economy is feeling the pinch from higher interest rates, particularly impacting the retail sector. Despite this, key industries like manufacturing and pipeline transportation lifted the second-quarter GDP estimate above the Bank of Canada’s forecast. However, this growth might be influenced more by temporary factors rather than a shift in momentum at this stage. With the Bank of Canada noting downside risks to inflation, any upward move in economic activity is positive news amidst broader challenges.

Andrew DiCapua, Senior Economist, Canadian Chamber of Commerce

KEY TAKEAWAYS

Headlines

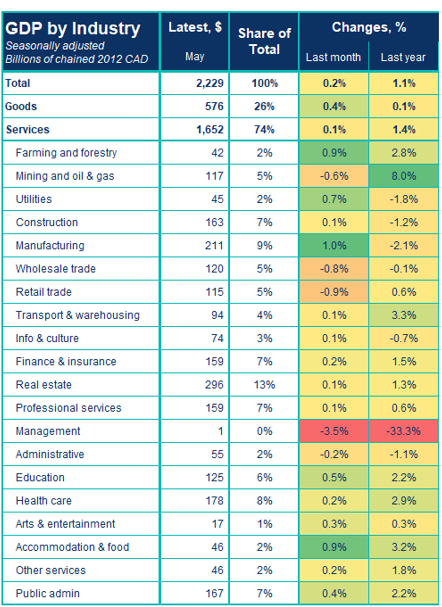

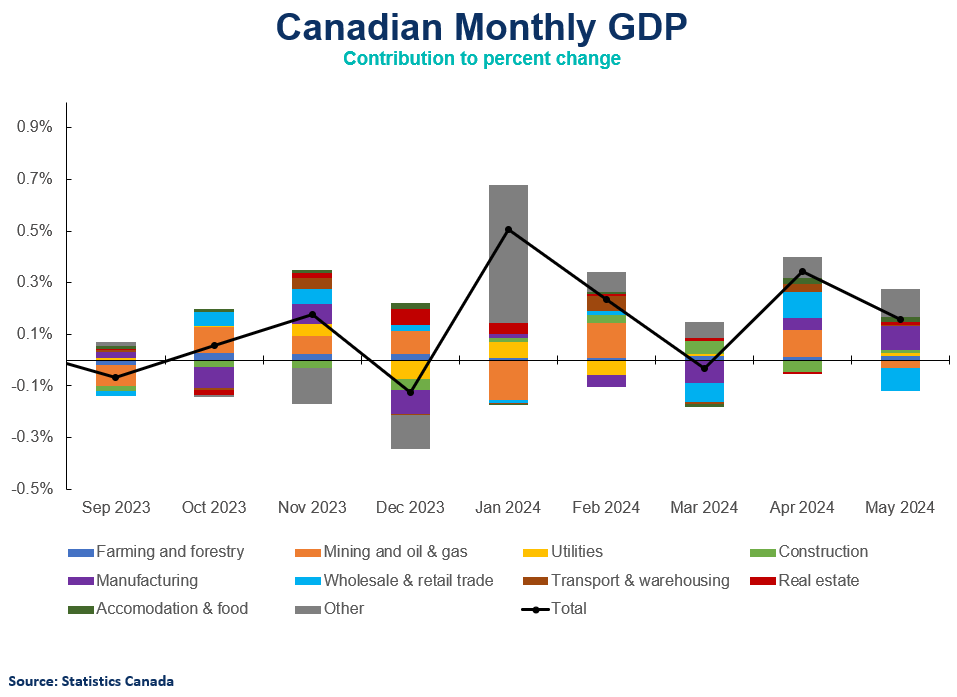

- Real gross domestic product rose 0.2% in May, exceeding consensus forecasts of 0.1%. Growth was broad-based across sectors, with goods leading the month, growing 0.4% and services lifting 0.1% m/m. This improves the prospects for the second quarter.

Movers and shakers

- Manufacturing: The manufacturing sector led the growth, expanding by 1.0%, driven by significant increases in both durable and non-durable goods. Some non-durable goods were impacted from petroleum and coal refineries coming online following maintenance.

- Mining, Oil and Gas: The mining, quarrying, and oil and gas extraction sector contracted by 0.6%, with oil sands extraction declining due to maintenance activities.

- Pipeline Transportation: Despite the extraction sector posting a decline, pipeline transportation expanded by 0.6%, bolstered by the commencement of the expanded Trans Mountain pipeline. This is not as strong as expected but still adds to the export capabilities of the sector.

- Accommodation and Food Services: For the second month in a row, accommodation and food services grew, posting 0.9% growth in May. Statistics Canada attributes some of this having to do with three Canadian teams playing in the NHL playoffs, increasing spending on entertainment.

- Retail Trade: Retail trade was the largest detractor, contracting by 0.9%, with declines across most subsectors.

OUTLOOK AND IMPLICATIONS

The advanced estimate for real GDP in June is 0.1%. The second quarter is on track to grow by roughly 2.2% annualized, which is much higher than the Bank of Canada’s recent July forecast of 1.5%. The bank of Canada will need to assess the momentum into the summer months following this report and its impact on prices. But as Governor Macklem pointed out at the last decision, the balance of risks have shifted to the downside and economic activity needs to pick up. Despite some pick up in activity, a sustained period of economic growth is still a few quarters away.

SUMMARY TABLE

CHARTS

Other Commentaries

Oct 19, 2022

September 2022 Consumer Price Index data: Food and services prices still rising, no progress on core inflation

Sep 20, 2022

August 2022 Consumer Price Index data: Finally some good news on Canadian inflation.

Aug 16, 2022