Commentaries /

Labour Force Survey for August 2022: Slowing down

Labour Force Survey for August 2022: Slowing down

Our Chief Economist, Stephen Tapp says, “After three straight months of falling employment, Canada’s red hot labour market has started to cool off.” Read more on Tapp’s dive into August’s Labour Force Survey results.

Stephen Tapp

After three straight months of falling employment, Canada’s red hot labour market has started to cool off.

Stephen Tapp, Chief Economist, Canadian Chamber of Commerce

KEY TAKEAWAYS

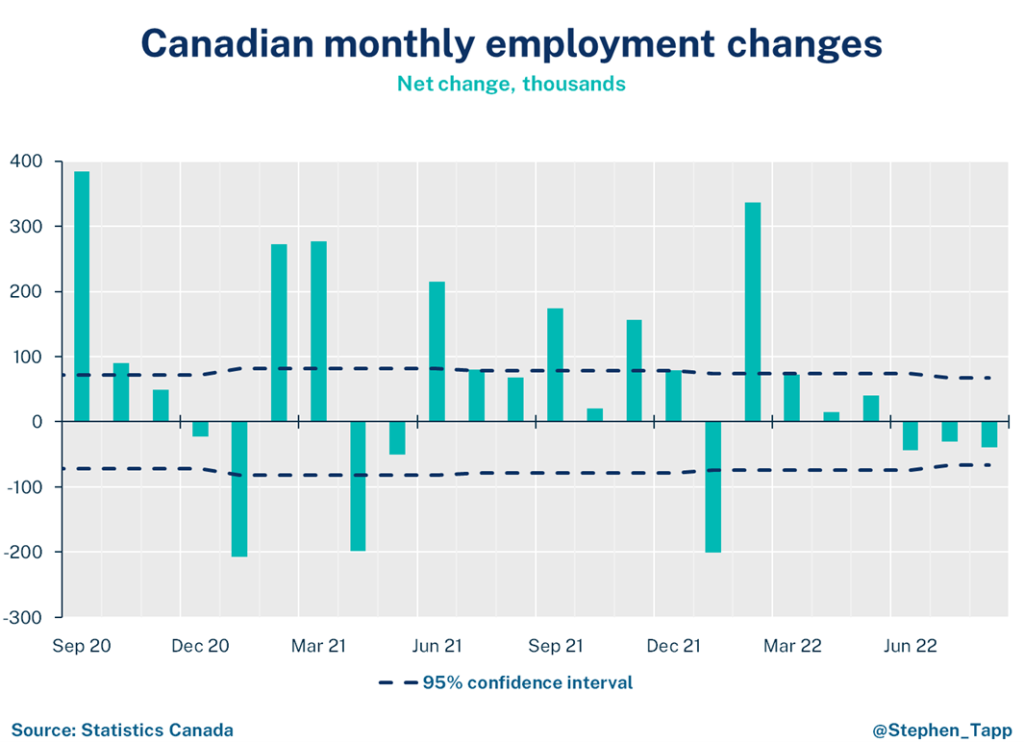

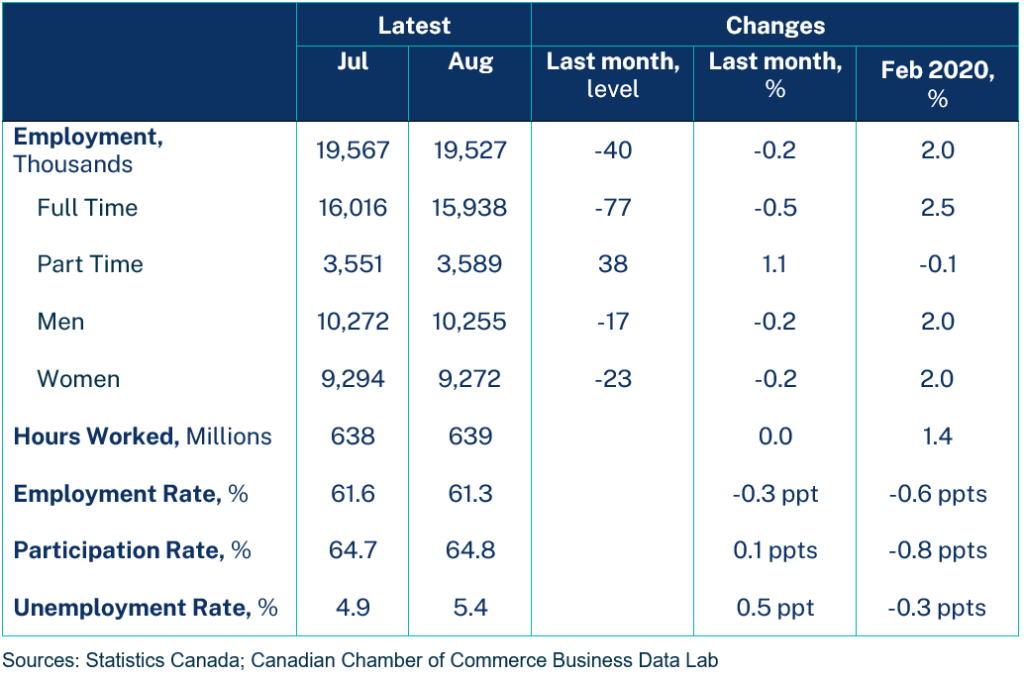

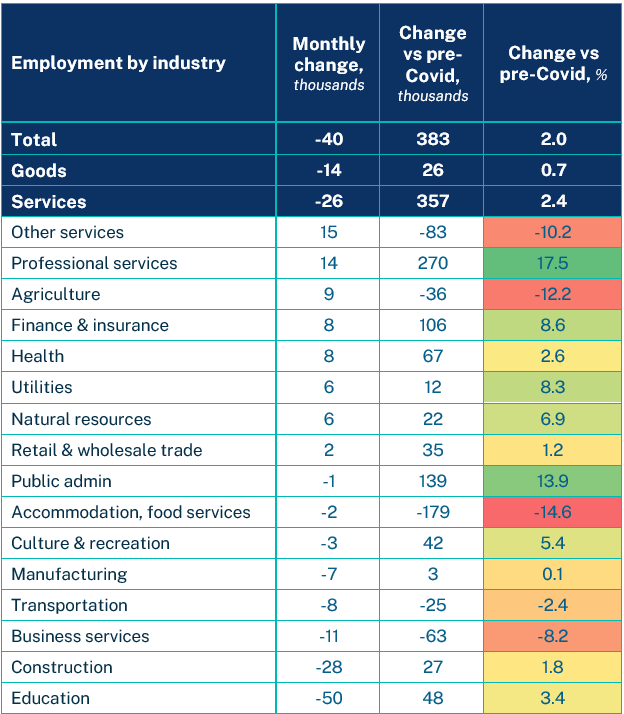

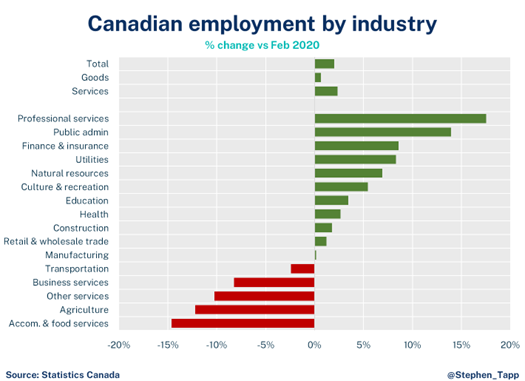

- Canadian employment fell by 40,000 jobs (-0.2%) in August — worse than the modest gain the market expected (+5k to +15k). This is the third consecutive monthly drop, which brings the cumulative decline to 114k net jobs (-0.6%) since May, which have been primarily full-time jobs.

- Total hours worked were unchanged (after falling 0.5% in July), though they remain up a healthy 3.7% year-over-year.

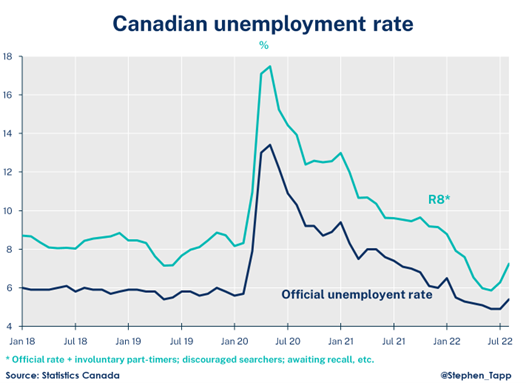

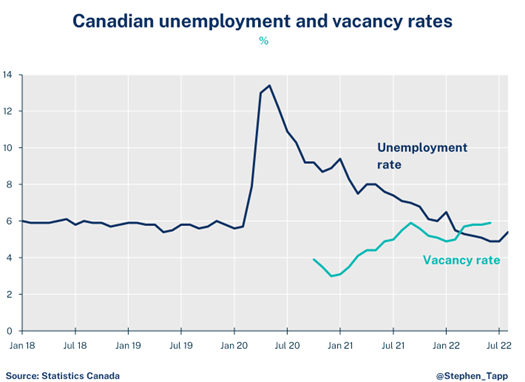

- The unemployment rate, which had been on a steady downward track to new record lows, increased significantly (to 5.4%, up 0.5 percentage points).

- Employment losses in August were concentrated in full-time jobs (-77k, as part-time employment rose 38k), and in education (-50k, -3.3%, although perhaps we should view this result with caution until we get September data, given that the timing of school contracts changes from year-to-year) and construction (-28k, -1.8%). “Other” and professional services continued to make gains. By gender, employment was down for both women (-23k) and men (-17k).

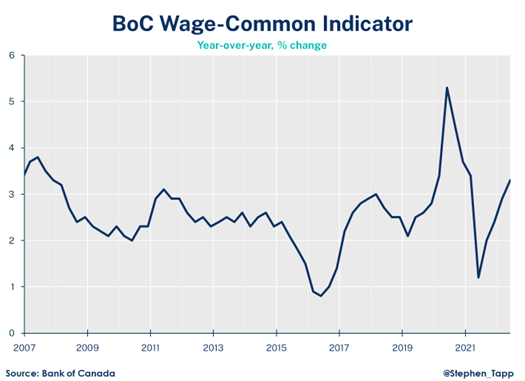

- Despite the recent slowdown in employment, labour markets remain tight. With employers looking to fill over one million job vacancies, and inflation near generational highs, wage growth accelerated to 5.4% year-over-year (up from 5.2%). Wages for non-unionized workers are up more (6.3%) than for the unionized (3.6%), where gains for the latter may be delayed until collective agreements expire and are renegotiated.

- Retirements are creeping up among baby boomers (307k annualized in August 2022, compared with 273k in August 2019). StatCan estimates that population aging reduced Canada’s labour force by 374k over this three-year period!

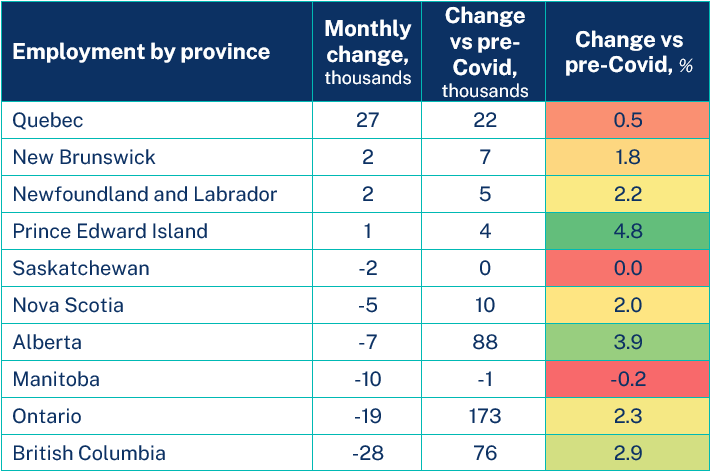

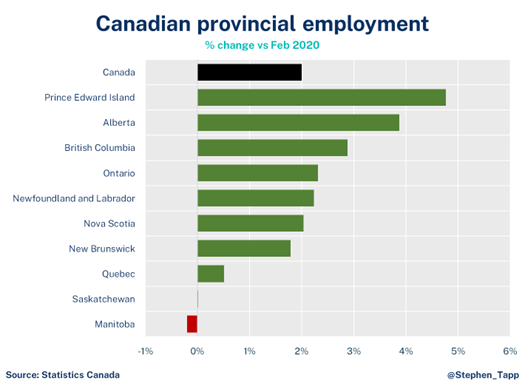

- Provincial employment fell in BC, Manitoba, Nova Scotia, but was up in Quebec. Moves in other provinces didn’t exceed the survey margin of error.

- In August, more than 1-in-4 workers were either fully remote (17%) or hybrid (9%).

SUMMARY TABLES

For more economic analysis and insights, visit our Business Data Lab.

Other Commentaries

commentaries

Oct 19, 2022

September 2022 Consumer Price Index data: Food and services prices still rising, no progress on core inflation

Our Chief Economist, Stephen Tapp, looks at Canada’s headline inflation, which edged down for the third month in a row. There was no progress on “core” inflation, which held steady at 5%.

commentaries

Sep 20, 2022

August 2022 Consumer Price Index data: Finally some good news on Canadian inflation.

Stephen Tapp, our Chief Economist, looks at Canada’s headline inflation for August, which fell for the second straight month. Core inflation and services measures have also finally started to slow.

commentaries

Aug 16, 2022

July 2022 Consumer Price Index data: Canada’s inflation finally turns a corner with falling gas prices, but core pressures remain

Our Chief Economist, Stephen Tapp, looks at Canada’s headline inflation, which is finally showing signs of cooling off.