Commentaries /

October 2022 GDP: Canadian output exceeding low expectations for the fourth quarter

October 2022 GDP: Canadian output exceeding low expectations for the fourth quarter

Our Chief Economist reviews Canada's GDP data from October 2022.

Stephen Tapp

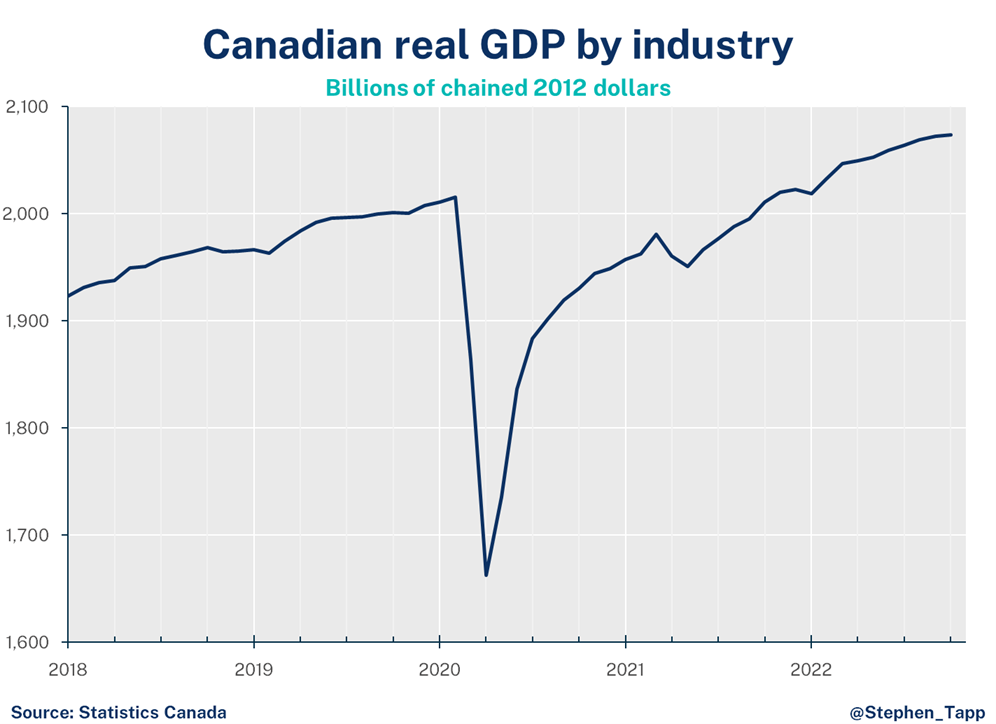

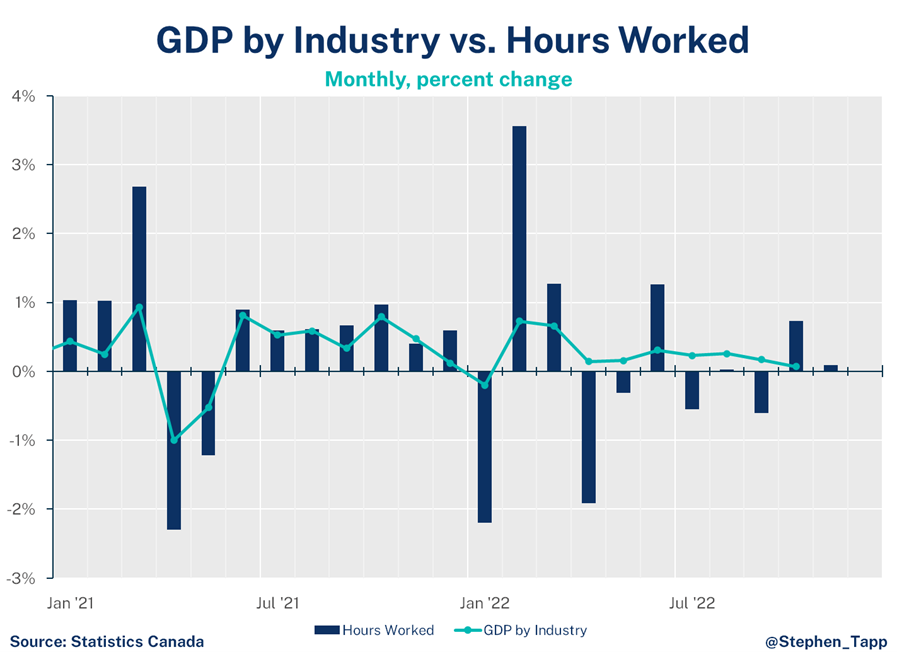

Today’s GDP data suggest Canada’s economy continues to outperform low expectations. Real GDP growth is on pace for an annualized +1.4% in 2022Q4, which means earlier recession calls may have to wait until the New Year for resolution.

Stephen Tapp, Chief Economist, Canadian Chamber of Commerce

Key Takeaways

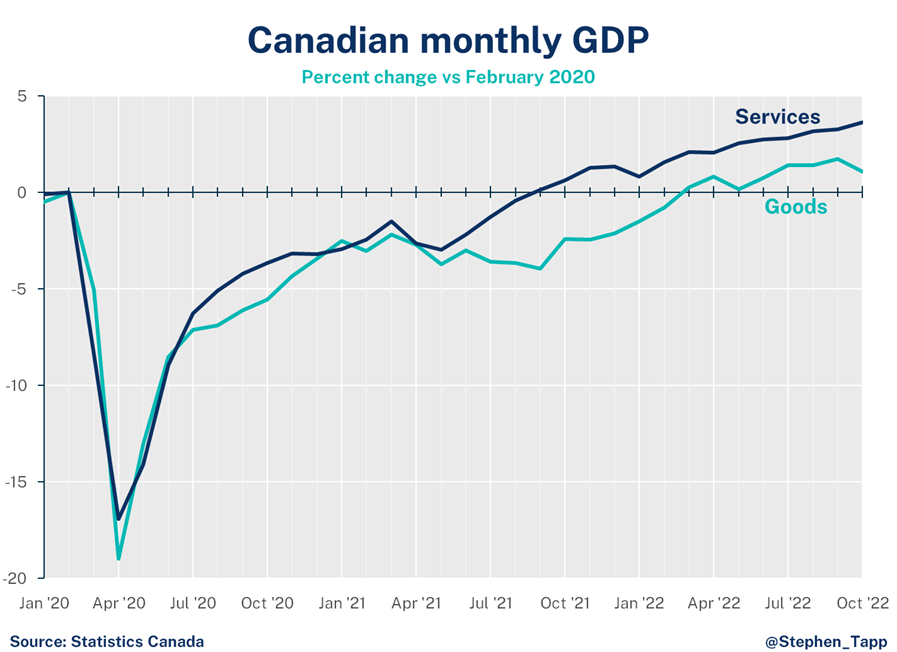

- Canada’s real gross domestic product (GDP) grew by 0.1% in October, as output gains in services were dragged down by falling goods production.This outcome is slightly better than the initial advanced estimate of essentially unchanged growth.

- StatCan’s advanced estimate for November is 0.1% growth (which was originally reported as 0%). Taken together, these estimates put real GDP growth on an annualized pace of almost 1.5% for 2022Q4, which is running ahead of the Bank of Canada’s forecast (0.5%).

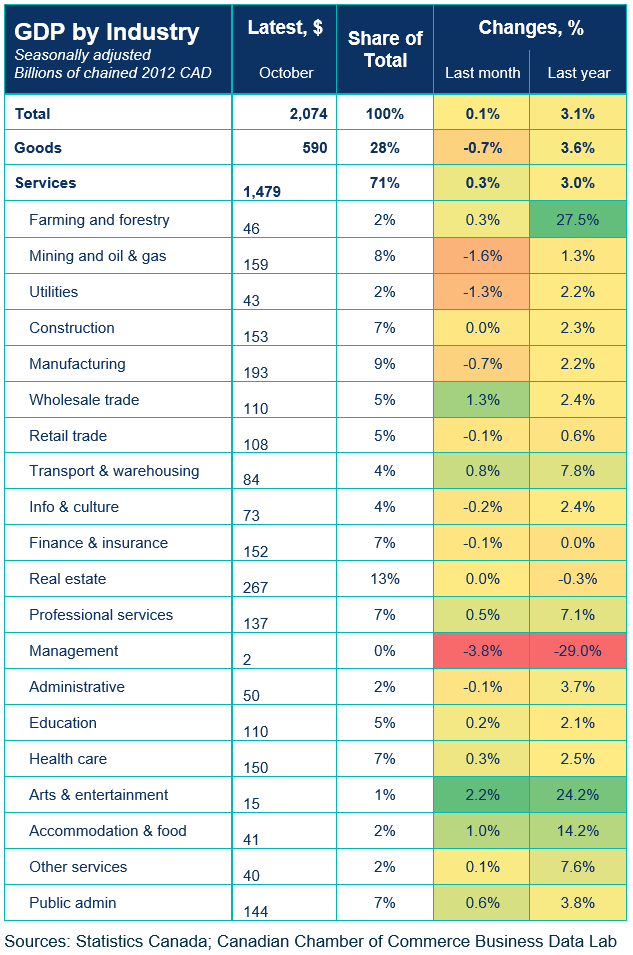

- In October, output increased in 11 of 20 sectors. Services led the way rising by 0.3%, due to gains in the public sector, wholesale, and customer-facing industries. Goods production fell0.7%, due to declines in mining, oil and gas, and manufacturing.

- Notable movers on the month:

- The recovery in “high-contact services” continues, as Canadians are taking flights (air transport, +5.5%), attending shows (arts, entertainment and recreation, +2.2%), and dining out at restaurants (food services and drinking places, +2.1%).

- The public sector grew by 0.4%, led by the federal government (1.0%), while the health care sector (0.3%) responded to additional demand coming from the triple-whammy of COVID-19, respiratory syncytial virus and flu cases.

- Wholesale trade (+1.3%) was active, reflecting the processing of new COVID variant boosters as well as farming products, which are supporting strong agricultural exports of wheat and canola this year.

- Oil sands extraction fell by 3.9% due to scheduled maintenance that interrupted production.

- Manufacturing (-0.7%) suffered its fourth decline in six months, falling to the lowest output level since December 2021.

Summary Table

For more great #cdnecon content, visit our Business Data Lab.

Other Commentaries

commentaries

Oct 19, 2022

September 2022 Consumer Price Index data: Food and services prices still rising, no progress on core inflation

Our Chief Economist, Stephen Tapp, looks at Canada’s headline inflation, which edged down for the third month in a row. There was no progress on “core” inflation, which held steady at 5%.

commentaries

Sep 20, 2022

August 2022 Consumer Price Index data: Finally some good news on Canadian inflation.

Stephen Tapp, our Chief Economist, looks at Canada’s headline inflation for August, which fell for the second straight month. Core inflation and services measures have also finally started to slow.

commentaries

Aug 16, 2022

July 2022 Consumer Price Index data: Canada’s inflation finally turns a corner with falling gas prices, but core pressures remain

Our Chief Economist, Stephen Tapp, looks at Canada’s headline inflation, which is finally showing signs of cooling off.