Commentaries /

December 2022 LFS: Blowing past expectations, a stellar and unexpected rebound for Canada’s labour market

December 2022 LFS: Blowing past expectations, a stellar and unexpected rebound for Canada’s labour market

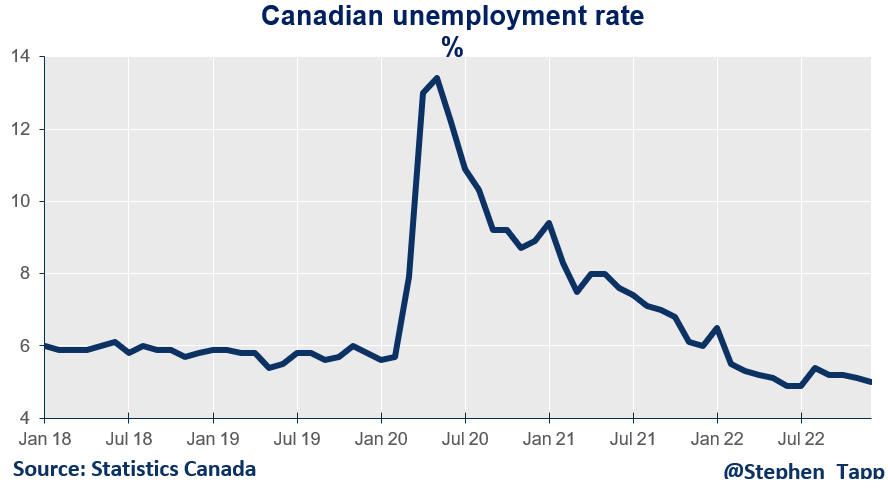

Today’s year-end data shows the strength of Canada’s labour market. At 5%, the December unemployment rate is back down near...

Marwa Abdou

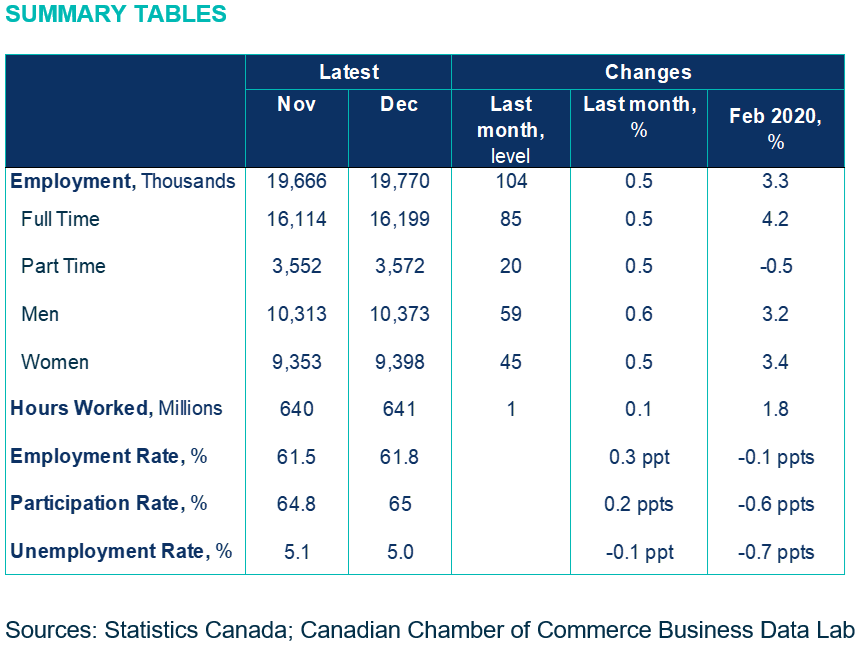

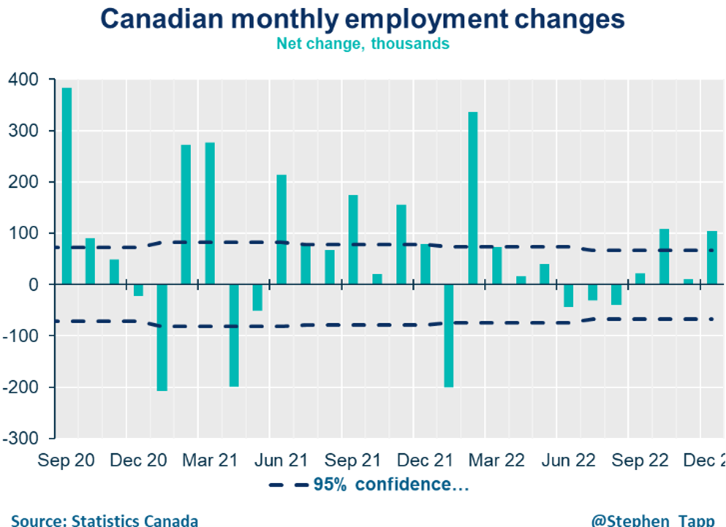

Today’s year-end data shows the strength of Canada’s labour market. At 5%, the December unemployment rate is back down near the record lows that we saw six months ago. We also had another impressive and unexpected gain of 104,000 jobs, following subdued November figures. This gain was broad-based across industries and provinces. It was also mostly led by full-time, private-sector positions for youth workers. Wage growth remained above 5% for a seventh consecutive month.

A single blemish on an otherwise stellar report is that hours worked were little changed from November. All in all, it leaves us anticipating another hike by the Bank of Canada (BoC) later this month as they continue to try and slow down this piping hot job market.

Marwa Abdou, Senior Research Director, Canadian Chamber of Commerce

Key Takeaways

- At 5.0%, the unemployment rate is only slightly above near 40-year record low of 4.9% seen in June and July.

- December experienced an increase of nearly 104K jobs (+0.5%) as employment continues an upward trend. This gain, which defied market expectations (of +5 to 10K jobs), was driven by an increase for full time (+85K) and private sector work (+112K).

- Fully recouping cumulative losses from July to September, employment among youth (age 15-24) had an impressive gain of 69K jobs.

- Although employment among people in the core working ages (25-54) was little changed, employment rate among women in this group showed an almost three-decade record high. Looking at year-over-year (y-o-y) figures – 81.0% of core-aged women were employed in 2022. Also, immigrant women workers saw a rate boost from 2019 (+9.7%).

- Hours worked saw little changefrom November – only up 1.4% y-o-y despite December’s massive job gain.

- December data highlighted an increase in staff absenteeism (8.1% compared to pre-pandemic average of 6.9%) due to illness as elevated cases of influenza and other respiratory viruses continue in many parts of the country.

- Average hourly wages remain strong at 5.1% though growth has decelerated. This is the seventh consecutive month that hourly wages have remained above the 5% mark. This is still well behind the country’s inflation rate (6.8% in November).

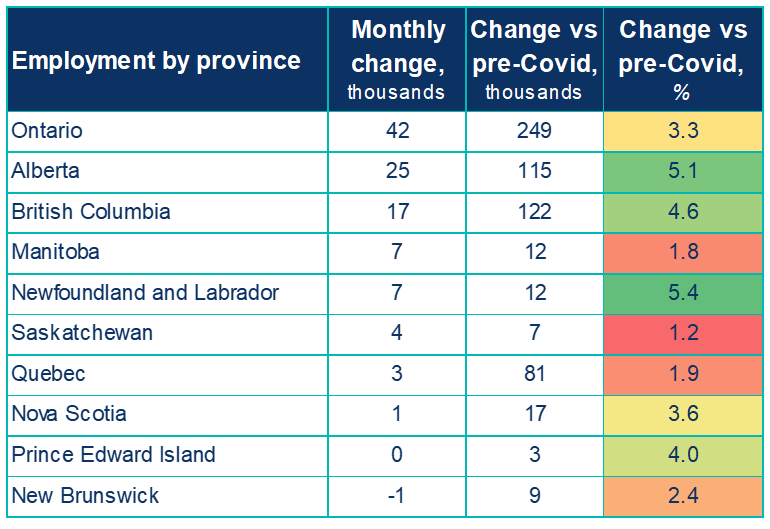

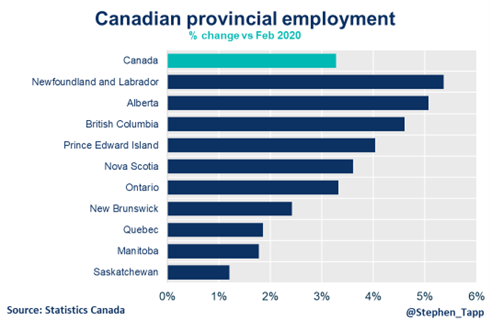

- Provincial employment increased across six provinces (Ontario, Alberta, British Columbia, Manitoba, Newfoundland and Labrador, and Saskatchewan). Ontario (+42K), Alberta (+25K) and British Columbia (+17K) clocked in the job growth figures from November.

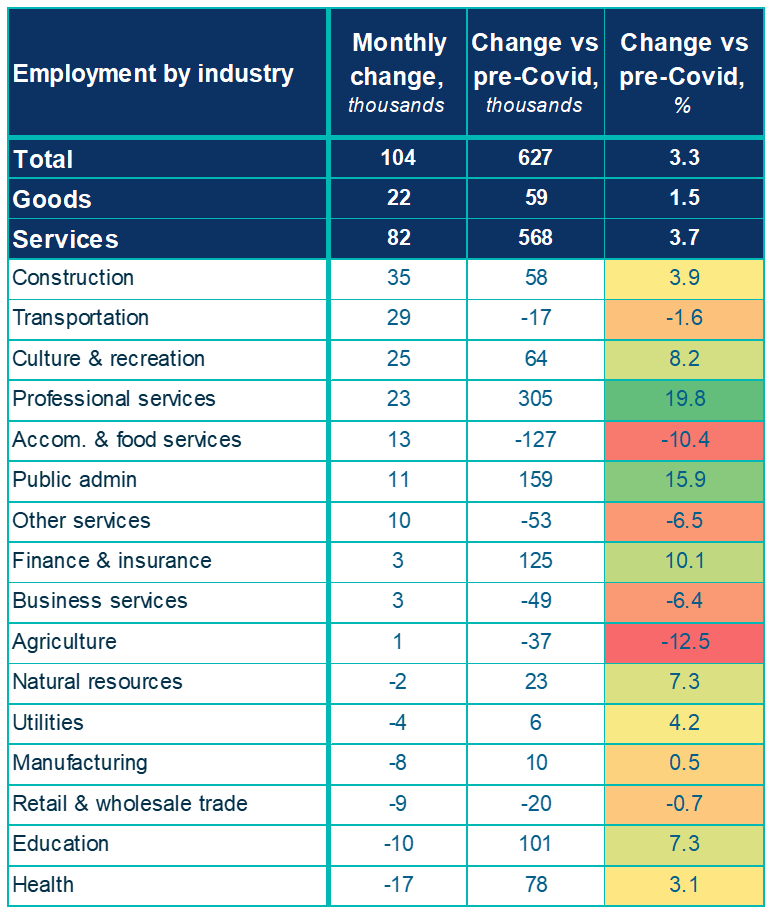

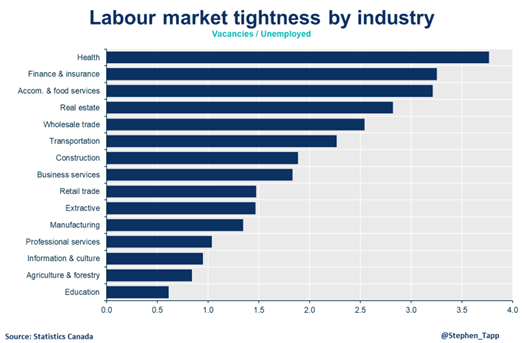

- Job gains were widespread across multiple service sector industries, including construction (+35k), transportation (+29k), culture and recreation (+25k), as well as professional and other services (+23K). Still, there were industries that slightly contracted including manufacturing (-8K), retail and wholesale trade (-9K), education (-10k) and health (-17K).

- All in all, December’s strong headline data increases the likelihood that the BoC will announce an additional interest rate hike by the end of this month. With working hours not budging, it also remains to be seen how this will translate in GDP figures.

Summary Tables

For more great #cdnecon content, visit our Business Data Lab.

Other Commentaries

Oct 19, 2022

September 2022 Consumer Price Index data: Food and services prices still rising, no progress on core inflation

Sep 20, 2022

August 2022 Consumer Price Index data: Finally some good news on Canadian inflation.

Aug 16, 2022