Commentaries /

May 2023 GDP: Canada’s economy set to slow —but still grow — in the second quarter

May 2023 GDP: Canada’s economy set to slow —but still grow — in the second quarter

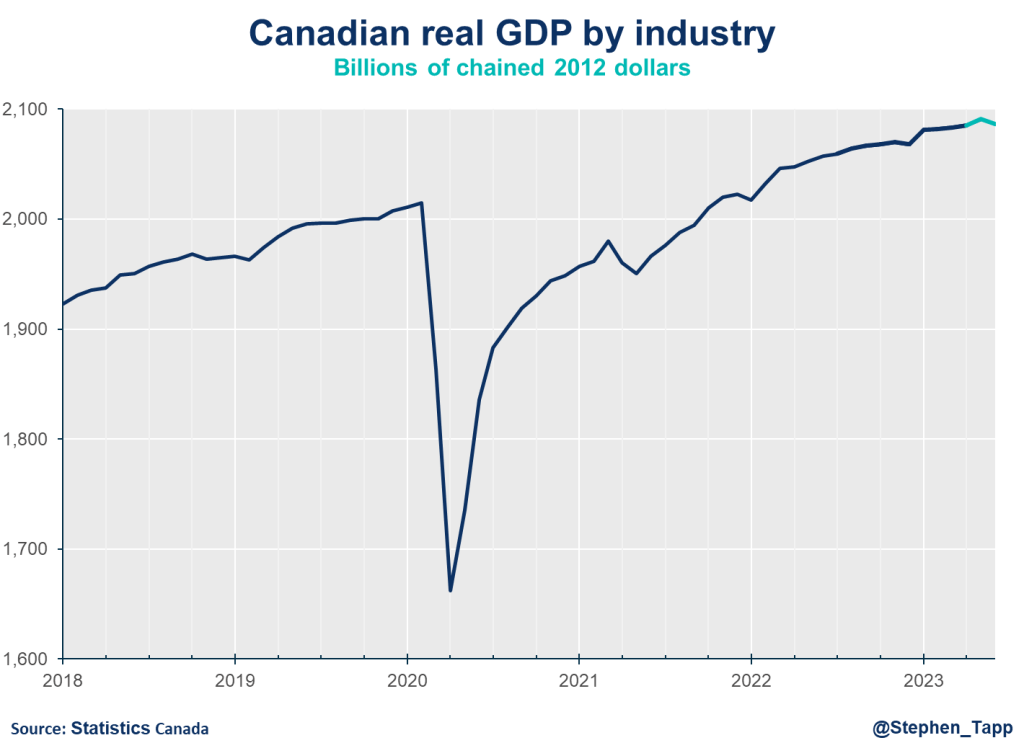

Canada’s GDP rose 0.3% in May, matching market expectations. Output was helped by the easing of supply chain pressures, the end of a federal public servant strike and continued momentum in real estate, but forest fires disrupted Alberta’s oil and gas sector.

Rewa

Canada’s GDP rose 0.3% in May, matching market expectations. Output was helped by the easing of supply chain pressures, the end of a federal public servant strike and continued momentum in real estate, but forest fires disrupted Alberta’s oil and gas sector.

Stephen Tapp, Chief Economist, Canadian Chamber of Commerce

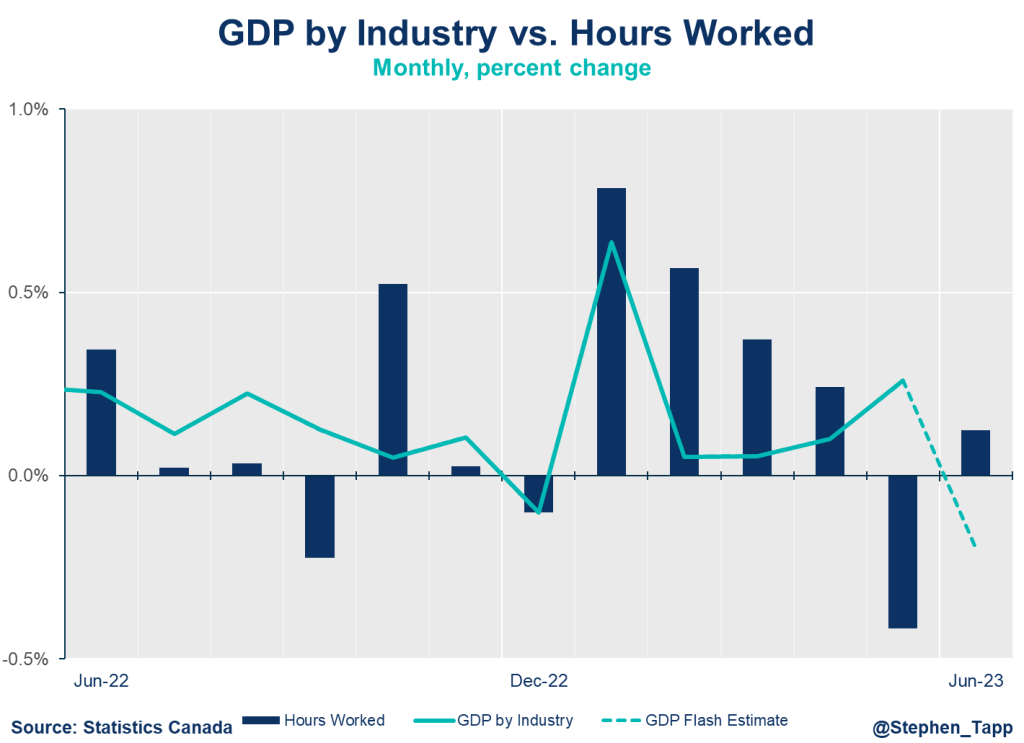

Factoring in StatCan’s flash estimate of a 0.2% drop in June, Canadian real GDP is expected to grow at approximately 1% in the second quarter — down noticeably from over 3% in Q1, slightly weaker than what the Bank of Canada had expected. As a result, we’re becoming more confident that the Bank of Canada will hold its policy rate at 5% in September, marking the peak of this tightening cycle.

KEY TAKEAWAYS

Headline

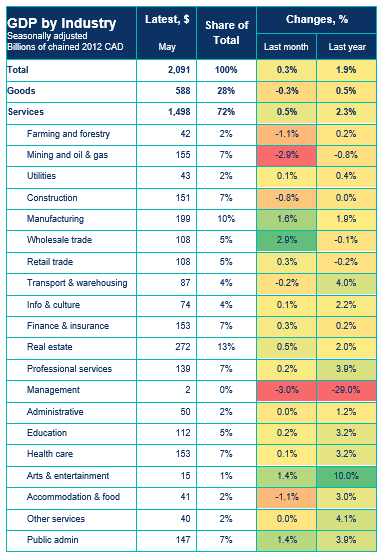

- Canada’s real gross domestic product (GDP) was up 0.3% in May, matching market expectations.

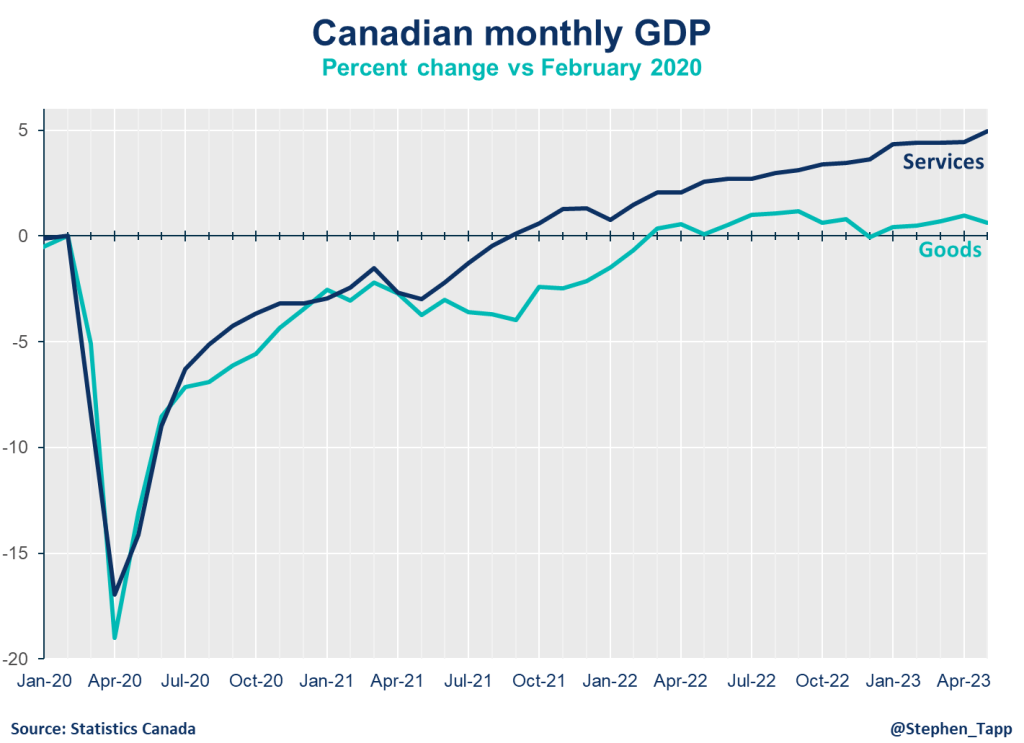

- Output grew in 12 of 20 sectors, led by gains in services, which were up 0.5% on the month, while the goods sector dropped 0.3%.

Movers and Shakers

- As expected, the public sector rebounded in May, following a federal public servant strike of April 19 to May 3, which had temporarily shaved off about 0.1% from the headline GDP number in April.

- In May, forest fires disrupted production in Canada’s energy sector (-2.1%). Alberta’s oil and gas in was hit hardest, dropping 6.6% and recording its largest monthly contraction in over three years. While this is a temporary disruption, we know that fires continued beyond May, and may act as a drag on output for a few more months.

- The easing of supply chains pressures —with an improved supply of semiconductor chips — helped propel wholesale trade (2.9%) and manufacturing (1.6%).

- Improvements in Canada’s real estate sector continue to support GDP, with gains for four consecutive months.

OUTLOOK & IMPLICATIONS

- StatCan’s flash estimate for June is -0.2%. This puts Canada’s real GDP on pace for growth of around 1% in the second quarter. This is slightly weaker than the BoC’s latest forecast, which sees growth of 1.5% for both Q2 and Q3, before slowing further for the following three quarters.

- The market consensus is slightly weaker than the Bank’s outlook: with growth expected to stall (0%) — but no longer fall — by the fourth quarter, consistent with a much softer landing than was previously expected. All told, the Bank of Canada will likely hold their policy rate at 5%, marking the peak of the tightening cycle.

SUMMARY TABLE

GRAPHS

Other Commentaries

Oct 19, 2022

September 2022 Consumer Price Index data: Food and services prices still rising, no progress on core inflation

Sep 20, 2022

August 2022 Consumer Price Index data: Finally some good news on Canadian inflation.

Aug 16, 2022