Commentaries /

July 2024 CPI: Inflation continues to roll its way to the 2% target.

July 2024 CPI: Inflation continues to roll its way to the 2% target.

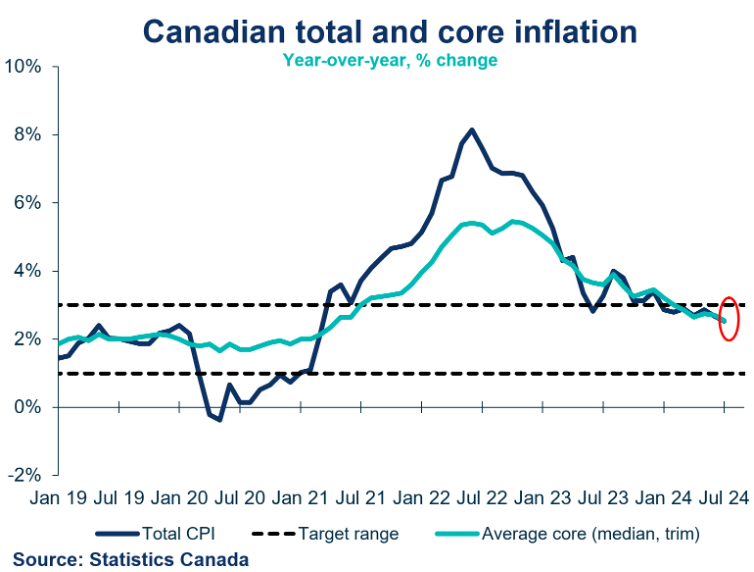

Canada’s headline inflation decelerated to 2.5% in July, in line with consensus (2.5%) on a year-over-year basis.

Andrew DiCapua

Inflation seems like it will continue rolling down the hill. July’s deceleration is welcome news especially with some price relief on the services side of the economy. There’s more to go in terms of reaching price stability as Canadian feel the pinch and pull back on spending. But we think the Bank of Canada will continue their path of interest rate cuts and move again in September, prioritizing economic growth as inflation moderates. Interest rates remain too restrictive given soft underlying growth. The Bank’s necessary medicine for the economy is lower rates.

Andrew DiCapua, Senior Economist

KEY TAKEAWAYS

Headline

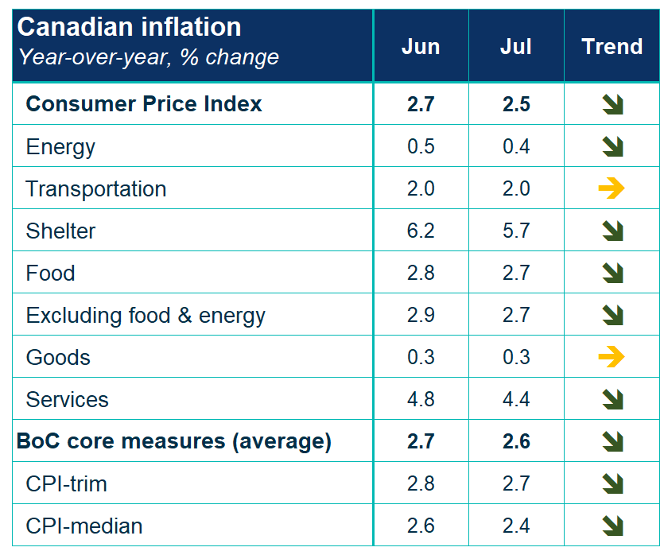

- Canada’s headline inflation decelerated to 2.5% in July, in line with consensus (2.5%) on a year-over-year basis. This marks the slowest acceleration in inflation since March 2021. Monthly seasonally adjusted prices grew 0.3% as gasoline prices accelerated on the month.

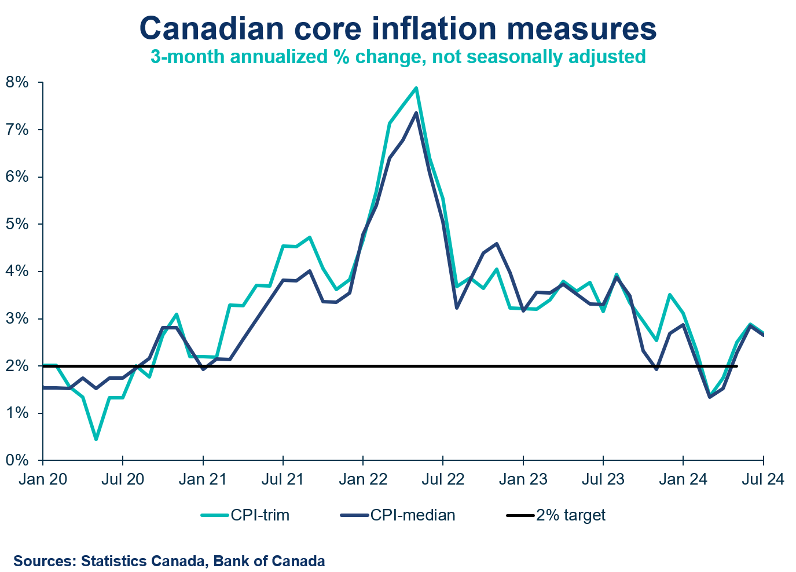

- The Bank of Canada’s core measures (Trim and Median) grew at a slower pace, rising 2.6% year-over-year. Short-run core measures (3-month change annualized) increased 2.7%, which is on the stronger side in recent months, but remains within range.

CPI Components

- Energy prices held steady in July (+0.4%), despite gasoline prices rising 1.9% due to reduced supply from the U.S. Excluding energy, July inflation rose 2.7%.

- Shelter prices decelerated to 5.7% (previously 6.2%) from lower electricity prices, mortgage interest costs, and other energy related items. Rent prices remain sticky but moderated to 8.5% annually (previously 8.8%).

- Goods inflation remains subdued, growing 0.3%, driven down by durable and semi-durable goods. This trend is likely to continue with monthly changes also showing negative growth. Services inflation made some progress in July, decelerating to 4.4% (previously 4.8%). This was led by travel tours and electricity costs decelerating, mainly due to base effects.

- Food price inflation improved in July, growing 2.7%. Both grocery store and restaurant prices made progress, despite being elevated over the past year.

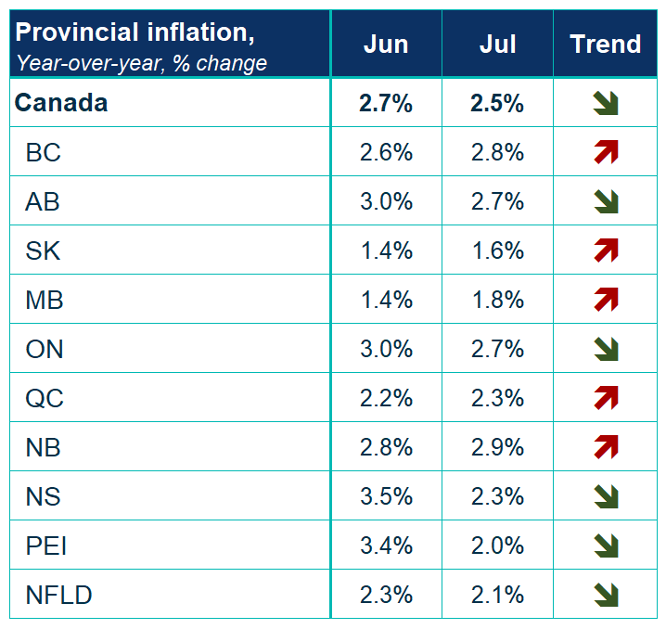

Provincial and Regional Inflation

Inflation decelerated in five provinces with the east coast provinces getting some price relief from lower energy prices.

SENTIMENT, OUTLOOK AND IMPLICATIONS

- July CPI was in line with the inflation forecast in the Bank of Canada’s July Monetary Policy Report, which expected 2.5% year-over-year growth. There’s more progress needed to achieve price stability, especially with services inflation elevated.

- Markets are expecting rate cuts at each of the remaining meetings this year. The Bank is likely to not surprise market participants unless with supporting data. But Governing Council’s dovish tone at their last meeting leads us to believe that they’ll continue lowering the policy rate, including at their September rate decision. The Canadian economy isn’t as strong as the quarterly GDP data will have us believe. Recent weakness in manufacturing sales could be trouble for investment in the coming months. The July CPI release is a nod for lower rates, which is the medicine sorely needed in the coming months.

SUMMARY TABLES

Sources: Statistics Canada; Bank of Canada; Canadian Chamber of Commerce Business Data Lab.

CHARTS

Other Commentaries

Oct 19, 2022

September 2022 Consumer Price Index data: Food and services prices still rising, no progress on core inflation

Sep 20, 2022

August 2022 Consumer Price Index data: Finally some good news on Canadian inflation.

Aug 16, 2022